Cryptocurrency Posts

Crypto Briefing

Bybit and Block Scholes report shows crypto traders leaning bearish as BTC drops below $100K and equities lose momentum.

The post Bybit publishes report with Block Scholes showing bearish crypto positioning despite US shutdown resolution appeared first on Crypto Briefing.

The expedited SEC process could accelerate the introduction of innovative financial products, potentially boosting market competition and investor options.

The post Bitwise’s spot XRP ETF may become the next launch as SEC moves to speed filings appeared first on Crypto Briefing.

Cardone's Bitcoin purchase highlights increasing institutional adoption, potentially boosting cryptocurrency's legitimacy as a store of value.

The post Grant Cardone places an order for 935 Bitcoin appeared first on Crypto Briefing.

Saylor's aggressive Bitcoin acquisition strategy highlights growing institutional confidence in digital assets despite market volatility.

The post Saylor says Strategy is buying “quite a lot” of Bitcoin appeared first on Crypto Briefing.

Saylor's firm stance against selling Bitcoin reinforces market confidence and highlights the ongoing debate over Bitcoin's role as a value store.

The post Michael Saylor dismisses rumor of Strategy selling Bitcoin appeared first on Crypto Briefing.

Bitcoin Magazine

Bitcoin Magazine

Trump Family-Linked American Bitcoin Doubles Revenue in Q3 Amid Aggressive Mining Expansion

American Bitcoin (NASDAQ: ABTC), the cryptocurrency mining firm backed by Eric Trump and Donald Trump Jr., reported a strong third quarter.

American Bitcoin posted revenue of $64.2 million, a 453% year-over-year increase, while net income soared to $3.47 million, reversing a $576,000 loss in the same period last year.

The Miami-based miner, which became a standalone public entity after spinning out from Hut 8 and merging with Gryphon Digital Mining, has aggressively scaled its operations.

During Q3, American Bitcoin expanded its mining capacity roughly 2.5 times to 25 exahash per second (EH/s), with its fleet achieving an efficiency of 16.3 joules per terahash (J/TH).

The company’s scalable, “asset-light” mining approach allowed it to generate bitcoin below market prices, while disciplined at-market purchases contributed to wider profit margins.

On the treasury front, American Bitcoin accumulated over 3,000 BTC during the quarter, ending Q3 with 3,418 BTC. As of this month, the company’s holdings grew to 4,004 BTC, equivalent to 432 satoshis per share.

Eric Trump emphasized that the firm’s strategy focuses on both production and accumulation, reinforcing long-term value creation as market conditions fluctuate.

Eric Trump shared some of the results on X with the short message “Just getting started! @ABTC”.

Despite strong fundamentals, ABTC shares fell more than 13% in pre-market trading Friday, reflecting a broader crypto market pullback as bitcoin dipped below $95,000.

Nevertheless, the company’s high-profile backing and strategic expansion have drawn investor attention, positioning American Bitcoin as a noteworthy player in the digital asset ecosystem.

With a combination of growing mining output, efficient operations, and a rapidly expanding bitcoin treasury, American Bitcoin is staking a claim as one of the more institutionally oriented, growth-focused bitcoin miners in the market, even amid ongoing price turbulence.

American Bitcoin merger details

Back in September, American Bitcoin Corp., completed a stock-for-stock merger with Gryphon Digital Mining, creating a Nasdaq-listed Bitcoin accumulation platform. The company, majority-owned by Hut 8, combined mining operations with strategic Bitcoin purchases to gain a structural cost advantage.

At the time, Eric Trump highlighted ABTC as a public vehicle giving investors direct exposure to Bitcoin while advancing U.S. leadership in the global crypto economy. The Trump family emphasized alignment with American values and leveraging public markets to scale operations efficiently.

This post Trump Family-Linked American Bitcoin Doubles Revenue in Q3 Amid Aggressive Mining Expansion first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

‘We Are Buying’: Michael Saylor Confirms Strategy (MSTR) Is Aggressively Buying Bitcoin

Amid a wave of panic in crypto markets, rumors surfaced Friday that Strategy (MSTR) was selling its bitcoin holdings as both BTC and MSTR stock tumbled.

Executive Chairman Michael Saylor quickly dismissed the chatter, telling CNBC, “We are buying bitcoin,” and promising that the company’s next purchases will be reported Monday. He added that Strategy is “accelerating [its] purchases” and suggested investors could be “pleasantly surprised” by recent activity.

The rumors stemmed from on-chain movements showing BTC leaving company-controlled wallets, coinciding with a brief drop in bitcoin below $95,000, its lowest level in roughly six months.

Saylor, however, maintained confidence, saying, “There is no truth to this rumor.”

MSTR shares fell under $200 in pre-market and early trading, down nearly 35% year-to-date, prompting concerns that the company might liquidate bitcoin to stabilize its balance sheet.

Saylor advised investors to maintain perspective amid the volatility. “Zoom out,” he said, noting that bitcoin was trading in the $55,000-$65,000 range just over a year ago. Even after recent declines, BTC at $95,000 “is still showing a pretty great return.”

He added that Strategy has “put in a pretty strong base of support around here” and expressed comfort that bitcoin could rally from current levels.

Strategy now holds more than 641,000 BTC, valued at roughly $22.5 billion, with an average purchase price of around $74,000 per coin. The company’s market capitalization has fallen below the value of its bitcoin holdings, pushing its market-to-net-asset value (mNAV) below 1, a metric often cited as evidence that the stock may be undervalued.

Despite these numbers, Saylor emphasized that Strategy’s balance sheet is “pretty stable” and only fractionally levered, with no imminent debt trigger points.

Bitcoin is always a good investment

On long-term prospects, Saylor remained bullish, stating, “Bitcoin is always a good investment,” provided investors are prepared for volatility and hold a time horizon of at least four years.

He compared BTC’s performance to traditional assets, noting that bitcoin has averaged roughly 50% annual growth over the past five years, outperforming gold and the S&P.

He also contrasted investment approaches, suggesting that those seeking exposure to digital credit instruments might prefer other products, while investors aiming for long-term ownership of “digital capital” should focus on bitcoin.

Even as market jitters continue and institutional outflows impact prices, Strategy is doubling down. “We’re always buying,” Saylor said, signaling that the firm intends to use market dips to expand its bitcoin holdings rather than sell.

Saylor: Trillions in Bitcoin

In a wide-ranging interview with Bitcoin Magazine earlier this year, Saylor outlined an ambitious vision to build a trillion-dollar Bitcoin balance sheet, using it as a foundation to reshape global finance.

He envisions accumulating $1 trillion in Bitcoin and growing it 20–30% annually, leveraging long-term appreciation to create a massive store of digital collateral.

From this base, Saylor plans to issue Bitcoin-backed credit at yields significantly higher than traditional fiat systems, potentially 2–4% above corporate or sovereign debt, offering safer, over-collateralized alternatives.

He anticipates this could revitalize credit markets, equity indexes, and corporate balance sheets while creating new financial products, including higher-yield savings accounts, money market funds, and insurance services denominated in Bitcoin.

Earlier this week, Strategy bought 487 BTC for about $49.9 million. At the time of announcement, Bitcoin’s price was near $106,000. The purchases, made between November 3 and 9 at an average of $102,557 per BTC, bring Strategy’s total holdings to 641,692 BTC, acquired for roughly $47.54 billion at an average price of $74,079 each, underscoring the company’s ongoing commitment to its Bitcoin treasury strategy.

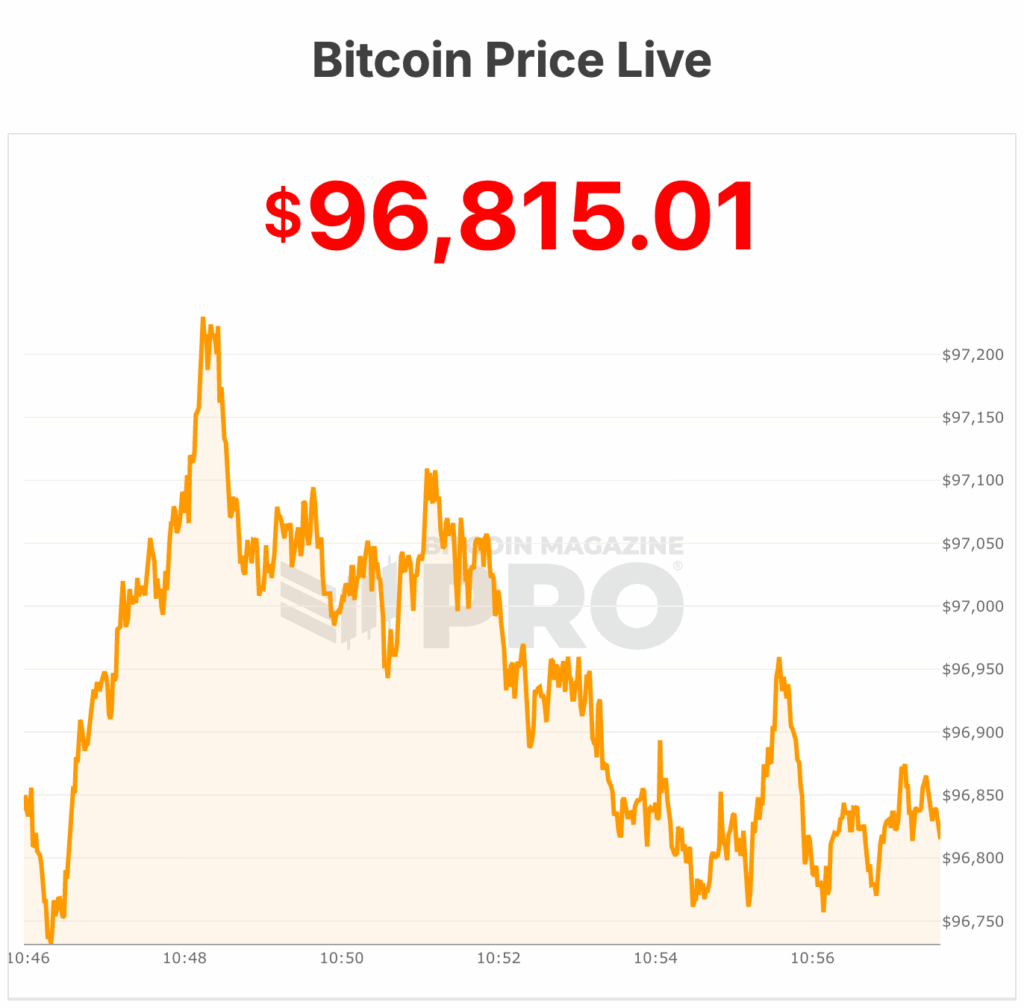

At the time of writing, Bitcoin is trading at $96,815, with lows recorded near $94,000.

