Cryptocurrency Posts

Crypto Briefing

Ripple launches a $750M share buyback, valuing the company at $50B as it expands its digital asset infrastructure business.

The post Ripple Labs launches $750M share buyback, valuing firm at $50B appeared first on Crypto Briefing.

Foundry plans to launch an institutional grade Zcash mining pool in April 2026, expanding compliant mining infrastructure for the network.

The post Foundry expands mining infrastructure with Zcash pool launch appeared first on Crypto Briefing.

Revolut receives PRA approval to launch a UK bank, enabling FSCS protected deposits and new services for its 13 million UK customers.

The post Revolut secures UK banking license enabling deposit and lending services appeared first on Crypto Briefing.

The integration of AI agents with blockchain infrastructure could revolutionize secure transaction execution, enhancing the onchain economy.

The post CoinFello unveils open source OpenClaw skill with MetaMask for AI agent transactions appeared first on Crypto Briefing.

The potential acquisition could reshape the competitive landscape in the pizza industry, impacting market dynamics and investor confidence.

The post Papa John’s weighs $1.5 billion takeover offer from Irth Capital, stock jumps 20% appeared first on Crypto Briefing.

Bitcoin Magazine

Bitcoin Magazine

Michael Saylor’s Strategy (MSTR) Estimated To Have Already Bought Over 1,200 Bitcoin Today

Data from STRC.live and market trackers indicate that Michael Saylor’s bitcoin‑focused firm, Strategy, has purchased an estimated 1,200 BTC so far today via its preferred equity issuance.

Yesterday, on March 10, Strategy’s Variable Rate Series A Preferred Stock (STRC) posted a record $409 million in daily trading volume, accompanied by 3% 30-day volatility and a one-month VWAP near $99.78, the highest sustained average since issuance.

According to on‑chain indicators and STRC.live X posts, over 2000 bitcoin were accumulated that day, marking one of the largest one‑day buying events since the instrument’s launch and surpassing prior highs.

Strategy, the world’s largest public corporate holder of Bitcoin, has started to really lean on its Stretch (STRC) perpetual preferred shares to finance additional BTC purchases.

By amending its at‑the‑market program earlier this year, the company enabled multiple agents to sell STRC concurrently, boosting liquidity and enabling significant capital raises specifically earmarked for Bitcoin acquisition.

This latest estimated purchase comes on the heels of a $1.28 billion acquisition of 17,994 BTC announced in a recent SEC filing, which lifted Strategy’s total holdings to approximately 738,731 BTC, or roughly 3.5 % of Bitcoin’s circulating supply.

That buy was funded through a combination of common stock and STRC issuance, underscoring the firm’s multi‑pronged funding approach.

How does Strategy’s STRC work?

STRC functions as a bridge between traditional income investors, who prefer predictable distributions, and Strategy’s Bitcoin-heavy balance sheet, which carries both long-term asymmetry and short-term volatility.

The preferred stock’s variable-rate structure maintains demand near its $100 par value while paying a monthly dividend yielding roughly 11.5% annually, effectively translating Bitcoin treasury economics into a format accessible to fixed-income investors.

The combination of record liquidity and low volatility signals a shift in the investor base toward income-focused capital, which stabilizes trading behavior. These trends are early signs of product-market fit: a financial instrument meeting structural demand rather than relying on promotion.

For corporate leaders evaluating Bitcoin treasury strategies, STRC represents a way to add Bitcoin into broader capital structures.

It channels capital from multiple investor classes toward a common strategic reserve, potentially reshaping how companies finance operations and deploy Bitcoin as a structural asset.

At the time of writing, Bitcoin is trading near $71,000 and Strategy’s stock (MSTR) is trading down half a percentage point on the day.

This post Michael Saylor’s Strategy (MSTR) Estimated To Have Already Bought Over 1,200 Bitcoin Today first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

Bitcoin is Now a Global Financial Player as Institutions Take the Helm: Bitwise

Bitcoin is crossing a structural threshold, evolving from an experimental digital asset into a macro-scale instrument with global capital relevance, according to analysis from Bitwise.

Bitcoin’s market capitalization, liquidity depth, and volatility profile now resemble established macro markets, with price dynamics being shaped by institutional flows rather than retail-driven reflexive cycles.

More than $1 trillion in capital has been absorbed by the Bitcoin network, showing its growing intrinsic value. The protocol continues to function as a high-value settlement system, with trillions of dollars in economically meaningful transfers moving across the base layer in recent years, Bitwise wrote.

Institutional participation has accelerated through US spot ETFs, which began trading on January 11, 2024. These products rapidly realised latent demand for regulated Bitcoin exposure, recording the fastest asset growth in ETF history.

According to Glassnode and Bitwise data, current holdings in US spot ETFs total 1.26 million BTC, equivalent to roughly 6.3% of circulating supply and $84.9 billion in economic value.

Net cumulative inflows reached $54.4 billion, suggesting ETFs are absorbing a substantial share of on-chain profit, estimated at close to 9% of realised gains.

The expansion of Bitcoin options markets further signals institutionalisation. Open interest across Deribit and IBIT reached tens of billions of dollars, providing liquid instruments for hedging and yield generation.

IBIT has gained parity with Deribit, reflecting broader participation from institutions employing options strategies to manage exposure and deploy larger spot positions.

On-chain activity shows structural transformation in investor behaviour. Large transactions above $1 million now dominate total volume, accounting for nearly 69% of all transfers since the November 2022 low.

Bitcoin’s long-term holders are increasing as price behavior changes

Long-Term Holders, defined as addresses holding coins for more than 155 days, captured 75% of realised profit this cycle, marking a shift from prior cycles where mature holders accounted for roughly half of profit. Coin age analysis indicates older, dormant supply is re-entering circulation, aligning with the phase of mature investor distribution.

Price behavior has also shifted. Bitcoin’s realised volatility has declined, and its drawdown profile now more closely resembles that of major equities, such as the QQQ.

Institutional participants have acted as a structural backstop during stress events, absorbing forced selling and mitigating extreme drawdowns. While the market remains sensitive to shocks, the combination of ETF accumulation, options hedging, and large-scale on-chain flows has created deeper market structure and liquidity.

Recent macro events have tested Bitcoin’s resilience. During geopolitical shocks over the last couple of weeks and market turbulence, BTC traded near $70,000, briefly dipping to $60,000.

Options positioning reflects cautious rebuilding of exposure, with risk reversals indicating sustained interest in downside protection.

The macro backdrop, characterised by higher Treasury yields, inflation pressures, and energy market volatility, has created a stagflationary environment, yet Bitcoin has maintained stability relative to traditional high-beta assets, according to analysis from QCP.

In other words, Bitcoin is moving beyond being just a speculative digital asset. It’s becoming a tool that plays a real role in the global financial system.

Long-time holders are gradually letting go of coins that have sat untouched for years, while ETFs and other big investors are stepping in to absorb them.

This shift shows that Bitcoin is increasingly seen as both a reliable store of value and a global settlement network — a sign that its role in finance is evolving for the long term.

This post Bitcoin is Now a Global Financial Player as Institutions Take the Helm: Bitwise first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

The Core Issue: Outrunning Entropy, Why Bitcoin Can’t Stand Still

The IBD Process

Synchronizing a new node to the network tip involves several distinct stages:

- Peer discovery and chain selection where the node connects to random peers and determines the most-work chain.

- Header download when block headers are fetched and connected to form the full header chain.

- Block download when the node requests blocks belonging to that chain from multiple peers simultaneously.

- Block and transaction validation where each block’s transactions are verified before the next one is processed.

While block validation itself is inherently sequential, each block depends on the state produced by the previous one, much of the surrounding work runs in parallel. Header synchronization, block downloads and script verification can all occur concurrently on different threads. An ideal IBD saturates all subsystems maximally: network threads fetching data, validation threads verifying signatures, and database threads writing the resulting state.

Without continuous performance improvement, cheap nodes might not be able to join the network in the future.

Intro

Bitcoin’s “don’t trust, verify” culture requires that the ledger can be rebuilt by anyone from scratch. After processing all historical transactions every user should arrive at the exact same local state of everyone’s funds as the rest of the network.

This reproducibility is at the heart of Bitcoin’s trust-minimized design, but it comes at a significant cost: after almost 17 years, this ever-growing database forces newcomers to do more work than ever before they can join the Bitcoin network.

When bootstrapping a new node it has to download, verify, and persist every block from genesis to the current chain tip – a resource-intensive synchronization process called Initial Block Download (IBD).

