Cryptocurrency Posts

Crypto Briefing

The incident highlights the challenges of preserving public art and the symbolic vulnerability of Bitcoin's enigmatic origins.

The post Where’s Satoshi? Statue of Bitcoin creator gets stolen, smashed, and lake-dumped in Lugano appeared first on Crypto Briefing.

Cardano's community-driven funding model sets a precedent for decentralized development, enhancing transparency and ecosystem resilience.

The post Cardano community approves treasury funding to support upgrades across performance, scalability, and UX appeared first on Crypto Briefing.

The unresolved 2020 Bitcoin heist highlights ongoing security vulnerabilities in crypto, potentially undermining trust in digital currencies.

The post Hacker still holds $14 billion in stolen Bitcoin from massive 2020 LuBian attack: Arkham appeared first on Crypto Briefing.

Eric Trump's crypto endorsements amid economic uncertainty highlight the growing intersection of politics and digital asset markets.

The post Eric Trump bull-posts Bitcoin, Ethereum amid tariff jitters appeared first on Crypto Briefing.

Hayes' crypto sell-off amid market decline may signal reduced confidence, potentially influencing investor sentiment and market stability.

The post Arthur Hayes offloads $13 million in ETH, PEPE, and ENA amid market pullback appeared first on Crypto Briefing.

HTTP error 403 on https://bitcoinmagazine.com/feed/

Failed to fetch feed: https://bitcoinmagazine.com/feed/

Failed to fetch feed.

CryptoSlate

Welcome to Slate Sundays, CryptoSlate’s new weekly feature showcasing in-depth interviews, expert analysis, and thought-provoking op-eds that go beyond the headlines to explore the ideas and voices shaping the future of crypto.

Hands up if you’ve heard of Luckycoin.

If it sounds familiar, you’re either an industry OG since the days of the Silk Road and Satoshi Dice, or a shiny new-wave crypto-curious with a penchant for collectors’ coins.

Why? Because Luckycoin dates all the way back to 2013, a veritable lifetime in the history of crypto, when Bitcoin was fun and the conversations took place on forums rather than shiny conference halls.

Think more Bitcoin scaling, BTC bubbles, nefarious actors, and software bugs; less Bitcoin ETFs, treasuries, presidential pumps, and strategic reserves.

But back to Lucky.

As a fork of Litecoin, one of the original altcoins in Bitcoin’s wake, Luckycoin was the 22nd coin created and listed on CoinMarketCap.

If you look at its price history today, it resembles a stalagmite. Even if it weren’t for Luckycoin’s anonymous creator and random winning tokenomics, this chart alone tells a story, and not the usual one you’ve come to expect.

So, take my hand and let me guide you through the twists and turns of Luckycoin’s journey. It’s a tale fraught with epic highs, crushing lows, and a decade-long slumber to rival Sleeping Beauty’s, and see the Bitcoin lineage memecoin emerge like a “phoenix from the ashes” to claim its rightful place as a revived piece of crypto history.

Let’s begin.

From anonymous beginnings to the Doge-father

Luckycoin was cut from the same cloth as Bitcoin, created by an anonymous developer known as “LuckyC.” Just as Satoshi Nakamoto did with Bitcoin, LuckyC embedded the financial headline of the day in its genesis block.

But Luckycoin was never intended to disrupt the corrosive financial system; it was an experiment meant to be “fun, fast, and fair.” Head of partnerships and BD in the Luckycoin community, Dan, explains:

“Fast, because of its quick epochs and speed, fair in the sense that no VCs were backing the coin, similar to Bitcoin. It’s completely decentralized, so it gave everyone the opportunity to buy at whatever price it was.

The fun aspect is that every block mined has an opportunity to earn 2x, 5x, or 58x the normal block rewards. This adds to the unpredictability associated with Lucky, and that’s where that meme aspect comes in.”

Luckycoin introduced the concept of LuckyBlocks, with additional random rewards at a 5%, 1%, and 0.01% probability, respectively. As a coin that’s now merge-mined along with Litecoin, Dogecoin, and other Scrypt coins, miners can simultaneously earn LKY at no extra cost when mining any of these other coins. Dan enthuses:

“We’re merge-mined as part of the Binance merge mining pool, which increases the hash rate of the blockchain, which then shores up the blockchain and makes it more secure.”