This post ‘We Are Buying’: Michael Saylor Confirms Strategy (MSTR) Is Aggressively Buying Bitcoin first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

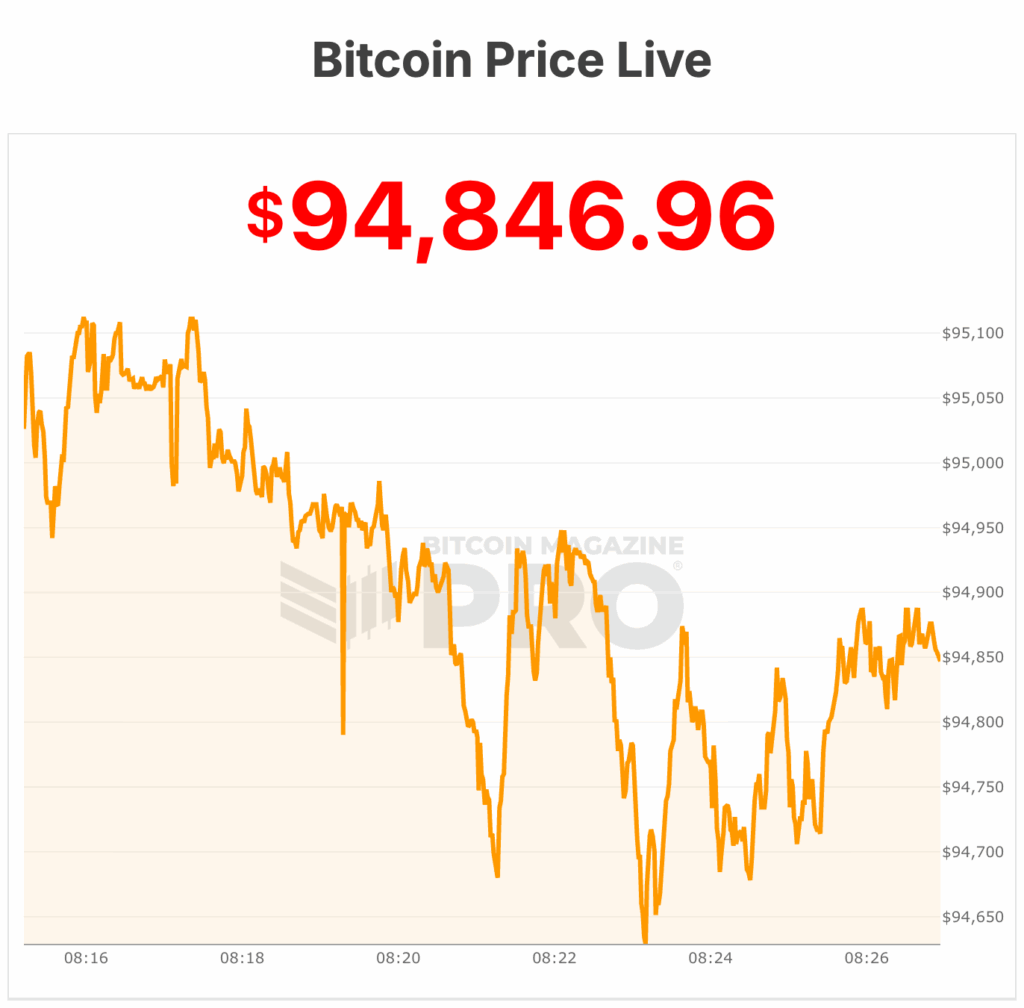

Bitcoin Price Crashes to $94,000 and New Six-Month Lows

Bitcoin price fell sharply today, sliding from an intraday high of $104,000 to $94,480, wiping out earlier gains and marking a decisive breakdown in price action.

Twelve hours ago, the Bitcoin price hit above $100,000 and then consistently bled down from the upper $101,000s to lows of $94,480.

Ethereum dropped below $3,100 at times and crypto stocks like Coinbase ($COIN) and Strategy ($MSTR) are trading in the red in pre-market trading.

Also, the Bitcoin Fear and Greed Index has plunged to a new “Extreme Fear” low, signaling deep market anxiety even as long-term holders stay the course.

The price dropped to these levels after weeks of weakening demand, heavy long-term holder sell-offs, and persistent outflows from spot Bitcoin ETFs. More than 815,000 BTC — nearly $79 billion — were sold by long-term holders in 30 days, while ETFs saw hundreds of millions in daily outflows, draining liquidity at the worst moment.

Futures funding have turned negative, roughly $550 million in positions have been liquidated as of November 13, and options traders rushed to buy protective puts ahead of a $4 billion expiry, reinforcing bearish momentum.

Macro pressure is adding fuel: tech stocks are sliding, key U.S. economic data is delayed, and uncertainty around the Federal Reserve’s rate path is elevating risk aversion.

Bitcoin has broken major technical supports, including its 200-day moving average and key Fibonacci levels, with analysts warning that a decisive drop below $97,000 could open the path toward $92,000–$74,000.

According to Bitcoin Magazine Pro data, the last time Bitcoin price was near these levels (sub $94,000) was in early May.

Bitcoin price: Who is selling Bitcoin?

One possible reason why the bitcoin price is dropping is long-term holders unloading at record levels. Data from CryptoQuant shows they’ve sold about 815,000 BTC in 30 days — the most since early 2024 — while spot and ETF demand weaken.

Institutional buying has also dropped below daily mining supply, intensifying sell pressure. Prices hover near the crucial 365-day moving average around $102,000, and failure to rebound could trigger deeper losses, according to Bitcoin Magazine Pro analysis.

Analysts at Bitfinex say the current bitcoin pullback mirrors past mid-cycle retracements, with the drop from October’s high matching the typical 22% drawdown seen throughout the 2023–2025 bull market.

“It is important to note too, that even at the $100,000 level, approximately 72 percent of the total BTC supply remains in profit,” Bitfinex analysts wrote to Bitcoin Magazine yesterday. They believe a short relief rally is likely but that a sustained recovery will require fresh demand.

According to The Block, JPMorgan analysts say bitcoin price’s current estimated production cost of $94,000 acts as a historical price floor, suggesting the bitcoin price is near the bottom now.

The analysts believe that rising network difficulty has pushed production costs higher, keeping bitcoin’s price-to-cost ratio near historical lows. The analysts maintain a bold 6–12 month upside projection of about $170,000.

Large bitcoin price swings aren’t driven by small retail investors—they’re driven by whales, institutions, and leveraged market structures. Whale wallets holding thousands of BTC can move more volume than entire exchanges, and even a single transfer can shift sentiment in low-liquidity conditions.

Meanwhile, ETF flows, hedge funds, and corporate treasuries now dominate daily market direction, with billions in inflows or outflows dictating whether Bitcoin rallies or plunges.

All this comes as the U.S. government has reopened after a record 43-day shutdown, the longest in history, following President Trump’s signing of a funding bill late Wednesday.

Under the bill Trump signed Wednesday night, funding for most federal agencies will run out at midnight on Jan. 30.

While federal operations are resuming, recovery will be slow. At the time of writing, Bitcoin’s price is $94,470.

