Cryptocurrency Posts

Crypto Briefing

BlackRock's cautious stance on expanding crypto ETFs beyond Bitcoin and Ethereum may slow broader market diversification and innovation.

The post BlackRock rules out XRP and SOL ETFs despite Ripple-SEC case closure appeared first on Crypto Briefing.

The potential launch of a $1.5 billion crypto firm could significantly impact the DeFi landscape, attracting major tech and crypto investors.

The post Trump-backed World Liberty in talks to launch $1.5 billion WLFI treasury firm appeared first on Crypto Briefing.

TRON's dominance in stablecoin transfers highlights its pivotal role in global financial inclusion and the shift towards decentralized finance.

The post CoinDesk data: TRON surpasses $600B in monthly stablecoin transfers appeared first on Crypto Briefing.

Coinbase's DEX integration could democratize token access, streamline trading, and challenge traditional exchange models, impacting market dynamics.

The post Coinbase is adding DEX trading to Coinbase app, starting with Base-native tokens appeared first on Crypto Briefing.

Block's new mining chips could accelerate Bitcoin's role as a global currency, enhancing transaction efficiency and financial decentralization.

The post Jack Dorsey’s Block set to release new Bitcoin mining chips next week appeared first on Crypto Briefing.

Bitcoin Magazine

Bitcoin Magazine

Even Robinson Crusoe Understood the Price and Value of Money

Nothing is as crucial to the functionality of a free market as its money. Money constitutes half of every transaction, representing one side of all value expressed in the exchange of goods and services. But what, exactly, is the price of money?

The commodity with the highest marketability tends to become a society’s preferred medium of exchange — that is, its money. Prices denominated in this common medium enable economic calculation, which in turn allows entrepreneurs to spot opportunities, make profits and push civilization forward.

We’ve seen how supply and demand determine the price of goods, but determining the price of money is a bit trickier. Our predicament is that we have no unit of account to measure the price of money because we already express prices in… you guessed it, money. And because we cannot use monetary terms to explain it, we must find another way to express money’s purchasing power.

People buy and sell money (exchange goods and services for it) based on what they expect that money will buy them in the future. As we’ve learned, acting individuals always make choices on the margin. Hence, the law of diminishing marginal utility. In other words, all actions are preceded by a value judgment in which actors choose between their most valued end and their next strongest desire. The law of diminishing marginal utility applies here as it does elsewhere: the more units of a good a person possesses, the less urgent the satisfaction each additional unit provides.

Money behaves no differently. Its value lies in the additional satisfaction it can provide. Whether that’s buying food, security or future options doesn’t matter. When people trade their labor for money, they do so only because they value the purchasing power of that money more than the immediate use of their time. The cost of money in an exchange is thus the highest utility a person could have derived from the amount of cash they gave up. If a person chooses to work for an hour to afford a rib-eye steak, they must value the meal more than one hour of forgone leisure.

Recall that the law of diminishing marginal returns tells us that each successive unit of a homogenous good satisfies a less urgent desire a person has. Therefore, the value a person attaches to an additional unit diminishes for each unit added. However, what constitutes a homogenous good is entirely up to the individual. Since value is subjective, the utility of each additional monetary token depends on what the individual wants to achieve. To the individual, each extra token is not homogenous in terms of what serviceability it brings to them. To a person who wishes to buy nothing but hot dogs with his money, a “unit of money” is the same as whatever the price of a hot dog is. That person has not added a unit of the homogenous good “money for hot dogs” until he has acquired enough cash to buy one more hot dog.

This is why Robinson Crusoe could look upon a pile of gold and deem it worthless. It couldn’t buy him food, tools or shelter. In isolation, money is meaningless. Like all languages, it requires at least two people to function. Money, above all, is a tool for communication.

Inflation and the Illusion of Idle Money

People choose to save, spend, or invest based on their time preference and their expectations about money’s future value. If they expect purchasing power to increase, they’ll save. If they expect it to fall, they’ll spend. Investors make similar judgments, often redirecting money toward assets they believe will outpace inflation. But whether saved or invested, money is always doing something for its owner. Even money “on the sidelines” serves a clear purpose: lowering uncertainty. A person who holds onto money instead of spending it is satisfying their desire for optionality and safety.

This is why the idea of money “in circulation” is misleading. Money does not flow like a river. It is always held by someone, always owned, always performing a service. Exchanges are actions, and actions happen at specific points in time. Therefore, there is no such thing as idle money.

Without its connection to historical prices, money would be unmoored, and personal economic calculation would be impossible. If a loaf of bread cost $1 last year and costs $1.10 today, we can infer something about the direction of purchasing power. Over time, these observations form the basis for economic expectations. Governments offer their own version of this analysis: the Consumer Price Index (CPI).

This index is supposed to reflect the “rate of inflation” through a fixed basket of goods. However, CPI deliberately ignores high-value assets like real estate, stocks, and fine art. Why? Because including them would reveal a truth governments would rather hide: Inflation is always far more pervasive than the people behind it admit. Measuring inflation through CPI is an attempt to hide the when-you-really-think-about-it obvious truth about it: The increase in prices is always proportional to the expansion of the money supply eventually. The creation of new money always leads to a decrease in the purchasing power of that money compared to what it could have been.

Price inflation is not caused by greedy producers or supply-chain hiccups. It is always, eventually, the result of monetary expansion. When more money is created, its purchasing power falls. Those closest to the source of new money benefit (banks, asset holders and state-connected companies and corporations), while the poor and wage-earning class bear the brunt of price increases.

The effects are delayed and are difficult to trace directly, which is why inflation is often called the most insidious form of theft. It destroys savings, widens inequality and increases financial instability. Ironically, even the wealthy would be better off under a sound monetary regime. In the long run, inflation harms everyone. Even those who appear to benefit in the short term.

The Origins of Money

If money’s value comes from what it can buy, and if that value is always judged against past prices, how did money acquire its initial worth? To answer this, we must look backward to the barter economy.

The good that evolved into money must have had nonmonetary value before it became money. Its purchasing power must initially have been determined by the demand for some other use case. Once it began serving a second function (as a medium of exchange), its demand increased, and so did its price. The good now served two distinct purposes for the owner: providing utility value on the one hand and functioning as a medium of exchange on the other. The need for the latter use case tends to overshadow the former over time.

This is the core of Mises’ Regression Theorem, which explains how money arises naturally in markets and always retains a link to past valuations. It is not an invention of the state but a spontaneous outgrowth of voluntary trade.

Gold became money because it met the criteria of being a good money: It was durable, divisible, recognizable, portable and scarce. Its use in jewelry and industry still gives it use-value today. For centuries, banknotes were mere receipts redeemable for gold. The lightweight and compact banknote proved the perfect solution to gold’s transportability problem. Unfortunately, the issuers of these receipts quickly realized they could issue more gold tickets (banknotes) than they had backing for in their vaults. This modus operandi is still in use today.

Once the link between gold and banknotes was severed altogether, governments and central banks were free to create money ex nihilo, leading to today’s unbacked fiat systems. Under fiat regimes, politically connected banks can be bailed out, even if they fail. The result is moral hazard, distorted risk signals, and systemic instability, all funded by the quiet expropriation of savings through inflation.

Money’s temporal connection to historical prices is vital for the market process. Without it, personal economic calculations would be impossible. The Money Regression Theorem, described in the previous section, is a praxeological insight often overlooked in discussions about money. It explains why money is not just an imaginary construct by some bureaucratic wizardry but has a real connection to a point when someone’s desire to trade means for a specific end spawned it into existence in the free market.

Money is a product of voluntary exchange, not a political invention, a shared illusion, or a social contract. Any commodity with a limited enough supply could be used as money, presuming it ticked off all the other boxes necessary for a suitable medium of exchange. Anything durable, portable, divisible, uniform, and acceptable will do.

Suppose the Mona Lisa had been infinitely divisible. In that case, its parts could have served as money, but only if there was an easy way to verify that they were actually from the Mona Lisa and not counterfeited.

Speaking of the Mona Lisa, there’s an anecdote about some of the most famous painters of the twentieth century that perfectly illustrates how an increase in the supply of a monetary good affects its perceived value. These painters realized they could use their celebrity status to enrich themselves in a peculiar way. They figured out that their signatures were valuable and that they could pay their restaurant bills by simply signing them. Salvador Dali allegedly even signed the wreck of a car that he had crashed into and thus magically transformed it into a valuable piece of art. Eventually, though, these tactics stopped working. The more signed bills, posters, and car wrecks there were, the less valuable an additional signature became, perfectly demonstrating the law of diminishing returns. By adding quantity, they reduced quality.

The World’s Largest Pyramid Scheme

Fiat currencies operate under similar logic. Increasing the money supply devalues each existing unit. While the early recipients of new money benefit, everyone else suffers. Inflation is not just a technical issue but a moral one, too. It distorts economic calculation, rewards debt over savings, and robs those least able to defend themselves against it. In this light, fiat currency is the world’s largest pyramid scheme, enriching the top at the expense of the base.

We accept broken money because it’s what we’ve inherited, not because it serves us best. However, when enough people realize that sound money (money that can’t be counterfeited) is better for the market and humanity, we may stop settling for fake gold receipts that cannot feed us and start building a world where value is real, honest and earned.

Sound money arises through voluntary choice, not political decree. Any item that satisfies the basic criteria of money can serve as money, but only sound money allows civilization to flourish long-term. Money is not merely an economic tool but a moral institution. When money is corrupted, everything downstream — savings, prices incentives and trust — is distorted. But when money is honest, the market can coordinate production, signal scarcity, reward thrift, and protect the vulnerable.

In the end, money is more than a means of exchange. It is a safeguard of time, a record of trust, and the most universal language of human cooperation. Corrupt that, and you don’t just break the economy. You break civilization itself.

“Man is a short-sighted creature, sees but a very little way before him, and as his passions are none of his best friends, so his particular affections are generally his worst counselors.”

Counterfeiting: Modern Money and the Fiat Illusion

Now that we’ve explored how a saleable good becomes money on the free market and how low-time-preference thinking leads to progress and falling prices, we can take a closer look at how money functions today. You may have heard about negative interest rates and

wondered how they square with the fundamental principle that time preference is always positive. Or perhaps you’ve noticed rising consumer prices, with media outlets blaming everything but monetary expansion.

