Cryptocurrency Posts

Crypto Briefing

El Salvador's new law could transform it into a regional financial hub, attracting foreign capital and enhancing its global financial reputation.

The post El Salvador passes law to allow investment banks to offer Bitcoin and digital asset services appeared first on Crypto Briefing.

Fundamental Global's strategy could significantly influence Ethereum's market dynamics and institutional adoption, impacting digital asset trends.

The post Fundamental Global files $5 billion shelf for Ethereum treasury strategy, targets 10% network stake appeared first on Crypto Briefing.

Hines' departure may impact the momentum of U.S. crypto policy, potentially affecting America's position in the global digital economy.

The post Trump’s top crypto advisor Bo Hines departs amid ongoing efforts to build America’s Bitcoin reserve appeared first on Crypto Briefing.

BlackRock's cautious stance on expanding crypto ETFs beyond Bitcoin and Ethereum may slow broader market diversification and innovation.

The post BlackRock rules out XRP and SOL ETFs despite Ripple-SEC case closure appeared first on Crypto Briefing.

The potential launch of a $1.5 billion crypto firm could significantly impact the DeFi landscape, attracting major tech and crypto investors.

The post Trump-backed World Liberty in talks to launch $1.5 billion WLFI treasury firm appeared first on Crypto Briefing.

Bitcoin Magazine

Bitcoin Magazine

Even Robinson Crusoe Understood the Price and Value of Money

Nothing is as crucial to the functionality of a free market as its money. Money constitutes half of every transaction, representing one side of all value expressed in the exchange of goods and services. But what, exactly, is the price of money?

The commodity with the highest marketability tends to become a society’s preferred medium of exchange — that is, its money. Prices denominated in this common medium enable economic calculation, which in turn allows entrepreneurs to spot opportunities, make profits and push civilization forward.

We’ve seen how supply and demand determine the price of goods, but determining the price of money is a bit trickier. Our predicament is that we have no unit of account to measure the price of money because we already express prices in… you guessed it, money. And because we cannot use monetary terms to explain it, we must find another way to express money’s purchasing power.

People buy and sell money (exchange goods and services for it) based on what they expect that money will buy them in the future. As we’ve learned, acting individuals always make choices on the margin. Hence, the law of diminishing marginal utility. In other words, all actions are preceded by a value judgment in which actors choose between their most valued end and their next strongest desire. The law of diminishing marginal utility applies here as it does elsewhere: the more units of a good a person possesses, the less urgent the satisfaction each additional unit provides.

Money behaves no differently. Its value lies in the additional satisfaction it can provide. Whether that’s buying food, security or future options doesn’t matter. When people trade their labor for money, they do so only because they value the purchasing power of that money more than the immediate use of their time. The cost of money in an exchange is thus the highest utility a person could have derived from the amount of cash they gave up. If a person chooses to work for an hour to afford a rib-eye steak, they must value the meal more than one hour of forgone leisure.

Recall that the law of diminishing marginal returns tells us that each successive unit of a homogenous good satisfies a less urgent desire a person has. Therefore, the value a person attaches to an additional unit diminishes for each unit added. However, what constitutes a homogenous good is entirely up to the individual. Since value is subjective, the utility of each additional monetary token depends on what the individual wants to achieve. To the individual, each extra token is not homogenous in terms of what serviceability it brings to them. To a person who wishes to buy nothing but hot dogs with his money, a “unit of money” is the same as whatever the price of a hot dog is. That person has not added a unit of the homogenous good “money for hot dogs” until he has acquired enough cash to buy one more hot dog.

This is why Robinson Crusoe could look upon a pile of gold and deem it worthless. It couldn’t buy him food, tools or shelter. In isolation, money is meaningless. Like all languages, it requires at least two people to function. Money, above all, is a tool for communication.

Inflation and the Illusion of Idle Money

People choose to save, spend, or invest based on their time preference and their expectations about money’s future value. If they expect purchasing power to increase, they’ll save. If they expect it to fall, they’ll spend. Investors make similar judgments, often redirecting money toward assets they believe will outpace inflation. But whether saved or invested, money is always doing something for its owner. Even money “on the sidelines” serves a clear purpose: lowering uncertainty. A person who holds onto money instead of spending it is satisfying their desire for optionality and safety.

This is why the idea of money “in circulation” is misleading. Money does not flow like a river. It is always held by someone, always owned, always performing a service. Exchanges are actions, and actions happen at specific points in time. Therefore, there is no such thing as idle money.

Without its connection to historical prices, money would be unmoored, and personal economic calculation would be impossible. If a loaf of bread cost $1 last year and costs $1.10 today, we can infer something about the direction of purchasing power. Over time, these observations form the basis for economic expectations. Governments offer their own version of this analysis: the Consumer Price Index (CPI).

This index is supposed to reflect the “rate of inflation” through a fixed basket of goods. However, CPI deliberately ignores high-value assets like real estate, stocks, and fine art. Why? Because including them would reveal a truth governments would rather hide: Inflation is always far more pervasive than the people behind it admit. Measuring inflation through CPI is an attempt to hide the when-you-really-think-about-it obvious truth about it: The increase in prices is always proportional to the expansion of the money supply eventually. The creation of new money always leads to a decrease in the purchasing power of that money compared to what it could have been.

Price inflation is not caused by greedy producers or supply-chain hiccups. It is always, eventually, the result of monetary expansion. When more money is created, its purchasing power falls. Those closest to the source of new money benefit (banks, asset holders and state-connected companies and corporations), while the poor and wage-earning class bear the brunt of price increases.

The effects are delayed and are difficult to trace directly, which is why inflation is often called the most insidious form of theft. It destroys savings, widens inequality and increases financial instability. Ironically, even the wealthy would be better off under a sound monetary regime. In the long run, inflation harms everyone. Even those who appear to benefit in the short term.

The Origins of Money

If money’s value comes from what it can buy, and if that value is always judged against past prices, how did money acquire its initial worth? To answer this, we must look backward to the barter economy.

The good that evolved into money must have had nonmonetary value before it became money. Its purchasing power must initially have been determined by the demand for some other use case. Once it began serving a second function (as a medium of exchange), its demand increased, and so did its price. The good now served two distinct purposes for the owner: providing utility value on the one hand and functioning as a medium of exchange on the other. The need for the latter use case tends to overshadow the former over time.

This is the core of Mises’ Regression Theorem, which explains how money arises naturally in markets and always retains a link to past valuations. It is not an invention of the state but a spontaneous outgrowth of voluntary trade.

Gold became money because it met the criteria of being a good money: It was durable, divisible, recognizable, portable and scarce. Its use in jewelry and industry still gives it use-value today. For centuries, banknotes were mere receipts redeemable for gold. The lightweight and compact banknote proved the perfect solution to gold’s transportability problem. Unfortunately, the issuers of these receipts quickly realized they could issue more gold tickets (banknotes) than they had backing for in their vaults. This modus operandi is still in use today.

Once the link between gold and banknotes was severed altogether, governments and central banks were free to create money ex nihilo, leading to today’s unbacked fiat systems. Under fiat regimes, politically connected banks can be bailed out, even if they fail. The result is moral hazard, distorted risk signals, and systemic instability, all funded by the quiet expropriation of savings through inflation.

Money’s temporal connection to historical prices is vital for the market process. Without it, personal economic calculations would be impossible. The Money Regression Theorem, described in the previous section, is a praxeological insight often overlooked in discussions about money. It explains why money is not just an imaginary construct by some bureaucratic wizardry but has a real connection to a point when someone’s desire to trade means for a specific end spawned it into existence in the free market.

Money is a product of voluntary exchange, not a political invention, a shared illusion, or a social contract. Any commodity with a limited enough supply could be used as money, presuming it ticked off all the other boxes necessary for a suitable medium of exchange. Anything durable, portable, divisible, uniform, and acceptable will do.

Suppose the Mona Lisa had been infinitely divisible. In that case, its parts could have served as money, but only if there was an easy way to verify that they were actually from the Mona Lisa and not counterfeited.

Speaking of the Mona Lisa, there’s an anecdote about some of the most famous painters of the twentieth century that perfectly illustrates how an increase in the supply of a monetary good affects its perceived value. These painters realized they could use their celebrity status to enrich themselves in a peculiar way. They figured out that their signatures were valuable and that they could pay their restaurant bills by simply signing them. Salvador Dali allegedly even signed the wreck of a car that he had crashed into and thus magically transformed it into a valuable piece of art. Eventually, though, these tactics stopped working. The more signed bills, posters, and car wrecks there were, the less valuable an additional signature became, perfectly demonstrating the law of diminishing returns. By adding quantity, they reduced quality.

The World’s Largest Pyramid Scheme

Fiat currencies operate under similar logic. Increasing the money supply devalues each existing unit. While the early recipients of new money benefit, everyone else suffers. Inflation is not just a technical issue but a moral one, too. It distorts economic calculation, rewards debt over savings, and robs those least able to defend themselves against it. In this light, fiat currency is the world’s largest pyramid scheme, enriching the top at the expense of the base.

We accept broken money because it’s what we’ve inherited, not because it serves us best. However, when enough people realize that sound money (money that can’t be counterfeited) is better for the market and humanity, we may stop settling for fake gold receipts that cannot feed us and start building a world where value is real, honest and earned.

Sound money arises through voluntary choice, not political decree. Any item that satisfies the basic criteria of money can serve as money, but only sound money allows civilization to flourish long-term. Money is not merely an economic tool but a moral institution. When money is corrupted, everything downstream — savings, prices incentives and trust — is distorted. But when money is honest, the market can coordinate production, signal scarcity, reward thrift, and protect the vulnerable.

In the end, money is more than a means of exchange. It is a safeguard of time, a record of trust, and the most universal language of human cooperation. Corrupt that, and you don’t just break the economy. You break civilization itself.

“Man is a short-sighted creature, sees but a very little way before him, and as his passions are none of his best friends, so his particular affections are generally his worst counselors.”

Counterfeiting: Modern Money and the Fiat Illusion

Now that we’ve explored how a saleable good becomes money on the free market and how low-time-preference thinking leads to progress and falling prices, we can take a closer look at how money functions today. You may have heard about negative interest rates and

wondered how they square with the fundamental principle that time preference is always positive. Or perhaps you’ve noticed rising consumer prices, with media outlets blaming everything but monetary expansion.