While consumer hardware continues to improve, keeping IBD requirements low remains critical for maintaining decentralization by keeping validation accessible to everyone – from lower-powered devices like Raspberry Pis to high-powered servers.

Benchmarking process

Performance optimization begins with understanding how software components, data patterns, hardware, and network conditions interact to create bottlenecks in performance. This requires extensive experimentation, most of which gets discarded. Beyond the usual balancing act between speed, memory usage, and maintainability, Bitcoin Core developers must choose the lowest-risk/highest-return changes. Valid-but-minor optimizations are often rejected as too risky relative to their benefit.

We have a significant suite of micro-benchmarks to ensure existing functionality doesn’t degrade in performance. These are useful for catching regressions, i.e. performance backslides in individual pieces of code, but aren’t necessarily representative of overall IBD performance.

Contributors proposing optimizations provide reproducers and measurements across different environments: operating systems, compilers, storage types (SSD vs HDD), network speeds, dbcache sizes, node configurations (pruned vs archival), and index combinations. We write single-use benchmarks and use compiler explorers for validating which setup would perform better in that specific scenario (e.g. intra-block duplicate transaction checking with Hash Set vs Sorted Set vs Sorted vector).

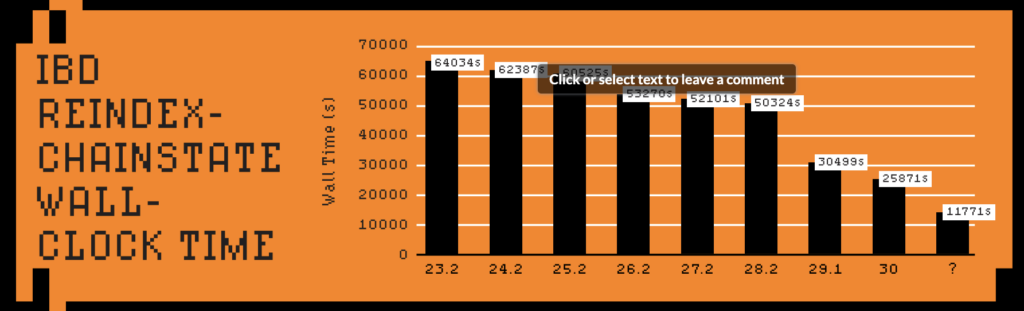

We’re also regularly benchmarking the IBD process. This can be done by reindexing the chainstate and optionally the block index from local block files, or doing a full IBD either from local peers (to avoid slow peers affecting timings) or from the wider p2p network itself.

IBD benchmarks often show smaller improvements than micro-benchmarks since network bandwidth or other I/O is often the bottleneck; downloading the blockchain alone takes ~16 hours with average global internet speeds.

For maximum reproducibility -reindex-chainstate is often favored, creating memory and CPU profiles before and after the optimization and validating how the change affects other functionality.

Historical and ongoing improvements

Early Bitcoin Core versions were designed for a much smaller blockchain. The original Satoshi prototype laid the foundations, but without constant innovation from Bitcoin Core developers it would not have been able to handle the network’s unprecedented growth.

Originally the block index stored every historic transaction and whether they were spent, but in 2012, “Ultraprune” (PR #1677) created a dedicated database for tracking unspent transaction outputs, forming the UTXO set, which pre-caches the latest state of all spendable coins, providing a unified view for validation. Combined with a database migration from Berkeley DB to LevelDB validation speeds were significantly improved.

However, this database migration caused the BIP50[1] chain fork when a block with many transaction inputs was accepted by upgraded nodes but rejected by older versions as being too complicated. This highlights how Bitcoin Core development differs from typical software engineering: even pure performance optimizations have the potential to result in unintended chain splits.

The following year (PR #2060) enabled multithreaded signature validation. Around the same time, the specialized cryptographic library libsecp256k1 was created, and was integrated into Bitcoin Core in 2014. Over the following decade, through continuous optimizations, it became more than 8x faster than the same functionality in the general-purpose OpenSSL library.

Headers-first sync (PR #4468, 2014) restructured the IBD process to first download the block header chain with the most accumulated work, then fetch blocks from multiple peers simultaneously. Besides accelerating IBD it also eliminated wasted bandwidth on blocks that would be orphaned as they were not in the main chain.

In 2016 PR #9049 removed what appeared to be a redundant duplicate-input check, introducing a consensus bug that could have allowed supply inflation. Fortunately, it was discovered and patched before exploitation. This incident drove major testing resource investments. Today, with differential fuzzing, broad coverage, and stricter review discipline, Bitcoin Core surfaces and resolves issues far more quickly, with no comparable consensus hazards reported since.[2].

In 2017 -assumevalid (PR #9484) separated general block validity checks from the expensive signature verification, making the latter optional for most of IBD, cutting its time roughly in half. Block structure, proof-of-work, and spending rules remain fully verified: -assumevalid skips signature checks entirely for all blocks up to a certain block height.

In 2022 PR #25325 replaced Bitcoin Core’s ordinary memory allocator with a custom pool-based allocator optimized for the coins cache. By designing specifically for Bitcoin’s allocation patterns, it reduced memory waste and improved cache efficiency, delivering ~21% faster IBD while fitting more coins in the same memory footprint.

While code itself doesn’t rot, the system it operates within constantly evolves. Every 10 minutes Bitcoin’s state changes – usage patterns shift, bottlenecks migrate. Maintenance and optimization aren’t optional; without constant adaptation, Bitcoin would accumulate vulnerabilities faster than a static codebase could defend against, and IBD performance would steadily regress despite advances in hardware.

The increasing size of the UTXO set and growth in average block weight exemplify this evolution. Tasks that were once CPU-bound (like signature verification) are now often Input/Output (IO)-bound due to heavier chainstate access (having to check the UTXO set on disk). This shift has driven new priorities: improving memory caching, reducing LevelDB flush frequency, and parallelizing disk reads to keep modern multi-core CPUs busy.

Recent optimizations

The software designs are based on predicted usage patterns, which inevitably diverge from reality as the network evolves. Bitcoin’s deterministic workload allows us to measure actual behavior and course correct later, ensuring performance keeps pace with the network’s growth.

We’re constantly adjusting defaults to better fit real-world usage patterns. A few examples:

- PR #30039 increased LevelDB’s max file size – a single parameter change that delivered ~30% IBD speedup by better matching how the chainstate database (UTXO set) is actually accessed.

- PR #31645 doubled the flush batch size, reducing fragmented disk writes during IBD’s most write-intensive phase and speeding up progress saves when IBD is interrupted.

- PR #32279 adjusted the internal prevector storage size (used mainly for in-memory script storage). The old pre-segwit threshold prioritized older script templates at the expense of newer ones. By adjusting the capacity to cover modern script sizes, heap allocations are avoided, memory fragmentation is reduced, and script execution benefits from better cache locality.

All small, surgical changes with measurable validation impacts.

Beyond parameter tuning, some changes required rethinking existing designs:

- PR #28280 improved how pruned nodes (which discard old blocks to save disk space) handle frequent memory cache flushes. The original design either dumped the entire cache or scanned it to find modified entries. Selectively tracking modified entries enabled over 30% speedup for pruned nodes with maximum dbcache and ~9% improvement with default settings.

- PR #31551 introduced read/write batching for block files, reducing the overhead of many small filesystem operations. The 4x-8x speedup in block file access improved not just IBD but other RPCs as well.

- PR #31144 optimized the existing optional block file obfuscation (used to make sure data isn’t stored in cleartext on disk) by processing 64-bit chunks instead of byte-by-byte operations, delivering another IBD speedup. With obfuscation being essentially free users no longer need to choose between safe storage and performance.

Other minor caching optimizations (such as PR #32487) enabled adding additional safety checks that were deemed too expensive before (PR #32638).

Similarly, we can now flush the cache more frequently to disk (PR #30611), ensuring nodes never lose more than one hour of validation work in case of crashes. The modest overhead was acceptable because earlier optimizations had already made IBD significantly faster.

PR #32043 currently serves as a tracker for IBD-related performance improvements. It groups a dozen ongoing efforts, from disk and cache tuning to concurrency enhancements, and provides a framework for measuring how each change affects real-world performance. This approach encourages contributors to present not only code but also reproducible benchmarks, profiling data, and cross-hardware comparisons.

