Cryptocurrency Posts

Crypto Briefing

KakaoBank's stablecoin venture could significantly enhance South Korea's digital finance landscape, fostering innovation and competition.

The post South Korea’s KakaoBank explores stablecoin issuance and custody services appeared first on Crypto Briefing.

Satsuma's strategic Bitcoin acquisition and funding success highlight London's growing role in blockchain innovation and decentralized finance.

The post Bitcoin treasury firm Satsuma adds over 1,000 BTC to its balance sheet following new convertible note round appeared first on Crypto Briefing.

SBI's ETF plans could boost institutional crypto adoption in Japan, aligning with regulatory shifts and expanding digital asset investment access.

The post TradFi giant SBI Holdings floats first-ever Bitcoin, XRP ETF launch in Japan appeared first on Crypto Briefing.

OpenAI's potential valuation surge highlights the intensifying competition for AI talent and the strategic maneuvers shaping tech industry dynamics.

The post OpenAI could reach $500 billion valuation in new stock deal for staff appeared first on Crypto Briefing.

The dismissal motion could impact future cross-border legal strategies in crypto disputes, highlighting jurisdictional complexities and procedural nuances.

The post Binance co-founder Changpeng Zhao files motion to dismiss $1.7 billion FTX suit appeared first on Crypto Briefing.

Bitcoin Magazine

Bitcoin Magazine

How Preston Pysh Changed My Mind on Bitcoin Treasuries

For a while, I was skeptical of bitcoin treasuries. All these bitcoin companies felt like another fiat-financial stunt, another way to play games with debt and derivatives while co-opting Bitcoin’s name. I didn’t want bitcoin financialized. I wanted it to flourish — cleanly, directly and outside the grasp of Wall Street.

But then I sat down for a conversation with Preston Pysh on my podcast “You’re the Voice.” That conversation changed everything for me.

Preston’s background is as unorthodox as his insight: an Apache helicopter pilot turned engineer and venture investor. And when he explained how bitcoin treasury companies function — not just structurally, but systemically — something clicked.

He called them “super spreaders of adoption.” And he didn’t mean that in a flashy, memetic way. He meant that these public companies are engineering themselves to bring bitcoin into the deepest corners of capital markets: pensions, retirement portfolios, bond funds. Through public transparency and financial engineering, they’re creating vehicles that allow bitcoin to seep into legacy systems — not by smashing the door down, but by flowing through the cracks.

“When you securitize Bitcoin through a public company, you’re creating a vehicle that can operate in the fiat world while accumulating sound money in the background,” Preston told me.

So, that’s how bitcoin infiltrates the fiat world…? Not through a revolution, but through clever replication. Or as Friedrich Hayek once put it: through a sly, roundabout way.

At first, I still hesitated: Isn’t that just more fiat games? Isn’t bitcoin supposed to be the exit?

So I pressed Preston: What’s the product here? What are these bitcoin treasuries actually offering? Do they even have a product or a service — or is bitcoin itself on the balance sheet enough?

His answer surprised me. The product, he said, is yield — and the demand for it is massive. The market isn’t just hungry for high-yield instruments — it’s desperate.

“The product is the desperation: retirees need high-yield income.”

It’s a tough truth, but it reflects the sad reality of fiat-based economies. We didn’t create this broken system — we’re living in it. And for millions of people trying to preserve their wealth, bitcoin treasury companies may actually be a lifeline. Especially pensioners, retirees and institutions trying to escape the erosion of fiat-denominated bonds. That’s the bridge: offer something familiar — a reliable income stream — while quietly onboarding the world to something revolutionary: Bitcoin.

As uncomfortable as that is — especially for people like Preston or me, who’ve dedicated years to Bitcoin education — it’s a needed reality check. If we’re serious about driving adoption, we have to meet people where they are. Sometimes, the bridge to Bitcoin is built from the tools of the old world.

But then he broke it down in systems terms — with Michael Saylor’s “multi-gear transmission” model as a case study. When credit is loose, raise debt to buy bitcoin. When credit tightens, use operating cash or issue equity. Always stack. Always adapt. Always keep accumulating. It’s not just about holding BTC — it’s about designing capital structures that serve Bitcoin, not the other way around.

A lightbulb went off. Maybe this isn’t the financialization of Bitcoin.

Maybe it’s the Bitcoinization of finance.

I think the idea that is shifting my perspective is this: transparency. This “super spreader” effect can only happen in public markets because of their regulatory visibility. You can’t hide what you’re doing. Auditors, investors, the public — everyone can see your books. That makes it harder to play scammy games and easier for Bitcoin’s incorruptible properties to shine through. As I told Preston in our chat, maybe that’s how Bitcoin ends up making fiat markets more honest.

Preston went further. He explained that one of the biggest untapped markets for Bitcoin treasury companies is retirees. People who want fixed income. Bonds. Yield. And through products like Strategy’s STRC security, companies are now offering bitcoin-backed yield instruments that can compete with traditional bonds — and maybe outperform them. That’s how bitcoin reaches even the most conservative portfolios.

“Saylor built a machine that shifts gears depending on liquidity in the system. It’s a genius piece of financial engineering that other public companies can copy — and they will.”

I’ve never been a fan of the idea that real change can come from within a broken system. But I also want to stay open to the possibility that this time might be different — that the fiat system won’t be overthrown in a single moment, but gradually transformed as better alternatives are quietly built inside it, until the change becomes undeniable.

Maybe we’re watching that unfold right now, in slow motion.

“To hand off the baton from legacy finance to the future Bitcoin system,” Pysh said, “the systems have to match frequency.”

That’s where stablecoins come in. Preston doesn’t romanticize them. He sees their flaws. But he also sees their role: to synchronize with Bitcoin, so the transition doesn’t break the relay. They’re the halfway step. A necessary bridge.

By 2030, he predicts, we’ll be living in a world with both CBDCs and bitcoin — a dual system. But not for long. “By 2030,” he said, “merchants will say, ‘We only want the Bitcoin.’”

The world is shifting. The Great Monetary Reset is already happening — beneath the headlines, inside balance sheets, behind cap tables. And maybe that’s the most radical part… It’s not a revolution on the streets: It’s a quiet, strategic rewiring of capital allocation.

I now get how bitcoin treasury companies aren’t the problem. Sure — if they don’t play smart, they may crash. If people go “all in” on them without hedging themselves, they may crash too. But these companies are fulfilling a role meant to be fulfilled: the role of super spreaders. And it might just lead us to the solution. Not perfectly. Not ideologically. But effectively.

The Great Monetary Reset isn’t ahead of us; it’s here — embedded in how capital is allocated, structured and stored. And if Preston is right, the playbook is already written for those ready to act.

This post How Preston Pysh Changed My Mind on Bitcoin Treasuries first appeared on Bitcoin Magazine and is written by Efrat Fenigson.

Bitcoin Magazine

Bitcoin Mining Is the Resurrection Of the Working-Class Hero

Most people think of bitcoin as just another asset: You buy some, throw it in cold storage and wait. Easy, right?

That’s the white-collar view of bitcoin: clean, polished and abstracted. Perfect for quarterly reports and portfolio charts.

But here’s the reality: Bitcoin mining is messy. It’s loud. It’s physical. Bitcoin mining is energy and infrastructure. It’s boots on the ground — not loafers on stage.

Miners don’t just hold bitcoin. Miners make bitcoin.

And that often overlooked reality matters more than most people realize.

I’ve Lived Both Sides

Before I started mining, I was deeply involved in the solar industry. I ran models, built forecasts and pitched clients. I knew the spreadsheets backward and forward. But it wasn’t until I was standing on rooftops in the California heat with the crew — scrambling to beat weather, deadlines and supply-chain disasters — that I learned what actually mattered.

The spreadsheet didn’t put the panels up — the crews did. The work made it real.

Bitcoin mining is no different.

These days, I wear both hats again — the executive in meetings and the operator walking sites. I’ve stood in our Paraguay facility, surrounded by hydropower-fed ASIC rigs humming like jet engines, steam rising off heat exchangers, spitting out hashrate at unbelievable speed. I’ve watched technicians troubleshooting in the middle of the night because if they don’t, we won’t win any blocks.

Bitcoin doesn’t come from the sky. It comes from work.

Bitcoin Mining and HODLing: Two Worlds

The Bitcoin community contains multitudes. Since 2020, many have come into the space through financial channels. They talk about ETFs, charts and cycles. They seek exposure, yield, and insulation from traditional finance.

But at Bitcoin’s core isn’t just theory — it’s thermodynamics. It’s not just about sovereignty; it’s sovereignty earned through proof-of-work. Miners don’t just debate decentralization. They live it.

A miner is uniquely able to understand scarcity because they see firsthand how hard it is to produce a single satoshi. It’s not just a yield. It’s sweat, capital and thermodynamics — every single day.

