Cryptocurrency Posts

Crypto Briefing

The rush to weaponize AI without adequate safeguards risks catastrophic outcomes, highlighting the urgent need for ethical oversight.

The post AI chose nukes in 95% of war games. The Pentagon wants to deploy it anyway. appeared first on Crypto Briefing.

Strategic partnerships are key to overcoming barriers in the evolving crypto payment landscape.

The post Alex Wilson: Building crypto payment solutions requires collaboration, regulatory compliance is crucial for market entry, and Shift4’s tailored products drive innovation | On The Brink with Castle Island appeared first on Crypto Briefing.

Bitwise donates $233K from BITB ETF profits to Bitcoin developers through Brink, OpenSats, and the HRF Bitcoin Development Fund.

The post Bitwise donates $230K from BITB ETF profits to Bitcoin open source developers appeared first on Crypto Briefing.

South Koreas KOSPI plunged 12% in its largest one day drop on record as margin calls and tensions triggered a $625B market selloff.

The post Korean stock market plunges 12% in historic one-day crash appeared first on Crypto Briefing.

Warsh's potential Fed leadership could shift US monetary policy towards embracing blockchain innovation and regulated crypto integration.

The post White House submits nomination of Kevin Warsh for Fed chair to Senate appeared first on Crypto Briefing.

Bitcoin Magazine

Bitcoin Magazine

Crypto Firm Zerohash is Seeking US National Trust Bank Charter

Digital asset infrastructure firm Zero Hash has applied for a national trust bank charter with the Office of the Comptroller of the Currency, seeking approval to expand its role in digital asset custody and settlement services.

The Chicago-based firm, which operates under the brand Zerohash, provides crypto infrastructure for banks, brokerages and fintech platforms.

Clients listed on its website include prediction markets platform Kalshi and asset manager BlackRock.

According to a report from Bloomberg, the proposed national trust bank would provide custody for digital assets, fiat currency and other assets. The entity would also offer custodial staking, transfer agent services and stablecoin management.

Zerohash chief legal officer Stephen Gardner is listed as the proposed chief executive officer of the trust bank.

The filing places Zerohash among a growing group of crypto and fintech firms seeking federal trust charters during the second administration of Donald Trump.

In December, the OCC granted conditional approval for trust charters requested by Circle Internet Group Inc., Ripple, BitGo Inc., Fidelity Digital Assets and Paxos.

Trust banks differ from traditional banks. They cannot take deposits or issue loans but can hold assets in custody.

Earlier this year, Mastercard considered acquiring blockchain infrastructure firm Zerohash for up to $2 billion but the company chose to remain independent, rejecting an outright purchase.

The two are now reportedly discussing a strategic investment, allowing Mastercard exposure to Zerohash’s technology and client base while preserving the company’s autonomy.

Kraken secures Federal Reserve master account

Earlier today, Kraken announced that they secured a Federal Reserve master account, gaining direct access to the U.S. central bank’s core payment infrastructure. Kraken Financial, the company’s banking arm, received approval from the Federal Reserve Bank of Kansas City, allowing it to settle U.S. dollar transactions directly through Fedwire, bypassing intermediary banks.

While the master account grants direct payment access, Kraken will not receive the full benefits of a traditional bank, such as earning interest on reserves or borrowing from the Fed’s lending facilities.

The approval marks a significant milestone for the crypto industry, long denied access to the Fed’s payment system. Sen. Cynthia Lummis called it a “watershed milestone.”

Other firms, including Ripple and Custodia Bank, have sought similar access, but regulatory approval remains selective. Kraken’s approval aligns with discussions on “skinny” master accounts, allowing limited Fed access without full bank privileges.

This post Crypto Firm Zerohash is Seeking US National Trust Bank Charter first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

Satlantis Emerges as Bitcoin-Native Alternative to Luma for Real-World Events

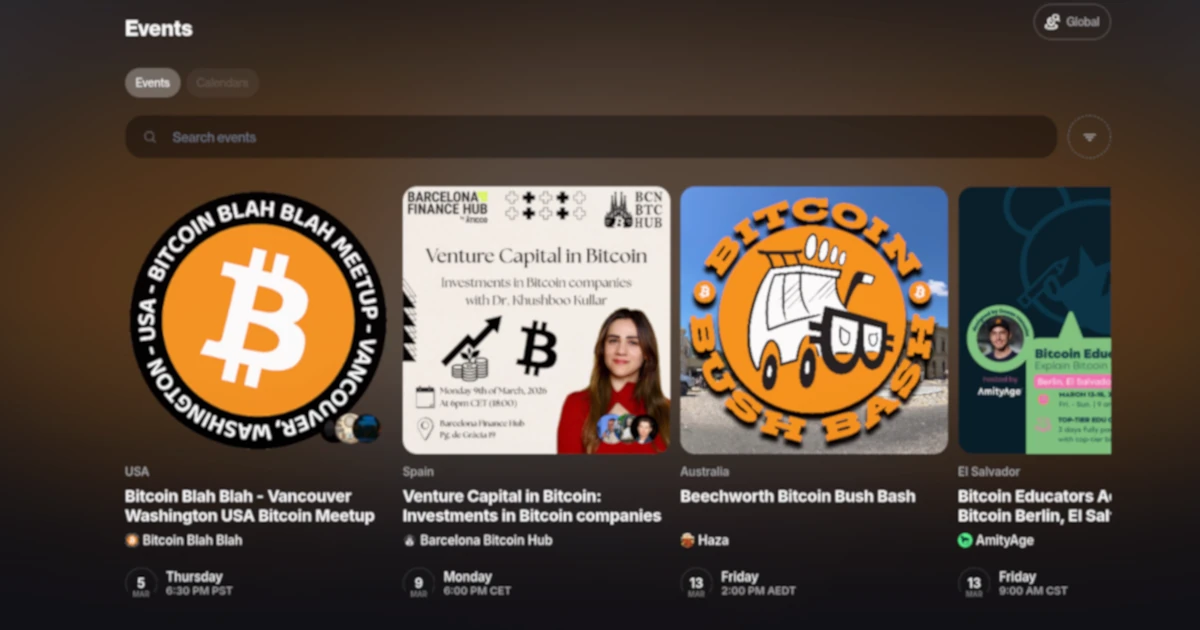

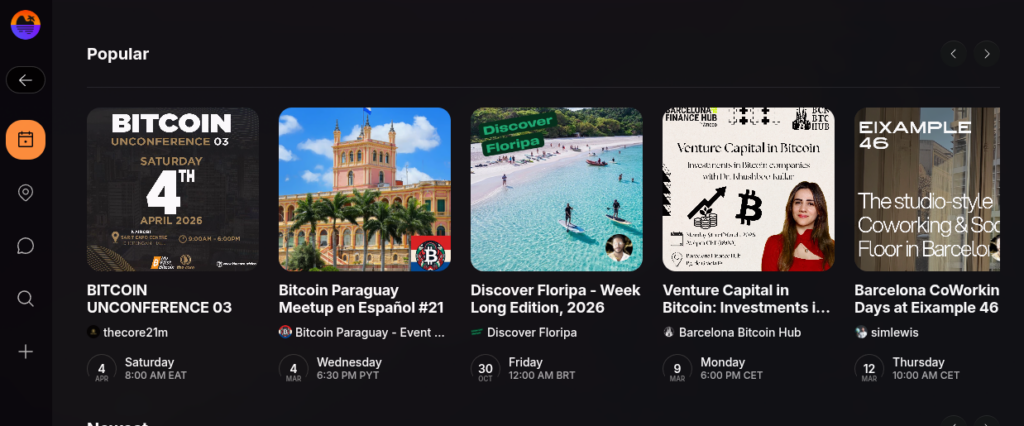

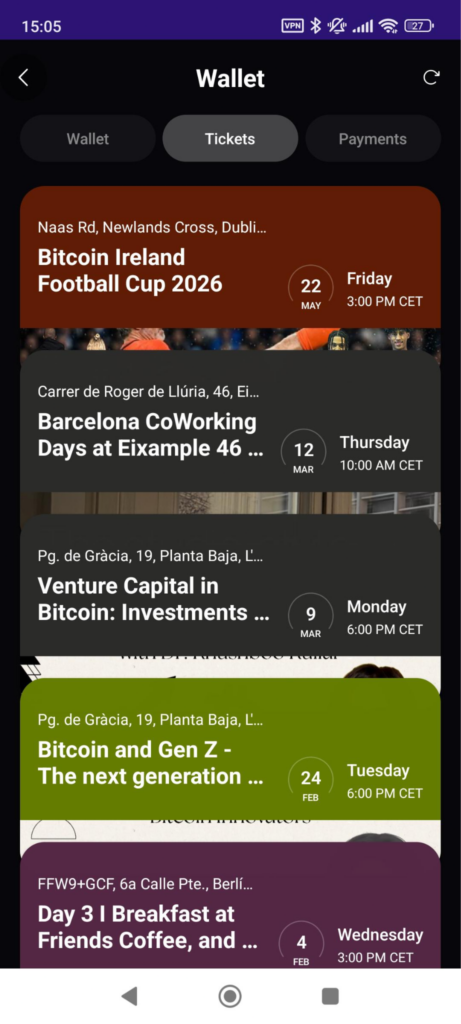

Built on Bitcoin’s ethos and technology, Satlantis is an event organizing platform designed for “real-world maxxing”, a Gen Z term for enjoying the real world with real people.

