Cryptocurrency Posts

Crypto Briefing

Bitcoin jumps toward $69K as stocks rebound and oil plunges as much as 30% amid USIran tensions after Trump signals war may end.

The post Bitcoin jumps toward $69K as oil plunges 30% amid US–Iran tensions appeared first on Crypto Briefing.

Bhutan moves $12M in Bitcoin as transfers surpass $42M in 2026 while remaining the 7th largest sovereign BTC holder.

The post Bhutan moves $12M in Bitcoin as government transfers top $42M so far this year appeared first on Crypto Briefing.

The rapid liquidation highlights the risks of high-leverage trading amid volatile markets, underscoring the need for strategic risk management.

The post Hyperliquid trader goes all in on oil and gets liquidated in under 40 minutes appeared first on Crypto Briefing.

Sharplink reports a $734M loss for 2025 as it expands its Ethereum treasury strategy and grows holdings to nearly 870K ETH.

The post Sharplink posts $734M loss as Ethereum treasury grows to nearly 870K ETH appeared first on Crypto Briefing.

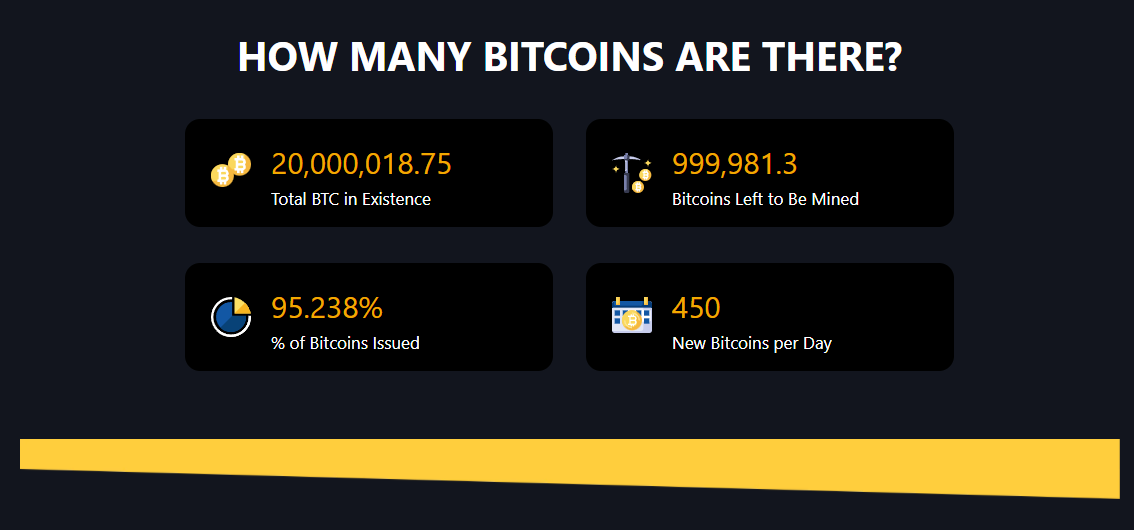

Bitcoin reaches 20 million mined coins, marking over 95% of total supply with the final 1 million BTC to be mined over the next 114 years.

The post Bitcoin passes 20 million mined coins as remaining supply falls below 1 million BTC appeared first on Crypto Briefing.

Bitcoin Magazine

Bitcoin Magazine

Bitcoin Has a Golden Opportunity With AI Agents, It’s Time to Build

For all of bitcoin’s life, it has been fighting an uphill battle against fiat currencies that mostly do the job of being money. Obviously, fiat has plenty of issues, but when it comes to impacts immediately visible to everyday people in much of the world, bitcoin isn’t 10x better. Some may even conclude that they would prefer a system based on neutral money to government-rigged ones, but entrenched fiat systems work well enough that few want to deal with the hassle of constant conversion. With the rapid growth in agents’ capabilities, a huge gap has opened that bitcoin has a shot at filling. Instead of competing with entrenched interests as you would with fiat, in the agentic payments field, everyone is starting from zero.

In a recent post on Spiral’s Substack, I pointed out that all of the payment standards being developed for AI agents haven’t yet gotten off the ground. Credit cards won’t work in a world where automated tooling is making purchases. The web is filled with captchas and heavy investments in blocking bots, rather than enabling their use for commerce. Even if they offered payment methods that agents could use, few merchants today have websites that agents can reasonably navigate. No matter what payment method agents ultimately use, it will require every merchant to adapt to a new world.

With no one company owning both the agent and merchant sides of the marketplace, this leaves a wide-open opportunity where it’s still anyone’s game. Better yet, with the popularity of open-source agents today, no company owns much of the purchasing side at all! If the bitcoin community plays its cards right, there’s a good shot at a large part of the future of commerce flowing over open rails not controlled by any single company.

There’s still a lot to build, however, and nearly every payments industry player is trying to position itself to take the crown. Visa is working on an “Intelligent Commerce” product, OpenAI and Stripe announced the Agentic Commerce Protocol (ACP), Google announced AP2 and Coinbase announced an extension of it for crypto – x402. The bitcoin community’s lack of central planning makes responding with their own options more chaotic and harder to follow, but that’s also its strength: lots of people trying lots of different approaches to achieve the same goal are more likely to succeed than a single, focused approach that might be wrong.

With Lightning surpassing a billion dollars in monthly transactions and Square enabling Lightning for its in-person merchants, it seems the technology is finally here that will let bitcoin cross the chasm and become everyday money. Some ideological merchants have been accepting bitcoin for years, and as we continue to integrate bitcoin wallets into agents, we’ll create yet more reasons for every merchant that wants to sell things to join in. But for that to work, bitcoiners have to step up and use the tools at their disposal. If people aren’t trying to buy things with bitcoin, merchants won’t care.

Luckily, these days, you don’t need code to build tools that find merchants accepting bitcoin payments. You don’t even have to sell your stack to buy things with bitcoin. Install an agent, give it a wallet, give it some bitcoin, and tell it to go buy your monthly beef tallow subscription. Tell it to email merchants it wants to buy from and ask them to support bitcoin. Point it to the Bitcoin Merchant Community and have it explain to any merchant it comes across that it wants to pay them without Visa taking a cut but wasn’t able to.

Thanks to extensive existing work, bitcoin is already one of the best ways to enable automated online commerce. Instead of merchants having to fill their sites with captchas to prevent bots from using stolen credit cards and dealing with chargebacks, many bitcoin payment processors can provide merchants with local currency within a day. Instead of being exposed to the risk that an operator’s single private key could seize their stablecoins, merchants can choose from many payment processors, whether foreign or domestic. This competition drives down fees and means we’re not building new payment rails on a platform that will inevitably seek higher rents once its dominance is cemented.

These issues aren’t top of mind for most, but we must get the new rails right. Stablecoins look great at first glance, but moving to a world where one company (Coinbase) owns both the platform (Base) and earns all the interest on the currency’s float (USDC) where payments are made is not a recipe for long-term success. Once everyone is locked into using one payment method, switching away as the operator increases fees won’t be practical. It doesn’t matter whether the protocol agents use to communicate with merchants is based on some “open standard.” If the vast majority of agents have funds on only one platform and the vast majority of merchants accept funds on only one platform, switching will be impossible.

While bitcoin has come a long way on its journey to becoming a reserve asset, it is only beginning its path towards everyday money. Bitcoin reaching escape velocity on the first does not imply that the second is guaranteed; in fact, far from it. With so much competition from every payments industry player, not to mention stablecoins, there’s a lot of outreach and work to be done to build payment momentum. Still, we can’t let this opportunity pass us by. If you believe commerce should happen on neutral money rather than corporate gatekeepers, it’s time to get to work.

This is a guest post by Matt Corallo. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

This post Bitcoin Has a Golden Opportunity With AI Agents, It’s Time to Build first appeared on Bitcoin Magazine and is written by Matt Corallo.

Bitcoin Magazine

Coinbase Launches Regulated Bitcoin and Crypto Futures Across Europe

Coinbase has rolled out futures contracts to traders in 26 European countries, including Germany, France, and the Netherlands, marking the first time the exchange has offered derivatives directly to users in the region.