Bitcoin is backed by physics. It’s backed by energy. It’s backed by those who don’t have the luxury of abstraction.

Historically, blue-collar work has aimed to evolve into white-collar comfort. But Bitcoin may flip that script.

What if this is the moment where white-collar professionals rediscover the dignity of physical contribution — where they roll up their sleeves and plug in, not just financially, but literally?

It could mark the re-ascension of the working-class hero.

Norway, Paraguay and the Meaning of Conviction

I’ve seen this in both hemispheres.

Norway wasn’t dramatic when I visited — just clear skies and the quiet power of hydro-powered miners doing their work. That’s the beauty of it: Real infrastructure doesn’t need theatrics.

While I was at our Paraguay site, the team was deep in the weeds troubleshooting power flows and shifting rigs to maximize uptime — no storm, no crazy headlines, just the kind of problem-solving that never shows up on Twitter.

When I talk about conviction, I’m not talking about holding through a dip. I’m talking about people willing to rewire panels in the dark, through heat or cold, because they know this work keeps Bitcoin alive.

These men and women aren’t traders. They aren’t portfolio managers. They’re stewards of the network.

Why Bitcoin Mining Matters

This isn’t just some romantic notion. It has real implications. When Bitcoin is tested — when energy prices spike, regulators get aggressive or liquidity dries up — it won’t be the financial pundits defending it. It will be the miners.

They’ll move.

They’ll adapt.

They’ll grind.

And they’ll do it because they don’t just believe in Bitcoin — they’ve staked their livelihoods on it.

This is where white-collar Bitcoiners might consider a shift in mindset.

We don’t just need miners to keep Bitcoin secure. We need more Bitcoiners mining. The more people contribute at the base layer, the faster we push out fiat-based incentives and build a Bitcoin-native economy.

There’s a moral angle here, too: If you understand Bitcoin’s power to change the world, then maybe you don’t just get to hold it. Perhaps you have an obligation to help create it.

A Call to the Community

Bitcoin needs both worlds — the blue-collar miner and the white-collar allocator. But we should be honest about who makes the magic happen.

Our favorite orange coin is secured, block by block, by people who show up, rain or shine, to solve real-world problems in physical space — not by numbers on a spreadsheet.

To the abstracted class: We invite you in. Get your hands dirty and start hashing. Whether you’re running one rig or managing a fleet, you’re contributing to something bigger than financial gain. You’re contributing to the heartbeat of Bitcoin.

Bitcoin is backed by proof-of-work. Miners are the ones doing the work. Let’s honor that — by joining them.

Kent Halliburton is the CEO and Co-founder of Sazmining. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

This post Bitcoin Mining Is the Resurrection Of the Working-Class Hero first appeared on Bitcoin Magazine and is written by Kent Halliburton.

Bitcoin Magazine

Tornado Cash Jury Still Deliberating — Here’s Why That’s A Good Thing

Today, the jury for the Tornado Cash trial concluded its third day of deliberation, as many in the Bitcoin and crypto space continue to wait restlessly for a verdict.

As someone who’s been in the courtroom for most days of the trial as well as these three (boring) days of deliberation, I, too, am more than ready for this trial to come to an end…

…but I’m happy it hasn’t yet.

Is that because I’m a maniac who likes sitting in an empty courtroom toward the southern tip of Manhattan without my phone or laptop, weekday after weekday, only to then spend my evenings publishing work and catching up on the news cycle?

No, sirs and ma’ams — it surely isn’t.

It’s because a number of lawyers with whom I’ve spoken have stated that the longer the deliberation takes, the better chance there is of Storm not being found guilty.

Zack Shapiro, head of policy at the Bitcoin Policy Institute, told me as much last week and also shared his thoughts on the matter in an X post on Wednesday.

“My guess is that the longer the deliberation takes, the better,” wrote Shapiro.

“The reasons why Roman Storm isn’t guilty (e.g. the t-shirt being a joke, and the immutable smart contract not “transmitting funds”) are nuanced and a bit complicated. A knee jerk reaction that money laundering = bad isn’t,” he added.

“So if we hear that [the] jury reached a verdict in the first half of the day tomorrow, that’s probably bad news. Whereas a prolonged deliberation means they are wrestling with the concepts.”

So, please, members of the jury, wrestle away with the admittedly very-difficult-to-grasp concepts in this case, and take your time coming to a conclusion as to whether or not you want to put a young software developer in jail for 45 years for creating novel noncustodial crypto privacy technology that, yes, some mega-bad actors used but that was primarily used by those who simply wanted to anonymize their crypto transactions.

I’m happy to stomach the mix of anxiety and boredom as I sit patiently in that quiet courtroom downtown, awaiting your decision.

This post Tornado Cash Jury Still Deliberating — Here’s Why That’s A Good Thing first appeared on Bitcoin Magazine and is written by Frank Corva.

Bitcoin Magazine

Tennessee Bitcoin Alliance to Position the Volunteer State at the Center of America’s Bitcoin Revolution

A new nonprofit organization, the Tennessee Bitcoin Alliance (TNBTC), has been formed to accelerate bitcoin adoption across Tennessee through coordinated public-education programs and a focused legislative agenda. Its stated mission is to integrate bitcoin with commercial activity in the state.

The organization was founded by seasoned technologists, entrepreneurs and political activists and aims to translate Tennessee’s favorable energy mix and business climate into long-term leadership in the adoption of bitcoin. The TNBTC launched last month with an in-person event in Franklin, Tennessee, with several state lawmakers and policy specialists attending.

Education First: Workshops and Merchant Integration

TNBTC will begin rolling out statewide workshops this fall. Sessions for households will cover practical topics such as acquiring, securing and spending bitcoin, while merchant-oriented programs will provide hands-on guidance for integrating Lightning-enabled point-of-sale systems. Additional free materials and bitcoin education curricula are planned for educators, civic groups and local officials to ensure a common understanding of Bitcoin’s technical fundamentals and economic implications.

A Legislative Roadmap for 2026

On the policy front, the alliance is circulating draft language for the 2026 General Assembly that would affirm every resident’s right to self-custody, recognize bitcoin node operation as constitutionally protected speech, permit contracts to be settled in bitcoin without adverse tax treatment and distinguish bitcoin from other digital assets in state code.

“Tennessee already combines a top-ten freedom ranking, abundant low-cost nuclear power, and a bipartisan appetite for innovation,” said Dave Birnbaum, TNBTC’s president and co-founder. “Our goal is to combine those advantages with bitcoin and position our state for rapid economic growth.”

Tennessee Bitcoin: Leveraging Energy and Industry Advantages

The Tennessee Valley Authority’s grid, which is nearly half nuclear, offers miners and data center operators a stable, low-carbon power source. The state also hosts existing high-performance computing infrastructure, from Oak Ridge National Laboratory to the xAI facilities in Memphis. According to the Coinbits Bitcoin Index, which aggregates tax policy, energy pricing, regulatory climate and adoption metrics, Tennessee currently ranks fifth nationwide for Bitcoin friendliness. TNBTC believes it can build upon this momentum.

“From Oak Ridge’s Frontier super-computer to FedEx’s global logistics hub, Tennessee has a history of converting frontier technology into real jobs,” said Steve Giraud, TNBTC vice-president and co-founder. “Bitcoin is the next frontier, and this initiative will make sure that the economic opportunity that bitcoin affords can reach every county in the state.”

Funding and Participation

TNBTC is supported entirely by individual and corporate donations. Membership information, program schedules and volunteer opportunities are available at tnbitcoinalliance.org. The organization’s first county-level meetups are slated for August, with pilot workshops targeting public-school educators and small-business owners.

If successful, the Tennessee Bitcoin Alliance could provide a replicable framework for state-level Bitcoin adoption rooted in practical education and clear statutory protections, cementing the Volunteer State’s reputation as a leading jurisdiction for innovative technologies that advance personal liberty.

This post Tennessee Bitcoin Alliance to Position the Volunteer State at the Center of America’s Bitcoin Revolution first appeared on Bitcoin Magazine and is written by Dave Birnbaum.

Bitcoin Magazine

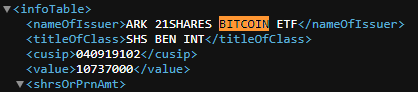

Michigan State Pension Fund Triples Bitcoin ETF Holdings to $10.7 Million

Michigan’s state pension fund has increased its exposure to Bitcoin through a significant purchase of the ARK 21Shares Bitcoin ETF (ARKB). According to a new SEC filing, the fund held 300,000 shares of ARKB as of June 30, up from 100,000 shares reported at the end of March.

The position is valued at approximately $10.7 million, compared to roughly $4.1 million three months earlier. The increase comes as spot Bitcoin ETFs continue to see inflows following their approval in January 2024.