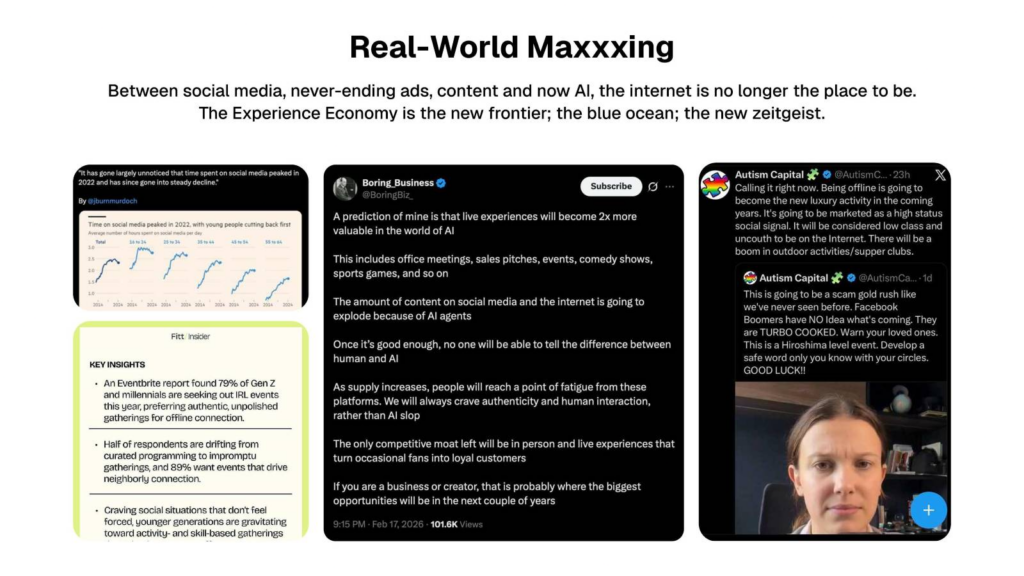

As AI fills social media, confusing and distorting whatever signal it once had, an exodus to real-world experiences has begun to take place. Some statistics show that social media usage peaked in 2022, a saturation induced by the COVID lockdowns that accelerated digital adoption of everything, only to remove its shine. Being online all the time is now ‘passé’.

Jordi Llonch, Head of Growth at Satlantis, told Bitcoin Magazine in an exclusive interview that the app is “a tool to promote commerce in real life,” adding that “AI has broken the internet, people are tired of online everything, people want events in real life.”

This emerging trend back to analogue social dynamics — if you will — won’t necessarily be led by Luddites; on the contrary, new social media tools and business models are emerging to facilitate quality time offline, rather than time online. Satlantis is just that, a tool that lets users discover, follow, and create real-world events of all kinds, bringing all the tools they need to access, market, and host events under one roof.

Satlantis serves as a Bitcoin-only alternative to Luma, the popular event page that is rumored to have an exclusive agreement with the Solana blockchain. You will find no memecoins on Satlantis; its goal is not to keep you online hooked on the roulette wheel of gamification. It’s the opposite, to get you out there in the real world, gathering with real people and seeding the use of sound money while you are at it.

Create, Host, Follow, and Share Events

Satlantis lets you create and customize events, which you can share with a permanent link. You can include images, identify the venue, sell tickets to attendees or host them for free.

Hosts can create their own organization of personal Calendars, which their friends and fans can follow for future events. Satlantis also comes with a sophisticated yet easy-to-use Customer Relationship Management (CRM) tool kit. Hosts can upload a CSV file with names, emails, and nostr pubs, and mass notify their contacts, friends, and followers about future events. Hosts can also target attendees of previous events, or fans who have confirmed attendance or are on the fence. Emails are sent from the Satlantis domain, avoiding spam filters.

Satlantis is deeply integrated with Nostr, a Bitcoin native social network protocol that lets users own their data, such as followers and posts, and migrate it across sites, rather than be locked into a specific social media platform. As such, when hosts create a calendar to list future events, users automatically follow their nostr accounts, creating online connections that last and can be migrated to other Bitcoin social apps like Primal. Users can log in with their existing Nostr keys or with their Google, Apple, or other email accounts.

Sell Tickets in Bitcoin and Fiat

Users can host events for free or sell tickets for bitcoin and local fiat currencies. A one click stripe integration solves the fiat payments problem, unlocking events like Bitcoin conferences that draw in new users. While the Bitcoin integration supports active communities and Bitcoin meetups.

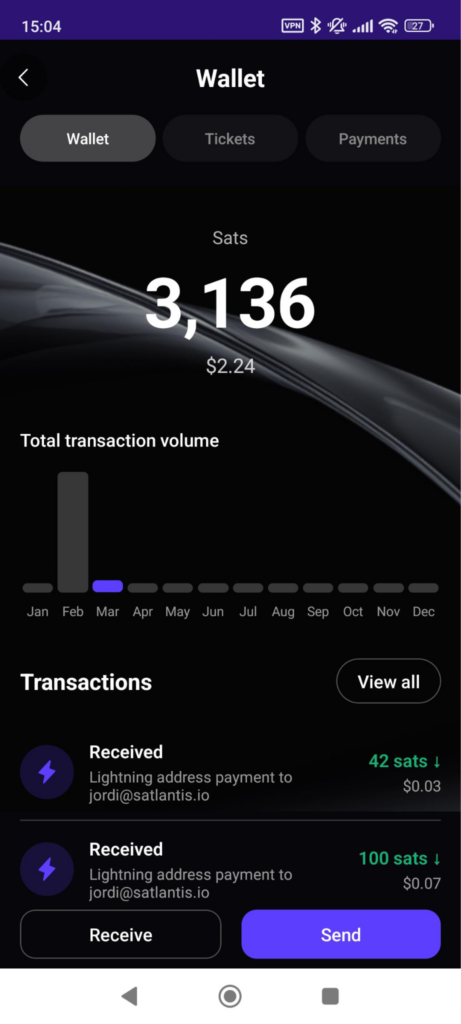

As a Bitcoin native app, every user of Satlantis has a bitcoin wallet built into their account by default, unlocking a wide range of possibilities. For example, hosts can enable fiat payment for tickets, but offer 20% of the value back in sats to attendees.

Hosts can manage ticket types, to offer VIP experiences, and of course, send targeted messages to specific groups of attendees via the CRM.

The Satlantis mobile app has a fully featured Bitcoin wallet that lets users send and receive sats, track ticket purchases to events, and payments earned from hosting them.

Every venue also gets a Bitcoin wallet, which attendees can tip, creating an incentive for venue owners to join the Bitcoin economy by creating a Satlantis account and claiming their Bitcoin tips. A sophisticated system is in active development to make sure only the owners of a venue can claim such wallets, likely via integration with Google Maps.

The Satlantis wallet is fully custodial and only supports Bitcoin’s Lightning Network and gives every user a Lightning URL address, such as Satoshi@satlantis.io. This design decision is highly intentional.1 Satlantis puts a hard cap of 1 million satoshis per account, forcing users to withdraw to their own wallets, minimizing the amount of value held by the platform in custody, but also keeping transaction speeds high and the user experience quick and snappy. Users can withdraw bitcoin to their wallets at any time with no questions asked.

Satlantis only charges 2% for ticket sales processing, as opposed to competitors that can charge up to 10%, though Stripe adds another 2.9% on top for fiat payments.

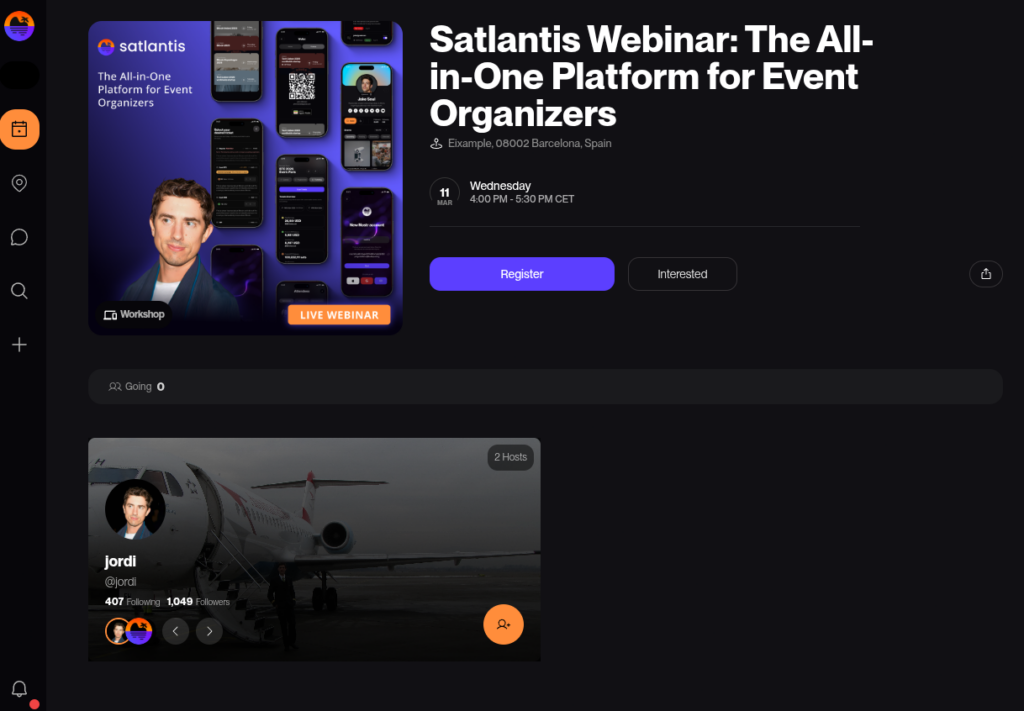

Llonch will be hosting a quick webinar to showcase the full capabilities of Satlantis soon, which might be a good excuse to try out the app.

This post Satlantis Emerges as Bitcoin-Native Alternative to Luma for Real-World Events first appeared on Bitcoin Magazine and is written by Juan Galt.

Bitcoin Magazine

Bitwise to Donate $233,000 to Bitcoin Open-Source Developers

Bitwise Asset Management announced its second annual donation to Bitcoin open-source developers, contributing $233,000 to support the programmers who maintain and secure the Bitcoin network.

The gift comes as part of Bitwise’s pledge to allocate 10% of gross profits from the Bitwise Bitcoin ETF (BITB) each year to support the ecosystem.

