Cryptocurrency Posts

Crypto Briefing

Gold breaks above $5,000 for the first time on geopolitical and economic risks, while silver hits records and crypto slips.

The post Gold surges past $5,000 for first time as silver tops $107 on safe-haven buying appeared first on Crypto Briefing.

The recent Bitcoin drop intensifies market fear, potentially leading to further declines and impacting the broader crypto ecosystem.

The post Bitcoin slides below $88K, triggering $135M in crypto long liquidations in the past hour appeared first on Crypto Briefing.

The US's leadership in crypto regulation could drive global innovation, attracting investment and talent while setting international standards.

The post CFTC Chair Selig says America is the crypto capital of the world appeared first on Crypto Briefing.

Gemini's pivot to a super app could streamline user experience but may limit NFT market diversity and innovation.

The post Gemini to close NFT marketplace Nifty Gateway as it sharpens focus on super app vision appeared first on Crypto Briefing.

Trump's tariff threat could strain US-Canada relations, impacting trade dynamics and potentially forcing Canada to reconsider its China strategy.

The post Trump threatens 100% tariff on Canadian goods over China deal appeared first on Crypto Briefing.

Bitcoin Magazine

Bitcoin Magazine

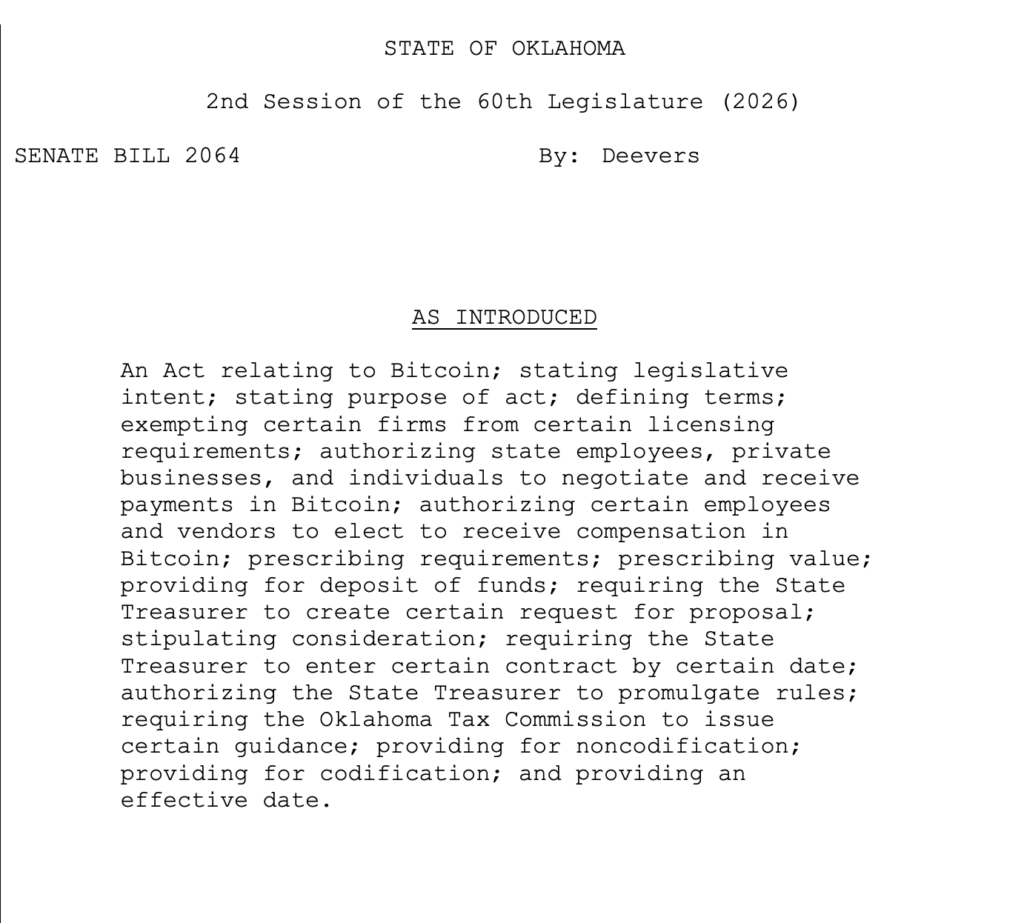

Oklahoma Introduces Bill Allowing State Employees and Vendors to Be Paid in Bitcoin

Oklahoma lawmakers introduced legislation this week that would allow state employees, vendors, private businesses, and residents to negotiate and receive payments in bitcoin.

Senate Bill 2064, introduced by Senator Dusty Deevers during the 2026 legislative session, establishes a legal framework for the use of bitcoin as a medium of exchange and compensation without designating it as legal tender.

The bill explicitly states that it does not conflict with the U.S. Constitution’s prohibition on states coining money or declaring legal tender other than gold and silver, instead recognizing bitcoin as a financial instrument operating within existing legal frameworks.

If enacted, the bill would permit Oklahoma state employees to elect to receive salaries or wages in bitcoin, either based on the asset’s market value at the start of a pay period or at the time of payment.

Employees would be allowed to revise their payment preference at the beginning of each pay period and could choose to receive compensation in bitcoin, U.S. dollars, or a combination of both.

Payments would be deposited either into a self-hosted wallet controlled by the employee or into a third-party custodial account designated by the employee.

The legislation would also allow vendors contracting with the state to opt into receiving payment in bitcoin on a per-transaction basis. The bitcoin value of those payments would be determined by the market price at the time of the transaction unless otherwise agreed upon in writing.

Beyond state payroll and procurement, the bill broadly authorizes private businesses and individuals in Oklahoma to negotiate and receive payments in bitcoin, reinforcing its use as a voluntary medium of exchange across the state economy.

SB 2064 includes provisions aimed at reducing regulatory friction for bitcoin-native businesses. Firms that deal exclusively in digital assets and do not exchange them for U.S. dollars would be exempt from Oklahoma’s money transmitter licensing requirements, according to legislation text.

The bill directs the Oklahoma State Treasurer to issue a request for proposals for a digital asset firm to process bitcoin payments for state employees and vendors.

In selecting a provider, the Treasurer must consider factors including fees, transaction speed, cybersecurity practices, custody options, and any relevant state licenses. The Treasurer would be required to finalize a contract with a provider by January 1, 2027, and is authorized to promulgate rules to implement the program.

Back in January 2025, Oklahoma State Senator Dusty Deevers introduced a similar initiative called the Bitcoin Freedom Act (SB 325). It was a bill designed to let employees, vendors, and businesses voluntarily receive and make payments in Bitcoin while creating a legal framework for its use in the state’s economy.

Oklahoma’s bitcoin adoption echoes other U.S. states

This move follows other states like New Hampshire and Texas in exploring ways to integrate Bitcoin into public finance.

New Hampshire passed the nation’s first Strategic Bitcoin Reserve law, allowing the state to hold up to 5% of its funds in high-market-cap digital assets and even approve a bitcoin-backed municipal bond.

Texas, meanwhile, has paired legislation with action, creating a Strategic Bitcoin Reserve and making the first U.S. state Bitcoin ETF purchase of around $5 million, framing it as both a hedge against economic volatility and a step toward modernizing state finances.

If passed, SB 2064 would take effect on November 1, 2026, positioning Oklahoma among a small but growing number of U.S. states exploring direct integration of bitcoin into government payment systems.

The Oklahoma Tax Commission would also be required to issue guidance on the tax treatment of digital assets received as payment by January 1, 2027, addressing an area that has often created uncertainty for employees and employers alike.

This post Oklahoma Introduces Bill Allowing State Employees and Vendors to Be Paid in Bitcoin first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

UBS Plans Bitcoin Trading for Select Wealth Clients

UBS Group AG is preparing to offer bitcoin trading to a select group of private banking clients in Switzerland.

According to a Bloomberg report citing people familiar with the matter, the Swiss banking giant has been in discussions for several months about launching a cryptocurrency trading offering and is currently in the process of selecting external partners.

The service would initially be limited to a small subset of Swiss private banking clients, with a broader rollout possible at a later stage.

UBS has not made a final decision on implementation, the people said, and the plans remain subject to regulatory, operational, and risk considerations.

Rather than building a full digital asset stack in-house, the banks is reportedly evaluating partnerships with third-party providers that could handle trading execution, custody, and compliance.

A partner-led model would allow the bank to offer crypto exposure while limiting balance sheet risk and operational complexity.

Such an approach mirrors strategies adopted by other major financial institutions entering the digital asset space, particularly those seeking to comply with stringent capital requirements under the Basel III framework.

Under the proposed structure, the company would initially allow eligible clients to buy and sell bitcoin (BTC) and ethereum (ETH), the two largest digital assets by market capitalization.

Additional assets have not been discussed.

Possible UBS expansion beyond Switzerland

While the initial rollout would focus on Switzerland, Bloomberg reported that UBS is considering expanding the service to other regions, including Asia-Pacific and the United States, depending on regulatory clarity and client demand.

UBS currently manages approximately $4.7 trillion in wealth assets as of September 30, making it the largest wealth manager globally, according to Bloomberg. Even a limited crypto offering could represent a meaningful step toward broader institutional adoption of bitcoin within traditional private banking.

The bank has historically maintained a cautious stance on cryptocurrencies.

In November 2023, UBS allowed wealthy clients in Hong Kong to trade cryptocurrency-linked exchange-traded funds, joining competitors such as HSBC, but stopped short of offering direct spot crypto trading.

A UBS spokesperson declined to comment on the specifics of the Bloomberg report but confirmed that the bank continues to explore digital asset initiatives.

“As part of UBS’s digital asset strategy, we actively monitor developments and explore initiatives that reflect client needs, regulatory developments, market trends and robust risk controls,” the spokesperson said. “We recognize the importance of distributed ledger technology like blockchain, which underpins digital assets.”

This post UBS Plans Bitcoin Trading for Select Wealth Clients first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

Nasdaq Moves to Remove Position Limits on Bitcoin ETF Options

Nasdaq has filed a rule change with the U.S. Securities and Exchange Commission seeking to remove position and exercise limits on options tied to spot Bitcoin exchange-traded funds, a move that would further integrate crypto-linked products into traditional derivatives markets.

The proposal, originally filed on Jan. 7 and made effective this week on the 21st, eliminates the current 25,000-contract cap on options linked to Bitcoin and Ethereum ETFs listed on Nasdaq.

Affected products include funds from BlackRock, Fidelity, Grayscale, Bitwise, ARK/21Shares and VanEck, according to the filing.

The SEC waived its standard 30-day waiting period, allowing the rule change to take effect immediately, while retaining the authority to suspend it within 60 days if further review is deemed necessary.

A public comment period is now open, with a final SEC determination expected by late February unless the rule is paused.