The products are available through Coinbase Advanced, the company’s high-performance trading interface, and are offered by its MiFID-registered European entity, ensuring compliance with EU financial regulations, the company said.

European traders have historically relied on unregulated offshore platforms for crypto derivatives, navigating regulatory gaps and exposure to operational risks.

Coinbase’s launch provides a regulated alternative, offering cash-settled futures on bitcoin and crypto-linked equity indices, including the “Mag7 + Crypto Equity Index Futures,” which blend exposure to major technology companies, Coinbase stock, and spot crypto exchange-traded funds.

The platform offers two main types of futures contracts. Perpetual-style contracts carry five-year expiries, use an hourly funding mechanism to align prices with the underlying assets, and settle daily. Dated contracts have monthly or quarterly expirations, are marked to market daily, and settle in cash at expiry if held to maturity.

Traders can use up to 10x leverage on select contracts, including Bitcoin, Ethereum, and certain equity indices, while other products offer leverage in the 4x to 5x range, the company said.

Trading fees start at 0.02% per contract, though they exclude exchange, clearing, and NFA fees.

Eligible users must pass trading experience checks and KYC verification before funding their accounts with euros or USDC to access futures trading.

Coinbase emphasized that derivatives are complex instruments, noting the potential for rapid losses due to leverage and advising users to consider professional guidance.

Coinbase adds stock trading for U.S. users

The launch forms part of Coinbase’s broader strategy to create an “exchange for everything.” Beyond crypto trading, Coinbase has added stock trading for U.S. users, offering equities such as Apple and Tesla around the clock, introduced prediction markets through a partnership with Kalshi, and outlined a tokenization roadmap aimed at on-chain access to traditional assets.

Coinbase’s European expansion comes amid a broader market decline. The $1.3 trillion crypto market is down roughly 50% from its October 2025 highs, reflecting geopolitical tensions, tariff uncertainties in the U.S., conflicts in the Middle East, and market concerns tied to advances in artificial intelligence.

In other news, Nasdaq said today that it plans to work with Kraken to distribute tokenized versions of publicly traded stocks to investors outside the United States, as part of a broader push to integrate blockchain infrastructure into traditional capital markets.

This post Coinbase Launches Regulated Bitcoin and Crypto Futures Across Europe first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

Nasdaq and Crypto-Exchange Kraken Partner to Bring Tokenized Stocks to Global Markets

Payward, the parent company of cryptocurrency exchange Kraken, has partnered with Nasdaq to build a gateway connecting traditional stock markets with blockchain networks.

The project will use Payward’s xStocks platform to move tokenized equities between regulated institutional markets and permissionless decentralized finance (DeFi) networks in regions where the service is approved, Kraken said.

In short, tokenization turns financial assets, like stocks, bonds, or funds, into digital tokens that can operate on blockchain networks.

For equities, tokenization allows shares to maintain their usual rights, including voting and dividends, while also being traded on digital networks or integrated into financial applications built on blockchain.

xStocks has already handled more than $25 billion in transactions since its launch, including $4 billion settled directly on-chain.

Last week, Kraken became the first crypto-native firm to gain direct access to the Federal Reserve’s core payment system after its banking arm, Kraken Financial, received a master account from the Fed.

This lets the company settle dollar payments on Fedwire without relying on intermediary banks, putting it on the same rails as traditional banks and credit unions.

Kraken gateway links tokenized and regulated equities

The platform has over 85,000 holders across supported networks. Nasdaq’s equity token framework, expected to go live in the first half of 2027, will preserve issuer control, follow existing regulations, and maintain the rights of shareholders.

The gateway is designed to make it easier to move tokenized shares between regulated markets and open blockchain networks.

Clients will be able to swap assets from institutional trading systems to decentralized networks while staying compliant with local rules. Payward Services will handle KYC and AML checks, making sure everyone accessing the gateway meets regulatory standards.

Arjun Sethi, Co-CEO of Payward and Kraken, said tokenization changes how equities function at a fundamental level. Traditional shares often stay locked inside brokerage systems, limiting their use to simple buying, selling, or broker-specific margin arrangements.

Tokenized equities can move between venues and blockchain networks, allowing the same shares to serve as collateral across multiple trading strategies at once.

This can expand effective exposure across markets while keeping risk under control through a unified margin system.

For international investors, tokenized equities can open access to markets where traditional brokerages are hard to reach. In more developed markets, tokenization can improve capital efficiency, letting equity collateral be used for trading, lending, and hedging within a shared pool of liquidity.

This partnership comes as tokenized equities expand globally. Platforms like Robinhood, Gemini, and Coinbase already offer tokenized stocks in Europe.

Nasdaq previously asked the U.S. Securities and Exchange Commission to allow tokenized and traditional versions of stocks and ETFs to trade side by side. Both forms would settle through the Depository Trust to stay interchangeable.

Tal Cohen, president of Nasdaq, said tokenization could create an “always-on financial ecosystem” where investors can access markets and issuers can engage with shareholders in new ways.

This post Nasdaq and Crypto-Exchange Kraken Partner to Bring Tokenized Stocks to Global Markets first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

Public Bitcoin Miners are Dumping Bitcoin for AI, a Historic Mistake

There is no doubt about it, this is the age of AI. Corporations are cutting their workforces in half to invest cash flow into hardware, while the stock market remains near all-time highs, mostly thanks to FAANG. OpenClaw, a self-hosted AI agent, has more stars on GitHub than Linux and React, while even Jack Dorsey is taking harsh measures to restructure Block in the face of digital, artificial intelligence. But how much of this AI wave is hype, and how many of the companies that build its infrastructure will actually capture the profits?

Public Bitcoin miners in the United States have made their choice, a variety of them committing capital to building out AI datacenters, and some even making full rebrands, distancing themselves from the orange coin. While there’s a full range of AI-related pivots and statements made by public Bitcoin miners on the matter, a couple stand out as the most radical.

Cypher Mining, estimated to be worth around six billion dollars — placing it among the biggest in the country – announced a full rebrand away from Bitcoin and on to the AI hype train. In their most recent investment report titled “Rebrands to Cipher Digital to Reflect Strategic Shift Toward HPC,” the company explained why they “Divested 49% Stake in Alborz, Bear, and Chief Mining Sites”. Bitfarms Ltd, another large public miner valued at over a billion dollars, also made a full pivot to AI. The CEO, Ben Gagnon, went as far as saying “We are no longer a Bitcoin company,” as reported by Coindesk, though they did keep the ‘Bit’ in the name.

Some of these public companies are expecting more dollar returns from digital intelligence than those they get from Bitcoin, at least in the short to mid term, while other are others might consider it a diversification or an opportunity too large to miss.

Kent Halliburton — Co-Founder & CEO of Sazminingexplained to Bitcoin Magazine in an exclusive interview that “The average cost to mine a bitcoin right now is about $87,000. The spot price of bitcoin is about $70,000. So most of the industry is underwater, and the public miners are using that as their excuse to pivot.” Sazmining is a private Bitcoin miner that specializes in frontier energy sources, with operations mostly outside of the United States.

Halliburtonalso noted that “$87,000 is an industry average — it includes guys running old-gen rigs on grid power in Texas. At our sites in Paraguay and Ethiopia, our clients are producing bitcoin on an energy cost basis of $50,000 to $64,000, on 100% renewable energy. That’s a 10 to 30 percent discount to spot. The profitability is right there.” It just requires a longer investment horizon or cheaper energy, neither of which appears to be actionable for American public miners who have dollar-denominated quarterly reports to target.

On the topic of cheaper energy, however, Halliburton suggests that public U.S. miners had the chance to be competitive but have failed to take advantage of their resources. He minced no words on the topic, saying that these public companies “had the power contracts, the land, the infrastructure — everything you need to mine bitcoin cheaply — and they’re handing it to Microsoft and Google in exchange for lease checks. They went from securing the Bitcoin network to securing rack space for hyperscalers, and they’re calling it a strategy. Meanwhile, they’ve dumped over 15,000 bitcoin off their balance sheets to fund the transition”.

