AI pressure points in tech labor are real, and Bitcoin will feel them through macro, not mystique

After years of claims that AI will cause chaos in the labor market, sentiment seems to be at an all-time low around AI layoffs, with social media accounts surfacing to track how fast white-collar tech work is already being hollowed out.

Reality is less straightforward. Companies are cutting selectively, management teams are using AI and efficiency language more openly, and hiring is shifting toward AI-heavy and infrastructure-heavy roles faster than unemployment is rising. That gap suggests the labor market narrative is changing before the labor market has fully broken.

The strongest evidence sits at the company level. Amazon confirmed a relatively small round of robotics cuts on March 4. Block said it would cut 4,000 of 10,000 employees, with Jack Dorsey tying the move to AI productivity. Pinterest said it would trim less than 15% of staff while reallocating toward AI-focused roles. Atlassian announced about 1,600 cuts and said AI is changing the mix of skills it needs.

Those are the on-record examples of management teams changing headcount plans around AI, productivity, and restructuring.

But posts on social media, suggesting that AI has already produced a clear, economy-wide white-collar employment shock, still run ahead of the data.

Anecdotal stories are now capturing real fear within software organizations. However, they do not, on their own, verify every dramatic claim about team replacement, performance-score purges, or overnight engineering compression.

The most important case from here is Oracle, because it ties labor pressure directly to AI infrastructure finance.

Oracle said on February 1 that it plans to raise $45 billion to $50 billion in 2026 to expand OCI for customers, including AMD, Meta, NVIDIA, OpenAI, TikTok, and xAI.

Oracle has also expanded its restructuring reserve to $2.1 billion and is preparing significant cuts. But the 30,000-layoff figure circulating online remains a reported possibility, not a company-confirmed number.

The macro backdrop is soft enough to make those reports believable. In the February jobs report, U.S. nonfarm payrolls fell by 92,000, unemployment held at 4.4%, and information-sector employment fell by 11,000 in the month after averaging losses of 5,000 per month over the prior year. That is not a labor-market collapse.

It is a sector-specific warning light. Software, media, and digital-platform hiring still look weaker than the broader economy, which helps explain why AI-driven cuts are finding such a receptive audience in markets and on social media.

Layoffs are elevated, but the clearest damage is showing up in role mix and entry-level hiring

The layoff data supports a more selective thesis than the doomer feeds suggest. Employers announced 48,307 cuts in February and 156,742 cuts year to date, while the technology sector led all industries with 33,330 cuts year to date, up from 22,042 a year earlier.

Challenger also said AI was cited for 4,680 February cuts and 12,304 cuts year to date, while announced hiring plans were down 56% from the same period of 2025. That is not trivial. Boards and management teams are now comfortable naming AI as part of a cost-cutting rationale.

Still, that does not prove mass AI unemployment in real time. The better-supported dynamic is entry-level compression and role reallocation.

Anthropic’s March 5 labor-market study found no systematic increase in unemployment for highly exposed workers since late 2022. It did, however, find suggestive evidence that younger workers entering exposed occupations are facing weaker hiring conditions.

The study estimated that for every 10-point increase in observed AI exposure, projected job growth falls by 0.6 percentage points. It also found a roughly 14% drop in job-finding rates for young workers entering exposed occupations in the post-ChatGPT period, though that estimate was only barely statistically significant.

That is the part of the ladder investors and operators should watch first. AI does not need to erase entire departments to reshape labor markets. It only needs to slow new hiring enough that the bottom rung narrows, promotion funnels tighten, and managers start expecting more output from fewer people.

Once that happens, the effects on compensation, retention, and startup formation can arrive before the effects on headline unemployment become obvious.

Even Anthropic’s capability data points in that direction. In computer and math work, Claude’s observed real-world coverage was 33%, compared with 94% theoretical potential.

In plain terms, the tools are powerful, but actual deployment across workflows remains far below their ceiling. That gap helps explain the current contradiction: executives are talking as if the reorganization is already here, while labor statistics still show a messier, slower transition.

CompTIA research found nearly 380,000 tech jobs were actively posted in December, with 162,000 new postings and 94,067 active postings citing an AI skill requirement, up 111% year over year. The same research said 64% of companies acknowledge using AI as cover for staffing decisions, while many firms that replace roles with AI also redeploy or add staff elsewhere.