The ARK 21Shares Bitcoin ETF is one of several spot Bitcoin funds approved by the SEC, allowing institutions to gain exposure to Bitcoin without directly holding the asset. These filings provide a window into how public funds and institutional investors are approaching Bitcoin within the framework of regulated financial products.

Michigan’s disclosure adds to a growing list of public institutions reporting Bitcoin related investments through ETFs. Earlier this year, the Wisconsin Investment Board reported positions in both the BlackRock and Grayscale Bitcoin ETFs. Similar disclosures have been made by smaller institutions, but Michigan’s filing is among the larger public pension entries.

As of today, Bitcoin is trading around $113,000 and is up approximately 21% year-to-date. The launch of spot ETFs has provided institutions with a regulated way to gain exposure. Public filings like this one suggest that traditional investors are beginning to explore Bitcoin more actively now that access has become more standardized.

This post Michigan State Pension Fund Triples Bitcoin ETF Holdings to $10.7 Million first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

CryptoSlate

China’s Ministry of State Security (MSS) has warned that a foreign crypto company is collecting iris scan data under the guise of token distribution, raising serious concerns about personal and national security.

In an Aug. 5 statement, the ministry revealed that the firm is gathering iris data from users worldwide and transmitting it to an overseas database. Authorities did not name the company, but they cautioned that the biometric information could be exploited if it fell into the wrong hands.

The MSS stressed that iris data, like other forms of biometric information, could be used for identity theft, fraud, and illegal surveillance once leaked.

Officials cited recent examples, including a foreign firm whose fingerprint payment system was compromised due to weak security controls. Hackers reportedly accessed sensitive user data by breaching the company’s internal systems.

According to the ministry, there is mounting evidence that foreign intelligence agencies have engaged in unauthorized collection of facial and biometric data. These actors allegedly falsify such data to access secure environments and conduct surveillance operations.

The MSS noted this represents a growing risk to China’s national security.

Considering this, the authorities stressed that Chinese law provides strict safeguards around biometric data, including facial and iris recognition technologies.

The MSS urged both citizens and organizations to comply with existing legal frameworks. It also encouraged the public to remain alert and report suspicious data collection activities.

Worldcoin suspected

While the Chinese ministry avoided directly naming the company, the description closely aligns with Worldcoin, which has now been rebranded as World.

The project scans users’ irises in return for WLD tokens, a practice already under investigation in multiple jurisdictions.

Over the past year, the Sam Altman-backed company has recorded significant growth by scanning the irises of more than 10 million people worldwide. At the same time, the firm has also expanded into countries like the United States and Malaysia.

However, its operations have triggered regulatory scrutiny in Colombia, Germany, Hong Kong, South Korea, and Indonesia.

Authorities in those regions have raised red flags over data protection violations, non-compliance with privacy laws, and a lack of transparency.

Meanwhile, Worldcoin has continued to stress its commitment to legal compliance, hashed data, and the high standards of its users’ privacy protection.

The post China’s security alarm on iris scans puts spotlight on Worldcoin appeared first on CryptoSlate.

US Securities and Exchange Commission (SEC) Commissioner Caroline Crenshaw has criticized recent staff guidance on liquid staking, warning that it fails to reflect the practice’s complexities.

On Aug. 5, the SEC’s Division of Corporation Finance asserted that certain liquid staking arrangements, specifically those involving receipt tokens, do not fall under securities regulations.

However, Crenshaw pushed back, arguing that the statement adds confusion rather than clarity to the legal treatment of liquid staking.

“Instead of clarifying the legal landscape, today’s statement, like other recent staff statements before it, only muddies the waters.”

Crenshaw pointed to two major flaws in the SEC staff’s position. First, she said the guidance relies on a long list of questionable assumptions about how liquid staking operates. Second, the staff’s legal conclusions are heavily caveated, making them unreliable for firms trying to navigate compliance.

She noted that any staking activity not fitting the precise conditions described in the document would fall outside its scope. Because of this, she argued, the guidance offers little protection or direction to those involved in staking-related services.

Crenshaw also reminded investors that the guidance represents the opinion of SEC staff, not the official stance of the Commission itself. As such, she believes it should have been framed as a cautionary alert, not a position of regulatory clarity.

Lehman-like risks in crypto staking

Adding to the concerns, Amanda Fischer, a former SEC Chief of Staff under Gary Gensler, drew parallels between liquid staking and the risky financial practices that led to Lehman Brothers’ collapse in 2008.

In a post on X (formerly Twitter), Fischer warned that liquid staking could expose crypto markets to cascading failures. She explained that the practice allows users to deposit digital assets and receive a synthetic version of the same token, which can be reused to earn additional rewards.

According to Fischer, this mirrors how Lehman reused client assets to back high-risk trades. She argued that liquid staking could replicate the same vulnerabilities without strong regulatory oversight.

The former SEC official also highlighted the risks of relying on token issuers, the possibility of long delays when unstaking, and the threat of technical failures or hacks. Together, these factors could amplify systemic risk across the crypto sector.

The post SEC official warns liquid staking guidance adds confusion, raising Lehman-like risks appeared first on CryptoSlate.

Crypto traders are preparing for potential price declines in Bitcoin (BTC) and Ethereum (ETH) this August, with options data from Derive.xyz showing a clear tilt toward bearish positioning.

Bitcoin bearish sentiment

According to data shared with CryptoSlate, open interest in Bitcoin put options with an Aug. 29 expiry date is nearly five times higher than call options.

Investors typically buy call options when they expect the asset’s price to increase. Conversely, they buy put options when they anticipate a decline in the asset’s value.

Notably, about 50% of that Derive’s put activity is concentrated around the $95,000 strike, while another 25% is split between $80,000 and $100,000.

Further confirmation comes from data from Deribit, a leading centralized derivatives exchange, where put options at the $110,000 and $95,000 strike prices account for over $2.8 billion in open interest.

This suggests traders are increasingly betting on a move below the six-figure mark.

Moreover, options skew, a measure comparing the cost of puts to calls, has shifted from +2% to -2% in the past month, reflecting a growing appetite for downside protection.

This shift in sentiment aligns with probability models that place an 18% chance on BTC revisiting $100,000 before the end of the month.

Ethereum volatility rises

Ethereum is also experiencing an increase in bearish sentiment, though to a lesser degree than Bitcoin.

Derive data shows that for the Aug. 29 expiry, put options outnumber calls by just over 10%.

The highest concentration of put activity is around the $3,200, $3,000, and $2,200 strike levels, suggesting traders are bracing for anything from mild declines to more significant drops in Ethereum’s price.

Moreover, ETH’s 30-day skew has dropped from +6% to -2%, suggesting a similar pattern of growing interest in downside protection.

Meanwhile, Ethereum’s monthly volatility remains higher, with an expected volatility of 65%, compared to Bitcoin’s 35%. This suggests Ethereum could experience a bumpier ride than Bitcoin in the weeks ahead.

Considering this, crypto traders on Derive have placed a 25% chance of ETH falling below $3,000 this month. However, with recent price rebounds, the odds of a close above $4,000 have doubled to 30% over the past week.

The post Bitcoin and Ethereum traders prepare for August slump as put options dominate appeared first on CryptoSlate.