The truth about modern money is a hard pill to swallow because once you understand the magnitude of the problem, things start looking pretty bleak. Human beings cannot resist the urge to enrich themselves by exploiting others through printing money. The only way to prevent this, it seems, would be to remove us from the process altogether, or, at the very least, separate money from state control. Nobel Prize-winning economist Friedrich Hayek believed this could only be done in “some sly, roundabout way.”

The United Kingdom was the first nation to weaken the link between national currencies and gold. Before World War I, nearly all currencies were redeemable in gold, a standard that had emerged over thousands of years as gold became the most saleable good on Earth. However, by 1971, convertibility was abandoned entirely when U.S. President Richard Nixon famously proclaimed he would “temporarily suspend the convertibility of the dollar into gold” and unilaterally severed the final link between the two. He did this (at least partially) to finance the Vietnam War and preserve his political power.

We won’t dive into every detail of fiat currency here, but here’s what matters: State-issued money today is not backed by anything tangible but entirely created as debt. Fiat currency masquerades as money, but unlike actual money (which emerges from voluntary exchange), fiat is a tool of debt and control.

Every new dollar, euro or yuan enters existence when a large bank issues a loan. That money is expected to be paid back with interest. And since that interest is never created alongside the principal, there is never enough money in circulation to repay all debts. In fact, more debt is necessary to keep the system alive. Modern central banks further manipulate the money supply through mechanisms like bailouts, which prevent inefficient banks from failing, and quantitative easing, which adds even more fuel to the fire.

Quantitative easing is when a central bank purchases government bonds by creating new money, effectively trading IOUs for freshly printed currency. A bond is a promise by the government to repay the borrowed money with interest. That promise is backed by the state’s power to tax present and future citizens while you and your heirs are forced to cope with rising prices. The result is a quiet, continuous wealth extraction from productive people through inflation and debt servitude.

Money printing continues under the banner of Keynesian economics — the doctrine that underpins most modern government policies. Keynesians argue that spending is what drives an economy forward and that if the private sector doesn’t keep spending, the government must. Every dollar spent, they claim, adds one dollar’s worth of value to the economy, but this view ignores the reality of value dilution through inflation. It’s Bastiat’s Broken Window Fallacy all over again. Adding zeros adds precisely zero value.

If money printing could actually increase wealth, we’d all own super yachts at this point. Wealth is created through production, planning and voluntary exchange, not by increasing the number of digits on a central bank’s balance sheet. Real progress stems from people trading with others and their future selves by accumulating capital, delaying gratification and investing in the future.

Fiat Currency’s Final Destination

Printing more money doesn’t speed up the market process, but distorts and retards it. Literally. Slow and stupid follows. Ever-decreasing purchasing power makes economic calculation more difficult and slows down long-term planning.

All fiat currencies eventually die. Some collapse via hyperinflation. Others are abandoned or absorbed into larger systems (such as smaller national currencies being replaced by the euro). But before their end, fiat currencies serve a hidden purpose — they transfer wealth from those who create value to those with political proximity.

This is the essence of the Cantillon effect, named after 18th-century economist Richard Cantillon. When new money enters the economy, its first recipients benefit most — they can buy goods before prices rise. Those furthest from the source (ordinary workers and savers) absorb the cost. Being poor in a fiat system is very expensive.

Despite this, politicians, central bankers and establishment economists continue to assert that a “healthy” inflation rate is necessary. They should know better. Inflation does not fuel prosperity. At best, it shifts purchasing power. At worst, it erodes the very foundation of civilization by undermining trust in money, savings and cooperation. The abundance of cheap goods in today’s world was created in spite of taxes, borders, inflation and bureaucracy — not because of them.

The Good, the Bad, and the Ugly

When left unhampered, we know that the market process tends to deliver better goods at lower prices for more people. That’s what real progress looks like. Interestingly, praxeology isn’t just a tool for critique but a framework for appreciation. Many people grow cynical once they see how deep the dysfunction runs, but praxeology offers clarity: It helps you see how productive people are the real drivers of human flourishing. Not governments. Once you understand this point, even the most mundane forms of labor take on greater meaning. The supermarket cashier, the cleaning staff and the taxi driver all contribute to a system that meets human needs through voluntary cooperation and value creation. They are civilization.

Markets produce goods. Governments, by contrast, tend to produce bads. Catallactic competition, where businesses strive to serve customers better, is the engine of innovation. Political competition, where parties fight to control the state, rewards manipulation, not merit. The most adaptable rise in markets. The most unscrupulous rise in politics.

Praxeology helps you understand human incentives. It teaches you to watch what people do, not just what they say. More importantly, it teaches you to consider what could have been, not just what is. That’s the unseen world, the alternative timelines erased by intervention.

Fear, Uncertainty and Doubt

Human psychology is biased toward fear. We evolved to survive threats, not to admire flowers. That’s why alarmism spreads faster than optimism. The proposed solution to every “crisis” — whether related to terrorism, pandemics, or climate change — is always the same: more political control.

Those who study human action know the reason why. For every individual actor, the end always justifies the means. The problem is, this fact is true for power-seekers, too. They offer security in exchange for freedom, but history shows us that fear-driven trade-offs rarely pay off. When you understand these dynamics, the world becomes clearer. The noise fades.

You turn off the television. You reclaim your time. And you realize that accumulating capital and freeing your time are not selfish acts. They are the basis for helping others.

Investing in yourself — in your skills, savings, and relationships — enlarges the pie for everyone. You participate in the division of labor. You produce value. And you do so voluntarily. The most radical action you can take in a broken system is to build something better outside of it.

Every time you use a fiat currency, you pay its issuers with your time. If you can avoid using them altogether, you help usher in a world with less theft and deceit. It may not be easy, but endeavors worth pursuing rarely are.

Knut Svanholm is a Bitcoin educator, author, armchair philosopher and podcaster. This is an extract from his revamped book Praxeology: The Invisible Hand that Feeds You, published by Lemniscate Media, May 27, 2025.

BM Big Reads are weekly, in-depth articles on some current topic relevant to Bitcoin and Bitcoiners. Opinions expressed are those of the authors and do not necessarily reflect those of BTC Inc or Bitcoin magazine. If you have a submission you think fits the model, feel free to reach out at editor[at]bitcoinmagazine.com.

This post Even Robinson Crusoe Understood the Price and Value of Money first appeared on Bitcoin Magazine and is written by Knut Svanholm.

Bitcoin Magazine

Will America Become the Bitcoin and Crypto Capital of the World? Here’s an Expert’s Take.

“…we’re definitely going to be the crypto capital of the world for regulated ETF funds, [but] are we serious about making America the crypto capital of the world for peer-to-peer transactions and individual liberty? We should be.” -Peter Van Valkenburgh

After Tornado Cash co-founder Roman Storm was found guilty of conspiracy to operate an unlicensed money transmitting business and the Samourai Wallet developers accepted a plea deal, Peter Van Valkenburgh is concerned that the United States may not become the crypto capital of the world — at least as far as transactional privacy and peer-to-peer rights are concerned.

In my interview with Van Valkenburgh, we discussed how the outcomes of the Tornado Cash and Samourai Wallet cases have put Americans’ ability to use bitcoin and crypto anonymously at risk.

Furthermore, Van Valkenburgh brought up whether or not pressing legislation like the CLARITY Act, which borrows key language from the Blockchain Regulatory Certainty Act (BRCA), will be enough to protect developers of noncustodial crypto technology, some of which is privacy-enhancing.

He also noted how the White House’s “Strengthening American Leadership in Digital Financial Technology” report calls for the passage of the BRCA, which he said is the “best way to stop prosecutions like the Tornado Cash prosecution from happening [again].”

Van Valkenburgh added that the money transmission charges should have never even been brought against the Tornado Cash and Samourai Wallet developers in the first place, as 2019 FinCEN guidance clearly states that noncustodial crypto technology should not be classified as money-transmission technology.

“Operating a CoinJoin server is kind of like running Craigslist,” explained Van Valkenburgh.

“People meet on Craigslist and do things like exchange value, but Craigslist isn’t exchanging value — they’re just connecting people who are going to exchange value themselves,” he added.

Van Valkenburgh argued that this ability for software developers to create technology that helps U.S. citizens anonymize their bitcoin and crypto transactions without fear of prosecution is key to fulfilling President Trump’s vision of the United States becoming the “crypto capital of the world.”

According to Van Valkenburgh, being able to use Bitcoin and crypto mixers, as well as other types of noncustodial Bitcoin and crypto technology, is essential to modern-day Americans’ right to individual liberty.

Without maintaining this liberty, he argued, the United States is no different than its adversaries.

“We won’t be America anymore if we have fully surveilled financial transactions like they do in China and North Korea,” said Van Valkenburgh.

This post Will America Become the Bitcoin and Crypto Capital of the World? Here’s an Expert’s Take. first appeared on Bitcoin Magazine and is written by Frank Corva.

Bitcoin Magazine

Know-Your-Customer: The Quiet Kill Switch

The know-your-customer (KYC) threat isn’t coming. It’s already here, and it didn’t arrive through a nationwide ban or an emergency executive order. It quietly showed up with a checkbox and a Terms of Service agreement.

While the influencers make noise about CBDCs and paper bitcoin, the real control system has already been deployed: Know Your Customer.

Not dramatic. Not dystopian. Just regulated, normalized and accepted.

But compliance isn’t neutral. It’s the infrastructure of financial control, and if you’re still handing over your ID to stack sats, you’re not buying freedom. You’re financing your own cage.

The Real Attack Vector from KYC

KYC regulations are marketed as a hedge against money laundering and fraud. The framing is safety. The reality is traceability.

The moment you attach your identity to Bitcoin through an exchange signup — a utility bill attached, a passport uploaded — you forfeit the very autonomy that Bitcoin was designed to preserve. It’s not about what you’re doing. It’s about who you are.

Once that link is made, every transaction becomes searchable, timestamped and admissible. This isn’t a theory. It’s how the system is already working.

Canada froze bank accounts based on political donations. The U.K. arrests protestors using facial recognition. The U.S. executes geofence warrants without individual suspicion.

Add KYC to that apparatus, and you’ve built a turnkey surveillance machine. No subpoenas. No charges. Just silent blacklists and frozen withdrawals.

Didn’t you find it odd that they arrested the developers of mixers like Whirlpool and Tornado Cash, instead of the criminals that used them?

KYC is Centralization by Design

Governments didn’t need to outlaw Bitcoin; they just needed to know who’s using it.

The combination of centralized exchanges, KYC records and behavioral analytics turns every bitcoin purchase into a breadcrumb trail. Every withdrawal from Coinbase or Kraken becomes part of a profile logged, indexed, stored.

