Cryptocurrency Posts

Crypto Briefing

Cardano's community-driven funding model sets a precedent for decentralized development, enhancing transparency and ecosystem resilience.

The post Cardano community approves treasury funding to support upgrades across performance, scalability, and UX appeared first on Crypto Briefing.

The unresolved 2020 Bitcoin heist highlights ongoing security vulnerabilities in crypto, potentially undermining trust in digital currencies.

The post Hacker still holds $14 billion in stolen Bitcoin from massive 2020 LuBian attack: Arkham appeared first on Crypto Briefing.

Eric Trump's crypto endorsements amid economic uncertainty highlight the growing intersection of politics and digital asset markets.

The post Eric Trump bull-posts Bitcoin, Ethereum amid tariff jitters appeared first on Crypto Briefing.

Hayes' crypto sell-off amid market decline may signal reduced confidence, potentially influencing investor sentiment and market stability.

The post Arthur Hayes offloads $13 million in ETH, PEPE, and ENA amid market pullback appeared first on Crypto Briefing.

The merger could significantly boost U.S. Bitcoin mining capacity, impacting market dynamics and regulatory landscapes in the crypto industry.

The post Trump-backed American Bitcoin nears Nasdaq listing as Gryphon merger vote set for August 27 appeared first on Crypto Briefing.

HTTP error 403 on https://bitcoinmagazine.com/feed/

Failed to fetch feed: https://bitcoinmagazine.com/feed/

Failed to fetch feed.

CryptoSlate

The following is a guest post and opinion of Rostyslav Bortman, Founder of Ethereum Ukraine.

Even in wartime Kyiv, innovation doesn’t pause. At ETHKyiv 2025, more than 100 hackers proved it—shipping privacy-first dApps, competing for grants, and showing what’s possible when the world’s toughest challenges meet Web3 grit.

But the real shockwaves came from the founders themselves: Vitalik Buterin and Tomasz K. Stańczak, Executive Director at the Ethereum Foundation, who both appeared as the event’s online speakers, dropped two bombshells—400 TPS on Ethereum L1 this year, and a near future where anyone can run a full node on their smartphone.

So what’s next for the protocol? When does 400 TPS arrive, and what does “Ethereum on your phone” actually mean for developers and users? Here’s what we learned at ETHKyiv 2025.

Next-Gen UX: Nodes on a Phone

Vitalik Buterin’s keynote at ETHKyiv 2025 cut straight to Ethereum’s core roadmap. The biggest reveal:

“Pretty soon you’ll be able to spin up a node on your smartphones and even smartwatches.”

According to Buterin, instead of relying on servers with terabytes of storage, soon users will be able to run a full Ethereum node “without heavy-duty resources.” This first-of-its-kind case will be possible thanks to zero-knowledge Ethereum Virtual Machines (zkEVMs) that the Ethereum Foundation is currently implementing.

zkEVMs are making nodes drastically lighter, cutting storage through verifying transactions without revealing and importing any information about them.

On Ethereum’s L2s, zkEVMs already cut transaction costs by up to 90% and settle in their finality under three seconds. Buterin said the next step is bringing these improvements to the Ethereum mainnet, making blockchain interactions on it as fast and affordable as traditional web applications.

400 TPS with 3-Slot Finality by 2026

At ETHKyiv 2025, Tomasz K. Stańczak, Co-Executive Director of the Ethereum Foundation, spelled out exactly what’s next for Ethereum’s backbone: real performance gains on the mainnet itself.

He revealed that by the end of 2026, Ethereum will move to 3-Slot Finality (3SF), slashing average transaction confirmation time from 15 minutes down to only 36 seconds. For users, this will bring the experience of instant traditional digital payments while keeping all the benefits of decentralization.

Stańczak laid out the near-term milestones:

Ethereum L1 will hit 400 transactions per second (TPS) by the end of 2025.

Block gas limits will reach 100 million this year, with a jump to 60 million per block in a month or two (as of publication date—ed.).

For context: scaling Ethereum L1 is essential because it anchors the entire ecosystem, providing the security, settlement, and censorship resistance Layer 2s depend on. With faster mainnet throughput, users get greater assurance their transactions are finalized on a decentralized, global network—not bottlenecked by L2 operators.

As Vitalik Buterin summed up:

“The goal is to make Ethereum more private, more censorship-resistant, and at the same time, so easy that even people far from tech feel safe using it every day.”

What’s Really Fueling Ethereum’s Value and Mass Adoption?

For me and all the Ethereum followers, some big questions have always remained: what actually underpins Ethereum’s value, and what could trigger mass adoption?

When I pressed both Vitalik Buterin and Tomasz Stańczak for answers at ETHKyiv 2025, they each zeroed in on different but connected drivers.

Tomasz pointed to three non-negotiables: privacy, data protection, and transparency. According to him, these are precisely what enterprise clients and regular users now expect from any blockchain platform.

“Ethereum is a global network, and increased adoption directly boosts the value of the whole ecosystem,” he explained.

The more Ethereum is used for real-world utility—by businesses and by individuals—the more demand, and ultimately, value accrues.

Vitalik, meanwhile, framed the adoption question around financial utility. His thesis: mass adoption comes when Ethereum becomes the rails for real-world assets, particularly tokenized stocks and bonds.

“They’re the gateway to mass adoption and the bridge between traditional finance and Web3,” he said.

With heavyweights like BlackRock, Deutsche Bank, and Coinbase actively leveraging Ethereum for asset tokenization, we’re already seeing the lines blur between traditional finance’s $117 trillion market and Web3 infrastructure.

In short: Ethereum’s real value isn’t just speculative, but it’s being built right now at the intersection of security, privacy, and practical financial applications. That’s where mass adoption starts to look inevitable.

Why ETHKyiv 2025 Matters for Ukraine and Beyond

ETHKyiv 2025 indeed stood out for its access to global thought leaders. Despite all the war-related risks, developers here heard first-hand insights from Ethereum’s most influential builders.

As Stańczak himself described it:

“Enterprise, DeFi, explorations, AI, research, day-to-day problems, working with people—we have to understand the direction and give feedback. A lot of it.”

His daily routine—hours spent answering questions from developers—underscores how Ethereum’s power lies in its people, not just its protocol.

Crucially, ETHKyiv 2025 was never just another tech event on the calendar. Held against the backdrop of an ongoing war, it became living proof of something bigger: even in the darkest times, Ukraine’s tech community chooses to build, learn, and connect with the global ecosystem.

Throughout the hackathon, the wartime context was impossible to ignore, yet it wasn’t a shadow but a driving force. Performances by Moisei Bondarenko, the violinist-soldier whose music echoes through liberated Ukrainian cities, reminded everyone that innovation and humanity must go hand in hand. So did the tactical medicine session led by combat medic Artem Rudy, bringing practical skills and a sense of shared resilience to the room.

|

|

This is what set ETHKyiv 2025 apart: it was a gathering of minds and hearts, a testament to the persistence of community, curiosity, and shared values—even in wartime. The world watched not just for the tech, but for the spirit of resilience and solidarity that Ukraine’s builders brought to the stage.

The post 400 TPS and “Ethereum on your phone”: Vitalik Buterin & Tomasz K. Stańczak dropped big news at ETHKyiv 2025 appeared first on CryptoSlate.

Bitcoin’s on-chain activity lit up again as Blockstream CEO Adam Back alerted the Bitcoin community to the return of the so-called “Bitfinex whale.” According to Back, this unknown but powerful entity has been accumulating Bitcoin at a staggering rate, purchasing roughly 300 BTC per day over the past 48 hours using time-weighted average price (TWAP) buying strategies. He emphasized:

“For context 300btc/day that’s $400/second all day, historically they’ve done this days, weeks continuously and ramped it up too harder too up to 1000btc/day ($1300/second all-day at these prices).”

The Bitfinex whale effect

The sustained appetite of this whale, especially one connected with Bitfinex, is a potentially market-moving signal. Whale accumulation (large buys executed methodically over time) can soak up significant supply, causing upward pressure on price or stabilizing the market during volatility. Such whale behavior has preceded large bullish moves in previous cycles, as well as short-term volatility when whales shift gears or exit positions.

But not everyone sees this as unequivocally bullish. As one of Back’s followers commented:

“That’s not a good thing, as Bitfinex whales buy downtrends and sell uptrends.”

This highlights a long-debated dynamic. Some whales accumulate during market weakness and then distribute (sell) into liquidity during stronger markets, adding both buying support in downturns and potential resistance during rallies.

Whatever your take on the Bitfinex whale, Adam Back is no ordinary observer. As the inventor of Hashcash, a critical Proof-of-Work algorithm referenced in the original Bitcoin whitepaper, Back is seen as one of the founding figures in the crypto space.

He is the CEO and co-founder of Blockstream, a global leader in Bitcoin protocol development and infrastructure. Renowned as a cypherpunk and one of the first to correspond with Bitcoin’s anonymous creator, Satoshi Nakamoto, Back’s market commentary carries outsized weight within the industry.