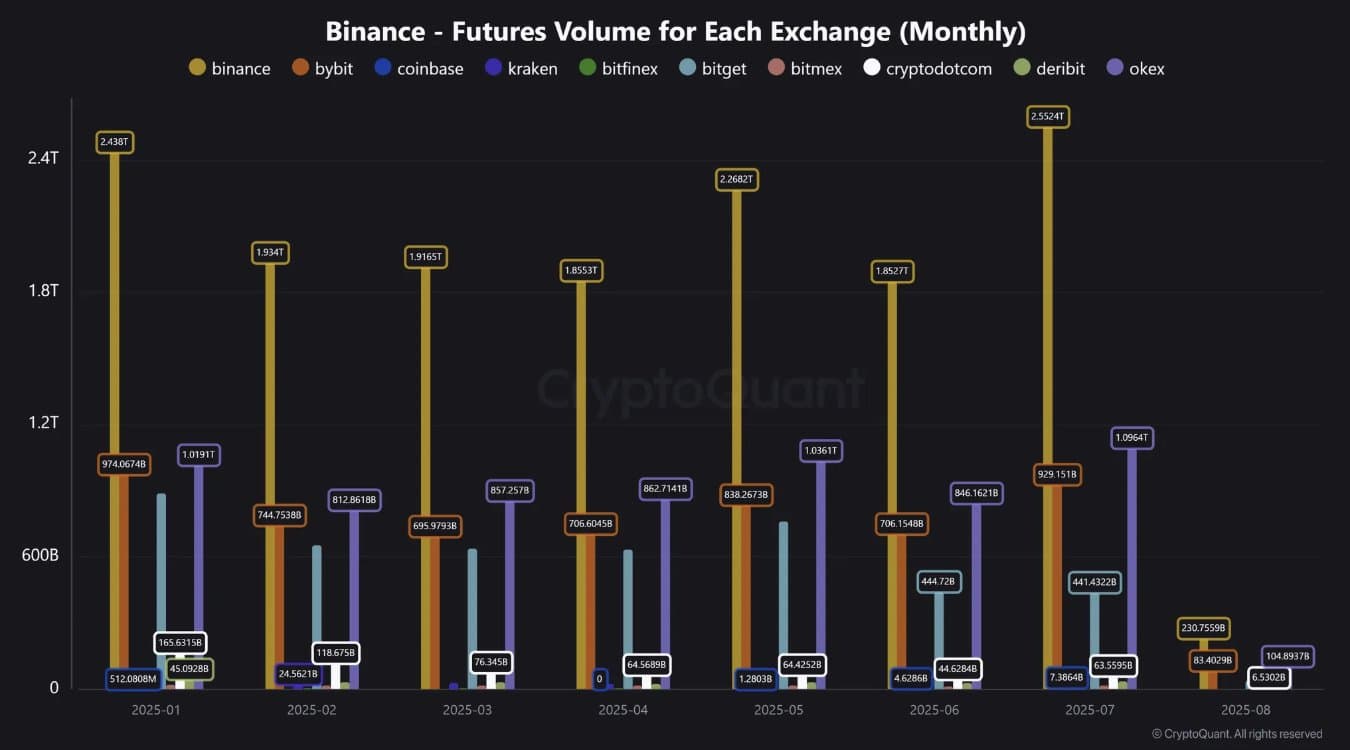

The crypto derivatives market saw $351.86 million in liquidations in the past 24 hours, with Ethereum accounting for $108.88 million and Bitcoin $56.01 million.

These liquidations followed a big intraday swing for Bitcoin and a relatively modest price move for Ethereum. BTC traded between $111,971 and $116,235 on Binance, closing at $114,291, while ETH ranged from $3,357 to $3,735 before settling at $3,645.91.

Despite smaller relative price changes, ETH’s liquidation volume outpaced BTC nearly 2-to-1, showing that its market was much more heavily leveraged or misaligned with short-term sentiment.

ETH saw $43.08 million in short liquidations, more than triple Bitcoin’s $14.35 million, suggesting many traders expected continued downside that failed to materialize. A lack of ETF activity and internal network developments seems to have increased speculation around ETH, which in turn triggered erratic leverage positioning.

Binance and Bybit saw the highest liquidations: $138.18 million and $102.87 million, respectively. This centralization in liquidation activity illustrates the leverage density of these platforms. Gate contributed another $42.18 million, with smaller numbers from OKX and HTX. Hyperliquid, while significantly less dominant in total volume, registered the largest single liquidation order at $5.17 million on a BTC-USD pair.

The total liquidation skew was heavily long-biased, with $238.97 million in long positions wiped out, compared to $112.88 million in shorts. This tells us traders positioned for a bullish breakout but were gradually forced out by range-bound or fading rallies. BTC’s relatively steady close, just slightly below the daily high, shielded it from more extreme liquidations, while ETH’s volatility drew aggressive positioning on both ends.

Despite a sharper -2.25% price drop to $164.44, Solana saw limited liquidations at $16.97 million. This could point to a lower leverage ratio or less directional conviction among traders. Interestingly, the data reflects that SOL shorts slightly outweighed longs over the day, contrasting the more bullish tilt seen in ETH and BTC positioning.

The post Market sees $351 million in liquidations as ETH takes most losses appeared first on CryptoSlate.

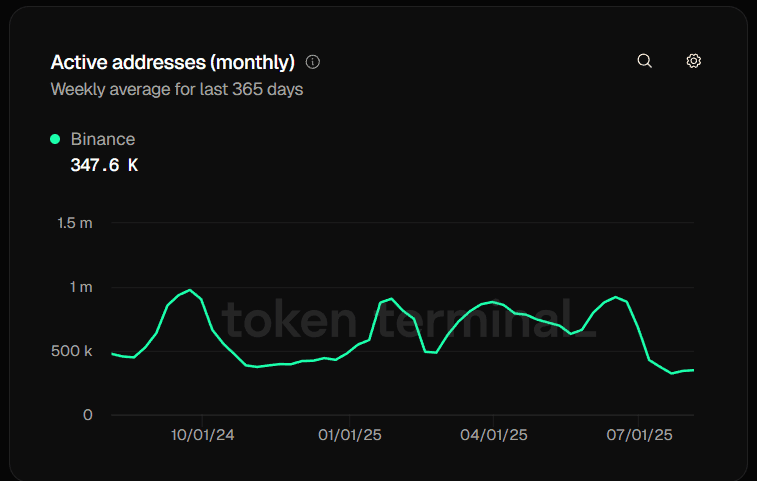

Investors’ appetite for risk seems to weaken as Bitcoin (BTC) signals weakness and altcoin traders capitulate.

According to the latest edition of the Bitfinex Alpha report, BTC slipped below its three-week range floor near $115,800 late last week. On August 5, BTC tagged $112,722.10 in early trading hours, while also flipping former support into potential resistance.

The breakdown follows weeks of weakening order flow and open interest that showed traders rotating into Ethereum (ETH) and higher-beta names. That rotation unwound abruptly, as the aggregate of altcoins outside the top 10 fell 16.3% between July 28 and August 2, erasing roughly $40 billion in value before a modest bounce.

De-risking moves

The synchronous drawdown across majors and the long tail point to a market-wide de-risking rather than a simple shift in leadership. From its all-time high of $123,054, BTC is down 6.6%. ETH is 9% off its recent local peak and closed last week 9.7% lower.

At the same time, the broader altcoin complex fared worse, starting the week with a slight pump to nearly $994 billion, but erasing the gains as of press time.

Despite the crashes registered last week, ENA and PENGU remained two outliers with 14% and 8.4% weekly price increases, respectively.

However, even the outliers are bleeding at the start of this week. ENA is down by 4.1% in the past 24 hours, while PENGU tanks a 7.6% correction.

The report noted that leverage amplified the correction move. On August 2, liquidations across major centralized venues topped $1 billion, with more than $922 million in longs wiped out as momentum stalled.

While BTC led the pain, ETH long liquidations comprised most of the remainder, evidence that traders had crowded into catch-up bets after ETH underperformed earlier in the cycle.

Furthermore, the report characterized liquidation flush as a “cleansing” event that typically resets open interest and positioning. Yet, it warned that the market remains in a reflexive, fragile phase where sharp reversals and liquidation cascades are more likely.

Bitcoin remains strong

Structurally, Bitcoin continues to diverge from the rest of crypto. Its market capitalization remains above $2.2 trillion, nearly double the 2021 cycle peak, while ETH and the aggregate altcoin market have yet to exceed their 2021 highs.

The report argued that this reflects BTC’s evolution into a more macro-resilient, institutional-grade asset, contrasted with an altcoin sector that still lacks sustained capital rotation and durable, structural demand.

As of now, Bitcoin executed the tactical bounce fueled by oversold conditions predicted by the report, recovering the $114,000 threshold after dipping below it.

However, without evidence of aggressive spot buying, renewed exchange-traded fund (ETF) inflows, and with a still-hawkish Federal Reserve backdrop, the expectation remains around a consolidation or further corrective price action.

The post Bitcoin loses key support at $115,800 as altcoin traders capitulate, signaling fading risk appetite appeared first on CryptoSlate.

Cryptoticker

Bitget, the leading cryptocurrency exchange and Web3 company, officially launches Crypto Experience Month 2025, a global youth activation campaign under its Blockchain4Youth initiative. Now in its third year, the campaign takes a step away from classrooms and webinars, transforming crypto from a buzzword into something tangible, usable, and real. As part of the third-year celebration of International Youth Day in August, Bitget plans to host Crypto Experience events throughout the month of August across multiple cities in the Middle East, Europe, South East Asia, and South Asia.

Crypto Experience Month 2025 is built around a simple tagline: Look What Crypto Can Do. While headlines often frame digital assets around market movements, this campaign flips the narrative, focusing instead on how blockchain is being applied in payments, gaming, DeFi, identity, and creative expression. Across pop-up activations set to roll out globally this August, Bitget is inviting young people to try crypto for themselves, not on charts, but in checkout lines, in metaverse arcades, and through everyday interactions.

From university campuses to creative hubs, attendees will explore zones where they can mint NFTs, experiment with stablecoin lending, trade tokenized stocks in real-time simulations, and test drive PayFi’s QR-based retail transactions. They’ll receive digital badges, load up a Bitget Wallet Mastercard, and even stake assets in DeFi setups guided by in-person educators. The format is designed to merge experience with understanding, where every station is part demo, part discovery.