When regulators talk about “compliance,” this is what they mean: usable data pipelines. Sanitized, labeled UTXOs. A fully mapped ecosystem of wallets tied to real names and IP addresses.

What they’re building isn’t about stopping crime. It’s about preemptively labeling dissent.

You Are the Honeypot

The most dangerous part of KYC is that it doesn’t look dangerous. There’s no siren, no red alert. Just a few forms, a phone verification — maybe a bonus if you sign up today.

But each form you complete feeds the machine. Not just for you, but for everyone you interact with.

KYC isn’t just surveillance. It’s contagious.

A single identity-linked wallet poisons the privacy of every address it touches. Chain analysis firms don’t need to know everyone, they just need to know someone. Once that anchor point is set, mapping becomes mathematics.

You’re not stacking sats. You’re stacking evidence.

Exit Is a Deadline

This is the accumulation phase. The calm before the enforcement.

We’re in the same pre-crackdown posture we saw before the war on cash. The pattern is familiar:

- Normalize surveillance

- Demonize privacy

- Criminalize autonomy

The result? Most users walked themselves into a trap. Not under threat, but under convenience.

The “just in case” crowd, the ones who signed up, KYC’d and hoped it wouldn’t matter, are already compromised. Not because they did something wrong, but because they let someone else decide what’s wrong.

And once that line moves? They’re already inside it.

“But they can’t stop me from moving my bitcoin and transacting P2P.” No one wants blacklisted coins: They’ll be radioactive and useless.

What Real Privacy Requires

There’s no affiliate link for real privacy. No app store solution. No 10% discount for using your ID.

It looks like discipline. Friction. Small decisions that don’t scale.

- Buying peer-to-peer instead of custodial

- Mining to clean wallets

- Using tools that don’t log your metadata

- Walking away from platforms that promise speed in exchange for obedience.

It’s not glamorous. But it’s the difference between ownership and permission.

Final Thought

Bitcoin was never supposed to be polite. It was a way out. But as we normalize compliance in exchange for access, we risk turning that exit ramp into a regulated channel.

KYC is not a bureaucratic detail. It’s the quiet kill switch for sovereignty.

It doesn’t matter how many sats you stack if every one of them is logged, tagged and ready for blacklist.

So ask yourself:

What does it mean to own something?

If the answer starts with a government ID, you’re already losing.

No name. No compromise. No delay.

Build the exit while you still can.

This post Know-Your-Customer: The Quiet Kill Switch first appeared on Bitcoin Magazine and is written by Ghost Ghost.

Bitcoin Magazine

Bitcoin Price Stays About $115,000 As Spain’s Banking Giant BBVA Partners With Binance To Provide Custody

Bitcoin price maintained its position above $115,000 on Friday as Binance, the world’s largest Bitcoin and crypto exchange, partners with Spain’s BBVA bank to provide third-party custody services, marking a significant step toward institutional-grade security.

The partnership enables Binance customers to store their assets in U.S. Treasury securities held by BBVA, Spain’s third-largest bank, which the exchange will accept as margin for trading. This arrangement effectively separates trading activities from asset custody, providing an additional layer of security for investors concerned about exchange risk.

The move comes as Binance continues to rebuild trust following its $4.3 billion settlement with U.S. regulators in 2023 over anti-money laundering violations. The exchange has been implementing stricter controls and clearer disclosures on fund management, including allowing clients to use third-party custodians such as Sygnum and FlowBank.

BBVA has been increasingly active in the Bitcoin and crypto sector, having launched crypto trading and custody services through its mobile app this year. The bank has also taken a bold stance by advising private clients to allocate up to 7% of their portfolios to Bitcoin and crypto, reflecting growing institutional confidence in crypto.

The custody arrangement addresses one of the primary concerns that emerged following the collapse of FTX in 2022, where customer funds were commingled with exchange operations. Under the new structure, if Binance were to face operational issues or regulatory challenges, customer funds would remain secure in Treasury securities under BBVA’s control.

This partnership represents a new standard for Bitcoin and crypto exchange security. The integration of traditional banking infrastructure with Bitcoin and crypto trading platforms could accelerate institutional adoption by providing a familiar and regulated framework.

The development comes amid accelerating corporate Bitcoin adoption, with the number of public companies holding Bitcoin on their balance sheets rising to over 200. Recent notable additions include Metaplanet’s purchase of 463 BTC worth $53.7 million and Smarter Web Company’s innovative $21 million Bitcoin-denominated convertible bond.

Market analysts suggest that the partnership between Binance and BBVA could set a precedent for similar arrangements between Bitcoin and crypro exchanges and traditional banks. The move effectively bridges the gap between conventional finance and Bitcoin, potentially attracting more institutional investors who have been hesitant to enter the Bitcoin market due to custody concerns.

Trading volumes across major Bitcoin and crypto exchanges have remained stable following the news, with Bitcoin price continuing to trade in the $115,000-$116,000 range. The market’s muted reaction suggests that institutional developments are becoming increasingly normalized as the Bitcoin and crypto industry matures.

This post Bitcoin Price Stays About $115,000 As Spain’s Banking Giant BBVA Partners With Binance To Provide Custody first appeared on Bitcoin Magazine and is written by Vivek Sen.