The truth about modern money is a hard pill to swallow because once you understand the magnitude of the problem, things start looking pretty bleak. Human beings cannot resist the urge to enrich themselves by exploiting others through printing money. The only way to prevent this, it seems, would be to remove us from the process altogether, or, at the very least, separate money from state control. Nobel Prize-winning economist Friedrich Hayek believed this could only be done in “some sly, roundabout way.”

The United Kingdom was the first nation to weaken the link between national currencies and gold. Before World War I, nearly all currencies were redeemable in gold, a standard that had emerged over thousands of years as gold became the most saleable good on Earth. However, by 1971, convertibility was abandoned entirely when U.S. President Richard Nixon famously proclaimed he would “temporarily suspend the convertibility of the dollar into gold” and unilaterally severed the final link between the two. He did this (at least partially) to finance the Vietnam War and preserve his political power.

We won’t dive into every detail of fiat currency here, but here’s what matters: State-issued money today is not backed by anything tangible but entirely created as debt. Fiat currency masquerades as money, but unlike actual money (which emerges from voluntary exchange), fiat is a tool of debt and control.

Every new dollar, euro or yuan enters existence when a large bank issues a loan. That money is expected to be paid back with interest. And since that interest is never created alongside the principal, there is never enough money in circulation to repay all debts. In fact, more debt is necessary to keep the system alive. Modern central banks further manipulate the money supply through mechanisms like bailouts, which prevent inefficient banks from failing, and quantitative easing, which adds even more fuel to the fire.

Quantitative easing is when a central bank purchases government bonds by creating new money, effectively trading IOUs for freshly printed currency. A bond is a promise by the government to repay the borrowed money with interest. That promise is backed by the state’s power to tax present and future citizens while you and your heirs are forced to cope with rising prices. The result is a quiet, continuous wealth extraction from productive people through inflation and debt servitude.

Money printing continues under the banner of Keynesian economics — the doctrine that underpins most modern government policies. Keynesians argue that spending is what drives an economy forward and that if the private sector doesn’t keep spending, the government must. Every dollar spent, they claim, adds one dollar’s worth of value to the economy, but this view ignores the reality of value dilution through inflation. It’s Bastiat’s Broken Window Fallacy all over again. Adding zeros adds precisely zero value.

If money printing could actually increase wealth, we’d all own super yachts at this point. Wealth is created through production, planning and voluntary exchange, not by increasing the number of digits on a central bank’s balance sheet. Real progress stems from people trading with others and their future selves by accumulating capital, delaying gratification and investing in the future.

Fiat Currency’s Final Destination

Printing more money doesn’t speed up the market process, but distorts and retards it. Literally. Slow and stupid follows. Ever-decreasing purchasing power makes economic calculation more difficult and slows down long-term planning.

All fiat currencies eventually die. Some collapse via hyperinflation. Others are abandoned or absorbed into larger systems (such as smaller national currencies being replaced by the euro). But before their end, fiat currencies serve a hidden purpose — they transfer wealth from those who create value to those with political proximity.

This is the essence of the Cantillon effect, named after 18th-century economist Richard Cantillon. When new money enters the economy, its first recipients benefit most — they can buy goods before prices rise. Those furthest from the source (ordinary workers and savers) absorb the cost. Being poor in a fiat system is very expensive.

Despite this, politicians, central bankers and establishment economists continue to assert that a “healthy” inflation rate is necessary. They should know better. Inflation does not fuel prosperity. At best, it shifts purchasing power. At worst, it erodes the very foundation of civilization by undermining trust in money, savings and cooperation. The abundance of cheap goods in today’s world was created in spite of taxes, borders, inflation and bureaucracy — not because of them.

The Good, the Bad, and the Ugly

When left unhampered, we know that the market process tends to deliver better goods at lower prices for more people. That’s what real progress looks like. Interestingly, praxeology isn’t just a tool for critique but a framework for appreciation. Many people grow cynical once they see how deep the dysfunction runs, but praxeology offers clarity: It helps you see how productive people are the real drivers of human flourishing. Not governments. Once you understand this point, even the most mundane forms of labor take on greater meaning. The supermarket cashier, the cleaning staff and the taxi driver all contribute to a system that meets human needs through voluntary cooperation and value creation. They are civilization.

Markets produce goods. Governments, by contrast, tend to produce bads. Catallactic competition, where businesses strive to serve customers better, is the engine of innovation. Political competition, where parties fight to control the state, rewards manipulation, not merit. The most adaptable rise in markets. The most unscrupulous rise in politics.

Praxeology helps you understand human incentives. It teaches you to watch what people do, not just what they say. More importantly, it teaches you to consider what could have been, not just what is. That’s the unseen world, the alternative timelines erased by intervention.

Fear, Uncertainty and Doubt

Human psychology is biased toward fear. We evolved to survive threats, not to admire flowers. That’s why alarmism spreads faster than optimism. The proposed solution to every “crisis” — whether related to terrorism, pandemics, or climate change — is always the same: more political control.

Those who study human action know the reason why. For every individual actor, the end always justifies the means. The problem is, this fact is true for power-seekers, too. They offer security in exchange for freedom, but history shows us that fear-driven trade-offs rarely pay off. When you understand these dynamics, the world becomes clearer. The noise fades.

You turn off the television. You reclaim your time. And you realize that accumulating capital and freeing your time are not selfish acts. They are the basis for helping others.

Investing in yourself — in your skills, savings, and relationships — enlarges the pie for everyone. You participate in the division of labor. You produce value. And you do so voluntarily. The most radical action you can take in a broken system is to build something better outside of it.

Every time you use a fiat currency, you pay its issuers with your time. If you can avoid using them altogether, you help usher in a world with less theft and deceit. It may not be easy, but endeavors worth pursuing rarely are.

Knut Svanholm is a Bitcoin educator, author, armchair philosopher and podcaster. This is an extract from his revamped book Praxeology: The Invisible Hand that Feeds You, published by Lemniscate Media, May 27, 2025.

BM Big Reads are weekly, in-depth articles on some current topic relevant to Bitcoin and Bitcoiners. Opinions expressed are those of the authors and do not necessarily reflect those of BTC Inc or Bitcoin magazine. If you have a submission you think fits the model, feel free to reach out at editor[at]bitcoinmagazine.com.

This post Even Robinson Crusoe Understood the Price and Value of Money first appeared on Bitcoin Magazine and is written by Knut Svanholm.

Bitcoin Magazine

Will America Become the Bitcoin and Crypto Capital of the World? Here’s an Expert’s Take.

“…we’re definitely going to be the crypto capital of the world for regulated ETF funds, [but] are we serious about making America the crypto capital of the world for peer-to-peer transactions and individual liberty? We should be.” -Peter Van Valkenburgh

After Tornado Cash co-founder Roman Storm was found guilty of conspiracy to operate an unlicensed money transmitting business and the Samourai Wallet developers accepted a plea deal, Peter Van Valkenburgh is concerned that the United States may not become the crypto capital of the world — at least as far as transactional privacy and peer-to-peer rights are concerned.

In my interview with Van Valkenburgh, we discussed how the outcomes of the Tornado Cash and Samourai Wallet cases have put Americans’ ability to use bitcoin and crypto anonymously at risk.

Furthermore, Van Valkenburgh brought up whether or not pressing legislation like the CLARITY Act, which borrows key language from the Blockchain Regulatory Certainty Act (BRCA), will be enough to protect developers of noncustodial crypto technology, some of which is privacy-enhancing.

He also noted how the White House’s “Strengthening American Leadership in Digital Financial Technology” report calls for the passage of the BRCA, which he said is the “best way to stop prosecutions like the Tornado Cash prosecution from happening [again].”

Van Valkenburgh added that the money transmission charges should have never even been brought against the Tornado Cash and Samourai Wallet developers in the first place, as 2019 FinCEN guidance clearly states that noncustodial crypto technology should not be classified as money-transmission technology.

“Operating a CoinJoin server is kind of like running Craigslist,” explained Van Valkenburgh.

“People meet on Craigslist and do things like exchange value, but Craigslist isn’t exchanging value — they’re just connecting people who are going to exchange value themselves,” he added.

Van Valkenburgh argued that this ability for software developers to create technology that helps U.S. citizens anonymize their bitcoin and crypto transactions without fear of prosecution is key to fulfilling President Trump’s vision of the United States becoming the “crypto capital of the world.”

According to Van Valkenburgh, being able to use Bitcoin and crypto mixers, as well as other types of noncustodial Bitcoin and crypto technology, is essential to modern-day Americans’ right to individual liberty.

Without maintaining this liberty, he argued, the United States is no different than its adversaries.

“We won’t be America anymore if we have fully surveilled financial transactions like they do in China and North Korea,” said Van Valkenburgh.

This post Will America Become the Bitcoin and Crypto Capital of the World? Here’s an Expert’s Take. first appeared on Bitcoin Magazine and is written by Frank Corva.

Bitcoin Magazine

Know-Your-Customer: The Quiet Kill Switch

The know-your-customer (KYC) threat isn’t coming. It’s already here, and it didn’t arrive through a nationwide ban or an emergency executive order. It quietly showed up with a checkbox and a Terms of Service agreement.

While the influencers make noise about CBDCs and paper bitcoin, the real control system has already been deployed: Know Your Customer.

Not dramatic. Not dystopian. Just regulated, normalized and accepted.

But compliance isn’t neutral. It’s the infrastructure of financial control, and if you’re still handing over your ID to stack sats, you’re not buying freedom. You’re financing your own cage.

The Real Attack Vector from KYC

KYC regulations are marketed as a hedge against money laundering and fraud. The framing is safety. The reality is traceability.

The moment you attach your identity to Bitcoin through an exchange signup — a utility bill attached, a passport uploaded — you forfeit the very autonomy that Bitcoin was designed to preserve. It’s not about what you’re doing. It’s about who you are.

Once that link is made, every transaction becomes searchable, timestamped and admissible. This isn’t a theory. It’s how the system is already working.

Canada froze bank accounts based on political donations. The U.K. arrests protestors using facial recognition. The U.S. executes geofence warrants without individual suspicion.

Add KYC to that apparatus, and you’ve built a turnkey surveillance machine. No subpoenas. No charges. Just silent blacklists and frozen withdrawals.

Didn’t you find it odd that they arrested the developers of mixers like Whirlpool and Tornado Cash, instead of the criminals that used them?

KYC is Centralization by Design

Governments didn’t need to outlaw Bitcoin; they just needed to know who’s using it.