As an OG Proof-of-Work coin, Lucky’s a direct descendant of Bitcoin and the chain from which Dogecoin was forked. Dan says:

“So it goes Bitcoin, then forked to Litecoin, which then forked to Lucky. Luckycoin itself was then forked to create Dogecoin, so it’s actually the father of Dogecoin.”

Who’s your daddy?

Those deep in the weeds of Dogecoin’s story may recall hearing about Billy Markus’ quest to create a joke crypto that would capture the imagination of its community.

He spent “a couple of hours” forking Luckycoin, changing its fonts, tokenomics, branding, and turning it into the chain every member of the Department of Government Efficiency has come to know and love.

Early versions of the Dogecoin wallet still contained references to Luckycoin, with a warning left over from the fork in Dogecoin’s client that said, “You will LOSE ALL OF YOUR LUCKYCOINS!” if you forget your passphrase.

Sadly, like many ungrateful offspring before it, Dogecoin’s success came to the detriment of Luckycoin. The Shiba Inu-themed memecoin went viral in 2014, becoming one of the most traded cryptos around and leaving Luckycoin in the dust.

All traces of LuckyC vanished, and there were no new updates onchain. Interest dwindled, and developers, miners, and Lucky enthusiasts dropped off a cliff, sending the chain into a 10-year dormancy.

The last block mined in the original run was block #81,743 on November 25, 2013. Luckycoin became a mere footnote in crypto history.

Luckycoin: gone but not forgotten

Between 2014 and 2024, no new blocks were mined. Luckycoin remained in a comatose state, its fate seemingly sealed among the echelons of failed cryptos, known only to a few as the forebear of Elon’s pet chain.

Yet, just like the ring of power, Luckycoin’s code base lay patiently in wait to be found years later by a new owner.

In August 2024, at the height of the meme coin craze, a group of unsuspecting developers came across an old backup of the Luckycoin blockchain from 2013. Destiny was ready to be rewritten.

Luckycoin was revived by a community takeover team (CTO). Instead of creating a new coin from scratch, the team elected to continue on the original chain, picking up where LuckyC left off and producing block #81,744 on August 25, 2024, to preserve the original genesis block and all historical transactions.

One of the first restorative tweaks the CTO team made was to adjust the Luckycoin code to run on modern systems by adding Auxiliary Proof-of-Work (AuxPoW) support. This enabled merge mining along with Dogecoin, Litecoin, and other Scrypt coins. Dan says:

“With merge mining, as long as Litecoin and Dogecoin are going to be around, then we’ll be around because I don’t see either of those two going out of business any time soon.”

Scarcer than a snowball in the Sahara

One of the most appealing aspects of Luckycoin is the scarcity of its supply: of the 20 million or so coins that will ever be mined, at least 15% have been lost forever, with a further 11% permanently out of circulation. Dan explains:

“It is one of the most scarce coins out there. Roughly 20 million lucky coins will be created. We say roughly because of that unpredictability with the LKY mining, the 2x, 5x, and 58x I mentioned, so you can’t ever get 20 million coins created. You probably get 20,000,100.”

Of the capped supply, more than 3.1 million LKY lie in dormant wallets, likely lost, and over 2.2 million are blacklisted and unable to be used. Dan clarifies:

“There’s a whole bunch of large coin holders that can never access them because they were sitting on exchanges that went out of business and went bust. Back in the day, you couldn’t store your coins on a Ledger or a Trezor, and they were pretty much sitting on exchanges that went down the drain. We have the list of the dormant cold wallets that have been untouched, and we’re tracking them. None of them has actually popped up.”

LKY to the moon… and back

By late 2024, major mining pools like Binance and ViaBTC were merge-mining LKY, boosting the network’s security and power, and sending the hash rate from ~5 TH/s to over 50 TH/s within a week of the revival. The new team also implemented a faster halving schedule (every 100k blocks) to accelerate the distribution of the remaining supply.

With the wind at its back, the sky was the limit for the plucky little chain that could. Lucky blocks, a scarce supply, and merge-mined along with one of the industry’s most popular memecoins, a frenzy for LKY ensued.