Nasdaq argued that lifting the limits would allow crypto ETF options to be treated “in the same manner as all other options that qualify for listing,” eliminating what it described as unequal treatment without undermining investor protections.

The exchange said the change would support market efficiency while maintaining safeguards against manipulation and excessive risk.

Options are derivative contracts that give traders the right, but not the obligation, to buy or sell an asset at a predetermined price before a set expiration date. Position and exercise limits are typically imposed to prevent concentrated positions that could amplify volatility or destabilize markets.

The filing builds on Nasdaq’s approval in late 2025 to list options on single-asset crypto ETFs as commodity-based trusts. While that decision allowed Bitcoin and Ethereum ETF options to trade on the exchange, existing position limits remained in place.

Nasdaq has steadily expanded its involvement in crypto markets in recent years.

Nasdaq’s bitcoin and digital asset push

In November, the exchange filed a separate proposal to raise position limits on options tied to BlackRock’s iShares Bitcoin Trust (IBIT) to as much as one million contracts, citing growing institutional demand and increased use of options for hedging strategies.

The exchange has also pushed into crypto indexing and tokenization. In January, Nasdaq and CME Group announced plans to unify their crypto benchmarks under the Nasdaq-CME Crypto Index, which tracks major digital assets including Bitcoin, Ether, XRP, Solana, Cardano and Avalanche.

If approved permanently, the latest rule change would mark another step toward normalizing Bitcoin derivatives within U.S. regulated markets, further blurring the line between traditional financial instruments and crypto-native assets.

This post Nasdaq Moves to Remove Position Limits on Bitcoin ETF Options first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

Epoch Ventures Predicts Bitcoin Hits $150K in 2026, Declares End of 4-Year Halving Cycle

Epoch, a venture firm specializing in Bitcoin infrastructure, issued its second annual ecosystem report on January 21, 2026, forecasting robust growth for the asset despite a subdued 2025 performance.

The 186-page document analyzes Bitcoin’s price dynamics, adoption trends, regulatory outlook, and technological risks, positioning the cryptocurrency as a maturing monetary system. Key highlights include a prediction that Bitcoin will reach at least $150,000 USD by year-end, driven by institutional inflows and decoupling from equities. The report also anticipates the Clarity Act failing to pass, though its substance on asset taxonomy and regulatory authority may advance through SEC guidance. Additional forecasts cover gold rotations boosting Bitcoin by 50 percent, major asset managers allocating 2 percent to model portfolios, and Bitcoin Core maintaining implementation dominance.

Eric Yakes, CFA charterholder and managing partner at Epoch Ventures, brings over a decade of finance expertise to the Bitcoin space, having started his career in corporate finance and restructuring at FTI Consulting before advancing to private equity at Lion Equity Partners, where he focused on buyouts. He left traditional finance in recent years to immerse himself in Bitcoin, authoring the influential book “The 7th Property: Bitcoin and the Monetary Revolution,” which explores Bitcoin’s role as a transformative monetary asset, and has since written extensively on its technologies and ecosystem. Yakes holds a double major in finance and economics from Creighton University, positioning him as a key voice in Bitcoin venture capital through Epoch, a firm dedicated to funding Bitcoin infrastructure.

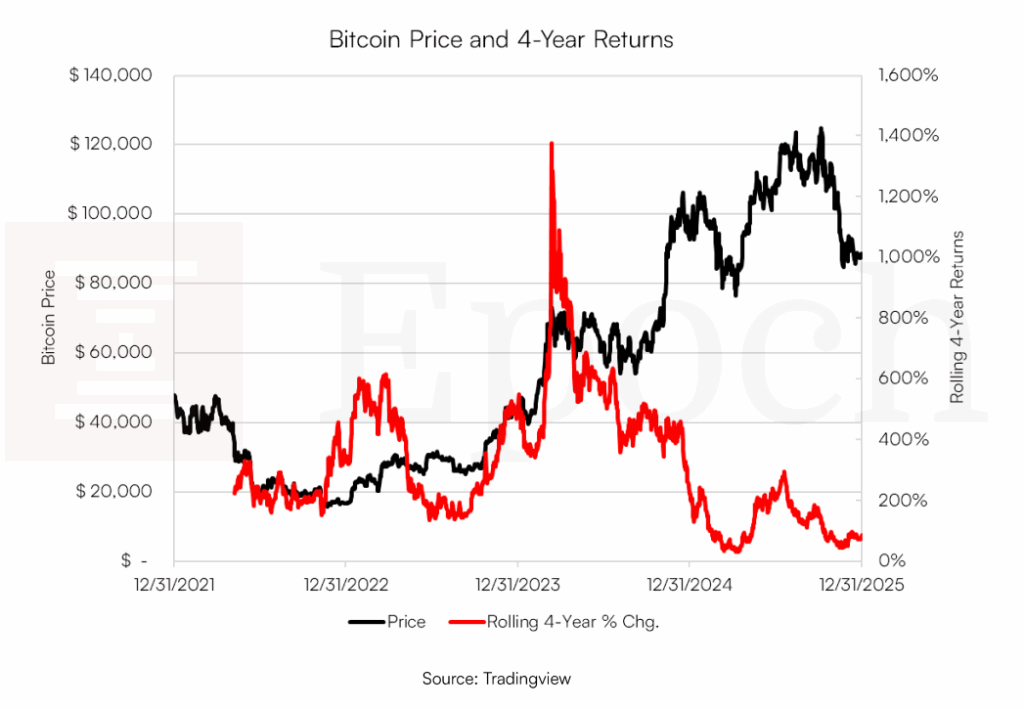

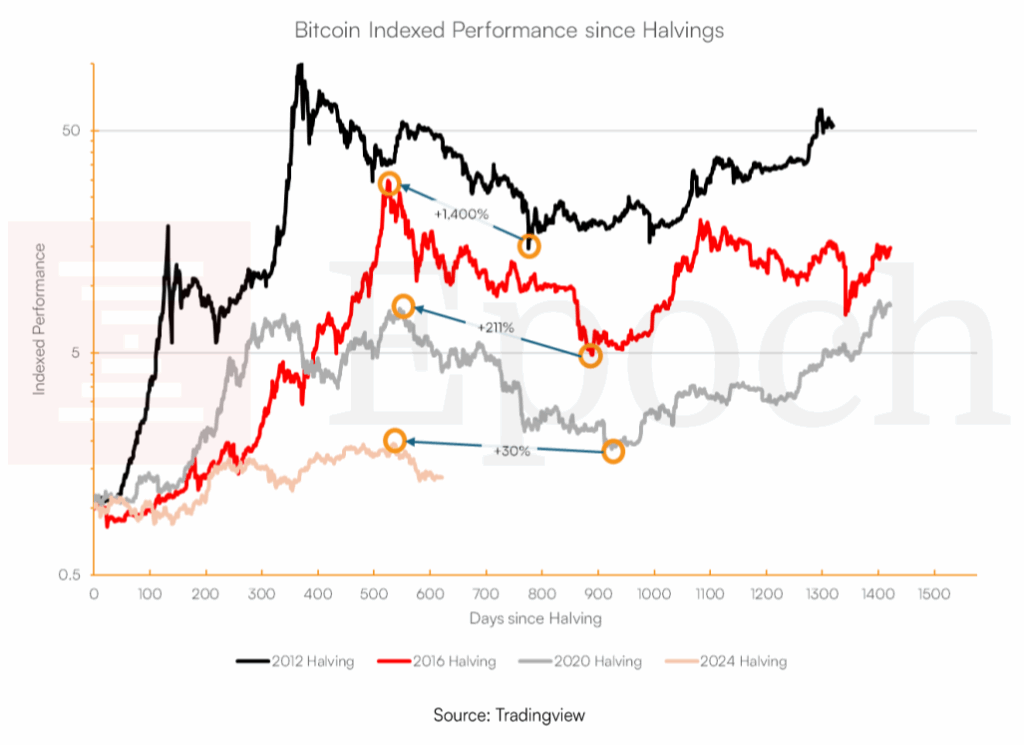

The Death of the Four-Year Cycle

Bitcoin closed 2025 at $87,500, marking a 6 percent annual decline but an 84 percent four-year gain that ranks in the bottom 3 percent historically. The report states the death of the 4-year cycle in no uncertain terms: “We believe cycle theory is a relic of the past, and the cycles themselves probably never existed. The fact is that Bitcoin is boring and growing gradually now. We make the case for why gradual growth is precisely what will drive a ‘gradually, then suddenly’ moment.”

The report goes on to discuss cycle theory in depth, presenting a view of the future that’s becoming the new market expectation: less volatility to the downside, slow and steady growth to the upside.

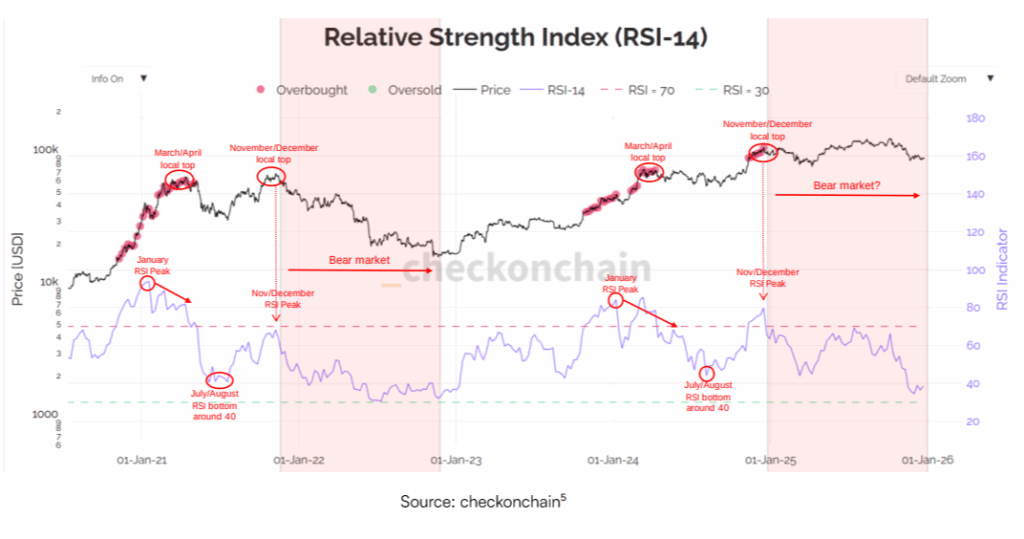

Price action suggests a new bull market commenced in 2026, with 2025’s drop from $126,000 to $81,000 potentially being a self-fulfilling prophecy due to cycle expectations, as RSI remained below overbought since late 2024, suggesting bitcoin already went through a bear market and we are commencing a new kind of cycle.