Of the biggest public Bitcoin miners, IREN Limited began its pivot to AI cloud services in April 2025, announcing a$9.7 billion, five-year agreement with Microsoft for 200 MW of critical IT load using NVIDIA GB300 GPUs. TeraWulf has executed multiple Google-backed HPC expansions through Fluidstack, securing 10 year agreements for over 200 MW.

Cipher Digital completed its full rebrand to an HPC landlord with 600 MW of contracted capacity, including a 15-year, 300 MW lease with AWS and a 10-year, 300 MW lease with Fluidstack backed by Google. Hut 8 signed a 15-year, 245 MW lease with Fluidstack, also backed by Google, eyeing future possible extensions and a right of first offer for over 1,000 MW. Core Scientific has expanded its HPC focus to 270 MW through partnerships with CoreWeave, which serves Microsoft and OpenAI workloads.

Riot Platforms is strategically evaluating an AI hosting expansion by partnering with AMD on an operational 10-year, 25 MW lease and assessments for 600 MW of AI/HPC at its Corsicana site, though no hyperscaler agreements have been announced.

MARA Holdings is diversifying into AI through a joint venture with Starwood Capital’s Starwood Digital Ventures, targeting 1 GW of near-term IT capacity expandable to over 2.5 GW for hyperscale and AI workloads, with Starwood leading financing and tenant sourcing, but without named hyperscaler contracts yet.

CleanSpark is pursuing a pivot to AI by acquiring Texas land and power for AI/HPC, including 447 acres in Brazoria County for 300–600 MW potential and an Austin County site contributing to 890 MW aggregate, funded by Bitcoin sales, with tenant discussions ongoing but no hyperscaler leases disclosed.

So the AI gold rush is here, there’s no doubt about it, many of these public miners apparently see an opportunity to build out the infrastructure of — what is without a doubt— a profound technological trend. But history has not been kind to those who build the infrastructure of a new era, not in the long term anyway. It tends to be a very high-risk, medium-reward kind of bet. How many of the companies that built the railroads — for example — are still around today? Or, without going back that far, can you name any company that built out internet fiber lines in the late 90’s and 2000’s?

There is a long list of railroad bankruptcies from the late 1800’s, which even led to a financial crisis in what’s called the Panic of 1873, many overleveraged in debt to fund build-outs for which there was not enough demand yet. After the panic, J.P. Morgan led a consolidation of bankrupt railroad companies, resolving debt disputes and bringing their real estate assets under new ownership. It was they who ended up capturing the upside of the railway build-out.

And just around the corner of the century, the dot com bubble of the 2000’s left a graveyard of fiber line infrastructure companies that were also, in the end, bought out by hyper scalers like Google and Meta during the post crash consolidation, for pennies on the dollar.

While both the railway and fiber line build-outs overall helped scale commerce for the world in incredible ways — demonstrating the overall wisdom of the markets — most individual companies involved did not survive the process, and venture capitalists looking at the AI boom today are aware of this dynamic.

The Capex vs Revenue AI Gap

Various investor groups are starting to question where the returns on this massive infrastructure spending will come from. In an October 2025 report titled “AI: In a bubble?”, GoldmanSachs took a argued that, while the investments so far could be supported by big tech revenue, the valuations of some of these companies were starting to get “frothy”.

David Chan at Sequoia has been pointing out the growing gap between AI-driven revenue and capital expenditures (Capex) since 2023, leading to a widely reported number of a $600 billion gap between them. Capex spending commitments in 2026 are north of $700 for the hyper scalers, but where are the returns?

OpenAI’s $20 billion annual recurring revenue (ARR) is impressive for a new company, but that represents “roughly 3% of the projected 2026 hyperscaler capex total” as reported by FuturumGroup, who noted that “Anthropic’s $9 billion run rate, while showing 9x year-over-year growth, occupies a similar position. The entire cohort of pure-play AI vendors – including Cohere ($150 million ARR), Mistral (~$400 million), Perplexity ($148 million annualized), and others – likely accounts for less than $35 billion in projected combined 2026 revenue.”

Skepticism about where the value of AI will actually be captured has also been aired by VC’s like Chamath Palihapitiya. He was a prominent investor in Groq, a company building custom silicon for the AI age, which was licensed by NVIDIA in a $20 billion deal last year, and was a Facebook insider through the company’s rise to become a hyperscaler. If he has his doubts about the profitability of building the railroads of artificial intelligence, then perhaps there’s something worth giving a very close look at.

Palihapitiya also argued in a recent All In Podcast that corporations might soon start to realize they are exposing their trade secrets to cloud AI, preferring instead to self-host. Building out in-house GPU farms might seem like a bit of a side quest, but can you really risk your trade secrets with AI providers who train on user data? After all, new versions of models trained on that data will have it in their knowledge base, exposed to the world. And even if corporate agreements not to train on corporate data become the norm, a very high trust relationship would be formed, posing a systemic risk to certain corporations, a risk that the data might get leaked or seen by the wrong insiders inside the cloud AI provider companies.

There are also questions about whether the market fundamentally wants cloud AI for the same reasons. Would you hire a personal assistant if you knew the data you share with them would end up on the internet? Probably not, but that’s what’s happening with AI. In fact, the U.S. Southern District of New York recently ruled that users do not have client-attorney privilege when getting legal help from AI chatbots, and thus, sensitive discussions with AI could be legally subpoenaed and used against the clients in a court of law, a sign of the risks involved with trusting AI blindly. Some speculate that new kinds of terms and agreements will need to be formed to support this use case. But the legal case points to a fundamental element of the demand for AI: people want humanoid intelligence, digital or otherwise, that they can trust.

AI Loyalty and Trust

Ah, “Trust”, that ubiquitous, almost supernatural word that does so much work to carry the weight of the world. But what is trust? Fundamentally, it is predictability, one person’s confidence that another human, system, or AI will behave in a certain way, in a reliable, predictable, and positive way towards one’s interests. AI, when hosted in the cloud, however, can not give such assurances; the data is fundamentally leaving the user’s machine to be processed by “the cloud,” and what happens up there is beyond us mortals. In fact, “the cloud” has legal risks that might prevent it from being loyal to you as a user in certain scenarios. Hence, perhaps the public’s fascination with OpenClaw.

In recent weeks, a new open source project in the AI world has taken the tech industry by storm. 289,000 stars on GitHub, more than Linux has gotten despite supporting the software infrastructure of the world, more than React, one of the most popular web development languages in the world. And it’s only been live for what, weeks? How could this be? Why do people like it so much?

Well, arguably two reasons. It feels more like a human assistant than a chatbot; it updates itself, remembers what you are interested in, journals, and develops around your preferences. But most important of all, you can host it on your machine. People were buyingMac minis in droves to run OpenClaw, pairing it up with Claude Max API token plans of about $200 a month. Some argue this is a revolution in self-hosting, even though the above setup is still dependent on the cloud. But what’s actually happening here is that OpenClaw appears loyal, it remembers you, it is “in your home” in your PC. It’s not a chat interface whose context window will eventually become too much for it to manage, ending in a small death, replaced by a new chat tab. OpenClaw is not a chatbot; it’s an AI entity of sorts that users create a relationship with. And good relationships are built on trust.

So what does all of this have to do with public Bitcoin Miners? Well, perhaps self-hosted AI is the future, Chinese AI models are increasingly leaner and can run on machines far from the cutting edge, arguably pressured into innovation by sanctions on specialized AI hardware like high-end Nvidia chips. Open source tools of all kinds that manage and host models locally are regularly launched and improved, and if history is any guide, the mass production of AI hardware will lead to the commoditization of powerful computers that will make it to end users’ homes, and can handle AI.

In fact, Apple, the FAANG that has had the worst AI products deployed to date, may end up becoming one of the biggest winners of the AI race. Why? Because their user hardware is excellent. Recent Macs don’t have a distinction between RAM and VRAM, an issue all other computers dependent on GPUs, such as Nvidia, have. This limits the size and speed of models that can be self-hosted. Instead, all RAM is unified in the latest Mac machines, letting users run powerful models locally that don’t easily run on non-Apple hardware. Self-hosted AI is the future.