It wasn’t only nostalgic miners and developers who returned. Luckycoin appealed to the next generation of crypto adopters who bought into its wild price action and historic lore. Luckycoin was a rare gem in a sea of pump.fun shills.

Drunk on its captivating story, LKY supporters continued to emerge and listings on exchanges like MEXC and Gate followed. Crypto influencers and KOLs like TheCryptoDog and Miles Deutscher began jumping on the bandwagon as well, dedicating a YouTube video to his Luckycoin thesis, wide-eyed, with the opening words:

“Oh boy, I think I’ve just found something absolutely huge.”

The boatload of momentum surrounding Lucky sent its price ripping into the stratosphere, from ~30 cents a coin all the way to an eyewatering all-time high of $16.83 on November 25, 2024.

It was all yacht parties, dancing girls, and champagne… until Lucky’s past came back to haunt it, and the price came crashing down like a piano from a tenth-floor window.

What goes up must come down

Over the 2024 Christmas and New Year’s holiday period, Luckycoin suffered a Replay Attack, and a vulnerability in its code was exploited by an unscrupulous villain, who was able to replay old transactions from the legacy chain and drain dormant wallets.

2,679,390.79 LKY were moved during the attack, involving 1,307 distinct input addresses (previously dormant) and 580 distinct output addresses, not just taking the wind out of Luckycoin’s sails, but stirring an almighty hurricane blasting it all the way back from whence it came. LKY lost ~95% of its value within a couple of weeks. Dan remarks:

“There was an old chain that was running concurrently, and they recalled a whole bunch of LKY to set a whole cascade of sell orders, so there was a flooding of LKY onto the market.”

The addresses in the replay attack were blacklisted, and the core vulnerability was fully patched at the cryptographic level, making legacy transactions invalid on the new chain, with “zero percent chance of it happening again.” Yet, the fallout was severe: LKY today trades at under 30 cents a coin.

While Lucky’s second demise was not malevolently executed in the pump-and-dump fashion of your average memecoin scam, a cursory glance at that price chart does little to instill faith in your average buyer. Dan laments:

“There was a massive price retrace, with people thinking that it was a scam, which it wasn’t because it’s completely decentralized.”

Third time’s a charm for Luckycoin?

Dan speaks about the strength of the community and how its CTO team members (the ones who didn’t flee) rallied around the OG memecoin and set about making amends.

“We’re a group of members that have come together who see the same vision in terms of restoring Lucky to its glory. Some of the old CTOs stepped down because of reputational damage, and a new CTO came on board.

It happened organically, and it happened during the mess of the replay attack. Out of that was a phoenix rising, where we all came together, with the same vision and mission.”

Since its painful retracement, the new CTO has worked tirelessly to bring Lucky back to life for a third time, patching the code, restoring trust, and building key partnerships and community.

Luckycoin recently joined forces with one of the longest-standing crypto wallets in the industry, Coinomi, enabling LKY holders to store their coins safely, non-custodially, and offchain. Dan regails:

“Coinomi was running a competition where they would partner with the largest engaging community, so that just goes to show you the community we have.”

Beyond its partnerships with MEXC and Gate, an initiative with Scrypt Wallet to bridge LKY to the Solana ecosystem is now in its final stages. Dan enthuses:

“A Lucky to Solana bridge will be great because it opens up LKY to all of the Solana people.”

The team is also looking to implement a hard wallet integration and is in the early stages of partnerships with Trezor, with plans to extend support to Ledger.

They are also busily working on a “marketing push” to raise the LKY price to a dollar and produce enough volume to be listed by a larger exchange, such as Binance or OKX. Dan shares:

“We need to grow the community first and use the current exchanges that we have to go to the bigger players.”

Will the coin’s scarcity, Bitcoin lineage, Lucky Blocks, and great lore be enough to see Luckycoin shine for a third time? Dan certainly thinks so:

“It’s a long-term cycle coin, and it has such a unique place in crypto history that we’re trying to maintain.”

ICYMI: You can catch the AMA recording with Coinomi and the Luckycoin CTO here, in which they cover Luckycoin’s past, present, and future. You can find additional updates on Luckycoin on X.