Will Bitcoin price shake off broader slump?

Earlier today, former BitMEX CEO, Arthur Hayes warned of a global liquidity crunch and expected BTC to test $100,000 in the near term, adjusting his positions accordingly. Can traders expect this to change with the Bitfinex whale back on scene?

On-chain data suggests that when whales accumulate at this scale, it’s typically a sign of strong hands preparing for the next price move, or smart money stepping in to absorb panic selling. With supply on exchanges already at record lows and institutional interest surging, continuous spot buying from traders like the Bitfinex whale could fuel both a relief rally and long-term supply squeeze, especially if sustained over days or weeks.

However, whale accumulation doesn’t guarantee a straight line upward. Recent years have shown that large holders are just as likely to defend support as they are to take profit if the opportunity arises. Traders will be watching closely for signs of a trend reversal or major move.

The post Bitfinex whale returns: Adam Back sights massive Bitcoin accumulation appeared first on CryptoSlate.

Arthur Hayes is once again sounding the alarm on a greater shakeup in the crypto market after worse-than-expected data from the U.S. Non-Farm Payrolls (NFP) jobs report sparked downside volatility in both traditional and digital markets. Despite his reputation as a long-term crypto bull, Hayes has recently moved assets and cash, preparing for further volatility ahead.

Hayes’ prediction comes as Bitcoin hovers in a turbulent range after a sharp June and July rally that saw the coin blast through $120,000 before encountering resistance and correcting down to below $114,000 in early August.

Hayes, a long-time advocate of Bitcoin’s macro potential, is now warning that short-term headwinds could push BTC below $100,000 and ETH below $3,000 in the aftermath of the latest jobs report, a number that fell well short of expectations and wiped $1.1 trillion from the stock market.

Risk assets sell off as Schiff reinforces ‘Bitcoin is not digital gold’

The crux of Arthur Hayes’ argument is rooted in macro liquidity. In his recent comment, he points to the spike in market volatility following the weaker-than-expected NFP, with risk assets selling off hard as traders rush to reprice interest rate expectations and the path ahead for Federal Reserve policy. For the crypto market, this unfolding reset spells trouble in the short term.

Bitcoin led the crypto downturn but managed to show relative strength compared to altcoins, which were hit even harder. Hayes points out that liquidity is being drained from markets as traders brace for further turbulence. Forced liquidations and margin calls are accelerating the move lower, with $172 million in Bitcoin long positions wiped out across exchanges in a 24-hour window as prices stumbled.

Bitcoin critic Peter Schiff wasted no opportunity to dunk on the number-one digital asset while praising the virtues of gold, commenting:

“Days like today make it clear that Bitcoin is not digital gold. We got bad economic news that sent gold and the Japanese yen up 2.2% and the euro up 1.5%. The NASDAQ went the other way, falling 2.2%. Bitcoin tanked 3%, tracking high-risk assets lower, not safe havens higher.”

Arthur Hayes is repositioning his assets

In the early hours of August 2, Hayes offloaded 2,373 ETH ($8.32 million), 7.76 million ENA ($4.62 million), and 38.86 billion PEPE ($414,700), causing a flurry of comments among the crypto community, most notably, Ethereum bulls who pointed out that Hayes had only recently been advocating for a $10K ETH. One follower commented:

“Classic Arthur shilling and dumping at the same time. Never fails.”

Hayes has been right before, predicting a BTC drop to $70,000 earlier in the current cycle when optimism and leverage were at fever pitch.

In April 2024, as Bitcoin scaled all-time highs and market euphoria peaked, Hayes issued a warning that the tides would soon turn, again calling out warning signs in liquidity, U.S. macro data, and the growing risks from overextended leverage in derivatives markets. Despite offloading ETH showing near-term caution, Hayes’ long-term view remains bullish.

The post Former BitMEX CEO Arthur Hayes positions for market slump: predicts BTC to test $100K after NFP print appeared first on CryptoSlate.

Geneva, Switzerland – August 1, 2025 – CryptoRank, Messari and Nansen, leading platforms in blockchain research and analytics, have released comprehensive reports highlighting the TRON network’s exceptional performance throughout the first half of 2025. These independent analyses demonstrate TRON’s continued dominance in the global stablecoin ecosystem, record-breaking revenue generation, and sustained growth across key network fundamentals, reinforcing its position as a premier blockchain infrastructure for digital finance.

CryptoRank

TRON H1 2025: Consistent Growth Across Key Fundamental Metrics provides an in-depth assessment of TRON’s performance, revealing the blockchain’s sustained momentum across critical operational metrics and its strong position in the competitive Layer 1 landscape.

Key Insights from CryptoRank:

- USDT Dominance Expands: USDT supply on TRON surged 41% to 81.2 billion, reinforcing the network’s position as the primary infrastructure and preferred settlement layer for stablecoin transactions.

- Top-Tier User Activity: TRON ranked top 3 among all blockchains in average daily active addresses during H1 2025.

- Revenue Leadership: TRON achieved nearly $1 billion in quarterly revenue by Q2 2025, representing the network’s highest revenue to date. TRON led all blockchain platforms in revenue burn during H1 2025, with nearly $319 million — significantly surpassing Ethereum and Solana — highlighting its unmatched economic activity and deflationary token model.

Read the full report from CryptoRank here.

Messari

State of TRON Q2 2025 delivered a comprehensive quarterly analysis highlighting TRON’s performance, technical developments, and ecosystem expansion, confirming the network’s multi-faceted growth trajectory.

Key Insights from Messari:

- Ecosystem Activity: Ecosystem momentum was fueled by collaborations with Privy and Bridge (both Stripe companies), AEON Pay, and others, alongside expanded stablecoin offerings like USD1.

- Sustained Growth and Rising User Activity: Daily average transactions increased 12.6% QoQ from 7.7 million to 8.6 million, and daily active addresses grew 5.9% QoQ from 2.4 million to 2.5 million. Average daily new addresses increased in Q2, up 16.6% QoQ from 170,870 to 199,194.

- Stablecoin Activity Steadily Trending Up: The second-largest stablecoin on TRON, USDD, was up 71.2% QoQ from $252.8 million to $432.8 million. USDD reached a milestone of over 409,000 accounts (+269,000 holders in Q2) that hold the stablecoin.

Read the full report from Messari here.

Nansen

TRON Quarterly Report – Q2 2025 highlights robust performance and continued ecosystem growth across DeFi, enterprise and global adoption on TRON.

Key Insights from Nansen:

- During the first half of 2025, the TRON network saw a dominant share of its user activity and transaction throughput driven by centralized exchanges such as Bybit, Binance, OKX, and KuCoin, collectively contributing to a significant portion of network usage, underscoring TRON’s deep integration into global trading platforms.

- Canary Capital filed a proposal with U.S. regulators for a TRON ETF that includes native staking rewards, a first-of-its-kind structure in traditional finance. The fund would offer institutional exposure to TRX while enabling passive income via on-chain staking, bridging digital asset yields with regulated investment products.

- DeFi activity remained strong, led by platforms like SunSwap and JustLend, while new integrations with Chainlink oracles brought greater composability and risk management to TRON-based protocols.

Read the full report from Nansen here.

CryptoRank, Messari, and Nansen recognized TRON for its leading role in the blockchain space, particularly as a core infrastructure for stablecoins. Its dominance in USDT issuance, transaction volume, daily user activity, and growing institutional interest underscores its position as a key player in global digital finance. With steady ecosystem growth and expanding utility across DeFi and cross-border payments, TRON is well-positioned to sustain its momentum as a foundational force in the evolving digital economy.

About TRON DAO

TRON DAO is a community-governed DAO dedicated to accelerating the decentralization of the internet via blockchain technology and dApps.

Founded in September 2017 by H.E. Justin Sun, the TRON blockchain has experienced significant growth since its MainNet launch in May 2018. TRON hosts the largest circulating supply of USD Tether (USDT) stablecoin, exceeding $82 billion. As of August 2025, the TRON blockchain has recorded over 323 million in total user accounts, more than 11 billion in total transactions, and over $26 billion in total value locked (TVL), based on TRONSCAN.

TRONNetwork | TRONDAO | X | YouTube | Telegram | Discord | Reddit | GitHub | Medium | Forum

Media Contact

Yeweon Park

press@tron.network

The post TRON Recognized by CryptoRank, Messari, and Nansen: $916M Revenue and $81B USDT Supply in H1 2025 appeared first on CryptoSlate.

The number of tradable crypto tokens has gone parabolic since 2022, with CoinMarketCap now tracking roughly 18.9 million digital assets, compared to a little over 20,000 in 2022.

In January of that year, roughly 20,000 assets were listed across major trackers. By mid-2025, that universe swelled to an estimated 18.9 million, an astonishing 945x increase in just three and a half years.

The surge isn’t evenly distributed, as three high-throughput networks are responsible for about 90% of the new supply: Solana, Base, and BNB, driven by low fees, turnkey launchpads, and a culture of rapid experimentation.