And thus, public Bitcoin miners, in the pursuit of mid-term fiat gains, might have just fallen for a trap. The same trap the giants of the dot-com bubble fell for. The same trap that the titans of the industrial era, who built the railroads, fell for. The infrastructure that runs the future does not necessarily capture the gains.

This post Public Bitcoin Miners are Dumping Bitcoin for AI, a Historic Mistake first appeared on Bitcoin Magazine and is written by Juan Galt.

Bitcoin Magazine

Bitcoin Price Teeters Near $69,000 Despite Market Volatility and Oil Price Swings

Bitcoin price traded near $69,000 on Monday, stabilizing after last week’s brief rally and then sell-off into the weekend. The cryptocurrency has remained resilient even as traditional equities and oil markets experience sharp swings.

Bitcoin price remains confined to the $62,500–$72,000 range following February’s sharp decline, with repeated attempts to break above $72,000 failing, according to Bitfinex analysts.

A high of $74,047 on March 4 marked a brief breakout for the bitcoin price, but momentum could not be sustained, and the move was quickly reversed. The March 6 spike in negative realized profits of around $900 million shows that many investors exited positions at a loss during the failed rally.

Passive sell orders and late-entry leveraged longs absorbed buying pressure, keeping the price trapped within its established range.

Since the February low, dip buyers have supported a 20.5% recovery, helping stabilize the market.

Realized losses have now sharply compressed, suggesting that forced selling has largely subsided, but upside remains capped until $72,000 is decisively cleared, according to Bitfinex.

Bitcoin price weathers macro turbulence

The surge in volatility comes alongside dramatic movements in energy markets, where West Texas Intermediate crude briefly rose above $110 per barrel before easing back.

Supply concerns driven by geopolitical tensions in the Middle East have weighed on global equities and safe-haven assets such as gold, while pushing demand toward the U.S. dollar.

Bitcoin’s own volatility measures suggest the crypto market may have already experienced its most stressful phase. The Bitcoin Volmex Implied Volatility Index (BVIV) spiked earlier this year when bitcoin price briefly fell to $60,000, indicating heightened market stress.

Since then, volatility has eased, suggesting that crypto markets front-ran some of the turbulence now affecting traditional assets.

Despite macro uncertainty, bitcoin’s price has held above $66,000, recovering from minor pullbacks that followed attempts to break through resistance near $74,000. The market has seen a consolidation phase, with buyers defending levels around $66,000 to $69,000, according to Bitcoin Magazine Pro data.

The ongoing conflict in the Middle East and disruptions to shipping routes have contributed to sharp spikes in oil prices. The Strait of Hormuz closure and recent strikes on regional depots tightened supply, adding upward pressure on crude and fueling concerns about global inflation. Rising energy costs ripple through industries worldwide, potentially increasing borrowing costs and putting pressure on risk-sensitive assets, including bitcoin.

On top of this, underlying financial pressures that could influence Bitcoin’s appeal.

“While chaotic global events are getting most of the attention and are often credited for bitcoin’s price moves, there may be deeper stresses forming beneath the surface,” Timot Lamarre, director of market research at Unchained, wrote to Bitcoin Magazine. “In the private credit market, including unusually high withdrawal requests from large funds, suggests liquidity in parts of the financial system may be tightening. Markets tend to anticipate the policy response to financial stress before it happens, and if investors begin expecting another round of monetary expansion, the incentive to hold bitcoin only grows stronger.”

Global equities have reflected these pressures. Japan’s Nikkei and South Korea’s KOSPI both dropped more than 7% after market openings, while China and Hong Kong’s indices recorded smaller declines.

The strength of the U.S. dollar, coupled with elevated yields, has reinforced its role as a primary defensive asset in the current environment, leaving bitcoin price and other risk assets to navigate a more complex landscape.

Within this context, bitcoin price has maintained relative stability. Its market capitalization has remained above $1.3 trillion, and trading activity shows continued interest across spot and derivatives markets.

Bitcoin’s mined supply also surpassed 20 million BTC today — over 95 % of the 21 million cap — leaving just about 1 million coins left to be mined over the next century.

This post Bitcoin Price Teeters Near $69,000 Despite Market Volatility and Oil Price Swings first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

CryptoSlate

Treasury’s mixer language points to a new U.S. line on crypto privacy

A new Treasury report says lawful users may use mixers for financial privacy on public blockchains. The language leaves Treasury’s money-laundering case intact, while opening room for privacy tools that can operate inside regulated U.S. crypto markets.

In a report to Congress this week, the U.S. Treasury said lawful users of digital assets may use mixers to protect financial privacy on public blockchains.

Treasury gave ordinary examples. It said users may want to shield personal wealth, business payments, charitable donations, and consumer spending from full public view.

The same report also kept the department’s enforcement case in place. Treasury said criminals use mixing, bridging, and swapping to break audit trails and highlighted North Korean activity.

It added that bridges have received about $1.6 billion in deposits from mixing services since May 2020, with more than $900 million reaching one bridge that later drew scrutiny over failures tied to DPRK laundering.

Treasury’s wording still marks a significant change in official language. For several years, the department described mixers mainly through the lens of sanctions risk, darknet activity, ransomware payments, and state-backed theft.

The report puts lawful privacy use into the record alongside those risks. That wording points to a narrower policy distinction between illicit concealment and supervised privacy services on public chains.

President Donald Trump made U.S. leadership in digital financial technology a formal goal by executive order at the start of his term.

The July 2025 digital-assets report then told Treasury to revisit its 2023 mixer proposal in a way that still blocks illicit finance while protecting privacy and lowering regulatory burden.

Those steps, however, do not suggest a broad pardon for mixers, but Washington wants more crypto activity, more dollar-linked settlements, and more institutional capital inside domestic channels.

Once that becomes official policy, privacy starts to look less like an edge case and more like missing infrastructure for public-chain finance.

Treasury’s own numbers show why privacy is back in the policy record

Treasury’s report said successful monthly transactions on public blockchains reached 3.8 billion in early 2025, up 96% year over year.

That scale changes the policy question. A network carrying billions of transactions each month does not serve only traders and protocol users.

It starts to carry payroll-adjacent activity, treasury movements, commercial settlement, donations, and consumer payments. At that point, full public visibility becomes a business risk for many lawful users, not just a compliance benefit for investigators.

Treasury paired that growth figure with a warning, not a retreat. The department also released a new money-laundering risk assessment, which says digital assets are increasingly used alongside social media, encrypted messaging, and AI-enabled fraud.

Another review from the FATF this month also said criminals’ misuse of stablecoins through peer-to-peer transfers and unhosted wallets is a growing concern.

That mix of signals points to a more selective U.S. approach. Treasury’s report said custodial mixers, if they register and comply as money services businesses, can still generate off-chain information useful to regulators and law enforcement.

In practice, that points toward privacy tools that preserve records, screening, and suspicious activity reporting, while keeping pressure on tools that operate outside those controls.

A hedge fund, issuer, or corporate treasury may want confidentiality around counterparties, payment amounts, and wallet relationships.

Treasury is signaling that the government can accept some forms of confidentiality if service providers remain legible to the state. The department is drawing lines around provider type, recordkeeping, and supervision rather than treating every privacy use case as identical.

| Signal | Verified figure | Implication |

|---|---|---|

| Public-chain activity | 3.8 billion successful monthly transactions in early 2025, up 96% year over year, Treasury said in its March 2026 report | Commercial users face greater disclosure risk as more activity moves onchain. |

| Mixer-linked bridge flows | About $1.6 billion since May 2020, with more than $900 million reaching one bridge, according to the same report | Treasury still has a clear enforcement basis for action against illicit routing. |

| Institutional privacy use | $1.22 trillion in institutional stablecoin transfers over two years, but only 0.013% touched privacy protocols, according to a February 2026 Cambridge analysis | There is a wide gap between institutional scale and actual privacy-tool use. |

| ETF channel | About $1.7 billion moved into spot bitcoin ETFs over a late-February to early-March window in market data | Large pools of U.S. capital already access bitcoin through regulated products. |

The resulting policy picture is more skeptical than the celebratory reading circulating in some circles. Treasury has not changed its view that mixers can serve as laundering infrastructure.