Bitcoin Magazine

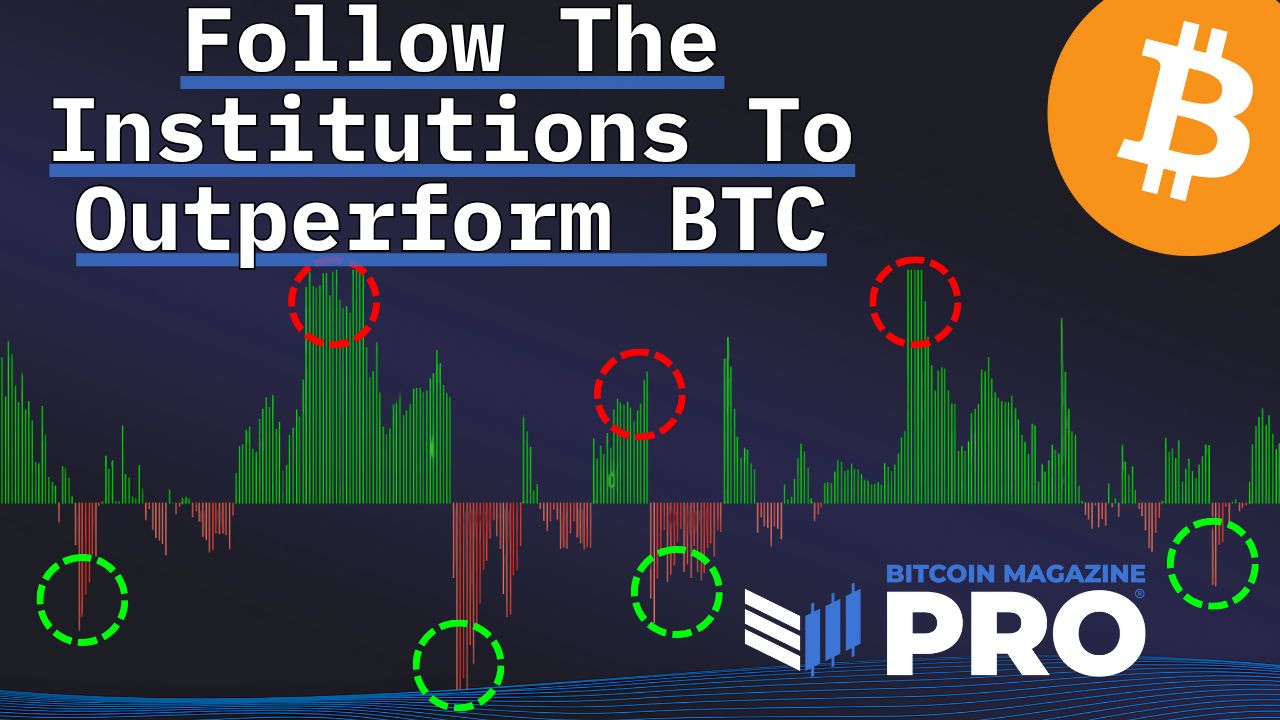

This Bitcoin ETF Strategy Has Outperformed BTC Buy-and-Hold

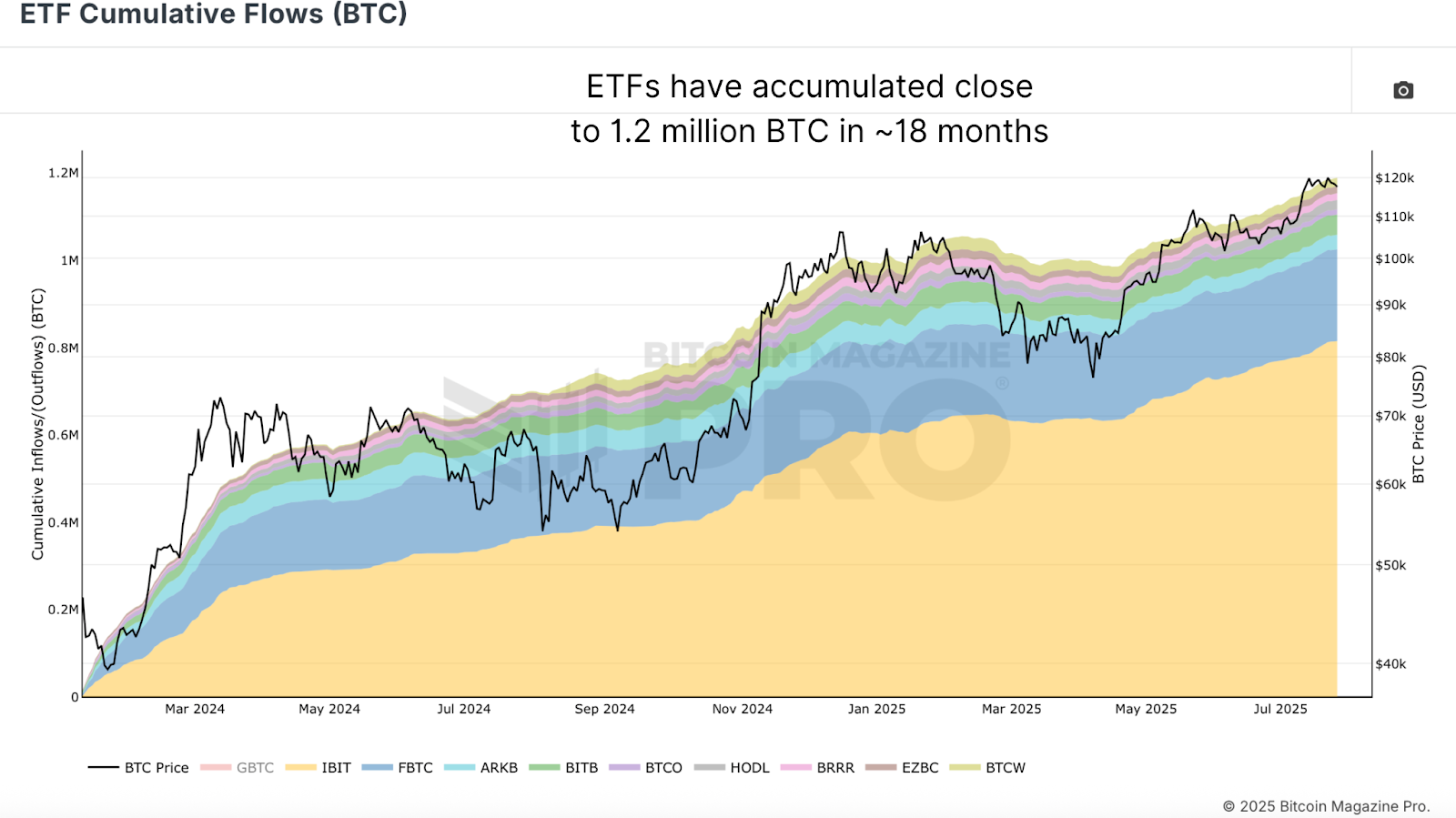

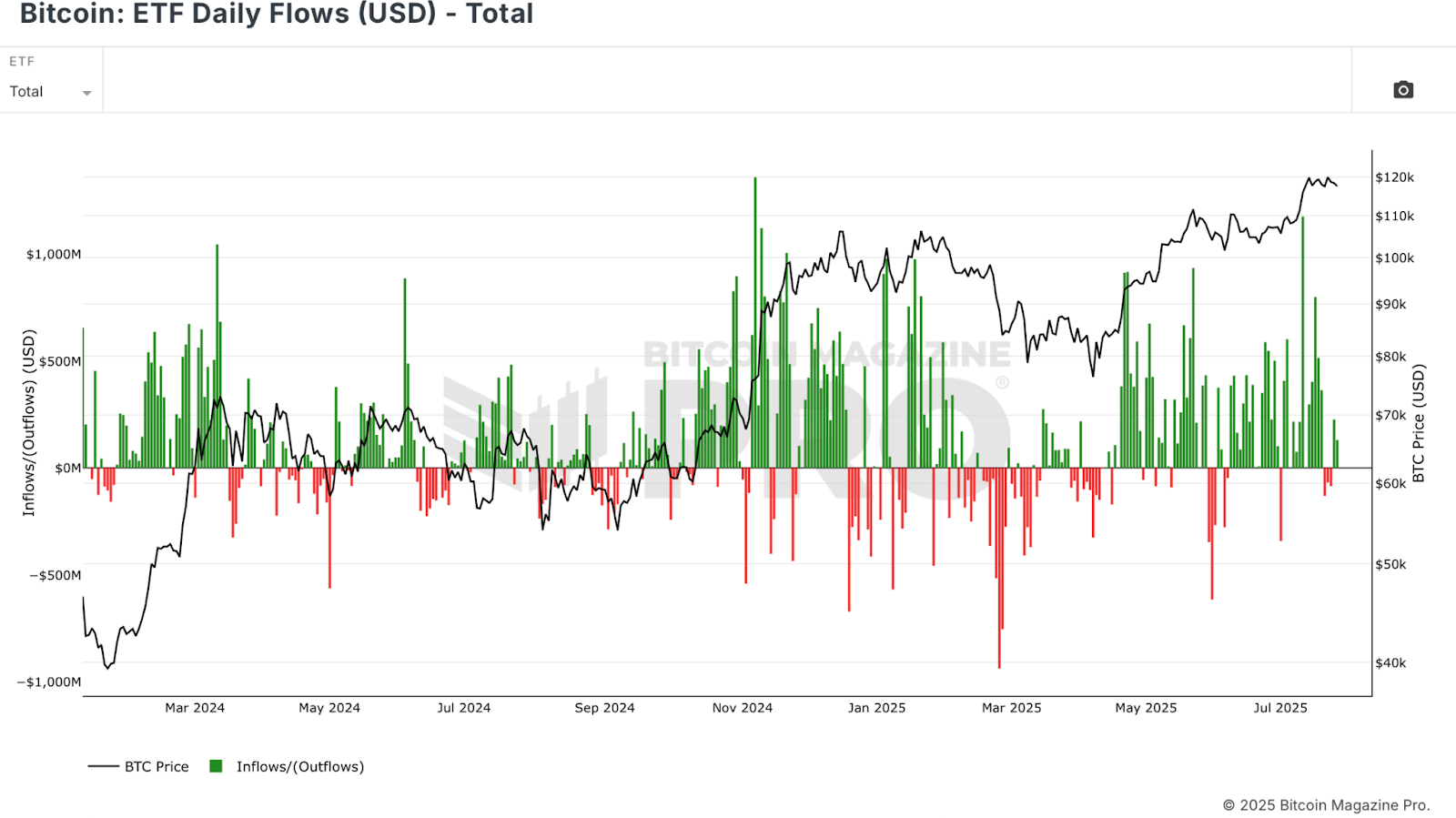

Bitcoin ETF inflows are accelerating the influence of institutional investors on the market, reshaping BTC’s supply dynamics and overall structure. As these ETFs have flooded into the space, many see this wave of institutional participation as an unprecedented shift in Bitcoin’s narrative. But what if this institutional data could be used not just to observe the market, but to outperform bitcoin itself?

Who Really Buys Bitcoin ETFs? Defining ‘Institutional’

The term “institutional” is frequently used as shorthand for ETF buyers, but in reality, these inflows represent a mix of high-net-worth individuals, family offices, and some actual institutional funds. Perhaps only 30–40% are what we would consider true institutions. Regardless, ETF Cumulative Flows have grown exponentially to almost 1.2 million BTC since January 2024. That’s a transformative amount, arguably removing a meaningful chunk of available supply from the open market indefinitely.

This kind of accumulation, especially when paired with long-term holding behavior from treasury companies and potentially even nation-states, has permanently altered Bitcoin’s liquidity profile. These coins may never re-enter circulation.

Turning ETF Flow Data Into a Profitable Bitcoin Trading Strategy

Many assume these ETF participants are the epitome of smart money, savvy investors moving against the grain to exploit retail sentiment. But the data tells a different story. Analysis of the ETF Daily Flows (USD) chart reveals a herd-like behavior of buying heavily into local tops and capitulating at local bottoms.

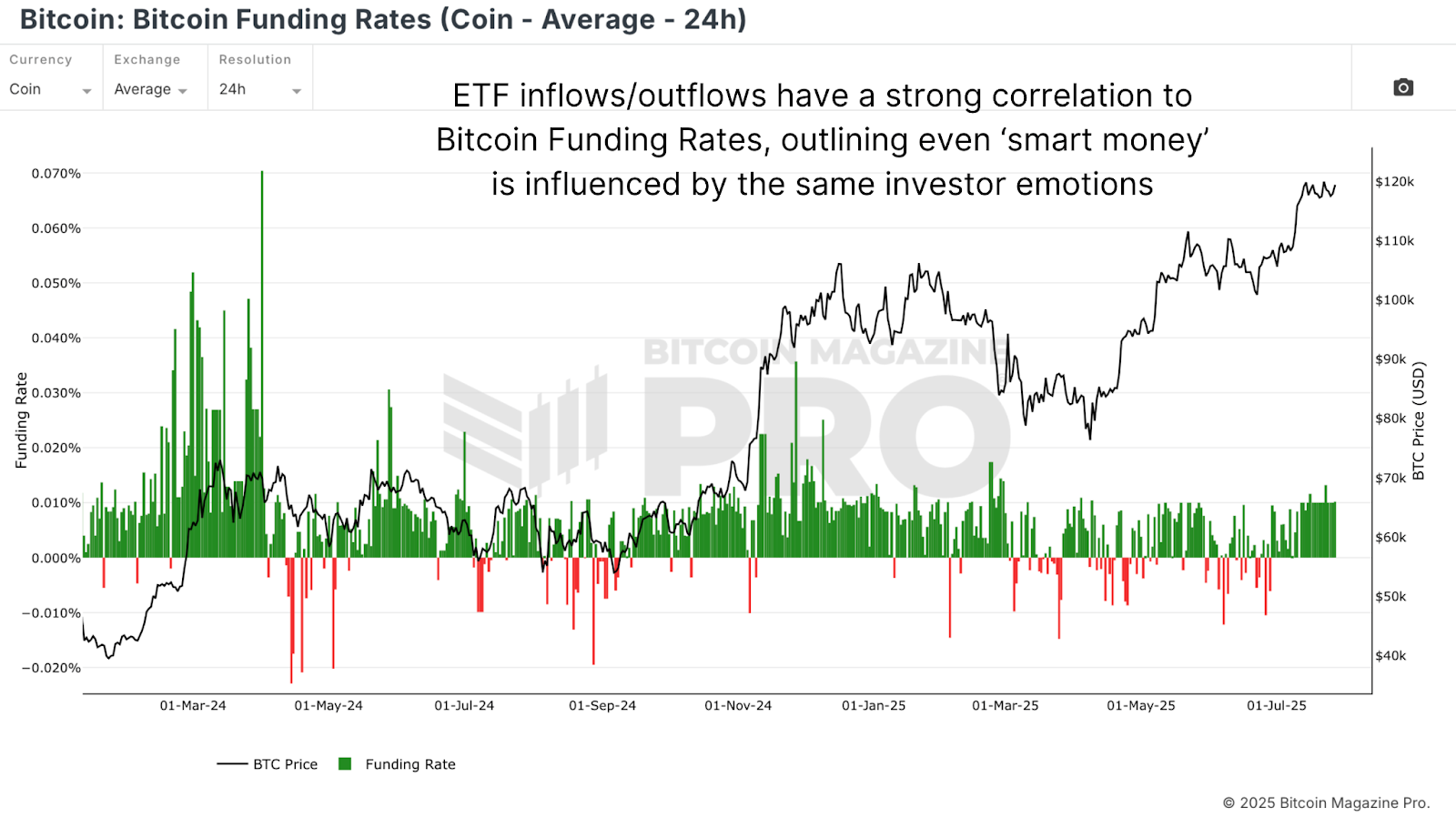

A comparison between ETF Flows and Bitcoin Funding Rates, a retail sentiment barometer, shows an uncanny synchronicity. Institutions are essentially buying and selling in lockstep with retail, not ahead of them. This shouldn’t be surprising. Human psychology, cognitive bias, and FOMO don’t stop affecting people just because they manage large sums of money. Even treasury departments of large corporations often end up buying into bullish euphoria.