The three kings

Solana is the epicenter. Over the past year alone, the chain saw on the order of 18 million new tokens minted as memecoin factories and no-code issuers lowered the barrier to creation to pennies.

Pump.fun has produced approximately 11.4 million SPL tokens by late July 2025, according to the Dune dashboard by user oladee, which tracks the app’s on-chain mints. That’s up from roughly 8.7 million in March 2025, adding almost 2.7 million in four months, up by 31%.

The count exceeds the combined new token count on Base, BSC, Tron, Polygon, Optimism, Arbitrum, and Ethereum during the same period.

The result is a torrent of micro-cap assets, most launched for fun, virality, or speculation, and many never progressing beyond a few wallets and a shallow liquidity pool.

Base has emerged as the fastest follower. In barely a year, developers and creators deployed more than 8.4 million fungible tokens on the network.

Creator coin tooling tied to Zora ignited a rapid mint cycle on Coinbase’s L2. A Dune dashboard by user Sealaunch reported over 1.5 million creator coins minted in 2025, as the model spread, with much of this activity centered on Base following its integration into the Base App.

In late July, Base briefly outpaced Solana by daily token count as “content coins” turned social posts into micro-tokens at scale.

Binance Smart Chain (BSC), which pioneered the cheap-token boom in 2021, continues to significantly contribute to new token launches.

BscScan’s token tracker lists nearly 4.7 million BEP-20 token contracts on BNB Chain, the ecosystem that BSC is part of. This highlights its role as a mass-mint venue for fungible assets.

While its share of new issuance has faded relative to Solana and Base, BSC remains a go-to venue for fast, low-cost launches.

Liquidity per token shrinks

The catch to this Cambrian explosion is liquidity. Capital simply hasn’t kept pace with supply. Average stablecoin liquidity per token has collapsed from around $1.8 million in 2021 to roughly $5,500 in early 2025.

In practical terms, most of the 18.9 million tokens are illiquid, thinly traded, and highly susceptible to manipulation. Prices can rocket or crater on a few hundred dollars of flow, and rug-pulls remain a risk wherever low-effort issuance thrives.

That imbalance is reshaping market structure. Despite the proliferation of assets, value continues to concentrate in a few hundred names, with Bitcoin’s and Ethereum’s dominance climbing as capital consolidates into proven networks while the long tail languishes.

For teams, the sheer existence of a token no longer confers value. Protocols must prove durable demand by showing users, fees, cash flows, or compelling utility to attract liquidity in a saturated field.

Networks face their own trade-offs. High throughput and low fees empower permissionless creativity but also invite spam and churn.

The post Crypto tokens explode from 20k in 2022 to 18.9M following launchpad frenzy on Solana, Base, BSC appeared first on CryptoSlate.

Cryptoticker

Toncoin just got a serious credibility boost. Its leading decentralized exchange, STONfi, pulled in $9.5 million in Series A funding led by Ribbit Capital and CoinFund. These aren’t your average crypto VCs—they’re heavy hitters in fintech. This isn’t just capital; it’s a greenlight from the top tier. Now the real question is whether TON’s price can turn this backing into a breakout. Let’s break it down.

TON Price Prediction: Why This Funding Round Changes the Game?

STONfi dominates the TON DeFi scene. It’s responsible for 80 percent of all DeFi users on the network and has already processed more than $6 billion in total volume. This isn’t a project looking for product-market fit—it already has it.

With this new capital, STONfi is gearing up to roll out professional-grade features. Think concentrated liquidity for LPs and native limit orders for traders. Add cross-chain swaps through the Omniston protocol, and you’re looking at a platform that's about to get a lot more serious.

From a macro view, this kind of institutional vote of confidence usually trickles down into the asset itself. Investors might not be directly buying TON yet, but they are buying into its infrastructure. That’s a signal.

TON Price Prediction: What the Price Is Telling Us?

Toncoin price is trading around $3.66 with a strong +4.46 percent daily gain. The candles are Heikin Ashi, and they show consistent green bodies over the past two weeks—clear sign of sustained bullish momentum.

The TON price just broke through the upper band of the Bollinger Bands. That’s often a sign of short-term overextension, but in trending markets, it can also signal the beginning of an aggressive push. The Bollinger Bands are widening, which supports the idea of increased volatility, not a reversal just yet.

Support sits around $3.27 and $2.97, the mid and lower bands respectively. But the real interest is in the levels above.

Fibonacci extensions suggest a potential short-term target of $4.00 followed by $4.40 if momentum holds. If Toncoin price pushes past $4.50 with volume, it opens the door to test $5.00. That level isn’t just psychological—it aligns with prior resistance back in early Q2.

What Could Go Wrong?

STONfi’s funding gives the ecosystem firepower, but execution still matters. If features get delayed or fail to attract new liquidity, the hype fizzles. Also, TON still lacks the developer saturation that Ethereum or Solana enjoy. One DEX does not make a full DeFi ecosystem.

On the technical side, watch for bearish divergence or any sharp pullbacks toward $3.25. That would weaken the current setup.

TON Price Prediction: Is $5 in Sight?

If momentum continues and the new features roll out on schedule, Toncoin price could rally toward the $4.40 to $5.00 zone within the next 2 to 4 weeks. Volume confirmation is key. If we get two more strong daily closes above $3.70 with rising volume, $4 is almost a given.

If broader market sentiment stays neutral or bullish, this TON price rally has legs. But any sudden shift in risk appetite or delays in promised upgrades could stall the run around $4.

Institutional backing doesn’t guarantee a price pump, but it adds serious weight to the long-term thesis. Toncoin is no longer just Telegram’s side project. It’s building a DeFi layer with real traction and serious funding. If the bulls hold this momentum, the next stop could be $5. Keep a close eye on volume and the $3.70 to $4.00 breakout zone.

Buy TON on OKX

Looking to buy TON? OKX is one of the top exchanges with low fees, fast execution, and hundreds of listed assets.

👉 Join OKX here and claim your welcome bonus

$Toncoin, $TON, $STONfi

Bitcoin Crash Reason: What Caused the Bitcoin Drop?

The Federal Reserve's decision to hold rates steady on July 30 created macro pressure on risk assets. Bitcoin, which had consolidated below the $123K resistance, finally gave in and triggered a cascading sell-off across the market. Crypto tends to perform better in low interest environments, and this "no-cut" policy stalled any bullish momentum.

BTC Coin Price: Chart Breakdown

BTC/USD 4-hours chart - TradingView

- Failed breakout at $123K, followed by range-bound movement between $116K–$118K

- Clean breakdown below $116K, which is now flipped into resistance

- 9/21 MA bear cross, with 9MA (orange) curving sharply down

- RSI at 29.34 → oversold zone, but with no bullish divergence yet

What to Watch Next for BTC

- Immediate support sits near $111K–$112K. If this breaks, we could see Bitcoin drop toward $108K or even $104K short-term.

- A potential relief bounce may occur, but it must reclaim $116K to flip the structure.

- Keep an eye on volume – if we see high sell volume near $111K, the market may accelerate downward.

- Macro events like further Fed commentary or inflation data could inject new volatility.

$BTC, $Bitcoin

Crypto Market Overview: Red Dominates

The total crypto market cap has plunged by over 3.2% in the past 24 hours, currently standing at $3.65 trillion. The drop marks a sharp continuation of the downtrend that began in late July. Almost every major altcoin is flashing red, with Bitcoin ($BTC) and Ethereum ($ETH) dragging the market lower, and several altcoins following suit with deeper losses.

Total Crypto Market Cap Chart Analysis

- The market cap failed to hold the $3.72T support, now turned resistance.

- The 21 EMA is sloping down, showing continued bearish pressure.

- The RSI is deep in oversold territory at 27.18, suggesting a potential relief bounce but confirming the current weakness.

- Volume spikes and aggressive sell-offs hint at institutional unloading.

Outlook: If $3.65T breaks further, the next major support lies near $3.54T. Upside recovery will only start once $3.72T is reclaimed and held.

Bitcoin Chart Analysis: $113K and Dropping?

Bitcoin’s 4H chart paints a similarly bearish picture:

- Price rejected at $118.6K, a major resistance zone highlighted by a horizontal orange line.

- It broke down from the short-term support at $116K, now acting as resistance.

- The 9 and 21 MA cross is bearish, with the 9MA sharply sloping below the 21MA.

- RSI at 29.20 confirms oversold conditions, yet no reversal signals are visible.

Outlook: If BTC doesn’t reclaim $116K soon, the next support rests around $111K–$112K. Only a strong close above $118.6K can reestablish bullish control.