The post Anonymous creators, storybook slumbers, and a Marvel-style villian: Luckycoin’s stranger-than-fiction journey appeared first on CryptoSlate.

The following is a guest post and opinion of Ken Jon Miyachi , Co-Founder of Bitmind.

According to the “Q1 2025 Deepfake Incident Report,” 163 deepfake scammers took more than $200 million from victims in the first four months of 2025. It’s not simply an issue for the rich or famous; it’s impacting regular folks just as much. Deepfake frauds are no longer a little problem.

Deepfakes used to be a fun way to make viral videos, but now criminals use them as weapons. Scammers use artificial intelligence to make phony voices, faces, and sometimes whole video calls that are so convincing they deceive consumers into giving them money or private information.

Surge in Scams

The survey says that 41% of these scams target famous people and politicians, while 34% target regular people. That means that you, your parents, or your neighbor could be next. The emotional damage is worse than the monetary damage. You feel violated, betrayed, or helpless.

For instance, in February 2024, a company lost $25 million in one scam. Using a deepfake video discussion, hackers purported to be the company’s chief financial officer and demanded wire transfers to fake accounts straight away. The worker sent the money since they thought they were doing what they were told.

It wasn’t until they called the corporate office that they realized the call was bogus. This wasn’t simply one thing that took place. Similar techniques have hurt engineering, computer, and even cybersecurity organizations. If smart people can be fooled, how can the rest of us stay safe without better defenses?

Its Impact

The technology used in these scams is quite scary. Scammers may copy someone’s voice with 85% accuracy using only a few seconds of audio, as from a YouTube video or a social media post. It’s much tougher to tell if a video is phony; 68% of individuals can’t tell the difference between fake and actual material.

Criminals search the internet for things to use to make these fakes, and they use our own posts and videos against us. Think about how a scammer may use a recording of your voice to get your family to send them money or a false video of a CEO directing a huge transfer. These things are not just science fiction; they are happening right now.

There is more damage than just money. The survey says that 32% of deepfake cases involved explicit content, and they commonly target people to humiliate or blackmail them. 23% of the crimes are financial fraud, 14% are political manipulation, and 13% are disinformation.

These scams make it hard to believe what we read and hear online. Imagine getting a call from a loved one who needed help, only to find out it was a scam. Or a fake seller who steals all of a small business owner’s money. There are more and more of these stories, and the stakes are getting higher.

So, what can we do? It begins with educating oneself. Companies can show their employees how to spot warning signs, like video conversations that seek money straight away. A fraud can be avoided by basic tests like asking someone to move their head in a certain way or answer a personal question. Companies should also limit how much high-quality media of their CEOs is available to the public and add watermarks to videos to make them harder to misuse.

Everyone’s a Target

It is really important for people to be vigilant. Be careful what you put online. Scammers can use any audio or video recording you post as a weapon. If you get an odd request, don’t do anything immediately. You can either call the person again on a number you trust or check in another method. Efforts to raise public awareness can help stop bad behaviors, especially among groups who are more prone to be affected, such as elders who may not understand the effects. Media literacy isn’t just a trendy word; it’s a shield.

Governments also have a role to play. The Resemble AI study suggests that all countries should have the same laws that define what deepfakes are and how to punish them. New U.S. laws say that social media sites have to take down explicit deepfake content within 48 hours.

First Lady Melania Trump, who has talked about how it affects young people, was one of the persons who pushed for this. But laws by themselves aren’t enough. Scammers operate in a lot of different countries, and it’s not always easy to detect them. It could be a good idea to set worldwide criteria for watermarking and content authentication, but first, IT companies and governments need to agree on them.

There isn’t much time left. By 2027, deepfakes are expected to cost the U.S. $40 billion, with a growth rate of 32% each year. In North America, these scams rose by 1,740% in 2023, and they are still rising. But we can change it.

We can fight back using smart technology—such as systems that can detect deepfakes in real time—as well as better regulations and good practices. It’s about getting back the trust we used to have in the digital world. The next time you get a video call or hear someone you know ask for money, take a big breath and check again. It’s worth it for your peace of mind, your money, and your good name.