That is why AI-linked layoffs can be both real and overstated at the same time. The rhetoric is broad. The measured labor effect is still uneven.

| Indicator | Latest figure in the pack | What it points to |

|---|---|---|

| U.S. nonfarm payrolls | -92,000 in February 2026 | Broader labor softness, but not a collapse |

| Information-sector employment | -11,000 in February 2026 | Persistent pressure in software, media, and digital platforms |

| Tech-sector cuts | 33,330 year to date | Layoffs remain elevated versus 2025 |

| AI-cited cuts | 12,304 year to date | AI is now an explicit boardroom rationale |

| Active postings with AI skill requirements | 94,067 | Demand is concentrating around AI-linked work |

| Young-worker job-finding rate in exposed occupations | Roughly 14% lower | Entry-level hiring looks like the first fault line |

Selective hiring is still alive, which is why the labor reset looks more like repricing than extinction

The strongest counterweight to the viral collapse narrative is that hiring has not frozen across tech. CompTIA’s March 2026 snapshot showed software developer and engineer postings at 50,743 in February, up 4,830 month over month. AI engineer postings rose to 9,875, up 1,044, while IT and custom software services employment rose by 5,900.

That is the opposite of a uniform hiring shutdown. It shows that companies are still paying for scarce technical labor tied to AI, systems, and infrastructure even as they trim elsewhere.

Long-term government projections point in the same direction. The BLS outlook says computer and information technology occupations are projected to grow faster than average from 2024 to 2034, with about 317,700 openings per year on average.

That baseline does not fit a clean job-apocalypse frame. It points instead to a mix shift: fewer generic seats, more demand for workers who can build, govern, secure, and integrate AI into revenue-producing workflows.

That is also where long-run forecasts converge. The World Economic Forum projects structural labor-market change will create the equivalent of 170 million jobs and displace 92 million from 2025 to 2030, for a net gain of 78 million globally.

It also says 39% of current skills will be transformed or outdated, and 40% of employers expect to reduce staff where skills become less relevant, or AI can automate tasks.

Goldman Sachs says widespread AI adoption could displace 6% to 7% of the U.S. workforce over time, but with a more limited effect on unemployment if workers are absorbed elsewhere.

McKinsey says AI-powered agents and robots could generate about $2.9 trillion in annual U.S. economic value by 2030 if companies redesign workflows rather than simply bolt AI onto old org charts.

So the key question is not whether AI will affect labor. It already does.

The question is where the adjustment lands first and how markets price it.

The data says the first-order effects are showing up in junior hiring, management layers, and generalized software roles, while demand remains stronger for workers attached to infrastructure, security, and AI deployment.

That is a repricing of labor rather than the end of labor.

One more caveat belongs in any serious version of this analysis: even the size of the layoff wave varies by tracker methodology.

TrueUp said 2026 had seen 55,755 people impacted across 162 tech layoffs as of today, while the pack notes another tracker showed 38,645 employees laid off across 60 companies. The direction is clear. The exact scale still depends on the counting method.

For Bitcoin, the transmission channel runs through Nasdaq correlation, growth fears, and rate expectations

The labor angle is a second-order macro dynamic for Bitcoin rather than a tail risk for liquidity if the labor force collapses.