The combination of centralized exchanges, KYC records and behavioral analytics turns every bitcoin purchase into a breadcrumb trail. Every withdrawal from Coinbase or Kraken becomes part of a profile logged, indexed, stored.

When regulators talk about “compliance,” this is what they mean: usable data pipelines. Sanitized, labeled UTXOs. A fully mapped ecosystem of wallets tied to real names and IP addresses.

What they’re building isn’t about stopping crime. It’s about preemptively labeling dissent.

You Are the Honeypot

The most dangerous part of KYC is that it doesn’t look dangerous. There’s no siren, no red alert. Just a few forms, a phone verification — maybe a bonus if you sign up today.

But each form you complete feeds the machine. Not just for you, but for everyone you interact with.

KYC isn’t just surveillance. It’s contagious.

A single identity-linked wallet poisons the privacy of every address it touches. Chain analysis firms don’t need to know everyone, they just need to know someone. Once that anchor point is set, mapping becomes mathematics.

You’re not stacking sats. You’re stacking evidence.

Exit Is a Deadline

This is the accumulation phase. The calm before the enforcement.

We’re in the same pre-crackdown posture we saw before the war on cash. The pattern is familiar:

- Normalize surveillance

- Demonize privacy

- Criminalize autonomy

The result? Most users walked themselves into a trap. Not under threat, but under convenience.

The “just in case” crowd, the ones who signed up, KYC’d and hoped it wouldn’t matter, are already compromised. Not because they did something wrong, but because they let someone else decide what’s wrong.

And once that line moves? They’re already inside it.

“But they can’t stop me from moving my bitcoin and transacting P2P.” No one wants blacklisted coins: They’ll be radioactive and useless.

What Real Privacy Requires

There’s no affiliate link for real privacy. No app store solution. No 10% discount for using your ID.

It looks like discipline. Friction. Small decisions that don’t scale.

- Buying peer-to-peer instead of custodial

- Mining to clean wallets

- Using tools that don’t log your metadata

- Walking away from platforms that promise speed in exchange for obedience.

It’s not glamorous. But it’s the difference between ownership and permission.

Final Thought

Bitcoin was never supposed to be polite. It was a way out. But as we normalize compliance in exchange for access, we risk turning that exit ramp into a regulated channel.

KYC is not a bureaucratic detail. It’s the quiet kill switch for sovereignty.

It doesn’t matter how many sats you stack if every one of them is logged, tagged and ready for blacklist.

So ask yourself:

What does it mean to own something?

If the answer starts with a government ID, you’re already losing.

No name. No compromise. No delay.

Build the exit while you still can.

This post Know-Your-Customer: The Quiet Kill Switch first appeared on Bitcoin Magazine and is written by Ghost Ghost.

Bitcoin Magazine

Bitcoin Price Stays About $115,000 As Spain’s Banking Giant BBVA Partners With Binance To Provide Custody

Bitcoin price maintained its position above $115,000 on Friday as Binance, the world’s largest Bitcoin and crypto exchange, partners with Spain’s BBVA bank to provide third-party custody services, marking a significant step toward institutional-grade security.

The partnership enables Binance customers to store their assets in U.S. Treasury securities held by BBVA, Spain’s third-largest bank, which the exchange will accept as margin for trading. This arrangement effectively separates trading activities from asset custody, providing an additional layer of security for investors concerned about exchange risk.

The move comes as Binance continues to rebuild trust following its $4.3 billion settlement with U.S. regulators in 2023 over anti-money laundering violations. The exchange has been implementing stricter controls and clearer disclosures on fund management, including allowing clients to use third-party custodians such as Sygnum and FlowBank.

BBVA has been increasingly active in the Bitcoin and crypto sector, having launched crypto trading and custody services through its mobile app this year. The bank has also taken a bold stance by advising private clients to allocate up to 7% of their portfolios to Bitcoin and crypto, reflecting growing institutional confidence in crypto.

The custody arrangement addresses one of the primary concerns that emerged following the collapse of FTX in 2022, where customer funds were commingled with exchange operations. Under the new structure, if Binance were to face operational issues or regulatory challenges, customer funds would remain secure in Treasury securities under BBVA’s control.

This partnership represents a new standard for Bitcoin and crypto exchange security. The integration of traditional banking infrastructure with Bitcoin and crypto trading platforms could accelerate institutional adoption by providing a familiar and regulated framework.

The development comes amid accelerating corporate Bitcoin adoption, with the number of public companies holding Bitcoin on their balance sheets rising to over 200. Recent notable additions include Metaplanet’s purchase of 463 BTC worth $53.7 million and Smarter Web Company’s innovative $21 million Bitcoin-denominated convertible bond.

Market analysts suggest that the partnership between Binance and BBVA could set a precedent for similar arrangements between Bitcoin and crypro exchanges and traditional banks. The move effectively bridges the gap between conventional finance and Bitcoin, potentially attracting more institutional investors who have been hesitant to enter the Bitcoin market due to custody concerns.

Trading volumes across major Bitcoin and crypto exchanges have remained stable following the news, with Bitcoin price continuing to trade in the $115,000-$116,000 range. The market’s muted reaction suggests that institutional developments are becoming increasingly normalized as the Bitcoin and crypto industry matures.

This post Bitcoin Price Stays About $115,000 As Spain’s Banking Giant BBVA Partners With Binance To Provide Custody first appeared on Bitcoin Magazine and is written by Vivek Sen.