Top 10 Crypto Performance (Excluding Stablecoins)

From the latest data snapshot, here’s how the top 10 non-stablecoin cryptos are performing:

| Rank | Name | Price | 24h % | 7d % | Market Cap |

|---|---|---|---|---|---|

| 1 | Bitcoin | $115,654.77 | -2.44% | -0.64% | $2.3T |

| 2 | Ethereum | $3,657.06 | -4.60% | -1.68% | $441B |

| 3 | XRP | $2.99 | -4.41% | -4.32% | $177B |

| 5 | BNB | $772.62 | -3.16% | -0.21% | $107B |

| 6 | Solana | $169.25 | -5.55% | -6.64% | $91B |

| 8 | Dogecoin | $0.2078 | -5.93% | -10.30% | $31.2B |

| 9 | TRON | $0.3273 | -0.15% | +4.00% | $31B |

| 10 | Cardano | $0.7292 | -6.19% | -10.46% | $25.8B |

Key Observations:

- Bitcoin held relatively better than altcoins but remains in a technical downtrend.

- Ethereum continues underperforming BTC, showing a sharper daily decline.

- XRP, ADA, and DOGE are among the worst weekly performers, each dropping over 10%.

- Solana is breaking down after ETF hype cooled, now at -6.64% weekly.

- TRON (TRX) stands out as the only green token over the past 7 days (+4.00%), possibly due to recent ecosystem or regulatory news.

What’s Next?

The market is clearly risk-off. Bitcoin must reclaim $116K–$118K to reverse sentiment. RSI on major assets is deeply oversold, so a technical bounce could occur — but the trend remains down. Altcoins are more vulnerable, especially those with high volatility like ADA and DOGE.

$BTC, $ETH, $XRP, $BNB, $SOL, $DOGE, $TRX, $ADA

The decentralized finance (DeFi) market just shed over $4 billion in Total Value Locked (TVL) within a single day. That kind of drop usually spooks people. But zoom out, and something more strategic comes into focus. The data from DeFiLlama reveals not a collapse, but a recalibration across protocols, categories, and capital flows. Let’s unpack what’s really happening, what matters in these charts, and where things may be heading next in the crypto market.

Total Value Locked Takes a Hit, but Momentum Remains Intact

According to DefiLlama, TVL across all DeFi protocols now stands at $135.81 billion, down 3.14 percent over the past 24 hours. This marks a noticeable dip in an otherwise upward trend that’s been building since late 2023. The historical TVL chart shows a clear recovery from the brutal drawdowns of 2022 and the stagnation through much of 2023. While we’re not at the highs of the 2021-2022 DeFi summer, we are seeing a much healthier and more distributed recovery.

A one-day decline doesn’t change the larger structure. TVL is still up significantly year-to-date, and the composition of where the value is moving tells a more useful story than the headline number.

AAVE, Lido, and EigenLayer Dominate TVL, but Not the Growth

AAVE leads with $33.64 billion in TVL across 17 chains. That’s nearly one-fourth of the entire DeFi TVL in one protocol. Over the past 24 hours, AAVE saw a 2.6 percent drop in locked value, though it posted a modest 1.05 percent gain over the week and nearly 36 percent growth over the month.

Lido, the liquid staking heavyweight, follows closely with $32.73 billion. Its 7-day change is negative 2.27 percent, but like AAVE, it gained over 47 percent in the past month. These are big protocols with huge liquidity. They often act as liquidity sources or sinks during macro DeFi movements.

Then there’s EigenLayer, sitting at $17.51 billion. Despite a 5 percent daily TVL drop, it’s up almost 54 percent this month. That level of volatility on the upside and downside suggests hot capital flow, likely tied to yield-chasing restaking dynamics.

ether.fi and Ethena: The Outliers Everyone Should Be Watching

Where things get interesting is outside the traditional top three.

ether.fi, with just under $10 billion in TVL, is down nearly 4 percent on the day. Still, it has grown over 58 percent this past month. That is massive relative expansion. Even more impressive is its daily fee generation. It clocked in over $5.25 million in fees in the last 24 hours, which dwarfs even AAVE and Lido. However, its revenue remains low, just $72,353, implying high operational cost or aggressive reward emission strategies.

Ethena is the wild card. It’s the only protocol in the top six with positive daily and weekly TVL changes, up 0.7 percent and 21.15 percent respectively. Over the month, it has grown 59.66 percent. Even more impressive is its 24-hour fee haul: $13.92 million. That puts it at the top of the revenue leaderboard, well ahead of Lido and AAVE. Its revenue for the day, $2.43 million, reflects strong actual economic activity and suggests that it's not just emitting tokens to attract liquidity. Ethena appears to be monetizing real usage.

In short, the data shows that while traditional protocols are stabilizing or declining slightly, newer or more agile players like ether.fi and Ethena are gaining attention and traction quickly.

Fee Generation and Real Yield: A New Set of Winners

Across DeFi, total fees paid in the last 24 hours came in at $113.93 million. That number should not be underestimated. It reflects that usage is active, even when TVL dips. In fact, comparing this figure to DEX volumes ($19.38 billion in 24h) and perp volumes ($18.46 billion in 24h) highlights a healthy rotation across DeFi’s verticals.

Notably, many users are not simply holding liquidity in vaults or LPs. They are actively trading, bridging, restaking, and using leverage. This explains why protocols with lower TVLs (like Ethena) can outperform high-TVL incumbents in revenue. Capital is becoming more efficient.

ETF Outflows Reveal Institutional Hesitation or Strategic Rotation

One detail that should not be ignored: ETF inflows were negative $97.8 million over 24 hours. That is not just noise. It shows traditional finance pulling back slightly from crypto wrappers. Whether this capital is moving into stablecoins, DeFi protocols, or sitting idle is unclear, but the juxtaposition with the increase in DeFi protocol fees suggests that some of it may be rotating into on-chain opportunities.

In other words, while institutional products are bleeding capital, native DeFi protocols may be catching the upside from those flows.

Stablecoin Liquidity Continues Quiet Expansion

Stablecoins represent dry powder. Their market cap has now reached $266.92 billion, up 0.65 percent over the past week. That’s a key metric. While TVL in DeFi protocols has dropped, stablecoin supply is growing. That suggests capital is not leaving the ecosystem but sitting on the sidelines, likely waiting for reentry.

This further supports the idea that the 3 percent TVL drop is less about exit and more about reallocation.

RWA TVL Declines, but Still Significant

Real World Assets (RWA) represent $12.2 billion of TVL and have declined 3.15 percent over the week. This is in line with broader TVL decline but signals something worth watching. If stablecoin capital starts rotating into yield-generating RWAs, we could see protocols like Centrifuge or Maple Finance start outperforming again.

So far, most of the growth this month has been in staking, restaking, and synthetic dollar protocols.

Over $624 million in token unlocks are expected in the next 14 days. While that doesn’t always correlate to selling pressure, it often creates volatility. Projects undergoing large unlocks may see temporary price weakness, potentially creating entry points for long-term accumulation.

What This All Means for the Crypto Market?

- The short-term TVL drop is not a sign of collapse. It’s a reaction to market rotations, unlocks, and strategic reshuffling across protocols.

- Protocols like Ethena and ether.fi are gaining real traction. Their growth in both usage and revenue suggests sustainable momentum rather than fleeting hype.

- Legacy leaders like AAVE and Lido are still strong, but slowing. These giants may become stability anchors while newer protocols chase growth.

- Stablecoin growth and ETF outflows hint at capital movement. Liquidity isn’t vanishing. It’s waiting for the next wave or entering more agile strategies.

- The broader trend is still intact. Zoom out on the TVL chart and you’ll see a recovery trend from early 2023 lows. The current dip fits within that structure.

The market is not breaking. It’s breathing. The next few weeks will likely determine which protocols can convert short-term momentum into long-term dominance. For now, DeFi looks alive, active, and preparing for its next move.

$Crypto, $CryptoMarket, $BTC, $AAVE, $LDO, $ENA, $DeFi, $ETHFI

Retirement Reform: 401(k) Crypto Investments on the Horizon

A major retirement reform is underway as a new executive order is expected to encourage 401(k) plans to include nontraditional assets—most notably, cryptocurrencies. This shift reflects the growing mainstream acceptance of digital assets and aligns with the administration’s broader financial innovation goals. A comprehensive digital-asset strategy report is also expected to accompany the order, offering guidance on how retirement plans can safely and strategically integrate crypto investments.

Crypto Holdings to Reshape Mortgage Standards

The Trump administration’s Federal Housing Finance Agency (FHFA) has instructed mortgage giants Fannie Mae and Freddie Mac to begin considering cryptocurrency holdings as part of borrowers’ mortgage collateral. This unprecedented move aims to modernize home lending criteria and accommodate the growing influence of digital assets. However, critics like Senator Elizabeth Warren caution that such a change could inject instability into the housing market, given the inherent volatility of crypto.

Democratic Lawmakers Oppose Crypto-Fueled Financial Reforms

Political resistance to crypto integration is mounting, with Democratic lawmakers sending a formal letter to FHFA Director William Pulte. They argue that incorporating volatile digital assets into core financial systems—like retirement and housing—could jeopardize economic stability. Despite the criticism, the Trump administration remains firm in its stance, touting crypto adoption as a “concrete achievement” that advances the U.S. as a global leader in digital finance.