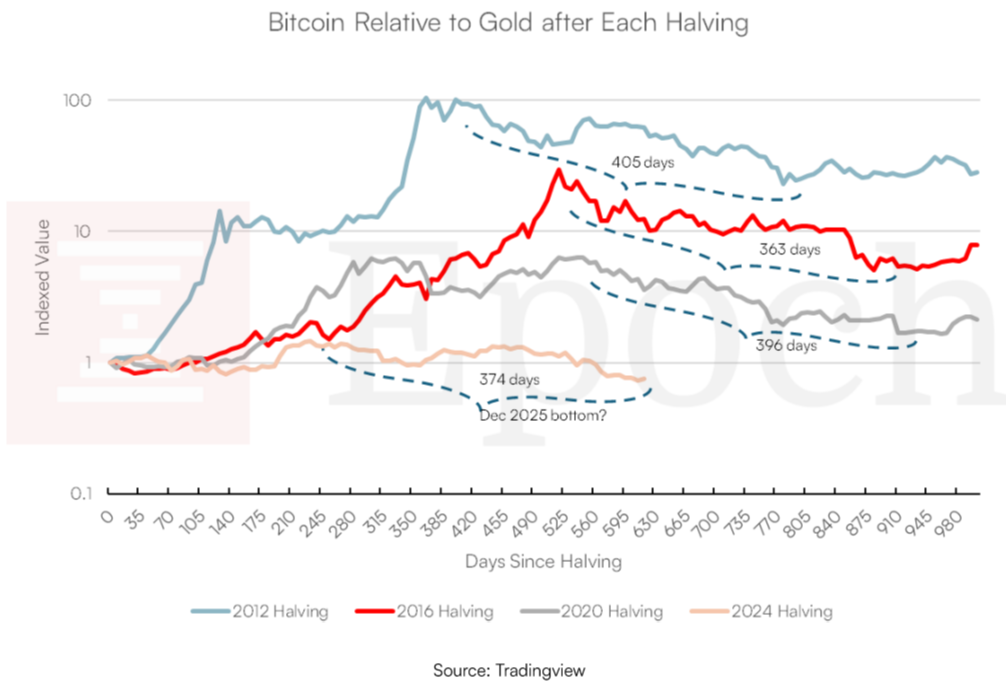

Versus gold, Bitcoin is down 49 percent from its highs, in a bear market since December 2024. Gold’s meteoric rise presents a potential price catalyst for bitcoin; a small rebalancing reallocation from gold of 0.5% would induce greater inflows than the U.S. ETFs; at 5.5%, it would equal bitcoin’s market capitalization. Gold’s rise makes bitcoin more attractive on a relative basis, and the higher gold goes, the more likely a rotation into bitcoin. Timing analysis, as seen in the chart below, which counts days from the local top, suggests Bitcoin might be nearing a bottom versus Gold.

In terms of volatility bitcoin has aligned with mega-caps like Tesla, with 2025 averages for Nasdaq 100 leaders exceeding Bitcoin’s, suggesting a risk-asset decoupling and limiting drawdowns. Long-term stock correlations persist, but maturing credit markets and safe-haven narratives may pivot Bitcoin toward gold-like behavior.

The report goes in-depth into other potential catalysts for 2026, defending its bullish thesis, such as:

- Consistent ETF Inflows

- Nation State Adoption

- Mega-cap Companies Allocating to Bitcoin

- Wealth Managers Allocating Clients

- Inheritance Allocation

FUD, Sentiment and Media Analysis

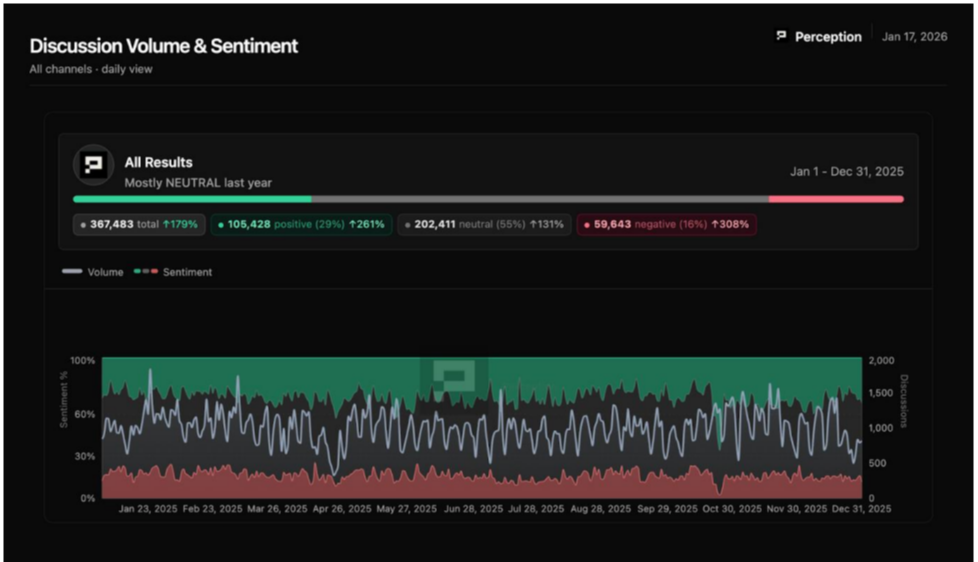

Analysis of 356,423 datapoints from 653 sources reveals a fractured sentiment landscape, with “Bitcoin is dead” narratives concluded. FUD is stable at 12-18 percent but the topics rotate, crime and legal themes are up 277 percent, while environmental FUD is down 41 percent.

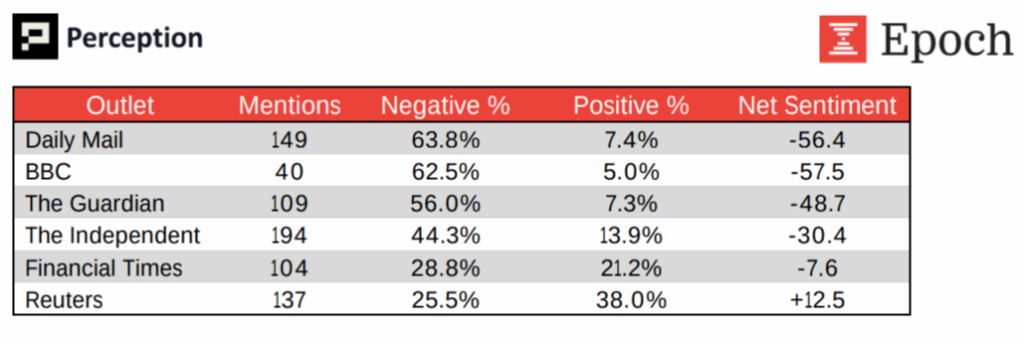

A 125-point perception gap exists between conference attendees (+90 positive) while tech media is generally negative at (-35). UK outlets show 56-64 percent negativity, 2-3 times international averages.

The Lightning Network coverage dominates podcasts at 33 percent but garners only 0.28 percent mainstream coverage, a 119x disparity. Layer 2 solutions are not zero-sum, with Lightning at 58 percent mentions and Ark up 154 percent.

Media framing has caused mining sentiment to swing 67 points: mainstream outlets cover the sector at 75.6 percent positive, while Bitcoin communities view it at only 8.4 percent positive, underscoring the importance of narrative and audience credibility for mining companies.