Bitcoin Magazine

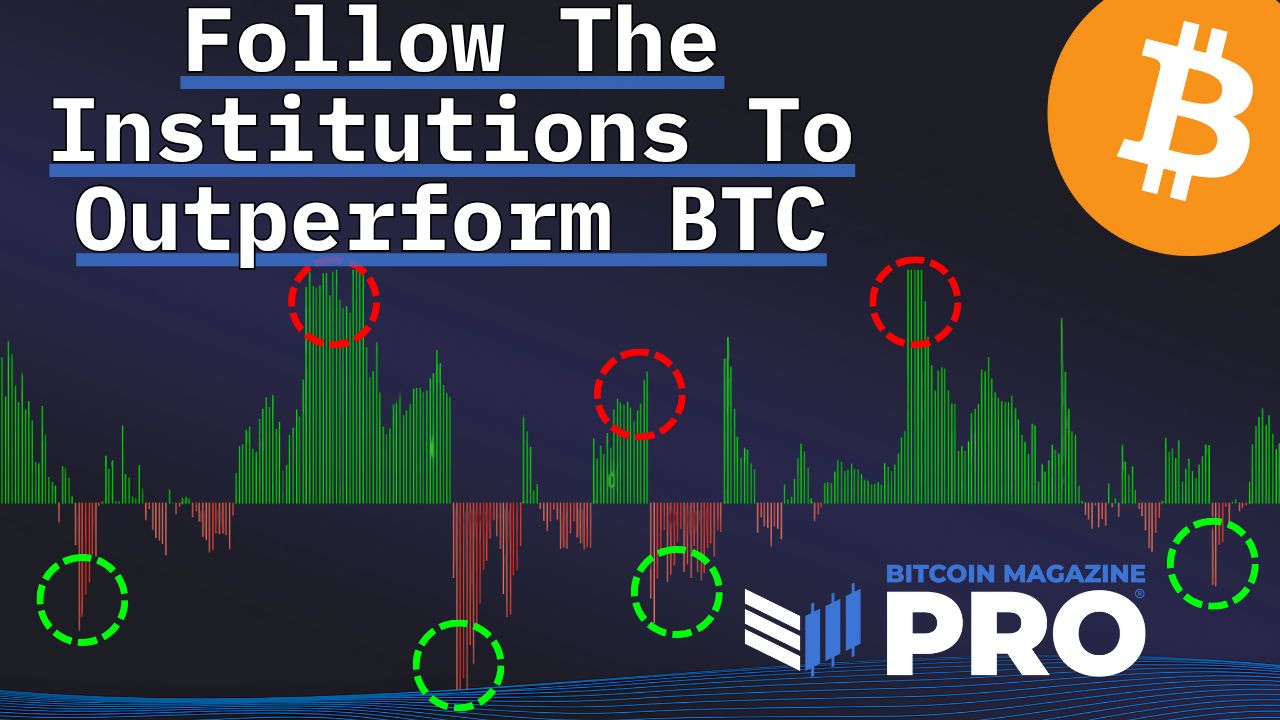

This Bitcoin ETF Strategy Has Outperformed BTC Buy-and-Hold

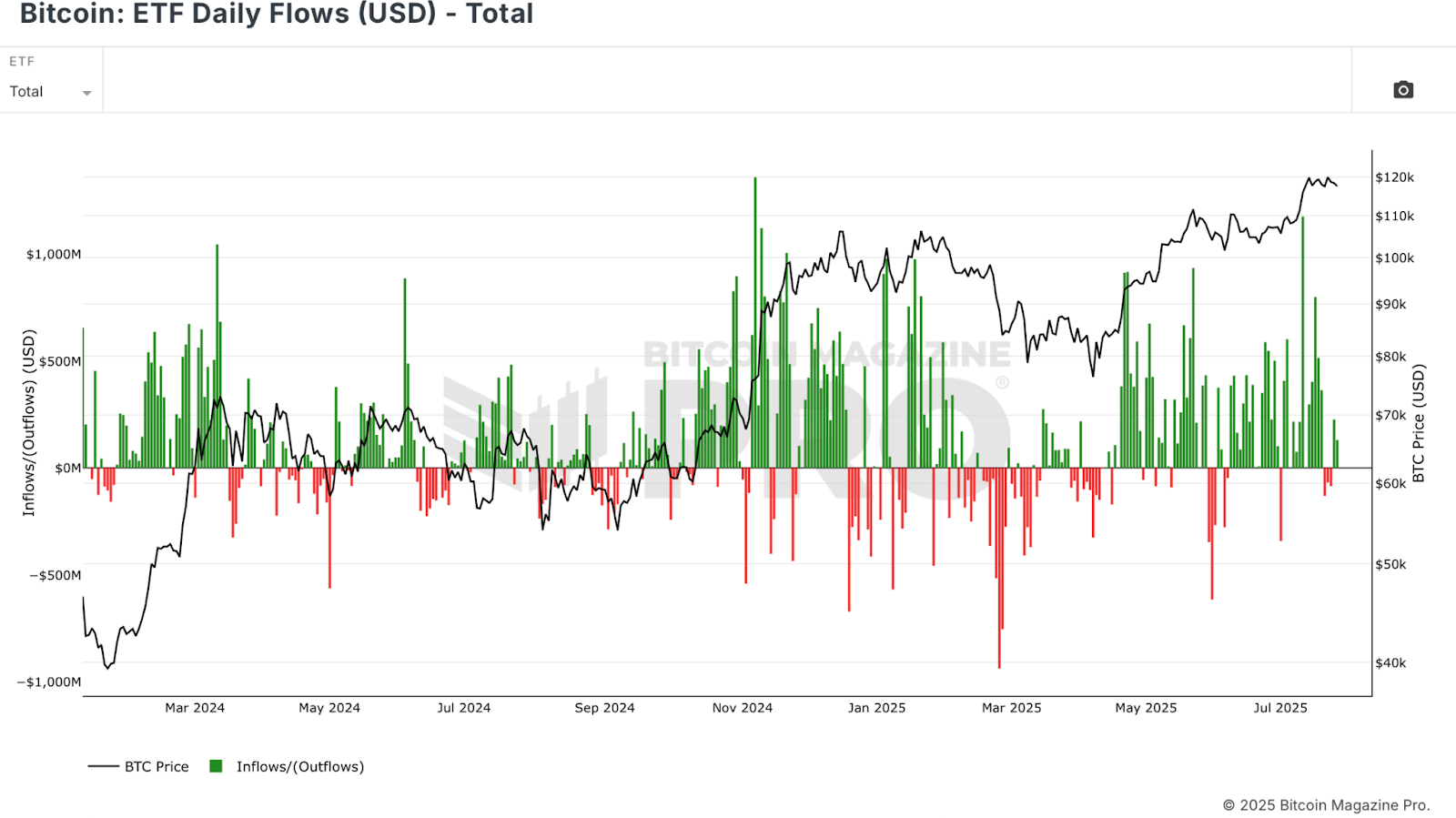

Bitcoin ETF inflows are accelerating the influence of institutional investors on the market, reshaping BTC’s supply dynamics and overall structure. As these ETFs have flooded into the space, many see this wave of institutional participation as an unprecedented shift in Bitcoin’s narrative. But what if this institutional data could be used not just to observe the market, but to outperform bitcoin itself?

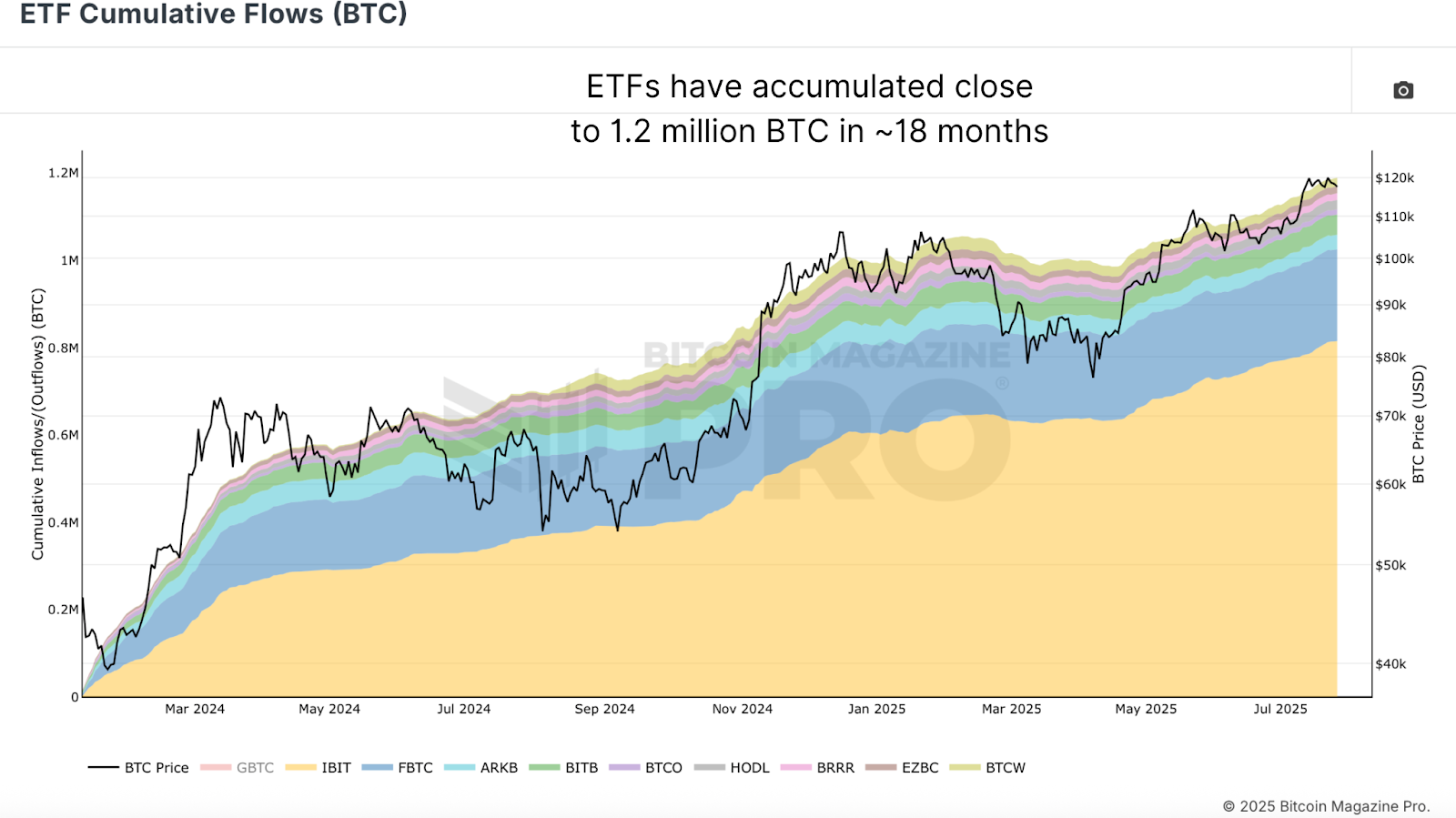

Who Really Buys Bitcoin ETFs? Defining ‘Institutional’

The term “institutional” is frequently used as shorthand for ETF buyers, but in reality, these inflows represent a mix of high-net-worth individuals, family offices, and some actual institutional funds. Perhaps only 30–40% are what we would consider true institutions. Regardless, ETF Cumulative Flows have grown exponentially to almost 1.2 million BTC since January 2024. That’s a transformative amount, arguably removing a meaningful chunk of available supply from the open market indefinitely.

This kind of accumulation, especially when paired with long-term holding behavior from treasury companies and potentially even nation-states, has permanently altered Bitcoin’s liquidity profile. These coins may never re-enter circulation.

Turning ETF Flow Data Into a Profitable Bitcoin Trading Strategy

Many assume these ETF participants are the epitome of smart money, savvy investors moving against the grain to exploit retail sentiment. But the data tells a different story. Analysis of the ETF Daily Flows (USD) chart reveals a herd-like behavior of buying heavily into local tops and capitulating at local bottoms.

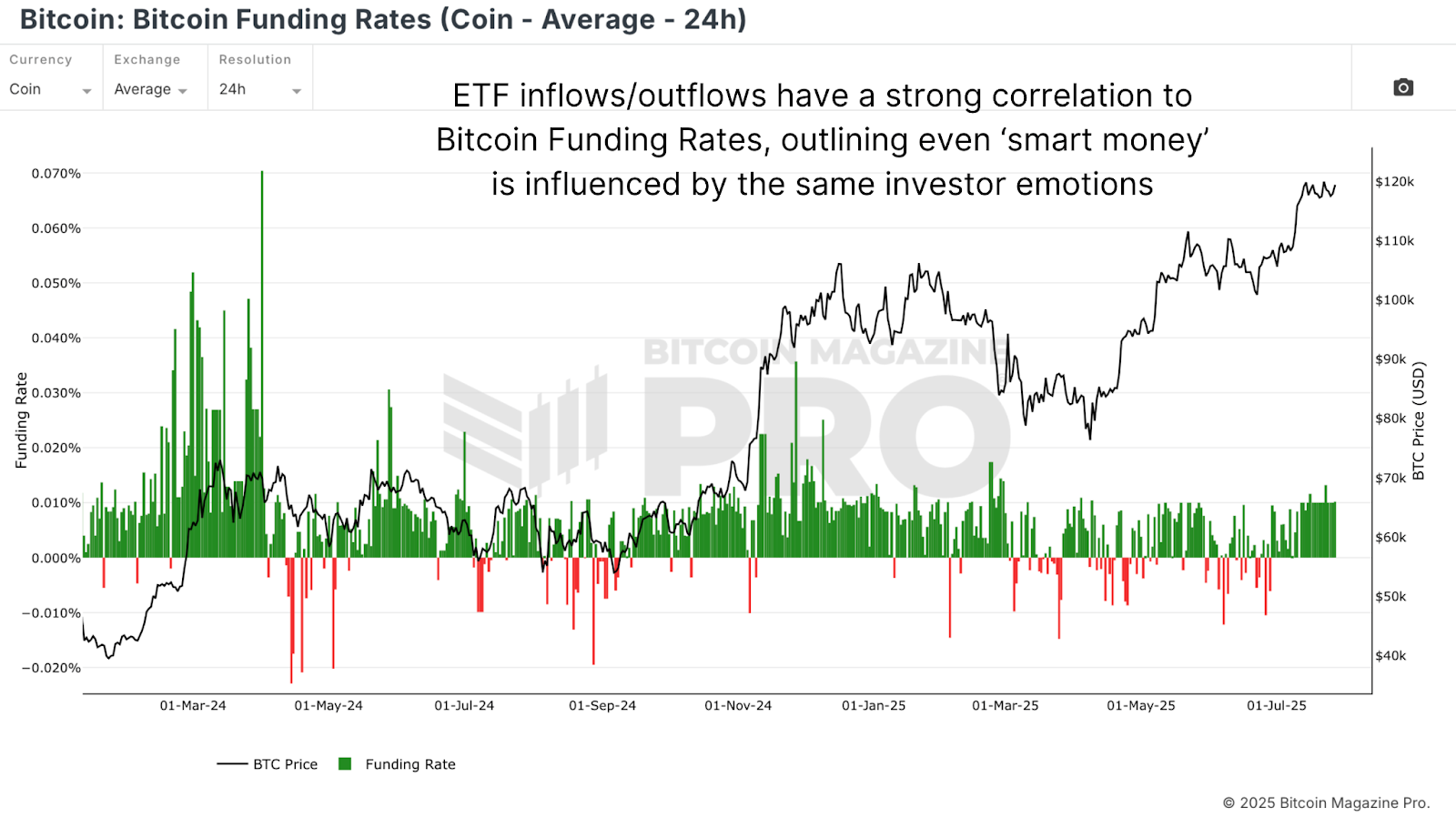

A comparison between ETF Flows and Bitcoin Funding Rates, a retail sentiment barometer, shows an uncanny synchronicity. Institutions are essentially buying and selling in lockstep with retail, not ahead of them. This shouldn’t be surprising. Human psychology, cognitive bias, and FOMO don’t stop affecting people just because they manage large sums of money. Even treasury departments of large corporations often end up buying into bullish euphoria.