The post Deepfake scams cost $200M: A threat we can’t ignore appeared first on CryptoSlate.

The Bitcoin art world has suffered a blow as the enigmatic statue of Bitcoin’s pseudonymous creator, Satoshi Nakamoto, has vanished from its current home in Lugano, Switzerland. The Satoshigallery, which curated and displayed the piece, has announced a reward of 0.1 BTC to anyone who can help recover the stolen statue, further deepening the mystery that shrouds both Satoshi Nakamoto and this distinctive work of art.

The Satoshigallery team took to X following the theft to offer a reward for its recovery and to reinforce its determination to place 21 Satoshi statues around the world. This mission is meant to echo Bitcoin’s 21 million coin limit, reinforcing the principles of scarcity, decentralization, and indestructibility. The gallery wrote:

“You can steal our symbol but you will never be able to steal our souls.”

Embodying the spirit of Satoshi Nakamoto

The statue was celebrated not just as a physical memorial, but for its conceptual brilliance. Designed to embody the spirit of Bitcoin’s elusive creator, the piece plays with perception and meaning, appearing invisible from the front, a clever nod to Nakamoto’s anonymity.

When viewed from the side, the form emerges, reminding viewers that Satoshi may be hidden, but always present within Bitcoin’s ethos, capturing how Nakamoto’s indelible impact remains at the very core of the crypto movement.

Support from the Bitcoin community

Messages of support have poured in from around the world, with members of the Bitcoin community expressing solidarity. For many, the statue is more than just art; it is a symbol of resilience, innovation, and the ongoing quest for financial sovereignty.

Tuur Demeester, Blockstream advisor and Bitcoin OG, commented:

“Very sad… Next one should maybe be in a few cubics of granite”

Founder of TIP Preston Pysh simply said:

“Even his statue disappears…”

As the search continues, the story of Satoshi (the person and the statue) reaffirms that some mysteries, in the digital age, only grow stronger with every attempt to erase them.

Anyone with information regarding the whereabouts of the statue of Satoshi Nakamoto is encouraged to contact the Satoshigallery team.

The post Satoshi vanishes for a second time as Swiss gallery offers 0.1 BTC to recover stolen statue appeared first on CryptoSlate.