The shift from education to interaction marks a new chapter for the campaign. Launched in 2023 with Crypto Experience Day, the campaign expanded to an entire month in 2024, reaching over 15,000 participants across 12 countries. This year’s edition pushes further, prioritizing physical presence and hands-on engagement to help bridge the growing gap between Web2 curiosity and Web3 confidence.

Vugar Usi Zade, Bitget’s Chief Operating Officer and the executive sponsor of Blockchain4Youth, believes that relevance comes from application. “You can’t build belief in the future of crypto through theory alone. You need to let people feel it, use it, question it,” he said. “Crypto Experience Month is about making the technology real and giving young people a reason to care about where it’s going.”

Bitget Wallet will serve as the official campaign partner, integrating its latest features, including PayFi, and on-chain tools into the experience zones. Jamie Elkaleh, Chief Marketing Officer at Bitget Wallet, added, “The onboarding is just the start. It’s also about showing how crypto can empower everyday actions, from payments to creativity. We’re excited to bring that vision to life on the ground.”

Followers of the campaign can look forward to a recap video capturing highlights from each activation in early September. Until then, Bitget’s message is clear: crypto isn’t just coming to the real world. It’s already here, and this August, it’s handing over the controls to the next generation.

About Bitget

Established in 2018, Bitget is the world's leading cryptocurrency exchange and Web3 company. Serving over 120 million users in 150+ countries and regions, the Bitget exchange is committed to helping users trade smarter with its pioneering copy trading feature and other trading solutions, while offering real-time access to Bitcoin price, Ethereum price, and other cryptocurrency prices. Bitget Wallet is a leading non-custodial crypto wallet supporting 130+ blockchains and millions of tokens. It offers multi-chain trading, staking, payments, and direct access to 20,000+ DApps, with advanced swaps and market insights built into a single platform.

Bitget is driving crypto adoption through strategic partnerships, such as its role as the Official Crypto Partner of the World's Top Football League, LALIGA, in EASTERN, SEA and LATAM markets, as well as a global partner of Turkish National athletes Buse Tosun Çavuşoğlu (Wrestling world champion), Samet Gümüş (Boxing gold medalist) and İlkin Aydın (Volleyball national team), to inspire the global community to embrace the future of cryptocurrency.

Aligned with its global impact strategy, Bitget has joined hands with UNICEF to support blockchain education for 1.1 million people by 2027. In the world of motorsports, Bitget is the exclusive cryptocurrency exchange partner of MotoGP™, one of the world’s most thrilling championships.

Risk Warning: Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, please refer to our Terms of Use.

BNB price just got a major confidence boost from Wall Street. CEA Industries, a Nasdaq-listed company, has raised half a billion dollars to buy BNB and shift its entire treasury strategy to the BNB ecosystem. But here’s the thing—despite the headlines, BNB’s price hasn’t exploded. Let’s break down what’s really going on and what the daily chart is signaling.

Why Is This CEA BNB News a Big Deal?

CEA isn’t just buying a few tokens. They’ve raised $500 million in a private placement and will buy BNB as their primary reserve asset. The initiative is backed by Binance founder CZ’s family office, YZi Labs, and supported by big names like Pantera Capital, Blockchain.com, and Arrington Capital.

They’re even rebranding their ticker from VAPE to BNC. That’s not a pivot—it’s a full-blown identity shift. They’re committing to the BNB Chain ecosystem long-term, and an additional $750 million could be unlocked through warrants. That brings the total possible BNB treasury to $1.25 billion.

This puts BNB price in the same narrative space where Bitcoin was when MicroStrategy made its first major buy. It signals institutional belief not just in Binance’s token, but in the ecosystem it anchors.

BNB is entering a new phase of institutional adoption. Just a few days ago, Nasdaq-listed biotech firm Windtree Therapeutics announced plans to buy up to $700 million worth of BNB. Now, CEA Industries has followed up with a confirmed $500 million raise to execute its own BNB treasury strategy. That’s $1.2 billion in fresh capital flowing toward BNB from two publicly traded companies within the same week.

BNB Price Prediction: What Does the Daily Chart Say About BNB’s Price?

Looking at the daily chart, BNB price is trading at around $757 after a strong July rally that peaked near $870. What followed was a typical retracement phase. Price action has now pulled back into the Bollinger Band midline zone near $773 and slightly dipped below it.

The Heikin Ashi candles show a loss of bullish momentum with a string of smaller-bodied orange candles. This suggests some indecision or early profit-taking following the July surge. However, the lower wick support around $740 has held up for several sessions now.

The key zones to watch:

- Resistance at $773 to $790: This is the Bollinger midline and the range top from the early August pullback.

- Support near $715 to $740: The lower Bollinger Band and previous local demand zone.

- Breakout trigger: A daily close above $790 with strong volume could resume the uptrend and retest the $870 high.

So far, there’s no breakdown. BNB is just cooling off after a vertical climb.

Could CEA’s Move Trigger a Second BNB Price Rally?

This isn’t hype-driven retail volume. This is structured institutional capital entering BNB. If CEA starts executing its buys over the next few days or weeks, that could provide serious demand-side pressure. The news also sets precedent—other firms might now consider BNB as a treasury asset, similar to the domino effect that followed MicroStrategy's Bitcoin strategy.

If more announcements follow, or if CEA reveals actual BNB purchases via on-chain data, we could see BNB push toward four-figure levels by Q4.

BNB Price Prediction: What Happens If the Market Ignores the BNB News?

If BNB price breaks below the $715 zone, we’re looking at deeper retracements toward $680 and even $640, which align with the lower Bollinger projection. That would suggest the market is still digesting the recent rally and may need more time before pushing higher.

But from a structure point of view, the chart still leans bullish. The trend is intact, the fundamentals just got stronger, and BNB has become more than just an exchange token. It’s now a treasury-grade asset for public companies.

The CEA BNB news is a massive long-term validation for BNB. The market hasn’t priced it in fully—yet. Technically, BNB is at a decision point. If bulls defend this support and push above $790, a fresh rally toward $900 and beyond is likely.

If you're watching for entries, keep an eye on the $740 to $760 consolidation range. If volume starts picking up and price closes strong above resistance, that’s your signal.

BNB news just entered the big leagues. And this might just be the beginning.

Litecoin just saw its strongest price spike in months, and it’s not hard to see why. A powerful mix of speculative energy, corporate action, and ETF optimism has lit a fire under LTC, pushing it to a five-month high of $128.40. But is this LTC price momentum sustainable, or is the market getting ahead of itself?

Let’s break it down.

Litecoin Price Prediction: What’s Driving the Price Surge?

First, the numbers. Litecoin is up over 41 percent this month and nearly 6 percent in the past 24 hours alone. As of now, it’s holding around $123, giving it a market cap close to $9.4 billion. That move isn’t random. It comes right after two major catalysts.

The big one? MEI Pharma raised $100 million—not for R&D, not for expansion, but to become a Litecoin treasury firm. That’s a massive bet on LTC from a publicly listed pharmaceutical player, and it’s sending a strong message to the broader market: Litecoin isn’t just for payments anymore, it’s a corporate asset.

Then there’s the ETF speculation. While prediction platform Polymarket places the odds of a Litecoin ETF approval this year at 83 percent, competing platforms like Myriad show users expect XRP to beat Litecoin to the finish line. Regardless, multiple filings from Canary Capital, Grayscale, and CoinShares suggest the race is on. The fact that these institutions are even in the conversation is enough to inject serious momentum.

What the LTC Price Chart Says?

Looking at the TradingView daily chart, LTC broke above both the midline and upper band of the Bollinger Bands, which typically signals an overbought yet strong bullish condition. It’s riding above the 20-day moving average comfortably, and the Heikin Ashi candles show clear bullish continuity after a minor pullback.

That pullback after hitting $128.40 wasn’t a reversal—it looks more like a healthy consolidation. The current candle has reclaimed the upper Bollinger Band, suggesting that bulls are still in control. Momentum is strong, and the price structure is climbing with higher lows and higher highs.

If Litecoin can close above $125 in the next couple of sessions, the door opens to a retest of $135 to $140. Above that, $150 becomes the psychological level to watch. On the downside, $110 acts as strong support, and a drop below $105 would invalidate this bullish thesis.

Are ETF Rumors Already Priced In?

Litecoin ETF approval speculation has been around since February, when the SEC first acknowledged the filings. What we’re seeing now isn’t fresh news—it’s a resurfacing of old optimism, coupled with fresh capital from MEI Pharma. That matters.

In fact, the MEI investment could be the more important long-term catalyst. ETF approvals can move prices quickly, but if more firms start adding LTC to their balance sheets, that builds a deeper base of demand. And unlike ETF rumors, treasury allocations tend to stick around.