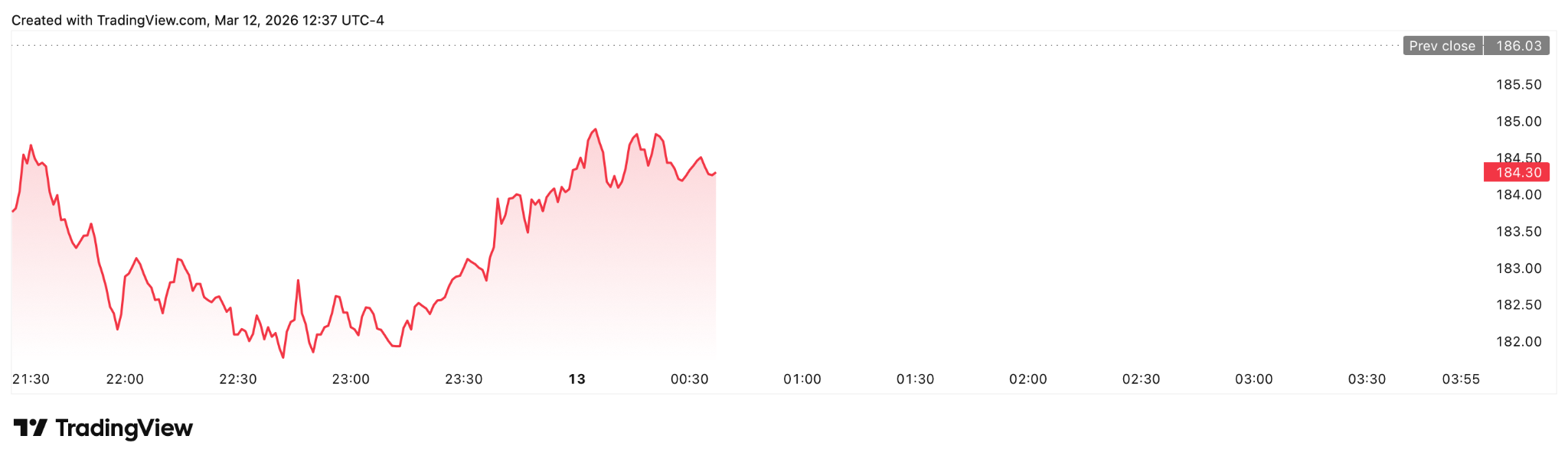

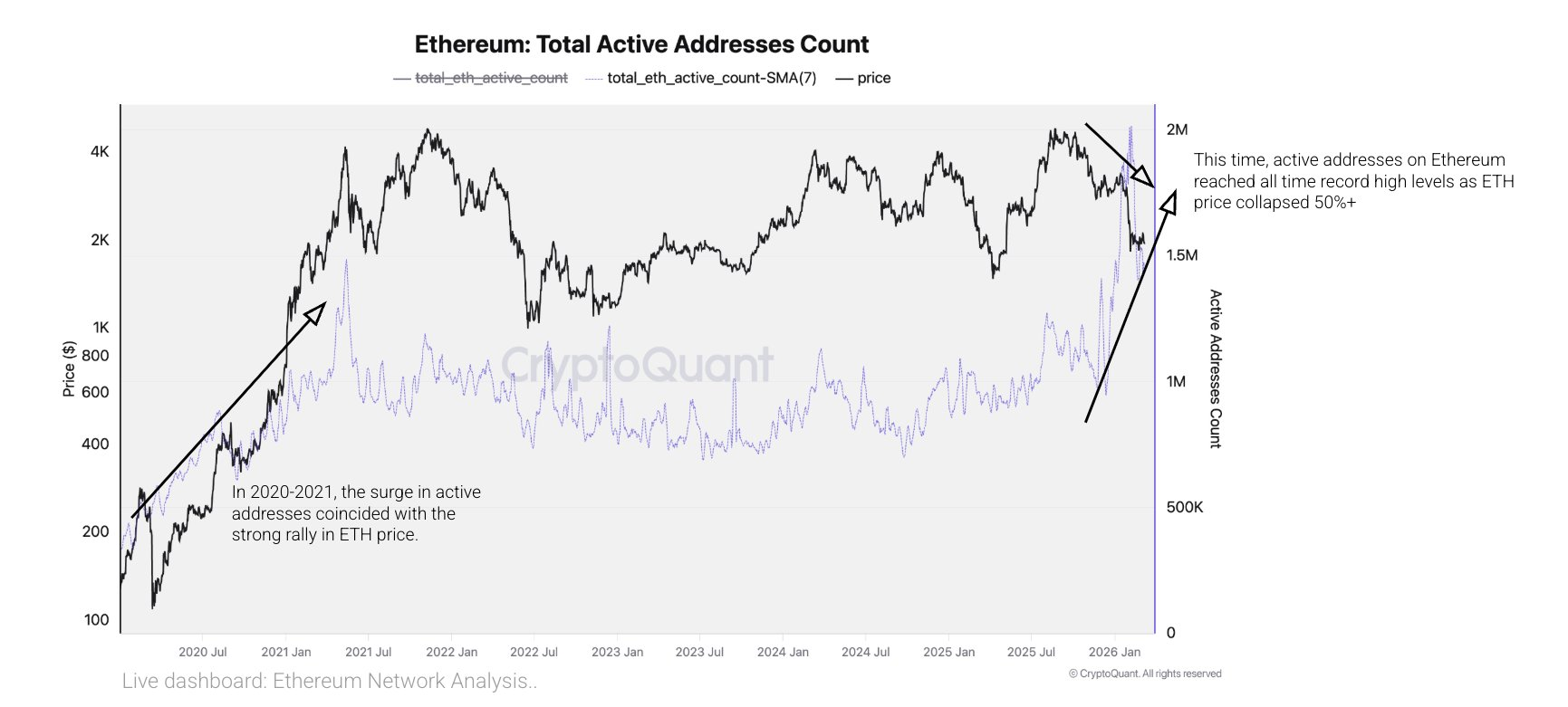

CME research says Bitcoin has remained positively correlated with the Nasdaq 100 since 2020, with correlations as high as roughly +0.35 to +0.6 in 2025 and early 2026. That means tech-labor weakness matters because it shapes the market’s view of growth, earnings multiples, and policy, not because BTC suddenly becomes a direct hedge against job cuts.

The near-term read-through is straightforward. If layoffs signal weaker demand and weaker earnings, risk assets can fall together. But the medium-term read-through can flip.

The Federal Reserve currently sits at 3.5% to 3.75%, with the next FOMC meeting on March 17 and 18, 2026. The pack also notes that nonfarm business productivity rose 2.8% in Q4 2025 while unit labor costs also rose 2.8%.

If labor softens while productivity holds up, markets can start pricing easier policy without needing a full recession. In that setup, Bitcoin can benefit as part of the broader liquidity trade.

But Bitcoin has not consistently traded like digital gold when stress hits. Kaiko notes that recent tariff volatility sent Bitcoin lower while gold rose.

That undercuts the lazy version of the thesis. BTC is not a hedge against layoffs in any clean sense.

It is still behaving, much of the time, like a high-beta macro asset whose upside improves when financial conditions loosen and whose downside grows when growth fears hit before easing expectations do.

There is also a crypto-specific wrinkle worth remembering. Block is not just another fintech cutting staff. Its business includes Bitkey and Proto, both tied to Bitcoin self-custody and mining. So one of the clearest recent examples of AI-linked staff compression is happening inside a company that is also deepening its Bitcoin stack.

Where do we go from here?