This post Bitcoin Price Crashes to $94,000 and New Six-Month Lows first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

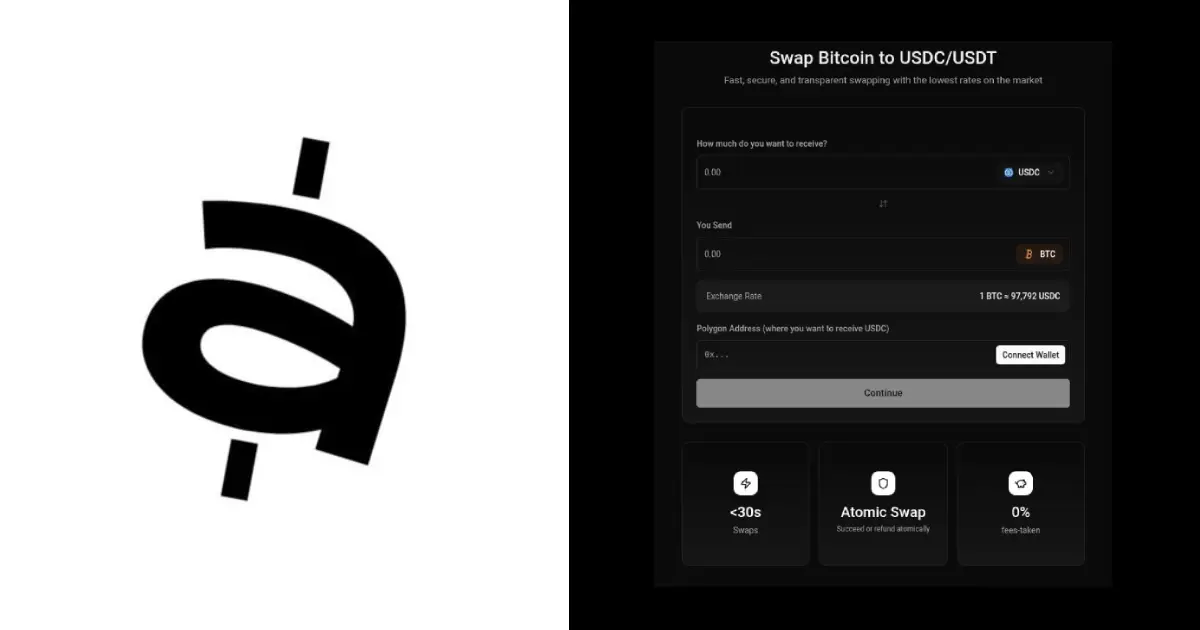

Lendasat Unveils Lendaswap: Non-Custodial Cross Blockchain Exchange for Bitcoin and Stablecoins

Lendasat, a Bitcoin-native peer-to-peer lending platform, announced today the launch of Lendaswap, an atomic swap exchange enabling instant, non-custodial trades between Bitcoin and stablecoins across Ethereum and leading EVM-compatible chains.

Powered by the Arkade protocol, Lendaswap uses HTLC-based atomic swaps — a technology similar to that of the Lightning Network — to deliver a seamless experience for anyone looking to swap BTC and stablecoins “without giving up self-custody, creating accounts, or relying on wrapped tokens,” according to a press release shared with Bitcoin Magazine.

Lendaswap will support Ethereum and Polygon at launch, with planned expansion to Base, Solana, Binance Smart Chain, Arbitrum, and Optimism. Swaps are executed via Arkade, the new implementation of the Ark protocol, which should deliver “instant execution” on the Bitcoin side. Trades are also expected to be possible in both directions, so users will be able to swap BTC for stablecoins and vice versa.

“Bitcoin self-custody needs more than passive holding, it needs infrastructure,” said Philipp Hoenisch, co-founder of Lendasat, adding that “Lendaswap is a major step in unlocking more utility for BTC, and marks the first step for BitcoinFi. For the first time, anyone can move between Bitcoin and stablecoins without trusting a custodian, without wrapping, and without asking permission. This is what Bitcoin-native finance should look like.”

The startup demonstrates the power and potential of the Bitcoin scripting language, which had for years been dismissed as inferior to that of Ethereum-era blockchains. The Ark protocol used to make Lendaswap possible is an increasingly popular technology among Bitcoin enthusiasts and entrepreneurs.

The smart contract involved in the dex is open source, as well as the front end interface. Lendaswap is now live at https://swap.lendasat.com/

This post Lendasat Unveils Lendaswap: Non-Custodial Cross Blockchain Exchange for Bitcoin and Stablecoins first appeared on Bitcoin Magazine and is written by Juan Galt.

Bitcoin Magazine

Bitcoin Price Crashes Below $98,000 Close to Six-Month Lows

Bitcoin price fell sharply today, sliding from an intraday high of $104,000 to $98,113, wiping out earlier gains and marking a decisive breakdown in price action.

Starting in morning trading, the Bitcoin price consistently bled down from the upper $102,000s to lows of $97,870.

According to Bitcoin Magazine Pro data, the last time Bitcoin price was near these levels (sub $98,000) was in early May — roughly May 8 depending on time zone. Bitcoin price vaulted above $100,000 for over 40 days after that before dipping back to $98,000 in late June.

One possible reason why the bitcoin price is long-term holders that are unloading at record levels. Data from CryptoQuant shows they’ve sold about 815,000 BTC in 30 days — the most since early 2024 — while spot and ETF demand weaken. Profit-taking dominates, with $3 billion in realized gains on Nov. 7 alone.

Institutional buying has also dropped below daily mining supply, intensifying sell pressure. Prices hover near the crucial 365-day moving average around $102,000, and failure to hold it could trigger deeper losses, according to Bitcoin Magazine Pro analysis.

Analysts at Bitfinex say the current bitcoin pullback mirrors past mid-cycle retracements, with the drop from October’s high matching the typical 22% drawdown seen throughout the 2023–2025 bull market.

“It is important to note too, that even at the $100,000 level, approximately 72 percent of the total BTC supply remains in profit,” Bitfinex analysts wrote to Bitcoin Magazine. They believe a short relief rally is likely but that a sustained recovery will require fresh demand.

According to The Block, JPMorgan analysts say bitcoin price’s current estimated production cost of $94,000 acts as a historical price floor, suggesting limited downside.

The analysts believe that rising network difficulty has pushed production costs higher, keeping bitcoin’s price-to-cost ratio near historical lows. The analysts maintain a bold 6–12 month upside projection of about $170,000.

All this comes as the U.S. government has reopened after a record 43-day shutdown, the longest in history, following President Trump’s signing of a funding bill late Wednesday.

While federal operations are resuming, recovery will be slow. Federal workers still await backpay, and air travel delays may persist.

Timot Lamarre, director of market research at Unchained, described bitcoin to Bitcoin Magazine as a “canary-in-the-coal-mine for liquidity drying up in the market.” He notes that the recent government shutdown caused the Treasury General Account to swell, absorbing liquidity, and adds that with the government reopening, “more liquidity injected into the system will benefit bitcoin’s dollar price in the near term.”

Agencies like the IRS face major backlogs, and national parks struggle to recover lost revenue. The short-term funding measure only extends through January 30, leaving the threat of another shutdown looming.

The return to normalcy will take time as the effects of the prolonged closure continue to ripple through the economy and public services.

Bitcoin price roared into October as the government shutdown began, surging to new all-time highs above $126,000. But the excitement quickly gave way to turbulence — the bitcoin price swung wildly through the rest of October and into November.

At the time of writing, Bitcoin’s price is at $98,470.

Despite an overall bullish mood in the market, the bitcoin price has continued to slide deeper into the month.

Bitcoin price and Nasdaq is the correlation that only hurts: Wintermute

Bitcoin is still closely tied to the Nasdaq, but it’s showing an unusual pattern: it reacts more strongly to stock market drops than it does to gains, according to a recent report from Wintermute.

This “negative skew”—falling harder on bad equity days than rising on good ones—is typically seen in bear markets, not when BTC is near all-time highs. It suggests that investors are somewhat fatigued, not euphoric.

Two main factors are driving this. First, attention and capital have shifted toward equities in 2025. Big tech and Nasdaq growth stocks are soaking up much of the risk appetite that might have flowed into crypto. Bitcoin moves with the market when things go wrong but doesn’t get the same lift when optimism returns, acting like a high-beta tail of macro risk.

Second, liquidity in crypto is thinner than before. Stablecoin issuance has stalled, ETF inflows have slowed, and exchange depth hasn’t fully recovered. This makes downside moves more pronounced and widens the performance gap.

That said, BTC is holding up remarkably well, according to Wintermute. Even with this persistent downside bias, it’s less than 20% below its all-time high. The pattern is unusual near tops — it usually shows up near bottoms — but it also reflects Bitcoin’s growing maturity as a macro asset.

This post Bitcoin Price Crashes Below $98,000 Close to Six-Month Lows first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

CryptoSlate

Grayscale filed an S-1 form with the Securities and Exchange Commission (SEC) on Nov. 13 to list Class A common stock on the New York Stock Exchange under ticker symbol GRAY.

The firm manages approximately $35 billion across more than 40 crypto products, including spot Bitcoin and Ethereum ETFs.

As a public company, Grayscale will have to disclose more financials and face shareholder pressure, which could influence future fee decisions and product strategy.

The filing does not specify share count or pricing range for the proposed offering. Morgan Stanley, BofA Securities, Jefferies, and Cantor will serve as lead managing bookrunners.

Financial performance shows revenue pressure

Grayscale reported $318.7 million in revenue for the nine months ended Sept. 30, down from $397.9 million in the same period of 2024. The company posted net income of $203.3 million through September 2025 compared with $223.7 million a year earlier.

Operating margin reached 65.7% in the recent nine-month period.

The firm’s weighted-average management fee declined to 1.39% through September 2025 from 1.67% in the prior-year period, reflecting competitive pressure from lower-cost ETF entrants, including BlackRock and Fidelity.

Average assets under management slipped to $30.6 billion from $31.8 billion year-over-year.

Full-year 2024 results showed revenue of $506.2 million and net income of $282.1 million, down from $512.7 million and $325 million, respectively, in 2023. The company attributed the decline to reduced management fees, outflows, and distributions.

Dual-class structure preserves DCG control

The offering employs a dual-class share structure, giving Digital Currency Group, Grayscale’s parent company, 10 votes per Class B share compared with one vote per Class A share.