Bitcoin ETF Flow Strategy vs. Buy-and-Hold: The Results

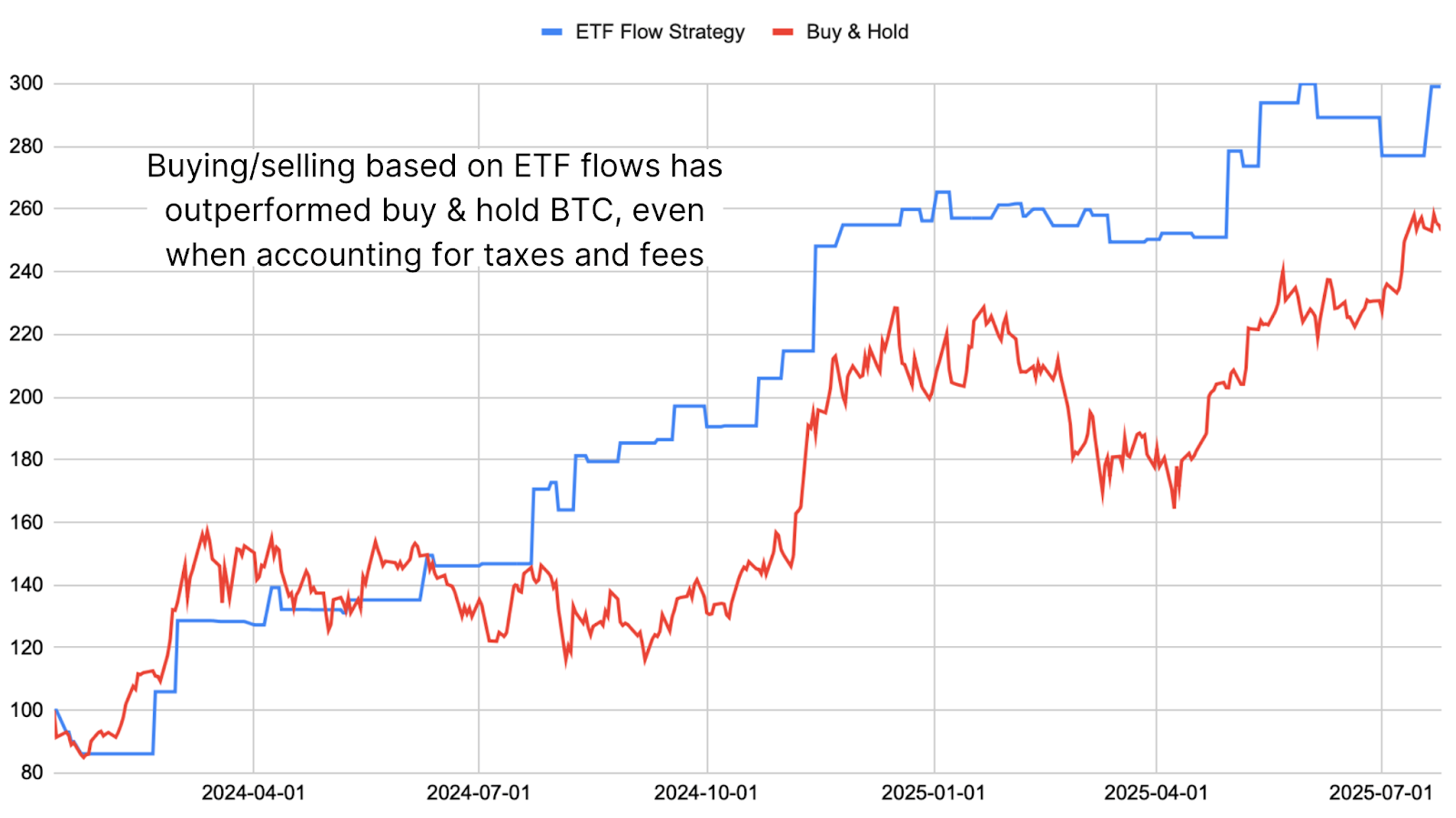

If ETF buyers are simply following the trend of buying as price increases and selling as price decreases, then their inflows and outflows can serve as a potential entry/exit signal, or better yet, as a momentum indicator when interpreted correctly. To test this theory, we created a simple strategy using ETF flow data via the Bitcoin Magazine Pro API.

The logic is straightforward: buy Bitcoin when ETFs show inflows, and sell when they show outflows. It isn’t a perfect signal; early trades show drawdowns and a noticeable underperformance compared to buy and hold, but when this strategy is applied over the full span since ETFs launched, the returns are impressive. Nearly 200% versus approximately 155% for a buy-and-hold strategy. Even when factoring in a nominal 20% taxation rate on profitable trades, the strategy still outperformed.

Should You Use a Bitcoin ETF Flow Strategy?

This kind of tactical strategy isn’t for everyone. Many Bitcoiners are long-term holders who would never consider selling. But for those willing to manage risk and capture edge in the market, this ETF-based strategy offers a way to leverage the behavior of the big market participants.

So, does following institutional flows give you an edge? On its own, probably not a consistent one. While undoubtedly impressive, it has worked this long, I personally have doubts this will work over multiple cycles. But paired with the broader market context, it becomes a useful tool for gauging the trend and reinforcing other signals to compound returns.

Loved this deep dive into bitcoin price dynamics? Subscribe to Bitcoin Magazine Pro on YouTube for more expert market insights and analysis!

For more deep-dive research, technical indicators, real-time market alerts, and access to expert analysis, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post This Bitcoin ETF Strategy Has Outperformed BTC Buy-and-Hold first appeared on Bitcoin Magazine and is written by Matt Crosby.

CryptoSlate

President Donald Trump issued a debanking executive order this week aimed at stopping what his administration described as unfair banking discrimination toward the crypto sector.

Will the order be the definitive blow to the so-called Operation Choke Point 2.0? Will banks that debanked crypto companies unfairly be forced to reinstate them? Custodia Bank founder and CEO Caitlin Long dives into the finer points of the order:

Debanking executive order installs independent overseer

The first “hidden gem,” according to Long, is that Trump’s debanking executive order installs an independent overseer, highlighting the administration’s reservations with the existing three federal banking regulators, the FDIC, the Federal Reserve (Fed), and the Office of the Comptroller of the Currency (OCC).

Instead, it places the Small Business Administration (SBA), a non-bank regulator, as an independent overseer above these agencies to monitor debanking issues. This looks an awful lot like a lack of faith in existing agencies’ willingness or ability to address political and unfair debanking practices.

The SBA’s leader is a long-time Bitcoiner, Kelly Loeffler

President Trump picked Kelly Loeffler, a former senator, business executive, and known supporter of Bitcoin and the broader crypto industry, to lead the SBA. This appointment speaks volumes in the crypto community, as Loeffler was the CEO of Bakkt, an institutional bitcoin futures platform, before her Senate career.

The decision to place her in charge of monitoring debanking is an indication that this administration is serious about reform and that its trust in the previous regulatory agencies is low.

Political leanings inside the banking agencies

Long highlights the political leanings of staff at agencies like the Fed and FDIC. According to contribution records, a large majority of donations from Fed and FDIC staff went to Democratic candidates in recent elections, with Long placing the figure as high as 92% for Democrats in 2024.

This raises concerns for some that regulatory actions may have been driven by partisan biases, especially given the history of crypto-related “debanking” during the Biden administration.

Definition and scope of ‘politicized or unlawful debanking’

Trump’s debanking executive order defines “politicized/unlawful debanking” broadly, focusing on “lawful business activities” rather than naming crypto or any specific sector. This language means banks can no longer refuse service simply because a business is a crypto firm if it is otherwise in compliance. The order targets not just crypto companies, but any lawful firms that may face political discrimination. As Long points out:

“Banks that refused to serve or debanked lawful crypto companies are on the hook.”

The litmus test: Custodia and other crypto banks

Custodia Bank previously faced debanking after regulators pressured multiple banks to cut ties due to their crypto business, even though the bank had a clean compliance record.

Long asserts that the true test of Trump’s debanking executive order will be whether banks that debanked Custodia (and similar crypto firms) are compelled to reinstate them. The order’s success, then, will be measured by real outcomes in banking access for crypto companies.

“If they reinstate us, then the EO succeeded”

The post Custodia Bank founder Caitlin Long dives into Trump’s debanking executive order appeared first on CryptoSlate.

Altcoin traders can hardly contain themselves as the long-awaited breakout appears to have begun. ETH posted gains of over 20% the last seven days and smaller cap coins like SOL, DOGE, and BNB are close behind, with Chainlink’s LINK token up 30% in the same timeframe. Does this mean alt season finally here?

A painful bull market for altcoin traders

2025 has been a stellar year for Bitcoin, seeing the number-one crypto climb steadily higher, marking a fresh all-time high of ~$122,838 on July 14, fueled by rising institutional demand and a favorable regulatory climate stateside.

The same cannot be said of altcoins, which have languished far from their peak levels. Ethereum’s lackluster performance, in particular, caused divisions within its community, leading many to question whether the divergence between technology and price was an existential issue.

Just as ETH price was beginning to break out and see sustained momentum, renowned trader and former BitMEX CEO Arthur Hayes rattled ETH holders, selling 2,373 coins from his stash and forecasting near-term headwinds for the number-one alt, which, he believed, would test the $3,000 mark based on a weaker-than-expected jobs report and a short-term slowdown in global liquidity.

Those who continued to HODL their ETH are feeling euphoric today as ETH price has surged more than 50% in a month, with some prediction platforms forecasting price targets over $60,000. Even Hayes has taken to crypto Twitter this morning to admit the folly of his decision, tagging Tommy Lee’s Fundstrat, now the largest holder of ETH, with the words:

“Had to buy it all back, do you forgive me? I pinky swear, I’ll never take profit again.”

Is alt season finally here?