The funds will be distributed to three non-profit organizations: Brink, OpenSats, and the Human Rights Foundation’s Bitcoin Development Fund. Each organization was selected for its track record in funding critical Bitcoin open-source projects and advancing the technology’s long-term development.

“Developers are the unsung heroes of the Bitcoin network,” said Hong Kim, Bitwise co-founder and chief technology officer.

“When we launched BITB, we wanted to ensure that as interest in crypto grew, the developers who maintain and secure the network would be supported. No matter where we are in the market cycle, developers continue to build and maintain. We’re proud to continue our support of this important work with our second annual donation to these great organizations.”

Bitwise’s Bitcoin ETF

The donation is tied to the growth of the Bitwise Bitcoin ETF. Since its inception in January 2024, BITB has amassed over $2.5 billion in inflows, the company said.

Bitwise noted that as the ETF grows, future contributions to the open-source community will also increase.

Bitwise manages more than $15 billion in client assets through a suite of over 40 crypto investment products, the company said. These products include ETFs, private funds, hedge fund strategies, and staking.

The firm serves more than 5,000 clients all over the world, ranging from private wealth teams and family offices to banks and broker-dealers, with offices in San Francisco, New York, and London.

Funding from firms like Bitwise allows developers to focus on protocol upgrades, security improvements, and other projects essential to the network’s stability.

“Investors who chose this journey with us made this possible,” Bitwise stated. “We are grateful for their trust and proud to stand alongside them in sustaining the open-source heart of Bitcoin.”

Bitwise emphasized that the donation is not a one-time commitment but part of a continuing effort to support the community that underpins the world’s largest cryptocurrency.

As BITB grows, so too will the firm’s contributions to open-source development initiatives, the company said.

This post Bitwise to Donate $233,000 to Bitcoin Open-Source Developers first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

Standard Chartered Named Custodian for TP ICAP’s Fusion Digital Assets

Standard Chartered has been appointed as the digital asset custodian and settlement agent for TP ICAP’s Fusion Digital Assets platform, deepening the collaboration first announced in October 2024.

The move supports TP ICAP as it expands matched-principal trading in spot crypto assets, marking a major operational step for both firms.

Fusion Digital Assets, operated by TP ICAP E&C Limited and registered with the Financial Conduct Authority for crypto-asset activities, allows institutional clients to trade digital assets on a UK-regulated exchange.

Through the new arrangement, shared clients can access Standard Chartered’s regulated digital asset custody services alongside Fusion Digital Assets’ trading infrastructure.

The timing of the appointment coincides with Fusion Digital Assets’ transition to a matched-principal model. Under this structure, TP ICAP acts as counterparty to both sides of every trade, requiring robust internal settlement and custody capabilities.

The model eliminates prefunding requirements for clients, allows settlement post-execution, and uses multilateral netting to reduce gross settlement volumes, improving operational efficiency.

The custody arrangement is agnostic on the client side, enabling counterparties to deliver assets from their preferred custodian rather than mandating Standard Chartered.

Margaret Harwood-Jones, Global Head of Financing & Securities Services at Standard Chartered, said: “We are pleased to deepen our collaboration with TP ICAP, reinforcing our shared vision of bridging traditional and digital finance. Our custody and settlement solutions will enable TP ICAP to scale its matched principal activity securely and efficiently, meeting growing institutional demand.”

Duncan Trenholme, Managing Director and Global Co-Head of Digital Assets at TP ICAP, described the milestone as a key step in the firm’s digital asset strategy. “With Standard Chartered’s support, we will be able to settle blockchain-based assets through our own accounts for the first time and offer a broader array of on-chain assets and execution services to clients,” he said.

Standard Chartered and B2C2 partner

Earlier this year, Standard Chartered and B2C2 announced a strategic partnership to enhance institutional access to crypto markets.

The collaboration combines Standard Chartered’s global banking infrastructure with B2C2’s liquidity across spot and options trading, allowing asset managers, hedge funds, corporates, and family offices direct connectivity to regulated banking and settlement services.

The partnership is to streamline fiat-to-crypto transactions, offering faster, more reliable settlement while enabling institutions to trade and manage both fiat and digital assets efficiently.

The move reflects growing institutional adoption of digital assets, particularly in Asia, and builds on Standard Chartered’s recent expansion of regulated crypto services, including spot Bitcoin trading through its UK branch.

This post Standard Chartered Named Custodian for TP ICAP’s Fusion Digital Assets first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

Strategy (MSTR), Coinbase (COIN) Surge as Bitcoin Pumps Near $73,000

Shares of Strategy, Inc. (MSTR) jumped 12.3% to $148.94 on Wednesday, marking a sharp rebound for the Bitcoin proxy after months of losses.

Coinbase Global (COIN) rose 16.2% to $211.84, extending its recent rally, while Robinhood Markets (HOOD) gained 8.5% to $82.50.

The moves comes as Bitcoin surged past $73,000 this morning, hitting a one-month high after recovering from six straight weekly losses and five months of declines.

The rebound came as traders covered bearish bets and adjusted positions, following heavy shorting amid fears of an escalating conflict in Iran.

Bitcoin mining and crypto services stocks also advanced. Galaxy Digital Holdings (GLXY) climbed 15% to $23.78, underscoring the broader sector’s sensitivity to Bitcoin momentum. Marathon Digital (MARA) rose 6.76% to $9.24 today, adding $0.59 per share.

Broadly speaking, many crypto-related stocks and altcoins are following Bitcoin’s lead and posting strong green days.

Earlier this week, Strategy purchased 3,015 bitcoin for around $204 million, raising its total holdings to 720,737 BTC acquired at an average of $75,985 per coin. The current bitcoin price is getting near to that average.

Bitcoin moves after Coinbase meets with President Trump

Yesterday, President Donald Trump met privately with Coinbase CEO Brian Armstrong. The meeting came just before Trump criticized banks for blocking progress on cryptocurrency legislation, aligning with Coinbase’s stance.

On Truth Social, Trump said banks “need to make a good deal with the Crypto Industry” and called it unacceptable that the recently passed GENIUS Act is “being threatened and undermined by the Banks.”

The dispute revolves around whether crypto exchanges can offer rewards programs that pay annual percentage yields on stablecoins, digital tokens pegged to $1.

Banks argue such yields could siphon deposits from traditional accounts, threatening lending operations, and are pushing for a ban in pending Senate legislation. Coinbase and other digital asset firms oppose restrictions, claiming they would stifle innovation and competition.

In January, Armstrong opposed amendments to the crypto bill limiting stablecoin rewards. Senate markup of the legislation was postponed, leaving the bill stalled.

The White House has attempted mediation between banks and crypto firms, but no resolution has been reached.

At the time of writing, Bitcoin is trading above $73,000 with an intraday high of $73,800. It is up roughly 8% on the day.

This post Strategy (MSTR), Coinbase (COIN) Surge as Bitcoin Pumps Near $73,000 first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

CryptoSlate

Kraken has cleared a regulatory hurdle that crypto firms have chased for years: direct access to the Federal Reserve’s core payments infrastructure.

On March 4, the exchange said its Wyoming-chartered bank, Kraken Financial, has been granted a Federal Reserve master account, allowing it to settle US dollar payments directly over Fed rails instead of routing transfers through sponsor banks.

The US Fed confirmed that the crypto firm's bank was granted approval as a Tier 3 entity with a limited-purpose account authorized for an initial one-year term.

This approval gives the digital-asset industry a practical example of what more direct access to the US payments system could look like.

It also arrives at a moment when the Fed is trying to define a narrower form of central bank access, one that could give certain institutions the ability to connect to key settlement services without extending the full package of benefits traditionally associated with Fed accounts.

Kansas City Fed President Jeff Schmid said:

“As we know, the payments landscape is actively evolving. Throughout this transformation, the integrity and stability of the US payments system remain our priority.”

That is why the decision matters beyond one crypto company.

Kraken’s account appears to be an early real-world test of a payments-focused model that policymakers in Washington have been debating, one designed to separate settlement access from the broader public backstops tied to the banking system.

A pilot inside a broader policy shift

For decades, Fed master accounts have been the gateway to settlement in central bank money, final, irreversible, and highly prized by large financial institutions.

That status has made them one of the most consequential forms of financial access in the US system.

In recent years, however, new charter types such as Wyoming’s Special Purpose Depository Institutions, or SPDIs, and other fintech-like banking models have forced regulators into a harder conversation.

Should nontraditional institutions be able to settle directly at the Fed? If so, how far should that access extend?

The Fed’s answer has been moving toward a narrower framework rather than a broad opening.

In December 2025, the central bank formally asked for public comment on a prototype “Payment Account,” a concept distinct from a full master account and designed to provide access only to a subset of payment services.

Under that proposal, the Fed would offer a tightly limited package with no interest paid on balances. There would be no access to the discount window, no intraday credit, and built-in controls to prevent overdrafts.

The prototype would also impose an overnight balance cap, the lesser of $500 million and 10% of total assets. Services would be restricted to certain settlement rails, including Fedwire Funds and FedNow, while excluding others such as FedACH.

That design reflects a broader regulatory goal. The Fed appears to be trying to preserve the efficiency benefits of direct settlement access while limiting the ways nontraditional institutions can tap into the central bank safety net.

In public remarks, Fed Governor Christopher Waller has said streamlined payment accounts should be operational by late 2026, underscoring that the central bank is thinking about how to modernize access without expanding risk in ways that resemble shadow banking.

Kraken’s approval fits neatly into that policy backdrop. Even if the account is formally classified as a master account, the one-year, limited-purpose structure makes it look closer to a controlled policy experiment than a full embrace of open access.

Why crypto firms care about direct settlement

For most crypto firms, dollar payments still depend on a small number of partner banks willing to provide access to the broader financial system.

That arrangement creates a structural weakness. When sponsor banks change their risk appetite, face regulatory pressure, or decide to reduce exposure to crypto clients, exchanges and stablecoin firms can lose key payment channels even when customer demand remains strong.