DCG will retain approximately 70% of total voting power after the IPO through its Class B holdings, which carry no economic rights. Each Class A share will receive one vote and full economic participation.

The structure qualifies Grayscale as a “controlled company” under NYSE rules, exempting it from certain corporate governance requirements. The Class B super-voting rights terminate when DCG’s ownership falls below 20% of total shares outstanding.

Impact on ETF holders remains indirect

The IPO does not alter the legal structure, custody arrangements, or operations of Grayscale’s existing trusts and ETFs.

Fund assets remain held by third-party custodians under separate trust agreements.

The company completed a reorganization into a Delaware holding structure earlier in 2025, which it stated would not materially affect trust operations.

Net proceeds from the offering will be used to purchase membership interests from existing owners in Grayscale Operating, rather than funding capital expenditures.

The transaction converts private ownership stakes into publicly tradable equity without requiring the injection of new capital into fund operations or altering sponsor fee arrangements.

Grayscale reserved a portion of IPO shares for eligible investors in its Bitcoin Trust ETF (GBTC) and Ethereum Trust ETF (ETHE) through a directed share program.

Participants must have held GBTC or ETHE shares as of Oct. 28 and complete pre-registration by Nov. 24. The program does not guarantee allocations, and shares purchased through it face no lock-up restrictions.

The public listing will subject Grayscale to quarterly and annual reporting requirements, providing ETF investors with increased visibility into the sponsor’s financial condition, litigation exposure, and product concentration.

The registration statement indicates that future fee decisions and product expansion plans will face scrutiny from public equity holders alongside existing competitive pressure in the ETF market.

The post How the Grayscale IPO changes the cost to hold $35 billion crypto ETF shares appeared first on CryptoSlate.

Earlier in the year, Europe’s Central Bank (ECB) President Christine Lagarde insisted that Bitcoin would not be included in the reserve portfolios of central banks under the ECB’s umbrella; the statement was intended to draw a firm boundary around sovereign engagement with digital assets.

For more than two decades, reserve cohesion has served as a marker of European stability, with eurozone institutions typically presenting a united front on monetary doctrine questions.

Yet within the same year, the Czech National Bank introduced an unexpected complication, not through debate or public dissent, but through a modest transaction that quietly expanded the technical perimeter of European reserve management.

On Nov. 13, the CNB confirmed that it had acquired roughly $1 million in Bitcoin, USD-backed stablecoins, and a tokenized deposit, placing the assets in a dedicated “test portfolio” designed to evaluate custody, valuation, compliance, and settlement procedures.

The bank’s leadership emphasized that the purchase would not be incorporated into official reserves and was not intended to signal any policy shift.

However, the act of conducting the experiment and doing so with live assets rather than laboratory models marks the first time an EU-member central bank has created and disclosed an operational framework capable of supporting Bitcoin at a sovereign scale.

That alone is enough to alter how markets interpret Bitcoin’s long-term role in the global financial system.

A test portfolio that expands the boundaries of what Bitcoin represents

The importance of the Czech pilot lies less in its size than in the infrastructure it puts into motion. Central banks regularly conduct internal analysis on new asset classes, but they rarely build a complete operational workflow unless they believe that such capabilities may eventually be required.

In this case, the CNB is examining the full suite of procedures necessary for managing digital instruments under reserve-grade scrutiny: secure key management, multi-layer approval chains, AML verification standards, crisis-response simulations, mark-to-market reconciliation, and integration with established reporting frameworks.

These processes are difficult to design and expensive to maintain, which is precisely why institutions do not establish them unless they anticipate that the underlying asset may become relevant in scenarios where preparation matters more than public signaling.

Once a central bank possesses the architecture to store and manage Bitcoin, the distinction between “test asset” and “reserve asset” becomes a matter of policy choice rather than operational feasibility.

For markets, this changes Bitcoin’s position in the sovereign selectorate. The asset shifts from being a conceptual outlier to a technically viable option whose adoption probability, however small today, is no longer zero.

Pricing models for long-duration assets respond to possibility as much as reality, and Bitcoin is particularly sensitive to changes in perceived legitimacy because a significant portion of its valuation has always reflected expectations about its future monetary relevance rather than current institutional participation.

How Prague’s move reshapes the market narrative around Bitcoin

The Czech experiment arrives at a moment when Bitcoin’s macro profile is already evolving, driven by ETF inflows, expanding liquidity, and a growing body of historical data about its correlation behavior under different rate environments.

What the CNB adds to that landscape is an entirely different form of signal: a sovereign institution treating Bitcoin as an instrument demanding operational mastery, even without committing to eventual adoption.

This reframing matters because central banks influence markets not only through their purchases but through the categories they create.

Therefore, when Bitcoin enters the realm of assets that a central bank must understand, it establishes a structural foothold in the global financial architecture.

For traders, the significance lies not in the Czech Republic suddenly accumulating a meaningful position, but in Bitcoin having crossed into the class of instruments that sovereign institutions are preparing to interact with if conditions change.

That preparation introduces what some macro analysts describe as a “sovereign option premium”: a valuation component reflecting the non-zero probability that future reserve diversification, stress-hedging, or geopolitical responses could involve digital assets.

Even if no central bank adopts Bitcoin in the near term, the act of operational testing reduces the asset’s existential risk profile and the fear that governments would remain universally hostile or permanently structurally excluded from interacting with it. In asset-pricing models, lower existential risk translates into higher long-term fair value.

This mechanism explains why a small, symbolic purchase can reshape Bitcoin’s strategic narrative without directly affecting its liquidity. Sovereign institutions rarely begin with large allocations; instead, they start with the infrastructure that enables them to act without improvisation.

Thus, the Czech step signals that Bitcoin has entered this preparatory phase, and markets tend to anticipate the implications of such transitions long before they occur.

Longer-term impact on BTC

The Czech Republic occupies a unique institutional position. It is bound by EU regulation, including MiCA, but operates outside the eurozone and thus retains full autonomy over its reserve composition.

Historically, non-Euro EU members have informally aligned with ECB reserve norms in the interest of maintaining credibility and cohesion; however, the absence of formal enforcement mechanisms has meant that such alignment has always been voluntary.

The CNB’s experiment does not constitute a break with the ECB. Yet, it demonstrates the limits of centralized guidance in an era when inflation cycles, debt dynamics, and technological change encourage reserve managers to pursue a broader palette of options.

For Bitcoin, this creates an important precedent. Europe is the world’s second-largest reserve bloc, and even minor shifts in its analytical posture can influence global perceptions of what constitutes a legitimate sovereign asset.

Suppose other non-Euro EU central banks or mid-sized institutions outside Europe, facing similar diversification pressures, replicate the Czech approach. In that case, Bitcoin’s sovereign thesis will mature more quickly than policy statements alone would suggest.

Central banks do not need to adopt Bitcoin for the asset to benefit from the operational normalization underway. They need only acknowledge that the capacity to manage it is part of their institutional toolkit.

The CNB has not signaled any intention to add Bitcoin to official reserves, and its leadership remains aligned with Europe’s cautious stance on digital assets. Even so, the act of building the infrastructure subtly changes the baseline from which future decisions will be made.

In that sense, the impact on Bitcoin is less about immediate demand and more about the narrative foundation it gains from being treated as a reserve-relevant instrument. Markets understand this dynamic well: institutional readiness is often the earliest indicator of eventual adoption, even if actual positions come years later.

Bitcoin’s long-term valuation models now incorporate the reality that at least one European central bank has decided the asset deserves operational competence rather than rhetorical dismissal.

The post EU shock Bitcoin move: A European central bank quietly bought BTC despite ECB’s hard “No” appeared first on CryptoSlate.

For months, crypto traders have timed leverage, funding, and liquidity around the monthly U.S. inflation print.

This week, those who had hoped the recent vote to reopen the government would bring new macro data were disappointed to find nothing on the tape. The Bureau of Labor Statistics said in October that

“No other releases will be rescheduled or produced until the resumption of regular government services.”

The last completed CPI report, covering September, was released late on October 24, following the shutdown’s interruption of normal operations.

The all-items index level came in at 324.80, with headline and core inflation both at 3.0% year-over-year. Trading Economics currently lists December 10 as the next scheduled date on the CPI calendar.

Why the Missing October Print Matters for Markets

There is now a gap for October that may never be filled. Because the shutdown covered the full data-collection period, field staff were unable to gather the price sample that underpins CPI. That may be collated and included in the December update, but the indication is that there will now be a gap.

White House Press Secretary blamed the gap on the Democrats, asserting,

“The Democrats may have permanently damaged the Federal Statistical System with October CPI and jobs reports likely never being released.”

Without that survey, the BLS could not post an update on Nov. 13, the standard date when markets would have received the October reading. Officials have signaled that October may not be reconstructable even after operations return to normal, as there is no primary data to benchmark against.

For crypto markets, the absence of a number mattered more than any hypothetical value. Bitcoin and Ethereum entered the week positioned for a volatility event that never materialized. Though volatility came regardless.

Spot Bitcoin fell around 6% over the session, along with a sea of red across the entire crypto market. Liquidity remains thin, and derivatives open interest edged lower, a behavior that aligns with a market waiting for macroeconomic information that did not materialize.

The missing CPI broke the usual chain that connects inflation data to crypto price action.

Normally, a softer print feeds expectations for a less restrictive Federal Reserve path. Treasury yields edge down, the dollar weakens, and risk assets, including Bitcoin, catch a bid.

