Cryptocurrency Posts

Crypto Briefing

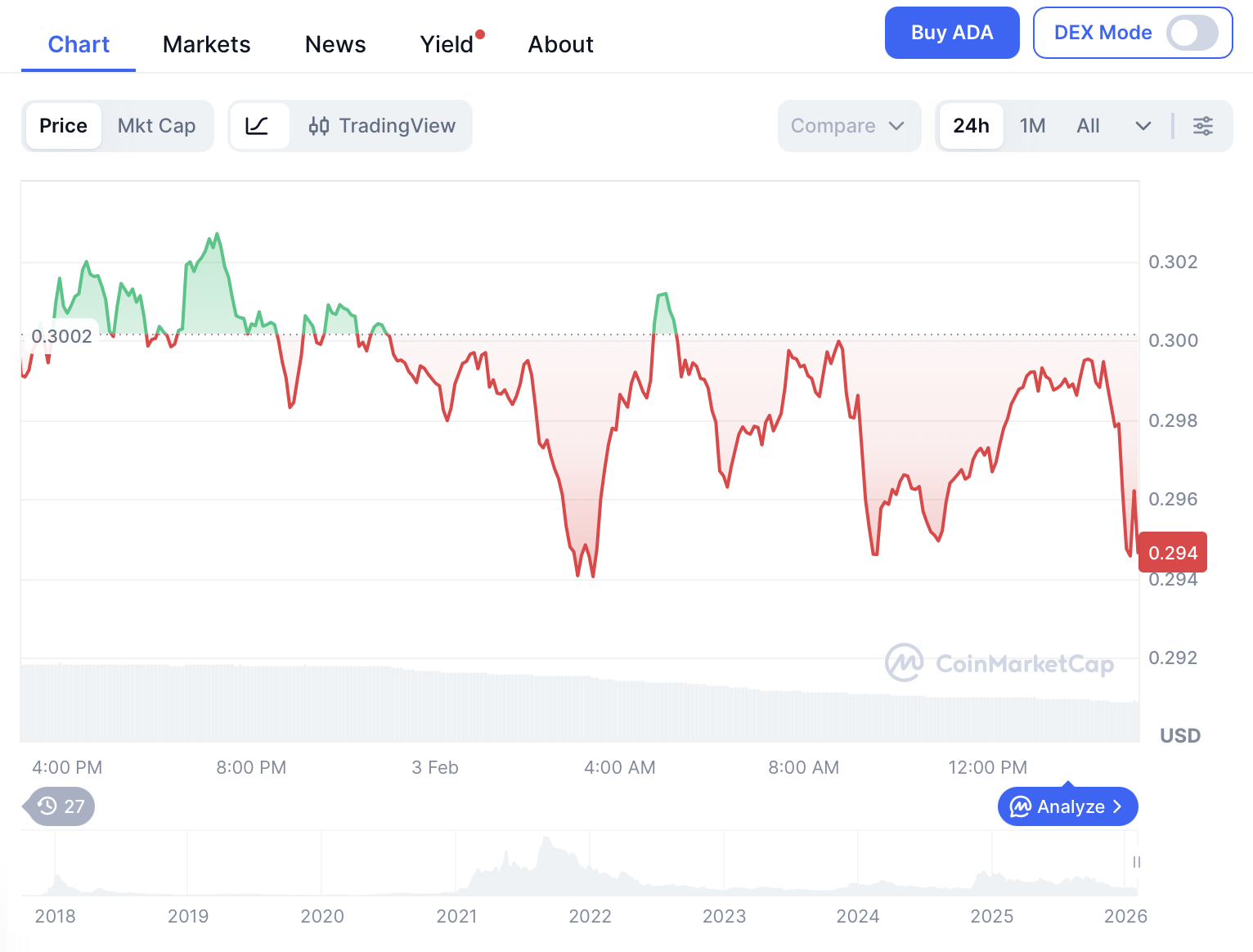

Bitcoin slid to $72K, extending its selloff and dragging crypto stocks, miners, and treasury firms lower amid broader market weakness.

The post Bitcoin slides to $72K, extending selloff and dragging crypto stocks lower appeared first on Crypto Briefing.

BBVA's involvement in the consortium could enhance Europe's financial independence and innovation, challenging US dominance in stablecoins.

The post Spanish banking giant BBVA joins Qivalis consortium to issue European stablecoin appeared first on Crypto Briefing.

Amazon is reportedly in talks with OpenAI on custom AI models as a potential $50B investment and major funding round take shape.

The post Amazon in talks with OpenAI to develop custom AI models for Alexa and broader product suite appeared first on Crypto Briefing.

Fidelity launched its first stablecoin, FIDD, offering a dollar backed digital asset as regulatory clarity fuels Wall Street adoption.

The post Fidelity stablecoin FIDD goes live as Wall Street moves deeper onchain appeared first on Crypto Briefing.

Ripple's integration of Hyperliquid into its platform could significantly enhance institutional DeFi liquidity, driving broader market innovation.

The post Ripple integrates Hyperliquid to expand institutional DeFi access appeared first on Crypto Briefing.

Bitcoin Magazine

Bitcoin Magazine

Strategy ($MSTR) Shares Sink Over 20% in 5 Days as Bitcoin Crashes to $72,000

Shares of Strategy ($MSTR) plunged again today as Bitcoin’s sell‑off deepened, reinforcing the tight correlation between the world’s largest corporate Bitcoin holder and the digital asset’s price action.

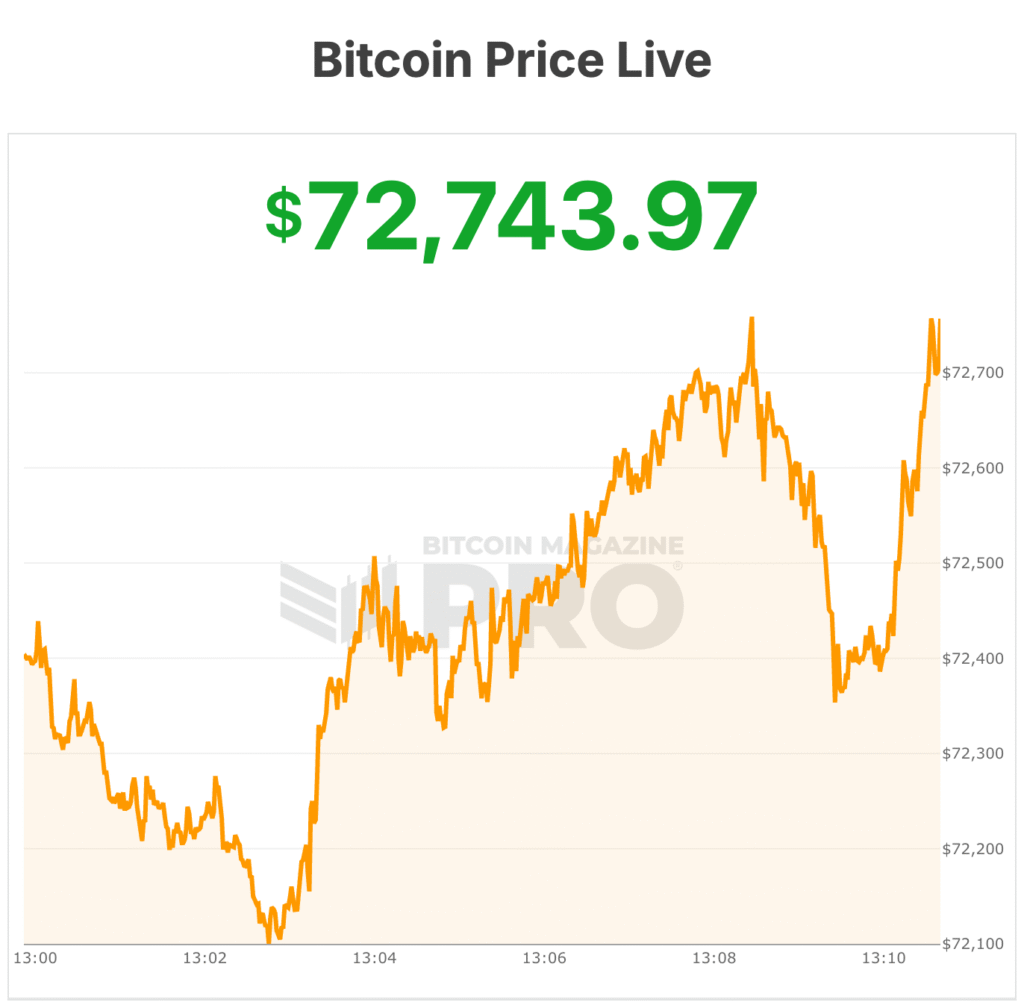

Bitcoin cratered toward $72,000, extending losses to levels not seen since late 2024, while MSTR shares tumbled roughly 9% on the session, dipping to intraday lows near $121.19.

At current levels the stock is down roughly 15% year‑to‑date and a staggering 72% from its November 2024 peak.

The drop in Bitcoin — now hovering near $72,000, far below the multi‑year highs seen in 2025 — has rippled across the broader crypto complex.

With sentiment souring and tactical traders eyeing technical support levels near the mid‑$60,000 range, risk assets have taken on a pronounced downbeat tone.