Bitcoin ETF Flow Strategy vs. Buy-and-Hold: The Results

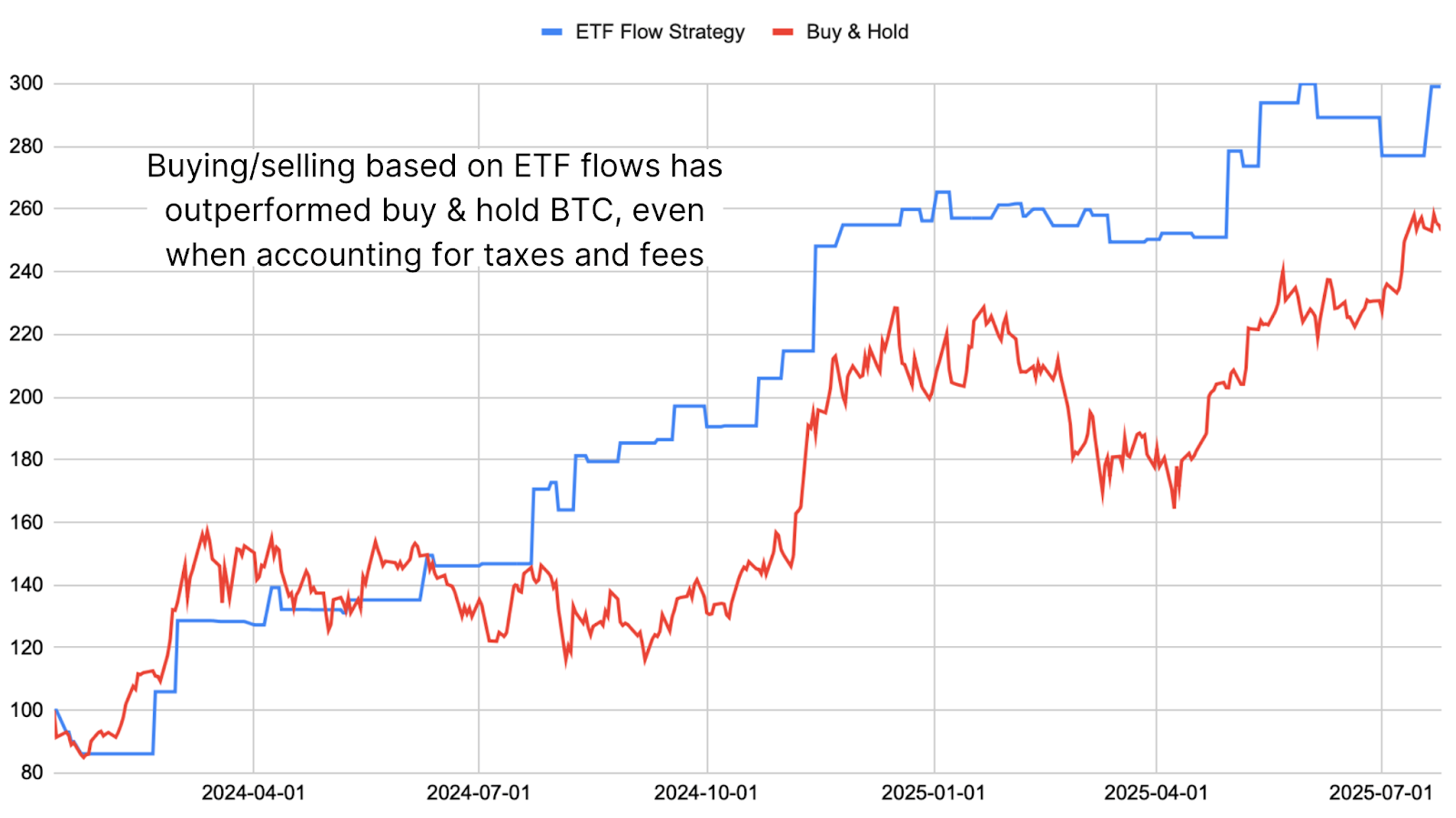

If ETF buyers are simply following the trend of buying as price increases and selling as price decreases, then their inflows and outflows can serve as a potential entry/exit signal, or better yet, as a momentum indicator when interpreted correctly. To test this theory, we created a simple strategy using ETF flow data via the Bitcoin Magazine Pro API.

The logic is straightforward: buy Bitcoin when ETFs show inflows, and sell when they show outflows. It isn’t a perfect signal; early trades show drawdowns and a noticeable underperformance compared to buy and hold, but when this strategy is applied over the full span since ETFs launched, the returns are impressive. Nearly 200% versus approximately 155% for a buy-and-hold strategy. Even when factoring in a nominal 20% taxation rate on profitable trades, the strategy still outperformed.

Should You Use a Bitcoin ETF Flow Strategy?

This kind of tactical strategy isn’t for everyone. Many Bitcoiners are long-term holders who would never consider selling. But for those willing to manage risk and capture edge in the market, this ETF-based strategy offers a way to leverage the behavior of the big market participants.

So, does following institutional flows give you an edge? On its own, probably not a consistent one. While undoubtedly impressive, it has worked this long, I personally have doubts this will work over multiple cycles. But paired with the broader market context, it becomes a useful tool for gauging the trend and reinforcing other signals to compound returns.

Loved this deep dive into bitcoin price dynamics? Subscribe to Bitcoin Magazine Pro on YouTube for more expert market insights and analysis!

For more deep-dive research, technical indicators, real-time market alerts, and access to expert analysis, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post This Bitcoin ETF Strategy Has Outperformed BTC Buy-and-Hold first appeared on Bitcoin Magazine and is written by Matt Crosby.

CryptoSlate

The following article is a guest post and opinion of Maksym Sakharov, Co-founder and CEO of WeFi

Last month, Japan’s Financial Services Agency proposed a wholesale reclassification of cryptocurrencies that would introduce a flat 20% tax on digital asset income and help introduce crypto exchange-traded funds.

For a long time, the country’s progressive tax system has imposed levies on crypto gains at rates of up to 55%, a factor many feel makes investing in crypto quite unattractive.

Institutionalized Inertia

However, this is not the only obstacle in the path of a potential Bitcoin ETF approval in Japan; it’s not even the most pressing. Late last year, Prime Minister Shigeru Ishiba seemingly dismissed the idea of crypto ETFs, questioning whether the government should promote digital assets like it does traditional investments.

His ruling coalition lost its majority in the upper house following a bruising contest that saw them fall three seats shy of the 50 needed to maintain their advantage. Yet, even as political control hangs in the balance—and Ishiba vows to stay regardless of the election outcome—one thing has remained consistent: Japan’s deep-rooted caution.

Ishiba’s noncommittal stance on ETF approvals is merely a symptom of a deeper malaise. The country’s regulatory reflex isn’t about consumer safety alone—it’s about an entrenched culture of compliance that resists risk at all costs. This mindset, not the much-maligned 55% crypto tax, is what’s truly stifling innovation.

The irony is that Japan was once ahead of neighbors like South Korea and Hong Kong. It recognized crypto as a means of payment back in 2017 and built some of the world’s earliest regulatory infrastructure. Furthermore, in the second quarter of 2024, Metaplanet kick-started a wave of Bitcoin buying by Japanese listed companies, amassing a treasury worth almost $2 billion in BTC at last count. And that’s not all. Progress has also been made in the development of stablecoins and crypto payments infrastructure, with Sumitomo Mitsui signing an MoU with Ava Labs and Fireblocks in preparation to issue fiat-pegged cryptocurrencies.

Yet, beneath these seeming success stories lies a bureaucratic labyrinth killing businesses. Under the current framework, small startups with dreams of offering virtual asset services have found it hard to meet the stringent requirements that include extensive documentation, a local bank account, a Japan-based compliance team, and at least 10 million yen in capital, among others.

Some may argue that the rules are there to protect users, and that’s valid. But couldn’t there be a happy balance between consumer protection and leeway for innovation? It almost feels like the FSA is isolating regulators from builders, with pencil pushers designing rules without stress-testing them against real-world tech constraints.

If taxes were the real barrier for Web3 innovation, the FSA’s proposed reforms would ignite a boom.

Reform Roadmap

To pivot from compliance to competitiveness, Japan needs to rewire some of its long-held approaches. For starters, the government must sunset the pre-approval model and adopt a quicker system that lets exchanges release tokens with post-launch audits. Here, tokens just need to meet baseline disclosure and security attestation requirements to be listed. Full regulatory and technical audits can then be conducted within 30 days of the launch. This way, investor protections are still preserved through enforceable audit sanctions and delisting authority, while at the same time dramatically reducing listing lead times.

The country’s regulators also have to launch dynamic sandboxes that could use zero-knowledge proofs for privacy-safe verification. There’s also a need for state capital injection. Japan could create a $500 million FSA-matched fund directly backing Web3 startups that meet security benchmarks, effectively giving it some skin in the game.

Finally, to foster cooperation and shake off its bureaucratic isolation, the financial regulator could seat tech founders on its advisory boards. This would give it a firsthand look at industry pain points, allowing it to shape policies with the end user in mind rather than to be defensive, status quo-preserving tenets.

These are not radical demands. They’re already standard in the jurisdictions that are now leading global crypto adoption.

Builders are watching. With populist parties like Sanseito gaining traction on “Japan First” rhetoric, the political winds are shifting. If Ishiba’s coalition falls, a new administration could usher in a more innovation-friendly era. But only if Japan’s regulators pivot away from their risk-averse DNA. Without that shift, tax reform will be cosmetic, ETFs will remain in limbo, and Japan’s early advantage in crypto will fade into history.

The post Japan’s crypto paralysis is cultural; tax cuts won’t fix it appeared first on CryptoSlate.