The department has acknowledged that lawful users on transparent blockchains may also want privacy, and that some providers may be able to offer it inside a regulated perimeter.

Institutional capital helps explain why the language changed now

The White House’s crypto agenda helps explain the timing. The January 2025 executive order made digital-asset leadership a U.S. goal.

The March 2025 Bitcoin reserve fact sheet added a sovereign signal around Bitcoin. The July 2025 digital-assets report told agencies to reduce unnecessary drag while keeping anti-money-laundering controls in place.

Treasury’s mixer language fits that sequence.

Institutional flows add the market side. The regulated bitcoin channel is already large.

Market data showed about $1.7 billion moving into spot bitcoin ETFs over a late-February to early-March window, even after sharp outflow days.

That does not prove institutions want mixer access, but it does show that large investors already use U.S.-approved crypto vehicles at scale, and that the policy debate has moved from whether institutions will enter the market to how the surrounding infrastructure will work once they do.

Privacy has become part of that infrastructure discussion. Coinbase Institutional said in its 2026 market outlook that rising institutional adoption is increasing demand for privacy technologies such as zero-knowledge proofs and fully homomorphic encryption.

Cambridge’s February 2026 analysis pushed the point further, arguing that sanctions pushed away legitimate users faster than criminals and said the mixer market has shifted toward more compliant privacy protocols.

The Cambridge figures are particularly useful because they show how early this shift still is. Institutions moved $1.22 trillion in stablecoin transactions over two years, yet only 0.013% of these transactions touched privacy protocols, according to the same analysis.

That tiny share can support two readings at once. One reading says institutional demand for privacy remains marginal in practice.

The other says a large privacy gap remains between the amount of value institutions already move onchain and the tools they are currently willing or able to use.

Bitcoin sits at the center of that gap. The asset now sits inside ETF wrappers, reserve policy, and large-scale portfolio allocation.

Its base layer also remains highly transparent. If the United States wants tokenized dollars, tokenized deposits, and public-chain settlement to develop under domestic rules, commercial users will keep asking for ways to hide counterparties and payment details without stepping outside compliance systems.

Thus, Treasury’s report suggests Washington has started to accept that demand as a feature of market structure, not just a risk category.

The next phase will decide who gets privacy, and under what conditions

The next policy phase will likely turn on provider design. The White House already asked Treasury to revisit the older mixer policy in a way that protects privacy while reducing the burden.

Treasury has now added lawful privacy use to the official record. The unresolved question is whether agencies will convert that language into a broader framework for regulated public-chain finance or limit it to a narrow set of supervised intermediaries.

What happens from here?

| Scenario | What changes | Numeric markers already on the table | What to watch |

|---|---|---|---|

| Base case | Treasury and other agencies make room for privacy tools that keep records, screening, and reporting, while pressure stays high on open-ended obfuscation. | Public-chain traffic is already at 3.8 billion monthly transactions and up 96% year over year in Treasury’s March 2026 report. | Whether licensed providers start offering privacy features for onchain payments, settlement, and treasury management. |

| Bull case | Compliant privacy tools become standard for tokenized dollars and large public-chain transfers, narrowing the gap between institutional scale and privacy use. | Cambridge’s February 2026 analysis said only 0.013% of $1.22 trillion in institutional stablecoin transfers touched privacy protocols over two years. | Whether that share starts to move materially higher as regulated firms test zero-knowledge and similar tools. |

| Bear case | Washington keeps the new language but uses it mainly to bless permissioned systems, while FATF pressure and enforcement actions further isolate non-custodial privacy tools. | Treasury’s March 2026 assessment and FATF’s 2026 review both point to tighter scrutiny of illicit digital-asset use. | Whether agencies pair privacy-friendly language with fresh limits on unhosted wallets, peer-to-peer stablecoin transfers, or developer exposure. |

For Bitcoin, the immediate implication is indirect. Treasury has made it easier for policymakers and regulated firms to argue that lawful users on public chains may need confidentiality tools around payments and settlement.

That argument helps institutions, issuers, and market infrastructure providers far more than it helps every open-source privacy project.

The sharper question is who gets to provide that confidentiality. If banks, custodians, and other licensed firms control most of it, the policy shift will support institutional crypto growth while leaving permissionless privacy projects under pressure.

A wider circle of approved providers would point to a broader change in U.S. policy. A narrow circle would still mark a meaningful change, though one aimed at regulated channels first.

Treasury’s March 2026 report, therefore, lands at a useful moment for the market. The White House wants more crypto activity onshore. Institutional money is already moving through regulated bitcoin products.

Public-chain activity has reached 3.8 billion successful monthly transactions. Against that backdrop, Treasury has put lawful financial privacy back into the federal record.

The next round of guidance will show whether that privacy belongs only to supervised intermediaries or whether it becomes part of the normal public-chain market structure in the United States.

The post US Treasury signals regulated crypto privacy may have a future in the US appeared first on CryptoSlate.

America may reject the name “CBDC” while still building the conditions for CBDC-like control through private dollar infrastructure.

Washington has ruled out a retail Federal Reserve digital dollar in legal form. At the same time, the stablecoin regime now taking shape can normalize freeze, block, reject, and temporary hold functions across private dollar tokens and, increasingly, tokenized financial assets.

Back in January, President Donald Trump signed an executive order barring agencies from establishing, issuing, or promoting a U.S. central bank digital currency.

That made the politics plain: Washington wanted to be seen as anti-CBDC.

But the policy stack that followed points in another direction.

In July 2025, the GENIUS Act created a federal framework for permitted stablecoin issuers that requires anti-money-laundering programs, sanctions compliance, suspicious-activity monitoring, and the technical ability to block, freeze, reject, or prevent transfers when a lawful order demands it.

That does not mean America already has a CBDC by stealth. A stablecoin remains a private liability rather than a direct claim on the central bank.

The current system also lacks a single national ledger, a universal state wallet, or evidence of a federal plan to force households onto a Fed-run retail money stack.

If it isn’t a CBDC, why does it look like one?

But is Washington rejecting the label while building a regulated system of private digital dollars that can deliver some of the same control functions in practice?

The gap between legal identity and user experience is where the main policy question now sits.

That question has been visible in state politics for more than a year.

Several states have enacted anti-CBDC measures, though the evidence supports a narrower formulation than saying states broadly “banned” them.

Florida moved in 2023 to exclude CBDCs from treatment as money under its UCC framework.

Wyoming’s 2025 legislative findings laid out the core civil-liberties case in unusually direct language: a CBDC could centralize financial data, strengthen the link between household spending and the state, and make some purchases easier to restrict.

That language is useful because it sets the benchmark. The live question is whether regulated stablecoins can produce some of the same outcomes without direct Federal Reserve issuance.

The federal government has already started answering part of that question.

A July 30, 2025 White House report said a “unique feature” of stablecoins is that issuers can coordinate with law enforcement to freeze and seize assets.

The same report urged Congress to consider a digital-asset-specific hold law that would give institutions a safe harbor if they temporarily and voluntarily hold assets during short investigations into suspected theft or fraud.

At the same time, the report also backed self-custody and lawful peer-to-peer transfers without a financial intermediary.

The policy design is multi-layered.

It pairs permissionless rhetoric at the edges with explicit control tools at the center of the regulated dollar layer.

The architecture Washington is actually building

The GENIUS framework hardened that direction from policy recommendation into law.

The statute says permitted stablecoin issuers must have the technical capability, policies, and procedures to block, freeze, and reject specific or impermissible transactions and to comply with lawful orders.

It defines those orders broadly enough to include commands to seize, freeze, burn, or prevent the transfer of payment stablecoins, so long as the order identifies the relevant accounts or coins and is reviewable.

Foreign-issued payment stablecoins offered in the U.S. must also be able to comply.

That makes the current U.S. position internally coherent: no retail CBDC, and a private digital-dollar sector with embedded enforcement hooks.

One case study captures the contradiction better than any abstract argument.