Commentary from market strategists has ranged from cautionary to outright bearish, with calls for deeper retracements if demand fails to stabilize.

Analyst slashes $MSTR price target by 60%

In a notable update this week, Canaccord Genuity analyst Joseph Vafi, long viewed as one of MSTR’s most vocal supporters, dramatically slashed his price target from $474 to $185 — a 61% reduction — while maintaining a Buy rating on the stock.

According to Vafi’s revised outlook, the new target still implies “significant upside” from current levels if volatility subsides and Bitcoin finds a tradable bottom.

Vafi’s retained bullish stance — despite the sharp target cut — highlights a nuanced view among some Wall Street strategists: even amid brutal downside, the stock’s deep discount to theoretical Bitcoin net‑asset value could eventually reprice upward.

Strategy continues bitcoin purchasing

Earlier this week, Strategy said it purchased 855 bitcoin for about $75.3 million, paying an average price of $87,974 per BTC, according to a Monday filing.

The acquisition came just days before bitcoin fell below $75,000 over the weekend on some rapid selling, briefly pushing Strategy’s treasury close to $1 billion in unrealized losses. Now, the price of bitcoin is below those levels at $72,000.

The company now holds 713,502 BTC, acquired for roughly $54.26 billion at an average cost of $76,052 per coin.

Last week’s purchase was fully funded through the sale of common stock, following Strategy’s ongoing capital-raising approach to finance bitcoin buys. The purchase of 855 bitcoin was significantly smaller compared to prior company purchases.

All eyes remain on MSTR’s upcoming fourth‑quarter 2025 earnings release, scheduled for later this week, a report that could provide more color on its capital‑raising cadence, BTC purchase strategy, and the evolving balance between leverage and asset coverage.

At the time of writing, bitcoin’s price dropped to lows near $72,000 today, its lowest level in over a year. The bitcoin price has now retraced more than 40% from its all‑time highs reached in late 2025.

This post Strategy ($MSTR) Shares Sink Over 20% in 5 Days as Bitcoin Crashes to $72,000 first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

Bhutan Continues Consistent BTC Selling as Bitcoin Price Tanks to $72,000

Bhutan has transferred $22.4 million worth of Bitcoin from its wallets over the past week, continuing a pattern of periodic BTC sales observed over the past several years.

According to blockchain analytics firm Arkham, one of the transfers, executed five days ago, was sent directly to addresses labeled as belonging to market maker QCP Capital.

Data from Arkham indicates that Bhutan is selling Bitcoin in increments of roughly $50 million, with a particularly heavy selling period recorded in mid-to-late September 2025. Bhutan has been mining Bitcoin since 2019, producing over $765 million in BTC profits while incurring estimated energy costs of around $120 million.

Bhutan mined the majority of its Bitcoin before the 2024 halving, tapering production afterward as mining costs roughly doubled. The country’s peak mining year was 2023, when it produced around 8,200 BTC, bringing total holdings at the time to over 13,000 BTC.

Annual production estimates include approximately 2,500 BTC in 2021, 1,800 BTC in 2022, 8,200 BTC in 2023, and 3,000 BTC in 2024, Arkham said.

Bitcoin is cratering to one-year lows

All this is happening as Bitcoin has fallen roughly 40% from its October peak, reigniting concerns about a repeat of its historical four-year cycle downturns.

K33 Research Head Vetle Lunde acknowledged unsettling similarities to past deep sell-offs, such as those in 2018 and 2022 in a recent investor note, but stresses that the current market environment differs structurally.

Increased institutional adoption, inflows into regulated products, and an easing rate backdrop provide stronger tailwinds than in prior cycles, while the market has not experienced the forced deleveraging events that exacerbated the 2022 credit unwind.

Lunde noted that cycle psychology can be self-reinforcing, with long-term holders trimming positions and hesitant new capital contributing to selling pressure, creating patterns reminiscent of past downturns.

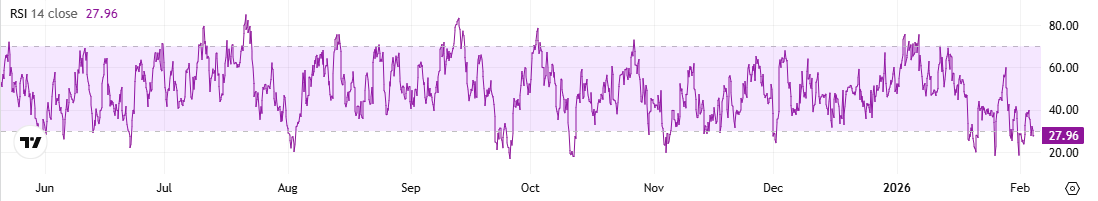

Yet, certain indicators hint at a potential market bottom: February 2 saw high spot trading volume above $8 billion, and derivatives markets experienced extreme negative open interest and funding rates, conditions that historically precede reversals.

Despite these signals, Lunde said that evidence remains inconclusive, as similar extremes have occurred during false starts. Critical support is identified around $74,000, with further downside possible toward $69,000 or the 200-week moving average near $58,000 if broken.

At the time of writing, bitcoin is trading near $72,000.

This post Bhutan Continues Consistent BTC Selling as Bitcoin Price Tanks to $72,000 first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

Rutherford Chang Retrospective: Hundreds and Thousands at UCCA Beijing

When people describe Rutherford Chang’s work, you hear words like: obsessive, conceptual, minimalist. These descriptions aren’t wrong, they point to something real in his practice. But they also miss what makes his approach distinctive. Chang worked with objects that industrial culture designed to be identical: records pressed in millions of copies, portraits drawn according to strict house style, coins minted for perfect interchange. His interest lay in the precise moment when the promise of sameness begins to fail, when time and human handling leave marks that transform supposedly identical objects into singular things.

The retrospective Rutherford Chang: Hundreds and Thousands opened January 17, 2026 at UCCA Center for Contemporary Art in Beijing, one of China’s leading institutions for contemporary art. This exhibition is significant for several reasons. It represents Chang’s first institutional retrospective and his most comprehensive solo presentation to date. It is also a posthumous one. Chang died in 2025 at the age of 45, leaving behind a body of work built almost entirely around the practice of collecting and arranging mass-produced objects until their individual histories became visible and legible.

Beijing provides a fitting location for this retrospective, though not for the obvious reasons alone. Yes, Chang moved frequently between New York and China throughout his career, and yes, he showed work in Beijing early on. But the city itself offers something more specific: a context shaped by rapid cycles of construction and replacement, by the constant acceleration of change and circulation. In such an environment, Chang’s patient attention to what gets left behind, to the residues and traces that accumulate on objects even as they move through systems designed to keep them uniform, takes on particular resonance. The exhibition is co-curated by Philip Tinari, director of UCCA, and Aki Sasamoto, a fellow artist – both longtime friends of Chang who understand his working methods from the inside. Their collaboration keeps the exhibition close to the work as practice, with process and method in the foreground.

To understand Chang’s approach, we need to look carefully at the exhibition’s title. Hundreds and Thousands sounds like simple measurement, like a gesture toward quantification. Chang typically worked at scale. He collected not dozens but hundreds or thousands of examples. But what the title really describes is a method and a particular way of working that emerges when you engage with mass-produced objects at sufficient volume. Chang discovered that quantity, at a certain point, stops behaving in predictable ways. At a certain scale, repetition starts to reveal detail. Put hundreds of nearly identical objects next to each other and you start to see time. You start to see touch. You see accidents. You see storage. You see neglect. You also see care. The marks of individual handling become visible. What you’re looking at, ultimately, is a record of lived life pressed into objects that industrial culture designed to keep stable and interchangeable.

We Buy White Albums

One of Chang’s best-known projects demonstrates this method with particular clarity. We Buy White Albums operates from a constraint simple enough to state in a single sentence, though its implications unfold over years: Chang established a record store that stocked only first pressings of the Beatles’ The Beatles (1968), commonly known as “The White Album”. The store had one rule that inverted normal commercial logic: It sold nothing, it only bought.

This premise is deliberately narrow, and it remains narrow throughout the project’s duration, which turns out to be part of what allows it to scale so effectively over time. During exhibitions where Chang was present, the work functioned in real time: people could show up with their own copy of the White Album and sell it to the archive while the exhibition was on view. The act of buying became a moment of direct exchange between the work and its audience, and the archive grew through these individual transactions instead of curatorial selection or market acquisition. Each copy arrived already marked by years of handling. These marks, the accumulated evidence of circulation, carried the work forward.

To understand why this project works as it does, we need to look more carefully at the White Album itself as an object. Richard Hamilton designed the cover as an almost completely blank white surface. Minimalism at its most reductive form. And yet early pressings carry a stamped serial number, a small detail that complicates the apparent simplicity. This serial number performs a curious double function: it frames each copy as one among many (your copy is number 0234561 out of millions), while simultaneously gesturing toward something like limited edition status through the very act of numbering. Here we find the contradiction built directly into the object itself: mass-produced minimalism making a paradoxical claim to uniqueness. The serial number tells you this is just one copy out of millions, while the blank white cover invites you to make it yours.