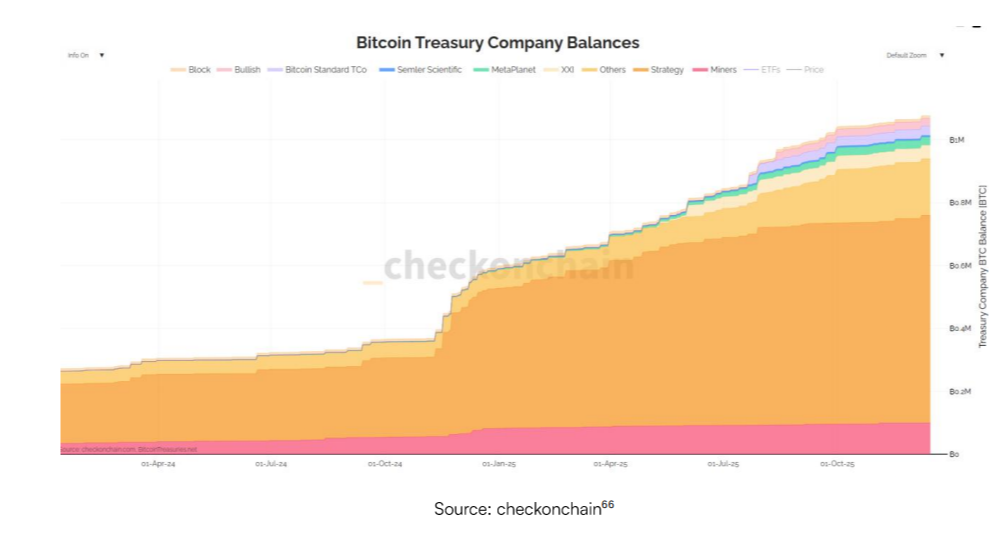

Bitcoin Treasury Companies

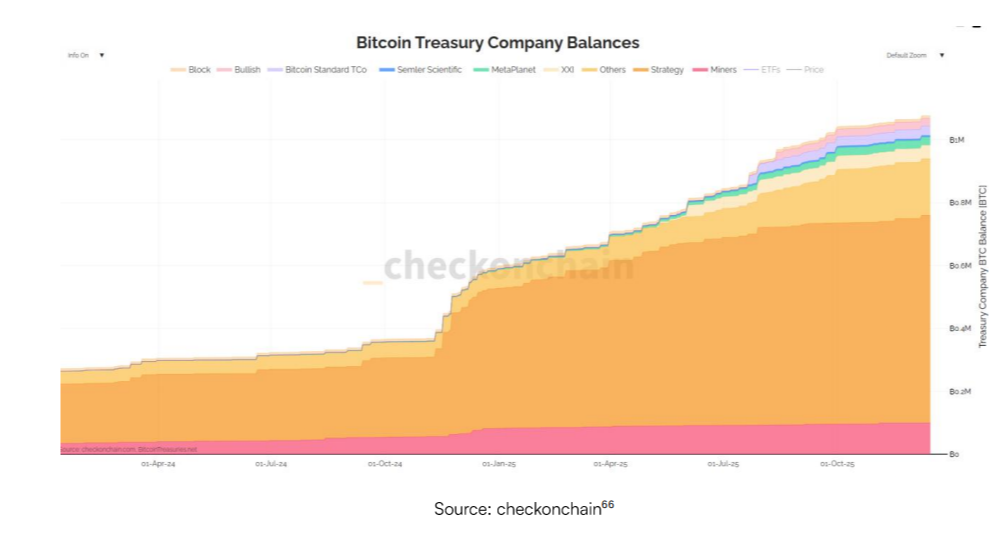

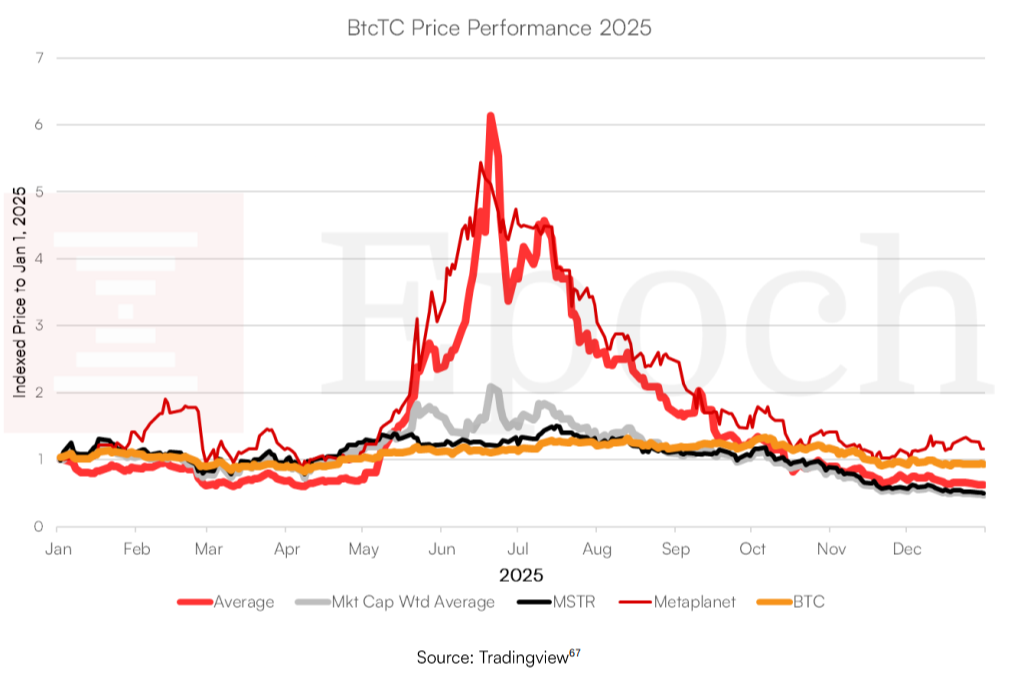

More companies added Bitcoin to their balance sheets in 2025 than in any previous year, marking a major step in corporate adoption. Established firms that already held Bitcoin—known as Bitcoin treasury companies, or BtcTCs—bought even larger amounts, while new entrants went public specifically to raise money and purchase Bitcoin. According to the report, public company bitcoin holdings increased 82% y/y to ₿1.08 million and the number of public companies holding bitcoin grew from 69 to over 191 throughout 2025.65 Corporations own at least 6.4% of total Bitcoin supply – public companies 5.1% and private companies 1.3%. This created a clear boom-and-bust pattern throughout the year.

Company valuations rose sharply through mid-2025 before pulling back when the broader Bitcoin price corrected. The report explains that these public treasury companies offer investors easier access through traditional brokers, the ability to borrow against holdings, and even dividend payments, though with dilution risks. In contrast, buying and holding Bitcoin directly remains simpler and preserves the asset’s full scarcity.

Looking ahead, Epoch expects Japan’s Metaplanet to post the highest multiple on net asset value (mNAV)—a key valuation metric—among all treasury companies with a market cap above $1 billion. The firm also predicts that an activist investor or rival company will force the liquidation of one underperforming treasury firm to capture the discount between its share price and the actual value of its Bitcoin holdings.

Over time, these companies will stand out by offering competitive yields on their Bitcoin. In total, treasury companies acquired roughly 486,000 BTC during 2025, equal to 2.3 percent of the entire Bitcoin supply, drawing further corporate interest in Bitcoin. For business owners considering a Bitcoin treasury, the report highlights both the growth potential and the risks of public-market volatility.

The Bitcoin Treasury Companies section of the report explores:

- The fundamentals of a Bitcoin treasury allocation including the potential benefits and risks of Bitcoin treasury company investing.

- The 2025 timeline of Bitcoin Treasury companies.

- Current valuations of BtcTCs.

- Our opinion on BtcTCs broadly, and how we view them compared to owning Bitcoin directly.

- Commentary on specific BtcTCs.

- Predictions on Bitcoin treasury companies in the coming years.

Regulation Expectations for 2026

Epoch predicts the Clarity Act—a proposed bill to clarify digital asset oversight by dividing authority between the SEC and CFTC—will not pass Congress in 2026. However, the report expects the bill’s main ideas, including clear definitions for asset categories and regulatory jurisdiction, to advance through SEC rulemaking or guidance instead. The firm also forecasts Republican losses in the midterm elections, which could trigger new regulatory pressure on crypto, most likely in the form of consumer protection measures aimed at perceived industry risks. On high-profile legal cases, Epoch does not expect pardons for the founders of Samurai Wallet or Tornado Cash this year, though future legal appeals or related proceedings may ultimately support their defenses.

The report takes a critical view of recent legislative efforts, arguing that bills like the GENIUS Act (focused on stablecoins) and the Clarity Act prioritize industry lobbying over the concerns of everyday Bitcoin users, especially the ability to hold and control assets directly without third-party interference (self-custody).

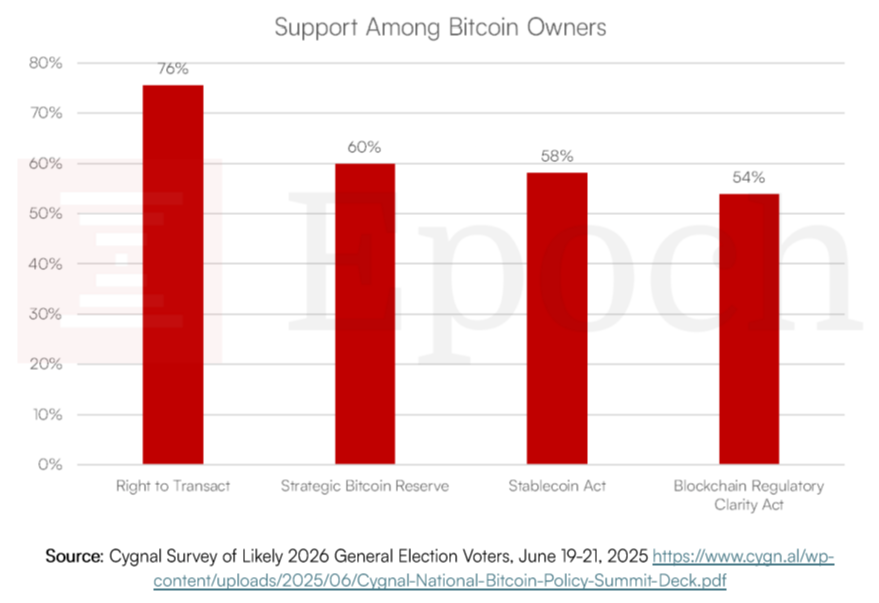

The report points out a discrepancy between what crypto-owning voters want — a majority preferring above all, the right to transact. While the Clarity and Genius Acts focus on less popular special interests, they just fall within the 50% support range. Epoch warns that “This deviation between the will of the voters and the will of the largest industry players is an early warning sign of the potential harm from regulatory capture (intentional or otherwise)”.

The report is particularly critical of the way the GENIUS Act set up the regulatory structure for stablecoins. The paragraph on the topic is so poignant that it merits being printed in its entirety:

“Meet the new boss, same as the old boss:

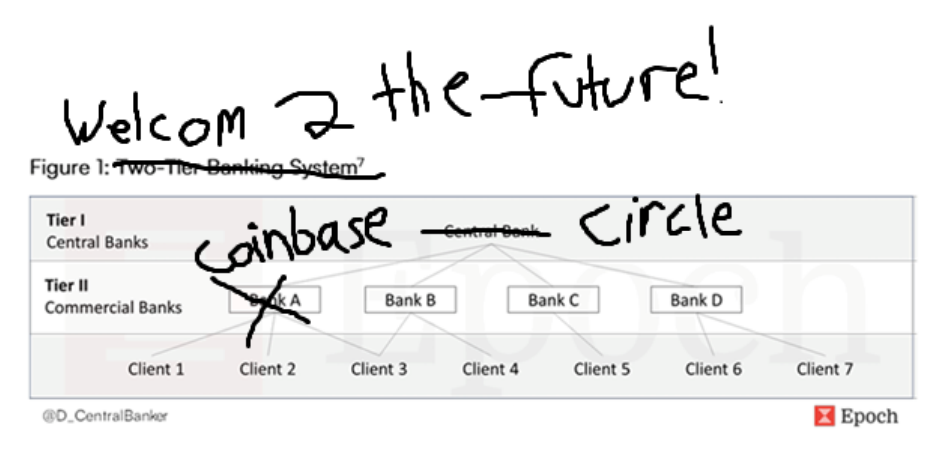

Last year, in our Bitcoin Banking Report, we discussed the structure of the 2-tier banking system in the US (see figure below). In this system, the Central Bank pays a yield on the deposits it receives from the Tier II Commercial banks, who then go on to share a portion of that yield with their depositors. Sound familiar?

The compromise structure in the GENIUS Act essentially creates a parallel banking system where stablecoin issuers play the role of Tier I Central Banks and the crypto exchanges play the role of Tier II Commercial Banks.

To make matters worse, stablecoin issuers are required to keep their reserves with regulated Tier II banks and are unlikely to have access to Fed Master accounts. The upshot of all this is that the GENIUS act converts a peer-to-peer payment mechanism into a heavily intermediated payment network that sits on top of another heavily intermediate payment network.”

The report goes into further depth on topics of regulation and regulatory capture risk, closing the topic with an analysis of how the CLARITY Act might and, in their opinion, should take shape.

Quantum Computing Risk

Concerns about quantum computing potentially breaking Bitcoin’s cryptography surfaced prominently in late 2025, in part contributing to institutional sell-offs as investors reacted to headlines about rapid advances in the field. The Epoch report attributes much of this reaction to behavioral biases, including loss aversion—where people fear losses more than they value equivalent gains—and herd mentality, in which market participants follow the crowd without independent assessment. The authors describe the perceived threat as significantly overhyped, noting that claims of exponential progress in quantum capabilities, often tied to “Neven’s Law,” lack solid observational evidence to date.

“Neven’s law states that the computational power of quantum computers increases at a double exponential rate of classical computers. If true, the timeline to break Bitcoin’s cryptography could be as short as 5 years.

However, Moore’s law was an observation. Neven’s law is not an observation because logical qubits are not increasing at such a rate.

Neven’s law is an expectation of experts. Based on our understanding of expert opinion in the fields we are knowledgeable about, we are highly skeptical of expert projections,” the Epoch report explained.