Future optimization suggestions

PR #31132 parallelizes transaction input fetching during block validation. Currently, each input is fetched from the UTXO set sequentially – cache misses require disk round trips, creating an IO bottleneck. The PR introduces parallel fetching across multiple worker threads, achieving up to ~30% faster -reindex-chainstate (~10 hours on a Raspberry Pi 5 with 450MB dbcache). As a side effect, this narrows the performance gap between small and large -dbcache values, potentially allowing nodes with modest memory to sync nearly as fast as high-memory configurations.

Besides IBD, PR #26966 parallelizes block filter and transaction index construction using configurable worker threads.

Keeping the persisted UTXO set compact is critical for node accessibility. PR #33817 experiments with reducing it slightly by removing an optional LevelDB feature that might not be needed for Bitcoin’s specific use case.

SwiftSync[3] is an experimental approach leveraging our hindsight about historical blocks. Knowing the actual outcome, we can categorize every encountered coin by its final state at the target height: those still unspent (which we store) and those spent by that height (which we can ignore, merely verifying they appear in matching create/spend pairs anywhere). Pre-generated hints encode this classification, allowing nodes to skip UTXO operations for short-lived coins entirely.

Bitcoin Is Open To Anyone

Beyond synthetic benchmarks, a recent experiment[4] ran the SwiftSync prototype on an underclocked Raspberry Pi 5 powered by a battery pack over WiFi, completing -reindex-chainstate of 888,888 blocks in 3h 14m. Measurements with equivalent configurations show a 250% full validation speedup[5] across recent Bitcoin Core versions.

Years of accumulated work translate to genuine impact: fully validating nearly a million blocks can now be done in less than a day on cheap hardware, maintaining accessibility despite continuous blockchain growth.

Self-sovereignty is more accessible than ever.

Don’t miss your chance to own The Core Issue — featuring articles written by many Core Developers explaining the projects they work on themselves!

This piece is the Letter from the Editor featured in the latest Print edition of Bitcoin Magazine, The Core Issue. We’re sharing it here as an early look at the ideas explored throughout the full issue.

[1] https://github.com/bitcoin/bips/blob/master/bip-0050.mediawiki

[2] https://en.bitcoin.it/wiki/Common_Vulnerabilities_and_Exposures

[3] https://delvingbitcoin.org/t/swiftsync-speeding-up-ibd-with-pre-generated-hints-poc/1562

[4] https://x.com/L0RINC/status/1972062557835088347

[5] https://x.com/L0RINC/status/1970918510248575358

All Pull Requests (PR) listed in this article can be looked up by number here: https://github.com/bitcoin/bitcoin/pulls

This post The Core Issue: Outrunning Entropy, Why Bitcoin Can’t Stand Still first appeared on Bitcoin Magazine and is written by willcl-ark, l0rinc and hodlinator.

Bitcoin Magazine

Mastercard Launches Global Crypto Partner Program to Bridge Digital Assets and Traditional Payments

Mastercard has unveiled a new global initiative aimed at bringing crypto into the mainstream of financial services.

The Crypto Partner Program, announced Wednesday, gathers more than 85 companies across the blockchain, fintech, and traditional banking sectors, including Binance, Circle, Gemini, PayPal, Paxos, Ripple, BitGo, and Crypto.com.

The program is designed to explore practical applications for on-chain technology within existing payment infrastructure, focusing on areas such as cross-border transfers, business-to-business payments, and global payouts.

Executives at Mastercard, including Raj Dhamodharan, executive vice president of Digital Asset Blockchain Products & Partnerships, and Sherri Haymond, executive vice president of Digital Commercialization, described the launch as a response to the evolving role of digital assets in financial markets.

They said that digital assets are entering a new phase, noting that blockchain and crypto are increasingly used to solve real-world problems rather than operate purely as parallel systems.

For instance, blockchain tools can enable instant settlement, programmable payments, and round-the-clock cross-border transfers—capabilities that complement existing payment rails rather than replace them.

Mastercard’s collaboration across crypto

The Crypto Partner Program is structured to promote collaboration across the ecosystem. Participants will work directly with Mastercard teams on product development and strategic direction, helping to shape services that integrate the speed and flexibility of on-chain payments with the global infrastructure of card networks.

The program also provides forums for partners to exchange ideas, share expertise, and coordinate on industry standards.

According to Mastercard, the goal is practical execution: translating technical innovation into solutions that are scalable, compliant, and capable of operating across multiple markets.

This initiative builds on years of previous engagement with the crypto sector.

Mastercard has supported crypto-linked payment cards, backed blockchain startups through its Start Path accelerator, and developed services to help banks manage compliance and risk around digital assets.

By creating a structured partnership framework, the company hopes to accelerate adoption of digital assets while maintaining the trust, oversight, and global connectivity that define its core business.

The move comes amid broader efforts by traditional payment networks to integrate digital assets. Visa, for example, has tested settlements using stablecoins and collaborated with blockchain firms to explore tokenized dollar payments.

Banks are similarly experimenting with blockchain-based deposits and payment systems. Mastercard’s approach emphasizes the integration of innovation into the systems consumers and businesses already rely on.

Its network touches banks, merchants, and consumers in over 200 countries, providing a scale and reliability that on-chain solutions alone cannot match.

Mastercard describes the program as “built for innovators, designed for deployment.” By fostering collaboration among crypto-native companies, payment providers, and financial institutions, the initiative aims to align innovation across the industry while supporting responsible growth.

For Dhamodharan and Haymond, the objective is clear: “By bridging on-chain innovation with the framework that powers everyday payments, we’re helping ensure that what’s next works with what already does.”

This post Mastercard Launches Global Crypto Partner Program to Bridge Digital Assets and Traditional Payments first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

Strive (ASST) Raises Dividend, Adds Bitcoin and Strategy (MSTR) Preferred Stock to Balance Sheet

Strive, Inc. said Wednesday it raised the dividend rate on its preferred equity product while adding more bitcoin and a new credit instrument to its balance sheet, moves the firm said are designed to stabilize its digital credit strategy.

The Dallas-based company increased the dividend rate on its SATA preferred stock by 25 basis points to 12.75% and declared a dividend of $1.0625 per share payable April 15 to shareholders of record on April 1.

At the same time, Strive narrowed its targeted trading range for SATA to $99–$101 from the previous $95–$105 and updated guidance to avoid issuing new shares below $100 through at-the-market or follow-on offerings.

The firm also disclosed additional balance sheet activity, including the purchase of 179 bitcoin since its last filing. That brings Strive’s holdings to roughly 13,311 BTC.

Separately, Strive allocated $50 million to acquire 500,000 shares of Strategy Inc.’s Variable Rate Series A Perpetual Stretch Preferred Stock, trading under the ticker STRC on Nasdaq Composite.

Executives framed the moves as part of a broader effort to strengthen the credit profile of SATA, which the company describes as a “digital credit” product tied to bitcoin-focused capital strategies.

CEO Matthew Cole said the adjustments are intended to maintain a stable trading range for the preferred shares while supporting long-term returns for common shareholders relative to bitcoin performance.

Chief Risk Officer Jeff Walton said the addition of STRC reflects the company’s view that the instrument offers higher yield and liquidity than traditional fixed income, allowing Strive to manage short- and medium-duration capital more efficiently.

As of March 9, Strive held $143.4 million in cash and cash equivalents before the STRC purchase, alongside its bitcoin holdings.

The company said its combined bitcoin, STRC, and cash reserves currently cover more than 19 years of SATA interest payments.

Strive and Strategy get upgraded ratings

This comes as Strategy Inc. disclosed that it spent $1.28 billion to acquire 17,994 bitcoin last week, raising its total holdings to 738,731 BTC worth about $50 billion at current prices.

Against that backdrop, investment bank B. Riley Financial initiated coverage of Strategy and Strive, Inc. with Buy ratings and price targets of $175 and $12, respectively, arguing that the recent decline in bitcoin and related equities has compressed valuations and created a potential entry point for investors.

Analysts pointed to Strategy’s scale and market dominance as the largest corporate bitcoin holder, as well as its ability to raise capital across cycles through a layered structure that includes common equity, convertible notes, and multiple series of perpetual preferred stock.

Meanwhile, Strive was highlighted for its “dual-engine” model combining a roughly 13,132 BTC treasury with an asset management business overseeing about $2.5 billion, alongside a recent all-stock acquisition of Semler Scientific.