Why It Matters

If enacted, these changes would normalize crypto as collateral and investment in mainstream finance, potentially increasing demand and liquidity. However, the debate highlights the tension between innovation and prudential regulation. Investors should monitor policy announcements and legislative responses closely.

Want to stay informed? Learn what blockchain is and compare trading platforms via our exchange comparison before entering the market.

$crypto, $bitcoin, $btc

Decrypt

With the passing of the GENIUS Act, stablecoins are no longer a regulatory grey area—but usability challenges still remain.

Bitcoin miners had a profitable month in July, JP Morgan analysts noted in a report, as the price of the digital coin broke a new record.

Although Coinbase shares fell 17% on Friday, the stock could gain ground as the trading platform expands its services through different acquisitions, analysts wrote.

Amid a confluence of bearish political and economic developments, Bitcoin and other assets are down while liquidations only keep rising.

MicroStrategy aims to have the biggest corporate treasury stash ever—Bitcoin or otherwise—while Metaplanet raises $3.7 billion for its BTC buying spree.

U.Today - IT, AI and Fintech Daily News for You Today

Ethereum reached major yearly record just before price went down

Bitcoin price is in distress, but bulls are optimistic as more holders are in profit

Ripple has filed application for national bank charter

Shiba Inu slides in crucial open interest trend as bulls prepare for historically bearish August

Shiba Inu marks five years in market

Blockonomi

Top TradingView analysts have earned a reputation for identifying breakout tokens long before the mainstream catches on. Their latest watchlist includes a DeFi up-and-comer that has begun gaining serious traction: Mutuum Finance (MUTM). With smart contract deployment on the rise and consistent on-chain activity signaling strong development momentum, experts are already drawing parallels to past success stories—only this time, they’re pointing to a $2 price target.

At the heart of Mutuum Finance (MUTM)’s growing popularity is its forward-thinking DeFi infrastructure, built for real utility and scalable adoption. The platform is preparing to launch on a Layer-2 network to enhance speed and reduce gas fees, while its smart contract suite introduces lending innovation that many believe will define the next era of crypto finance. Its standout mechanism? Peer-to-Contract (P2C) lending, which allows users to deposit assets like BTC, ETH, or SOL and start earning yield instantly from pool utilization. Meanwhile, borrowers can access overcollateralized loans without giving up exposure to their long-term crypto positions.

TradingView veterans aren’t just looking at the platform’s architecture—they’re also keeping an eye on its rapid presale progress. Mutuum Finance (MUTM) is currently in Phase 6 of its public sale, with each token priced at just $0.035. This entry point is roughly 15% lower than the next phase’s price of $0.040, offering a limited-time window for those aiming to maximize upside before listing. With more than 14,800 unique holders and over $13.90 million raised so far, the current momentum reflects strong investor conviction and early community strength.

Smart Contracts, Serious Traction, and Real Yield

Unlike hype-fueled meme coins or narrative-driven tokens with no working product, Mutuum Finance (MUTM) is rooted in real DeFi mechanics. Its lending system is divided into two models: P2C, which uses shared liquidity pools to automate interest rates based on utilization, and Peer-to-Peer (P2P), which allows users to negotiate terms directly for rarer or higher-risk assets. The P2C model already shows signs of disrupting traditional lending by offering flexibility and yield with minimal friction.

For example, lenders supplying assets like SOL or BTC to the P2C pool are expected to earn up to 12.4% APY—derived entirely from borrower activity within the protocol. On the other side of the equation, a user locking in blue-chip tokens at a 65% loan-to-value (LTV) ratio can unlock capital without selling their original holdings, effectively gaining liquidity while preserving long-term upside.

Beyond lending, Mutuum Finance (MUTM) will soon introduce a fully decentralized stablecoin, which will be minted only when loans are issued and burned upon repayment. This supply-tight mechanism is designed to maintain a $1 peg while preventing inflation—a crucial feature that TradingView analysts believe sets it apart from algorithmic stablecoin failures of the past.

Another critical factor drawing analyst attention is the upcoming staking mechanism. Once live, users who stake their interest-bearing mtTokens into designated smart contracts will start earning MUTM rewards. These MUTM tokens will be bought back from the open market using real revenue generated by the protocol, creating a positive feedback loop that benefits both stakers and price dynamics.

Institutional Security, Retail Buzz, and the $2 Target

While utility is a strong draw, Mutuum Finance (MUTM)’s security infrastructure is also playing a key role in winning over serious investors. A $50,000 bug bounty is live in partnership with CertiK, and the project has received high scores from the industry leader: a 95.00 Token Scan and 78.00 Skynet rating, reinforcing the protocol’s long-term reliability. With institutional-grade auditing and transparent development, MUTM is capturing attention from both retail and early-stage crypto funds.

Incentives are also boosting presale engagement. A $100,000 giveaway campaign is ongoing, where ten lucky participants will receive $10,000 worth of MUTM tokens. With token listings targeted for platforms like Binance, KuCoin, and Kraken in the near future, buyers in Phase 6 aren’t just getting a discount—they’re positioning themselves ahead of what analysts expect to be a massive retail wave.

So far, early buyers from Phase 1 have already seen 3.5x returns. Those entering at the current $0.035 price point still stand to see nearly 2x gains at listing, when the price is set at $0.060. But TradingView analysts have gone further, projecting a longer-term price point of $2. That’s over 57x from current levels—and with the fundamentals in place, that forecast is gaining credibility.

Mutuum Finance (MUTM) is not promising hype or empty roadmaps. It’s offering a real product, a growing ecosystem, and a clear path to scale. The current window to get in at presale pricing is narrowing fast, and the analysts watching this token know exactly what comes next.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

The post From $0.035 Entry to $2 Goal, TradingView Veterans Say Mutuum Finance (MUTM) Will Be the Top Performer of 2025 appeared first on Blockonomi.

The debate over whether Solana (SOL) can surpass XRP is heating up in today’s crypto markets. As institutional investment flows shift and ETF rumors create fresh price momentum, 2025 is more nuanced than a simple two-token race. The new twist? Analysts and smart-money movers are increasingly pointing to $MAGACOIN FINANCE as the cycle’s most explosive altcoin—one with a higher asymmetric upside than either blue-chip favorite.

XRP and Solana: The Stats as of Today

- XRP continues to attract major attention, holding near $3.13 and benefiting from bullish sentiment around its ETF prospects and continued large wallet inflows. Market activity across July has seen XRP outperforming many peers, especially in futures trading volume, due to revived optimism from recent policy clarity and whale accumulation.

- Solana (SOL), meanwhile, remains in the spotlight after the U.S. approval of the spot + staking ETF. SOL currently trades at $180.07, declining slightly by 1.04% over the past 24 hours, struggling to reclaim previous highs above $200. Analysts note institutional capital increasingly favors Solana ETFs over XRP, though price action has been capped by significant resistance levels.

The expert consensus? Solana’s ETF approval is significant, creating a pathway for SOL to potentially catch or outperform XRP in the next macro bull market stage. Still, as of July 31, XRP commands higher futures volume and maintains a critical edge in institutional sentiment on some exchanges.

MAGACOIN FINANCE: The Outlier With 9600x Potential

While XRP and Solana battle for the limelight, a larger expert focus today is on $MAGACOIN FINANCE, with multiple research briefings and market commentators citing it as the most compelling high-upside play in the current cycle.

Why the analyst buzz around $MAGACOIN FINANCE?

- Presale Momentum: $MAGACOIN FINANCE recently completed one of the fastest, most oversubscribed launches in the market, selling out all stages and attracting record-setting capital inflows for a political meme coin.

- Community Surge: On-chain trackers report a rapidly growing holder base—now past 12,500—driven by tiered rewards and viral support across social channels.

- Analyst Targets: Experts project returns up to 9600x based on current tokenomics, scarcity mechanics, and initial listing price. Analysts today explicitly compare $MAGACOIN FINANCE to early SHIB or PEPE territory before their exponential runs.

- Smart Money Rotation: Funds are flowing out of blue chips like XRP and Solana into early-stage altcoins, with $MAGACOIN FINANCE cited as “the top strategic bet” due to its unique blend of political branding, DeFi features, and fully audited security.

The Takeaway for July 31

- Solana may be closing the gap with XRP thanks to ETF-driven institutional demand, but market consensus today is that neither offers the kind of multi-thousand-percent upside smart money seeks from this cycle’s breakout projects.

- $MAGACOIN FINANCE stands out as the 9600x contender, with analysts explicitly stating it carries the “highest risk/reward ratio” for those looking beyond gradual large-cap moves. Its rapid market entry, viral engagement, and aggressive price trajectory place it squarely in the crosshairs of investors searching for exponential returns.

Bottom line: As of July 31, 2025, Solana and XRP continue their blue-chip rivalry—but the real expert consensus is clear. For those chasing parabolic potential, all arrows point to $MAGACOIN FINANCE as the altcoin likeliest to deliver moonshot results in the months ahead.