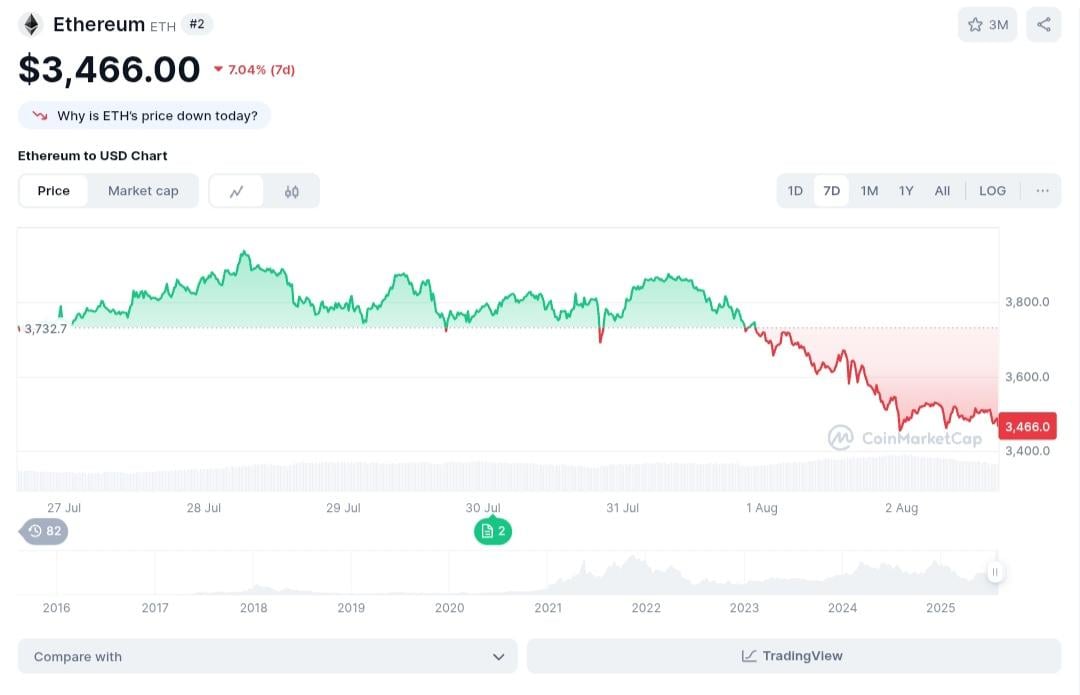

As global markets hit the skids this week and forced liquidations and margin calls wipe out more levered longs, prominent traders are repositioning accordingly. New tariffs announced by the Trump administration and a sharply weaker U.S. jobs report caused anxiety in global markets; the S&P 500 lost 1.6% in a day, and Bitcoin, true to form, followed risk sentiment lower.

In times of uncertainty, it pays to use a wider lens: over the last two years, Bitcoin has consistently outperformed all major assets, and nothing else comes close.

Bitcoin vs major assets: the 2-year scorecard

Between July 2023 and July 2025, Bitcoin rallied by an eyewatering 301.7% more than quadrupling in price and cementing itself as the top-performing major asset class. As ecoinometrics points out:

“Bitcoin is dipping again but the long-term picture hasn’t changed… This isn’t a one-off. For two years now, Bitcoin has been a consistent leader.”

Bitcoin’s performance vastly dwarfs traditional stock investments. The leading U.S. stock benchmark, the S&P 500, delivered a far more modest 38% return over the past two years. Despite a strong equities market and multiple record highs for large-cap stocks, the index couldn’t match BTC’s explosive momentum.

Gold, which had a stellar run in its own right, stoked by rising inflation and geopolitical uncertainty, rose 69.8% over the last two years, and couldn’t come close to returning Bitcoin’s gains, proving all laser-eyed Bitcoin maxis right: there is no second best. As Adam Back commented:

“there is no second best. only runner up is treasury companies.”

Even looking at the crypto industry’s number-two coin, Ethereum, only serves to further illustrate Back’s point: ETH posted a roughly 56% gain over the last 24 months.

Bringing up the rear among the major assets is crude oil which saw only marginal growth over the last two years, with returns oscillating and ending flat by summer 2025..

Why Bitcoin keeps leading

The recent selloff has more to do with macroeconomic jitters, tariffs, and employment worries than any change in Bitcoin’s fundamental value proposition. Bitcoin’s volatility still tracks closely with broader market nerves during such risk-off stretches. But for two years straight, Bitcoin has shaken off the corrections like a champ and set the pace for asset growth.

Its predictable supply schedule, decentralized nature, and increasing adoption by both retail and institutional investors have kept the rally alive.

Meanwhile, Ethereum remains competitive but has not been able to outpace BTC, and gold’s reliable inflation hedge status has still meant far smaller returns. Crude oil continues to struggle under the weight of shifting energy trends and macroeconomic pressures, providing little of the performance or excitement seen in digital and financial assets.

Bitcoin’s short-term slumps may look dramatic, but pullbacks are part of its DNA and the data doesn’t lie: since mid-2023, BTC has trounced gold, U.S. stocks, Ethereum, and crude oil. If in doubt, zoom out, as ecoinometrics states:

“maybe it’s not worth panicking over a move that looks more sentiment-driven than based on fundamentals.”

The post There is no second best: Bitcoin consistently outperforms all major assets despite near-term selloff appeared first on CryptoSlate.

Crypto advertising is often characterized by big promises and technological jargon. Yet, Coinbase’s “Everything Is Fine” campaign stands out for its wicked humor, cultural savvy, and unapologetic take on inflation, the housing market, and the general state of the United Kingdom in 2025.

Released on Thursday, Coinbase’s dark satire was quickly spotlighted by Ad Age for its wit and originality, marking a creative shift in how financial brands tackle the everyday anxieties facing consumers.

Coinbase presents a satirical mirror on financial reality

Created in partnership with the agency Mother and directed by the acclaimed Steve Rogers, “Everything Is Fine” coincides with a moment of heightened public awareness about economic instability.