This post Strive (ASST) Raises Dividend, Adds Bitcoin and Strategy (MSTR) Preferred Stock to Balance Sheet first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

CryptoSlate

Binance returns to Iran sanctions scrutiny after its $4.3 billion U.S. plea

The Justice Department is reportedly probing Iran’s use of Binance to evade sanctions, pulling the world’s largest crypto exchange back into a national security case less than three years after it pleaded guilty in the U.S. and agreed to a resolution worth more than $4.3 billion.

The clearest fact at the outset is the contradiction. Binance already admitted to sanctions and anti-money-laundering failures in 2023.

It accepted penalties, a monitor, and years of U.S. oversight. Now prosecutors are reportedly examining alleged Iran-linked activity that earlier Wall Street Journal reporting said Binance’s own investigators had flagged internally.

The most concrete detail in that earlier report is the alleged route. More than $1 billion was reportedly tied to Blessed Trust, and about $1.7 billion in suspect transfers was allegedly identified overall.

One key account was reportedly marked “internal.” Those details raise questions about how intermediary accounts were handled and how internal controls were applied when investigators reviewed activity connected to Iranian entities and proxies.

Binance disputes that account. The company said its review found no sanctions violations, that the entities in question were investigated and offboarded, and that no Iran-based entities transacted directly on the platform.

Binance also filed a defamation suit over the coverage, turning a compliance dispute into an active courtroom fight.

The central question is whether the largest offshore venue in crypto still has weaknesses in the parts of its business regulators examine most closely under sanctions law.

Crypto can be misused in many settings, but this case centers on whether controls introduced after the 2023 plea were strong enough to detect and stop activity linked to Iran.

That is a direct test of the credibility Binance has tried to rebuild with users, counterparties, and regulators since the U.S. settlement and founder Changpeng Zhao's pardon.

The scale raises the stakes well beyond a public relations problem. Kaiko research showed Binance reached 300 million registered accounts in December 2025 and processed more than $20 billion in daily spot volume across 1,630 trading pairs.

Separate market share data from CoinGecko put Binance at 38.3% of centralized exchange spot activity in December 2025, with $361.8 billion in monthly spot volume that month and $7.3 trillion across 2025.

Exchange data showed about $10.0 billion in 24-hour spot volume and $151.2 billion in reported reserve assets. When a venue that large reenters an Iran sanctions case, the issue extends to offshore price discovery, settlement, and market-making across the wider sector.

What current prices show, and what they do not

Current price action points to legal-risk pricing, with no sign of panic yet. CryptoSlate market data showed Bitcoin at $69,909, down 1.17% over 24 hours and 2.01% over seven days, while BNB traded at $643, down 0.59% over 24 hours and 1.15% over seven days.

Over 30 days, Bitcoin was up 1.12%, and BNB was up 2.65%. Bitcoin dominance stood at 58%, a sign the market still leans toward the deepest and most liquid asset while treating Binance-specific risk as separate from Bitcoin’s institutional position.

That split matters for market structure. Bitcoin’s role in ETF portfolios and large institutional allocations does not automatically move with confidence in offshore exchanges.

Users and trading firms can cut exposure to exchange-linked risk without abandoning Bitcoin itself. They can rebalance between venues, trim exposure to exchange-linked tokens, or reduce activity in pairs that depend more heavily on offshore liquidity.

BNB remains the cleaner pressure valve because it sits closer to Binance’s brand and business. With a market cap of $87.75 billion, BNB is far smaller than Bitcoin and can absorb reputational stress more abruptly if the legal dispute produces visible user behavior.

No public reserve cliff has emerged so far. No sharp break in spot share data has surfaced, and no broad counterparty retreat is visible in the available market snapshot.

Even so, confidence can shift quickly once users decide to diversify balances across venues.

The scale of any balance migration is already large in dollar terms. Using Binance’s disclosed assets of about $150.36 billion, a 2% shift would equal roughly $3 billion.

A 5% shift would equal about $7.5 billion, and a 10% shift would equal about $15 billion. Those figures are scenario markers, not predictions.

They show the size of the balance base that could move if the dispute widens from legal scrutiny into a trust problem among users, market makers, and trading firms.

Those same ranges also help frame trading activity. Against Binance’s current 24-hour spot volume of about $10 billion, a 2% asset shift would equal about 30% of one day’s turnover.

A 5% move would equal about 75%, and a 10% move would equal about 150%. The comparison is imperfect because reserves and daily volume measure different things, but it gives readers a concrete sense of how quickly a legal dispute can overlap with exchange liquidity if behavior changes.

| Metric | Current figure | Why readers should watch it |

|---|---|---|

| U.S. resolution | $4.3B+ | Shows Binance already settled major sanctions and AML failures once |

| Registered accounts | 300M | Shows how many users face exchange-level trust risk |

| Centralized spot share | 38.3% | Shows Binance remains near the center of offshore liquidity |

| 24-hour spot volume | $10.0B | Shows how much trading still runs through the venue each day |

| Reported reserve assets | $151.2B | Sets the scale for any future user or counterparty outflows |

There is also a legal limit on what can be stated today. The report did not establish whether prosecutors are examining Binance itself, specific users, intermediary accounts, or some combination of them.

That distinction shapes the whole case. A probe centered on customer misuse would still be serious.

A probe that shifts toward whether Binance enabled or failed to stop the activity after the 2023 plea would carry much heavier consequences.

Why the Iran angle extends beyond Binance

The broader enforcement backdrop suggests U.S. agencies are already focused on crypto routes tied to Iran. On Jan. 30, the Treasury Department designated Zedcex and Zedxion, two UK-registered digital asset exchanges tied to Iranian sanctions evasion and the IRGC.

Treasury said Zedcex had processed more than $94 billion in transactions. That action shows regulators are examining venues, intermediary companies, and cross-border settlement networks rather than limiting their attention to isolated wallet addresses.

Blockchain data points in the same direction. TRM Labs research said stablecoin activity exceeded $1 trillion in monthly transaction volume multiple times in 2025.

It also said illicit entities received about $141 billion through stablecoin wallets, with sanctions-related activity accounting for 86% of all illicit crypto flows in 2025.

Those figures put stablecoins near the center of sanctions-linked crypto activity and help explain why alleged Binance activity connected to Iran draws attention well beyond one exchange.

Iran’s own crypto market structure reinforces that point. A separate TRM Labs analysis said Nobitex handled more than 87% of Iranian crypto volume in 2025 and processed about $3 billion.

About $2 billion moved over TRON, mainly in TRC-20 USDT and TRX. Regulators following sanctions evasion through digital assets are therefore likely to focus on stablecoins, partner entities, and chain-specific settlement corridors that can support trade and transfers at scale.

Activity in Washington over the past few weeks fits that broader pattern. Sen. Richard Blumenthal opened an inquiry on Feb. 24 that cited the reported $1.7 billion in transfers, the alleged roles of Blessed Trust and Hexa Whale, and roughly 2,000 accounts associated with Iranian entities.

Senate Banking Democrats then pressed Treasury and DOJ on Feb. 27 to investigate Binance over sanctions and illicit-finance concerns.

Those steps do not prove prosecutors will act against Binance. Pressure has, however, shifted from media reporting to formal questions within the U.S. enforcement system.

Binance’s defense remains significant. The company said exposure to wallets linked to illicit activity fell nearly 97% from early 2024 to mid-2025, including a 97.3% reduction in exposure to major Iranian crypto exchanges.

It also said there were no direct transactions involving Iran-based entities on Binance. If that account holds up, the dispute could narrow to intermediaries, offboarding decisions, and whether published claims overstated what internal reviews actually found.

The lawsuit filed today is meant to push that dispute into discovery and court filings.

Markets reprice risk on uncertainty, reassessing whether Binance’s offshore dominance still deserves the same trust premium.

At the moment, the most likely path is a prolonged probe with limited immediate market damage. A softer outcome would keep the focus on users or intermediaries and leave balance migration below roughly 2% of disclosed assets, or about $3 billion.

A harsher outcome would shift attention toward Binance itself, pressure counterparties, and push migration into the 2% to 5% range, or roughly $3 billion to $7.5 billion.