USDe has set a new industry record by hitting $10 billion in total value locked (TVL) in just 500 days, making it the fastest stablecoin in history to reach that milestone.

The protocol behind USDe, Ethena Labs, posted:

“everyone wants to know what we’d say if we didn’t reach $10b supply

i guess we’ll never know”

The GENIUS behind the rise of USDe

USDe’s rapid climb has coincided with the passing of the GENIUS Act, the Guiding and Establishing National Innovation for U.S. Stablecoins Act, which represents the first comprehensive federal framework for stablecoins in the United States.

Enacted on July 18, 2025, it imposes strict new rules on issuers, including 1:1 reserve requirements in low-risk assets, robust federal oversight for large issuers, and strong consumer protections such as priority repayment rights in the event of failure.

The most impactful provision of the ACT, however, and the catalyst behind the rise of USDe, is the prohibition on regulated issuers paying yields on stablecoins, as CoinFund president Chris Perkins told CryptoSlate:

“Under GENIUS, stablecoins do not pay interest to end users, and without interest, stablecoins are depreciating assets. So, holders will seek yield. And that’s where DeFi comes in. If the Treasury Department’s projections are correct and trillions of stablecoins come into the system, expect DeFi summer on steroids as users seek to maximize yield by engaging across a variety of yield strategies. Users will be drawn to yield-bearing vaults, and they will commission AI agents to optimize their returns.”

This ban on yield payments is causing a profound realignment in the stablecoin market. Capital that once flowed to traditional, yield-paying stablecoins such as USDC has been seeking alternatives, and much of it has landed with USDe. As prominent crypto trader, Cas Abbé, pointed out:

“The reason behind this growth is GENIUS Act approval, which prohibit issuers to provide yields on stablecoins.

Due to this, big money has now shifted to $USDe which provides lucrative yield.”

DeFi yield opportunities fuel demand

Ethena Labs has been able to attract this demand thanks to continued yield offerings via decentralized finance (DeFi) mechanisms, which fall outside the restrictions placed on federally supervised issuers. The result is a massive inflow of institutional and retail capital, propelling USDe past many of its competitors. The ENA governance token has also experienced a price appreciation of over 100% in the past month.

USDe’s $10 billion milestone is a testament to how dramatically the GENIUS Act has reshaped the stablecoin landscape. While the law tightens controls and imposes new safeguards, it has also created opportunities for nimble, DeFi-native protocols to capture yield-hungry capital, proving that regulatory shifts don’t have to stifle innovation.

The post Ethena Labs’ USDe overtakes rivals as fastest-growing stablecoin, reaching $10B in TVL in just 500 days appeared first on CryptoSlate.

A new report from Bitcoin veteran Tuur Demeester and Adamant Research argues that the current market phase may be “quiet strength” for Bitcoin; a mid-cycle stage in what could become one of the “most significant bull runs” in Bitcoin’s history.

How to position for the Bitcoin boom

The report, titled ‘How to Position for the Bitcoin Boom’, led by Bitcoin economist and early investor Tuur Demeester, projects that there’s still potential for a 4–10x price appreciation from current levels, which would mean targets above $500,000 per BTC in the years ahead:

“We think this is the mid-cycle in what could become one of the most significant bull runs in bitcoin’s history. From its current range, we believe there is still a path toward a 4-10x value appreciation, which would imply bitcoin price targets north of $500,000.”

Several indicators support this thesis, as on-chain trends suggest a deep conviction among experienced holders. For example, according to the report, larger investors (whales) are holding, not dumping. The HODLer Net Position Change shows no sign of large-scale capitulation so far in 2025, a behavior commonly associated with market peaks.

“Whales have been moving some coins in the last two years, when bitcoin re-tested previous all-time highs during a tumultuous US election. However, nowhere in 2025 have HODLers been net movers of over 100,000 coins in a day, which historically has been indicative of selling activity during late stage exuberance.”

Another metric is the Net Unrealized Profit/Loss (NUPL), which suggests that 50–70% of the Bitcoin supply sits in unrealized profit. This is more consistent with healthy, mid-cycle optimism rather than late-stage euphoria.

Potential headwinds remain low-probability

The report outlines possible catalysts for a correction but sees limited risk of them derailing the bull market. For example, a major hack could dent confidence, yet past examples barely impacted the BTC price:

“We think only in extreme cases could a hack actually arrest or end the bitcoin bull market. When 120,000 bitcoin was stolen from Bitfinex in 2016, it barely registered in the price.”

Moreover, Mt. Gox and bankruptcy coin distributions have been absorbed quickly by market demand, with a July 2025 liquidation of 80,000 BTC moving prices just 4%.

A massive 10% of the Bitcoin supply is reportedly being held by Coinbase, which could pose a centralization risk. However, ETF issuers have begun diversifying their custody options, and custody seizures have low odds under the current U.S. administration, which is actively integrating Bitcoin into its financial policy.

While a macro crash could cause short-term volatility, the report expects Bitcoin to resume outperforming commodities and inflation over the longer term.

Tuur Demeester is firm: Bitcoin over altcoins

The report makes a clean break from its 2015 advice to keep a small altcoin allocation, instead recommending holding Bitcoin exclusively and avoiding scattering capital across “vastly inferior” projects that lack its network effect, security model, and monetary purity.

The authors compare BTC’s role to the base layer of the internet, a singular, dominant protocol, and predict rivals like Ethereum, Ripple, and Cardano will lose relevance over time.

Tuur Demeester singles out “long-term store of value” demand as the core engine of Bitcoin’s current and future growth. This is driven by several factors, including persistent inflation, fiscal deficits, bonds losing their decades-long safe-haven status, real estate’s diminishing appeal as a hedge, and capital rotation toward liquid, low-counterparty-risk assets.

After El Salvador’s 2021 legal tender move, U.S. adoption has accelerated under pro-Bitcoin policies from the Trump administration, such as the creation of a National Strategic Bitcoin Reserve, supportive legislation like the GENIUS Act, and rapid uptake of spot Bitcoin ETFs, which now hold around 1.4 million BTC.

Such aggressive moves by the U.S. are pushing other nations to explore their own Bitcoin strategies. As the report points out:

“These strong endorsements are beginning to cause a global ripple effect.”

When it comes to how much Bitcoin investors should allocate to their portfolios, several factors should be considered, such as risk tolerance and conviction levels. According to the report, a 5% allocation serves as insurance against systemic risks, whereas doubling that to 10% is seen as a speculative hedge in a diversified portfolio. Holders with a 20–50% allocation signal their high conviction and “early retirement” play.

When it comes to custody, the report favors collaborative multi-signature setups as the best balance between self-sovereignty and operational safety, especially for new adopters.

Mid-cycle, not the peak

Tuur Demeester and Adamant Research see Bitcoin’s current bull market as far from over, with institutional adoption, macroeconomic tailwinds, and strong holder conviction setting the stage for potentially historic gains.

This is “mid-cycle,” not the peak, and if Bitcoin delivers on its store-of-value promise, the next few years could redefine its place in the global financial system.

The post Bitcoin’s ‘mid-cycle strength’: Tuur Demeester predicts $500k target and historic institutional bull run appeared first on CryptoSlate.

President Donald Trump issued a debanking executive order this week aimed at stopping what his administration described as unfair banking discrimination toward the crypto sector.

Will the order be the definitive blow to the so-called Operation Choke Point 2.0? Will banks that debanked crypto companies unfairly be forced to reinstate them? Custodia Bank founder and CEO Caitlin Long dives into the finer points of the order:

Debanking executive order installs independent overseer

The first “hidden gem,” according to Long, is that Trump’s debanking executive order installs an independent overseer, highlighting the administration’s reservations with the existing three federal banking regulators, the FDIC, the Federal Reserve (Fed), and the Office of the Comptroller of the Currency (OCC).

Instead, it places the Small Business Administration (SBA), a non-bank regulator, as an independent overseer above these agencies to monitor debanking issues. This looks an awful lot like a lack of faith in existing agencies’ willingness or ability to address political and unfair debanking practices.

The SBA’s leader is a long-time Bitcoiner, Kelly Loeffler

President Trump picked Kelly Loeffler, a former senator, business executive, and known supporter of Bitcoin and the broader crypto industry, to lead the SBA. This appointment speaks volumes in the crypto community, as Loeffler was the CEO of Bakkt, an institutional bitcoin futures platform, before her Senate career.

The decision to place her in charge of monitoring debanking is an indication that this administration is serious about reform and that its trust in the previous regulatory agencies is low.

Political leanings inside the banking agencies

Long highlights the political leanings of staff at agencies like the Fed and FDIC. According to contribution records, a large majority of donations from Fed and FDIC staff went to Democratic candidates in recent elections, with Long placing the figure as high as 92% for Democrats in 2024.

This raises concerns for some that regulatory actions may have been driven by partisan biases, especially given the history of crypto-related “debanking” during the Biden administration.

Definition and scope of ‘politicized or unlawful debanking’

Trump’s debanking executive order defines “politicized/unlawful debanking” broadly, focusing on “lawful business activities” rather than naming crypto or any specific sector. This language means banks can no longer refuse service simply because a business is a crypto firm if it is otherwise in compliance. The order targets not just crypto companies, but any lawful firms that may face political discrimination. As Long points out:

“Banks that refused to serve or debanked lawful crypto companies are on the hook.”

The litmus test: Custodia and other crypto banks

Custodia Bank previously faced debanking after regulators pressured multiple banks to cut ties due to their crypto business, even though the bank had a clean compliance record.

Long asserts that the true test of Trump’s debanking executive order will be whether banks that debanked Custodia (and similar crypto firms) are compelled to reinstate them. The order’s success, then, will be measured by real outcomes in banking access for crypto companies.

“If they reinstate us, then the EO succeeded”

The post Custodia Bank founder Caitlin Long dives into Trump’s debanking executive order appeared first on CryptoSlate.