With Hayes back on board, BTC and crypto allowed in 401ks, and Ethereum bulls from Buterin to Bankless, finally believing in the strength of this latest rally, does this mean that the long-awaited alt season is finally here?

It certainly looks that way as smaller-cap coins begin to pump across the board. Before you get over your skis, however, take note: this year’s alt season may differ from previous cycles. As prominent day trader and LINK ambassador Ito Shimotsuma, points out:

“Each #Altseason is smaller than the previous ones. And this is why I tell you to focus more on DYOR. In 2017, any random ICO pumped 100x. In 2021, any VC backed alt pumped 50x-100x. This time, very selective alts will outperform. Look for those alts with strong narrative and revenue sharing.”

Another well-known altcoin trader, Miles Deutscher, similarly exercises more caution, confirming that, in his opinion, a mini alt season is finally happening, but watch out for the rotation back into BTC between the $120-140K mark.

Into the Cryptoverse founder Benjamin Cowen is notably less bullish on alts, warning:

“This is not alt season.

This is ETH season

Let’s not confuse the two”

Is Bitcoin’s rally finally over?

With Ethereum and alts pumping, Bitcoin is currently being outperformed, and Bitcoin dominance has dropped to 59.2% at the time of writing after months of holding steady over 60%.

According to Bitcoin macro strategy analyst ecoinometrics, Bitcoin’s correlation with the Nasdaq is behind this recent stall.

“Bitcoin’s correlation with the Nasdaq helps explain recent price action.

When stocks dropped sharply late last week, Bitcoin followed. That’s what you expect when correlations are elevated.

Now that the Nasdaq is resuming its uptrend, Bitcoin is moving with it again.”

All eyes will be on the broader macro picture moving into next week to see what Bitcoin’s next move will be, and how long this alt season may last.

The post As Ethereum rips and smaller caps follow, is alt season finally here? appeared first on CryptoSlate.

Coinbase has begun integrating DEX trading directly into its app via Base, expanding user access to millions of tokens compared to the current 300 listed assets, according to an Aug. 8 announcement.

The feature allows select US customers, excluding those in New York State, to trade newly created Base-native assets within moments of their launch using Coinbase’s existing interface.

The integration marks a significant shift for the exchange, merging the speed and breadth of decentralized finance (DeFi) markets with the usability of a centralized trading platform.

According to DefiLlama data, Base registered the fourth-largest spot monthly volume in July, surpassing $41 billion.

At launch, users can discover and trade tokens from projects such as Virtuals, SoSo Value Indices, Auki Labs, and Super Champs.

Trades are routed through leading protocols like Aerodrome and Uniswap, with aggregators scanning available liquidity to secure the best pricing.

Coinbase’s system abstracts away many of the complexities of decentralized trading by including a built-in self-custody wallet, sponsoring all network fees, and allowing customers to fund transactions from their Coinbase balance or USDC.

Furthermore, the company is rolling out DEX asset support in batches to ensure performance and reliability, with plans to index more Base assets daily and to expand to other networks such as Solana shortly.

It is also preparing to extend DEX access beyond the US. Coinbase emphasized that while it does not list or review DEX assets, it will block tokens flagged as malicious or fraudulent by trusted third-party vendors and will surface on-chain data to give traders more transparency.

Coinbase says issuers who launch on Base, even without a centralized exchange listing, can reach millions of traders through the DEX interface within about an hour of their token being indexed.

Jesse Pollak, creator of the Base network, said the move “puts Base builders on a level playing field.”

He added:

“Base is for everyone, but because of the antiquated listings process, that didn’t always feel true. Now it is, and it’s up to builders to earn the attention with hard work. Onwards!”

By embedding DEX functionality into its consumer app, Coinbase is increasing asset accessibility and signaling a more profound commitment to supporting the fast-growing on-chain economy.

The post From Aerodrome to Uniswap: Coinbase now routes DEX trades inside its app appeared first on CryptoSlate.

Crypto projects captured $2.67 billion in investments last month and is equivalent to 85% of money raised during the entire second quarter.

DefiLlama data shows that the funding amount in July is 6% larger than June, when crypto startups surpassed $2.5 billion by a small margin.

Additionally, July was the second-largest month in funding, bested only by March’s $3.5 billion. Pump.fun’s pre-sales contributed heavily to July’s numbers, as it attracted nearly $1 billion before its token generation event.

Treasuries shine

DefiLlama tracked investments into crypto-related companies under the category “Investments,” which received $512 million in funding.

BitMine raised $250 million to add Ethereum to its treasury, representing the largest amount in the “investments” category. Meanwhile, Upexi’s $200 million funding was the second-largest capital raise in the category, which was destined to add Solana to its holdings.

Together, both companies represented 88% of all funding in the “investments” category in July.

“Stablecoin infrastructure” also received significant attention from investors, with $352.5 million directed to projects in the segement.

Hong Kong-based OSL Group dominated the funding, gathering $300 million to boost its global expansion.

RD Technologies is another project from Hong Kong, which received $40 million to create regulated systems for stablecoins ranging from issuance to distribution.

DeFi strong even without Pump.fun

Despite Pump.fun adding a considerable amount to the “DeFi” category, projects developing products for the decentralized finance ecosystem raised $107 million. The amount is relatively substantial compared to other sectors.

Kuru received $11.6 million to develop a central limit order book (CLOB) based on the Monad infrastructure. At the same time, GAIB captured $10 million to create a decentralized economic layer to tokenize GPUs and their revenue stream.

Falcon Finance also received a two-digit funding, as World Liberty Financial backed the project with $10 million to build an overcolateralized stablecoin.

The last of the sectors that got at least $100 million in funding is “infrastructure.” Bitzero raised $25 million in a Series B funding round to support its mining operations.

Furthermore, xTAO received $22.8 million to continue its work of supporting and scaling the Bittensor ecosystem.

Soluna secured a two-digit investment, capturing $20 million to enhance operations, including Bitcoin mining with green energy.

The post Crypto attracts $2.67B in funding during July, bolstered by Pumpfun and stablecoin interest appeared first on CryptoSlate.

Harvard Management Co. (HMC) reported a position in BlackRock’s iShares Bitcoin Trust (IBIT) worth $116,666,260.

According to a Form 13F filed with the US Securities and Exchange Commission (SEC) on August 8, HMC had 1,906,000 shares of IBIT as of June 30.

Based on the values shown on the same page, the Bitcoin allocation represents roughly 8% of the filing’s reported portfolio worth over $1.4 billion, placing it in the same tier as several of Harvard’s largest US-listed holdings.

Notably, HMC now holds more Bitcoin than gold, as its shares of SPDR Gold Trust were priced at approximately $102 million at the end of the second quarter.

The portfolio snapshot is notably selective and concentrated in mega-cap names. Microsoft appears at about $310 million, Amazon near $235 million, Booking Holdings around $182 million, Meta roughly $120 million, Alphabet close to $114 million, and Nvidia about $104 million.

The filing offers the clearest on-the-record sign yet of Harvard’s progression from exploratory crypto exposure to a visible, sized allocation within its US-reportable assets.

Harvard has reportedly engaged with digital assets over multiple years. The institution was among the early university investors allocating to crypto-focused venture funds in 2018.

Furthermore, a 2019 SEC filing for Blockstack’s qualified token sale documented purchases of Stacks (STX) tied to a fund whose limited partners included Harvard affiliates. Lastly, reports from 2021 2021 indicated Harvard had been buying crypto directly through exchange accounts.

The IBIT stake formalizes that arc by placing spot Bitcoin exposure in the same table as Harvard’s blue-chip equities and gold.

Form 13F covers only specific US-listed securities and does not represent Harvard’s entire portfolio, but the composition is instructive.

By adding IBIT at roughly 8% of reported holdings, Harvard has elevated Bitcoin to a core component of its public-markets book for this quarter.

The post Harvard discloses $116.7M exposure to Bitcoin via BlackRock’s IBIT ETF appeared first on CryptoSlate.

Cryptoticker

TROLL on Solana: BIG Moves

In just a month, $TROLL has gone from a relatively unknown Solana meme coin to one of the fastest climbers in the market, posting gains of over 1,100%. This explosive rally has pushed it to a fresh all-time high and drawn in both eager buyers and cautious short-sellers. With sentiment still heavily bullish, the question is whether the trend has more fuel—or if gravity is about to take over.

Key Stats on TROLL Coin

- Price: ~$0.238 (fresh ATH ~$0.2555)

- 1-Month Performance: +1,191%

- Market Cap: ~$237.8M

- Fully Diluted Valuation (FDV): ~$237.8M (≈ market cap)

- Circulating Supply: ~998.98M TROLL (near 1B max)

- 24h Volume: ~$42.2M

Troll (SOL) chart over the past month - coinmarketcap

Why a Pullback Looks Likely

- Parabolic move: +10–12× in ~30 days is classic “blow-off” territory. Parabolic climbs rarely sustain without mean reversion.

- Fresh ATH into euphoria: Printing a new high while sentiment shows ~80% bullish often precedes sharp shakeouts as late buyers crowd in.

- FDV ≈ Market Cap: With most supply circulating already, valuation already reflects near-full dilution—leaving less “unlock upside” narrative.

- Liquidity pockets below: After vertical runs, thin liquidity below recent highs can accelerate a quick 15–30% snapback.

What a healthy pullback could look like:

- A lower high after the ATH, followed by a loss of momentum and a break back into the last consolidation area.

- Typical mean-reversion targets sit near prior breakout levels and volume nodes (e.g., the mid-.20s to high-.10s zones).

- Invalidation: A strong reclaim and close above the ATH with rising volume.

This is market commentary, not financial advice. Manage risk.

A Simple Short Setup Framework (For TROLL or Any Overextended Meme Coin)

- Wait for weakness: Don’t pre-short a vertical candle. Look for a failed retest near the highs and the first clean lower high on the 15m–1h chart.

- Trigger: Enter only on a break of the prior swing low or a clean loss of the intraday trendline/EMA.

- Stop: Above the most recent lower high (keep it tight, use isolated margin).

- Targets: Prior breakout areas and obvious supports. Scale out on the way down.

- Risk: Size so a 2–3% move against you doesn’t wreck the account. Funding and volatility can change fast.

If TROLL perps aren’t listed on your venue, apply the same framework to other overextended coins that do have USDT-M perps (e.g., popular Solana/ETH memes like BONK, PEPE, WIF—availability varies).

How to Trade TROLL Coin When a Token Is Listed Only Onchain (Bitget Guide)

What is Onchain trading on Bitget?