They add that current quantum computers have not succeeded in factoring numbers larger than 15, and error rates increase exponentially with scale, making reliable large-scale computation far from practical. The report argues that progress in physical qubits has not yet translated into the logical qubits or error-corrected systems needed for factorization of the large numbers underpinning Bitcoin’s security.

Implementing quantum-resistant signatures prematurely — which do exist — would introduce inefficiencies, consuming more block space on the network, while emerging schemes remain untested in real-world conditions. Until meaningful advances in factorization occur, Epoch concludes the quantum threat does not warrant immediate priority or network changes.

Mining Expectations

The report forecasts that no company among the top ten public Bitcoin miners will generate more than 30 percent of its revenue from AI computing services during the 2026 fiscal year. This outcome stems from significant delays in the development and deployment of the necessary infrastructure for large-scale AI workloads, preventing miners from pivoting as quickly as some market narratives suggested.

Media coverage of Bitcoin mining shows a stark divide depending on who is framing the discussion. Mainstream outlets tend to portray the industry positively—75.6 percent of coverage is favorable, often emphasizing energy innovation, job creation, or economic benefits—while conversations within Bitcoin communities remain far more skeptical, with only 8.4 percent positive sentiment. This 67-point swing in net positivity highlights how framing and audience shape perceptions of the same sector, with community credibility remaining a critical factor for mining companies seeking to maintain support among Bitcoin holders.

The report has a lot more to offer including analysis of layer two systems and Bitcoin adoption data on multiple fronts, it can be read on Epoch’s website for free.

This post Epoch Ventures Predicts Bitcoin Hits $150K in 2026, Declares End of 4-Year Halving Cycle first appeared on Bitcoin Magazine and is written by Juan Galt.

Bitcoin Magazine

Kansas Introduce Bill to Establish Strategic Bitcoin Reserve

Kansas has become the latest U.S. state to explore a formal role for Bitcoin and digital assets in public finance, with lawmakers introducing legislation that would create a state-managed Bitcoin and Digital Assets Reserve Fund.

The bill, introduced by State Senator Craig Bowser, proposes amending Kansas’ unclaimed property laws to explicitly recognize digital assets, including cryptocurrencies and virtual currencies, and to establish a framework for their custody, management, and potential sale.

If passed, the legislation would place oversight of the reserve with the Kansas State Treasurer.

Under the proposal, unclaimed digital assets, like Bitcoin, would be transferred to the state after three years of inactivity following undeliverable written or electronic communication to the owner.

There is some ambiguity around what an ‘unclaimed digital asset’ is but the bill appears to apply only to custodial digital assets held by a legally defined “holder,” such as exchanges, banks, trust companies, or other licensed custodians, not to self-custodied wallets.

Per the bill, the three-year abandonment clock begins only after written or electronic communication to the owner is returned as undeliverable, and it stops immediately if the owner shows any sign of activity, including logging in or accessing another account with the same custodian.

Unlike many traditional forms of unclaimed property, the bill allows these assets to be delivered and held in their native digital form, rather than being immediately liquidated.

The legislation also permits the state’s designated qualified custodian to stake digital assets and receive airdrops, subject to direction from the treasurer.

Any staking rewards or airdropped assets generated after three years would be transferred into the BTC and Digital Assets Reserve Fund, creating a mechanism for the state to accumulate digital assets over time.

In a notable provision, the bill prohibits BTC from being deposited into the state’s general fund.

Instead, Kansas would retain Bitcoin as part of its reserve, while directing 10% of deposits of non-bitcoin digital assets into the general fund, contingent on legislative appropriations. Supporters argue this structure treats BTC as a long-term reserve asset rather than a short-term revenue source.

States are actively pushing for bitcoin reserves

The bill also lays out how the state would handle the sale of digital assets. Cryptocurrencies that trade on established exchanges would have to be sold at market prices, while assets without active exchange listings could be sold using other commercially reasonable methods.

The goal of all this is to minimize market disruption while adding clearer guardrails around how state-held digital assets are managed.

If passed, the legislation would put Kansas alongside a growing number of U.S. states exploring how Bitcoin and other digital assets might fit into long-term financial and custodial strategies.

In recent years, state lawmakers across the country have debated whether Bitcoin could serve as a hedge against inflation, a diversification tool, or a way to modernize public finance infrastructure.

This post Kansas Introduce Bill to Establish Strategic Bitcoin Reserve first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

CryptoSlate

Wall Street’s next leap may look boring from the outside, but it's a huge development that's shrouded in corporate speak: T+0 settlement, shorthand for settling a trade the same day it happens.

Deloitte’s 2026 outlook flags it as one of the main themes of the year, alongside signals that regulators want to streamline rules, encourage experimentation, and open paths for blockchain-based products. The report’s message is blunt: if faster settlement arrives, companies should evaluate what it enables, including T+0 products “such as tokenized securities and stablecoins.”

A tokenized security is a familiar asset, like a bond or stock, represented in a digital form that can move on modern rails. The promise of tokenization is simple: fewer handoffs, faster movement of assets and cash, and clearer records.

But, its hurdle is also simple: the real world still runs on settlement cycles, reconciliations, and reporting. If settlement speeds up, tokenization stops being a niche experiment and becomes a practical upgrade everyone has to do.

Roy Ben-Hur and Meghan Burns, the managing director and manager at Deloitte & Touche LLP, told CryptoSlate the most realistic path for tokenization isn't a sweeping flip of the entire market. The path will most likely start with contained pilots that reveal tradeoffs before anything becomes mandatory.

“Signals point towards initial market experimentation via pilots rather than a full market shift.”

That matters because pilots determine whether tokenization becomes a cleaner, safer version of today’s system or a fragmented maze of new venues and rule interpretations.

Why T+0 matters

T+0 changes the financial system in the same way instant delivery changes retail. The faster the delivery, the more pressure on inventory, quality control, and logistics. In financial markets, “inventory” means liquidity and collateral.

When trades settle faster, there's less time to fix errors, source cash, locate securities, or manage margin calls. While that can reduce some risks, like counterparty exposure, it can increase others, like operational failure and sudden liquidity needs.

Deloitte ties this to a broader 2026 shift in market structure. Ben-Hur and Burns expect the cash portion of the US Treasury central clearing initiative to end, and it says “other changes could emerge,” while the SEC signals it intends to propose changes to Regulation NMS. The theme here is plumbing: clearing, settlement speed, and how orders route through a growing number of venues.

The main issue for crypto is where stablecoins and tokenized collateral fit. Ben-Hur and Burns expect early traction in collateral workflows because collateral is a daily, intraday problem for large firms. If collateral can move faster in a reliable dollar-linked form, it reduces friction in the parts of the system where time is money.

“The CFTC is exploring the use of stablecoins and tokenized collateral, so this may be an early use case that gains traction, the main benefits being instant settlement in a liquid, dollar-linked asset. The intra-day nature of collateral commitments makes it an attractive use case for an asset with these features and liquidity commitments. Custody and clearing will help it to scale.”

That's why T+0 can make tokenization mainstream without requiring retail users to change behavior. If large institutions adopt tokenized assets because it improves collateral movement and settlement certainty, the market can shift from the inside out. The thing retail users see and interact with, like an app or exchange listing, often comes later.

Deloitte also points to competition pressure. It says the current approach favors experimentation and could “lead to new entrants and greater competition,” and it notes that “a preponderance of venues” may create new opportunities for order routing and execution.

Faster settlement can amplify that effect. When money and securities move faster, venue design and routing incentives matter more, not less.

Pilots, no-action letters, and the new risks

Pilots are so much more than just technical tests. If executed correctly, they can become a subtle form of policy, especially as regulators keep deferring to the industry via things like no-action letters, self-certification, and staff non-objections, as Deloitte’s outlook puts it.

No-action letters are especially important because they can allow a market practice to proceed without waiting for full rulemaking, as long as it fits within guardrails.

Ben-Hur and Burns said this tool has already been central to tokenization progress:

“So far, the main tool the SEC has been using to enable tokenization, aside from staff guidance, is the no-action letter. In this context, it is a powerful tool to quickly enable changes in industry practice or available marketplace offerings, and we are seeing this already with approvals the SEC has granted recently.”

However, that speed comes with a price. Pilots can create a temporary world where the same asset exists in two forms, one tokenized and one conventional, and the market has to decide how to price them, where liquidity gathers, and how order routing evolves. Ben-Hur and Burns described that transition as a likely reality in equities.

“As the markets transition to tokenized versions of what we think of as traditional assets (equities, bonds, deposits, etc.), we’re likely to temporarily live in a world where there are tokenized and non-tokenized versions of the same asset. This raises a lot of questions about how these assets trade and are priced.”

In that world, the key question is where liquidity will move, and who will benefit from that movement. If liquidity concentrates in a new, possibly crypto-native venue with faster settlement, it can pull price discovery away from legacy pools. If it splits across multiple venues, spreads can widen, and market depth can thin, even if the technology is better.

Deloitte flags a second risk that's easy to miss in all of the excitement surrounding “streamlining.” It warns that efforts to reduce reporting burdens can increase opacity, leaving markets blind.

Faster settlement with weaker visibility is a dangerous combination. It compresses the time available to detect manipulation, reconcile discrepancies, and react to stress.

Deloitte’s answer to this is to build better controls, not slow down development. It urges companies to streamline reporting in ways that improve “auditability,” and it frames the broader environment as market-based experimentation with an “eye toward fraud” through enforcement and exams.

Ben-Hur and Burns put this in practical terms: compliance programs, supervision, documentation, audit trails, surveillance, and cybersecurity become more important as systems speed up.

The best way to think about 2026 is this: faster settlement is a stress test for how markets handle information, liquidity, and trust.

If pilots prove that tokenized assets can improve settlement and collateral workflows without reducing transparency, tokenization will stop being a shiny new idea and become a part of the infrastructure.

If pilots increase fragmentation and cut visibility, regulators will tighten the leash, and the mainstream rollout will slow down or even completely stop.

Either way, T+0 is the hinge. It's the upgrade that makes tokenization either useful at scale or stuck in the demo phase.

The post Deloitte warns of dangerous “blind spot” in tokenized settlement that will make market manipulation nearly impossible to stop appeared first on CryptoSlate.

Tokenized US Treasuries crossed $10 billion in total value this week, a milestone that confirms the category has moved from proof-of-concept to operational infrastructure.

Yet, something happening underneath this achievement is just as important: Circle's USYC has edged past BlackRock's BUIDL as the largest tokenized Treasury product, signaling that distribution rails and collateral mechanics now matter more than brand recognition in determining which on-chain cash equivalents win.

As of Jan. 22, USYC holds $1.69 billion in assets under management compared to BUIDL's $1.684 billion, a gap of roughly $6.14 million, or 0.36%.

Over the past 30 days, USYC's assets grew 11% while BUIDL's contracted 2.85%, a divergence that reads less like marketing success and more like net creation flowing in one direction while redemptions drain the other.