The commercial opens with reassuring narration (“Everything is fine”), but the imagery starkly and comically tells a drastically different story: a leaking roof collapses, houseplants wilt, wallpaper peels, and rats scurry around amid the garbage. Each visual is a metaphor for inflation, the state of the economy, and the fragility of financial security, realities that traditional institutions rarely confront so openly.

Unlike most crypto ads, “Everything Is Fine” doesn’t shout about technological utopia or imminent riches. Instead, it leans into the quiet dread and surreal comedy people feel when their money seems to be shrinking in value while daily life gets more expensive. The result is a campaign that’s instantly relatable and eerily memorable.

Creative strategy: humor and honesty

Instead of scaring viewers or bombarding them with technical jargon, Coinbase and its creative team use deadpan humor and universal symbols of decline (filthy streets, dirty clothes) to capture what so many consumers feel: that official reassurances don’t always match their lived experience.

Perhaps the most on-point moment of the ad is the part where an affluent couple in a convertible pulls up, saying:

“We’re off to Dubai, it’s time to jump ship.”

This is a commentary on the exodus of high-net-worth individuals (HNWIs) from the UK, with an estimated 16,500 millionaires leaving the country in 2025 so far, according to Henley & Partners. These figures mark the steepest annual increase in millionaire outflows ever recorded, more than doubling the number from the previous year, with many opting for friendlier pastures like Portugal or Dubai.

The commercial unsurprisingly sparked a lot of comments from the crypto community. Former What Bitcoin Did podcast host, Peter McCormack, congratulated Coinbase CEO Brian Armstrong, saying:

“This is brilliant.”

As a Brit based in Bedford, UK, and now hosting The Peter McCormack show, which dives into the issues affecting the country, if anyone has a finger on the pulse of UK society, it’s McCormack.

“Everything Is Fine” exemplifies a new phase of advertising in crypto, where the best campaigns don’t simply explain blockchain; they reflect culture, poke fun at the absurd, and use storytelling to build trust, making Coinbase feel radically more human than competitors still pitching dreams.

The post Coinbase presents a darkly comic take on the state of the UK with ‘Everything Is Fine’ campaign appeared first on CryptoSlate.

Cryptoticker

Bitcoin Dips Below Support — But the Bigger Trend is Still Bullish

$Bitcoin has pulled back sharply in recent days, dropping from the $118K range to the $113K level, breaking below the key $115K–$116K support zone. But despite the short-term weakness, BTC is still trading well above its 200-day SMA and remains up significantly year-to-date.

Let’s break down what the chart says and why this might be a healthy correction rather than a bearish reversal.

BTC/USD 1-day chart - TradingView

Key Technical Levels and Indicators

- Support Just Broken: $BTC broke below ~$116K (orange line), the previous support turned resistance.

- Current Price: ~$113,932

- 50-day SMA: ~$112,110 (holding as immediate support)

- Next Major Support: ~$111,350 (horizontal structure)

- 200-day SMA: ~$99,280

- RSI (14): Rebounded from 45.12, suggesting neutral territory — not oversold yet.

The move down is notable, but BTC is still well above the 200-day SMA, which keeps the long-term uptrend intact. The RSI is also recovering from local lows, hinting that bears may be losing momentum.

Bitcoin Analysis: Suggested Buy Zones

For those looking to buy the dip or scale in:

$112,000 – $111,000 Zone

This is a key confluence of support: 50-SMA and recent structure. As long as BTC stays above here, it could be a low-risk buy zone.

$100,000 – $99,280 Zone

Strong psychological and structural support, backed by the 200-SMA. If BTC drops this far, expect heavy accumulation.

$75,000 (Extreme Bear Scenario)

This would represent a 35% drawdown from the recent top — ideal for long-term entries if macro turns ugly.

Bitcoin Price Prediction: Watch These Zones for Exits or Risk Management

$116,000 – $118,000

Recently lost support. If BTC pushes back into this zone but fails to hold, it could become a bull trap. Be cautious.

Break Below $111,000

If BTC closes below this level with strong volume, expect a drop toward $100K or lower.

Final Thoughts: Will Bitcoin Price Recover?

Bitcoin is in the middle of a healthy correction — and while short-term sentiment has turned cautious, long-term structure is holding. Unless BTC breaks below $100K, this dip could offer one of the last major buy zones before the next leg higher.