A low-probability shock would involve direct action touching linked entities or routes and could force more than 10% of disclosed assets, or more than $15 billion, to move or be repositioned.

| Scenario | Editorial probability | What changes | What to watch |

|---|---|---|---|

| Prolonged probe, limited immediate damage | 50% | DOJ keeps gathering facts, with no immediate public charge against Binance, and users mostly stay put | Scope of the probe, BNB versus BTC, reserve stability |

| Soft landing for Binance | 20% | Scrutiny stays focused on users or intermediaries, and Binance’s offboarding defense holds | Defense holds up, asset movement stays below about $3B |

| Binance becomes the clearer target | 25% | Counterparties tighten, some users diversify away, and Binance share slips | Market share changes, reserve moves, BNB weakness |

| Sanctions-plumbing shock | 5% | Named actions touch linked entities or routes, and scrutiny spreads to stablecoins and TRON | Designations, wallet freezes, asset movement above $15B |

The next set of public facts should clarify whether this dispute stays in the zone of reporting, denial, and litigation or develops into a visible market event.

The most important signals are reserve changes, spot share shifts, BNB weakness versus Bitcoin, and any steps by DOJ, Treasury, FinCEN, or OFAC that put names and allegations behind the current scrutiny.

For now, the clearest point remains unchanged. Binance already paid to resolve one major U.S. sanctions and AML case, and it is now back under fresh Iran-linked scrutiny while trying to fight the allegations in court.

The post DOJ probes Binance again over Iran-linked crypto flows after $4.3B settlement and CZ pardon appeared first on CryptoSlate.

An Oil Scare Near Hormuz Showed How Fast Bitcoin Reverts to a Risk Trade

While Bitcoin has rebounded and held above $70,000 over the last 48 hours, the acute phase of the latest oil shock showed the market’s first instinct: sell crypto when inflation fear rises, and the path to easier money gets harder.

Still, why does the price of oil even matter for Bitcoin? Few Bitcoin miners use oil to power machines, so shouldn't Bitcoin be detached from energy volatility?

Well, on March 9, Bitcoin fell to a seven-day low as Brent crude surged and traders cut exposure across risk assets.

You see, energy pricing is a major factor in determining inflation, which Bitcoin is meant to be a hedge against. That axiom, however, has become a long-running debate.

The move did not settle whether Bitcoin can protect holders from inflation over the long term. It did, however, clarify something narrower and more immediate.

In the first phase of a war-driven oil scare, traders treated Bitcoin like a liquidity-sensitive macro asset rather than a refuge. Fresh attacks near the Strait of Hormuz and the threat of wider shipping disruption pushed oil higher before any fully confirmed physical closure of the route.

The Strait of Hormuz still carries about 20 million barrels a day of oil and oil products and nearly 20% of global LNG trade.

The surge lifted the energy risk premium, revived inflation concerns, and hardened the market’s view that central banks may have less room to ease.

The direct Bitcoin link appeared in both price action and flows.

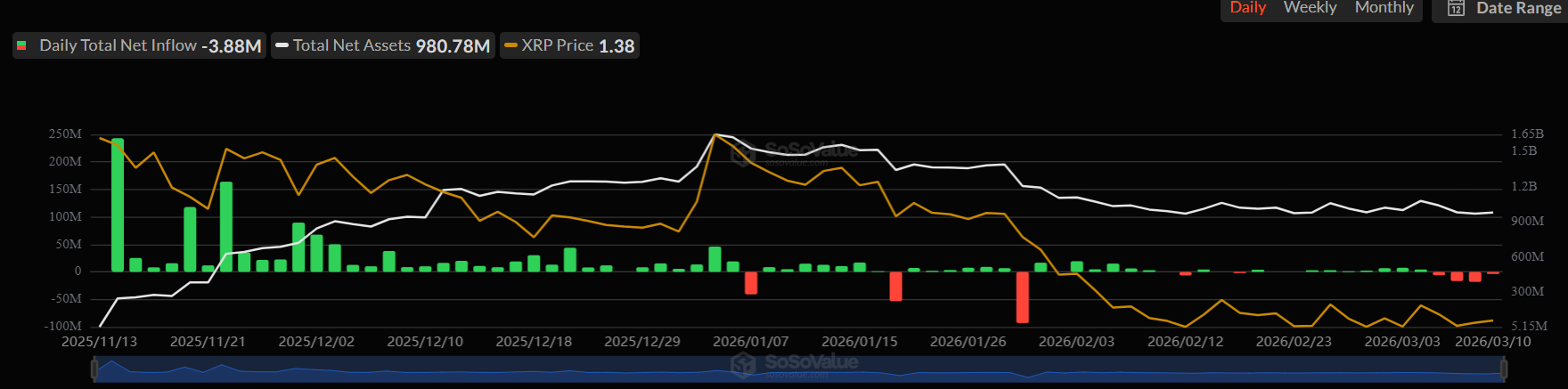

U.S. spot Bitcoin ETFs recorded net outflows of $227.9 million on March 5 and $348.9 million on March 6. Flows then flipped to inflows of $167.1 million on March 9 and $246.9 million on March 10 as oil cooled and reserve-release discussions gained traction.

Bitcoin’s market cap fell from about $1.453 trillion on March 5 to about $1.322 trillion on March 9, a roughly $131 billion drop. By March 11, the asset had rebounded to around $70,200, up about 0.9% over 24 hours, 1.3% over seven days, and 2.0% over 30 days.

It's now clear that real-world inflation panic, especially when it arrives through oil and shipping risk, still pushes Bitcoin to trade like a risk asset first.

The rebound indicates the selloff belonged to the acute shock window, when traders reacted to higher energy costs, tighter financial conditions, and a rapid repricing of macro risk.

| Date | Signal | Bitcoin response | What changed |

|---|---|---|---|

| Feb. 27 | Brent averaged $71 | Bitcoin was still trading in a calmer macro backdrop | Oil risk premium was limited |

| March 5-6 | Oil shock intensified, inflation fear rose | ETF flows turned to -$227.9 million and -$348.9 million | Traders cut exposure |

| March 9 | Brent reached $94 on average | Bitcoin hit a seven-day low | Acute inflation scare peaked |

| March 9-10 | Reserve-release discussions and de-escalation signals increased | ETF flows swung to +$167.1 million and +$246.9 million, based on flows | Bitcoin rebounded with broader risk appetite |

| March 11 | Three commercial vessels were reportedly hit near Hormuz | Bitcoin traded back above $70,000 | The situation shifted from panic to watchfulness |

Hormuz Still Hits Bitcoin Even if the U.S. Does Not Need Many of Its Barrels

The United States does not need to import large volumes of crude through Hormuz for Bitcoin to feel the shock. EIA data shows the U.S. imported about 0.5 million barrels a day of crude and condensate through the strait in 2024, equal to roughly 2% of U.S. petroleum liquids consumption.

The familiar “America is energy independent” shorthand, therefore, offers limited guidance in this situation. Physical dependence is low, but financial exposure remains significant.

Hormuz remains the world’s primary oil chokepoint.

The IEA estimates flows through the strait at roughly 20 million barrels a day in 2025, about a quarter of global seaborne oil trade. Bypass capacity is only about 3.5 million to 5.5 million barrels a day.

The route also carries LNG exports from Qatar and the UAE equal to nearly one-fifth of global LNG trade. Asia absorbs most of that exposure. EIA data shows about 84% of Hormuz crude and condensate flows and 83% of LNG flows move to Asian markets.

However, benchmark pricing does not remain confined to Asia. Brent resets globally, as do freight costs, insurance pricing, airline fuel assumptions, and inflation expectations.

Those pricing shifts reach Bitcoin through macro channels.

When oil rises quickly, traders begin pricing in stickier inflation and less urgency for rate cuts.

U.S. five-year breakeven inflation rose from 2.46% on March 4 to 2.56% on March 6 and March 9, before easing slightly to 2.53% on March 10.

We're talking about market expectations here, not the final verdict on inflation, and they shifted before any full physical shortage at the pump appeared.

The timing is important.

The latest U.S. CPI data, at 2.4% year-over-year, largely predates the latest oil shock.

Yet, the war now keeps the issue alive ahead of the March 17–18 Federal Open Market Committee meeting.

If oil holds in the high $80s or $90s instead of retreating, inflation expectations may shift again. That environment makes it harder for policymakers to signal easier financial conditions, and speculative trades tend to react quickly.

Bitcoin sits within that category.

The asset still benefits from long-run scarcity narratives and periodic distrust of fiat systems. During an abrupt oil scare, however, traders often reduce positions in liquid and volatile assets first.

Shipping risk can therefore tighten Bitcoin’s macro backdrop before any American refinery faces a crude shortage.

The ETF Wrapper Has Made the Macro Transmission Faster and Easier to Read

March volatility also highlighted how much Bitcoin’s market structure has changed. The ETF era has not insulated crypto from macro stress. Instead, it has made the impact easier to measure in real time.