This isn't a story about Circle beating BlackRock in a brand war. It's about collateral workflow design outperforming logo recognition.

Additionally, it maps directly onto the infrastructure question that regulators and institutions are now asking out loud: who shapes the stack that turns idle crypto capital into productive, yield-bearing collateral?

Distribution plus collateralization beats brand

USYC's clearest structural advantage is distribution through exchange collateral rails.

On July 24, Binance announced that institutional customers could hold USYC and use it as off-exchange collateral for derivatives, with custody handled through Banking Triparty or Ceffu and near-instant redemption into USDC.

Binance added BUIDL to its off-exchange collateral list on Nov. 14, four months after USYC.

That sequencing matters. If the cash collateral stack is built first inside prime brokerage and derivatives workflows, the product that integrates earlier captures the flow.

USYC didn't just get listed, it got embedded into the operational layer where institutions manage margin and collateral automation.

Circle positioned USYC explicitly as yield-bearing collateral that travels alongside USDC rails, meaning institutions that already route stablecoin flows through Circle's ecosystem can onboard USYC without building new operational pathways.

BlackRock's BUIDL entered the market with brand authority but without the same plug-and-play integration into crypto-native collateral systems.

Product mechanics suit trading collateral

RWA.xyz labels the two products differently under “Use of Income.” USYC is marked as “Accumulates,” meaning interest accrues within the token balance. BUIDL is marked as “Distributes,” meaning returns are paid out separately.

This distinction is mechanical, not cosmetic. Collateral systems, especially automated margin and derivatives infrastructure, prefer set-and-forget balances where value compounds without requiring operational handling of payouts.

An accumulating structure integrates more cleanly into collateral automation than a distributing one.

For institutions building collateral rails that need to scale across multiple venues and counterparties, the simpler the structure, the lower the operational drag.

RWA.xyz lists materially different entry requirements for the two products.

BUIDL restricts access to US Qualified Purchasers, requiring a minimum investment of $5 million in USDC. USYC targets non-US investors with a minimum of $100,000 USDC.

The funnel difference is structural. Qualified Purchaser status in the US requires $5 million in investable assets for individuals or $25 million for entities, a narrow gate that excludes most crypto-native funds, prop desks, and smaller institutional players.

USYC's $100,000 minimum and non-US eligibility open access to a broader set of offshore institutions, family offices, and trading firms that operate outside US regulatory perimeters but still need dollar-denominated, yield-bearing collateral.

BlackRock's brand carries weight, but the brand doesn't override access constraints. If a fund can't meet the Qualified Purchaser threshold or operates outside the US, BUIDL isn't an option. USYC is.

The addressable market for on-chain collateral skews heavily toward non-US entities and smaller institutions, exactly the segment USYC is designed to serve.

Net creation versus net redemption

The simplest explanation for the flip is the cleanest: flows moved.

USYC grew by 11% over the past 30 days, while BUIDL shrank by 2.85%. That's not a marketing differential. It's net issuance into one product, offset by net outflows from the other.

The recent flip suggests a discrete event or allocation decision rather than gradual drift. USYC's Binance integration, its accumulating income structure, and its lower entry threshold all reduce friction. BUIDL hasn't added comparable distribution momentum in the same window.

Tokenized Treasuries at $10 billion remain a small fraction of the $310 billion stablecoin market, but their role is shifting from niche experiment to operational default.

The International Organization of Securities Commissions (IOSCO) noted in recent guidance that tokenized money market funds are increasingly used as stablecoin reserve assets and as collateral for crypto-related transactions. This is precisely the interlinkages driving USYC's growth.

JPMorgan framed tokenized money market funds as the next frontier after stablecoins, centered on portability and collateral efficiency.

The bank's analysis treats tokenized Treasuries not as an alternative to stablecoins but as an evolution of them. They are programmable cash equivalents that settle faster, move across blockchains more easily, and integrate into collateral systems with less operational overhead than traditional custody arrangements.

With stablecoin yields near zero, tokenized Treasuries offer a risk-free on-chain rate without requiring users to exit crypto rails.

Instead of parking cash in non-yielding stablecoins or moving it off-chain to earn returns, institutions can now hold yield-bearing collateral on-chain that functions like cash but compounds like Treasuries.

What happens next

The $10 billion milestone is less important than the capture rate it represents.

Tokenized Treasuries currently account for roughly 3% to 4% of the stablecoin float. If that rate doubles over the next 12 months, which is a conservative assumption given current flow momentum and collateral integrations, tokenized Treasuries could reach $20 billion to $25 billion.

If collateral flywheels accelerate and more venues replicate Binance-style off-exchange rails, the range stretches to $40 billion to $60 billion.

The metrics that matter are all measurable: net issuance trends, collateral integration announcements, changes to eligibility requirements, and shifts in income-handling preferences.

USYC's 30-day growth rate and BUIDL's contraction are early signals. The Binance integration timeline is another. The funnel gap is a third.

USYC didn't flip BUIDL because Circle outspent BlackRock on marketing. It flipped because distribution, mechanics, and access constraints aligned with how institutions actually use on-chain collateral.

The category crossed $10 billion not because one flagship product dominated, but because multiple products are now competing on infrastructure terms: who integrates faster, who reduces friction, who widens the funnel.

Brand recognition opened doors. Collateral workflow design is keeping them open.

The post How BlackRock lost control of the $10B tokenized Treasury market to Circle for one simple, mechanical reason appeared first on CryptoSlate.

The Digital Asset Market Clarity Act, better known as the CLARITY Act, was supposed to draw clean lines around crypto assets and which regulator gets the first call.

CryptoSlate has already walked readers through the bill’s larger architecture ahead of the January markup, including what changed, what stayed unresolved, and why jurisdiction and state preemption may matter as much as the headline definitions.

The part consuming the most oxygen right now is narrower and much more nuanced: it's about who can pay consumers to keep dollars parked in a particular place.

That dispute became harder to ignore after Coinbase said it couldn't support the Senate draft in its current form, and the Senate Banking Committee postponed a planned markup. Since then, the bill has shifted into the phase where staff rewrite verbs, and lawmakers test whether a new coalition is real.

Senate Democrats said they would keep talking with industry representatives about concerns, while the Senate Agriculture Committee pointed to a parallel schedule, including their Jan. 21 draft and a hearing scheduled for Jan. 27.

If you want the simplest way to understand why stablecoin rewards became the tripwire, forget the slogans and picture one screen: a user sees a dollar balance labeled USDC or another stablecoin and an offer to earn something for keeping it there. In Washington, that “something” is interest. In banking, “there” is a substitute for deposits.

In the Senate draft, the conflict is concentrated in Section 404, titled “Preserving rewards for stablecoin holders,” a section that essentially tells platforms what they can and cannot do.

The line Congress is trying to draw

Section 404 says digital asset service providers can't provide any form of interest or yield that's “solely in connection with the holding of a payment stablecoin.”

That targets the simplest rewards product: park a payment stablecoin on an exchange or in a hosted wallet and receive a quoted return that accrues over time, with no additional behavior required. That looks like interest to lawmakers, and it looks like a direct funding competitor to banks that rely on deposits.

The key phrase here is “solely in connection with the holding,” as it makes the ban depend on causality. If the only reason a user receives value is that they hold the stablecoin, the platform is out of bounds. If a platform can credibly tie the value to something else, the draft offers a path forward.

CLARITY tries to define that path by allowing “activity-based rewards and incentives,” then listing what that activity can include: transactions and settlement, using a wallet or platform, loyalty or subscription programs, merchant acceptance rebates, providing liquidity or collateral, and even “governance, validation, staking, or other ecosystem participation.”

Put simply, Section 404 is separating being paid for parking from being paid for participation. In product language, it invites a second fight over what counts as participation, because fintech has spent a decade learning how to convert economics into engagement with a few extra taps.

The parts users will actually notice

Most readers will focus on the yield ban and overlook the layer that could reshape the front end of stablecoin products: marketing and disclosures.

Section 404 prohibits marketing that suggests a payment stablecoin is a bank deposit or FDIC insured, that rewards are “risk-free” or comparable to deposit interest, or that the stablecoin itself is paying the reward. It also pushes toward standardized plain-language statements that a payment stablecoin isn't a deposit and isn't government-insured, plus clear attribution of who is funding the reward and what a user must do to receive it.

Banks and credit unions care about perception because perception is what moves deposits. Their public argument is that passive stablecoin yield encourages consumers to treat stablecoin balances like safe cash, which can accelerate deposit migration, with community banks taking the hit first.

The Senate draft validates that concern by requiring a future report on deposit outflows and explicitly calling out deposit flight from community banks as a risk to study.

However, crypto companies say that stablecoin reserves already generate income, and platforms want flexibility to share some of that value with users, especially in products that compete with bank accounts and money market funds.

The most useful question we can ask here is what survives this bill and in what form.

A flat APY for holding stablecoins on an exchange is the high-risk case, because the benefit is “solely” tied to holding, and platforms will need a genuine activity hook to keep that going.

Cashback or points for spending stablecoins is much safer, because merchant rebates and transaction-linked rewards are explicitly contemplated, and that tends to favor cards, commerce perks, and various other “use-to-earn” mechanics.

Collateral or liquidity-based rewards are likely possible because “providing liquidity or collateral” appears in the list, but the UX burden rises there because the risk profile looks more like lending than payments. DeFi pass-through yield inside a custodial wrapper remains possible in theory.

However, platforms won't be able to avoid disclosures, and disclosures create friction, because platforms will have to explain who's paying, what qualifies, and what risks exist in a way that will be tested in enforcement and in court.

The throughline is that Section 404 nudges rewards away from idle balance yield and toward rewards that look like payments, loyalty, subscriptions, and commerce.

The issuer firewall and the phrase that will decide partnerships

Section 404 also includes a clause that doesn't look like much until you place it next to real-world stablecoin distribution deals. It says a permitted payment stablecoin issuer is not deemed to be paying interest or yield just because a third party offers rewards independently, unless the issuer “directs the program.”

This is the bill’s attempt to keep issuers from being treated like interest-paying banks because an exchange or wallet layered incentives on top. It also warns issuers to be careful about how close they get to platform rewards, because that closeness can easily be seen as direction.

“Directs the program” is the main hinge here. Direction can mean formal control, but the hard cases are influence that looks like control from the outside: co-marketing, revenue shares tied to balances, technical integrations designed to support a rewards funnel, or contractual requirements about how a platform describes the stablecoin experience.

After Coinbase’s objection and the markup delay, that ambiguity became the battleground, because late-stage bill work often comes down to whether a single word is narrowed, broadened, or defined.

The most plausible endpoint is, unfortunately, not a clean victory for either side. The market will most likely see a new regime implemented where platforms still offer rewards, but they do so through activity-based programs that look like payments and engagement mechanics, while issuers keep their distance unless they're prepared to be treated as participants in the compensation structure.