To learn more about MAGACOIN FINANCE, please visit:

Website: https://magacoinfinance.com

Presale: https://magacoinfinance.com/presale

Twitter/X: https://x.com/magacoinfinance

The post Will Solana (SOL) Overtake XRP? Expert Consensus Points to $MAGACOIN FINANCE as a Stronger 9600x Play 2025 appeared first on Blockonomi.

With fresh momentum returning to crypto, savvy investors are seeking altcoins ready to jump. While Solana steals headlines, the real movers of August could be different. Three tokens stand out: Cardano (ADA), XRP, and Remittix (RTX), each offering distinct upside depending on your play style.

We explore their setups, map their growth paths, and highlight why they may outshine many other top altcoins this month.

Cardano (ADA): Building a Bullish Breakout

The ADA price is trading near $0.78, struggling to maintain momentum after a recent decline. Prediction models expect ADA to trade between $0.78–$0.82 through August. Year-end projections increase further, with forecasts ranging between $0.66–$1.88, and some potentially eyeing $2.36 if critical levels hold.

Cardano’s technicals and long-term positioning keep it a smart pick among the top altcoins heading into the next leg.

XRP: Quiet Accumulation Amid ETF Hype

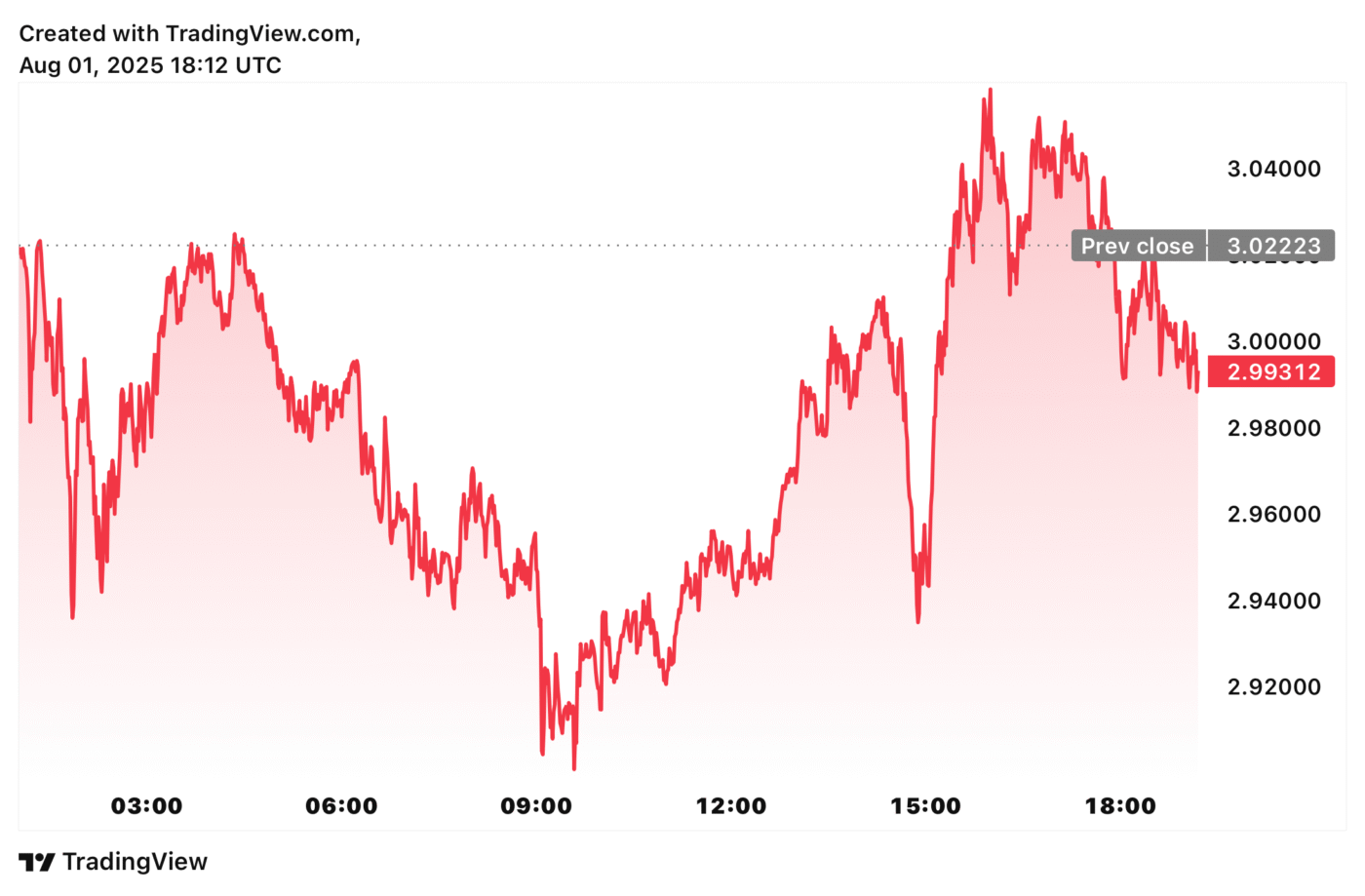

XRP price remains strong near $2.99–$3.10, trading in a tight window between $2.90 and $3.18. While short-term models lean neutral or slightly bearish heading into early August, experts are calling for a 60% rally to $4.47.

Source: TradingView

Market activity shows XRP holding firm amid regulatory and institutional tailwinds. If continuation patterns persist, a rally above $4 could be a trigger point long before meme coins re-enter phase two.

Remittix (RTX): The Fast-Rising PayFi Utility Token

For traders seeking explosive moves, Remittix (RTX) is the name on the tip of many tongues. It’s an Ethereum-native PayFi token built to send crypto directly to bank accounts in 30+ countries.

Here’s Why Remittix is Topping Charts as a 100x Crypto:

- Supports crypto-to-bank transfers

- Raised over $18 million in presale

- Q3 mobile wallet launch

Investors and analysts now tag RTX as one of the top altcoins to watch for breakout potential. Predictions mention paradoxical 50–100× upside as adoption builds, placing it in conversations with DeFi leaders and meme-season power picks.

Its Q3 mobile wallet launch will let users send crypto to cash via local rails, no KYC, no exchange required. That real-world use, backed by an active presale, sets it apart.

Top 3 100x Crypto to Buy Now

ADA price offers reliable breakout pressure with predictable upside if its chart breaks right. XRP price is consolidating while building strength for a potential 60% move if smart money rallies. Remittix (RTX) delivers real utility, strong early adoption, and explosive upside potential far beyond typical altcoin moves.

If you’re searching for top altcoins to buy in August, these three offer paths for both steady gains and big upside. Solana may dominate attention, but your smart move may be splitting exposure between ADA, XRP, and the real-use workhorses like RTX.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

The post Top 3 Altcoins to Buy Before They Surge This August, Solana Isn’t On The List appeared first on Blockonomi.

As July’s bull run heats up, three coins are standing out for potentially massive returns. Investors across both retail and institutional circles are scanning the market for future-proof projects that can deliver real performance in the next crypto breakout. The names that keep surfacing—again and again—are Solana, Ethereum, and the fast-rising MAGACOIN FINANCE.

These aren’t speculative one-hit wonders. They represent infrastructure, culture, and high-upside potential in a rapidly evolving ecosystem. From scalability and staking to political momentum, this trio is shaping up as the best altcoins to buy for July 2025.

Solana: The Scalable Speed King Returns to Form

Solana is once again dominating conversations among those tracking next-gen Layer-1 blockchains. Known for blazing-fast speeds and low fees, the network has reclaimed its status as the go-to hub for DeFi, NFTs, and consumer-grade crypto apps.

Solana’s comeback is being fueled by two powerful forces: developer growth and institutional capital. With new projects launching weekly, and integrations with real-world payment systems expanding, the Solana price prediction from leading analysts points to a potential 700% upside in this bull cycle.

As capital rotates away from Bitcoin, Solana offers a compelling mix of performance and real-world usability—making it a long-term crypto pick in every sense.

Ethereum: ETF Momentum and Staking Demand Drive Institutional Frenzy

Ethereum remains the foundation of the smart contract economy—but in 2025, it’s evolving into something even more powerful. With the launch of BlackRock’s ETHA spot ETF and $7.9 billion in assets under management, ETH is now entering the portfolios of traditional investors with confidence.

That’s not all. With talk of SEC approval for staking via ETFs, Ethereum is moving from a volatile asset to a yield-generating machine. Add in the continued Layer-2 scaling rollouts, a deflationary supply post-merge, and Ethereum’s deep dominance in DeFi, and you get a recipe for serious long-term upside.

No surprise that Ethereum altcoin bull run predictions now include 5x to 7x targets across high-conviction portfolios.

MAGACOIN FINANCE: The Political Meme Token Evolving into a Cycle Leader

While Ethereum and Solana dominate the headlines, MAGACOIN FINANCE 2025 is capturing alpha group attention with speed—and scale. Launched with a fixed 170B supply, zero-tax trading, and no VC control, the project is becoming more than a meme—it’s a movement.