A hotter print does the opposite, firming expectations for tighter policy and pressuring long-duration assets.

With no data, rates desks had no fresh input for real yields or breakeven inflation. The Fed outlook shifts to a trade on speeches, market-based inflation swaps, and secondary indicators.

That macro vacuum pushed crypto further into its role as a proxy for expectations about future policy rather than a simple high-beta extension of equities.

Without CPI, desks leaned more on liquidity, ETF flows, and options positioning. Funding rates on major futures pairs compressed as new directional leverage stayed on the sidelines.

All of this redirects attention to Dec. 10, the next date on the CPI calendar. Trading Economics lists that day as the “next release,” although the value field is empty, emphasizing that it is a placeholder rather than a confirmed dataset.

The Market Impact of October’s Unfillable CPI Gap

Markets now have to price three broad paths for what that date could bring.

One path is for the BLS to manage the reconstruction of some form of October CPI using partial samples, imputation, or model-based estimates.

If that happens, traders may treat the number as lower quality than a normal print, since the underlying survey would not follow the standard methodology. Reaction in crypto could be modest.

If the headline monthly change lands at 0.2% or below, consistent with a controlled disinflation trend, the usual pattern would be dollar softness, a pullback in yields, and a Bitcoin bounce.

Ethereum is likely to outperform over the next one to two days as traders re-engage with higher-beta risk. Smaller altcoins tend to follow, often moving in the 5–12% range once liquidity shifts down the risk curve.

If the reconstructed number or a clean November print falls in a “sticky” zone around 0.3–0.4% month-on-month, the message for policy becomes less clear.

Yields may move in a narrow range, and crypto could end the day close to where it started. Bitcoin may trade flat, with altcoins underperforming as traders cut marginal risk.

Funding rates in perpetual futures could slide into slightly negative territory as short-term hedging flows dominate.

A third path is that inflation data comes in hot at 0.5% or above. That outcome would strengthen expectations that the Fed needs to keep policy tight for longer, pulling the dollar higher and pushing Treasury yields up across the curve.

In previous episodes, such combinations have been associated with a 3–6% intraday drop in Bitcoin, sharper moves in Ethereum, and a broad deleveraging in altcoins.

Liquidation volumes in such washouts often run two to four times above recent norms as overleveraged positions are forced out.

How the CPI Void Reshapes Short-Term Macro Trading

The more unusual scenario is that Dec. 10 arrives with no October CPI at all because the BLS decides the missing survey cannot be credibly reconstructed or additional delays occur in the pipeline.

In that world, the next clean reading would reflect November conditions, and the gap between hard inflation data points would stretch to almost two months.

Treasuries would need to lean more heavily on breakeven markets and inflation swaps to anchor expectations. The term’ premium across the curve’ could embed a fatter risk buffer for the uncertainty surrounding true price dynamics.

Trading Economics currently forecasts continued inflation pressure into next year, with CPI rising month-on-month.

For digital assets, a world with unreliable or irregular inflation data introduces a new kind of macro regime.

Crypto becomes more of a “macro-smoothed” asset class, trading on slower-moving forces such as ETF flows, structural demand from long-only allocators, corporate balance sheet decisions, and the plumbing of dollar liquidity.

Short-term volatility driven by scheduled data would fall, replaced by longer episodes of uncertainty punctuated by policy communication and idiosyncratic crypto events.

That regime would likely reinforce Bitcoin’s status as the sector’s benchmark. When macroeconomic uncertainty is high but data are sparse, traders have a lower appetite for tokens farther out on the risk spectrum.

Capital tends to consolidate into assets with deeper liquidity, clearer narratives, and more developed derivatives markets. Altcoins that rely on high leverage or speculative momentum for price support may find these conditions scarce until regular macroeconomic releases resume.

The CPI gap also elevates the importance of alternative data sources and nowcasting models that attempt to infer inflation from high-frequency inputs such as card spending, freight rates, or online prices.

Traditional macro desks already track those indicators, but without a monthly BLS checkpoint, they carry more weight.

Crypto traders may have to incorporate such tools more systematically if the formal inflation pipeline remains unstable.

For now, the CPI story is not about an upside or downside surprise but about an empty line in the macro calendar.

The last confirmed reading shows a 324.80 index level for September with 3.0% inflation on both headline and core measures.

The next entry is a blank field on Dec. 10 that may or may not contain October’s missing data. Crypto markets are trading around this absence, waiting to see whether the world’s most-watched inflation gauge reappears or whether the macro vacuum persists.

The post US inflation data goes dark: Shutdown wipes out October CPI, leaving Bitcoin hanging appeared first on CryptoSlate.

Bitcoin has done what many bulls dreaded: it plunged below six figures, crashed through $100,000, and even tumbled past $98,000 in a wave of liquidations not seen since May.

As reported by CryptoSlate, BTC fell to $98,550, triggering $190 million in long liquidations in one hour and $655 million in 24 hours as spot ETFs saw a $278 million net outflow on Nov. 12 and $961 million for the month so far.

This event shifted a slow decline into a sharp drop, clearing leveraged longs and forcing the market to face the on-chain support below the price.

On-chain data reveals shifting market structure beneath $100k

Coinbase data showed the extent of the move in the US after liquidations began. Bitcoin peaked at $103,988 before falling to $95,900, last closing near $96,940: barely 2% above $95,000, the on-chain HODLers Wall. The market fell from a 5% cushion above the wall to nearly touching it.

The on-chain wall’s structure remains, but price behavior has changed. Cost-basis distribution shows that approximately 65% of all invested USD in Bitcoin is above $95,000, with every short-term holder’s coin priced there or higher, and 30% of the long-term holder supply in the same range.

This isn’t the thin, speculative air of 2017’s top or the initial 2021 peak. It’s similar to the denser “second-wind” structure of late 2021, where seasoned holders and new entrants shared the topping zone, and resolution took months.

That density explains why spot has dragged for so long. The US election rally last year pulled a broad swath of buyers into the $95k–$115k range and trapped them through a year of sideways trading.

With the short-term holder cost basis already breached at about $112,000, every failed attempt to recover that level trapped more recent buyers underwater while long-term holders sat on a layered cost-basis ladder just below the highs.

Futures unwind and ETF outflows reveal a thinning support zone

The latest cascade exposed that structure: once futures longs started to unwind, there was very little fresh demand between the $106k-$118k resistance area that Glassnode flagged and the psychological $100k handle, and ETF demand was no longer strong enough to absorb forced selling.

The key difference now is who’s selling. In 2017 and 2021, supply near the top was mostly from short-term holders. After those peaks, older, in-profit coins rotated out. Then, unrealized losses reached 15% of the market cap within six weeks, filling old air pockets.

In 2025, unrealized losses are about half what they were in January 2022, despite BTC trading under $100k and touching the wall.

Glassnode data shows STHs have been underwater against their $111,900 cost basis since October. Their realized profit-loss ratio fell below 0.21 near $98,000, meaning over 80% of the value they moved there was sold at a loss.

This is classic capitulation by top buyers, not a broad LTH exit. Checkonchain confirms: almost half the coins recently sold came from high-entry, recent buyers exiting as the market hovers near the wall.

That’s why $95k still matters. It was a theoretical bull cycle “fail point”; now the price nears it. New Coinbase data shows that BTC’s $95,900 low places it deep within the long-term holder zone, where most coins remain unmoved. If this group stays firm, the wall can absorb forced STH and derivatives selling.

However, if Bitcoin cleanly loses $95,000, the roadmap is reasonably clear. The first shelf sits around $85,000, the “tariff tantrum” low, where spot hammered out a local bottom during earlier policy jitters and briefly refilled part of last year’s air pocket.

Below that is the True Market Mean at $82,000, which sits directly over the residual gap from the US election pump and would be a natural magnet for a deeper flush. Only beyond those levels does the large, older demand band between $50,000 and $75,000 re-enter the conversation.

How this cycle’s risk profile differs from 2022

There is another key difference from 2022 that the current price action has not undone.

Back then, the loss of the $45k base of that cycle’s HODLers Wall was swift and brutal: STH cost basis gave way at $54k, the wall at $45k offered almost no support, and the market spilled straight down to the True Market Mean around $36k, intersecting a multi-year air-pocket that went all the way back to the start of the cycle.

In this cycle, the potential fall from the wall to the mean is much shorter, and the underlying demand from the 2024 range is closer in price. A move from $95k to the low-$80ks would hurt, but it would not recreate the kind of deep, multi-year bear that followed the 2021 peaks.

The short-term backdrop remains fragile. ETF flows tilt negative, redemptions replacing the steady inflows that supported Bitcoin for most of the year. Perpetual funding and open interest have declined since October’s leverage flush. Options markets now pay an 11% implied volatility premium for puts over calls, signaling traders are hedging for downside.

What happens next depends less on short-term traders than on the holders who own the bulk of the supply above and just below $95k.

If they hold their nerve, the wall can continue to act as a floor, giving the market time to rebuild demand. If they crack, the path through $85k and down toward the $82k mean is already drawn on the on-chain chart.

The post Bitcoin tests the $95k HODL wall after cascade knocks out $655M from bulls appeared first on CryptoSlate.

Equity screens show a broad red, with the S&P 500 down around 1.8% and the entire crypto market under pressure simultaneously.

What appears to be an unexplained wipeout is, in fact, a layered move driven by interest rate expectations, crowded positioning in tech and AI names, and a shift in global risk appetite that is pulling liquidity from the parts of the market that led the prior rally.