That's why Section 404 matters beyond the current news cycle. It's about which rewards can be offered at scale without stablecoins being sold as deposits by another name, and about which partnerships will be deemed to cross the line from distribution into direction.

The post Will crypto rewards survive upcoming CLARITY law? A plain-English guide to Section 404 appeared first on CryptoSlate.

When Solana maintainers told validators to move quickly on Agave v3.0.14, the message arrived with more urgency than detail.

The Solana Status account called the release “urgent” and said it contained a “critical set of patches” for Mainnet Beta validators.

Within a day, the public conversation drifted toward a harder question: if a proof-of-stake network needs a fast coordinated upgrade, what happens when the operators do not move together?

That gap showed up in early adoption snapshots. On Jan. 11, one widely circulated account said only 18% of stake had migrated to v3.0.14 at the time, leaving much of the network’s economic weight on older versions during a period labeled urgent.

For a chain that has spent the past year selling reliability alongside speed, the story shifted from the code itself to whether the operator fleet could converge fast enough when it mattered.

Over the next ten or so days, the picture became clearer and more useful than the first-wave headlines implied.

Anza, the team behind Agave, published a security patch summary on Jan. 16 explaining why v3.0.14 mattered and why operators were told to upgrade quickly.

Around the same time, Solana’s ecosystem signaled that coordination is not left to goodwill alone, because the Solana Foundation’s delegation criteria now explicitly references required software versions, including Agave 3.0.14 and Frankendancer 0.808.30014, as part of the standards validators must meet to receive delegated stake.

Taken together, those developments turn v3.0.14 into a case study in what “always-on finance” demands in practice on Solana, not just from software, but from incentives and operator behavior under time pressure.

A high-speed chain still runs on human operations

Solana is a proof-of-stake blockchain designed to process large volumes of transactions quickly, with validators that vote on blocks and secure the ledger in proportion to staked SOL delegated to them.

For users who don't run validators, delegation routes stake to an operator, and that stake becomes both a security input and an economic signal that rewards validators who stay online and perform well.

That design has a consequence that's easy to miss if you only watch token price charts. A blockchain isn't one machine in one place. On Solana, “the network” is thousands of independent operators running compatible software, upgrading at different times, across different hosting setups, with different levels of automation and risk tolerance.

When things go smoothly, this independence limits single points of control. When an upgrade is urgent, the same independence makes coordination harder.

Solana’s validator-client landscape raises the stakes for coordination. The most common production lineage is the client maintained through Anza’s Agave fork, and the network is also progressing toward broader client diversity via Jump Crypto’s Firedancer effort, with Frankendancer as an earlier milestone on that path.

Client diversity can reduce the risk that one bug takes a large share of stake offline at once, but it does not eliminate the need for coordinated security upgrades when a fix is time-sensitive.

That's the context in which v3.0.14 landed. The urgency was about closing potential paths to disruption before they could be exploited.

What changed in the last 10 days: the why became public, and incentives became visible

Anza’s disclosure filled in the missing center of the story. Two critical potential vulnerabilities were disclosed in December 2025 via GitHub security advisories, and Anza said the issues were patched in collaboration with Firedancer, Jito, and the Solana Foundation.

One issue involved Solana’s gossip system, the mechanism validators use to share certain network messages even when block production is disrupted. According to Anza, a flaw in how some messages were handled could cause validators to crash under certain conditions, and a coordinated exploit that took enough stake offline could have reduced cluster availability.

The second issue involved vote processing, which is central to how validators participate in consensus. Per Anza, a missing verification step could have allowed an attacker to flood validators with invalid vote messages in a way that interfered with normal vote handling, potentially stalling consensus if done at scale.

The fix was to ensure that vote messages are properly verified before being accepted into the workflow used during block production.

That disclosure changes how the early “adoption lag” framing reads. The upgrade was urgent because it closed two plausible routes to severe disruption, one by crashing validators and one by interfering with voting at scale.

The operator question still matters, but it becomes more specific: how quickly can a distributed fleet deploy a fix when the failure modes are concrete and systemic?

In parallel, Solana’s delegation rules made the coordination mechanism easier to see. The Solana Foundation’s delegation criteria includes software-version requirements and a stated responsiveness standard.

Its published schedule for required validator software versions lists Agave 3.0.14 and Frankendancer 0.808.30014 as required versions across multiple epochs. For operators who receive Foundation delegation, upgrades become economic, because failing requirements can result in delegation being removed until the criteria are met.

That is the operational reality behind “always-on finance.” It's built through code, but maintained through incentives, dashboards, and norms that push thousands of independent actors to converge during narrow windows that security incidents create.

Even with disclosures and clear stakes, fast adoption is far from frictionless. Anza said operators need to build from source following Anza’s installation instructions.

Building from source isn't inherently risky, but it raises the operational bar because validators rely on build pipelines, dependency management, and internal testing before rolling changes to production.

Those requirements matter most during urgent upgrades, because urgency compresses the time validators have to test, stage, and schedule maintenance, while mistakes carry direct reward loss and reputational damage in a competitive delegation market.

The v3.0.14 episode also didn't pause Solana’s broader release cadence.

On Jan. 19, the Agave repository shipped v3.1.7, labeled as a testnet release recommended for devnet and up to 10% of mainnet beta, signaling a pipeline of changes operators must track and plan for. On Jan. 22, Agave’s v3.1 release schedule page was updated with a tentative rollout plan.

Readiness becomes measurable in grounded ways.

One measure is the convergence of versions under pressure, meaning how quickly stake migrates to the recommended version when an urgent advisory hits, and early reporting around v3.0.14 showed the costs of slow movement.

Another is resilience against correlated failure, where client diversity through Firedancer and Frankendancer reduces the risk of one software lineage taking the network down, but only if alternative clients reach meaningful deployment levels.

A third is incentive alignment, where delegation criteria and required versions turn security hygiene into an economic requirement for many operators.

The v3.0.14 episode began as an urgency label and an adoption worry, then became a clearer window into how Solana patches, coordinates, and enforces standards across a distributed validator fleet.

The post Terrifying Solana flaw just exposed how easily the “always-on” network could have been stalled by hackers appeared first on CryptoSlate.

Institutions have learned to live with Bitcoin’s volatility because volatility is measurable and, for many strategies, manageable. What still holds back large allocations is the risk of moving the market while getting in or out.

A fund can hedge price swings with options or futures, but it can't hedge the cost of pushing through a thin order book, widening spreads, and turning a rebalance into visible slippage.

That's why liquidity matters more than most headlines admit. Liquidity isn't the same thing as volume, and it's much more than just a general feeling that the market is “healthy.”

Put into as few words as possible, liquidity is the market’s capacity to absorb trades at predictable costs.

The only way to understand it clearly is to treat it as a stack of measurable layers: spot order books, derivatives positioning, ETF trading and creations/redemptions, and stablecoin rails that move cash and collateral across platforms.

Start with spot: spreads, depth, and how fast books refill

The first layer is spot execution. The easiest number to quote is the bid-ask spread, the gap between the best buy and sell prices. While spread is useful, it can stay tight even when the book behind it is thin. Depth is more informative because it shows how much size is available near the current price, not just at a single level.

Kaiko’s research often uses 1% market depth, meaning the total buy and sell liquidity sitting within 1% of the mid price, as a practical way to gauge how much the market can absorb before price moves materially.

When the 1% depth falls, the same trade size tends to cause larger price moves, and execution costs become much less predictable. Kaiko has also warned about liquidity concentration and how depth can thin across venues even when aggregate volume looks strong.

A second piece that matters is the refill. Depth isn'tt static, and books can look fine until they get hit with a large order. What separates resilient markets from fragile ones is how quickly liquidity returns after a sweep. This is why it helps to track the same metrics over time rather than relying on a single snapshot.

Liquidity changes by hour, and that matters more than 24/7 implies

Crypto trades all day, but institutional liquidity isn't equally available across every hour. Depth and spreads can vary by session, with noticeable differences between periods of high participation and periods where market makers and larger players quote less aggressively.

Amberdata's report on temporal patterns in market depth shows how intraday and weekly rhythms affect how much liquidity is available at different times. This means that a market can look liquid during overlapping business hours and noticeably thinner at other times, and that affects how far the price can move for a given trade size.

CryptoSlate has made this point in its own order book reporting around round number levels, noting that thinner aggregated depth can make markets more sensitive near widely watched prices. One example referenced a roughly 30% drop in aggregated 2% depth from prior highs, framing the issue as mechanical fragility rather than a price call.

This is the kind of case study that's useful because it shows liquidity depends on execution risk more than it does on narrative claims.

Derivatives and ETFs can transmit stress into spot, or reduce it

Once spot books thin, derivatives start to matter more because forced flows become more disruptive. Perpetual swaps and futures can concentrate leverage. When funding rates spike or futures basis becomes stretched, it often means positioning is crowded and more sensitive to price moves.

If the market then trades into liquidations, those liquidations are executed as market orders. When liquidity is thin, that increases slippage and the chance of sharp gaps.

ETFs matter for a different reason. They create a second venue for liquidity: a secondary market where shares trade, and the primary market where authorized participants create and redeem shares. Under normal conditions, creations and redemptions help keep an ETF close to the value of its holdings.

For Bitcoin, strong secondary market liquidity can let some investors adjust exposure without immediately pushing through spot exchange books.

On the other hand, large one-way flows that result in heavy creations or redemptions can push activity back into the underlying market, especially if liquidity is thinner on the venues that participants use to source or hedge.

The overlooked rail: stablecoins and where cash can move quickly

The last layer is cash mobility. Institutions need more than just BTC liquidity; they need reliable cash and collateral rails that can move between venues and sit inside margin systems. Stablecoins are central to that because a large share of spot and derivatives activity is still routed through stablecoin pairs and stablecoin collateral.

The market is already familiar with the effect stablecoin trading across exchanges has on price formation. Regulated rails and stablecoin-led liquidity are becoming more important in shaping how crypto markets function, which makes liquidity partly policy-shaped rather than purely market-made.

This is important because liquidity can be abundant in places that some institutions cannot use, and thinner on the venues they can. The result is a market that looks deep in aggregate but still produces higher execution costs for certain participants.

Measuring liquidity without the guesswork

To see whether liquidity is improving or deteriorating, we need to focus on a few metrics.

The 1% depth on major venues, paired with top of book spreads and a standardized slippage read at fixed sizes, can tell you whether liquidity is expanding or contracting week to week.

Perp funding and futures basis can act as a positioning temperature check. When leverage gets expensive and crowded, thin spot conditions become more dangerous because forced flows can move prices farther.

Monitor ETF secondary market liquidity with simple inputs such as share spreads and traded volume, then cross-check against creations and redemptions where that data is available.

Finally, watch stablecoin liquidity and where it concentrates across venues, because cash mobility is a prerequisite for reliable execution, especially when markets move quickly.