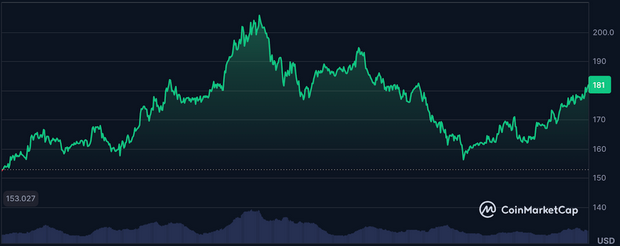

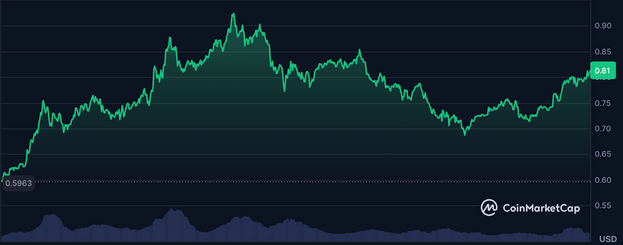

Altcoin traders can hardly contain themselves as the long-awaited breakout appears to have begun. ETH posted gains of over 20% the last seven days and smaller cap coins like SOL, DOGE, and BNB are close behind, with Chainlink’s LINK token up 30% in the same timeframe. Does this mean alt season finally here?

A painful bull market for altcoin traders

2025 has been a stellar year for Bitcoin, seeing the number-one crypto climb steadily higher, marking a fresh all-time high of ~$122,838 on July 14, fueled by rising institutional demand and a favorable regulatory climate stateside.

The same cannot be said of altcoins, which have languished far from their peak levels. Ethereum’s lackluster performance, in particular, caused divisions within its community, leading many to question whether the divergence between technology and price was an existential issue.

Just as ETH price was beginning to break out and see sustained momentum, renowned trader and former BitMEX CEO Arthur Hayes rattled ETH holders, selling 2,373 coins from his stash and forecasting near-term headwinds for the number-one alt, which, he believed, would test the $3,000 mark based on a weaker-than-expected jobs report and a short-term slowdown in global liquidity.

Those who continued to HODL their ETH are feeling euphoric today as ETH price has surged more than 50% in a month, with some prediction platforms forecasting price targets over $60,000. Even Hayes has taken to crypto Twitter this morning to admit the folly of his decision, tagging Tommy Lee’s Fundstrat, now the largest holder of ETH, with the words:

“Had to buy it all back, do you forgive me? I pinky swear, I’ll never take profit again.”

Is alt season finally here?

With Hayes back on board, BTC and crypto allowed in 401ks, and Ethereum bulls from Buterin to Bankless, finally believing in the strength of this latest rally, does this mean that the long-awaited alt season is finally here?

It certainly looks that way as smaller-cap coins begin to pump across the board. Before you get over your skis, however, take note: this year’s alt season may differ from previous cycles. As prominent day trader and LINK ambassador Ito Shimotsuma, points out:

“Each #Altseason is smaller than the previous ones. And this is why I tell you to focus more on DYOR. In 2017, any random ICO pumped 100x. In 2021, any VC backed alt pumped 50x-100x. This time, very selective alts will outperform. Look for those alts with strong narrative and revenue sharing.”

Another well-known altcoin trader, Miles Deutscher, similarly exercises more caution, confirming that, in his opinion, a mini alt season is finally happening, but watch out for the rotation back into BTC between the $120-140K mark.

Into the Cryptoverse founder Benjamin Cowen is notably less bullish on alts, warning:

“This is not alt season.

This is ETH season

Let’s not confuse the two”

Is Bitcoin’s rally finally over?

With Ethereum and alts pumping, Bitcoin is currently being outperformed, and Bitcoin dominance has dropped to 59.2% at the time of writing after months of holding steady over 60%.

According to Bitcoin macro strategy analyst ecoinometrics, Bitcoin’s correlation with the Nasdaq is behind this recent stall.

“Bitcoin’s correlation with the Nasdaq helps explain recent price action.

When stocks dropped sharply late last week, Bitcoin followed. That’s what you expect when correlations are elevated.

Now that the Nasdaq is resuming its uptrend, Bitcoin is moving with it again.”

All eyes will be on the broader macro picture moving into next week to see what Bitcoin’s next move will be, and how long this alt season may last.

The post As Ethereum rips and smaller caps follow, is alt season finally here? appeared first on CryptoSlate.

Cryptoticker

The cryptocurrency market might be about to get another high-profile entrant with heavyweight political ties. World Liberty Financial (WLFI), the DeFi project backed by the Trump family, is in advanced talks to raise $1.5 billion for a publicly traded treasury company that will hold its WLFI tokens. Bloomberg reports that Eric Trump and Donald Trump Jr. are expected to sit on the board.

Why Is World Liberty Financial (WLFI) Creating a Treasury Company?

Treasury companies in crypto are gaining traction because they provide a publicly listed, regulated entity to hold and manage digital assets. This structure can give investors indirect exposure to a token without directly holding it, potentially attracting capital from institutions that have compliance or custody constraints.

WLFI’s move mirrors the playbooks of other projects building treasuries around core tokens, with the twist that its portfolio already spans multiple major and emerging assets. Arkham data shows holdings of $55 million in Ethereum (including staked ETH), $19 million in wrapped bitcoin, $14 million in Tron, plus positions in EOS, Mantle, Ondo, and more. This diversification could make its treasury less volatile compared to single-asset strategies like MicroStrategy’s bitcoin-only approach.

How Will WLFI Token Trading Impact the Market?

Currently, WLFI tokens aren’t tradable. That changes soon, thanks to a near-unanimous July community vote approving market access for early investor tokens. However, the rest of the 100 billion supply remains locked until a second vote determines the release schedule.

This phased approach could reduce immediate sell pressure, but it also means that price discovery will happen with limited liquidity at first. If early backers see strong demand, the token could experience sharp volatility—both upward from speculative hype and downward from profit-taking.

The big wildcard is the size of the $1.5 billion raise. If achieved, it could create a perception of deep-pocketed backing, which often fuels momentum buying. On the flip side, failure to secure significant funding might deflate early enthusiasm.

What Role Does the USD1 Stablecoin Play?

WLFI is also pushing adoption of its USD1 stablecoin, with plans to reward users through a points system. Stablecoin incentives have historically been a powerful growth engine in DeFi ecosystems, attracting liquidity providers and traders who later convert rewards into the project’s native token.

If USD1 gains meaningful transaction volume, WLFI could create a recurring revenue stream from stablecoin operations, helping sustain its treasury and potentially supporting WLFI’s value during market downturns.

Potential Price Scenarios for WLFI Post-Launch

Given the combination of celebrity branding, political influence, and a sizable crypto treasury, WLFI could see one of two paths post-listing:

- Hype-driven rally: Limited float and intense speculation drive the token sharply higher in early trading, especially if the $1.5 billion raise is confirmed.

- Whipsaw volatility: Early backers cash out on initial strength, triggering steep pullbacks before the market stabilizes.

In either case, the long-term trajectory will depend on actual adoption of WLFI’s ecosystem, treasury growth, and the credibility of its governance.

Risks to Watch

- Regulatory scrutiny given the Trump family’s political involvement and the project’s U.S. exposure.

- Liquidity shocks if large token unlocks happen too quickly.

- Treasury management risks, especially if holdings concentrate in volatile assets without proper hedging.

Bottom Line

WLFI’s debut on exchanges could be one of the most closely watched token launches of the year. Its mix of political star power, diversified treasury assets, and a phased token unlock schedule sets the stage for a potentially explosive—but risky—market entry. Traders should expect heavy volatility and keep an eye on treasury disclosures, community governance votes, and the progress of the $1.5 billion funding round.

$WLFI, $WorldLibertyFinancial, $USD1, $crypto

Bitcoin ($BTC) is back in the spotlight as prices recover to $118,236 after briefly dipping to $112,600 earlier this week. The rebound, supported by a break above a long-term descending trendline, has reignited bullish sentiment. Traders are now asking the big question: can BTC finally break above $120,000 and set the stage for a new rally?

Bitcoin Chart Analysis: What's Happening to BTC Coin?

The 4-hour BTC/USD chart shows a clear breakout from the descending resistance line that has capped price since mid-July. This breakout coincided with the price moving above both the 50-day SMA at $115,225 and the 200-day SMA at $116,673 — a bullish technical signal suggesting momentum is shifting upward.

The RSI is currently at 62.97, indicating that BTC has room to push higher before entering overbought territory. However, $118,616 remains a strong resistance level; a daily close above this zone could open the door toward $120,000 and beyond.

BTC/USD 4-hours chart - TradingView

Key Support & Resistance Levels

- Immediate Resistance: $118,616

- Major Resistance: $120,000

- Immediate Support: $116,673 (200 SMA)

- Key Support: $112,142 – $111,350

If $Bitcoin fails to hold above $116,673, a drop toward the $112,000 zone is possible, where strong buying interest could re-emerge.

Bitcoin Price Prediction: Market Outlook and BTC Future Price

The breakout above trendline resistance is a strong technical development. As long as BTC maintains support above $116,000, the path of least resistance remains upward. A confirmed close above $120,000 could set the stage for a push toward $123,500 and potentially $130,000 in the coming weeks.

Trading Strategy Considerations: How to Trade BTC Today

Traders may look for long entries on retests of the breakout level ($116,700–$117,000) with targets near $120,000 and $123,500. Risk management remains key, as rejection at $120K could trigger a pullback to lower supports.

👉 Click here to start Trading Bitcoin and get up to 100 euros with OKX 👈

Bitcoin’s recent rebound has put bulls back in control, but the battle at $120K will determine whether this is the start of a major rally or just another short-term spike. For now, the technical setup favors further upside.

The $crypto market is seeing renewed volatility as $Bitcoin rebounds above $118,000 and $Ethereum holds near $4,200 after recent highs. In a political twist, Bo Hines, White House crypto adviser to President Donald Trump, has announced his resignation — a move that could shift the administration’s digital asset policy.

Bitcoin Holds Above $118K

After dipping to $112,600 earlier this week, Bitcoin ($BTC) has bounced back, currently trading just above $118,000. The recovery follows a consolidation phase and renewed buying interest near major support levels. Analysts suggest the next hurdle lies at $120,000, where strong resistance could decide the next market direction.

BTC/USD 4-hours chart - TradingView

Ethereum Corrects After Breaking $4,300

Ethereum ($ETH) briefly broke the $4,300 level, signaling strong bullish momentum, before a minor pullback brought it to around $4,200. While the correction is seen as healthy, traders are closely watching whether $4,000 holds as a key support in the coming days. A sustained bounce from this level could set up a push toward $5,000.

ETH/USD 4-hours chart - TradingView

White House Adviser Bo Hines Steps Down

Bo Hines, who chaired the Council of Advisers on Digital Assets under the Trump administration, confirmed his departure on Saturday, saying he will return to the private sector. Late last month, Hines led a cryptocurrency working group that outlined the administration’s stance on digital asset regulation, urging the SEC to draft specific rules for the sector. His resignation raises questions about continuity in U.S. crypto policy.