The July momentum is no accident. MAGACOIN FINANCE has gained traction thanks to its alignment with the Trump-backed $600 crypto tax exemption, which could make small crypto payments tax-free across the U.S.

With surging Telegram growth, wallet integrations with MetaMask and Coinbase Wallet, and strong community-led campaigns, the coin is outperforming Ethereum and SUI on engagement and early-stage inflows.

Conclusion

If you’re scanning the market for altcoins to buy July 2025, these three projects demand attention. Solana brings speed and scalability. Ethereum offers institutional-grade staking and ecosystem dominance. And MAGACOIN FINANCE is setting the tone for the meme-political crossover narrative.

Each offers a unique angle for growth—and together, they represent a powerful portfolio setup for anyone chasing that 700% gain in the upcoming cycle.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

The post Best Altcoins to Watch: Solana, Ethereum, and This New Coin Tipped for 700% Gains as the July 2025 Bull Run Picks Up appeared first on Blockonomi.

Things are currently looking dim for payments giant XRP in the ongoing bull market, according to the latest XRP news, as the token has failed to join the ongoing price appreciation rally washing over the crypto industry.

Analysts can’t seem to place a finger on why XRP is performing so poorly in the market, especially since it had a meteoric rise at the start of the year.

XRP, which nearly surged past the psychological $5 mark in the first quarter of the year, has now fallen below $3, a critical support level for the token. While the token’s future hangs in the balance, Remittix (RTX), another payments token, is gradually growing in reputation and could become the top payments token in the industry at the end of the ongoing cycle.

XRP Price Prediction: Analysts Say Token To Fall Below $3

If the latest XRP price prediction by crypto analysts is anything to go by, XRP investors may want to pivot their portfolios or at least some parts of it into more promising altcoins as we head deeper into the ongoing cycle. Analysts believe the payments giant could dip below the psychological $3 barrier over the coming weeks. If they are right, it would represent the token’s lowest price dip this year as it continues to struggle in the market.

XRP’s recent woes come as a bit of a surprise, considering that it was just a few cents away from surging past the $5 mark during the first quarter of the year. If it did, it would have set a new all-time high for price, but alas, it fell short just towards the finish line.

With XRP currently in decline, investors interested in payment tokens may want to consider other options, such as Remittix, the upcoming PayFi token, generating lots of interest within the industry ahead of its launch.

Remittix To Outperform Major Tokens This Cycle: Analysts

The ongoing cycle may have just begun, but the verdicts and predictions are already rolling in by the hundreds, and one of the more popular ones is that the upcoming PayFi project, Remittix, could outperform major tokens once it launches.

Remittix has caught the eye ahead of its launch thanks to a plethora of impressive features and offerings that vastly improve the global payments experience. These include:

- Direct crypto-to-bank transfers in over 30 countries worldwide

- 50% token bonus for early adopters and supporters

- 20% referral rewards for onboarding new users

It has also been in the news recently following the launch of its $250,000 mega giveaway and the recent crypto wallet beta launch.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

The post XRP Price Prediction: XRP Price Could Drop Below $3, While Traders Hedge With Remittix (RTX) appeared first on Blockonomi.

CryptoPotato

TL;DR

- The primary cryptocurrency has been in a free-fall state for the past few days, dropping from $119,000 to a multi-week low of under $112,000 hours ago.

- A popular analyst has highlighted the most significant support zones that could be tested next.

The chart above paints a clear picture. Bitcoin peaked in mid-July after an impressive rally and shot beyond $123,000 to mark its latest record. However, it couldn’t maintain such high levels and started to retrace.

It spent the next ten days or so in a relatively tight range between $117,000 and $120,000 with little to no success during its breakout attempts in either direction.

After a fakeout on July 25, which the bulls managed to defend, the actual breakdown started to take place at the end of the month and as August began. BTC was rejected at the $119,000 line and pushed south to just under $112,000 yesterday, which became a new three-week low.

Some of the reasons behind this notable nosedive can be found here, which range from macro tension and uncertainty to investors offloading substantial BTC quantities. Building on the latter, Ali Martinez noted that miners have also been selling lately, dumping more than 3,000 BTC in just two weeks.

Miners have offloaded over 3,000 Bitcoin $BTC in the past two weeks! pic.twitter.com/enP4JtUyMs

— Ali (@ali_charts) August 2, 2025

Given bitcoin’s crash, which liquidated nearly $1 billion in over-leveraged positions at one point, the analyst also discussed the next key support zones for the asset. They range between $105,000 and $107,000. Later, Martinez reiterated the importance of the $107,100 line as a large accumulation point for BTC’s future price trajectory.

$107,160 continues to emerge as a crucial support level for Bitcoin $BTC! pic.twitter.com/izOejLbagA

— Ali (@ali_charts) August 2, 2025

So far, the cryptocurrency has remained well above that level as it currently trades above $113,000. However, more volatility is expected on Monday when all financial markets open. Additionally, Trump has a habit of making important announcements that rattle markets on Sundays, so watch out.

The post BTC Down $10K From ATH – Here Are Bitcoin’s Next Support Zones (Analyst) appeared first on CryptoPotato.

Positivity in the crypto markets remains strong despite the most recent turmoil on the charts. This is especially true for ETH’s community, as the altcoin has seen more than 35% added to its price over the past 30 days.

But who are the biggest players making the Ethereum trade and driving ETH prices ever higher?

ETH Gains Lag Behind BTC Since 2022

In chemical science, ether is a humor, and the better part of good humor is excellent timing.

Over most 30-day periods in the past 12 months, crypto investors would have been better off holding Bitcoin if their goal was to achieve a higher 30-day ROI from their investment.

The trailing 12-month return on investment for BTC is +75% compared to ETH’s +19% over the same period. Some Ethereum holders have been wondering what’s up with its market action compared to Bitcoin’s.

In large part, the Ethereum base layer, by design, sacrificed capital inflows over the past 12 months to low-fee Layer 2 Ethereum networks and capital inflows to their currencies.

These include, among some of the largest by total market cap, Mantle (MNT), POL (POL), Arbitrum (ARB), Optimism (OP), and Starknet (STRK).

It’s like trying to inflate a balloon, but there’s a vent with extra air going into a bunch of other balloons first before you get enough air pressure to keep inflating the main balloon.

To top that off, Ethereum is a very big balloon, clocking August 2nd at $468 billion in market capitalization on a fascinating multi-year trend line since 2015 for long-term saver investors.

That said, here are four bullish portents that the sign of ETH is rising in the air:

1. Ethereum Roars Back In Multi-Billion Dollar Wall Street Frenzy

A month into Q3, the pressure from inflows to the Ether economy has finally built up to the point of pushing its price back up and really moving the needle.

Ethereum’s phenomenal July price gains show demand has grown broad and deep enough to overcome the massive planned leakage of inflows to Ethereum Layer 2s.

That’s got the bulls posting wild price predictions, like BitMEX founder Arthur Hayes, who said, “Ether = $10,000” on Jul. 22. He also made these comments in a post on his Medium blog:

“Ever since Solana rose from the FTX ashes from $7 to $280, Ether has been the most hated large-cap crypto. No more; the Western institutional investor class, whose chief cheerleader is Tom Lee, loves Ether. Buy first, ask questions later.”

2. Ethereum ETFs Blowout Record Inflows

Iconic Wall Street mascot Gordon Gekko once said, “Greed is good.”

A massive cohort on Wall Street is already aware of blockchain’s usefulness and has become addicted to Bitcoin and Ether returns in 2025. They’ve been backing up the entire boat and loading up on Ether tokens through ETFs, custody services, and on-chain developments.

Capital inflows to buy Ethereum ETFs shattered a record in July as feverish demand on Wall Street picked up pace. Ether ETFs attracted $2.12 billion in a week in mid-July and continued to ramp up huge sums in the weeks that followed, despite the relative market slowdown.

Matt Hougan, CIO of Bitwise Investments, wrote on July 22 a note outlining the “Ethereum Demand Shock,” which is pumping ETH prices up with all this ROI-hungry capital from Wall Street ETF buyers and a bevy of new Ether corporate treasury companies with publicly traded shares on the US stock market.

3. SharpLink Gaming Stakes Hundreds of Millions in ETH

This online sports betting company, based in Minneapolis and traded on Nasdaq, has a business model ripe for disruption by blockchain solutions to create fairness and security for online players.

Following up on Strategy, Inc.’s BTC treasury campaign, SharpLink had acquired 188,478 ETH by June 25. That would be worth nearly three-quarters of a billion dollars a month later.

After that, over five days in mid-July, SharpLink took another whale-sized corporate bite out of the Ethereum supply. The online sports betting specialists locked in 60,582 ETH worth some $180 million.

Meanwhile, Wall Street rewarded the company for the move, jolting its stock by 17% in under 24 hours.