When the oil scare intensified, money left U.S. spot products quickly. When pressure eased, the same wrapper showed buyers returning just as rapidly.

This provides a clearer signal than older exchange-based narratives centered on offshore leverage or crypto-native sentiment.

The sequence is straightforward. On March 5 and March 6, net flows across U.S. spot Bitcoin ETFs were sharply negative. By March 9 and March 10, those flows had turned positive again.

The reversal followed the same macro pattern visible in oil. Risk assets sold off amid rising inflation fears, then recovered after discussions about reserve releases and signs of de-escalation eased pressure.

IEA Executive Director Fatih Birol said all options, including emergency stock releases, were discussed. Member countries hold more than 1.2 billion barrels of public emergency reserves plus another 600 million barrels of industry stocks under government obligation.

The possibility of reserve releases helped establish a potential ceiling for the most extreme oil outcomes. That shift encouraged buyers to return to Bitcoin.

The initial reaction resembled a conventional sell-the-risk trade; it also carried a measurable cost.

The roughly $131.5 billion decline in Bitcoin’s market cap between March 5 and March 9 provides a concrete measure of how quickly an external shipping shock can erase value from crypto markets.

The market recovered part of that decline once crude prices cooled. Even so, the drawdown highlighted Bitcoin’s sensitivity to the same inflation and interest-rate dynamics that affect high-beta equities.

The oil surge also puts pressure on gasoline, travel, and household budgets. In the U.K., the OBR warned the crisis could push inflation to 3% by the end of 2026, one percentage point above its earlier projection.

One narrow waterway can therefore influence fuel costs, inflation expectations, central-bank policy signals, and Bitcoin demand within the same week.

What Traders Need to Watch Before the Fed Meets

The next phase depends on several immediate variables.

Traders should monitor whether attacks on commercial shipping continue, whether insurers and tanker operators avoid the route, and whether emergency stock discussions turn into formal action.

Also, whether Brent holds in the high $80s and $90s or falls further, and whether ETF inflows remain positive.

The March 17–18 FOMC meeting is the next major checkpoint.

It will not resolve the oil market, but it could clarify whether policymakers treat the latest energy shock as temporary noise or a complication for the easing path.

EIA’s base case still points to lower oil later in the year. Its March outlook projects Brent averaging $91 in the second quarter of 2026 before falling to $70 in the fourth quarter and $64 in 2027. The forecast assumes global inventories rise by 1.9 million barrels a day in 2026 and 3.0 million barrels a day in 2027.

Standard Chartered, by contrast, raised its 2026 Brent average forecast to $70 from $63.50, citing upside risk if conflict damages production or shipping further.

JPMorgan has warned that if Hormuz remains effectively closed for more than 25 days, storage constraints could force Gulf producers into shut-ins, or involuntary production stoppages.

That range leaves multiple possible outcomes.

The base case assumes disruption without catastrophe, enough tension to keep inflation expectations elevated but not enough to trigger a sustained collapse in flows.

A bullish outcome for Bitcoin would involve oil retreating further, stronger confidence that reserves can cap prices, and steady ETF inflows.

A bearish outcome would involve renewed attacks, persistent shipping avoidance, and crude moving back toward triple digits.

The tail risk involves a prolonged effective closure that forces production shut-ins across Gulf producers and keeps the inflation impulse alive long enough to shift policy expectations more sharply.

| Scenario | Editorial probability | Oil path | Bitcoin read-through | Key trigger |

|---|---|---|---|---|

| Base | 45% | Brent holds around $85-$95 | Choppy trade, risk asset first, hedge second | Serious disruption, but no sustained collapse in flows |

| Bull | 25% | Brent falls toward $75-$85 | ETF inflows improve and Bitcoin rebounds with broader risk | De-escalation developments hold and reserve fears ease |

| Bear | 20% | Brent returns to $100-$120 | Bitcoin revisits stress levels from the weekend scare | Attacks persist and shipping avoidance hardens |

| Tail risk | 10% | Extreme squeeze, broader reporting has floated $120-$150 | Forced-liquidity selling overwhelms any “hard money” bid | Effective closure lasts long enough to trigger shut-ins |

For now, the clearest take is that the inflation-hedge narrative faced a real-time test.

Inflation concerns driven by oil prompted traders to sell Bitcoin during the initial shock.

The rebound above $70,000 shows how quickly sentiment can reverse once crude prices cool and supply fears ease.

The next test arrives with the Fed meeting on March 17–18, and any developments affecting shipping through Hormuz.

If oil remains elevated, the tension between Bitcoin’s hedge narrative and its behavior as a macro risk asset will remain unresolved.

The post Why oil panic hitting global markets caused traders to dump Bitcoin instead of hiding in it appeared first on CryptoSlate.

Kalshi's first move outside the United States is not London, not Singapore, not any of the financial centers that have spent years building crypto-friendly regulatory frameworks.

It is Brazil, through XP International and its brokerage arm, Clear, offering prediction markets to Brazilian investors as a “new asset class” anchored at launch to economic events such as inflation prints and interest rate decisions.

The company frames the product as a federally regulated derivative rather than a bet.

Brazil's government frames what it is already dealing with as a public health emergency.

Both things can be true. The tension between them is the story.

What Kalshi and XP actually built

The Mar. 9 announcement describes prediction markets as “derivative financial instruments” under the CFTC's regulatory framework.

Access begins with Clear clients who already hold international investment accounts through XP International. Bloomberg reported the initial contracts center on Brazilian macro variables, such as IPCA inflation and Selic rate decisions, rather than sports outcomes or electoral results.

That product framing matters: Kalshi's entry pitch is macro-first, brokerage-distributed, and aimed at an investor base that already navigates international markets.

XP is not a niche vehicle for this. The firm reported 4.762 million active clients, R$1.491 trillion in client assets, and 18,000 advisors as of the fourth quarter of 2025.

Kalshi's cofounder cited the logic directly: international partners “already have the customers” and “the brand.” The distribution math explains the geography before any cultural argument is made.

| Confirmed at launch | Not announced / not proven | Why it matters |

|---|---|---|

| Kalshi and XP describe prediction markets as “derivative financial instruments” under a CFTC-regulated framework. | That description does not settle the gambling-vs-derivatives debate in how regulators or the public may view the product in practice. | It frames the launch as a financial-market product, not a sportsbook. |

| Distribution runs through XP International and Clear. Access begins with Clear clients who already have international investment accounts. | There is no public indication the launch is open to the entire Brazilian mass market on day one. | This supports the argument that the rollout is brokerage-distributed and aimed first at an existing investor base. |

| Bloomberg reported the initial contracts focus on Brazilian macro variables such as inflation and interest rates. | Kalshi has not announced Brazil-specific sports or election contracts. | This keeps the story fair: the launch is macro-first, not overtly sports- or politics-first. |

| XP is a large retail-investment funnel, with about 4.762 million active clients, R$1.491 trillion in client assets, and 18,000 advisors as of 4Q25. | There is no proof Kalshi chose Brazil because of gambling prevalence or 2026 headline events. | The distribution math alone makes Brazil a strategically important first foreign market. |

| Kalshi has publicly said working with international partners makes sense because they already have “the customers” and “the brand.” | That does not prove the company intends to expand into event contracts tied to the World Cup or election. | It strengthens the interpretation that this is initially a customer-acquisition and distribution play. |

| Brazil is simultaneously building national betting-harm infrastructure, including 25,000+ illegal sites blocked in 2025 and 217,000+ self-exclusion requests in the first 40 days of the centralized platform. | There is no direct evidence Kalshi’s launch itself triggered that response. | This is the contradiction at the center of the piece: a “new asset class” is entering a market already treating adjacent retail speculation as a consumer-protection and public health problem. |

The country Kalshi is entering

Brazil spent 2025 building anti-addiction infrastructure at the national scale.

The Finance Ministry blocked more than 25,000 illegal betting sites that year. The government's centralized self-exclusion platform received more than 217,000 self-blocking requests in its first 40 days of operation.

The amount is equivalent to 73% of users choosing indefinite blocks, and 37% explicitly cited loss of control or mental health as the reason.

Brazil's Health Ministry launched a betting health observatory, a dedicated line of care for gambling-related harms, and tele-mental-health support beginning in February 2026, with 20,000 professionals in training.

The prevalence data behind these moves is not soft.

A LENAD-based study reported by FAPESP found roughly 10.9 million Brazilians over age 14 gamble in ways that harm their finances, family life, or mental health, with about 1.4 million fitting a more severe gambling disorder profile.