Litecoin Price Prediction: What Comes Next for LTC Price?

Short term, expect volatility. The market is jittery, and LTC will swing on every new ETF headline. But if treasury adoption continues and Litecoin maintains its role as a top payment coin—it recently captured 14.5 percent of crypto payments on CoinGate—there’s a longer runway here.

Keep an eye on three things: SEC decisions around Litecoin ETFs, corporate announcements hinting at LTC treasury positions, and any major payment platform adopting LTC.

The price is reacting to signals of real-world usage and institutional interest. If those signals get stronger, this could be the beginning of a structural uptrend, not just a hype-driven pump.

Buy LTC on OKX

Looking to buy LTC? OKX is one of the top exchanges with low fees, fast execution, and hundreds of listed assets.

👉 Join OKX here and claim your welcome bonus

$LTC, $Litecoin, $LTCPrice, $LitecoinPrice, $LitecoinETF, $ETF

XRP Price Prediction: Will Support at $3 Hold?

XRP ($XRP) is currently trading around $3.02, down 1.53% on the day and 3.17% over the past week, according to the latest market performance. Despite these short-term losses, the token is still up 36.34% over the past month, 27.02% in 6 months, and a solid 45.51% year-to-date.

But can this momentum continue—or are we looking at the beginning of a deeper correction?

XRP Chart Analysis: Key Levels to Watch

The daily chart shows XRP recently broke down from a local top near $3.60 and is now consolidating just above the psychological $3.00 level. This level is critical for bullish momentum to remain intact.

- Support Zones: $3.00 (green horizontal), followed by the 50-day SMA at $2.68 and the 200-day SMA at $2.45.

- Resistance Zones: Immediate resistance lies near $3.20. A breakout above this could trigger a retest of $3.61.

- RSI (Relative Strength Index): RSI has cooled off from its overbought zone and is now hovering around 52. This suggests XRP has room to move in either direction but lacks strong momentum for now.

XRP/USD 1-day chart - TradingView

A breakdown below $3.00 could open the doors to a quick dip towards $2.68 or even $2.45. However, holding this level would signal bullish consolidation and the potential for a bounce.

Market Context: Ripple's Blockchain Report Adds Confidence

In the midst of this technical uncertainty, $Ripple official X post offers a bullish long-term narrative for XRP and blockchain adoption:

“The shift is happening: banks are investing in blockchain.

➡️ $100B+ invested in blockchain companies since 2020

➡️ $700B/month in stablecoin volume

➡️ $18T projected in tokenized assets by 2033”

This data comes from Ripple's new report in partnership with CB Insights and UK Cryptoasset Business Council, highlighting the growing integration of blockchain into traditional finance.

These macro signals can act as a tailwind for XRP’s future valuation—especially if XRP remains a go-to option for cross-border payments and tokenized liquidity.

XRP Outlook: Price Prediction for August 2025

If XRP can maintain support above $3.00, the next leg up could push toward the $3.60 resistance zone. However, if Bitcoin ($BTC) continues to slide or the broader crypto market weakens, XRP may revisit lower support levels.

Potential Scenarios:

- Bullish Case: Bounce from $3.00, retest $3.20, and aim for $3.60+. Breakout above $3.60 could send XRP to new highs.

- Bearish Case: Failure to hold $3.00 sends XRP down to $2.68 or even $2.45. RSI breakdown would confirm bearish momentum.

The crypto market in the US might be on the verge of a major turning point. Donald Trump is expected to sign an executive order that takes aim at what many in the space have called a quiet crackdown by banks and regulators. The order would investigate whether financial institutions acted illegally when they dropped crypto clients, and it could force a regulatory reset that reopens critical banking access. For a sector still recovering from the FTX fallout and ongoing regulatory pressure, this move could change everything. Let’s look at what’s really happening — and what comes next.

Trump’s Executive Order on Crypto Debanking Could Reshape the US Digital Asset Market

Donald Trump is reportedly preparing to sign an executive order that challenges the long-standing accusations of unfair treatment toward crypto firms by US banking regulators. If this order is signed as expected, it could mark a pivotal shift in how traditional financial institutions engage with digital asset companies.

Could This Reverse the Chill from Operation Choke Point 2.0?

For over two years, crypto executives have argued that regulators quietly squeezed digital asset firms out of the financial system. They called it Operation Choke Point 2.0. The accusation? Regulators allegedly pressured banks to cut ties with crypto businesses, especially after the FTX collapse. A Freedom of Information Act request revealed that the FDIC even asked banks to pause crypto activities, validating what many insiders had claimed all along.

Trump’s proposed executive order goes straight for the jugular of this issue. It directs federal agencies to examine whether those regulatory moves violated antitrust or fair lending laws. If regulators are found complicit, legal action may follow. That sends a loud signal that a new sheriff could be back in town—and that crypto firms might soon find the doors of traditional finance swinging back open.

What This Means for the Crypto Market in the Short Term

If Trump signs the order this week, expect a sentiment boost across the crypto sector. Coins most dependent on US banking infrastructure, such as stablecoins and platforms like Coinbase, could see immediate bullish momentum. Even before the ink dries, the market tends to price in regulatory easing when it sees political will leaning toward crypto support.

Tokens with close ties to US innovation—think Ethereum, Chainlink, and Solana—may benefit from improved fiat on-ramps and less friction for US-based liquidity providers. If banks begin re-evaluating their relationships with crypto firms, that could mean more capital flows, better infrastructure support, and reduced compliance headaches.

How Might Investors React Over the Coming Weeks?

This is where things get more complex. Regulatory relief doesn’t mean the SEC and CFTC will instantly back down. Investors will wait to see whether the Department of Justice actually follows up on the order and whether banking policies truly change. But even anticipation of those changes could push Bitcoin and other top tokens higher in the near term.

The key trigger to watch: whether financial institutions begin re-engaging with previously off-limits crypto clients. If major banks like JPMorgan or Wells Fargo quietly resume onboarding or offering services to digital asset companies, that would confirm the shift is real—not just political posturing.

Could This Open the Floodgates for a US Crypto Revival?

Not overnight. The order would first trigger investigations and reviews, not immediate enforcement. But it sets the groundwork. For startups, this could remove one of the biggest barriers to growth: banking access. For large exchanges like Coinbase, it could reduce compliance risks and strengthen US market positioning.

If the order also restores confidence in the rule of law for conservative political groups, it could unite two powerful constituencies—crypto libertarians and right-leaning financial backers—under a shared cause. That political alignment could shape future US crypto policy for years.

What to Watch Next?

Three things matter now.

- Whether Trump actually signs the order this week or delays it

- The reaction from US banking regulators like the FDIC and Federal Reserve

- Price movement in US-domiciled crypto assets and listed companies like Coinbase

If this story develops into real regulatory pressure on agencies that sidelined crypto firms, expect a new wave of bullish energy to enter the market. It’s early days, but the crypto winter in the US might finally be thawing.

$CryptoMarket, $Bitcoin, $DonaldTrump, $ETH, $SOL, $LINK, $Coinbase, $FTX

Decrypt

Ten offshore platforms were flagged by regulators earlier this week and are now inaccessible through at least one major ISP.

It appears the SEC is accelerating their efforts to turn Project Crypto into reality, and soon...

CZ argued that a Delaware court has no authority over him in a case tied to 2021 crypto transfers from Sam Bankman-Fried.

Michigan’s state pension fund tripled its exposure to Bitcoin in Q2, signaling growing institutional adoption despite recent ETF outflows.

Chirag Tomar, convicted in the U.S. for a $20M crypto scam using fake Coinbase websites, ran a phishing network targeting global victims.

U.Today - IT, AI and Fintech Daily News for You Today

Dogecoin futures market has seen major liquidation imbalance as DOGE price faces sell-off

Shiba Inu might see great recovery setup thanks to higher low

SHIB burns have soared 286%, but there's a major catch

Coinbase's CEO spotlights crypto exchange's recent milestone

Dogecoin whales return with 1,000,000,000 DOGE buy during market bloodbath

Blockonomi

With the Web3 gaming sector evolving rapidly, few projects have shown the discipline and clarity of purpose that FUNToken ($FUN) has demonstrated. Trading around $0.0187 at the time of writing, FUNToken has laid out a roadmap for Q3 and Q4 that is designed to cement its place as a leader in community-driven, reward-powered gaming; while strategically increasing its user base.

Here are some such initiatives, and how they are positioned to make FUNToken a central pillar in the Web3 gaming landscape.

Expanding the Gaming Ecosystem to 30 Titles

At the core of FUNToken’s Q3/Q4 strategy is a significant expansion of its gaming catalog. The project plans to launch enough new titles to bring the total to 30 live games across Telegram, iOS, and Android.