Chang understood what this contradiction sets in motion once these objects enter circulation and begin moving through time. The clean white surface that Hamilton designed with such care doesn’t stay clean for long. Everyday life rewrites it. Water damage spreads across the cardboard in irregular patterns. Corners get torn or bent through careless handling or too-tight shelving. Owners write their names on the cover, add notes about when and where they bought the album, sometimes include dedications or detailed lists of favorite tracks. Price stickers from second-hand shops accumulate in layers, creating unintended collages of commercial history. In some cases, mold sets in during storage in damp basements or attics, creating organic patterns that can look almost intentional, or lets say, almost artistic. Through all of this, the album stops being a uniform industrial product and becomes something singular, that’s marked by its particular history.

The decision to collect these albums in any condition and not searching only for pristine, museum-quality copies, represents a choice with significant consequences for how the work means. It means treating damage and wear as information and not as degradation to be corrected or restored. This shift in how we value objects is crucial to understanding the project. A pristine copy might tell you something about careful preservation, about someone who valued the object enough to keep it protected from the world. But a tattered copy, covered in stains and marks, tells a different and probably richer story. In Chang’s hands, these marks remain visible and begin to matter in new ways. He returns again and again, across different projects, to this precise point where objects designed for perfect interchange start to fray at the edges, where they begin to carry their own record of circulation that makes them individually readable.

The work doesn’t stop with physical collection, however. Chang took the project a step further by recording multiple copies of the album and layering them into a single audio piece. One hundred versions of the White Album play simultaneously, drifting gradually out of sync as small differences in quality and accumulated wear compound into a shifting chorus of sound. The result doesn’t register as a remix or a mashup in any conventional sense. It feels closer to the archive itself made audible, a way of hearing how uniformity fails when you stack enough iterations on top of each other. What comes to the surface is not purity or fidelity to an original, but time itself, materialized in the form of friction and noise. The piece functions as what we might call material memory, with surprisingly little interest in fan culture, or the mythology that typically surrounds The Beatles.

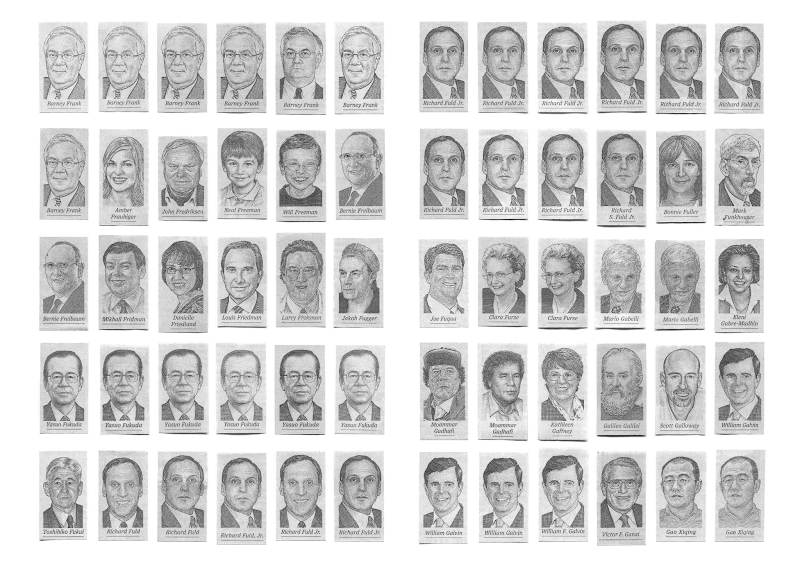

The Class of 2008

Chang applied this same basic methodological approach to a very different kind of mass-produced object: printed news media. The Class of 2008 presents itself as a straightforward catalogue. It’s an alphabetical listing of every hedcut portrait published in The Wall Street Journal during the year 2008. Before we can understand what Chang does with this material, though, we need to understand what hedcuts are and why they matter. Hedcuts are the distinctive stippled, engraving-style portraits that the Journal uses for certain figures in its reporting. The technique is borrowed deliberately from nineteenth-century engraving, and it carries with it specific associations: authority, permanence, trustworthiness, the visual register of something meant to hold up under scrutiny and stand the test of time.

The structure of the catalogue is deceptively simple: alphabetical order, with repetition kept visible in the record. If someone appeared multiple times in 2008, this is clearly indicated in the book, and those appearances are explicitly not reduced to a single representative entry. This decision about how to organize the material matters, because it allows patterns of repetition and recurrence to emerge through the reader’s encounter with the work. And the timing of the project sharpens its implications considerably. 2008 was, of course as we all know, the year when financial authority came under extraordinary strain, when economic structures that had seemed most stable revealed themselves to be fragile or even illusory. And yet throughout this period, the visual language of legitimacy in the Journal continued without interruption, day after day rendering certain faces in this particular register of authority and trust.

Chang’s catalogue simply records this continuity without adding editorial commentary or explicit critique. The alphabetical organization flattens any narrative arc that the year’s events might suggest. There’s no chronological story being told about crisis and response, no hierarchy of importance imposed through the order of presentation. Instead, repetition itself does the interpretive work. As you page through the book, you notice who appears once and who appears again and again and again. You start to see patterns in who gets rendered in this authoritative visual register and who remains outside it. The hedcut becomes not just a neutral technique of illustration but a question about legitimacy and representation: who gets marked as worth this particular kind of attention, who gets enrolled in this visual vocabulary of permanence and authority, and who remains invisible to this institutional gaze?

Game Boy Tetris

If Chang’s collecting projects make time visible through the gradual accumulation of marks on physical objects, Game Boy Tetris approaches the question of time and repetition through a different medium: labor itself, as the repetitive effort of trying and failing and trying again. The work documents Chang’s repeated attempts to achieve the highest possible score in the original Game Boy version of Tetris, filming the process over an extended period until the accumulation of attempts becomes the substance and meaning of the work. At one point during this extended engagement, he surpassed Steve Wozniak’s score on the leaderboard. A detail he noted with evident satisfaction –– a reminder of how seriously he took questions of record-keeping and documented proof of achievement.

The same simple rule-based system holds your attention through long stretches of concentration punctuated by failure and the decision to restart. The desire for completion, for reaching some definitive endpoint, keeps pulling you back into the loop even as the reasons for continuing become harder to articulate. Progress remains measurable throughout — you can track improvement across attempts, watch skills developing and patterns emerging — even as the larger meaning or purpose of this progress starts to slip away, even as the question of why this particular score matters becomes increasingly difficult to answer with any conviction.

Chang wasn’t observing obsessive cultures or completionist practices from a safe critical distance, making work about collecting or repetition without genuinely participating in those structures himself. Instead, he built systems and constraints that could absorb years of his own attention and effort while still continuing to demand more. Over time, through this sustained and genuine engagement with repetitive structures, Chang himself starts to resemble the thing he’s ostensibly studying. He becomes, in a real sense, a kind of repetitive system himself as lived practice.

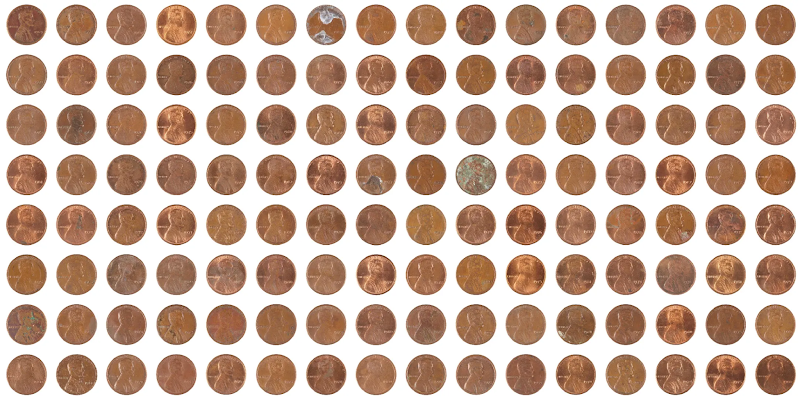

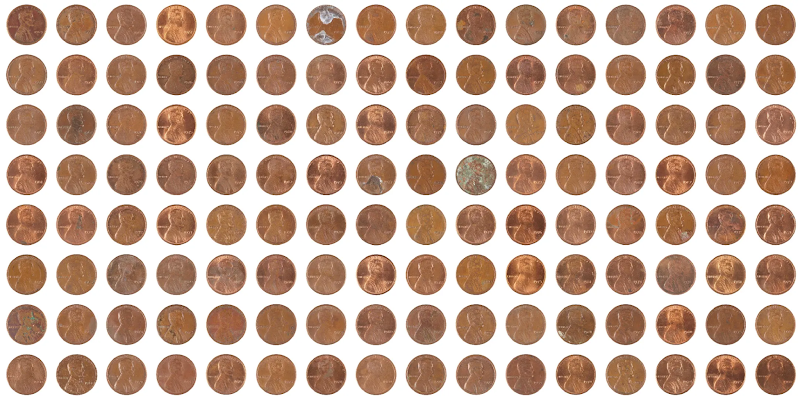

CENTS

Chang’s final major project takes his long-standing interest in units, standards, and systems of record-keeping and extends it into what has become an ongoing and in some ways autonomous condition. He completed the physical collection and documentation of ten thousand copper cents in 2023, at a moment when the one-cent coin was still in regular circulation throughout the United States. In 2024 the digital records of these ten thousand individual coins were inscribed onto Bitcoin, allowing the work to continue circulating and accumulating meaning beyond Chang’s direct control or intervention. Then, in a development that gives the entire project an another historical dimension, the U.S. Mint stopped producing the circulating one-cent coin on November 12, 2025. What this means is that in hindsight, with the perspective that historical distance provides, the penny itself has begun to read as a historical object, something that belongs to a particular moment of currency and exchange that is now passing into the past.