That tension is revealing. AI efficiency and Bitcoin expansion are not competing balance-sheet dynamics inside tech. In some firms, they are now being financed by the same push for productivity and capital discipline.

- The base case from here is selective compression, not labor-market collapse. Information-sector jobs can keep trending lower, Challenger tech cuts can stay high versus 2025, and software, systems, and AI postings can still recover in bursts.

- The bull case is a productivity boom without recession, where firms cut low-conviction functions, redesign workflows, and give markets room to price easier policy.

- The bear case is a white-collar recession, where AI becomes a cost-cutting tool well before it becomes a revenue engine.

- The black-swan version runs through infrastructure finance: if debt-funded AI capex stops looking credible before labor stabilizes, the market could see layoffs and capex restraint at the same time.

That is why the clearest framing here is not that AI has already killed tech jobs.

AI is already changing who gets hired, who gets cut, and which parts of the labor market investors decide to fear first.

So, Bitcoin will trade that shift through the same channel it trades most macro shocks: correlation, liquidity, and rate expectations.

The next test is whether the softness now visible in information-sector employment and entry-level hiring spreads into a broader growth scare before productivity gains show up strongly enough to offset it.

Get Your Bitcoin 2026 Pass

Get Your Bitcoin 2026 Pass  Location: The Venetian, Las Vegas

Location: The Venetian, Las Vegas Dates: April 27–29, 2026

Dates: April 27–29, 2026

Bitcoin 2026 Whale Pass

Bitcoin 2026 Whale Pass

Bitcoin 2026 After Hours Pass

Bitcoin 2026 After Hours Pass

Whale Pass holders get 10% off the 3rd Annual Bitcoin Golf Championship in Las Vegas on April 26, 2026 @TheBitcoinConf

Whale Pass holders get 10% off the 3rd Annual Bitcoin Golf Championship in Las Vegas on April 26, 2026 @TheBitcoinConf