Onchain trading allows you to access tokens that aren’t listed on Bitget’s main spot or futures markets. Instead, trades are executed directly through integrated DEX liquidity on supported blockchains—meaning you can buy and sell tokens like TROLL without them being officially listed in Bitget’s central order books. This is ideal for newly launched or niche coins, but it also means that futures shorting is not available for these pairs.

Since TROLL is currently only available in Bitget’s Onchain section, you can’t short it directly via Bitget futures. However, you can still:

- Trade it spot through Onchain Swap if you want to sell your holdings.

- Apply the same short strategy to other overheated coins that are listed on Bitget futures (e.g., BONKUSDT, PEPEUSDT, WIFUSDT).

Bitget Onchain Trading - Bitget

How to Short on Bitget (Step-by-Step)

- Sign up / Log in: Create an account using this link.

- Secure your account: Enable 2FA and set an anti-phishing code.

- Complete KYC: Required for higher limits and to use fiat on-ramps.

- Fund your account: Deposit USDT or supported crypto to your Spot wallet.

- Go to Onchain Trading: In the Bitget menu, select Trade → Onchain.

- Search for TROLL: Enter “TROLL” in the token search bar.

- Select the pair: Choose TROLL/USDT or the available trading pair.

- Set amount & confirm swap: Enter how much you want to buy or sell, confirm the rate, and approve the transaction.

- Track holdings: Your TROLL balance will appear in your Onchain portfolio.

Pro Tips for Shorting Overpriced Memes

- No knife-catching in reverse: Let trend flip first.

- One trade, one plan: Pre-define invalidation; don’t widen stops.

- News risk: Listings, influencer posts, or exchange campaigns can rip price—reduce size around events.

- Daily loss cap: Stop for the day if you hit it.

TROLL’s month-long eruption checks all the boxes for a cooling phase. If momentum rolls over, disciplined shorts can capture the mean reversion—provided you wait for confirmation and manage risk tightly. If TROLL perps aren’t listed, apply the same plan to another overheated meme pair on Bitget.

Gold ETFs and Bitcoin ETFs both make hard to hold assets easy to own. One wraps a centuries old store of value. The other packages a new digital asset that moves fast. Here is the thing. They solve different problems, behave very differently, and fit different investors.

Gold ETFs vs Bitcoin ETFs: What problem these ETFs solve?

Both vehicles remove the headaches of custody. You get price exposure inside a regular brokerage account, with simple trading and familiar statements. That convenience comes with fees, tracking quirks, and a layer of fund structure risk that you should understand before you click buy.

How a Gold ETF works?

A Gold ETF tracks the spot price of gold through holdings at a custodian. You do not own bars in your name. You own fund shares. Expense ratios are usually in the 0.25 to 0.40 range. That looks low, but the meter runs every day. Add brokerage commissions, spreads, and any platform costs and long holding periods can see noticeable drag. Liquidity on major exchanges is strong, yet timing still matters. If you sell into a downdraft you can lock in poor pricing. If a fund ever winds down you may face forced liquidation at an awkward moment. Tracking error is usually small, but it exists, so fund returns can slip a bit versus the metal.

Risks unique to Gold ETFs

Gold ETFs introduce counterparty and structure risk that physical coins do not. The metal sits with custodians and sometimes sub custodians. You are relying on that chain to function as designed. Redemption for bars is out of reach for regular holders. For example a large flagship fund requires around one hundred thousand shares to swap for ten thousand ounces. For most investors that means you can only ever exit by selling shares for cash.

Why people buy Gold ETFs?

Investors often use gold as a hedge against inflation spikes, currency stress, or equity bear markets. The ETF wrapper makes that hedge simple to hold and rebalance. The trade off is the steady expense ratio, possible tracking slippage, and the small but real risks that come with any fund structure.

How a Bitcoin ETF works?

A Bitcoin ETF holds or tracks Bitcoin and turns it into a brokerage friendly security. You get exposure without wallets, seed phrases, or learning blockchain tools. Fees are higher than gold funds, commonly around 0.75 to 1.25. That reflects the cost of managing crypto market operations and custody. The shares trade on stock exchanges during market hours just like any equity ETF.

What really drives a Bitcoin ETF?

The engine is Bitcoin itself. Price can move hard in both directions on sentiment shifts, liquidity changes, and policy headlines. Small news can produce big swings. The upside is large when capital flows in. The downside is painful when risk appetite dries up. Fund level issues can add noise, including premiums or discounts during fast markets and brief tracking gaps around volatile sessions.

Risks unique to Bitcoin ETFs

Expect higher volatility and sharper drawdowns than almost any traditional asset. Regulatory changes can affect operations, index methodology, or access in certain regions. If market makers step back during stress, spreads can widen and execution gets tricky. None of this requires crypto technical skill from you, but you are still riding a very volatile asset through a financial wrapper.

Fees, tracking error, and all the hidden costs

Gold ETF fees typically look modest, yet they compound. Bitcoin ETF fees are higher and bite faster. Add trading commissions where they still exist, custodial passes that some brokers add, and the spread you pay on each trade. Tracking error for both types can build over years. Fast markets can also push quotes away from net asset value for short bursts, which matters to frequent traders.

Liquidity and accessibility

Both categories trade on major exchanges with healthy daily volume in the bigger funds. That said, not all funds are equal. Use the most liquid tickers when possible. Gold ETF redemptions for metal are not practical for regular holders, so treat shares as price exposure only. Bitcoin ETFs settle in cash like any stock and cannot be redeemed for coins by retail holders, so if you ever want self custody of Bitcoin, a fund is not the path.

Volatility and drawdowns

Gold tends to move in calmer ranges and can grind for months. Bitcoin can rise or fall by double digits in a week. That volatility is not a bug for every investor. Traders and growth seekers prize it. Capital preservation mandates usually avoid it or size it very small. Know which camp you are in before you size a position.

Taxes and reporting

Gold ETF sales trigger capital gains taxes, with exact rates set by your local rules. Bitcoin ETF sales are also taxed, and because swings are larger you can realize gains or losses more frequently. Always check the rules for your jurisdiction and account type. Tax location matters. Holding inside retirement or tax deferred accounts can change the outcome.

Correlation and role in a portfolio

Gold often behaves like a crisis hedge or real asset diversifier. It can help when inflation runs hot or when equities stumble. Bitcoin behaves more like a high beta growth asset tied to liquidity cycles and risk appetite. In a diversified portfolio, gold is usually a stabilizer while Bitcoin is a return amplifier. That framing helps you decide sizing and rebalancing rules.

Who should pick what and when?

Choose a Gold ETF if your priority is wealth preservation, inflation hedging, and low maintenance exposure. Accept the steady fee drag and structure nuances.

Choose a Bitcoin ETF if you want asymmetric upside and can handle rapid swings, headline risk, and higher fees. Position size conservatively and plan for volatility.

Gold ETFs vs Bitcoin ETFs: Clear takeaway

Gold ETFs package a slow and steady hedge with known costs and small structure risks. Bitcoin ETFs package a fast moving asset with higher fees and real volatility that can power returns or punish impatience. Match the tool to your objective, size it to your risk tolerance, and write down your rebalance plan before you buy.

$Bitcoin, $BTC, $BitcoinETF, $GoldETF, $XAU, $XAUETF

Ethereum Price Breaks $4,000 and Powers to $4,200

Ethereum ($ETH) has smashed through the $4,000 resistance, climbing to $4,200 after a powerful 8% surge in the past 24 hours and a 20% rise over the last week. The broader crypto market is also showing signs of strength, up 1.7% overall, as Bitcoin recovers from a low of $112,000 to trade just above the strong $117,000 support level.

Ethereum Price Prediction: Can Ethereum Reach $5,000?

With momentum clearly on $Ethereum side, the next natural target for bulls is the previous all-time high (ATH) of around $4,800. A break above this level would open the pathway to the psychological $5,000 mark — a milestone that could attract even more institutional and retail interest.

ETH/USD 4-hours chart - TradingView

ETH Coin: Key Levels to Watch

While the outlook remains bullish, traders should keep an eye on the $4,000 level. A sustained drop below this support could signal a deeper correction, especially if accompanied by a broader market downturn. However, a brief dip under $4,000 without wider market weakness could be nothing more than a fakeout before prices rebound.

Harvard University has quietly made a major statement in the cryptocurrency market. Filings from Friday show the Ivy League giant ended the second quarter holding $117 million worth of shares in BlackRock Bitcoin ETF. This investment made the Bitcoin fund Harvard’s fifth largest holding, ahead of even its $114 million stake in Alphabet, Google’s parent company.

Why Harvard University's Move Matters?

Harvard’s portfolio is managed by Harvard Management Co Inc., which typically takes a long-term, strategic approach to investments. Its largest position remains Microsoft, valued at more than $310 million. The decision to rank Bitcoin alongside tech titans like Microsoft, Alphabet, and other blue-chip names reflects a shifting perception of cryptocurrency as a legitimate institutional asset class.

BlackRock Bitcoin ETF has been one of the most successful ETF launches in history. With $84 billion in assets under management, it has rapidly become a go-to vehicle for institutions seeking Bitcoin exposure without direct custody risks. The fund’s popularity is not limited to Harvard. An Abu Dhabi sovereign wealth fund ended the first quarter with more than $500 million invested, underscoring the global appeal.

Institutional Trend Beyond Harvard

Harvard is not alone in stepping into Bitcoin ETFs. Earlier this week, the State of Michigan Retirement System revealed it held nearly $11 million worth of the ARK 21Shares Bitcoin ETF at the end of the second quarter. This trend suggests Bitcoin ETFs are no longer viewed as speculative experiments but as serious portfolio components for pensions, endowments, and sovereign funds.

Short-Term Market Impact

From a trading perspective, large-scale institutional entries like Harvard’s can create sustained demand for spot Bitcoin ETFs, potentially tightening supply on exchanges and supporting upward price momentum. While Bitcoin’s price remains subject to broader macroeconomic trends and Federal Reserve policy, consistent inflows from heavyweight investors help build a stronger base for future rallies.

Predictive Outlook

If institutional participation continues at the current pace, Bitcoin could see a significant price floor develop above key psychological levels, making deep corrections less likely. Historical patterns show that when elite funds such as university endowments diversify into emerging asset classes, it often precedes broader adoption by smaller institutions. Over the next two quarters, a wave of follow-on investments from other universities, pension funds, and asset managers could provide a fresh tailwind for Bitcoin, potentially setting the stage for a push toward new highs.