The project starts, like most of Chang’s work, from a condition that many people vaguely know about but rarely think through with any care or precision. Chang limited his collection specifically to cents minted before 1982, the year when the U.S. Mint changed the composition of the penny to reduce costs. Before 1982, pennies were made primarily of copper; after that date, they became copper-plated zinc. This seemingly minor detail has real consequences: pennies from the earlier period can, under certain market conditions, exceed their face value when considered purely as raw material. The copper content might be worth more than one cent. This creates an odd situation where the State continues to define each coin as being worth exactly one cent (and makes melting them for their metal content illegal), while the material reality of the object suggests a different value entirely. Chang doesn’t treat this as a paradox to resolve or a problem to solve. He treats it as a given, as one of the structural conditions that makes the work possible and interesting.

The process he developed is methodical and systematic. He removed ten thousand copper cents from circulation, pulling them out of the flow of exchange and use, and documented each one individually through detailed photography (obverse and reverse, better known as heads and tails). The coins were then smelted together into a single copper block weighing sixty-eight pounds. At this moment, individual units disappear entirely into undifferentiated mass. The penny’s ordinary role in exchange, its function as a discrete unit of value that can circulate and combine with other units, comes to a definitive end. But the block itself continues to exist in multiple forms. It was rendered as a detailed 3D digital model and inscribed as a single massive inscription filling the entirety of Bitcoin block #839969. This digital version was then sold at Christie’s in 2024, entering yet another system of value and circulation, moving from material object to digital record to collectible artwork in the contemporary art market.

The documentation, meanwhile, moves in the opposite direction from this consolidation. While the physical coins condense into a single unified object and lose their existence as separable, countable units, each individual cent remains readable as a distinct record. The photographic images stay separate and individuated, each one assigned to a fixed and permanent position in the set through inscription onto individual satoshis. What disappears completely at the level of material form — you can no longer hold these particular ten thousand pennies in your hand, can no longer sort through them or arrange them or put them back into circulation — remains perfectly intact at the level of the record. You can still look at the photograph of each specific coin, still examine the particular wear patterns and surface marks and small imperfections that distinguished it from the nine thousand nine hundred and ninety-nine others.

This structure allows CENTS to hold in tension several different and potentially conflicting ideas about where value is located and how it gets established and maintained. There’s value as defined by governmental authority: the State declares that this coin is worth one cent, and that declaration carries legal force. There’s value registered in material composition: the copper content might actually be worth more than one cent when calculated according to commodity prices. And there’s value produced through preservation and documentation: the decision to photograph each coin individually, to maintain the archive’s legibility over time, to treat these mass-produced objects as worthy of sustained attention. These different registers of value remain distinct within the work, not collapsing into a single unified meaning or resolving into some synthesis.

When we place CENTS alongside We Buy White Albums and think about them as part of a consistent practice, the underlying logic becomes clear. Objects that were designed and manufactured for perfect interchange, for being functionally identical and mutually substitutable, become readable as singular and individual once their circulation is interrupted and held still, once their particular histories are made visible through careful documentation and systematic archiving.

It’s worth noting here — because it matters for understanding how the work continues to function after Chang’s death — that CENTS was initiated through collaboration with Sovrn Art, an independent, artist-first platform that provided the initial framework and support for the project’s development. After the full inscription of the work onto Bitcoin was completed, a council formed independently of Chang himself, without his organization or oversight. This council is made up of collectors who chose, for their own reasons, to take responsibility for the work’s continuation and interpretation. The council members come from different generations and different professional fields, bringing various forms of expertise and perspective to their engagement with the archive. Their work has focused consistently on keeping the distinctions within the archive visible and legible — through close reading of the documentation, through careful cataloguing of variations and patterns, through writing that approaches the material from multiple angles and asks different kinds of questions. Their involvement has centered particularly on the problem of how to keep this archive readable and meaningful over time, how to maintain the precision and care of the record as it continues to circulate through systems and contexts that Chang himself could not have anticipated.

Archive as Practice

It is easy to call Rutherford obsessive. The sustained attention over years, the commitment to completeness and thoroughness, the willingness to spend enormous amounts of time and effort on projects built around deliberately narrow constraints. The word isn’t inaccurate. And yet it still manages to miss something important about the dimension of what Chang was actually doing with his time and attention. He treated mass culture and industrial production with a kind of patience that’s rare in contemporary art. He made rarity and singularity visible inside precisely those things we’ve learned to overlook or dismiss as generic and interchangeable. He listened carefully to what we might call the noise inside familiar symbols and objects — the small variations and accumulated marks that circulation and handling inscribe on surfaces that were designed specifically to resist such marking and remain stable over time.

This attention to what accumulates in the gaps and margins of systems designed for uniformity helps explain why Hundreds and Thousands works so effectively as a title for this retrospective. On one level, it simply names the scale at which Chang characteristically worked: collecting not dozens but hundreds, not hundreds but thousands of examples. But it also names something more fundamental. A discipline, a particular kind of methodical practice that requires looking long enough and carefully enough that difference begins to appear within what first presents itself as sameness. The practice keeps returning, with remarkable consistency across different projects and materials, to what circulation leaves behind: the marks and traces that accumulate even on objects designed to remain stable and unchanged.

Chang’s work can be read, in many ways, as a sustained practice of custody and care. He kept objects, pulled them out of circulation or gathered them from its margins. He indexed and organized them into systems that made their individual histories newly visible and legible. And then, crucially, he returned them to circulation in altered form: as archives open to examination, as exhibitions that invited direct encounter, as permanent records inscribed on Bitcoin. Through this process, he built situations and structures in which circulation itself becomes visible as a process. In which value turns concrete and measurable. The archive is consistently where this transformation takes place in his work — the site and the method through which individual objects become readable as parts of larger systems and patterns.

The retrospective gathers Chang’s method into a single frame and brings together projects from different moments in his career to demonstrate the underlying consistency of his approach across various materials and contexts. What remains is the structure he built, the archives he assembled with such care, the questions he persistently refused to resolve or close down prematurely. The promise of sameness keeps failing. Difference keeps appearing in the gaps and variations. The marks stay visible for anyone willing to look closely enough, and patiently enough, to actually see them.

This is a guest post by Steven Reiss. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

This post Rutherford Chang Retrospective: Hundreds and Thousands at UCCA Beijing first appeared on Bitcoin Magazine and is written by Steven Reiss.

Bitcoin Magazine

U.S. Treasury: U.S. Government Cannot Deploy Taxpayer Funds to ‘Bail Out’ Bitcoin

As Treasury Secretary Scott Bessent testified before the House Financial Services Committee Wednesday morning, Rep. Brad Sherman pressed Bessent over whether the U.S. government could ever step in to “bail out” bitcoin.

Bessent was presenting over the Financial Stability Oversight Council’s annual report on emerging economic risks and much of the comments and questions from the Council reference the Trump administration growing scrutiny over its economic agenda.

During a tense exchange, Sherman referenced the 2008 financial crisis and argued that bailouts have historically protected powerful institutions when markets collapse.

He asked whether Treasury or federal financial regulators could take similar action for bitcoin, including directing banks to buy BTC or changing banking rules to encourage crypto holdings.

Bessent rejected the premise outright. “I am Secretary of the Treasury. I do not have the authority to do that,” he said, adding that neither the Treasury nor his role as chair of the Economic Stability Oversight Council provides power to order banks to invest in BTC or to allocate public funds into crypto assets.

Sherman attempted to clarify whether taxpayer money under Treasury management could ever be deployed into BTC, but Bessent emphasized that the government’s current BTC exposure comes only through law enforcement seizures, not investment decisions.

“We are retaining seized bitcoin,” Bessent said. “That is an asset of the U.S.,” he later said.

Bessent then elaborated on that point, noting that retained bitcoin from past seizures has appreciated significantly over time.

He cited an example in which roughly $500 million in retained BTC later grew into more than $15 billion in value, underscoring bitcoin’s potential upside even as policymakers remain skeptical of direct government involvement.

The exchange ended when the chair cut Sherman off after his allotted time expired.

Bessent: U.S. will stop selling bitcoin

Earlier this year, Bessent said the U.S. government’s stance is to stop selling seized BTC and instead add it to the Strategic Bitcoin Reserve.

Speaking at the World Economic Forum in Davos, he framed the move as part of a broader push to bring digital-asset innovation back to the U.S.

The comments came amid questions over BTC seizures tied to cases involving Tornado Cash and Samourai Wallet developers.

While declining to discuss active litigation, Bessent stressed that seized BTC will be retained by the federal government once legal damages are resolved.

Any selling of BTC would contradict Executive Order 14233, which requires forfeited bitcoin to be held in the U.S. Strategic Bitcoin Reserve rather than liquidated.