That has happened repeatedly in the industry, particularly during periods of regulatory scrutiny or banking stress. The result has been a system in which many crypto firms remain dependent on intermediaries for basic dollar movement.

Direct settlement could reduce that reliance.

For Kraken, access to Fed rails could improve the speed, resilience, and predictability of dollar payments.

It could reduce the operational friction of routing transfers through partner banks, and it could give the company greater control over a part of the user experience that has often been vulnerable to external disruptions.

Arjun Sethi, Co-CEO of Payward and Kraken, said:

“This architecture could enable atomic settlement between fiat and crypto, institutional-grade cash management integrated with digital asset custody, and programmable financial products built within a fully regulated framework. This is what it looks like when crypto infrastructure matures into core financial infrastructure.”

For the broader industry, the development introduces a possible new divide.

Firms that can meet bank-like standards for regulation, governance, and supervision may be able to internalize more of their payments stack.

However, others that cannot will likely remain reliant on sponsor banks and exposed to the same bottlenecks that have shaped crypto banking access in the United States.

Meanwhile, Kraken’s path also highlights how regulation itself can become a competitive advantage.

The company pursued access through a Wyoming SPDI, a charter type the state describes as fully reserved and not permitted to lend customers' fiat deposits as traditional fractional-reserve banks do.

That structure may make the model easier for regulators to evaluate because it reduces some of the classic maturity-mismatch and bank-run risks associated with conventional banking.

At the same time, it raises the threshold for the rest of the industry. Many crypto firms are unlikely to pursue bank-style charters. And even among those that do, there is no guarantee that direct Fed access will follow.

The likely paths from here

The Fed has said its Payment Account prototype does not change legal eligibility requirements.

That means the most expansive scenario, in which ordinary fintech companies suddenly gain direct access to the central bank, remains unlikely.

So, a narrower outcome is more plausible.

One possibility is that Kraken remains an exception. In that scenario, the Fed treats the arrangement as a contained test case, uses it to assess controls and operational risks, and then proceeds cautiously or delays additional approvals due to supervisory or political concerns.

A second possibility is the development of a small cluster of institutions with similar access. That group could include crypto custody banks, trust banks, or narrowly focused payments institutions with bank-like governance and legal eligibility.

Under that model, the sponsor-bank bottleneck would ease, but only for firms willing and able to operate within a highly regulated structure.

A third possibility is broader standardization after 2026 if the Fed formally launches payment accounts on the timeline Waller has outlined.

If that happens, a payments-only access layer could become a more durable option for eligible institutions seeking connectivity to services such as Fedwire or FedNow.

Even then, access would likely remain limited to firms that meet strict regulatory and compliance standards.

What the industry should watch

The next phase of this development is likely to be less about the approval process and more about how the arrangement functions in practice.

For Kraken, the first question is whether the limited-purpose, one-year approval is renewed. The second is whether the scope of the account eventually aligns more clearly with the Fed’s emerging payments-only framework or expands beyond it.

For the industry, the key issue is whether the model can be replicated.

If other special-purpose or narrowly chartered institutions receive comparable access, that would suggest the Fed is prepared to move beyond a single-company case and develop a more systematic approach.

That is what makes Kraken’s approval important.

It is not only a corporate milestone for a crypto exchange seeking closer access to the center of the dollar system. It is also a policy experiment with implications for the future design of US payments access.

If the arrangement works operationally and satisfies supervisors, it could strengthen the case for allowing a narrow class of regulated, payments-focused institutions to settle more directly over Fed rails.

If it does not, it could reinforce the argument that access to the central bank should remain tightly linked to traditional banking.

Either way, the issue that crypto firms have debated for years is no longer abstract. It is now being tested inside the machinery of the US payments system.

The post Kraken just got rare Federal Reserve access in a move crypto firms have chased for years appeared first on CryptoSlate.

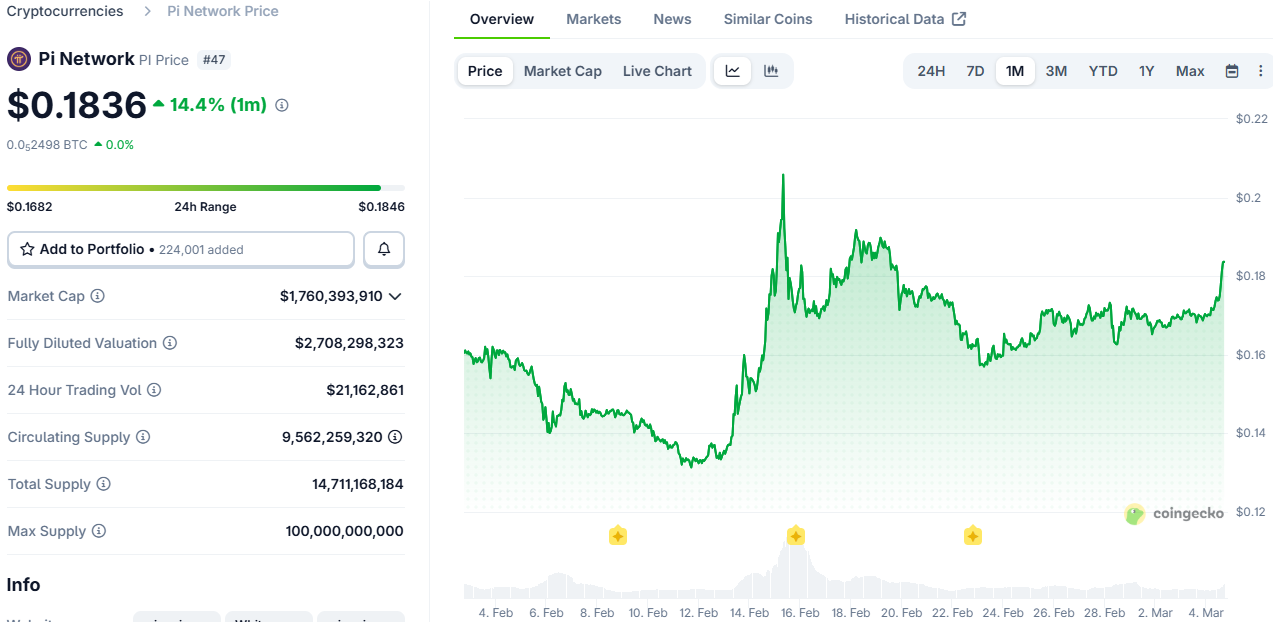

Switzerland-registered FANtium AG launched $BANK on Solana today, with a public sale via Metaplex Spotlight.

The token is designed to give holders liquid on-chain exposure to a professionally managed poker bankroll. The sale window runs through March 6, 00:00 UTC, accepts payment in $SOL, and carries no KYC requirement, excluding restricted jurisdictions.

How $BANK Works

The core premise replaces private, relationship-based poker staking deals with a single tradable on-chain asset. Capital raised will fund high-stakes tournament buy-ins, and treasury activity is described as observable on-chain. Token-gated features and poker-native markets are planned for later stages, but neither is live at launch.

The total supply is fixed at 1B tokens, with 50M allocated to the public sale and fully unlocked at launch. The remaining supply sits across allocation buckets with vesting schedules and staged unlocks.

How the Launch Pool Mechanism Works

Metaplex's Launch Pool format runs on a deposit window rather than a fixed-price mint. Token distribution is proportional to each participant's share of total deposits, so no single buyer gets sniped by being first. Metaplex charges a 2% protocol fee on deposits, plus standard Solana network fees.

That structure reduces the bot advantage seen in first-come-first-served sales. It does not, however, eliminate the liquidity depth problem that drives most Solana launch volatility. Pool depth on Raydium, slippage behavior, and whether on-chain liquidity matches project materials will be the key things to watch on day one.

What the Track Record on Metaplex Launches Shows

Metaplex's Genesis protocol has built a credible record across recent Solana launches. Its six ICOs averaged an 8.63x all-time-high return on investment, led by Collector Crypt at 19.7x, Omnipair at 16.3X, Portals at 10x, and DeFiTuna at 9.7x. Those numbers reflect genuine demand for structured, vetted launches on Solana, though they came with a catch.

Trading volumes fell sharply after initial launch days across nearly all tokens, with most recording drops of over 99% in volume within the first week. Only one project in that batch, $CARDS, recorded higher activity on day six, driven by trading-card-game hype. The pattern is consistent: launch mechanics can produce clean distribution, but sustained volume requires a durable demand loop beyond the opening window.

Why Tokenized Real-World Exposure Is Gaining Ground

$BANK enters the market at a moment when tokenizing real-world performance is attracting serious capital.

Onchain prediction markets have seen major spikes in trading volumes since the start of 2024, approaching $166B mid-October 2025.

Poker bankroll exposure fits that same demand, giving participants a way to take a position on a real-world performance stream without relying on private off-chain arrangements.

The structural advantage $BANK offers over traditional poker staking is transparency. Private staking deals have no on-chain footprint, no standardized reporting, and no liquid exit. A token backed by observable on-chain activity gives participants a verifiable record that legacy staking arrangements cannot match.

Solana itself provides a favorable backdrop for this type of launch. New tokens created through Metaplex doubled in the first half of 2025 even as broader DEX trading volumes fell, with the protocol generating $13.7 million in revenue across the period. That growth reflects a market that is still actively allocating to new asset categories on Solana, including those tied to real-world cashflows rather than purely on-chain activity.

The Value-Capture Question

The key question for $BANK beyond launch day is whether positive bankroll performance will translate into measurable token demand. FANtium's project materials reference buybacks, token-gated utility, and fee routing as mechanisms, but none are operational at launch. Tokens that require holding for a core function, whether as collateral, access, or settlement, tend to sustain demand better than those where the link between performance and token value remains discretionary.

FANtium's reporting cadence between tournaments will carry real weight in that equation. The poker calendar provides natural catalysts, and each major series gives the project a public moment to demonstrate treasury activity and results.

How consistently and transparently FANtium communicates those updates will shape whether $BANK holds attention past its opening window.