Brazil's Justice Ministry put it more bluntly: 38.6% of people who participate in betting show some degree of addiction risk or disorder, a figure that climbs to 55.2% among adolescents aged 14 to 17.

Brazil's Central Bank documented 24 million people making at least one Pix transfer to betting firms between January and August 2024, with monthly flows later revised upward to as much as R$30 billion in 2025.

The country Kalshi is entering already treats binary event speculation at mass retail scale as a consumer protection problem that requires government infrastructure to contain it.

Why 2026 makes the contradiction visible

The launch calendar accelerates the tension without requiring Kalshi to have planned it that way.

Brazil's general election runs on Oct. 4, with a runoff on Oct. 25 if needed. The 2026 FIFA World Cup runs from Jun. 11 through Jul. 19.

Kalshi's first foreign market is now live in the year most saturated with exactly the binary, high-stakes, headline-driven events that prediction market platforms typically monetize most.

Kalshi has not announced any election or sports contracts for Brazil, and the official rollout language remains macro.

However, the brokerage infrastructure now exists, the distribution partner has nearly five million active clients, and the product category has already demonstrated that event contract volume can scale rapidly when the public perceives an election outcome as genuinely uncertain.

Whether Kalshi expands its Brazilian contract menu toward those events is a product decision, not a foregone conclusion. The surrounding conditions make the contradictions harder to contain, if they do.

The economics that the “Market of Truth” pitch skips

Prediction markets carry an idealistic intellectual framing, surrounding Vitalik Buterin's “info finance” thesis, the idea that contract prices aggregate dispersed knowledge into useful probability estimates.

Academic work on Kalshi's own contracts adds friction to that story.

A CEPR analysis of more than 300,000 Kalshi contracts found that prices become more informative as expiry approaches, but also a favorite longshot bias, and that makers consistently outperform takers. The average pre-fee contract returns are around -20%, and the average after-fee returns are around -22%.

On Polygon-based Polymarket, a Dune dashboard shows on-chain wallet-level analysis of roughly 1.7 million addresses found about 70% realized losses, with profits heavily concentrated. This is equivalent to fewer than 0.04% of accounts capturing more than 70% of total realized gains, approximately $3.7 billion.

That data describes a user economics structure in which retail participants lose at rates consistent with negative sum speculation, and in which gains concentrate at the top of the participant distribution.

Brazil's regulators did not build a national self-exclusion system and block 25,000 websites because that description sounded unfamiliar.

The bet Kalshi is making on Brazil

The bull case for this launch is coherent: Brazil's macro environment in early 2026 is genuinely “tradable” in binary form.

The Central Bank's Mar. 6 Focus survey showed median 2026 expectations for IPCA at 3.91%, GDP growth at 1.82%, and the Selic rate at 12.13%, with active market debate over whether the March Copom meeting would deliver a 25- or 50-basis-point cut.

Interest rate and inflation contracts on a platform like Kalshi, distributed through an investment brokerage to clients who already think in portfolio terms, look more like structured macro exposure than a sportsbook.

The bear case is that the brokerage wrapper does not permanently insulate the product from the regulatory and reputational environment in which it operates.

If contract scope broadens during a World Cup year and an election year, in a country where the state already frames event-driven retail speculation as a public health issue, the “regulated derivative” label absorbs pressure from both sides.

The pressure will come from Brazilian regulators looking for jurisdictional footholds, and from US regulators who have watched state gaming authorities challenge Kalshi's not-gambling classification in domestic courts.

Kalshi is betting that distribution through a brokerage, a macro-first product frame, and a CFTC regulatory backstory are enough to keep the product in a different legal and cultural category than what Brazil is already fighting.

Brazil's own infrastructure is built on the premise that the category distinction breaks down in practice at scale.

One of them is right. The answer will be visible in Brazil by the end of the year.

The post Kalshi’s Brazil prediction market launch lands in a country already fighting a betting addiction crisis appeared first on CryptoSlate.

The infrastructure race for agentic commerce is already producing winners.

Anthropic's Model Context Protocol now runs on more than 10,000 public servers and pulls 97 million monthly SDK downloads, connecting AI applications to external tools and data.

Google's Agent-to-Agent protocol launched in April 2025 with 50 partners and scaled to more than 100 supporting companies before moving under Linux Foundation governance.

On Jan. 11, Google unveiled the Universal Commerce Protocol, pulling in Shopify, Walmart, Target, Mastercard, Stripe, Visa, and American Express as early supporters, aiming to standardize how agents navigate live checkout flows.

Coinbase's x402 protocol handles the payment transport layer, enabling automatic stablecoin payments over HTTP. The project reported more than 100 million payments processed across APIs, apps, and AI agents by late 2025.

That is a lot of standardization for a technology category that barely existed three years ago.

However, every one of those protocols addresses the same narrow slice: how agents connect, coordinate, and initiate payments.

None of them answers the harder commercial question sitting one step further down the stack: Who decides the work was actually done?

| Protocol / standard | What it does | What it does not solve | Why it matters in this story |

|---|---|---|---|

| MCP (Model Context Protocol) | Connects AI applications and agents to external tools, APIs, and data sources | Does not verify whether a task outcome was actually delivered | It handles the tool/data layer, not the trust layer around completed work |

| A2A (Agent-to-Agent) | Lets agents communicate and coordinate across systems or organizations | Does not hold funds in escrow or judge deliverable quality | It solves agent interoperability, but not conditional settlement |

| UCP (Universal Commerce Protocol) | Standardizes agent-driven commerce and checkout flows | Does not determine whether a purchased service or task was satisfactorily completed | It pushes agents deeper into real transactions, making the missing verification layer more visible |

| AP2 (Agent Payment Protocol) | Uses signed payment mandates to prove what an agent is authorized to spend | Proves permission, not whether the paid-for outcome materialized | It is an authorization standard, not a work-verification standard |

| x402 | Enables automatic payments over HTTP, including stablecoin payments | Moves money, but does not decide whether money should move only after work is verified | It is the payment transport rail, not the escrow/adjudication layer |

| Mastercard Verifiable Intent | Creates a trust and audit layer for proving user purchase authorization | Focuses on sanctioned purchases and dispute trails, not task completion itself | It shows incumbents are standardizing intent and accountability, but still not full outcome verification |

| ERC-8183 | Defines a job-based escrow flow: funds locked, work submitted, evaluator completes or rejects, expiry can refund client | Does not solve evaluator trust, disputes, or “agentic” identity by itself | It is the article’s hook because it targets the missing conditional payment / verification step |

| ERC-8004 | Provides a trust/reputation framework for agents and counterparties | Is not itself an escrow or payment-release mechanism | It is the likely composition layer for making ERC-8183-style evaluation more trustworthy |

| Oracle / staking / zkML / TEE-style trust systems | Potential ways to verify outcomes or back evaluator judgments with stronger guarantees | None is a settled standard for broad agentic commerce yet | These are possible answers to the article’s central question: who gets to judge that the job was done? |

Escrow as the missing primitive

ERC-8183, a draft Ethereum standard published Feb. 25, is crypto's attempt to make that judgment programmable.

Strip the jargon, and the proposal is a minimal state machine for task-based commerce: a client locks the budget into escrow, a provider submits work, and an evaluator marks the job complete or rejects it.

Expiry refunds the client automatically. The spec calls this sequence: Open, Funded, Submitted, Terminal. Additionally, it explicitly states that the evaluator alone may mark a job as completed once work lands.

That architecture is narrower than its “agentic commerce” framing implies.

Critics in the Ethereum Magicians discussion thread pointed out that there is “nothing especially ‘agentic'” about the proposal. One commenter called it “a job registry with escrowed funds.”

The critique is accurate, and also the most useful thing about the story.

What ERC-8183 actually specifies is a programmable escrow primitive applicable to any task-based transaction, human or machine.

The AI framing is layered on top of a structure that predates agents entirely. The more interesting question is whether that structure is the one piece the stack currently lacks.

The authorization-verification gap

The payments incumbents building around agentic commerce are solving authorization, not verification.

Google's Agent Payment Protocol frames payments around cryptographically signed mandates that prove what an agent was permitted to spend.

Mastercard's Verifiable Intent, co-developed with Google and introduced on Mar. 5, creates a trust layer for proving what a user authorized and an audit trail designed for dispute resolution.

Those are robust answers to “Was this purchase sanctioned?” They say nothing about whether the purchased outcome materialized.