This post U.S. Treasury: U.S. Government Cannot Deploy Taxpayer Funds to ‘Bail Out’ Bitcoin first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

UBS to Build Digital-Asset Infrastructure, Eyes Bitcoin Services for Individuals

UBS Group AG is exploring ways to offer bitcoin and crypto access to individual clients, CEO Sergio Ermotti said during the bank’s earnings call on Wednesday.

Ermotti said the Zurich-based lender is building the core infrastructure needed for digital-asset services while evaluating targeted products, ranging from crypto access for wealthy clients to tokenized deposit solutions for corporate customers.

“We are building out the core infrastructure and exploring targeted offerings from crypto access for individual clients to tokenized deposit solutions for corporates,” Ermotti said.

The UBS chief stressed the bank does not plan to be a first mover in blockchain-based technology.

Instead, UBS is pursuing what Ermotti described as a “fast follower” strategy in tokenized assets, with expansion expected to unfold over the next three to five years alongside its traditional banking business.

It was reported last month that UBS is in the process of selecting partners for a crypto offering aimed at some of its high-net-worth clients, marking a shift for a bank that has historically taken a cautious stance on virtual tokens.

Like many global lenders, UBS has so far focused its digital-asset work on blockchain infrastructure for tokenized funds and payments.

Banks have generally moved slowly into areas like crypto trading, in part due to stricter capital requirements under the Basel III framework.

Other European banks like UBS exploring bitcoin

Other banks are also starting to embrace bitcoin and crypto offerings. DZ Bank recently secured MiCAR approval and will roll out its “meinKrypto” platform across cooperative banks, allowing customers to trade and custody Bitcoin and other digital assets directly within existing banking apps, while also joining a consortium developing a regulated euro stablecoin.

Also, the Sparkassen-Finanzgruppe plans to launch Bitcoin and crypto trading for private customers by the summer of 2026, with technical support from DekaBank, marking a reversal from its earlier skepticism toward digital assets and crypto.

Also earlier this week, ING Deutschland, one of Germany’s largest retail banks, said they will began offering retail clients access to cryptocurrency-linked exchange-traded notes (ETNs) and products, allowing customers to gain exposure to bitcoin and other crypto directly through their existing securities accounts.

According to information published on ING’s website, the products are physically backed exchange-traded instruments issued by established asset managers including the likes of 21Shares, Bitwise, and VanEck.

This post UBS to Build Digital-Asset Infrastructure, Eyes Bitcoin Services for Individuals first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

CryptoSlate

The White House's end-of-February deadline for banks and crypto firms to resolve the “stablecoin yield” debate exposes a structural fault line that was never going to stay buried.

This isn't a speed bump on the road to crypto-friendly regulation. Instead, it's a core collision that happens when digital dollars scale large enough to threaten the business model of deposit-taking itself.

According to multiple reports, the White House convened banks and crypto representatives with an explicit mandate: find common ground on whether platforms can offer rewards on stablecoin holdings, or risk broader market structure legislation collapsing in 2026.

Reuters confirmed the summit's focus on “interest and other rewards,” framing it as an attempt to unstick a bill already delayed by this exact clash.

The stakes are binary.

If Coinbase, banks, and other stakeholders reach consensus this month, the CLARITY Act advances. However, almost certainly in a form that neither side currently recognizes.

If they don't, the broader digital asset market structure package dies for the year, and crypto's regulatory momentum fractures into agency-by-agency enforcement rather than comprehensive legislation.

What's actually being fought over

The technical dispute centers on whether exchanges, wallets, or other intermediaries can pass Treasury yields to users as “rewards” on stablecoin holdings.

Stablecoin issuers earn yield on reserves, such as primarily short-dated Treasuries and overnight instruments. Yet, under the framework Congress designed, issuers themselves cannot pay interest directly to holders.

That prohibition was intentional: lawmakers wanted to distinguish payment stablecoins from deposit accounts.

Banks argue that allowing exchanges or affiliates to offer yield-like rewards circumvents that intent.

The American Bankers Association and Bank Policy Institute have urged senators to “close the loophole,” arguing that any third party paying rewards tied to stablecoin balances effectively converts a payment instrument into a savings product.

Coinbase and crypto trade groups counter that Congress deliberately preserved the ability for third parties to offer lawful rewards.

The Blockchain Association's letters argue that GENIUS, the stablecoin framework, prohibited issuer interest but left room for platforms to design incentive structures tied to usage, transactions, or other engagement.

This isn't semantic hairsplitting. It's a distributional fight over who gets to route Treasury yields to consumers digitally, and whether doing so outside the banking system constitutes unfair competition or legitimate product innovation.

Why the fight matters now

Stablecoins crossed a threshold where hypothetical risk became quantifiable exposure.

Total stablecoin market capitalization sits around $305 billion as of early February 2026. That's large enough for banks to model deposit flight scenarios and large enough for regulators to worry about financial stability.

Standard Chartered estimated roughly $500 billion in US bank deposit outflows by the end of 2028, tied to stablecoin adoption, explicitly noting that the trajectory depends on whether third parties can offer interest.

The Bank Policy Institute cited a Treasury-attributed estimate of up to $6.6 trillion in deposit outflows under certain assumptions. This is a high-end stress scenario designed for persuasion but reflective of the scale banks now see as plausible.

The global context tightens the clock.

Hong Kong's regulator expects to issue its first stablecoin issuer licenses in March 2026.

The Bank for International Settlements documented three broad global approaches to stablecoin-related yields: complete bans, retail bans with institutional carve-outs, and no explicit prohibition.

The UK is designing a regime in which systemic payment stablecoin issuers hold a portion of their backing assets unremunerated with the central bank, specifically to prevent stablecoins from becoming savings products.

A deal happens, CLARITY advances

If consensus emerges by the end of February, the bill that moves forward will not resemble the clean House-passed version.

A crucial technical detail clarifies what “different format” likely means: the House Digital Asset Market Clarity Act's Section 404 addresses exchange registration with the CFTC, not stablecoin rewards.

The controversial “yield Section 404” language exists in Senate Banking drafts, not the House chassis.

So “different format” almost certainly means a Senate Banking overlay that bolts a stablecoin inducements title onto the House market-structure framework.

Three drafting pathways map to what stakeholders are already signaling.

The most likely compromise is an “activity-based rewards” safe harbor. Senate-side language being discussed publicly centers on banning yield paid solely for holding a payment stablecoin while allowing rewards tied to activity: payments, transactions, loyalty programs, and settlement.

The bill would define “solely for holding” tightly, prohibiting time-based APY marketing while permitting behavioral incentives.

If this version passes, stablecoin rewards become a regulated marketing and product-structure engineering exercise. Expectations are that platforms will shift from “park USDC, earn 4%” to “transact or route payments, earn rebates.”

A second pathway involves a “reserve-at-community-banks” quid pro quo. Reports suggest compromise discussions include requiring stablecoin reserves to be held with community banks.

This is political and industrial policy: turn stablecoins into a new distribution channel for bank balance sheets rather than a substitute for them.

A third option splits retail and institutional treatment. A bill could prohibit retail “yield-like” rewards while allowing institutions to receive fee rebates or settlement incentives, subject to disclosure and capital rules.

This tilts stablecoin growth away from consumer savings substitution and toward B2B settlement, collateral, and treasury operations, which is precisely where banks also want to compete.

Standard Chartered's $500 billion deposit outflow scenario assumes meaningful rewards remain available.

If the deal sharply constrains retail rewards, adoption tilts away from “savings substitute” and toward “payments rail,” lowering outflow risk relative to the high-end bank memos.

| Draft pathway | What it bans | What it allows | What Coinbase sells to users | What banks get | Who wins / loses | Regulatory implication |

|---|---|---|---|---|---|---|

| Activity-based rewards safe harbor | Rewards paid solely for holding a payment stablecoin; time-based APY marketing; “park-and-earn” framing | Rewards tied to activity: payments, transactions, loyalty programs, settlement/routing; clearly disclosed platform-funded incentives | “Earn rebates for using stablecoins” (spend/route/pay) rather than “earn yield for holding” | Reduced risk of stablecoins behaving like deposit substitutes; clearer boundary between payments vs savings | Winners: compliant platforms + payments-focused stablecoins. Losers: passive-yield products and “savings wrapper” UX | Forces product-structure engineering + marketing rules: definitions, disclosures, audit trails around what counts as “activity” |

| Reserve-at-community-banks quid pro quo | (Typically) unconstrained rewards without reserve-placement/partnering conditions; reserve structures that bypass local bank channels | Some rewards may remain, but reserves (or a portion) must be held via community banks / bank channels; creates a banking “participation” requirement | “Rewards stay (maybe), but backed by a more bank-integrated plumbing” | A direct balance-sheet foothold in stablecoin growth; political cover via “local lending” narrative | Winners: community banks and issuers/platforms that can operationalize reserve routing. Losers: issuers/platforms designed to minimize bank dependence | Turns stablecoins into industrial policy: codifies which institutions get the reserve float, adds operational compliance and concentration/eligibility rules |

| Retail vs institutional split | Retail-facing yield-like rewards; consumer products that resemble savings accounts | Institutional fee rebates / settlement incentives under conditions (disclosure, risk controls, capital treatment); B2B settlement/collateral use cases | “Retail won’t earn yield for holding; institutions get efficiency rebates” | Retail deposit protection; banks can compete where they already play: treasury, settlement, collateral | Winners: institutions, market makers, treasury platforms; banks in wholesale rails. Losers: retail exchanges/wallets relying on yield to acquire users | Accelerates a two-track stablecoin market (retail constrained, institutional permissive), shifting growth toward B2B rails and formal supervisory perimeter |

No deal, CLARITY dead for 2026

If no consensus emerges by the deadline, two things happen simultaneously.