$Bitcoin, $BTC, $BitcoinETF, $ETF

PENGU Surpasses BONK to Become Solana’s Meme Coin Leader

PENGU (Pudgy Penguins) has officially overtaken BONK to claim the top spot among Solana-based meme coins. In late July 2025, PENGU’s market cap climbed to nearly $2.88 billion, edging past BONK’s ~$2.84 billion in a dramatic shift.

This isn’t the first time PENGU has flipped BONK. Back in December 2024, it briefly took the lead before BONK reclaimed the position. However, the latest surge is being fueled by strong momentum and growing market exposure, keeping the rivalry tighter than ever.

What’s Driving PENGU’s Momentum?

PENGU’s rise is tied to its deep connection with the Pudgy Penguins NFT brand, which gives it more cultural traction than traditional meme coins. The brand’s NFT success has spilled over into the token’s popularity, attracting a loyal community and generating strong online buzz.

Additionally, high trading volumes in global markets, especially in Asia, have accelerated PENGU’s rally. The token’s price has broken into new highs, drawing in both retail traders and speculative investors eager to ride the hype.

The PEPE Challenge: Can PENGU Break Into the Top 3?

With BONK in the rearview mirror, attention now turns to PEPE, the third-largest meme coin by market cap. To surpass PEPE, PENGU would need to grow its valuation significantly, but its recent momentum suggests it might not be out of reach.

If the current pace continues, some traders believe PENGU could crack the top 3 meme coins by late 2025. However, meme coin history shows that flips like this can be short-lived, making sustained growth the bigger challenge.

New Listings Boosting Accessibility

A major factor behind PENGU’s surge is its increasing presence on top trading platforms. The most recent boost came from Robinhood, which added PENGU to its offerings alongside other trending meme coins.

This listing follows multiple exchange additions throughout 2025, widening accessibility for retail investors and increasing trading liquidity. Greater exposure to mainstream traders could be a key driver for future price appreciation.

Outlook for 2025

PENGU’s rapid climb over BONK underscores the power of community-driven and brand-backed meme coins. If hype continues, supported by new listings and broader adoption, a run toward PEPE’s market cap is possible before year-end.

However, meme coins are notoriously volatile, and PENGU’s next big test will be holding its gains long enough to prove it’s more than just a temporary hype cycle.

$PENGU, $BONK, $PEPE, $DOGE, $SHIB

Decrypt

Hï Ibiza, The Night League, and W1 Curates have launched a permanent art gallery inside a nightclub, featuring digital and physical works.

Creator of vintage internet meme Nyan Cat has claimed $700,000 in royalties associated with meme coins, but does not endorse them.

This week on Public Keys: Coinbase's $2 billion raise, Core Scientific's merger battle, and Block's Bitcoin treasury expansion.

Harvard is the latest major institution to buy Bitcoin via regulated investment vehicles.

Users say GPT-5 is slower, less engaging, and prone to errors despite OpenAI’s lofty promises.

U.Today - IT, AI and Fintech Daily News for You Today

Major SHIB metric collapses, but here's what's still good about this

Market hinting at classic August pattern

Total crypto cap exceeds $4 billion, meme coins leading market recovery today

Shiba Inu turns around with 12% rally, but there's major twist

Dogecoin up 23%, outperforming top 10 cryptocurrencies in gains

Blockonomi

TLDR

- Bo Hines will leave his role as head of the Presidential Council of Advisers for Digital Assets.

- Patrick Witt is expected to replace Bo Hines as the leader of the White House crypto council.

- Bo Hines confirmed his departure in a statement on X and thanked the crypto community for its support.

- He will continue as an adviser to assist David Sacks with AI-related initiatives.

- Patrick Witt has previously served in senior government roles and has no direct work history in the crypto industry.

Bo Hines will leave his position as head of the Presidential Council of Advisers for Digital Assets this month. Journalist Eleanor Terrett reported that Hines will transition back to the private sector after nearly eight months in the role. Patrick Witt, his deputy, is expected to assume the position.

SCOOP: @BoHines, Executive Director of the White House Crypto Council, is stepping down to return to the private sector.

Hines, who previously worked as a partner at a growth equity firm before joining the Trump administration, will remain on as a special government employee…

— Eleanor Terrett (@EleanorTerrett) August 9, 2025

Hines confirmed his departure in a post on X, saying,

“As I return to the private sector, I look forward to continuing my support for the crypto ecosystem.”

He will remain an adviser to assist White House AI and Crypto czar David Sacks with AI-related initiatives. President Trump appointed Hines to the role in December 2024.

During his tenure, Bo Hines said he met with 150 industry leaders within his first three months.

He described his office as

“an administrator and/or sherpa between White House policy, industry, interagency activity and Capitol Hill.”

His efforts focused on strengthening ties between policymakers and the digital assets sector.

Serving in President Trump’s administration and working alongside our brilliant AI & Crypto Czar @DavidSacks as Executive Director of the White House Crypto Council has been the honor of a lifetime. Together, we have positioned America as the crypto capital of the world. I’m…

— Bo Hines (@BoHines) August 9, 2025

Patrick Witt Expected to Replace Bo Hines

Patrick Witt, the deputy director of the crypto council, is expected to replace Bo Hines, according to Terrett. Witt also serves as acting director of the Office of Strategic Capital at the Department of Defense. He previously worked as Deputy Chief of Staff at the U.S. Office of Personnel Management during the first Trump administration.

Witt ran for Congress in Georgia’s 10th district in 2021 but withdrew to run for Georgia State Insurance Commissioner. He lost in the Republican primary but rejoined public service in 2025. Witt has no known professional background in the crypto industry.

Like Bo Hines, Witt played college football, serving as quarterback for Yale University. He briefly signed with the New Orleans Saints as a free agent. Witt withdrew from Rhodes Scholarship candidacy after a misconduct complaint, which he has denied.

Bo Hines’ Legacy and Next Steps

Bo Hines’s leadership marked an active engagement with crypto stakeholders during a time of growing industry scrutiny. He prioritized collaboration between the administration, regulators, and technology innovators. His meetings and outreach aimed to promote a balanced approach to digital asset policy.

While stepping down, Bo Hines will retain an advisory role focused on AI initiatives. This continued involvement keeps him connected to federal technology policy. Industry observers note his quick network-building within the sector during his tenure.

Patrick Witt’s appointment signals continuity in the council’s leadership. His dual roles in defense and crypto policy could influence future priorities. Hines’ departure marks a shift but not a complete break in the administration’s digital asset strategy.

The post Just In: Bo Hines Exits White House Crypto Role: Successor Named Amid Big Shift appeared first on Blockonomi.

TLDR

- The Ethereum price reached $4,196.30, marking its highest level in 2025, after a 5.52% rise in 24 hours.

- Ethereum co-founder Jeffrey Wilcke transferred 9,840 ETH worth $9.22 million to Kraken during the rally.

- Wilcke still holds 95,897 ETH valued at approximately $401.6 million after the latest movement.

- Arthur Hayes sold 2,373 ETH last week and repurchased using 10.5 million USDC at a higher Ethereum price.

- Whale wallet 0xF436 withdrew 17,655 ETH worth $72.7 million from exchanges within the past 18 hours.

Ethereum’s latest rally has triggered significant whale activity, with prominent industry figures executing multimillion-dollar transactions within days. The Ethereum price reached $4,196.30, marking its highest point this year after gaining 5.52% in the last 24 hours. Large buys and sales from influential holders are shaping market momentum and short-term expectations.

Whale Activity Rises as Ethereum Price Peaks

Ethereum co-founder Jeffrey Wilcke moved 9,840 ETH, valued at $9.22 million, to Kraken as Ethereum price hit a new yearly high. The transfer occurred about an hour ago, according to Lookonchain, marking his first major movement since March. Three months ago, Wilcke moved 105,737 ETH to eight newly created wallets.

Jeffrey Wilcke, the Co-founder of #Ethereum, deposited 9,840 $ETH($9.22M) into #Kraken an hour ago.

Jeffrey Wilcke transferred 105,737 $ETH to 8 newly created wallets 3 months ago and currently holds 95,897 $ETH($401.6M).https://t.co/ZysQUM1zVg https://t.co/i61jUjYrIB pic.twitter.com/rUL93r5IWU

— Lookonchain (@lookonchain) August 9, 2025

Despite the latest sale, Wilcke still holds 95,897 ETH, valued at approximately $401.6 million at the current Ethereum price. Market observers note that the timing aligns with renewed momentum following Ethereum’s breakout above $4,000. The rally has intensified trading activity and reinforced demand among both institutional and retail participants.

This transaction highlights mixed whale behavior as some take profits while others increase positions. “These are opportunistic moves during high liquidity phases,” an analyst remarked. Sustained buying pressure could push the Ethereum price toward higher resistance levels if momentum continues.

Arthur Hayes Re-Enters Ethereum Position

BitMEX co-founder Arthur Hayes sold 2,373 ETH for $8.32 million a week ago when the Ethereum price traded near $3,507. Four hours ago, Lookonchain recorded his transfer of 10.5 million USDC to repurchase ETH at higher levels. Hayes confirmed the move publicly, humorously asking for forgiveness for selling too early.

Arthur Hayes(@CryptoHayes) sold 2,373 $ETH($8.32M) a week ago when the $ETH price was ~$3,507.

4 hours ago, he moved out 10.5M $USDC to buy back $ETH at a higher price.https://t.co/SUhcOE4I0o pic.twitter.com/VzEBgje7dh

— Lookonchain (@lookonchain) August 9, 2025

The buyback underscores ongoing bullish sentiment among certain large holders despite previous profit-taking. Whale wallet 0xF436 also withdrew 17,655 ETH worth $72.7 million from exchanges in the past 18 hours. Another wallet, 0x3684, spent 34 million USDT to acquire 8,109 ETH at $4,193 each.

Such accumulation signals confidence in short-term performance while helping absorb selling pressure from other whales. Analysts believe that large-scale withdrawals often indicate longer-term holding strategies. The Ethereum price has maintained stability despite heavy transactions on both sides of the market.

Erik Voorhees Sells 6,581 ETH at $4,161

ShapeShift founder Erik Voorhees sold 6,581 ETH, valued at $27.38 million, earlier today when the Ethereum price reached $4,161. Nine years ago, when the token traded at $7.74, he originally received 14,945 ETH from ShapeShift. That allocation was worth $115,600 then and is now valued at $62.68 million.