That gap is the productive contradiction in the stack.

A2A ensures agents can talk across organizational boundaries. MCP ensures they can reach the right tools and data. AP2 and x402 ensure money moves automatically. ERC-8183 proposes that the funds be held conditionally until an evaluator attests that the deliverable has cleared.

Whether that evaluator is the client, an oracle network, a staking system, or a zkML proof is left to implementers, but the spec explicitly names ERC-8004's trust and reputation layer as the recommended composition point for higher-value jobs.

The power center nobody named

The evaluator role is where the proposal becomes politically interesting.

ERC-8183's security section warns that a malicious evaluator can arbitrarily complete or reject jobs, recommends reputation or staking mechanisms for higher-value contracts, and acknowledges that there is no dispute resolution within the core spec.

One builder in the Magicians thread wrote that “the Evaluator is where the real complexity lives.” Another summarized the broader problem as “everyone verifies the payment, nobody verifies the work.”

Those observations point to a structural dynamic in any open agent marketplace: whoever controls evaluation controls the marketplace.

The spec's design makes the tension explicit.

For enterprise deployments where the client and evaluator are the same entity, the complexity is manageable. For multi-party agent networks where a provider in one organization submits work to a client in another, the evaluator becomes a trust bottleneck with platform-level leverage.

ERC-8183 names the choke point without yet having a durable answer for it.

Where the stack actually stands

The adoption numbers suggest the surrounding layers are moving faster than verification.

Gartner says 33% of enterprise software applications will include agentic AI by 2028, and 15% of day-to-day work decisions will run autonomously by that year, up from 0% in 2024.

Deloitte pegs the global agentic AI market at $8.5 billion in 2026, rising toward $35 billion by 2030, with 75% of companies potentially investing in the category by the end of this year.

IBM and NRF reported in January that 45% of consumers already use AI during buying journeys, including 41% for product research.

That volume of agentic activity needs settlement infrastructure.

The bull case for ERC-8183 and its surrounding stack is that open agent marketplaces, covering research, code, inference, data, and microservices, generate enough cross-organizational, machine-to-machine commerce that on-chain conditional settlement becomes genuinely necessary.

The bear case is that payments incumbents and enterprise software absorb the verification problem before crypto builds a durable wedge.

AP2's cryptographic mandates, Verifiable Intent's authorization audit trail, and UCP's live retailer integrations are already positioning card networks and Big Tech at exactly the layer that ERC-8183 targets from the other direction.

Who owns the judgment layer

If Gartner's 2028 projections hold, and agentic AI handles a meaningful share of enterprise procurement, research outsourcing, and service buying, the highest-margin position in that stack will not be held by the model provider.

It will belong to whoever owns the moment of conditional payment, which is the infrastructure that holds funds, attests to outcomes, and releases money only when the work clears verification.

ERC-8183 may be that layer, or it may be marketplace escrow wearing better branding.

The Magicians thread is right that the underlying structure predates AI entirely. Yet the same holds for most financial primitives that turned out to matter.

Escrow predates the internet. Conditional payment predates blockchains.

The theory being stress-tested right now is whether the verification problem in agentic commerce is best solved by Big Tech's authorization standards or by programmable on-chain escrow with composable trust layers.

Both approaches are live, neither is settled, and the answer will likely depend on where agents are doing the most economically meaningful work when adoption crosses the threshold that makes the infrastructure fight worth having.

The post Is crypto needed to protect the security of AI agents paying each other online? appeared first on CryptoSlate.

Washington sent two messages about crypto privacy in the same week.

Treasury told Congress that lawful users of digital assets may leverage mixers to protect personal wealth, business payments, charitable donations, and consumer spending habits from public view on transparent blockchains.

Days later, SDNY prosecutors filed a letter proposing to retry Tornado Cash co-founder Roman Storm in October 2026 on the two counts where jurors deadlocked last August: conspiracy to commit money laundering and conspiracy to violate sanctions. Each count carries a maximum of 20 years.

The policy thaw is real. It may just stop where privacy tools begin.

For retail investors, what matters is if markets have priced the shift in Washington's crypto posture correctly. The evidence suggests they may not have.

| Government action / statement | What softened | What stayed hardline | Investor takeaway |

|---|---|---|---|

| Treasury delists Tornado Cash (Mar. 21, 2025) | Sanctions posture eased; Washington acknowledged the legal and policy complexity around applying sanctions in an evolving technology environment | Treasury still said it remained deeply concerned about DPRK-linked hacking and laundering | Delisting did not mean privacy infrastructure was broadly de-risked |

| DOJ memo ending “regulation by prosecution” (Apr. 2025) | DOJ said it would stop targeting exchanges, mixers, and wallets for the acts of end users or unwitting regulatory violations | DOJ preserved priority treatment for cases involving sanctions, hacking, terrorism, organized crime, and sanctioned states | The policy thaw looks real for some crypto sectors, but not for the national-security bucket |

| Treasury report to Congress (Mar. 2026) | Treasury explicitly acknowledged that lawful users may use mixers for financial privacy | The same report highlighted mixer-linked illicit flows and recommended stronger tools, including a possible “hold law” to freeze suspicious assets temporarily | Privacy use is being acknowledged, but privacy infrastructure is still being framed as a live enforcement risk |

| SDNY retrial push on Roman Storm (Mar. 2026) | No visible softening in this step | Prosecutors want another shot on the money-laundering and sanctions counts, the two counts most aligned with the government’s preserved hardline priorities | Privacy-adjacent projects still appear to sit in a different legal-risk bucket from the rest of crypto |

| Overall Washington message | Friendlier posture toward mainstream crypto market structure, payments, and infrastructure | Continued aggressiveness where privacy tools can be linked to sanctions evasion, laundering, or North Korea | Investors should stop treating “pro-crypto policy” as a single uniform discount across the whole sector |

What the jury left unresolved

Last August's verdict was a split decision that clarified almost nothing.

The jury convicted Storm on the unlicensed money-transmitting count, which carries a maximum of 5 years, but deadlocked on the money-laundering and sanctions counts.

Prosecutors now want those two counts retried, with a proposed start date around Oct. 5 or Oct. 12 and an expected three-week run. Storm's Rule 29 motion for acquittal also argues that the evidence was insufficient on the convicted count, and that argument will be presented to a judge on Apr. 9.

The distinction between the counts matters for anyone trying to read this case as a policy signal.

DOJ's April 2025 memo, the one that declared an end to “regulation by prosecution,” said the department would stop targeting exchanges, mixers, and wallets for the acts of end users or unwitting regulatory violations.

That language fits awkwardly around the unlicensed-transmission count, where the theory of liability is closest to holding a developer responsible for running infrastructure.

It's less awkward around money laundering and sanctions, where prosecutors can argue Storm knew specific illicit activity was flowing through the protocol and continued anyway.

The government is retrying the counts it chose to keep, rather than the one that most directly conflicts with its own stated policy evolution.

The real limits of the thaw

Treasury delisted Tornado Cash on Mar. 21, 2025, citing “novel legal and policy issues” raised by the sanctions regime in an “evolving technology and legal environment.”

DOJ disbanded its crypto enforcement unit and narrowed its prosecution priorities, resulting in a major reduction in the department's crypto posture. None of that is theater.

The administration deliberately chose to pull back from the broadest definition of crypto legal risk.

However, Treasury's delisting statement did not arrive alone.

The same document said Treasury remained “deeply concerned” about DPRK-linked hacking and money laundering. It warned US persons to exercise caution when dealing with transactions that may benefit North Korean cyber actors.

DOJ's memo preserved priority treatment for cases involving terrorism, organized crime, hacking, and sanctioned states. The administration narrowed the target, it did not eliminate it.

Storm's remaining exposure sits precisely in the preserved bucket: laundering and sanctions, with prosecutors arguing the protocol was used as infrastructure for North Korea-linked theft proceeds. Treasury's March 2026 report to Congress adds the sharpest numbers to that story.

Since May 2020, bridges on public blockchains received roughly $1.6 billion in deposits originating from mixing services. More than $900 million of those mixer-originated deposits flowed into a single bridge that faced scrutiny for failing to intervene in DPRK-linked laundering activity.

Treasury acknowledged lawful privacy uses in the same document while also recommending that Congress consider a new “hold law” that would give institutions a safe harbor to freeze suspicious digital assets during short-term investigations.

The report that validated mixer privacy is also the one asking for stronger tools to freeze suspected mixer flows.

What investors are likely mispricing