The first is that legislative momentum stalls. Reuters framed the White House summit as an attempt to unstick a bill already delayed by the bank-crypto clash. Commentary points to the midterm timing and the lack of bipartisan runway as structural risks to passage if this drags on.

Even if everyone stays “pro crypto,” the calendar can kill the package. However, regulatory momentum fragments instead of vanishing.

Even if CLARITY slips, stablecoin rules still move via existing law and implementation. GENIUS implementation questions are part of why “loophole” fights matter. The US ends up with a stablecoin regime but no unified market-structure perimeter.

That means enforcement and agency interpretation fill the gap.

“No CLARITY” doesn't mean “no regulation.” It means more path dependence: case-by-case constraints, uneven state and federal overlays, and product design shaped by enforcement risk rather than statutory clarity.

Stablecoins move faster than the broader token market because they touch banks, deposits, and payments, areas where regulators already have tools.

Tribalism survives even if CLARITY passes

The stablecoin yield fight exposed that “crypto” is not a single lobby but competing profit centers with different optimal rules.

The coalition is business models versus business models, and not “crypto versus banks.” The fault lines now run through the industry itself.

Brogan Law reported that Tether's US operation told Senate Banking members it supports the draft approach restricting yield and distanced itself from Coinbase's decision to take the fight public.

The logic is clear: Coinbase and USDC distribution economics make rewards central to growth, while Tether's dominant offshore footprint makes it less dependent on US retail reward mechanics.

The split matters because it sets expectations for future legislative fights.

Once “stablecoin yield” becomes the gating factor for market structure, it becomes a reusable veto point. Next time Congress tries to legislate DeFi, custody, or taxation, expect firms to defect early if the draft threatens their profit-and-loss statements.

This has permanent effects even if a deal is struck.

Banks now have a template: pair financial stability memos with community-bank “local lending” narratives and force a hard yes-or-no on economic incentives.

Additionally, global competitive framing hardens, as other jurisdictions actively license and structure regimes. Meanwhile, the US indecision becomes part of the story firms tell boards about where to base product lines.

The question that remains open

The stablecoin yield war is a structurally inevitable collision that occurs when payment instruments scale large enough to function as deposit substitutes, routing the risk-free rate to consumers.

Regulators worldwide agree on a principle: payment stablecoins should not resemble savings products. The US tried to thread that needle by banning issuer interest while leaving third-party rewards ambiguous.

That ambiguity is now the battleground. Whether it results in an activity-based compromise, a reserve-placement deal, or a retail-versus-institutional split, the outcome determines not just CLARITY's fate but also the blueprint for every future crypto bill.

The fight clarifies what “crypto-friendly regulation” actually means: not frictionless adoption, but negotiated settlements where someone's business model loses.

The deadline is February 28. What happens next determines whether the US enacts comprehensive digital asset legislation in 2026 or watches stablecoin rules advance while market structure fragments into agency enforcement and jurisdictional patchwork.

The post White House sets February deadline to settle $6.6 trillion fight between Coinbase and banks appeared first on CryptoSlate.

Hyperliquid has broken ranks with the broader digital asset market, posting a massive double-digit rally while Bitcoin and other major altcoins like XRP suffer from the bear market.

According to CryptoSlate's data, Hyperliquid's HYPE is one of the crypto market's top performers over the past two weeks, jumping roughly 71% to a high of $35, its highest price since last December.

This price performance reflects crypto traders’ positive sentiment about the protocol's potential to expand product offerings.

Notably, the price action stands in sharp contrast to the ugly tape elsewhere. Over the past weeks, a sharp risk-off wave has hit corners of the market, and the damage hasn’t been isolated to digital assets.

The same macro tremors that knocked crypto lower also jolted precious metals and other risk trades, wiping around $6 trillion over the first few weeks of 2026.

And yet in the middle of that giant market-wide red screen, HYPE is acting like a different animal, with US investors driving its uptrend.

The simplest explanation that capital is just rotating into a strong chart misses what makes this move structurally interesting.

Essentially, HYPE is increasingly trading less like a generic altcoin and more like an exchange-linked asset whose demand can rise because markets get messy. In a risk-off regime, most tokens are punished for being “risk.”

However, venues that monetize volatility can see fundamentals improve when everyone else’s fundamentals degrade.

Hyperliquid's volatility revenue

Hyperliquid’s core product is perpetual futures. When volatility spikes, perpetual volume typically rises as traders hedge, speculate, rotate across assets, and are liquidated more frequently.

That activity throws off fees, and Hyperliquid’s design links those fees back to token demand in a direct, mechanical loop.

On DefiLlama, Hyperliquid Perps shows a 30-day perp volume of $216.286 billion and a 24-hour perp volume of $11.778 billion.

This activity is accompanied by 30-day revenue of $68.42 million and annualized revenue of $834.7 million. At the same time, open interest on the platform currently exceeds $6 billion.

These numbers matter because of the “what happens next” step. DefiLlama’s methodology notes that 99% of fees go to an Assistance Fund for buying HYPE tokens, excluding builder fees.

In other words, more trading activity can translate into more buy pressure for the token, which is built into the plumbing rather than dependent on sentiment.

That is the core reason HYPE can appear to be the “sole winner” during broad drawdowns. If fear increases turnover, the protocol’s cashflow loop can strengthen even while the rest of the market deleverages.

For context, data from ASXN show that the daily HYPE buyback rate climbed to nearly $4 million earlier this month, the highest level since last November. When expanded to the past month, the rate exceeded $55 million.

Two takeaways fall out of that set of numbers.

First, buyback intensity has accelerated recently. The 30-day figure implies an average of approximately $1.86 million per day, whereas the 7-day figure implies $2.85 million per day, consistent with a market that has become more active and more volatile.

Second, the buybacks have been executed at progressively higher average prices over shorter windows ($25.81 over 30 days versus $31.36 over the past 24 hours), which fits the broader point that HYPE demand is tightening as activity rises.

Hyperliquid is widening the volatility surface area

Hyperliquid’s significant price gains also have strong product catalysts that are easy to overlook if you only track price.

The protocol is effectively widening the “volatility surface area” it can capture by moving beyond standard crypto assets into Real World Assets (RWAs) and permissionless markets, a strategy unlocked by its recent HIP-3 upgrade.

HIP-3 made Hyperliquid more permissionless on listings, allowing the protocol to support builder-deployed perpetual markets. These deployers must maintain 500,000 staked HYPE and are subject to slashing via a validator vote in the event of malicious operation.

That stake requirement serves as a direct token sink and imposes a “cost of entry” for builders seeking to rapidly list markets.

This infrastructure enabled the platform's rapid expansion into commodities. Milk Road, a crypto commentary platform, noted that this trend deserves way more attention than it is getting.

The firm attributed HYPE's rally to this integration of RWAs, noting that Hyperliquid has captured 2% of the world's primary silver market despite listing the metal roughly 30 days ago.

Milk Road described this volume as “INSANE,” emphasizing that silver trading volume indicates that the HYPE token can thrive rather than merely survive the market downturn.

Data from Flowscan show that cumulative open interest across HIP-3 DEXs has exceeded $28 billion.

New competitor against Polymarket?

Meanwhile, the newest narrative tailwind is HIP-4, which introduces outcome-style, event-based markets.

Hyperliquid stated that HIP-4 will introduce fully collateralized contracts that settle within fixed ranges. These are positioned as prediction-market-like instruments and limited-risk, options-style structures designed to avoid margin calls and liquidation cascades.

According to the firm:

“Outcomes bring non-linearity, dated contracts, and an alternative form of derivative trading that does not involve leverage or liquidations. The outcome primitive expands the expressivity of HyperCore, while composing with other primitives such as portfolio margin and the HyperEVM.”

Data from Santiment indicates that the crowd appears to be hyped about Hyperliquid rolling out HIP-4. The firm noted that recent price action suggests that community expectations regarding new derivatives and prediction markets could attract additional volume.

Notably, discussions of HIP-4 have also included comparisons with existing prediction platforms.

DeFi analyst Ignas said Hyperliquid's HIP-4 is notable because if outcomes compose with perps, a trader can long ETH and buy an ‘ETH below $2,000' outcome as a hedge, causing their margin to drop because the positions offset each other.

According to him, competitors such as Polymarket and Kalshi cannot do this.

Additionally, he noted that Hyperliquid's permissionless deployment could confer advantages, as the platform allows anyone to create markets, whereas upcoming rivals such as Polymarket do not support this feature.

HYPE faces an impending headwind

Despite the bullish structural arguments, HYPE faces a significant test this week.

Data from Tokenomist indicates that the next Hyperliquid unlock is scheduled for Feb. 6 and will release 9.92 million HYPE to core contributors, which is approximately $335 million at recent prices.