This move matters because it creates:

-

Broader appeal to casual and social gamers who want a variety of experiences

-

Daily transaction volume as players return to complete missions and earn rewards

-

A foundation for future leaderboards, tournaments, and cross-game achievements

The more diverse the content, the more reasons users have to engage, and the more revenue is generated to support quarterly token burns.

Introducing Staking in the Dedicated Mobile Wallet

Another milestone that will strengthen the ecosystem is the launch of the FUN Wallet mobile app, which will integrate staking seamlessly.

With staking built directly into the wallet, players will be able to:

-

Lock up their FUN tokens in a few taps

-

Earn predictable yields without needing separate DeFi platforms

-

Access exclusive in-game perks and bonuses

This approach is designed to remove friction and open staking to mainstream gamers, not just crypto-savvy users. Over time, higher staking participation will tighten circulating supply and support long-term price appreciation.

Fueling Growth with the $5 Million Giveaway

The $5 million giveaway remains one of FUNToken’s most ambitious initiatives. Rather than a short-term promotion, it is structured to drive consistent activity over multiple quarters.

Participants can earn rewards for:

-

Holding FUN tokens

-

Playing games through the Telegram bot

-

Referring friends to join the ecosystem

This program is a key part of the project’s strategy to build a loyal, active community that contributes to steady liquidity and organic adoption.

Strengthening Community Through Telegram

Throughout Q3 and Q4, the Telegram bot and the official Telegram channel will continue to anchor FUNToken’s daily engagement. With over 105,000 active users, Telegram has become a vital touchpoint for:

-

Delivering missions and spins that keep players coming back

-

Distributing updates about new games and partnerships

-

Supporting the growth of a vibrant, collaborative community

This direct connection with users is a major differentiator in a market where many projects struggle to maintain active participation.

Building Strategic Partnerships and Developer Relationships

FUNToken’s roadmap also calls for forging partnerships with mid-size gaming studios that will integrate FUN as a native currency inside their own games. These partnerships will:

-

Expand the token’s reach beyond its core ecosystem

-

Bring new players into the FUNToken community

-

Create more use cases that drive transaction volume and deflationary burns

Additionally, the project plans to prepare for the first Global FUN Gaming Summit, where developers, investors, and players will come together to showcase innovation and share strategies for growing the Web3 gaming economy.

Why This Approach Sets FUNToken Apart

Here is why FUNToken’s approach stands out:

Drive Daily Adoption Through Accessible, Rewarding Gameplay

By launching a broad catalog of games across Telegram, mobile apps, and web platforms, FUNToken ensures that players always have new ways to engage. The focus on hyper-casual formats means anyone can join without prior gaming experience or complex onboarding. This steady stream of daily activity is the foundation of sustainable token demand.

Reduce Supply via Staking and Consistent Burns

FUNToken combines two proven strategies to steadily tighten supply over time:

-

Quarterly buybacks and burns, funded by platform revenue from gameplay and transaction fees

-

Staking, which locks up tokens for predictable periods and reduces the circulating float

When both happen in tandem, the effect compounds. As more players stake and more tokens are burned, scarcity grows in a transparent, trackable way.

Reward Participation Through One of the Largest Community Incentive Campaigns

The $5 million giveaway is not just a promotional stunt. It is a structured, long-term initiative that rewards players for:

-

Holding FUN tokens

-

Completing daily and weekly missions

-

Referring new users

This program fuels consistent engagement and word-of-mouth growth. It also reinforces loyalty by giving active participants more ways to benefit directly from the ecosystem’s success.

Grow Brand Presence by Partnering with Other Game Developers

While many projects remain closed ecosystems, FUNToken plans to integrate with mid-sized game studios that will use FUN as their in-game currency. This strategy:

-

Exposes FUNToken to new player communities

-

Diversifies the ecosystem beyond its core Telegram and app experiences

-

Creates additional demand for the token as more games adopt it as a payment and rewards mechanism

These partnerships help FUNToken expand its brand beyond its own platform and position itself as a universal currency for gaming.

Maintain Transparency with Clear Communication

Trust is essential for any Web3 project to scale. FUNToken’s commitment to transparency is reflected in:

-

Regular roadmap updates published on funtoken.io

-

Daily community updates and support in the official Telegram channel

-

On-chain records of every burn event, showing exactly how much supply has been removed

This openness builds confidence among both retail participants and potential partners.

In short, FUNToken is creating a self-reinforcing cycle:

-

Every new player fuels more transactions.

-

More transactions generate revenue for buybacks.

-

Buybacks reduce supply.

-

Scarcity supports price growth.

-

Stronger price growth attracts more users.

-

Community rewards keep participants active and engaged.

This cycle is exactly why many investors and analysts believe FUNToken is positioned to evolve into a dominant force in Web3 gaming, and what sets FUNToken apart.

Final Thoughts

FUNToken’s Q3 and Q4 roadmap represents a decisive pivot from building foundations to scaling the ecosystem. With 30 games planned, the launch of staking, the $5 million giveaway, strategic partnerships, and an expanding Telegram community, the project is demonstrating how disciplined execution can solidify a leadership position in Web3 gaming.

For investors, players, and developers, the months ahead are set to be a critical proving ground that could transform FUNToken from an emerging platform into a dominant force.

Note: The price mentioned was accurate at the time of writing (July 14, 2025) and may have changed since

The post FUNToken’s Strategic Initiatives Set to Solidify Web3 Gaming Ecosystem with FUN in Q3/Q4 appeared first on Blockonomi.

Ethereum ETFs are now live. Mainstream financial media is celebrating the inflows. But under the surface, something is clear: retail isn’t buying it. The inflows are slow. The impact on ETH’s price is muted. And most importantly, holders are still waiting for a yield that feels real.

Ethereum’s staking system may be proof-of-stake, but it’s not proof-of-reward. The average ETH staker is earning a minimal return while locking up assets. Meanwhile, fees remain high, gas prices continue to spike, and yield distribution remains far from dynamic.

Investors who once chased Ethereum’s passive income promises are now turning to Bitcoin Swift (BTC3), an AI-powered blockchain where Proof-of-Yield rewards don’t wait. BTC3 is not just a promising utility. It is delivering 121% APY, protocol access, and AI-enforced governance before the token even hits exchanges.

CRYPTO EXPERTS CALLED IT: BTC3 IS DOMINATING FEED SPACE

There’s a wave of influencer momentum behind BTC3. A review by Crypto Sister points out what many investors are realizing: Bitcoin Swift is setting a new benchmark for what a presale can offer.

While other projects push hype and delay delivery, BTC3 has already completed audits, verified its team, and built a live programmable yield system.

BREAKING DOWN BITCOIN SWIFT’S CORE TECH

AI-GOVERNED ENERGY LOGIC

Bitcoin Swift uses AI to track real-time energy usage across its protocol. It rewards participants based on clean energy alignment. When the network leans into sustainability, rewards increase. AI oracles constantly feed performance metrics into BTC3’s core engine, adjusting PoY scoring with no manual interference.

QUADRATIC VOTING AND AI RISK FILTERING

BTC3’s governance architecture is designed to prevent centralization. AI modules review each proposal for risk. Only those that pass are sent to a quadratic vote. Reputation is linked to DID credentials, meaning voting power is earned by trust and transparency, not wallet size.

The entire protocol has passed formal audits, including Solidproof, Spywolf, and is backed by full KYC verification. This is not another mystery team project. It’s built for compliance and credibility from the start.

SMART, SELF-DISTRIBUTED REWARDS

BTC3’s reward engine doesn’t need centralized approval. PoY rewards are generated and distributed automatically at the end of each presale stage. They’re calculated based on:

- Network activity

- Clean energy metrics

- Validator participation

- Smart contract usage

This makes BTC3 the first AI-regulated staking protocol that works before launch. You don’t stake and wait. You join and earn.

Track updates and live development on X or visit the official Bitcoin Swift website.

FINAL STAGE 3 HOURS: WHY THIS MATTERS NOW

Bitcoin Swift is now in the final day of Stage 3 of its tightly timed 64-day presale. The price is $3, and it will rise to $4 in Stage 4. The confirmed exchange launch price is $15, with Orca handling the initial listing.

Stage 3 also delivers a 121% APY through the programmable PoY system. These rewards are distributed automatically once this stage ends, no need to wait for the mainnet. Investors joining now are earning directly from the protocol’s engine, while others continue to chase charts and hope for price pumps.

This is not just a fast presale. It is one of the few presales offering real-time yield, AI utility, and verified governance, all before going live.

THIS IS WHAT THE NEXT PHASE OF CRYPTO LOOKS LIKE

While Ethereum waits for ETF money to trickle in, Bitcoin Swift is already rewriting the rules of DeFi. It delivers verified identity, auto-yield distribution, and AI-powered governance in a package that rewards contributors from the very first step.