Disclaimer: This is a sponsored post. CryptoSlate does not endorse any of the projects mentioned in this article. Investors are encouraged to perform necessary due diligence.

The post $BANK Sale Begins on Solana, Targeting Poker Staking Market appeared first on CryptoSlate.

Bitcoin rose above $70,000 today for the first time since early February, extending a rebound that is starting to look less like a brief relief rally and more like a market trying to reverse momentum after months of heavy selling.

CryptoSlate data showed Bitcoin gaining over 7% on the day, lifting the flagship digital asset to its highest level in almost a month. The move came amid renewed geopolitical tension over Iran, a backdrop that has kept volatility elevated across global markets.

What makes the latest bounce notable is not only the headline price move. It is the condition Bitcoin was in before the rebound started.

Vetle Lunde, the head of research at K33 Research, said Bitcoin had entered the previous weekend heavily oversold, heavily shorted, and significantly underowned.

That matters because Bitcoin was already trading under very different conditions from gold, stocks, and other major assets before the latest Middle East escalation added a new layer of uncertainty.

According to K33, Bitcoin had fallen 50% after five consecutive months of downside price action. Its weekly relative strength index had dropped to its third-lowest reading ever.

In other words, Bitcoin entered the week in an unusually stretched state, one that looked statistically abnormal even before geopolitical stress became the dominant market theme.

That backdrop is central to the reversal argument now taking shape.

A market already primed to snap back

K33’s case is that Bitcoin was vulnerable to a sharp move higher because positioning had become too one-sided.

Institutional investors had already reduced exposure considerably during the previous months of selling pressure.

For context, spot Bitcoin ETFs had endured nearly 100,000 BTC in outflows, while notional CME open interest had fallen 30% from October levels.

That meant one of the investor groups most likely to use Bitcoin as a hedge against uncertainty had already stepped back, allowing some of the asset’s usual correlations to soften.

At the same time, crypto-native positioning had become unusually defensive. K33 said funding rates in perpetual futures had been unusually low, and that throughout February, traders had paid premiums to sit short.

That is atypical behavior for Bitcoin, an asset that tends to maintain a structural long bias over time.

The firm said similar funding-rate regimes have often appeared during bottoming phases, reflecting crowding, imbalances, and signs of seller exhaustion.

Notably, the options markets were sending a similar message. In February, skews jumped to levels seen only during the worst panic periods of 2022, including the collapses linked to Luna, Three Arrows Capital, and FTX.

There were signs from the chain as well. K33 pointed to long-term holder distribution subsiding as Bitcoin lost support at $75,000 and approached its 200-week moving average.

Taken together, the setup was one of an asset that had already absorbed a large amount of bad news, washed out leverage and sentiment, and was increasingly positioned for a sharp reversal if selling pressure eased.

Why resilience matters in this macro backdrop

The reversal thesis has gained traction in part because Bitcoin has held up better than some expected, given the broader stress building around it.

Data from CryptoQuant showed that US tensions with Iran have continued to escalate, with oil and gas trade flows becoming more complex, while gas prices in Europe surged by more than 70%, and South Korean stocks fell another 12% on the day.

Yet within that environment, Bitcoin broke above $71,000 and reclaimed the $70,000 level.

That resilience is not being read as a random bounce. CryptoQuant said it was supported by five days of inflows into spot Bitcoin ETFs over the last six trading days. During that period, cumulative inflows into the spot Bitcoin ETFs exceeded $1.6 billion.

Derivatives have also started to reawaken. CryptoQuant said Binance’s taker buy-sell ratio reached 1.18, the highest level of the year.

That metric measures the balance between aggressive buy and sell activity in the derivatives order book, and the latest reading suggests buyers are starting to regain control after a long stretch in which selling pressure dominated.

The pace of buying was notable. CryptoQuant said taker buy volume exceeded $1 billion per hour several times in a single day, helping push Bitcoin above $71,000.

Moreover, additional data from K33 showed that notional open interest on Binance’s BTCUSDT perpetual contract rose by 7,547 BTC over the previous four hours, marking the first four-hour growth of that magnitude since 2023.

The implication is that derivatives traders, who had spent weeks leaning heavily bearish, were suddenly being forced to respond to strength.

So, if ETF inflows continue and derivatives buyers maintain the upper hand, the firm said a short-term reaction higher would not be surprising.

This is where the current story becomes more nuanced. The rebound is not simply about spot demand returning. It is also about the way a deeply oversold market can move when short positioning becomes crowded and aggressive buyers start to press back.

The reversal signal is coming from US demand

Another reason analysts see scope for a broader momentum turn is that US investors appear to be reengaging with the market

Notably, CryptoSlate previously reported that US investors were leading the current phase of Bitcoin buying.

One of the clearest signs came from the Coinbase Premium Index, which turned positive in February 2026. Since then, Bitcoin has risen 15% and reclaimed $71,000, a level it had not seen in 27 days, according to CryptoQuant data.

The signal matters because the Coinbase Premium Index is often used as a gauge of US-led spot demand.

When it turns positive and stays there, it suggests buyers on Coinbase are willing to pay more than traders on offshore venues, often a sign that the US appetite is strengthening.

In this case, the index turned positive and has held that zone roughly one week ago on the hourly timeframe, before the latest leg higher unfolded.

If the premium remains positive, it would reinforce the idea that the rally is not just a derivatives-driven squeeze but a broader recovery in demand.

The $70,000 zone is still contested

Despite these moves, this does not mean the market has cleanly broken through resistance.

Crypto analytics firm Glassnode said perpetual open interest posted its largest daily percentage increase since July 2025 as leverage expanded while Bitcoin tested about $69,400.

That level has consistently served as a rejection zone for BTC during periods of intensified profit-taking by traders.

Moreover, Glassnode added that each time the 12-hour simple moving average of net realized profit and loss rose above $5 million per hour, price stalled and reversed near the $69,400 range high.

In that framework, the market still has a demand problem to solve. Buyers have been strong enough to push Bitcoin back toward $70,000, but not yet strong enough to absorb profit-taking there without hesitation.

The firm’s conclusion was clear. Until that profit-taking can be absorbed without triggering rejection, $70,000 remains a ceiling, not a floor.

That view broadly matches how analysts at Bitunix crypto exchange described the recent move.

These analysts told CryptoSlate that Bitcoin's rapid surge above $70,000 had formed what they called a classic upside liquidity sweep.

As a result, they identified the $69,500 to $70,500 area as the most concentrated zone of short pressure and liquidity buildup.

According to Bitunix, long leverage below $68,000 has largely been cleared, while secondary liquidity remains near $64,000.

In its reading, the market has already completed the first phase of long liquidation. The next question is whether overhead short positions will be squeezed hard enough to turn resistance into a breakout.

If repeated tests above $69,000 fail to produce firm acceptance, Bitunix said that zone could harden into a short-term resistance core and pull Bitcoin back into a range.

On the other hand, if a high-volume breakout absorbs liquidity above $69,800, forced short covering could follow, and volatility could intensify.

Still, that does not guarantee a straight line higher.

However, it would show that Bitcoin is increasingly looking like an asset with room to sustain an upward momentum for the first time in weeks.

The post Bitcoin bears could walk into a brutal short squeeze next as BTC retakes $70k appeared first on CryptoSlate.

Tether has landed a Big Four accounting firm’s name on a reserve report tied to its US strategy.

On Feb. 27, Deloitte issued an independent accountant’s report on Anchorage Digital Bank’s “USAT Reserve Report,” an attestation covering USAT, a US dollar token issued by Anchorage Digital Bank, National Association, in collaboration with Tether.

The development is notable because Tether has long faced questions about the quality, transparency, and verification of reserves backing its tokens. But the Deloitte work does not cover USDT, Tether’s flagship stablecoin, and the largest dollar-pegged token in the market.

This distinction is central to how the development should be understood.

USAT is a small, federally regulated token issued through an Office of the Comptroller of the Currency (OCC)-regulated national trust bank. USDT is the much larger token that serves as core trading infrastructure across crypto exchanges, offshore venues, and dollar-based trading pairs worldwide.

That means the Deloitte-linked milestone gives Tether a recognizable accounting name attached to a regulated US stablecoin product, but it does not resolve the much broader questions surrounding USDT.

What Deloitte reviewed

The Deloitte report is narrower than a full corporate audit, and the language in the filing makes that clear.

According to the document, Deloitte issued an Independent Accountant’s Report on Anchorage Digital Bank’s USAT Reserve Report. The engagement did not seek to determine whether Anchorage complied with federal, state, or local laws or satisfied contractual obligations to customers.

Deloitte also said it did not evaluate the design's suitability or the operating effectiveness of controls.

In effect, the accounting firm examined a reserve report at a specific point in time rather than the stablecoin business's full legal, operational, or financial condition.

As of Jan. 31, 2026, Anchorage reported $17.6 million in reserve assets against $17.5 million in USAT redeemable tokens outstanding, resulting in a surplus of $103,325.

The reserve composition was straightforward: $3,654,716 in cash and $13,950,000 in reverse repurchase agreements collateralized by US Treasury securities.

The report said those assets were held in segregated fiduciary trust accounts for the benefit of token holders.

That structure is part of the message Anchorage appears to be sending. The bank has described USAT as a dollar-backed stablecoin for the US market under the post-GENIUS Act framework, with the bank overseeing issuance, reserve management, compliance, and risk controls.

In practical terms, that gives Tether exposure to an onshore, federally supervised stablecoin product with a simpler reserve design than the portfolio behind USDT.

For Tether, that matters politically and commercially. A US-regulated token tied to the company can now point to a report from Deloitte, even if Tether’s main stablecoin still does not have the full audit critics have long demanded.

Why USDT still matters more

Even so, market attention remains centered on USDT because it is the token that matters most for trading, liquidity, and systemic importance in crypto markets.

USDT’s reserves have never been subject to a full audit. That has remained a persistent concern for investors, regulators, and market observers, especially because the token has become deeply embedded in global crypto market plumbing.