A company co-owned by the president of the United States has its own stablecoin. World Liberty Financial’s website confirms Trump and family affiliates have a major economic interest in the venture, while BitGo serves as the official issuer and custodian of USD1.

The token’s risk disclosures state that BitGo can deny access to certain addresses, freeze USD1 temporarily or permanently if it believes an address is tied to illegal activity or terms violations, report information to law enforcement, comply with legal orders, and block transfers to or from specific on-chain addresses.

The politics say “anti-CBDC.” The operating documents, however, contain powers that CBDC critics often warn about. And that pattern extends beyond a single Trump-linked token.

Circle’s USDC risk factors say Circle can block certain addresses, freeze USDC temporarily or permanently, report to law enforcement, and comply with legal orders.

Tether’s January 2026 USA₮ launch for the U.S. market stressed in its announcement that the token is not legal tender and is not government-issued or government-guaranteed.

That distinction remains important. The operational point, though, is already settled.

Freeze-capable stablecoins exist now.

The policy debate has moved on to whether those powers remain targeted enforcement tools or become normal features of the dominant digital-dollar stack.

| Metric | Latest figure | Why it is relevant |

|---|---|---|

| Total stablecoin market | About $313 billion | Digital dollars are already large enough to shape market structure, based on current data. |

| USDC market cap | About $77 billion | A major compliant dollar token already operates at scale, according to market data. |

| USD1 market cap | About $4.6 billion | The Trump-linked case study is no longer marginal, based on current data. |

| Annual on-chain stablecoin transfers | More than $62 trillion | Only about $4.2 trillion reflects real economic activity, according to research. |

| 2030 stablecoin issuance forecast | $1.9 trillion base case; $4.0 trillion bull case | The governance question scales sharply if issuance grows as forecast. |

| FedNow 2025 volume and value | 8.4 million payments; $853.4 billion | The U.S. also has a public instant-payment rail that is not a CBDC, according to FedNow stats. |

The size numbers help show scale, and their composition adds needed context.

The White House put fiat-backed stablecoins at $238 billion as of July 14, 2025, in its July report. Current market data now show roughly $313 billion. That is a large jump in less than a year.

Yet the usage picture is more restrained than the top-line totals suggest.

A 2026 BCG report estimated that while on-chain stablecoin transfers exceed $62 trillion annually, only about $4.2 trillion reflects real economic activity.

The balance is still tied to trading, treasury management, and other crypto-market plumbing.

The rail is strategically important. It is not yet the default checkout lane for the U.S. consumer economy.

The market is large enough for the design choices to count

That nuance is exactly why the medium-term debate carries so much weight.

Stablecoins are no longer a niche product, and they are still some distance from becoming a universal household payment tool.

Citi’s April 2026 research projects stablecoin issuance could reach $1.9 trillion by 2030 in its base case and $4.0 trillion in its bull case.

It also sees transaction activity approaching $100 trillion in the base case and $200 trillion in the bull case, assuming high velocity.

Those are not trivial extrapolations as they imply that today’s design choices around lawful-order compliance, freezes, and temporary holds could apply to a much larger share of digital-dollar activity by the end of the decade.

The wider frame also reaches beyond payment stablecoins.

In December 2025, DTCC said it had received SEC no-action relief to offer a tokenization service for select DTC-custodied assets in a controlled production environment, with rollout expected in the second half of 2026.

The eligible assets include major U.S. equities, ETFs, and Treasuries.

The accompanying FAQ emphasizes wallet registration, governance, observability, resilience, and compliance-aware token features.

That widens the frame from “Can a stablecoin be frozen?” to “How much of the tokenized financial stack is being built around the same compliance logic?”

Once cash equivalents, collateral, fund interests, and Treasury exposure move onto rails designed for identity-aware access and lawful-order intervention, the boundary between private and public control can get blurry for end users.

The issuer may be private. The custodian may be private. The venue may be private. Yet the conditions attached to movement can still reflect public-policy priorities in fine detail.

That is the functional-convergence argument in its strongest form. It does not depend on saying stablecoins are CBDCs.

Money-like instruments and tokenized assets can increasingly share the same tools for screening, pausing, reversing, or denying transfers.

There is still a serious counterargument, and it should be stated plainly.

The Bank for International Settlements argued in its 2025 annual report that tokenization is transformative while expressing doubt that stablecoins will become the mainstay of the monetary system.

It pointed instead toward tokenized central bank reserves, commercial bank money, and government bonds as more durable building blocks.

Citi made a related point from the market side. Its 2030 report says bank tokens could process $100–$140 trillion in transaction volume by 2030 and may appeal to corporates because privacy on public chains remains a major problem.

Add FedNow’s 2025 payment totals, and the picture looks less like stablecoin monopoly and more like a plural system with multiple rails competing for different use cases.

What the next 3 to 7 years could look like

The base case is regulated private dollars rather than an American retail CBDC.

In that path, the United States keeps the anti-CBDC posture, scales a supervised stablecoin sector under the GENIUS framework, and leaves room for self-custody, peer-to-peer transfers, FedNow, and other forms of tokenized money to coexist.

Freezes remain targeted and legally framed rather than universal.

The system still becomes more comfortable with intervention than many CBDC critics expected from a supposedly private model.

The key shift is cultural as much as legal: blocking, freezing, and short-duration holds start to look less like exceptional measures and more like standard features of regulated digital-dollar infrastructure.

The more optimistic path is easy to describe.

Competition preserves escape valves.

Self-custody protections remain meaningful.

Peer-to-peer transfers stay lawful.

Privacy tools improve.

Institutional flows split among stablecoins, bank tokens, and other permissioned settlement media instead of forcing retail users into one dominant compliant token stack.

In that version, the United States gets more digital dollars without collapsing them into one state-shaped grid.

Bitcoin also keeps a cleaner lane. It remains the large digital asset with no issuer, no freeze key, and no lawful-order switch at the protocol layer, while stablecoins keep serving as the compliant dollar edge of crypto.

The downside case is subtler and probably more realistic than any cinematic “Fed wallet” scenario. The legal authorities stay formally narrow, while the operating culture expands.

The White House report already says issuers can coordinate with law enforcement to freeze and seize assets and recommends a hold law so institutions can temporarily pause funds during short investigations.

On paper, that is about scams, sanctions, fraud, and stolen assets.

In practice, the risk is mission creep: broader wallet screening, more frequent temporary holds, more aggressive readings of suspicious activity, and rising pressure on issuers and exchanges to act first and let users sort it out later.

The result still would not be a CBDC in legal form. It could start to feel like CBDC-style control in daily use.

The cleanest conclusion follows from that setup.

America is not launching a retail CBDC.

It is, however, building a private dollar system in which some of the control functions that critics fear in CBDCs are already present and may become more common as stablecoins grow and tokenization spreads.

The next policy fight is over limits: how broad a lawful order can be, how long a temporary hold can last, what due process exists when a freeze is mistaken, and whether self-custody remains a real alternative as the regulated digital-dollar layer gets larger.

Those questions will decide whether the United States ends up with a genuinely plural digital money system or a private version of the same controls it says it rejects.

The post Are US stablecoins just CBDCs in disguise? Look closely and the differences start to blur appeared first on CryptoSlate.

Bitcoin spent the weekend mostly within a familiar price channel, then slipped lower before recovering as traders reacted to the developing impact of the Iran war.

However, while real-world macro events now dictate Bitcoin's movements more than fundamentals or adoption levels, where on the chart it stops to test the waters has not changed.

Bitcoin has tested both long-term support and resistance since Friday. But with trading desks now back at their terminals, it has now rebounded into the middle of a price channel we've seen many times before.

This type of activity is exactly why I’ve kept coming back to the same price-channel framework since spot Bitcoin ETFs launched in early 2024.

My channels have consistently helped identify the zones where BTC is most likely to stall, bounce, or break into a new range, giving a clearer read on market structure than raw price action alone.

Introducing The Akiba Price Channel Indicator

Over the weekend, I built a tool around that framework. Instead of relying solely on chart screenshots, it tracks how Bitcoin interacts with those channels in real time, flagging key bounces and breaks, making the analysis faster, cleaner, and easier to review.