Across crypto, the tape was heavy over the last 24 hours: Bitcoin -5.8%, Ethereum -9.4%, XRP -8.8%, Solana -9.2%, and BNB -5.2%. As a result, the total market cap fell by 6% to $3.2 trillion from around $3.4 trillion.

Over $1.1 billion was wiped out from futures markets, according to CoinGlass data, with over $500 million liquidated from Bitcoin positions alone.

Tightening financial conditions reverberate through growth assets.

The first piece sits with the Federal Reserve. Markets spent much of the year pricing in a clear path toward rate cuts and a softer stance on policy.

Recent communication has pushed back on that comfort, with officials leaning toward keeping policy tight for longer and treating incoming data with caution.

Investors had built in a faster easing path, and the adjustment toward fewer or later cuts has pushed yields higher across the curve.

Higher real yields compress the present value of long-dated cash flows, which hits growth stocks and long-duration assets and pulls forward the valuation reset that had been delayed by abundant liquidity.

That repricing feeds directly into the sector that carried much of the index-level gains. The latest leg of the S&P 500 move was led by mega-cap tech and AI-related names.

Markets have been debating whether the earnings and spending path can match the premium baked into those stocks.

Shares of Nvidia, Alphabet, and Tesla have come under pressure as traders reassess how much AI-driven revenue and margin expansion can realistically land within the next few years.

When these names lose altitude, cap-weighted indices move with them, and passive products like SPY show broad declines even if other sectors are relatively stable.

Reshaping risk premiums and driving a broad rethink of where capital can safely sit.

The move is not only about valuations, it is also about positioning and flows. There has been a rotation out of the prior “everything up” phase toward a more defensive stance as policy, macro, and earnings uncertainty builds.

That is visible in the distribution of sector returns. In the most recent session, technology stocks fell by around 2%, while healthcare stocks gained close to 0.9%.

Capital is shifting from high-growth areas with multiple returns to value and defensive sectors, such as healthcare and, in some cases, energy.

From an index-level view, however, the heavy weight of tech means those smaller pockets of green are not enough to offset the drag from mega caps, so the screen still looks uniformly red.

Macro and political headlines are adding to that caution. The Dow fell approximately 397 points in a single session as traders sought to reduce risk and raise cash.

Concerns around fiscal negotiations and the prospect of government shutdown brinkmanship in the United States have added another source of uncertainty to the outlook for growth and policy.

In Europe, the upcoming UK budget forecasts are causing markets to react to the prospect of higher taxes and tighter fiscal room, which is pressuring domestic stocks and weighing on broader European sentiment.

Together, these factors create an environment where cross-border flows into US equities can slow or reverse, which further amplifies weakness in benchmarks such as the S&P 500.

This backdrop matters for crypto because the same drivers shape funding, leverage, and risk appetite on-chain and in derivatives.

How shifting rate expectations and tech unwinds triggered the sell-off.

For much of the year, Bitcoin and large-cap digital assets have behaved as high-beta expressions of the same macro trade that supported growth equities.

When real yields rise, the dollar strengthens, and volatility increases in stocks, multi-asset funds, and crossover traders often reduce their exposure across the board.

That means de-risking in tech portfolios can coincide with reductions in crypto holdings, forced liquidations in perpetual futures, and lower demand for leverage.

Even crypto-native flows feel the impact as stablecoin yields compete with Treasury rates and marginal capital faces a clearer opportunity cost.

At the same time, the structure of equity indices shapes how “everything red” appears on trading dashboards. SPY tracks large-cap US stocks, with considerable weight in information technology and communication services.

When those sectors come under pressure, the ETF reflects that move almost immediately.

According to the Financial Times, a renewed bout of “tech jitters” has driven broad US stock declines, as traders question whether the AI and cloud spend cycle can keep pace with prior expectations.

SPY’s drop of roughly 1.8% fits that pattern, where heavy selling in a concentrated group of leaders pulls the rest of the basket lower even if some defensive or value names are flat or slightly positive.

Flows also matter around the edges. When buyback programs pause during blackout windows, a steady source of corporate demand for shares temporarily disappears.

If that coincides with higher volatility, hawkish central bank messaging, and headline risk around budgets or shutdowns, selling pressure has fewer natural counterparties.

Earnings results have been solid in many cases; yet, the bar set by prior guidance and market expectations leaves less room for an upside surprise.

Parsing what comes next: why cross-asset signals matter now.

In that environment, “good enough” numbers can still lead to downward price moves as traders lock in gains and fade stretched narratives.

For crypto markets, the forward path hinges on how this macro repricing evolves rather than on any single equity session.

If the higher-for-longer policy remains the base case and the cost of capital stays elevated, the hurdle rate for speculative and long-duration assets remains high.

Bitcoin’s role as a liquidity asset, macro hedge, or risk asset can shift across cycles, so monitoring realized correlation with equities, ETF flow data, and stablecoin market value will be important for reading whether the current sell-off reflects a temporary flush or a deeper reset of risk appetite.

For now, a slower path to rate cuts, pressure on crowded tech and AI trades, and more cautious global capital flows are working together to keep both equities and crypto in the same red zone.

The post Why is everything down? Macro shock turns Bitcoin and other risk assets red across the board appeared first on CryptoSlate.

Cryptoticker

XRP Chart Analysis: The $2.20 Support Remains the Battleground

- $XRP touched the $2.20 level at least four times, each time producing a strong bounce.

- Several fakeouts occurred — price briefly dipped under $2.20 but immediately recovered, showing buyers aggressively defending the support.

- The most recent candle once again shows bullish reaction from this zone, confirming its significance.

- The upper resistance remains at $2.50, the level XRP has failed to break multiple times.

XRP/USD 4-hour chart - TradingView

This forms a range between $2.20 and $2.50, with higher volatility expected as Bitcoin continues to influence market direction.

Bitcoin Crash Puts XRP at Risk: Why XRP Is Still a Lagger

Even during positive market moments, XRP tends to move late compared to other altcoins — a well-known characteristic.

But when Bitcoin crashes, XRP often follows with amplified delay.

Currently:

- Bitcoin broke below $95,000, triggering heavy liquidations.

- Depth charts are showing thin liquidity.

- Market panic remains high.

- Altcoins are bleeding across the board.

XRP’s resilience at $2.20 is notable — but historically, when Bitcoin makes a violent move, XRP eventually reacts.

That means the real question becomes:

👉 What happens if Bitcoin continues falling toward $90K?

Bearish Scenario: What Happens if XRP Breaks Below $2.20?

If Bitcoin drops to $90,000, the probability of XRP losing its support increases sharply.

If $2.20 breaks:

- First target: $2.05–$2.10 (minor demand zone)

- Stronger downside target: $2.00 psychological support

- Worst-case wick: $1.90, matching prior consolidation areas

The market has shown multiple fakeouts below $2.20, but the structure suggests weakening demand — especially if external pressure (Bitcoin) intensifies.

XRP/USD 4-hour chart - TradingView

Bullish Scenario: Can XRP Rebound Toward $2.50 Again?

A successful rebound (as we see on the chart) can lead to:

- Retesting $2.35–$2.40

- A potential breakout toward $2.50, the range high

- If Bitcoin stabilizes above $100K again, volatility in altcoins should cool down, giving XRP space to climb

However, as long as Bitcoin remains unstable, XRP’s upside stays limited.

XRP Price Prediction: Short-Term Outlook

| Scenario | XRP Target |

|---|---|

| Bullish Bounce | $2.35 → $2.50 |

| Neutral Range | $2.20 → $2.35 |

| Bearish Breakdown | $2.05 → $2.00 (if BTC hits 90K) |

Given current chart signals, the $2.20 support remains the critical line for determining the next move.

Bitcoin is facing one of its sharpest drops in weeks after breaking below the critical $95,000 support level, triggering widespread panic across the crypto market. Major altcoins are tumbling even harder as liquidity evaporates and traders rush to derisk. However, a major macro catalyst is now on the horizon: the U.S. Treasury is preparing a liquidity injection expected within 2–3 days, with JP Morgan projecting nearly $300 billion in system-wide inflows by mid-December.

The combination of market fear and potential liquidity relief sets the stage for a pivotal moment in crypto.

Bitcoin Breaks Down Hard

Bitcoin’s decline has been fast and aggressive, slicing through support zones that previously held for weeks:

$100K → Lost

$98K → Lost

$96K → Lost

$95K → Broken decisively

BTC briefly touched the mid-$94K range, with increasing sell volume and weak spot bid support. Depth data suggests that the next meaningful demand zone sits around $92K–$90K, followed by stronger structural support near $88K and $85K.

The rapid breakdown shows clear signs of capitulation, especially as traders exit leveraged positions and liquidity thins across major exchanges.

Altcoins Drop Sharply as Fear Spreads

The broader market reacted violently to Bitcoin's fall:

- Ethereum down more than 10%

- Solana down 11%

- XRP down over 8%

- DOGE, ADA, LINK all down 8–12%

This type of synchronized sell-off indicates a full risk-off environment where liquidity leaves the entire market, not just Bitcoin. Technical indicators across leading altcoins show strong bearish momentum, with multiple majors nearing multi-week lows.

Sentiment Hits Extreme Fear

Market sentiment flipped instantly into extreme fear following the breakdown. Visuals circulating online emphasize the “HODL through the chaos” mindset, reflecting the emotional shock many traders are experiencing.