It is also the stablecoin most often scrutinized when questions arise about illicit finance, offshore market structure, or the resilience of stablecoin reserves under stress.

Tether’s latest published Financial Figures and Reserves Report, prepared with assurance work under ISAE 3000 Revised by BDO and dated Dec. 31, 2025, showed $192.878 billion in total assets against $186.540 billion in total liabilities, leaving $6.338 billion in equity.

That equity cushion is far larger in nominal terms than the modest surplus reported for USAT. But it is attached to a significantly larger and more complex reserve book.

According to BDO’s report, Tether’s reserves were concentrated in US Treasury bills and reverse repurchase agreements, but they also included $17.45 billion in precious metals, $8.43 billion in Bitcoin, $2.76 billion in other investments, and $17.04 billion in secured loans.

That portfolio differs from the narrow cash-and-Treasurys model policymakers increasingly favor for payment stablecoins.

It also helps explain why a Deloitte examination of USAT should not be mistaken for the full audit Tether has said it wants for USDT.

BDO’s language also highlighted the limitations of its work. The firm said its opinion applied to the report at a single point in time, that the report was prepared for transparency purposes and might not be suitable for other uses, and that asset values assumed normal trading conditions rather than stressed market scenarios.

Those caveats are standard in this kind of assurance work, but they reflect the gap between reserve attestations and a full audit of the stablecoin issuer and its financial position.

A long-running credibility gap

That gap has followed Tether for years.

The company has repeatedly said it wants a full audit of USDT’s reserves and financials, but it has not yet delivered one.

Reuters reported in March 2025 that Chief Executive Paolo Ardoino described a full Big Four audit as a “top priority” and said Tether was in talks with one of the major firms.

Pending the availability of such reports, Tether has continued publishing quarterly reserve reports, which continue to draw investor skepticism.

The USAT development, therefore, matters less as a final answer than as a partial signal. It shows that a Tether-linked product can operate inside a tighter regulatory perimeter, with a simpler reserve mix and a more recognizable accounting brand.

However, it does not settle the credibility debate surrounding USDT because the flagship token is larger, more globally important, and backed by a broader mix of assets.

Useful progress, but not the final test

For Tether, the Deloitte-backed USAT reserve report is still a meaningful development. It links the Tether ecosystem to a federally regulated US token with a plain reserve structure and a Big Four accounting firm.

That gives the company a cleaner response when dealing with US policymakers, institutional counterparties, and corporate clients who want a dollar token inside a clearer supervisory perimeter.

But the main credibility test has not changed. USDT remains the center of gravity for the stablecoin market, and it remains supported by a reserve portfolio that is larger, broader, and harder to fit into the narrowest definition of a payment coin.

Tether also continues to face scrutiny over illicit-finance controls, even as it emphasizes cooperation with law enforcement. Reuters reported that Tether said it had frozen about $4.2 billion in USDT linked to illicit activity, most of it over the last three years.

The result is a two-track reality: a US-regulated token linked to Tether has a Big Four attestation on a reserve report, while USDT, the stablecoin that dominates liquidity in crypto markets, still rests on periodic assurance snapshots and a reserve portfolio that is larger and more complex.

Whether the industry converges on the bank-style model embedded in USAT, or adapts the dominant offshore tokens to meet tightening rules, remains to be seen.

The post Tether finally lands a Big Four auditor – but the $189B USDT question still isn’t answered appeared first on CryptoSlate.

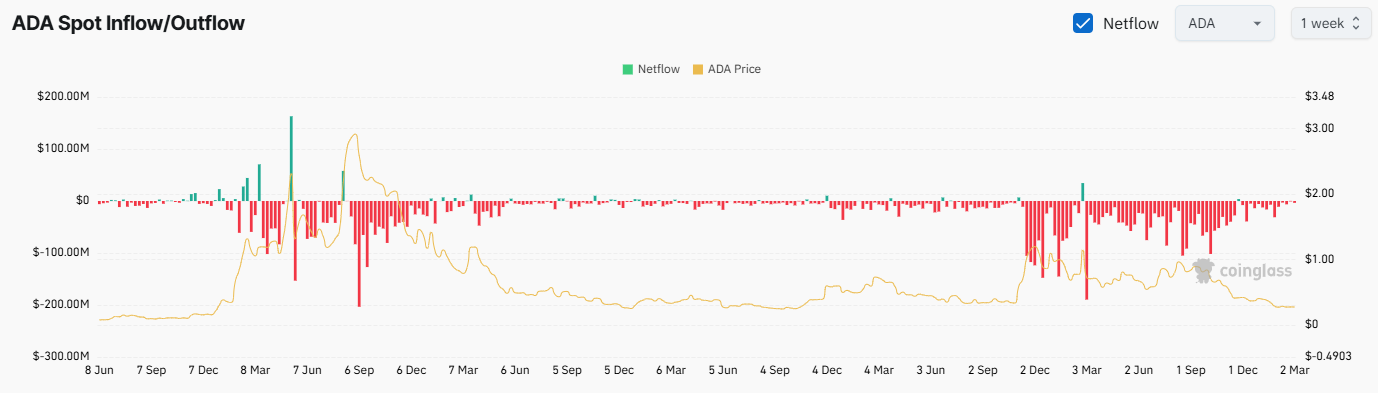

The South Korean stock market (KOSPI) closed near 5,094 after falling 12.06% in a single session today.

The index had already fallen 7.24% the prior session, taking the two-day slide to roughly 18.4% on a compounded basis. South Korean equities did not fall alone, but the magnitude set Korea apart in a global risk-off window.

However, Bitcoin moved higher during Asian hours to touch $72,000 for the first time since Feb. 8, proving that correlations can break hardest on the days when investors most expect them to hold.

Given Bitcoin's decline during APAC trading hours on Monday, seeing BTC surge today, while South Korean equities tumble, was unexpected.

In recent weeks, Bitcoin has mostly traded inside a broad $60,000–$70,000 band. Glassnode argued that the range itself had become part of the market structure, as traders respond to ETF flow trends and derivatives exposure rather than to macro developments alone.

The divergence between Korea’s benchmark and Bitcoin puts numbers behind the question, “When an Asia-first shock hits oil, foreign exchange, and equity leverage at once, which markets become the funding source, and which markets become the release valve?

The KOSPI move was the largest one-day drop since 2008. A sudden repricing of imported energy risk, pressure on the won, and forced de-risking in a market with concentrated exposures.

| Metric | Verified figure | Source link |

|---|---|---|

| KOSPI close (Mar. 4, 2026) | ~5,094 | KOSPI |

| KOSPI one-day move (Mar. 4, 2026) | -12.06% | close |

| KOSPI prior day move (Mar. 3, 2026) | -7.24% | daily |

| Two-day compounded move (Mar. 3–4, 2026) | ~ -18.4% | changes |

| Won stress level cited in reports | ~1,500 per USD | won |

| Brent level cited in reports | ~$83 | Brent |

| South Korea crude import exposure | ~2.6M b/d; >60% from Middle East | imports |

| Crypto fund flow pulse (weekly) | -$288M total; -$215M BTC | outflows |

| BTC range referenced by on-chain commentary | $60,000–$70,000 | range |

Korea repriced energy and FX risk in a market built on concentration

Korea’s selloff was a stress test of a specific macro profile. The country is a major energy importer, and official energy data show it has imported just under 2.6 million barrels per day of crude, with more than 60% sourced from the Middle East.

Those EIA figures make the sensitivity concrete: a shipping disruption does not need to shut off barrels to raise the risk premium across freight, insurance, and near-term supply contracts, and that premium can filter into inflation expectations quickly in an import-heavy economy.

The drop is tied to conflict-driven oil-disruption fears around Iran and to currency pressure that compounded the equity drawdown. The won also briefly weakened toward 1,500 per U.S. dollar. That FX pressure matters in practice because it changes the cost of energy imports in local terms and can force asset managers with currency hedges to rebalance. When the equity index is already extended from a strong run, those rebalances can turn into forced selling.

The next question for investors is whether oil and FX volatility remain elevated long enough to reset the market’s pricing of earnings risk, even if the underlying semiconductor export cycle stays firm.

The KOSPI entered March after a steep year-to-date climb in many accounts of the rally, and concentration tends to magnify both the rise and the fall when a handful of large companies dominate index weights.

That index concentration also changes the unwind: investors who use Korea as a liquid proxy for global tech exposure do not need a fundamental view on every sector to sell the benchmark.

Using back-of-envelope math, we can first look at Korea’s import volumes and a GDP reference of about $1.917 trillion.

That GDP base implies that a sustained $ 10-per-barrel increase amounts to roughly $9.5 billion in additional gross import costs per year, around 0.5% of GDP.

A $30 increase implies roughly $28.5 billion, around 1.5% of GDP.

That's not a one-for-one hit to growth or corporate earnings, because it ignores offsets and pass-through dynamics, but it does describe the size of the shock investors were asked to price in within a few sessions.

In tandem, the macro backdrop shows export strength, including a 29% year-over-year jump in February and record semiconductor exports. Export data sits alongside a second datapoint cited in local coverage: a record annual current account surplus of about $123 billion in 2025. That surplus provides a macro cushion over time, but the market can still demand a higher risk premium while geopolitical conditions keep oil and shipping uncertainty elevated.

As the selloff accelerated, the market experienced trading halts and circuit breakers as liquidity conditions tightened in Korea. Those halts matter for what comes next because liquidity is the hinge for the next phase.

If policymakers and market structure prevent a disorderly spiral, a technical rebound becomes plausible. If the won weakens again while oil risk stays elevated, foreign selling can persist even if local buyers step in.

Bitcoin’s move should be read through flows, positioning, and the $60,000–$70,000 band

Bitcoin’s relative strength during Asia hours sits on a different set of mechanics than Korea’s equity plunge. Recently, BTC price has been range-bound between $60,000 and $70,000, with thin conviction outside those levels and derivatives positioning that could amplify the next break.