By Jul. 16, SharpLink Gaming had locked in 280,000 ETH, worth around $900 million, throwing a supply pinch, rallying Ether bulls, and drastically changing the calculus for Ether price valuations. Its holdings continue to increase almost daily and stand at over 480,000 ETH as of August 3.

The company says it’s staking all of that and generating hundreds of thousands of dollars weekly in yields by holding its Ether staked.

4. Bitmine’s $250 Million and Growing Ether Fund

In addition to SharpLink Gaming, there’s Las Vegas-based Bitmine Immersion Technologies, a US blockchain firm that recently pivoted to buying, holding, and staking ETH.

They brought in Tom Lee, the FundStrat executive who used to appear on CNBC during the pandemic and say that Bitcoin would eventually reach $1 million. At the same time, the other commentators smiled and nodded.

To start off July, Bitmine launched a $250 million corporate Ether treasury, and its stock soared 3,000% in almost no time, rising from the penny bin to above $135 a share.

The post Here Are 4 Bullish Signals: ETH Momentum Is Building appeared first on CryptoPotato.

Samourai Wallet co-founders Keonne Rodriguez and William Lonergan Hill have decided to plead guilty to charges related to their mixer service.

The pair had previously denied guilt in April 2024 and had made several attempts to have their lawsuit dropped.

Pleas Changed on Wednesday

According to court documents shared earlier in the week, the executives agreed to change their admissions during a Wednesday morning hearing before Judge Denise Cote. The two faced charges of conspiring to launder money, a crime punishable by up to 20 years in prison, and operating an unlicensed money-transmitting business, which carries a five-year sentence. This brings their total possible prison time to 25 years.

Prosecutors alleged that Samourai processed more than $2 billion in illegal transactions and laundered over $100 million in criminal proceeds. This includes payments tied to illicit online marketplaces such as Silk Road.

The U.S. Department of Justice (DOJ) claims that the wallet’s Whirlpool and Ricochet features were designed to conceal the origins of Bitcoin transactions. The indictment also cited internal communications and social media posts showing the two were aware that Samourai was being used for criminal activity and actively marketed it for such operations.

The founders have made several attempts to dismiss the litigation against them. Following an April 12 memo issued by Deputy Attorney General Todd Blanche, which stated the DOJ would no longer pursue cases based on user actions or regulatory technicalities, their lawyers pushed for the charges to be dropped.

A month later, their defense lodged another motion, alleging that prosecutors withheld internal communications from FinCEN, which suggested that Samourai Wallet didn’t qualify as a money transmitter and therefore wasn’t legally required to register. However, the DOJ argued it didn’t have to share that evidence.

Harmful Legal Precedent

Elsewhere, Tornado Cash is facing similar legal action with Roman Storm, one of its co-founders, currently being tried before a jury. His trial began in July at a Manhattan federal court, where he faces allegations of money laundering, violating U.S. sanctions, and operating an unlicensed money-transmitting business.

Critics say these lawsuits could set a dangerous precedent by criminalizing open-source development for non-custodial tools that don’t hold user funds. They argue that programmers shouldn’t be held liable for how autonomous code is used, particularly when there’s no direct evidence of intent to commit crimes.

Earlier this year, a blockchain developer filed a lawsuit against the DOJ, in the twilight of the Biden administration, claiming it had undermined crypto innovation. He accused the authority of overreaching by treating creators of non-custodial crypto software as unlicensed money transmitters.

The post Samourai Wallet Founders Plead Guilty in $100M Bitcoin Laundering Case appeared first on CryptoPotato.

Crimes involving cryptocurrency are worryingly on the rise, becoming ever more aggressive and, as in this case, quite shocking.

Regardless of whether alleged or not, this is the harsh reality we are currently facing in this day and age.

Pleading Not Guilty

According to a story from Fox News, two culprits are accused of torturing an Italian millionaire in his apartment in New York, reportedly over a stash of $100 million in Bitcoin, and one of them was released after spending two months in the Rikers Island prison.

The discharged is John Woeltz, 37, on the condition of a $1 million parole, with the release coming a week after a Manhattan judge granted bond for him and an alleged accomplice, William Duplessie, aged 33. Both have pleaded not guilty, and the latter has remained in custody.

The duo is accused of kidnapping and tormenting Italian crypto trader Michael Valentino Teofrasto Carturan. The defense attorneys on the case stated that the alleged torture very closely resembled a “fraternity-like rite of passage.” Woeltz’s attorney, Wayne Gosnell, noted the following in a previous hearing:

“Mr. Carturan was there in the role of a pledge, he was essentially being hazed.”

The alleged torturer, who was released and is also involved in cryptocurrency trading, evaded questions about whether he actually carried out the claims against him, and how he felt to be freed from custody as he was walking out of the Supreme Court building in Manhattan.

As a condition to his release, the sum of which, reportedly, was a combination of cash and property put up by his father, he is subject to home arrest with an electronic monitoring bracelet. He will only be allowed to leave the premises of his home for doctor’s appointments, meetings with lawyers, or in the event of an emergency.

Violent and Graphic

Prosecutors stated in court that the duo kidnapped Carturan and tortured him for over three weeks, supposedly relieving him of his phone and passport. The attorneys further note that both Duplessie and Woeltz reportedly had a manifesto prepared with how they plan to steal the prisoners’ cryptocurrency.

“Informant further states that the defendant and unapprehended male demanded that Informant provide the defendant with Informant’s wallet password so that the defendant and unapprehended male could take Informant’s Bitcoin,” a criminal complaint states.

When the victim refused to provide the password to his crypto holdings, the two detainees allegedly subjected him to “physical beatings, in addition to, but not excluding, using electric shock, lacerating his head with blunt force from a firearm, and pointing said firearm at the Informant’s head several times. Further, the captive was dragged to the top of a flight of stairs, hanged over the ledge, and threatened with losing his life.”

The authorities further added that there were threats against the 28-year-old hostage’s family in Italy, while he was, supposedly, humiliated by having people urinate on him and by Woeltz forcing him to take drugs.

Both defendants are due to appear in court on October 15th.

The post Alleged Bitcoin Torture Suspect Freed on $1M Bail After 2 Months in Custody appeared first on CryptoPotato.

GAIA has partnered with Samsung to launch a limited-edition AI-native phone, built on the Galaxy S25 Edge. Designed for AI sovereignty, the device enables users to run large language models directly on-device, eliminating cloud dependency while offering privacy, ownership, and rewards through its decentralized AI ecosystem.

In this interview, Shashank Sripada, the project’s COO and Co-founder, explains how the GAIA Edition Galaxy S25 aims to make AI sovereignty tangible, offering users direct control over their data and digital assistants from the device itself.

You describe GAIA as enabling “AI sovereignty.” In practical terms, what does that mean for the average user in regions where privacy concerns are high but technical literacy is low?

AI sovereignty means control over your data, models, and the intelligence that acts on your behalf. For users in high-privacy regions with limited technical skill, GAIA offers turnkey domains and agent templates that let anyone deploy personal AI tools without ceding control to cloud platforms. Practically, this means:

Your data stays local – inference can happen on-device or in a domain you control.

You choose the agent – whether it’s open-source or fine-tuned to your context.

No centralized surveillance – responses are composable, auditable, and censorship-resistant.

Think of it like Signal meets ChatGPT – but powered by you, not a trillion-dollar cloud monopoly.

Some argue that decentralized AI layers will simply recreate centralization under different labels if network participation is limited. How will GAIA avoid this pitfall?

GAIA’s network economics, architecture, and governance are specifically designed to resist re-centralization:

Open Node Access: Anyone can run a node – even on mobile or low-power edge devices – and stake to participate in inference.

Deterministic Reward Distribution: Node rewards are tied to performance and decentralization, not centralized hosting or capital.

Decentralized Domains & Agents: Value capture happens at the edge – meaning builders, not just validators or miners, accrue value.

On-chain governance: Protocol upgrades and reward structures are governed by token holders, not a centralized foundation.

In short, participation is low-barrier and structurally distributed. The economic incentives scale with decentralization, not against it.

What regulatory or legal challenges do you anticipate GAIA facing with operating on-device AI inference and integrated wallets, especially with jurisdictions that have strict rules on AI and crypto?

We’re proactively navigating this intersection of AI and crypto with a jurisdiction-aware architecture:

On-device inference is akin to running local software or using open-source tools – not a regulated service on its own. Integrated wallets follow existing patterns from dApps and DeFi, but we ensure non-custodial design, user consent flows, and limited data exposure to stay clear of financial intermediation triggers.

Jurisdictional fallback: Where required, GAIA can implement region-specific gating, disclosures, or compliance toggles, especially around KYC, model access, and token transfers.

Partnerships with legal advisors in the US, EU, and Asia ensure we’re compliant with evolving AI transparency, explainability, and crypto rulesets. Regulation is inevitable – and GAIA’s modular structure makes it adaptable to emerging norms without compromising decentralization.

How does GAIA plan to handle potential regulatory challenges around crypto rewards tied to hardware sales, especially in the US, where token incentives may trigger securities scrutiny?