The dataset is built from horizontal price channels that I've tracked for over 2 years. The levels are manual, not machine-generated. They combine psychological round numbers, historical reaction zones, order-book depth, and leveraged futures accumulation. The interaction labels are also narrow by design.

- A “break up” means BTC moved through a boundary without first rejecting it.

- A “break down” means the same in the other direction.

- A “bounce” means the price rejected the line and stayed inside, or returned to, the channel structure.

With this framework, I'm not trying to call direction. The tools show where the market has actually reacted, and when it's likely to do so again.

That record still leans hard toward rejection over escape. Across the full sample, BTC logged 234 interactions, 178 bounces, 30 break downs, and 26 break ups. That puts the bounce share at 76.1%.

The data since March 3 tells a similar story. It shows 54 interactions, with 41 bounces, seven break downs, and six break ups.

The recency heuristic (which is not a predictive model) puts the next interaction at 72.4% for a bounce, 16.4% for a break down, and 11.2% for a break up.

The indicator says support returned, with resistance still overhead

Bitcoin moved back above the $67,995 boundary today after a failed break below $66,894 on Sunday.

The move put BTC back inside the $68,000-$71,500 range after a short trip into the lower $67,900-$61,700 channel. As of press time, Bitcoin is holding $69,000.

The clearest read is that BTC has repaired back into an active range, but it has not yet proved a new expansion leg.

The first fact in that view is simple, the March 8 move below $66,900 did not hold. The second is just as important, price has reclaimed $68,000, but it still sits below $71,500, the ceiling of the current channel. In other words, support returned before a breakout arrived.

That leaves Bitcoin heading into another week of macro releases and cross-market pressure with a working floor, but without a clear upside escape.

The strongest working level in the recent sample is $68,000. It drew 25 interactions, more than any other visible boundary. Twenty of those were bounces. Three were break downs. Two were break ups.

That does not make it permanent support, but it does make it the level that has done the most work.

The latest sequence reinforces that role. BTC first treated $68,000 as resistance after reclaiming $66,894, then moved through it, then bounced from above it. That is the clearest sign in the dataset that the market has rebuilt a floor after last week’s weakness.

The second line to watch is $66,894. That level is the top of the lower $66,900-$61,700 channel, so it acts as the failure line under the current repair. It saw 12 visible interactions, eight of them bounces.

The March 8 break down through that line was key, followed by a March 9 break up that reversed it.

When a downside move loses acceptance that quickly, the market usually treats it as a failed test rather than the start of a durable lower range. That is what the chart shows here. BTC did not stay below $66,900 long enough to build a new base there.

The main ceiling is $71,500. That level posted six visible interactions, five of them bounces and only one clean break up.

Above it sits $72,000, then the $73,500-$73,800 area, which also showed repeated rejection in the recent sample.

So the upside path is clear, but it is layered. BTC has moved from weakness back into a channel that still has a well-defined lid.

| Boundary | Recent interaction count | Recent mix | Working read |

|---|---|---|---|

| $68,000 | 25 | 20 bounces, 3 break downs, 2 break ups | First support and main pivot inside the active range |

| $66,900 | 12 | 8 bounces, 2 break downs, 2 break ups | Failure line, the latest downside move below it did not hold |

| $71,500 | 6 | 5 bounces, 0 break downs, 1 break up | Nearest ceiling, bulls still need acceptance above it |

| $72,000 | 4 | 2 bounces, 1 break down, 1 break up | Next trigger if $71,500 gives way |

| $73,500-$73,800 | 7 combined | 6 bounces, 1 break down, 0 break ups | Upper supply zone from last week’s failed push |

That structure also helps separate accepted moves from fragile ones. The March 7 break down through $68,000 was accepted for a time because BTC then spent roughly two days trading beneath that line and pressing into the $66,900 area.

By contrast, the March 8 break below $66,900 looks fragile because it reversed within hours. The March 9 move back above $68,000 now counts as an accepted reclaim, but only in an early sense. One bounce from above is a good start.

Full upside acceptance still requires a move through $71,500.

The broad message from the channel work is restrained. BTC has re-entered a range that has produced more rejections than escapes.

That makes $68,000 the first line that bulls need to defend and $71,500 the first line they still need to take.

Until price changes one of those facts in a durable way, the range remains the best description of the market.

Macro still points to a range, with event risk at the edges

The channel picture would look cleaner in a soft, risk-on macro backdrop. That is not the environment Bitcoin is trading in.

The Federal Reserve held its policy rate at 3.5%-3.75% in its January statement and said inflation remained somewhat elevated. January CPI was 2.4% year over year, while core PCE was still 3.0% year over year in December.

Labor data points the other way. February payrolls fell by 92,000, unemployment rose to 4.4%, and average hourly earnings were up 3.8% from a year earlier. That combination tends to keep markets guessing. Growth is cooling, but inflation is not fully gone.

Rates and commodities have added another layer. The US 10-year yield rose from 3.97% on Feb. 27 to 4.13% on March 5.

In a separate shock, Brent crude briefly rose to $119.50 before settling a little above $101 amid the Iran conflict. That does not determine Bitcoin’s path on its own. But it does show why markets have not shifted into a clean chase for risk.

Higher yields can limit how far risk assets rerate. Higher oil prices can keep inflation fears alive just as labor data softens. The result is a market that can bounce hard from washed-out levels without getting a free pass to trend.

How the broader crypto market is reacting

Crypto-specific positioning has improved enough to support the repair, but not enough to settle the argument. Digital-asset products took in $1 billion in the week of March 2, including $881 million into Bitcoin.

That ended a five-week run of outflows. But the same source said the earlier washout was large, five straight weeks of spot BTC and ETH ETF outflows totaled $4.3 billion. It also said futures open interest fell to about $7.6 billion and leverage dropped to 25% from 33% in October.

That is the kind of reset that can help a market build a floor. It still falls short of proof that fast money is ready to chase the next leg higher.

Options traders still look cautious. Bloomberg said traders continued to favor downside protection even after the recent rebound. That lines up with the channel data better than a breakout call does. The market has rejected lower acceptance below $66,900.

It has not yet embraced higher acceptance above $71,500. In a mixed macro setting, that is often how transitions look, support rebuilds first, conviction comes later, and sometimes it never comes at all.

A late-February update from CoinShares argued that Bitcoin was still in consolidation with a modest downside bias, even as several conditions for a bottom were starting to form. That fits the present setup. The data do not show a market that has broken free of macro drag.

They show one that has flushed leverage, found buyers back inside a known range, and is waiting for the next piece of evidence.

That is also why the latest bounce should be read as a repair inside uncertainty, rather than a settled verdict on the quarter.

Lower yields, calmer energy prices, or softer inflation prints could help BTC press the top of the range. Sticky inflation, firm yields, or another commodity shock could do the opposite.

The channel maps how price is responding to those drivers.

What the next move looks like from here

The least stretched narrative is that Bitcoin is stabilizing inside a reclaimed channel, rather than starting a confirmed trend. The numbers support that. The full sample is still bounce-dominant at 76.1%. The recent sample is bounce-dominant at 75.9%.

The recency heuristic still tilts toward another rejection rather than a clean directional break. And the most recent directional event that stands out is the failure of downside acceptance below $66,900.

That leaves three live paths and one tail risk. The weights below are an analytical overlay on the channel record, not market-implied odds.

| Scenario | Weight | What has to happen | Levels in play |

|---|---|---|---|

| Base | 50% | BTC holds $68,000 and spends time inside the current channel without full upside acceptance | $68,000 to $71,500, with possible probes toward $72,000 |

| Bull | 25% | BTC keeps support at $68,000, accepts above $71,500, and then clears $72,000 | $72,000, then $73,500 to $73,800, with $77,000 above |

| Bear | 20% | BTC loses $68,000 again and this time builds acceptance below $66,900 | $66,900, then $61,700 and $61,000 |

| Tail risk | 5% | Macro stress forces a deeper liquidation and lower-channel acceptance | $61,700, $61,000, then $56,650 |

The base case remains the cleanest because it asks the market to do what it has done most often in this sample, respect a boundary, move inside the range, and force traders to prove the next break instead of assuming it.