Glassnode framed the market as defensive rather than euphoric, pointing to conditions in which spot demand does not need to surge for price to move sharply. A shift in gamma exposure or a funding reset can do the work.

If investors reduce risk in equities, they may also reduce leverage in crypto, which would normally put pressure on prices. But if selling is already exhausted, or if traders hold short positions around a well-watched range high, the unwind can still push bitcoin up. The cleaner interpretation is microstructure, price can move because positioning changes faster than spot flows.

The Korea shock also introduces a regional lens crypto traders tend to watch closely: local currency stress can change crypto demand at the margin. When the won weakens, Bitcoin priced in won can rise even if dollar Bitcoin stays flat, and that can pull local activity forward.

The mechanism is straightforward: a weaker local currency can shift the timing of retail conversion into dollar-priced assets, and crypto is one of the fastest rails available.

Bitcoin and Korea’s equity benchmark also differ in that Bitcoin does not embed the same direct sensitivity to oil in corporate earnings.

Korea’s listed firms face margins, shipping costs, and currency translation, and the index bundles those exposures. Bitcoin reacts to liquidity, interest rate expectations, and risk appetite, but it can also reflect an investor's preference for assets not tied to a single country’s energy balance sheet. That preference is inconsistent over time.

On some days, Bitcoin trades like a high-beta tech instrument. On other days, it behaves like a volatility product, responding to its own market plumbing.

The next move depends less on narrative and more on observable market signals that traders can measure without interpretation:

- Whether price holds above the middle of the $60,000–$70,000 band.

- Whether weekly fund flow reports return to sustained outflows or continue to reverse.

- Whether broader risk markets keep tightening financial conditions, which tends to raise the cost of leverage across assets.

A single Asia session does not rewrite Bitcoin’s correlation history, but it can reveal which levers are currently in control.

What traders will test next: de-escalation, protracted risk premium, or renewed stress

The next several weeks are likely to be defined by whether the oil shock fades into the background or embeds itself into prices. Brent was priced around $83 during the selloff.

The oil level alone is less important than the risk premium attached to it. The EIA’s short-term outlook has also described a 2026 baseline that expects lower average Brent prices, even if near-term events can overwhelm that view. That forecast gap sets the stage for scenario work.

Scenario 1: Oil risk premium fades, and the won stabilizes. In this case, Korea’s two-day drawdown reads primarily as a leverage and positioning unwind layered on top of strong fundamentals. Export strength and the 2025 current account surplus support the macro picture, and lower perceived shipping risk eases inflation anxiety.

The account balance does not eliminate volatility, but it can reduce the duration of stress. For Bitcoin, a calmer macro backdrop shifts focus back to flows and market structure: the $60,000–$70,000 range becomes the primary battleground, and the question becomes whether demand replaces the derivatives-driven bounce described by on-chain commentary. That structure call is testable, price can hold and climb only if the next leg is supported by steadier inflows.

Scenario 2: Oil stays elevated and FX remains volatile. This scenario keeps Korea on the front line because of the scale of its crude import exposure. The earlier math is a guide: a $10 sustained oil rise implies about $9.5 billion in additional annual gross import costs, and a $30 rise implies about $28.5 billion.

Those costs do not need to fully hit earnings to affect pricing; investors only need to believe in the pass-through, and policy responses will increase uncertainty. In crypto, persistent macro volatility can support intermittent Bitcoin demand,

Scenario 3: Renewed stress forces broader deleveraging. If liquidity tightens further across markets, correlations can rise again, and Bitcoin can become part of the funding stack instead of an alternative. Korea’s experience with halts and rapid declines shows how quickly liquidity can evaporate when selling accelerates.

That liquidity warning translates directly to crypto when leveraged market participants need to raise cash. In that environment, traders will watch whether bitcoin behaves as a hedge in local-currency terms and, at the same time, whether global deleveraging pressure turns it into a source of liquidity.

A market pinned between $60,000 and $70,000 can gap through levels when forced flows appear.

For Korea, traders will watch Brent and the won, and whether policy signals aim to restore market function after the historic drop.

The policy response will also shape whether foreign selling persists. For Bitcoin, traders will watch whether reported fund flows continue to bleed and whether price action respects the range.

The divergence is stark. Korea repriced oil-and-FX risk in a single move, while Bitcoin traded to a different rhythm.

The next test is whether that rhythm holds once the market digests the simplest numbers on the screen: Brent near the low $80s, a won that flirted with 1,500 per dollar, and a crypto flow picture that still showed net outflows in late February.

The post Bitcoin jumps to $72,000 as Asia’s stock market meltdown deepens appeared first on CryptoSlate.

Cryptoticker

Global markets are facing a wave of instability as geopolitical tensions escalate across multiple regions. While traditional financial markets are experiencing sharp declines, the cryptocurrency market is moving in the opposite direction. Bitcoin has surged above $73,000, and Ethereum has reclaimed the $2,000 level, adding more than $100 billion to the total crypto market capitalization in just a few hours.

This unexpected surge comes amid rising fears of broader global conflict and economic uncertainty. As stock markets struggle and energy prices face the risk of sharp increases, cryptocurrencies appear to be attracting renewed investor attention.

But why is the crypto market rising while global markets are shaking?

Global Markets Are Under Pressure

Recent geopolitical developments have triggered strong reactions across traditional financial markets. Stock markets in several regions have experienced significant volatility. South Korea’s KOSPI index dropped sharply, wiping hundreds of billions of dollars in market value within days, while the Dubai Financial Market also saw notable declines.

At the same time, energy markets are on edge. Analysts have warned that oil prices could surge toward $100 per barrel if disruptions occur in the Strait of Hormuz, a critical passage for global oil supply. Such risks add further pressure to global economic stability.

Historically, periods of geopolitical uncertainty tend to trigger capital flight toward perceived safe-haven assets. Traditionally, investors moved into gold, government bonds, or the US dollar. However, the current market environment suggests that cryptocurrencies may be starting to play a similar role.

Bitcoin Is Increasingly Viewed as Digital Gold

One key explanation for the crypto rally is Bitcoin’s growing reputation as a potential hedge during times of global uncertainty. With a fixed supply and decentralized structure, Bitcoin is often compared to gold as a store of value outside traditional financial systems.

As geopolitical tensions rise, investors may seek assets that are not directly tied to government policies, national currencies, or banking systems. Bitcoin’s borderless and censorship resistant nature makes it appealing in periods where trust in traditional systems weakens.

The recent move above $73,000 reinforces the narrative that Bitcoin is increasingly being viewed as a form of digital gold during moments of global instability.

Institutional Money Continues to Enter the Market

Institutional participation also remains a major driver of the crypto rally. Bitcoin exchange traded funds continue to attract significant inflows, allowing traditional investors to gain exposure to Bitcoin through regulated financial products.

Large financial firms such as BlackRock have been steadily accumulating Bitcoin through ETF structures. When institutional money enters the market at scale, it can reduce available supply and trigger strong upward price momentum.

Institutional demand has been one of the most important catalysts behind Bitcoin’s growth over the past year and continues to support the current rally.

Technical Breakout Accelerates the Move

Beyond macroeconomic developments, technical market conditions also played a role in the surge. Bitcoin recently experienced extremely pessimistic sentiment, with fear levels across the market reaching historical extremes.

When Bitcoin broke above key resistance levels around $71,000, momentum traders quickly entered the market. This triggered additional buying pressure and short liquidations, accelerating the price rally.

Ethereum followed the move, breaking above the psychological $2,000 level and confirming broader strength across the crypto market.

Is Crypto Becoming the World’s Crisis Hedge?

The current market behavior raises an important question for investors and analysts. If cryptocurrencies continue to rise during periods of geopolitical instability while traditional markets struggle, digital assets may increasingly be seen as alternative macro hedges.

Bitcoin’s role in the global financial system has evolved significantly over the past decade. What was once viewed as a speculative asset is gradually gaining recognition as a potential store of value during uncertain times.

While volatility remains high, the recent rally suggests that cryptocurrencies could play a growing role in global portfolios during periods of economic or political disruption.

What Comes Next for Bitcoin?

With Bitcoin trading above $73,000, the next key level for the market will be whether the price can hold above the $70,000 support zone. If the market maintains this level, analysts believe Bitcoin could attempt to challenge previous highs and potentially move into new price discovery territory.

However, geopolitical developments and global macro conditions remain unpredictable, meaning volatility across all financial markets is likely to continue.

For now, the crypto market’s resilience during global uncertainty is sending a strong signal: digital assets may be evolving into one of the world’s emerging crisis hedges.

$BTC, $ETH

The cryptocurrency market has entered a phase of intense volatility and unexpected resilience. As of March 4, 2026, Bitcoin ($BTC) has successfully reclaimed the psychological and technical milestone of $70,000, sparking a renewed wave of optimism across the digital asset landscape. This breakout comes at a critical juncture where traditional markets are grappling with significant headwinds.

While the "king of crypto" leads the charge, the spotlight is increasingly shifting toward high-performing altcoins. Investors are navigating a complex environment shaped by both technological milestones and a darkening geopolitical shadow.

Why is the Crypto Market Rising?

Despite the prevailing "Extreme Fear" sentiment that dominated February 2026, the market is witnessing a classic "short squeeze" and a rotation into high-utility ecosystems. Bitcoin's ascent above $70,000 has acted as a catalyst, pulling several mid-cap and small-cap assets into double-digit gains within the last 24 hours.

Geopolitics and the Middle East Crisis

The current market strength is particularly notable given the instability in the Middle East. The escalating conflict has sent ripples through global trade, with oil prices hitting nine-month highs near $75–$80 per barrel. Typically, such geopolitical tension triggers a "risk-off" sentiment, leading investors to dump volatile assets like cryptocurrencies.

However, a new narrative is emerging. Analysts suggest that the potential for increased government deficits and further liquidity injections by central banks to fund defense expenditures is acting as a long-term bullish signal for $Bitcoin. As the U.S. Dollar faces inflationary pressures from war-related spending, decentralized assets are once again being viewed as a macro hedge.