Crypto Market Outlook

The market remains cautiously bullish, with Bitcoin, Ethereum, and several altcoins holding above key support zones. However, political developments and macroeconomic conditions could spark volatility ahead. Traders are advised to monitor both price action and policy headlines closely.

OKX Launches in Germany & Austria

OKX is officially launching in Germany and Austria. To celebrate this milestone, they’re offering a special campaign where you can earn up to 100€ in Bitcoin just by completing a few simple tasks.

Campaign Dates:

- Start Date: July 24, 2025 (10:00 am UTC+2)

- End Date: August 21, 2025 (11:59 pm UTC+2)

Whether you’re new to the world of crypto or a seasoned trader, now is the perfect time to join OKX, especially with their exciting launch offer.

--> Open an acount with OKX, start here <--

How to Participate and Earn

The process is simple. Here’s how you can start earning:

Sign Up & Complete ID Verification

To get started, sign up for an OKX account via the campaign page and complete your ID verification. Once verified, click the 'Join now' button to begin earning your rewards.

Complete Tasks and Earn Bitcoin

After joining, complete various tasks in any order to earn Bitcoin. Each task you complete will bring you closer to the full 100€ reward.

Tasks Include:

- Refer a friend and earn 20€ in Bitcoin

- Make your first deposit of 100€ or more

- Make your first trade of 100€ or more

- Make a deposit of 250€ or more

--> Start trading with OKX, Open an account here <--

Why OKX?

OKX is quickly gaining recognition as a top-tier exchange globally, and its launch in Germany and Austria is an exciting opportunity for those looking to get involved with one of the most innovative platforms in the crypto space. By joining OKX early, you not only get the chance to earn rewards, but also position yourself to take advantage of their advanced trading features, low fees, and strong security.

Starting with a trusted exchange like OKX is always a smart choice, especially with their solid reputation for fast transactions, a wide variety of crypto assets, and top-notch customer support.

Limited-Time Offer – Don’t Miss Out!

This exclusive offer is available for a limited time, and it operates on a first-come, first-served basis. With the campaign end date extended to August 21st, there’s still time to sign up, complete your tasks, and claim your rewards – but don’t wait too long!

Remember, the offer is only available to residents of Germany and Austria, and you must complete the required tasks before the campaign ends to qualify for your Bitcoin rewards.

Dogecoin price has entered August with a recovery that is starting to draw attention from traders and long-term holders alike. This rebound is not just a price action story; it is backed by stable network performance and favorable on-chain conditions. With DOGE price currently priced at 0.1726 USD, up 5.19 percent over the past 24 hours and 4.30 percent over the past week, momentum is tilting back toward the bulls after a choppy start to the month.

Dogecoin Price Prediction: Technical structure signals a possible breakout

The daily chart shows that Dogecoin found a firm base at the 0.185 support zone, an area that has repeatedly attracted buying interest. From there, price has climbed back above the 20-day simple moving average, often the first step in flipping short-term momentum from bearish to bullish. The current challenge lies at the 0.245 resistance, which coincides with the upper Bollinger Band. This level is critical because it marked previous rejection points during past rallies.

Bollinger Bands are starting to expand after weeks of narrowing. Band expansion following a support bounce typically indicates that volatility is returning, often leading to a decisive directional move. If DOGE can close above 0.245 with strong volume, the technical setup favors a push toward 0.285 and potentially 0.305. In a more aggressive scenario, a high-momentum breakout could stretch toward 0.35, especially if the wider crypto market is supportive.

Moving averages and momentum indicators

The 20-day moving average has already been reclaimed, and the 50-day is now the next objective. A close above both would confirm the shift in market structure and attract more momentum traders. If the 20-day crosses above the 50-day, that bullish crossover would be an additional technical confirmation. On the momentum side, indicators such as RSI and MACD should be monitored for divergence or confirmation, as these could either validate or challenge the breakout narrative.

Risk levels to watch

The bullish setup would be invalidated if price fails to break 0.245 and instead retreats below 0.224. In that case, DOGE would likely revisit 0.20 and potentially retest the 0.185 base. A breakdown below 0.185 would shift sentiment back toward sellers and delay any significant recovery.

Dogecoin News: Network fundamentals remain strong

Beyond the chart, Dogecoin’s network health adds another layer of support for the bullish argument. Mining difficulty sits at 25.98 MH, reflecting a stable mining environment without signs of miner capitulation or security concerns. The block height of 5,828,377 confirms that block production remains consistent, a sign of operational stability.

One of Dogecoin’s enduring strengths is its extremely low transaction cost. Even the fastest transactions cost just $0.000060 per byte, making it one of the cheapest major cryptocurrencies to move across the network. This cost advantage supports its ongoing use in microtransactions, tipping, and retail payments, which can maintain organic demand for DOGE regardless of speculative trends.

The interplay between technicals and fundamentals

The combination of a bullish technical recovery and solid network metrics creates a more convincing case for a sustained move higher. Price action shows accumulation at key support, while network conditions reinforce investor confidence. This alignment means that if technical resistance is breached, the move could carry further than it would on technical momentum alone.

Dogecoin Price Prediction: Short-term and medium-term forecast

In the short term, clearing the 0.245 resistance with above-average daily volume is the key trigger. If that happens, DOGE price has room to test 0.285 within one to two weeks, followed by 0.305. If the breakout coincides with a broader rally in Bitcoin and Ethereum, the 0.35 level could be reached before sellers step in. In the medium term, holding above 0.285 would be crucial to sustain a bullish cycle that could eventually challenge the 0.40 zone.

On the other hand, failure to break 0.245 or a sudden shift in market sentiment could pull Dogecoin price back into the 0.20 to 0.185 range, turning the current rally into a short-lived bounce rather than the start of a lasting uptrend.

Dogecoin News: Final outlook

Dogecoin’s recovery is at a critical juncture. Technical charts suggest that the groundwork for a breakout is being laid, with moving averages, Bollinger Bands, and support levels aligning in favor of buyers. Network stability, low fees, and healthy mining activity further strengthen the case for a continuation of the rally. The next move will depend on how price reacts to the 0.245 resistance. Break above it with conviction, and DOGE could be on its way toward 0.30 and beyond. Fail to clear it, and the market may be looking at another round of consolidation before the next attempt.

How to Trade Dogecoin?

- Identify your exchange – Compare fee structures and liquidity using our exchange comparison guide.

- Monitor price levels – Watch the price levels closely.

- Understand the asset – For new traders, read up on blockchain basics to appreciate the technology behind DOGE.

For live pricing and charts, visit the DOGE price page.

$DOGE, $Dogecoin, $DOGEPrice, $DogecoinPrice

Decrypt

Built into social media platform X, Grok is Musk’s edgy AI chatbot—real-time, irreverent, and mired in controversy.

Russian hacking group GreedyBear has scaled up operations, using 150 “weaponized Firefox extensions” to target victims and steal crypto.

The world's best players watched these supposedly brilliant AIs play like confused beginners.

Hï Ibiza, The Night League, and W1 Curates have launched a permanent art gallery inside a nightclub, featuring digital and physical works.

Creator of vintage internet meme Nyan Cat has claimed $700,000 in royalties associated with meme coins, but does not endorse them.

U.Today - IT, AI and Fintech Daily News for You Today

12 years since Satoshi contender's last Bitcoin message

New XRP price prediction points to $11 if this triangle pattern validates

Ethereum at $4,200 could be best risk-reward play in years

How long can bounce back of Bitcoin (BTC) last?

Can price of Cardano (ADA) rise upcoming week?

Blockonomi

In 2025, XRP, Shiba Inu, and Solana remain dominant in discussions, but Rollblock is gaining traction and diverting attention from these top altcoins.

This GameFi project tackles gaming fraud by recording every result on-chain, ensuring transparency and trust.

Its value-driven approach and strong fundamentals have analysts predicting RBLK could outperform bigger rivals, making it one of the year’s high-potential crypto plays.

Ripple Ends Long-Lasting Battle with the SEC

XRP is holding above $3.20 after Ripple closed its five-year legal battle with the U.S. SEC. Both sides dropped their appeals, removing a major overhang that had weighed on the XRP token since 2020.

The resolution triggered a sharp swing. The XRP price dipped from $3.34 to $3.20 before rebounding to test the $3.31–$3.33 resistance zone, where sellers are now pushing back.

The legal clarity has boosted investor confidence in the XRP token. Analysts have noted renewed interest from Japan-based funds, an important signal given Asia’s growing role in XRP adoption.

Shiba Inu Eyes Bullish Rally as Governance Shifts

Shiba Inu (SHIB) has climbed 4% in the past 24 hours to $0.00001289, pushing weekly gains to 6% on $313 million in trading volume. Analyst Javon Marks points to a bullish MACD divergence, suggesting that momentum could carry Shiba Inu toward $0.000032.

While Shiba Inu’s chart shows upside potential, the community is navigating internal tensions. Elections for an interim president are underway as part of Shiba Inu’s fifth anniversary celebrations and as a result SHIB could experience price fluctuations over the next quarter.

Solana Gains Massive Institutional Support

Solana (SOL) is seeing a sharp rise in corporate treasury adoption, with holdings in 2025 jumping from 173,000 SOL to 3.44 million SOL, now valued at roughly $647 million. The latest entrant, biotech firm iSpecimen, plans a $200 million Solana treasury as part of its digital asset strategy.

They join a growing list of institutional holders, including Upexi, DeFi Development Corporation, SOL Strategies, and Neptune Digital Assets, all attracted by Solana’s combination of growth potential and staking yields exceeding 7% annually.

On the market side, Solana is trading at $176, with $180 acting as a key resistance. A decisive breakout here could open the way for a retest of recent highs.

Rollblock Revolutionizes the $450 Billion Gaming Market with Crypto

The online gaming industry generates over $450 billion annually, but scams have surged 64% in two years and are expected to continue growing in 2025. Rollblock tackles this with a fully transparent Ethereum-based platform where every game result is on-chain.

Rollblock offers 12,000+ AI-powered games, from classic tables to sports betting, backed by an Anjouan Gaming Authority license and SolidProof audit. Running for over a year, it serves thousands daily with regular new games and features. Here are some more things that continue to attract investors and players:

-

Fully licensed under Anjouan Gaming

-

Up to 30% of profits are redistributed to token holders

-

New games and features are added regularly

-

Sports betting on the biggest events like the Club WC and UFC