Historically, such sudden sentiment collapses often occur near short-term bottoms — but only if external liquidity improves.

And that’s where today’s macro news becomes critical.

Liquidity Lifeline: U.S. Treasury Steps In

New financial data indicates that the U.S. Treasury is preparing a short-term liquidity injection expected to begin within the next 48–72 hours. This includes:

- TGA drawdowns

- Funding releases to the banking system

- Increased liquidity operations typically aimed at stabilizing markets

Risk assets — including crypto — often respond sharply to such inflows.

JP Morgan Projects $300 Billion in Liquidity by Mid-December

According to new projections, system-wide liquidity could rise by up to $300B by the middle of December. Historically, periods of rising liquidity align with:

- Stronger Bitcoin recoveries

- Reduced downside volatility

- Renewed inflows into altcoins

- A shift from fear to speculative momentum

With the crypto market already at peak fear, this liquidity boost could become a turning point.

What Comes Next? Key Scenarios

- Bullish Scenario: Liquidity Saves the Market

If the liquidity injection arrives quickly, Bitcoin could stabilize above $95K and potentially reclaim $97K–$100K, triggering fast rebounds in oversold altcoins. - Neutral Scenario: Volatility Before Recovery

BTC may retest $92K–$90K before any relief rally begins. This would align with typical liquidity crunch behavior before a macro reversal. - Bearish Scenario: Deeper Capitulation

If sentiment worsens and buy-side liquidity doesn’t increase, Bitcoin could slide toward $88K or even $85K, dragging alts down sharply.

Conclusion

Bitcoin’s drop below $95,000 has sent shockwaves through the entire crypto ecosystem. Markets are clearly in a high-fear, low-liquidity environment, with support levels failing rapidly. However, the upcoming U.S. Treasury liquidity injection — along with JP Morgan’s $300B projection — may provide the fuel needed for a stabilization or even a significant rebound.

The next 72 hours will be crucial. Liquidity will determine whether this crash becomes a long-term correction or the setup for a major recovery.

Strategy’s Market Cap Falls Below Its Bitcoin Holdings

$Strategy stock price has been in freefall for nearly a year. After peaking at $543 on November 21, 2024, the share price has collapsed to around $220, representing a staggering 60% decline.

$Bitcoin, in contrast, has held up relatively well — but Strategy has massively underperformed $BTC.

Strategy vs Bitcoin performance - TradingView

A Break in the Correlation

For years, Strategy traded almost in lockstep with Bitcoin. But in recent months, that correlation has cracked:

- Strategy shares dropped sharply

- Bitcoin stayed relatively stable

- Strategy’s performance fell dramatically behind BTC

This divergence has now created an unprecedented situation:

👉 Strategy’s market capitalization is now lower than the value of the Bitcoin it holds.

Current numbers:

- Market Cap: ~$63.5 billion

- Bitcoin Holdings: 641,692 BTC

- BTC Value: ~$65.5 billion

👉 Meaning: The market values the entire company at less than its Bitcoin balance.

Why mNAV Still Sits Above 1.0 — And Why It Matters

The most important metric for Bitcoin treasury companies is the multiple Net Asset Value (mNAV).

mNAV = Enterprise Value ÷ Bitcoin Holdings Value

To calculate Enterprise Value, liabilities must be included:

- Market Cap: ~$63.5B

- Convertible Notes: ~$8.25B

- Preferred Shares: ~$6.75B

Enterprise Value: ~$78.5B

mNAV: ~1.2×

So, despite the falling share price, Strategy still trades slightly above its Bitcoin-adjusted valuation once debts are included.

Why Strategy Is Struggling: Slowing BTC Purchases and Heavy Obligations

1. Slower Bitcoin Accumulation

Strategy has drastically reduced its BTC purchases:

- Past 12 months: >400,000 BTC acquired

- Since August 11: Only 12,746 BTC purchased

This slowdown signals increasing difficulty raising capital.

Bitcoin accumulation by Strategy

2. Dependence on Preferred Shares

To keep accumulating Bitcoin, Strategy turned heavily to preferred shares, which require dividend payments.

So far in 2025:

- Capital raised via preferred shares: ~$6B

- New Europe-focused STRE issuance: ~$700M

- Annual dividend obligations: >$700M

To pay these dividends, Strategy must often issue new common shares, which causes shareholder dilution — especially problematic when share prices are low.

Why the mNAV Problem Can Get Worse

A persistently low valuation creates a dangerous loop:

🔹 Lower share price = more dilution: Strategy must issue more shares to raise the same amount of capital.

🔹 Higher obligations = higher dilution pressure: Dividends and interest obligations continue rising.

🔹 Rising leverage = higher risk: If Strategy cannot issue shares efficiently, buying more BTC requires higher leverage — increasing risk.

🔹 Convertible debt deadlines approaching: More than $8B in convertible notes start coming due in 2028.

If the stock price is too low to convert debt into shares, Strategy may be forced to raise cash, refinance, or, in the worst case, liquidate assets.

Could Strategy Be Forced to Sell Bitcoin?

Not necessarily.

Strategy survived the 2022 bear market, during which:

- mNAV fell below 1.0

- The balance sheet was far more fragile

- Yet the company avoided selling BTC

mNAV later rebounded to 4.0×, restoring financial flexibility.

So while the situation is dangerous, it is not existential yet.

But the longer the valuation remains depressed, the greater the structural pressure becomes.

Strategy stock price - TradingView

Outlook: Can Shareholders Lose Even More?

Short-term risks

- Continued share dilution

- Declining ability to finance BTC purchases

- Mounting dividend obligations

- Debt maturities getting closer

- Underperformance vs. Bitcoin intensifying

Medium-term risks

- Leverage may need to increase

- Convertible debt may not convert

- Market may price in higher default risk

Long-term perspective

Strategy’s model only works when the stock trades at a healthy premium to its Bitcoin holdings. If the valuation stays compressed, the company’s ability to sustain its BTC-buying strategy weakens significantly.

Shareholders are not guaranteed to lose everything — but the structural risks are rising, and the path forward is narrower than at any point since 2020.

The bitcoin market just took another heavy hit. U.S. spot bitcoin ETFs recorded $869.9 million in outflows on Thursday, making it the second-largest daily exit since these products launched. That kind of number doesn’t happen quietly. It rippled through the entire market, dragged prices lower, and sparked fresh questions about whether this is fear taking over or simply a reset before the next leg up.

Why Did Spot Bitcoin ETFs Suddenly See Such Big Outflows?

Thursday’s mass exit wasn’t an accident. According to SoSoValue data, several major funds were hit hard. Grayscale’s Bitcoin Mini Trust saw the biggest drain at $318.2 million. BlockRock’s IBIT wasn’t far behind with $256.6 million slipping out, while Fidelity’s FBTC lost $119.9 million. Even GBTC and funds from Ark, 21Shares, Bitwise, VanEck, Invesco, Valkyrie, and Franklin Templeton were in the red.

This move ranks just behind the all-time record set on February 25, 2025, when investors pulled $1.14 billion in a day.

So what’s going on? The institutional flows tend to move together. When macro conditions start feeling shaky, these players reduce risk in clusters.

Vincent Liu, CIO of Kronos Research, summed it up well. Large outflows reflect a risk-off turn, he said. Institutions are stepping back as macro noise builds, but he doesn’t see it as a collapse in long-term demand. Instead, he views these drops as part of an oversold setup that long-term buyers might soon take advantage of.

What’s Triggering This Risk-Off Mood?

Markets aren’t reacting to a single shock. It’s more of a pile-up of small but worrying signals.

Min Jung of Presto Research noted that investors are rotating out of higher-beta assets and moving toward safety. The uncertainty around the Fed is a big piece of this. Weak ADP and NFIB readings point to a softening labor market. That feeds into expectations that the Fed is preparing to ease, but with caution. And traders hate uncertainty more than bad news.

Fed rate-cut odds for December have now slipped to 50.4 % according to the CME FedWatch Tool. When central bank direction becomes fuzzy, money tends to retreat from volatile assets first. Bitcoin is always at the front of that line.

How Did Bitcoin Price React to the Bitcoin ETFs Outflows?

The Bitcoin price action was quick and sharp. Bitcoin price dropped 6.4% over the past 24 hours, touching $96,956 early Friday.

Liu described the sell-off as a liquidity let-down. With cascading liquidations and fewer buyers in the order book, every drop hits harder. According to him, demand is clustering between $92,000 and $95,000, which could act as a cushion if selling continues.

Justin d’Anethan from Arctic Digital echoed the same idea. He pointed out that if bitcoin dips into the lower $90Ks, plenty of sidelined investors will view that zone as an opportunity. Not long ago, BTC was climbing past the mid-$120Ks. Many missed that move and are waiting for a deeper reset.

Is There a Bigger Trend Behind the Sell-Off?

Sometimes a crash has a clear trigger. This wasn’t one of those days. Jung noted that the pullback didn’t come from a single event. Instead, it was a blend of macro uncertainty, weakening risk appetite, and jittery flows ahead of the next FOMC meeting.

When the market feels unsure, even neutral data gets interpreted negatively. That’s the kind of environment bitcoin is dealing with right now.

What Happens Next?

The story isn’t over. The next few sessions will show whether the $92K to $95K range can hold. If it does, $BTC might see a relief bounce as liquidity stabilizes and buyers return. If it breaks, the lower $90Ks could come into focus quickly.