Top 5 Crypto Gainers in the Last 24 Hours

Based on the latest market data and exchange performance, these five assets have outperformed the broader market, capitalizing on ecosystem-specific news and technical breakouts.

1. SPX6900 (SPX)

- Price: $0.38

- 24h Gain: +19%

The "stock market parody" token has staged a massive comeback. After testing critical support at $0.27 earlier this week, SPX skyrocketed following rumors of expanded cross-chain integrations. The token remains a favorite for retail traders looking to play the "6900 vs 500" narrative against traditional equities.

2. Aerodrome Finance (AERO)

- Price: $0.38

- 24h Gain: +14%

As the primary liquidity hub for the Base network, Aerodrome Finance continues to benefit from the surge in on-chain activity. The recent spike is attributed to a significant increase in staking yields, which now sit at approximately 14.4%, attracting yield-seeking capital back into the DeFi sector.

3. Jupiter (JUP)

- Price: $0.19

- 24h Gain: +13%

Jupiter recently reported a staggering $1.16 trillion in annual volume for 2025, and its momentum has carried into 2026. The launch of the JupUSD stablecoin on Solana, in partnership with Ethena, has provided a massive fundamental boost, positioning JUP as a core "super-app" token.

4. Pump.fun (PUMP)

- Price: $0.0021

- 24h Gain: +11%

The Pump.fun ecosystem remains a juggernaut in the memecoin space. Following a massive $9.19 million token buyback program conducted over the last seven days, the PUMP token has seen aggressive whale accumulation, with one wallet reportedly scooping up over 900 million tokens in anticipation of a trend reversal.

5. Zcash (ZEC)

- Price: $238

- 24h Gain: +10%

In an era of increasing surveillance and geopolitical tracking, privacy-focused assets like Zcash are seeing renewed interest. ZEC has rallied as traders look for "hard money" alternatives that offer shielded transactions via zk-SNARKs technology, mirroring Bitcoin’s scarcity but with enhanced anonymity.

Strategic Market Organization

To better understand where to allocate capital during this rally, users should compare the top-tier platforms where these assets are traded.

| Token | Ecosystem | Primary Use Case |

|---|---|---|

| SPX | Multichain | Meme / Narrative |

| AERO | Base | DEX / Liquidity |

| JUP | Solana | Aggregator / DeFi |

| PUMP | Solana | Launchpad Utility |

| ZEC | Independent | Privacy / Store of Value |

Bitcoin Reclaims $70,000 Amid Global Uncertainty

$Bitcoin has successfully breached the $70,000 mark, marking a significant recovery in the face of escalating geopolitical tensions in the Middle East. As of March 4, 2026, the leading cryptocurrency surged over 5% within a 24-hour window, decoupling from traditional risk assets that have struggled under the weight of military escalations involving the U.S., Israel, and Iran.

This move marks a dramatic shift from the "extreme fear" sentiment observed earlier in the week. While global equities remain volatile due to energy supply concerns, Bitcoin is increasingly being utilized as a 24/7 liquidity hedge, allowing investors to reposition capital while traditional markets are closed.

Market Context: Why BTC is Surging Now

The primary catalyst for this breakout appears to be a "flight to sovereignty." Unlike the early February crash where $BTC mirrored the Nasdaq's decline, the current price action suggests a return to the "digital gold" thesis.

- Geopolitical Trigger: Following military strikes in the region, investors have sought assets outside the traditional banking perimeter.

- Liquidation Squeeze: Data indicates that over $1.2 billion in short positions were liquidated as Bitcoin surged from $63,000 to the current $70,000+ levels.

- Institutional Inflows: Spot Bitcoin ETFs have recorded three consecutive days of net positive inflows, suggesting that institutional players are "buying the dip" despite the macro-economic uncertainty.

Bitcoin Price Analysis: The Path to $77,000

The below BTC/USD chart reveals a classic V-shaped recovery. After bottoming near the $63,000 support zone, the price action cleared the 50-period moving average on the 4-hour timeframe, a move that historically precedes extended bullish momentum.

Key Levels to Watch

According to recent market analysis, the following technical barriers are now in play:

- Immediate Support ($70,000): Consolidating above this psychological level is crucial to invalidate the previous "bear flag" structure.

- Major Resistance ($77,000): This aligns with the 200-day moving average. A clean break here could open the doors for a retest of the $85,000 supply zone.

- Downside Protection ($64,000): Should tensions de-escalate or profit-taking ensue, this remains the critical floor to maintain the current bullish bias.

Expert Insight: "Bitcoin is acting as a macro hedge in the acute first stage of this geopolitical shock," noted analysts from Bloomberg. "The 24/7 nature of crypto markets makes them the 'first responders' to global events."

Ethereum Price Shows Bullish Momentum Amid Major Market Shifting

The $Ethereum price has entered a critical phase of price discovery in early March 2026. Following a period of consolidation, the second-largest cryptocurrency by market cap is currently testing the psychological and technical barrier of $2,100. This move comes at a time of significant institutional movement, most notably the high-profile rotation from Bitcoin into Ethereum by major endowments.

As of today, March 4, 2026, ETH is trading at approximately $2,082, marking a recovery from the recent local lows near $1,800. This analysis explores the technical indicators and fundamental drivers that could propel the Ethereum price toward the $2,200 mark or trigger a retracement to established support zones.

Ethereum Price Analysis: ETH Coin Battles the $2,100 Ceiling

The current 2-hour chart for ETH/USD reveals a series of higher lows, suggesting a gradual buildup of bullish pressure. After a sharp rejection at the $2,150 level in late February, Ethereum found solid ground at the $1,900 support zone.

Key Technical Indicators

- Support Levels: The green horizontal line at $1,900 remains the primary defensive line for bulls. A secondary, deeper support exists at $1,800, which has historically been a "buy the dip" zone for whales.

- Resistance Levels: The immediate hurdle is the $2,100 zone. A sustained candle close above this level is required to open the door for a retest of the red resistance line at $2,200.

- Relative Strength Index (RSI): The RSI is currently hovering around 67.74. While this indicates strong upward momentum, it is approaching the "overbought" threshold of 70. This suggests that while the trend is bullish, a short-term cooling period or minor consolidation might occur before the next leg up.

Institutional Catalyst: The "Harvard Effect"

One of the most significant fundamental drivers for the current Ethereum price action is the recent disclosure regarding institutional portfolios. Reports indicate that Harvard University’s $57 billion endowment has significantly trimmed its Bitcoin ETF exposure to rotate capital into the iShares Ethereum Trust (ETHA).

This $86.8 million entry by one of the world's most prestigious academic institutions signals a shift in sentiment. While $Bitcoin remains the primary macro asset, Ethereum is increasingly viewed as the essential "growth layer" of the digital economy. This institutional validation often precedes long-term price appreciation as other funds look to mirror the strategies of top-tier endowments.

"The rotation from BTC to ETH by entities like Harvard suggests that the market is beginning to value Ethereum's utility and staking yields as a distinct investment thesis from Bitcoin's 'digital gold' narrative." — Market Analyst Insight

Network Growth and Roadmap Milestones

Beyond the charts, the Ethereum network continues to evolve. The recent introduction of EIP-8141 by Vitalik Buterin, aimed at bringing native Account Abstraction to the base layer, has bolstered long-term investor confidence. This upgrade is expected to simplify the user experience significantly, potentially driving mass adoption by removing the need for users to hold ETH for gas fees through the use of "Payment Frames."

Furthermore, on-chain data shows that companies like BitMine have been aggressively accumulating. BitMine recently added over 50,000 ETH to its treasury, bringing its total holdings to over 4.4 million ETH. This corporate "HODLing" reduces the circulating supply, creating a supply-side liquidity crunch that can exacerbate price moves to the upside.

What’s Next for Ethereum?

If the Ethereum price can flip the $2,100 resistance into support, the path to $2,200 is relatively clear. However, traders should remain cautious of the RSI levels. A failure to break $2,100 on the current attempt could lead to a healthy retest of the $2,000 psychological level or the $1,900 technical support.

The global financial landscape is currently navigating a period of intense turbulence. On March 3, 2026, investors are closely watching the correlation between traditional equities and digital assets as a series of macro events shake confidence. With the US stock market showing signs of a potential "bloodbath," the question on every trader's mind is: will Bitcoin and the broader crypto market be the next to tumble?

Historically, cryptocurrencies have often moved in tandem with high-risk tech stocks. As major indices like the S&P 500 and Nasdaq face downward pressure from geopolitical conflicts in the Middle East and ongoing tariff uncertainties under the Trump administration, the "digital gold" narrative is once again being put to the test.

Will Crypto Prices Crash with the Stock Market?

Yes, a significant crash in the US stock market typically leads to a liquidity crunch that forces investors to sell off speculative assets, including cryptocurrencies. When institutional investors face margin calls in their equity portfolios, they often liquidate their most liquid and profitable assets—frequently Bitcoin and Ethereum—to cover losses.

Current Market Snapshot (March 3, 2026)

As of today, several key tech giants are experiencing a mixed but volatile session:

- NVIDIA (NVDA): ~$182.48 (+2.99%) – Showing resilience due to AI demand.

- Microsoft (MSFT): ~$398.55 (+1.48%)

- Alphabet (GOOGL): ~$306.52 (-1.68%) – Feeling the heat of broader market jitters.

- Apple (AAPL): ~$264.72 (+0.20%)

While some tech stocks are holding green, the broader sentiment is fragile. Reports indicate that over $1 trillion was recently wiped off global markets in a single day due to fears of a trade war and escalating conflict in the Middle East.

Why are Cryptos Crashing: Understanding the Risk

The current risk of a crypto crash stems from a "perfect storm" of three primary factors:

1. Geopolitical Escalation

The assassination of high-ranking leaders in the Middle East has sent shockwaves through the global economy. This has led to a surge in oil prices and a "risk-off" sentiment. In such environments, investors flee to safe havens like physical gold, often at the expense of Bitcoin.