The bull case is simple too, but it needs evidence. BTC would need to hold above $68,000 through the next round of macro data and then turn $71,500 from ceiling into floor. Only then does $72,000 become more than a wick target.

Above that, the failed supply zone around $73,500-$73,750 comes back into view, with $77,000 as the next upper channel boundary on the broader map.

The bear case is not dead just because the March 8 breakdown failed. It only lost the first test. If BTC falls back through $68,000 and then starts spending time below $66,900, the structure changes fast.

The lower $66,900-$61,700 channel would open again, and the conversation would shift from repair to renewed weakness.

A March 5 report cited a Standard Chartered view that still allowed for a near-term slide toward $50,000 before recovery and carried a $100,000 year-end 2026 target. The wide gap between those figures is useful because it shows how uncertain the path remains even when long-run forecasts stay high.

A more constructive case is easier to state than to prove. The market has already done the first part by rejecting a fresh stay below $67,900 and then taking back $68,000. The second part is harder. Bulls need repeated acceptance above $71,500 and then above $72,000, where last week’s move began to stall.

If that happens while flows keep improving and options hedging eases, the upper channel cluster near $73,500-$73,750 becomes a live retest rather than a memory of the last failed push.

For now, the channel offers a disciplined way to read that uncertainty.

BTC has taken back $68,000. It has rejected a fresh stay below $66,900. But it has not yet forced a change in the most important nearby fact, $71,500 still caps the current range. The next evidence is straightforward.

If Bitcoin keeps holding the lower edge and starts closing through the upper one, the upper channels return to the foreground.

If it loses both support lines again, the market will start looking back toward $61,726.

Until one of those things happens, the strongest conclusion is the narrow one, the range is alive, the lower breakdown failed, and the next test is still overhead.

If you'd like access to Akiba's Price Channel Indicator, send me a DM on Twitter

Disclaimer: This article is for informational and analytical purposes only and does not constitute financial or investment advice. Market scenarios and probabilities discussed are observational interpretations of price data, not predictions. Readers should conduct their own research and consult a qualified financial advisor before making investment decisions.

The post New Bitcoin indicator reveals we just avoided a major drop — but one level could decide the next breakout appeared first on CryptoSlate.

XRP remains under significant pressure as the latest oil shock and broader market unease push investors toward a more defensive stance.

The Ripple-linked digital asset has fallen 26% this year to about $1.34 and is down 54% over the past six months, according to CryptoSlate data. In the latest 24-hour session, XRP slid from about $1.37 to as low as $1.33 before recovering to nearly $1.35 as of press time.

The move was modest by crypto standards. However, the larger signal comes from on-chain and exchange data showing a market still working through a large pool of holders sitting on losses and a trading environment that has lost some of its depth.

Glassnode data show that about 36.8 billion XRP are being held at a loss at current prices. In dollar terms, those unrealized losses amount to about $50.8 billion, or roughly 60% of the circulating supply.

That leaves a wide band of investors who are still underwater and are likely to cut exposure as the price approaches their entry levels.

This dynamic helps explain why XRP has struggled to turn short-lived recoveries into a more durable advance.

When a large share of supply sits below cost basis, rallies can meet a steady stream of sellers seeking to exit closer to breakeven. In that setup, price strength has to do more than attract momentum buyers. It also has to absorb lingering supply from earlier holders.

At the same time, the macro backdrop has added to the pressure.

Rising oil prices and the broader repricing across risk assets have pushed traders to reassess exposure across digital tokens, especially older, more liquid names that often move quickly when sentiment turns.

XRP has been caught in that adjustment, though its internal positioning suggests the market was already vulnerable to renewed selling.

XRP's cost basis near $1.44 is shaping the market

The clearest line in the market sits around $1.44, where Glassnode places XRP’s realized price. Realized price is widely used as an on-chain proxy for holders' aggregate cost basis.

When spot trades below that level, the average holder is underwater. That condition often changes the behavior of rallies, turning them into opportunities to repair the balance sheet.

For XRP, that cost-basis gap has become central to the market’s structure.

With spot XRP trading around $1.35 and a realized price of around $1.44, the token remains below the level at which the broader holder base begins to move back toward profitability. That places the next meaningful recovery zone directly in an area where selling pressure can build.

Other on-chain indicators support the same picture. Glassnode’s Spent Output Profit Ratio (SOPR) remains below 1, indicating that coins moving on-chain are being spent at a loss on average.

At the same time, XRP's Net Unrealized Profit and Loss (NUPL) is also negative, indicating that the market as a whole remains in aggregate loss territory.

Taken together, those readings point to a market that has yet to move out of its loss regime.

However, these readings do not mean XRP price cannot rally. Instead, it shows that the hurdle for a sustained rally is higher.

This means that XRP needs sufficient new demand to clear a sizable block of supply held by holders who have been waiting for better exit levels. Until that happens, the realized-price band is likely to remain a reference point for both bulls and bears.

Sell-side aggression is showing up across order flow and derivatives

The institutional picture has also become less supportive of any uptrend for XRP.

Data from SoSoValue shows spot XRP exchange-traded fund (ETF) products recorded their third weekly outflow of the year in the week ending March 6, with about $5 million leaving the funds.

Those products still show about $70 million in net inflows for the year, though the shift in recent weeks suggests some allocators have become more selective amid rising volatility across markets.

For context, CoinShares data shows XRP-focused investment products are the worst-performing this month, with over $30 million in outflows.

The flow picture shows a marginal pullback rather than a collapse. In a market already carrying a large block of underwater supply, even small shifts in demand can have an outsized effect.

XRP can remain under pressure without a broad institutional retreat if fresh buying slows while existing holders use strength to lighten positions.

Meanwhile, the derivatives market also shows participation has cooled. Total XRP open interest has fallen to about $2.25 billion, the lowest level since January 2025.

Open interest tracks the value of outstanding futures contracts and is often used as a gauge of speculative appetite. A decline of that size suggests traders have been closing positions and reducing directional exposure rather than adding fresh leverage.

The same caution is visible in the digital asset's order flow, where the market is dominated by aggressive sell orders.

CryptoQuant's taker buy-sell ratio sits at around 0.912, indicating that aggressive sell orders are outweighing aggressive buy orders.

In practical terms, the side taking liquidity is dominated by sellers. That leaves buyers providing liquidity through resting limit orders rather than pressing the market higher with market orders.

With XRP trading around $1.34, that imbalance reinforces the view that the market lacks strong, aggressive demand.

Though XRP buyers are still present in the book, they are not driving the price upward with urgency.

That signal fits the broader setup. A market can stabilize for a period while passive buyers absorb incoming supply, but the price usually struggles to build momentum when the more aggressive side of the flow remains dominated by sellers.

The combination of all of the above leaves XRP with less upward momentum.

In stronger phases, rising open interest can reinforce a spot move and add urgency to the tape. In the current setup, a smaller open interest base means the price is relying more heavily on outright spot buying to push through resistance.

However, that is not happening because the market is currently dominated by sellers.

Thin exchange activity raises market’s sensitivity

Exchange data show activity has slowed in ways that could make the next move more abrupt.

CryptoQuant’s 30-day XRP volume z-score on Binance stands at about -1.16, indicating daily trading volume has fallen below its recent average. The latest reading corresponds with a daily volume of roughly 27 million XRP while the token trades near current levels.

Lower volume does not guarantee a larger move. However, it leaves the market with less cushion when orders arrive in size.

CryptoQuant data also show the net number of active wallets depositing and withdrawing XRP across 15 major exchanges has fallen to its lowest level since early 2025, with Binance still accounting for the largest share of activity.

That suggests a market with fewer participants actively repositioning and less urgency from both buyers and sellers.

When wallet activity and trading volume decline together, order books can become thinner, and prices can become more reactive.

Under those conditions, smaller flows can move the market further than they would in a deeper environment. A stable-looking chart can therefore mask a more fragile structure underneath, especially when macro headlines can jolt sentiment across assets.