Bitcoin Swift isn’t here to compete on marketing. It is here to make crypto useful again. And the clock is running out to get in before Stage 4 begins.

For more information on Bitcoin Swift:

Website: https://bitcoinswift.com

The post Ethereum ETF Flows vs AI‑Governed Yield Protocols: Bitcoin Swift Sets a New Standard appeared first on Blockonomi.

TLDR

- Succinct launched its mainnet on August 5, 2025

- PROVE token was introduced via airdrop with mixed community reception

- The network supports over 35 protocols and has processed 5+ million proofs

- Technical analysis suggests potential price movement to $1.56

- Succinct offers decentralized zero-knowledge proof infrastructure that has already secured $4 billion in value

Succinct officially launched its mainnet on August 5, 2025, marking a key milestone for decentralized zero-knowledge (ZK) infrastructure in the cryptocurrency space. The launch introduced a network of distributed provers powered by its native PROVE token.

The PROVE token sits at the heart of Succinct’s ecosystem, currently trading at around $1.50 after its recent debut. The token serves dual purposes – compensating provers for their work and acting as a security mechanism within the network.

ZK-proofs are already integrated into privacy-focused cryptocurrencies like Zcash and Monero, as well as Ethereum Layer-2 solutions such as zkSync and Starknet. What makes Succinct’s approach unique is its decentralized model for generating these proofs.

Unlike traditional centralized systems, Succinct distributes the task of generating ZK proofs across multiple independent provers. These proofs allow parties to verify data or transactions without revealing the underlying information.

The system operates as a two-sided marketplace on Ethereum. Applications submit proof requests, and independent provers compete to fulfill them. This structure makes ZK technology accessible to developers without requiring custom infrastructure.

Network Performance

The Succinct network has shown impressive traction in its early stages. It currently supports over 35 leading protocols and has processed proofs from 1,700 unique programs. More than five million proofs have been fulfilled for major protocols including Polygon, Mantle, Celestia, and Lido.

This infrastructure has already secured over $4 billion in value, demonstrating market confidence in Succinct’s approach to decentralized proving. The team moved quickly, going from whitepaper to working mainnet in just eight months.

John Guibas, CTO of Succinct Labs, stated: “Our goal from the start was to make proving infrastructure accessible at internet scale.” This vision aligns with broader industry trends, as Ethereum has made ZK technology a top priority on its roadmap.

The PROVE token distribution generated mixed reactions from the community. While some airdrop recipients received six-figure payouts, early testnet participants expressed frustration over being excluded from the airdrop criteria.

Many badge holders and Binance Alpha users reportedly received larger shares of the token supply. The unclaimed portion of the airdrop wasn’t redirected to testnet users but instead allocated to staking incentives, which sparked additional backlash.

Price Movement

Though PROVE has limited price history for comprehensive technical analysis, early charts show promising patterns. The price broke out from an ascending parallel channel, indicating impulsive upward movement.

Following the breakout, PROVE formed a symmetrical triangle pattern. While this is generally considered neutral, such patterns typically lead to trend continuation. Given the preceding upward movement, a breakout could potentially take the price to $1.56.

However, market observers note that a breakdown from the triangle could invalidate this prediction and possibly drive the price to the channel’s midline at approximately $1.20.

The long-term price performance of PROVE will depend heavily on several factors: network adoption, broader market sentiment, and continued technical development of the Succinct platform.

Uma Roy, CEO of Succinct Labs, expressed confidence in the project’s future:

“With mainnet live, Succinct is ready to support the next generation of applications that require verifiable computation.”

Developers interested in using the Succinct Prover Network can begin building today by visiting the project’s documentation site.

The PROVE token has demonstrated resilience since its launch, showing upward price momentum despite varied community reception to the distribution mechanism. The token price currently sits at $1.50 following its successful listing on exchanges including Binance and Upbit.

The post Succinct (PROVE) Price: Token Reaches $1.50 Following August 5 Mainnet Launch appeared first on Blockonomi.

- Inveniam invests $20 million in MANTRA to advance institutional infrastructure for tokenized private real-world assets from the UAE to global decentralized financial markets

- Inveniam’s data operations management solutions and AI Agent Suite will be integrated with MANTRA’s regulated Web3 infrastructure to scale private RWA solutions with, and for, asset owners, clients, and partners

Inveniam Capital Partners (“Inveniam”), a global leader in decentralized data infrastructure for private market assets, and MANTRA, a layer 1 blockchain focused on the tokenization of real-world assets (RWAs), today announced a strategic technology and commercial partnership.

The collaboration includes a $20 million investment in MANTRA to deliver private real-world assets (RWAs) packaged with real-time asset reporting and surveillance to DeFi and institutional capital allocators. It will enable institutional-grade private market assets with full data sovereignty, surveillance, and agentic solution sets to capitalize upon the rapidly expanding DeFi market with digitally-native smart financial instruments.

The partnership will integrate Inveniam’s data operations management solutions and AI Agent Suite with MANTRA’s regulated Web3 infrastructure to scale private RWA solutions with, and for, asset owners, clients, and partners. It will significantly grow Total Value Locked (TVL) and transaction throughput on MANTRA Chain, aligning with Inveniam’s vision for the systematic trading of private market assets in an AI driven, agentic future.

The partnership underscores Inveniam’s conviction in the accelerating convergence of scalable AI, tokenization, and blockchain-powered financial infrastructure—at a time when real-world assets (RWAs) are expected to grow at a 75% CAGR, expanding from $275 billion today to $18.9 trillion by 2033.

“We have been in discussions with MANTRA for some time. As we watched third party bad actors prey upon excellent builders and founders, we leaned in. In our diligence, we have found MANTRA to be a fundamentally excellent chain with great management, regulatory clarity, institutional focus, and the right partners,” Patrick O’Meara, Chairman and CEO of Inveniam said.

“We saw an exceptional opportunity to invest, partner, and support the right type of technologists, long-term builders, and crypto native operators. This partnership provides MANTRA with the capital and throughput needed to focus upon and scale its ecosystem and further develop its position as a leading layer 1 blockchain for real-world assets. This foundational step enables trillions of dollars in private assets to operate in digital environments, thereby ushering in a new generation of products for global allocators, builders, and hyper-scalers.”

John Patrick Mullin, CEO and Founder of MANTRA added, “We are incredibly excited about our partnership with Inveniam, and believe it will be a key driver in moving MANTRA to a significantly greater position in the global RWA marketplace. Inveniam’s investment and collaboration will allow us to better serve asset owners and capital allocators not just in the UAE, but in the United States and globally with leading decentralized infrastructure. Together, we will accelerate MANTRA’s development of a trusted, composable and scalable tokenized market for real-world assets, bringing tangible value to asset owners, investors and developers.”

The Key Benefits Of The Uae As A Strategic RWA Hub

Strategic Partnerships And Foundational Framework In The Uae

- Inveniam’s long-term partnership with the United Arab Emirates continues to grow. In 2024, G42 became a strategic investor in Inveniam. Inveniam has since established a corporate presence in Abu Dhabi with offices in Al Khatem Tower. Its wholly-owned subsidiary, Inveniam Mid East, Ltd (إنفينيم الشرق الأوسط), is in the Abu Dhabi Global Market (ADGM).

- MANTRA’s wholly-owned subsidiary, MANTRA Finance FZE, is licensed by Dubai’s Virtual Asset Regulatory Authority (VARA), which establishes a foundational framework for compliant, data-rich private market assets to be tokenized and integrated into the global DeFi ecosystem launching from the UAE. The VARA licensing includes digital asset exchange, broker-dealer, and investment services, and supports the end-to-end lifecycle of tokenized RWAs, from primary issuance to automated secondary market liquidity.

Integrated Market Infrastructure

- This joint effort will leverage ADGM’s institutional framework, G42’s data and AI capabilities, and Dubai’s crypto liquidity infrastructure to deliver a complete market stack for RWAs in the UAE.

- As the first multi-VM layer 1 blockchain purpose-built for RWAs, MANTRA enables cross-chain interoperability and seamless composability across networks. Its regulatory readiness and technical design position it as the leading network for institutional RWA activity.

- The Inveniam and MANTRA partnership will expand investment pathways to build the next generation of private market infrastructure, unlocking a $300 trillion opportunity.

Inveniam and MANTRA’s strategic partnership will set a new standard for compliant tokenization, combining MANTRA’s blockchain infrastructure with Inveniam’s data and AI capabilities. Together, they aim to unlock institutional access to RWAs and accelerate the growth of decentralized finance globally.

About Inveniam

Inveniam is a data operations management and orchestration solution for private market assets, bringing access, transparency, and trust to asset performance data. The company is building the foundation for scalable AI integration, decentralized data marketplaces, and the systematic trading of private market assets.

About MANTRA