This is where the “mechanical bid” narrative meets real market structure. If Hyperliquid Perps generates roughly $68.42 million in 30-day revenue, the unlock’s notional value is approximately 4.9 times the monthly run rate.

That doesn’t mean the buyback loop cannot handle it. It means the path matters. If unlocked holders sell aggressively and quickly, the market can gap down even with steady buybacks, especially if broader risk appetite remains weak.

However, if selling is staggered or volatility keeps volumes elevated, buybacks can act as a stabilizer, turning “unlock fear” into a buy-the-dip setup for traders.

But if the broader market volatility collapses as the macroeconomic backdrop calms and traders step away, the buyback yield declines, and HYPE starts trading more like a standard risk asset again.

The post Hyperliquid flips the bear market script with a 71% surge while trillions vanish from global risk trades appeared first on CryptoSlate.

Ethereum was cheaper than expected in 2020, and rollup decentralization was slower than promised in 2021. Those two realities are forced the ecosystem to rewrite what “a layer-2” is for.

Vitalik Buterin's recent post on Ethereum Research bluntly frames the shift: the original vision of layer-2 (L2) blockchains as “branded shards” of Ethereum is no longer viable, and the ecosystem requires a new path.

However, this isn't abandonment. Instead, it is a re-tiering of expectations and a sharper definition of what different types of rollups are actually building.

The question now is the new job description, since the premise underlying the rollup-centric roadmap has weakened.

Stage 2 is scarce

L2BEAT provides the clearest framework for understanding rollup decentralization through its Stages system.

Stage 0 denotes that training wheels remain in place, with meaningful trust assumptions persisting.

Stage 1 represents partial decentralization with stronger escape hatches and proof guarantees, but still meaningful upgrade or governance trust.

Stage 2 is the “no training wheels” milestone, in which critical safety properties are enforced by code rather than by discretionary actors.

The current distribution of value secured across the L2 ecosystem indicates this. According to L2BEAT's rollup scaling summary, approximately 91.5% of the listed value sits in Stage 1 rollups, 8.5% in Stage 0, and roughly 0.01% in Stage 2.

The top three rollups by value account for roughly 71% of the total, indicating that “Stage 2 progress” largely depends on the decisions of the largest few projects, rather than on what smaller experimental chains attempt.

The core blocker is whether the proof systems can be overridden and whether upgrades face strong delays and constraints.

Upgrade discretion remains common among the largest rollups, and moving beyond it has proven slower and more difficult than anticipated by the 2020-2021 optimism.

Some projects have explicitly stated that they may not wish to proceed beyond Stage 1, citing not only technical constraints related to zkEVM safety but also regulatory requirements that require absolute control.

That's a legitimate product decision for certain customer bases, but it clarifies that those chains are not “scaling Ethereum” in the sense the rollup-centric roadmap originally meant.

| Project | Stage | TVS ($) | Proof type | Upgrade key / security council present? | Notes |

|---|---|---|---|---|---|

| Arbitrum One | 1 | 16.16B | Optimistic | Yes | Emergency path can skip delays |

| Base Chain | 1 | 10.99B | Optimistic | Yes | Upgrades approved by multiple parties; no delay |

| OP Mainnet | 1 | 1.88B | Optimistic | Yes | Security council instant upgrade power |

| Lighter | 0 (Appchain) | 1.27B | Validity | Yes | 21d delay, emergency can go to 0 |

| Starknet | 1 | 676.17M | Validity | Yes | Security council can upgrade with no delay |

| Ink | 1 | 523.71M | Optimistic | Yes | Security council + foundation approvals; no regular delay |

| Linea | 0 | 492.93M | Validity | Yes | Multisig can upgrade with no delay |

| ZKsync Era | 0 | 417.07M | Validity | Yes | Emergency board can bypass upgrade delays |

| Katana | 0 | 297.94M | Validity | Yes | security council can remove the upgrade delay |

| Unichain | 1 | 168.81M | Optimistic | Yes | no exit window for regular upgrades; instant powers |

Why the constraints changed

The Oct. 2, 2020, post “A rollup-centric Ethereum roadmap” on the Fellowship of Ethereum Magicians laid out the original thesis.

Gas prices were climbing, some applications were being forced to shut down, and the conclusion was that the ecosystem would be “all-in on rollups” for the near and medium term.

Base-layer scaling should prioritize data capacity for rollups, and users would increasingly live on L2.

Two hard facts have shifted since then. First, L1 is substantially cheaper at present. Etherscan shows a seven-day average transaction fee of around $0.35 and gas snapshots in the fractions of a gwei.

On Jan. 16, Ethereum recorded an all-time high of 2,885,524 transactions in a single day. The narrative is “busier and cheaper,” exactly the opposite of the 2020 crisis that motivated the rollup-centric roadmap.

Second, L1 execution capacity is rising. Ethereum's block gas limit was raised to approximately 60 million after broad validator signaling in late 2025, up from the long-standing 30 million limit.

At roughly 12-second blocks, 60 million gas translates to approximately 5 million gas per second.

Aspirational community discussions have mentioned targets as high as 180 million gas, which would represent a threefold increase, though that remains directional rather than committed.

The clean interpretation: the 2020 premise that “L1 can't scale for most users” is weaker in today's fee regime. This creates room for L2s to be a spectrum of security and sovereignty trade-offs rather than all being near-identical “shards” competing solely on price.

L2s as a spectrum, not clones

Buterin's proposed reframing treats L2s as occupying a full spectrum.

On one end are chains backed by the full faith and credit of Ethereum, with unique properties, not just EVM clones but also privacy-focused systems, non-EVM execution environments, or ultra-low-latency sequencers.

At the other end are options with varying levels of Ethereum connectivity that users and applications can choose based on their specific needs.

The new minimum bar is straightforward: if you handle ETH or Ethereum-issued assets, reach at least Stage 1.

Otherwise, you're a separate L1 with a bridge, and should call yourself that. The differentiation bar is harder: be the best at something other than “cheap EVM.”

Examples Buterin cites include privacy, efficiency specialized to a particular application, truly extreme scaling beyond even an expanded L1, fundamentally different designs for non-financial applications such as social or identity systems, ultra-low-latency sequencing, or features such as built-in oracles or decentralized dispute resolution that aren't computationally verifiable.

The mechanism that might facilitate this is still under investigation. A “native rollup precompile” would enable Ethereum to verify a standard zkEVM proof within the protocol.

For rollups that are “EVM plus extras,” this means the canonical EVM verification occurs trustlessly at the protocol level, and the rollup only needs to prove its custom extensions separately.

This could enable stronger interoperability and pave the way for synchronous composability, in which contracts across different rollups can interact within the same transaction. Yet, it remains a research trajectory, not a deployed feature.

The Jan. 16 post “Combining preconfirmations with based rollups for synchronous composability” and the Feb. 2 post “Synchronous composability between rollups via realtime proving” lay out the design space but don't represent shipped protocol changes.

Three buckets emerging

If this reframing takes hold, expect rollups to split into clearer categories.

The first bucket is Stage 2-chasing settlement rollups that maximize Ethereum security inheritance.

These projects aim to achieve code-enforced guarantees with minimal discretionary governance, treating “scaling Ethereum” as their core mandate.

The second bucket is regulated or controlled execution environments.

These optimize for compliance, permissioning, or specific institutional requirements. They may never progress beyond Stage 1 by design, and they should market that control honestly as a feature rather than pretending to offer full decentralization.

The third bucket is specialized chains optimized for latency, privacy, app-specific execution, or non-financial use cases.

Privacy rollups using zkProofs to hide transaction details, ultra-low-latency sequencers for trading applications, or social and identity systems with fundamentally different state models all fall within this category.

These don't need to be EVM-compatible or even financial to justify their existence, they need to provide value that their users can't get elsewhere.

Projects such as Arbitrum One, Optimism, Base, zkSync Era, and Starknet will each need to decide which category they're pursuing. The ecosystem is large enough to support all three, but the assumption that every L2 performs the same function is fading.

What changes for users and builders

For users, the burden shifts to understanding guarantees. Escape hatches, upgrade delays, proof systems, and censorship resistance become product differentiators rather than assumed properties.

Wallets and interfaces will need to label trust assumptions more explicitly, and the L2BEAT Stages framework aims to make these assumptions legible.

For builders, “cheap EVM” is commoditized. Differentiation moves to privacy and custom virtual machines, ultra-low-latency sequencing, app-specific throughput optimizations, non-financial applications in social, identity, or AI contexts, or compliance and permissioning as an explicit product, without claiming it's “Ethereum scaling.”

For the broader market narrative, expect a louder debate about whether L2s “inherit Ethereum security” in practice rather than as an aspiration.

The critique is already a talking point among rival L1 proponents, and the ecosystem's acknowledgment that many large rollups remain at Stage 1 with discretionary governance gives that critique greater traction.

Is an L2 revolution about to start?

Ethereum is unlikely to see an L2 revolution. Instead, it will witness a re-tiering.

The rollup-centric roadmap assumed that L2s would be near-identical “branded shards” competing primarily on cost, while L1 would remain expensive and capacity-constrained.

That assumption no longer holds. L1 is cheaper and expanding, whereas L2s are diverging faster than they are converging in their security models and use cases, despite Stage 2 decentralization.