Here’s what matters most right now:

- Bitcoin ETF outflows are a reflection of macro anxiety, not a collapse in bitcoin’s long-term story.

- Liquidity is thin, so volatility stays elevated.

- Support zones are nearby, and long-term buyers are watching closely.

This is the kind of environment where panic selling and strategic accumulation happen at the same time. The next bounce will reveal which side is in control.

A Forward-Looking Forum for the Future of Energy

The Solar PLUS Forum 2025 stands as one of Germany’s most relevant platforms for exploring the future of the electric energy system. With rapid innovation across renewable energy, digital grid management, and real-world asset tokenization, the event brings together the thought leaders who are shaping Europe’s energy transition.

Professionals from engineering, research, finance, digital infrastructure, and Web3 will gather in Berlin to discuss how energy systems are evolving—and how digital technologies are transforming the way energy is produced, traded, stored, and financed.

Why Solar PLUS Forum 2025 Matters This Year

1. Energy Is Becoming a Digital Real-World Asset (RWA)

A growing share of assets in the energy sector—electricity, flexibility, certificates of origin, storage, and grid services—are being redesigned through digital and tokenized frameworks.

This shift unlocks:

- faster settlement processes

- transparent energy flow verification

- decentralized financing models

- new revenue structures for renewable projects

The forum highlights how real-world energy assets are merging with digital infrastructure at scale.

2. Technology Is Reshaping the Distribution Grid

From dynamic grid tariffs to AI-driven maintenance, the 2025 program reveals strong momentum in digital grid intelligence.

Key innovations include:

- intelligent network control with forecasts & dynamic charges (A3)

- reinforcement learning for optimizing transmission topologies (C3)

- hybrid PMU evaluations for system operations (C6)

- software-assisted system restoration (B4)

These technologies represent the backbone of future electricity systems.

3. BESS, Smart Grids & Sector Coupling Enter a New Phase

Battery Energy Storage Systems (BESS), electrification, and smart metering continue to accelerate across Europe.

Sessions such as:

- green BESS as performance boosters for PV projects (D5)

- electrification of heavy vehicles analyzed through ML (C5)

- AI-optimised asset & maintenance management (B1)

…show how energy storage and predictive technologies are shaping the next decade of renewable infrastructure.

Program Highlights: What to Expect

A. Structure of Future Energy Systems

B. System Stability & Grid Operations

C. Digitalization of the Electric Grid

D. Energy Economics & Market Design

You can click here to find out more.

Meet Industry Leaders & Explore New Opportunities

Participants will have the opportunity to connect with experts from Germany’s leading energy research institutions, grid operators, and innovative companies across the renewable sector.

Industry investors and innovators—including Dennis Weidner, who has spent significant time researching China’s energy landscape and exploring investment pathways in RWA/tokenization—will also be present to exchange ideas with attendees.

Join Solar PLUS Forum 2025

Whether you specialize in renewable energy, grid digitalization, BESS, tokenization, energy markets, or infrastructure finance, this event offers deep insights into where Europe’s energy transition is heading.

🎟️ Use this 10% discount code for your ticket:

2259_FORUM25_Crypto_10

Decrypt

2Wai’s new “HoloAvatar” tool turns minutes of footage into lifelike replicas of deceased loved ones, igniting ethical alarms over consent, privacy, and the commercialization of grief.

Strategy's co-founder and executive chairman described the company's hunger for Bitcoin as insatiable, while denying rumors of a recent sale.

A year prior to his death, the sex offender attempted to influence the Trump administration's crypto policy through Steve Bannon.

Travis Ford pleaded guilty to conspiracy to commit wire fraud in January, in a case involving millions in investor losses.

Crypto majors fell 7–12% in one of the year’s biggest selloffs, with Bitcoin down 8% to $95,200, Ethereum down 11% to $3,100, BNB down 7% to $895, and Solana down 12% to $137. A few assets bucked the trend, with ZEC up 3% and LEO up 1% among top movers. Bitcoin miners and crypto-related equities were hit as well, including declines in MicroStrategy (-7%), Coinbase (-7%), and Robinhood (-9%). Market sentiment remained deeply negative, with the Crypto Fear & Greed Index holding in Extreme Fear at 16. In more positive news, JPMorgan analysts turned bullish on Circle, upgrading the stock to Overweight and raising their price target on expectations of faster USDC and stablecoin growth; Cathie Wood’s ARK added $30 million in shares. Jack Dorsey’s Cash App announced that stablecoin payments on Solana and other networks are planned for early 2026. Separately, reports surfaced that China state-backed hackers allegedly used Anthropic’s Claude Code to assist in a major cyberattack affecting roughly 30 companies. Additional disclosures revealed Epstein estate emails referencing Bitcoin discussions between Brock Pierce and Larry Summers at Jeffrey Epstein’s Manhattan townhouse. Meanwhile, Emory University doubled its Bitcoin holdings in Grayscale’s BTC Trust, bringing its total to $52 million.

U.Today - IT, AI and Fintech Daily News for You Today

The Bitwise XRP ETF may be the next XRP ETF to launch, and it might launch sooner than the expected November 19 date as the SEC fast-tracks the process upon resumption.

BlackRock's BUIDL, the world's biggest tokenized RWA fund, lands on BNB Chain as integration with Binance is announced.

Shibarium has triggered new hope for the SHIB community with a sudden transaction spike.

Bitcoin saw a crash below $95,000 for the first time since May this year; Tether CEO reacts to Bitcoin crash, which wiped out $676 million in BTC liquidations.

Can bulls restore the rate of Bitcoin (BTC) above $100,000 by the end of the week?

Blockonomi

Transparency is the cornerstone of trust in crypto, and Zero Knowledge Proof (ZKP) has built its entire ecosystem on that principle. As the world’s largest blockchain presale auction prepares to go live, ZKP is introducing a feature that sets it apart from nearly every other network: a ready, verifiable performance dashboard.

Every task your Proof Pod will complete, every computation, every uptime minute, every proof generated, will be logged, verified, and displayed on your dashboard in real time. It’s your personal window into a working blockchain economy, one where you can literally watch your device generate rewards backed by cryptographic proof.

The whitelist is open now, and those joining early will be the first to access the dashboard when Proof Pods activate alongside the presale. This is how ZKP, already being hailed as one of the top crypto coins to watch, makes blockchain performance visible, not just promised.

Understanding the Dashboard: Your Control Center for Earning

Once the presale auction goes live, every Proof Pod owner will gain access to a personalized ZKP Dashboard, accessible through desktop and mobile devices.

The dashboard provides five key data views:

- Real-Time Performance Feed: Displays each compute task completed by your device.

- Uptime Tracker: Monitors operational hours and network connectivity.

- Proof Validation Log: Shows every verified proof your Pod contributes to the ZKP blockchain.

- Reward Analytics: Converts your performance data into daily ZKP earnings.

- Upgrade Management: Displays your Pod’s current level and upgrade options up to Level 300.

This isn’t theoretical tracking; every data point you see is on-chain verified. The dashboard connects directly to ZKP’s ready infrastructure, updating your stats in real time with cryptographic accuracy.

How to Use the ZKP Dashboard

Once your Proof Pod arrives and is connected to Wi-Fi (after the presale opens), logging in to your dashboard is straightforward:

- Go to the ZKP website and sign in using your wallet credentials.

- Select “Device Dashboard.” Your Proof Pod will appear automatically once connected.

- Monitor the Task Feed. You’ll see live updates each time your Pod completes an AI computation or zero-knowledge proof.

- Track Uptime. The dashboard displays your device’s uptime percentage, ensuring consistent rewards.

- Review Earnings. Your total daily ZKP tokens earned appear in real time, calculated based on the day’s auction price.

It’s simple, visual, and built for both beginners and advanced users, a hallmark of the top crypto coins built for real adoption.

How Tasks Become Verified Proofs

Every Proof Pod will perform useful AI computations that generate zero-knowledge proofs, mathematical validations that confirm the work was done correctly without revealing the underlying data.

The process looks like this:

- Task Assigned: The network sends your Proof Pod a small, privacy-preserving AI workload.

- Computation Performed: The device completes the task locally using its optimized chip.

- Proof Generated: A cryptographic “proof of compute” is created.

- Verification: The proof is uploaded and verified by ZKP’s blockchain nodes.

- Reward Distributed: Once confirmed, your dashboard reflects your ZKP token earnings instantly.

Every task, every proof, every payout is visible in your dashboard, a level of clarity that transforms how participants view blockchain contribution.

Reward Tracking: How Daily Auctions Define Earnings

The dashboard will also integrate with the Initial Coin Auction (ICA) data stream, meaning your rewards update daily based on the previous auction’s closing price.

Each day, the system automatically recalibrates your ZKP reward rate:

- If yesterday’s closing auction price was $0.01, your Level 50 Pod earns $50 worth of ZKP tokens.

- If today’s price moves to $0.02, your token count halves, but your total reward value remains consistent.

This balance creates a self-stabilizing economy, where your earnings are tied to both performance and transparent market conditions. No hidden multipliers, no staking tricks. Just verifiable economics from the best-designed Web3 infrastructure in the current top crypto coin landscape.

Performance Insights and Upgrade Planning

Your dashboard will also include long-term performance analytics, allowing you to:

- See uptime trends: Track operational stability over weeks or months.

- Plan upgrades: Estimate ROI for each level increase from Level 1 to Level 300.

- Forecast rewards: Use the daily auction rate to project future ZKP earnings.