If those layers improve together, the market becomes easier to trade in size without turning flows into price events. If they weaken together, institutions may still buy Bitcoin, but they'll do it more cautiously, rely on wrappers and hedges, and treat thin hours as higher risk for execution.

The post Bitcoin trades bleed cash during these “toxic” hours because market depth is a total illusion right now appeared first on CryptoSlate.

HTTP error 429 on https://cryptoticker.io/en/feed/

Failed to fetch feed: https://cryptoticker.io/en/feed/

Failed to fetch feed.

Decrypt

A new academic paper examines how autonomous AI agents could make influence campaigns harder to detect and more effective at scale.

Ethereum treasury firm SharpLink Gaming hopes to stand apart from the pack by focusing on the long-term—with shareholders top of mind.

X Games will share a title with MoonPay as part of an eight-figure deal, as the action sports spectacle adopts a league-based format.

Ethereum researcher Justin Drake said the ecosystem is moving from research to execution as the threat from quantum computing draws closer.

Nearly all stablecoins track the U.S. dollar. Experiments with baskets and commodities show how hard that grip is to loosen.

U.Today - IT, AI and Fintech Daily News for You Today

The market must cleanse itself before we receive a proper rally that will bring freshness back to the crypto industry.

If the month closes in the red, it will mark the first four-month losing streak for the asset since 2018..

Inspirational money has soured on cryptocurrency ETFs, and the "honeymoon phase" is officially over XRP ETFs..

XRP's burn rate has surged modestly in the last day, signaling a potential shift in market structure as network activity begins to rise after multiple days of being low.

The market might not be ready for a proper retrace despite the possibility of having one sooner rather than later.

Blockonomi

TLDR

- Dogecoin price trades at $0.1215 after recording a 1.06% decline during the last 24-hour trading session.

- Intraday price action shows an early rise toward $0.1233 before sustained selling pressure reversed momentum.

- The sharpest decline pushed the price below $0.119, marking the session’s lowest traded level.

- Recovery attempts lifted the price above $0.121, but repeated resistance capped gains near $0.122.

- Weekly chart data shows two identical 59.17% pullbacks, each spanning 19 weeks with matching structural behavior.

Dogecoin price has hinted at new market changes. During the Asian trading session, Dogecoin opened its market value with a price value of $0.1182 before an upward trend followed. The Dogecoin 24-hour price action adds over a 4% dip to the weekly performance.

Dogecoin Slides to $0.1215, Down 1.06% Over Last 24 Hours

Tracking the ongoing price trend at the time of press, CoinMarketCap data confirms that Dogecoin price trades at $0.1215 after a volatile 24-hour session marked by sharp swings and fading momentum. The price initially climbed toward $0.1233 before facing resistance and reversing direction. A downward movement followed, pushing the price into a declining trend through the mid-section of the session.

The steepest drop occurred when the DOGE price fell below $0.119, marking the day’s low. A quick recovery brought the price back above $0.121, but gains remained limited. Each rebound met resistance, preventing any sustained upward momentum beyond the $0.122 zone.

In the second half of the session, the price formed a pattern of lower highs. Attempts to regain earlier levels were brief and lacked follow-through. Despite recovery efforts, Dogecoin ended the period down 1.06%.

Dogecoin Price Weekly Chart Repeats Historical Pullback Pattern

Despite the 1.06% dip recorded over the 24 hours, market analysts have hinted otherwise. An observation by Trader Tardigrade shows that Dogecoin’s weekly price chart is unfolding into a symmetrical price structure. The comparative periods display a prolonged decline followed by a parabolic curve, suggesting directional transition.

The left section shows a -59.17% correction spanning 19 weekly candles. This movement was structured in lower highs and lower lows, forming a consistent downward trend. It ended with a rounded base that transitioned into a sustained upward run, lifting the price from the bottom of the correction to a higher level.

The current price action shows nearly identical characteristics. A visible downtrend persists across 19 weekly bars, resulting in a total decline of -59.17%. The movement is similarly structured; this structural similarity suggests the price has returned to a historically familiar pattern. Each price action in the current formation closely resembles the previous pattern, tracing a potential recovery path in alignment with the last breakout cycle.

The post Dogecoin Price Drops 1.06% as Weekly Pattern Mirrors Past Pullback: Is the Next Bullish Leg About to Begin? appeared first on Blockonomi.

TLDR

- Combined cliff and linear token unlocks from January 26 to February 2 surpass $464 million in value.

- Cliff token unlocks include SUI ($64.36M), SIGN ($11.61M), and TREE with the highest % unlock at 39.41%.

- RAIN ($89.86M), RIVER ($88.23M), and SOL ($57.18M) lead steady daily unlocks.

- Projects like TREE, SIGN, and SAHARA unlock over 8% of their circulating supply.

- Unlocks span across DeFi, L1s, memecoins, and infra tokens, affecting both large-cap and mid-cap ecosystems.

The week from January 26 to February 2 is a must-watch period in the crypto market. According to Tokenomist data, multiple large-scale token unlocks are scheduled, with a combined value exceeding $464 million.

Cliff Token Unlocks to Inject $135M

Cliff token unlocks refer to one-time, token releases that instantly increase market supply. In this week’s window, several projects will see cliff unlock events. A summary by Wu Blockchain reveals that SUI will unlock 45.97 million tokens worth $64.36 million, representing 1.21% of its adjusted released supply.

SIGN follows with a release of 290 million tokens valued at $11.61 million, forming 17.68% of its supply. EIGEN will unlock 36.82 million tokens worth $11.56 million, equal to 8.88% of its supply. KMNO will see 229.17 million tokens enter the market, valued at $10.07 million and representing 3.68% of its supply. JUP’s unlock stands at 53.47 million tokens, totaling $9.94 million, accounting for 1.63%.

OP is set to release 31.34 million tokens worth $8.97 million, or 1.62% of its circulating supply. TREE presents the highest percentage unlock this week, with 85.73 million tokens valued at $8.34 million, which equals 39.41% of its adjusted supply. SAHARA will unlock 232.93 million tokens worth $5.48 million, representing 8.81%. ZORA rounds off the cliff token unlocks with 166.67 million tokens valued at $5.06 million, or 4.00%.

$328M in Linear Token Unlocks to Hit Crypto Markets This Week

Linear token unlocks occur through consistent, often daily, token releases. These steady unlocks contribute to gradual changes in circulating supply, easing volatility pressure compared to cliff events.

RAIN leads the linear unlocks, releasing 9.41 billion tokens worth $89.86 million, which is 2.77% of its circulating supply. SOL follows with 480.20K tokens valued at $57.18 million, adding 0.82% to circulation. RIVER will unlock 1.25 million tokens worth $88.23 million, totaling 6.38%.

TRUMP will release 6.33 million tokens valued at $30.06 million, contributing 3.16% to the market. CC sees a release of 191.71 million tokens worth $27.58 million, equal to 1.73%. WLD adds 37.23 million tokens worth $16.47 million, accounting for 1.35%. DOGE enters with 96.39 million tokens valued at $11.53 million, contributing 0.80%. AVAX finalizes the list with a release of 699.98K tokens worth $8.05 million, forming 0.16%.

The post Top Token Unlocks to Watch This Week appeared first on Blockonomi.

Every crypto cycle creates legends and regrets. Ethereum once traded for under a dollar while powering obscure smart contracts. Bitcoin was dismissed as an internet experiment when it hovered below $100. Those who ignored them didn’t just miss gains; they missed generational wealth. Today, many investors search for the best crypto coins that still offer early-stage access before mass adoption locks out life-changing upside.

As we move through early 2026, the market is warming again. Bitcoin is stabilizing after ETF-driven demand, Ethereum continues to dominate DeFi and tokenization, and meme-driven ecosystems are reclaiming attention. But history shows that the largest returns don’t come from mature giants; they come from presales where entry prices are microscopic and momentum hasn’t peaked. That’s where APEMARS ($APRZ) enters the conversation as one of the best crypto coins to buy today.

APEMARS ($APRZ) Stage 5: Early Access Before the Crowd Arrives

APEMARS is currently in Stage 5 of its structured presale, offering tokens at $0.00003629 ahead of a confirmed $0.0055 listing price. At this stage alone, the projected upside from APEMARS presale to listing stands at 15,055.69% ROI, while the earliest supporters have already seen 113.59% ROI through earlier stages.

The traction is real, not theoretical. The presale has already raised over $100,000, attracted 525+ token holders, and distributed more than 4.9 billion tokens. This phase represents the final stretch during which entry remains accessible before stage prices are escalated, reshaping the risk–reward balance. For investors scanning the market for the best crypto coins with asymmetric upside, Stage 5 offers a rare window of opportunity.

Why APEMARS Is Being Watched as One of the Best Crypto Coins

APEMARS combines viral mechanics with disciplined token economics. Holders can access 63% APY staking, allowing long-term participants to compound rewards while supply remains locked. A 9.34% referral system fuels organic growth, while scheduled token burns at later presale milestones permanently reduce circulating supply.

This structure creates a feedback loop: reduced supply, increasing demand, and community-driven expansion. Unlike many speculative launches, the roadmap is clearly staged, transparent, and time-based. That clarity is why APEMARS continues to surface in discussions around the best crypto coins for early 2026 positioning.

Ethereum: The Smart Contract Revolution That Already Paid Early Believers

Ethereum changed crypto forever by introducing smart contracts, enabling decentralized finance, NFTs, tokenized assets, and DAOs. When ETH launched in 2015, it traded below $1, and few imagined it would become the backbone of Web3. Early adopters who accumulated Ethereum during its formative years saw exponential returns as the ecosystem exploded and developers flocked to build on the network.

Today, Ethereum remains a dominant Layer-1 blockchain with massive real-world usage and institutional adoption. However, its market maturity means price growth is now steadier rather than explosive. Ethereum is widely considered a foundational asset for long-term exposure, but the kind of life-changing upside seen in its earliest days is no longer easily achievable, which is why many investors now search for newer best crypto coins at earlier stages.

Bitcoin: Digital Gold That Delivered Historic Gains, Now in a Mature Phase

Bitcoin is the original cryptocurrency and the benchmark for the entire market. In its early years, Bitcoin traded for under $100, dismissed by many as a speculative experiment. Those who recognized its scarcity and decentralized value proposition early were rewarded as Bitcoin surged through multiple market cycles, becoming a globally recognized store of value.

As of today, Bitcoin benefits from institutional inflows, ETFs, and growing mainstream acceptance. While it remains one of the safest long-term crypto holdings, its size and market capitalization naturally limit upside multiples compared to emerging projects. Bitcoin continues to anchor portfolios, but investors seeking aggressive growth increasingly look beyond established giants toward earlier-stage best crypto coins.

$15,000 Investment Scenario: From Stage 5 to Listing