The new path acknowledges that reality. L2s that custody ETH or Ethereum-issued assets should meet a minimum security bar, Stage 1 at least. And beyond that, they should compete on specialization and explicit guarantees rather than pretending to be interchangeable.

Native verification primitives and research on synchronous composability signal where Ethereum aims to make that easier, but these are trajectories, not deployed features.

The job description changed.

The minimum bar is to offer credible security when handling Ethereum assets. The differentiation bar is being the best at something, and being honest about the trust model.

The rollup-centric roadmap got upgraded to accommodate the reality that L1 is scaling and L2s are more diverse than the original vision anticipated.

The post Ethereum fees are plummeting so fast that Vitalik Buterin says most Layer 2 chains now lack purpose appeared first on CryptoSlate.

While price action has always been volatile and, arguably, exciting, the Bitcoin network itself is built to feel boring. Ten minutes per block, tick tock, rinse and repeat, a metronome you can set your watch to.

Then every so often, it gets very human again.

Early this morning, block production slowed enough that the average block time briefly spiked to 19.33 minutes. On the surface, it appears to be a technical issue. Below, it reads like a real-time pulse check of an industry that operates on thin margins, loud fans, cheap power, and a lot of stress.

When miners shut down their machines, the network does not immediately adjust. Bitcoin’s difficulty only updates every 2,016 blocks, so if the hashrate drops quickly, blocks come in slower until the next retarget. That gap between reality and the protocol’s response is where you get the weird mornings, the longer waits, the uneasy posts in mining chats, the quiet “something’s off” feeling.

Right now, “off” looks a lot like miners backing away.

The network is telling you miners are stepping back

Over the last stretch of difficulty adjustments, more of them have been negative, and that matters because difficulty is Bitcoin’s way of matching the workload to the number of machines competing to solve blocks.

Hashrate Index’s latest weekly roundup noted the most recent difficulty adjustment on Jan. 22 came in at a -3.28% cut, bringing difficulty to about 141.67T, and it flagged an early estimate for another large negative adjustment in the next cycle, around the Feb. 8 window, with early-epoch projections bouncing near the mid-teens percentage range, while cautioning those estimates can change as the epoch develops.

Other trackers are landing in the same neighborhood. On mempool, the estimated next adjustment is a decline near 15%, and the site’s dashboard has average block time running around the 11 to 12 minute range in the current stretch.

That is slower than the ten-minute target, and it matches the story the charts are trying to tell, miners pulled back, the network is slogging along, the protocol is waiting for the next recalibration.

CoinWarz puts the next difficulty estimate at 121.78T, down about 14.04%, with the average block time around 11.63 minutes, and the retarget date pointing to Feb. 8.

The next adjustment is, therefore, set to be the sharpest drawdown since the post-China-ban era. A block-time spike is a symptom. A run of negative difficulty adjustments is a diagnosis.

Why a 14 to 18% difficulty cut would be a big deal

A double-digit difficulty cut is the protocol admitting the mining economy has changed fast enough that the previous setting no longer fits. For people outside mining, it's background noise. For miners, it is the difference between a fleet that limps along and a fleet that has to shut the lights off.

If the next adjustment lands around 14 to 18%, it would be large enough to put a marker down, especially coming after multiple negative adjustments in recent months. It would also be a reminder that Bitcoin’s difficulty algorithm is a shock absorber, not a crystal ball.

A move that size has happened before, and bigger ones have too.

The largest single downward difficulty adjustment on record came in early July 2021, when difficulty fell about 28% after China’s mining crackdown forced a massive chunk of the global hashrate offline.

So a 14 to 18% cut has precedent, and the network has seen much worse, the context is different though, the China era was a sudden geopolitical shock, today’s pressure looks like a slower squeeze, price, power, and profitability grinding against each other.

The impact for traders is the margin call

Mining is a business where the product is math and the input is electricity, which means the industry lives and dies by spreads.

When Bitcoin’s price falls, miners earn fewer dollars for the same amount of Bitcoin. When power costs rise, or when a region tightens supply during weather events, their input costs climb. When both happen together, older machines and higher-cost sites get pushed out first.

That is why the story keeps snapping back to “who can stay online.”

Hashrate Index’s roundup pegged USD hashprice around $39.22 per PH per day in its snapshot, which is one of the clearest shorthand metrics for miner revenue, and it noted that the forward market was pricing an average hashprice around $39.50 over the next six months.

However, the sharp price drop over the last week has since brought the 6-month forward market pricing down to $32.25.

That little detail is easy to skim past, and it might be the most useful forecasting anchor in the whole dataset. The fact that it repriced lower so quickly suggests the market is settling into a tighter, weaker profitability band rather than betting on a fast recovery.

If you talk to miners when hashprice compresses, the language gets less theoretical. It turns into power contracts, curtailment programs, lenders, machine loans, and the constant question of whether to keep plugging in gear that earns pennies over power, or to shut down and wait for difficulty to come to you.

That is what negative adjustments do, they act like relief.

When difficulty drops, every miner who stays online earns a bit more Bitcoin per unit of hashrate, all else equal. Some of the machines that were pushed out can come back. Some operators get to breathe again.

It is one of Bitcoin’s strange balancing acts, the protocol is indifferent, but the outcome is deeply personal for the people running warehouses of hardware.

What happens next, three paths to watch

The cleanest narrative from here is a difficulty relief bounce.

Difficulty cut

If the network cuts difficulty by something like 14 to 18%, block times should drift back closer to ten minutes, and profitability for online miners improves immediately.

That tends to slow the bleeding, and it can even bring some hashrate back, especially if the underlying issue was marginal economics rather than an external shock. The mempool dashboard on mempool gives a real-time view of whether block times are mean-reverting.

Difficulty cut and price decline

A tougher path is a prolonged squeeze.

Difficulty can fall, and miners can still struggle if Bitcoin’s price keeps sliding, or if energy costs stay elevated, or if credit conditions tighten further for mining firms that rely on financing.

In that world, you can see a loop, hashrate declines, difficulty adjusts down, revenue relief arrives, price pressure returns, and weaker operators get tapped out anyway.

Difficulty cut, price decline, and miner pivot

A third path is quieter, and it is about structural change.

Mining has been drifting toward flexible, power-aware operations for years, the miners that can curtail during peak prices and ramp up when the grid is cheap tend to survive longer.

The industry is leaning harder into that model, along with a shift toward AI. As certain regions face recurring curtailment and more power is diverted to AI, the hashrate line may stay lower for longer, and difficulty adapts to a new equilibrium.

Beyond the immediate operational changes, the shift signals how miners are being forced to adapt to tighter margins, evolving regulatory pressures, and increasing competition for energy resources.

As the industry matures, these adjustments could reshape the balance of power among mining firms, accelerate consolidation, and influence Bitcoin’s long-term network security and decentralization.

What this means for everyone else

For ordinary Bitcoin users, a slower block cadence mostly shows up as waiting, and sometimes as higher fees when demand stacks up. It is not usually catastrophic. It is more like traffic.

For miners, it is the entire business.

For the broader market, it is one of the few times you can see the invisible infrastructure wobble in public, the base layer showing its seams. Bitcoin’s security model is tied to miner revenue in dollar terms, and when that revenue compresses, the conversation about network health gets louder.

The thing is, Bitcoin is designed to keep going through this. Difficulty adjusts. Blocks keep arriving. The metronome finds the beat again.

The interesting part is the story inside that adjustment, the people on the other end of the machines, the operators doing the math at 3 a.m., deciding what stays on and what goes dark, and the network quietly recording those choices in the only language it knows, time between blocks.

If the next retarget lands anywhere near the mid-teens, it will read as a clear signal that miners are stepping back in a meaningful way, and it will also be a reminder that the protocol is still doing what it has always done, absorbing the shock, resetting the difficulty, and letting the system move forward, one block at a time.

The post Bitcoin mining profit crisis hits as difficulty to drop by 14% this weekend while block time spikes to 20 minutes appeared first on CryptoSlate.

US spot Bitcoin exchange-traded funds recorded $561.8 million in net inflows on Feb. 2, ending a four-day streak of nearly $1.5 billion in outflows.

Investors could interpret the number as a return of conviction after punishing outflows, but Jamie Coutts, chief crypto analyst at Real Vision, offered a different read.

According to him:

“Aggregate ETF flows are not buying the dip. Net institutional demand is coming almost entirely from a shrinking group of Treasury-style buyers with remaining balance-sheet capacity. That's not sustainable under continued pressure. A durable Bitcoin bottom likely requires these actors to reverse their positioning — not just slow their selling.”

The distinction matters because ETF inflows measure net share creation in the primary market, not whether the marginal buyer is taking directional Bitcoin risk.

A positive flow print can represent risk-on conviction or risk-off positioning dressed up as demand. The difference hinges on what occurs in the derivatives market immediately after those ETF shares are created.

Flows aren't exposure

Exchange-traded fund creations and redemptions are executed by authorized participants, which are large institutions that keep ETF prices close to net asset value through arbitrage.

When an ETF trades at a premium or discount to its underlying holdings, authorized participants can profit by creating or redeeming shares. That activity shows up as “flows” even when the initiating trade is market structure-driven rather than a macro dip-buy.