Whales, institutions, and long-term holders will likely be watching the $111K and $100K areas closely. And you should too.

A Whale Just Accumulated $274 Million — Here's Why It Matters

In one of the boldest accumulation moves seen recently, a single whale wallet has just scooped up a staggering 79,461 $ETH, worth around $274 million, over the past 72 hours. The inflow was detected across multiple high-value transactions, all originating from Galaxy Digital, and directed to the same wallet address: 0xdF0A67Ded855F8ea4b....

Breaking Down the Whale’s Moves

According to on-chain data:

- 19 ETH inflow transactions were registered from Galaxy Digital

- Largest single transfer: 19,000 ETH worth $72.97M

- Total ETH acquired: 79,461 ETH

- Total USD value: ~$274,000,000

This was not a random buy — this is highly coordinated, large-scale positioning. Most of these transfers happened over just 3 days, suggesting high conviction in Ethereum’s near-term and long-term value.

What Could Be Driving This?

Whale behavior is one of the strongest early indicators of macro crypto moves. When smart money accumulates in bulk — especially in a consolidating or correcting market — it’s often a sign that:

- They’re buying the dip — expecting a rebound.

- They anticipate a fundamental shift, such as ETF approval, upcoming tech upgrades, or institutional inflows.

- They’re positioning before retail traders catch on.

This is particularly interesting given that Ethereum has recently been under pressure, following Bitcoin’s correction and slowing ETF momentum. Yet this whale is moving in with size.

Total crypto market cap in USD over the past week - TradingView

What Should Traders and Investors Watch Now?

- ETH Price Reaction: Watch if ETH begins reversing or showing strength following this accumulation.

- Other Whale Wallets: Are similar patterns forming across other smart wallets?

- Macro News Flow: Any announcement around ETH ETFs, staking updates, or protocol upgrades could be a trigger.

To Sum Up: Don’t Ignore the Smart Money...

This isn’t just some random wallet flipping altcoins. This is a Galaxy Digital-linked address, pulling in nearly $300M worth of $Ethereum during a market cooldown. The message is clear: Whales are buying the dip.

Whether you're a retail trader or a long-term holder, this is your signal to watch Ethereum closely — the next move might already be in motion.

Shiba Inu price is back in the spotlight, not because of a meme or a marketing stunt, but due to a massive $6 million sell-off by a legendary early whale who originally spent just $3,800 on SHIB. This move comes at a time when SHIB's price has dropped around 10 percent, triggering both panic and speculation.

But what really stands out isn’t the sell—it’s the quiet accumulation happening underneath the noise. Whales have been buying hundreds of billions of SHIB during this dip, even as retail sentiment weakens. Combined with shrinking exchange supply and a steady burn rate, the current landscape sets the stage for something bigger than just a bounce. This isn’t just about a single transaction. It’s about what these movements signal, and whether SHIB is is quietly preparing for its next major breakout.

Shiba Inu Price Prediction: Is Shiba Inu Gearing Up for a Surprise Comeback?

A whale just unloaded 250 billion SHIB, pocketing $6.05 million in the process. That’s not small change. But the plot thickens when you realize this whale originally spent only $3,800 back in August 2020 to scoop up over 15 trillion SHIB. At SHIB’s all-time high, that stash was worth more than $1.2 billion.

Even after selling off a chunk, this investor still holds over 2 trillion tokens valued at $52 million, banking a total profit of around $109 million. The story doesn’t stop there.

In the middle of a 10 percent price drop, several whales—including that same early investor—moved 400 billion SHIB to Gemini.

At first glance, it looks like sell pressure. But here’s the thing: analysts and on-chain data tell a different story. Historically, whale accumulation during price dips has often signaled a coming rebound. The fact that major holders are buying and transferring tokens right now could mean they’re setting up for another round. Not a pump, but a strategic buildup.

So, what does this mean for SHIB’s price?

Confidence from whales at this stage, especially in the middle of a downturn, is important. These aren’t emotional traders. Their buys are calculated, and often done in consolidation phases when volatility is suppressed and public interest fades.

It’s a move we’ve seen before: soak up supply while prices are low, reduce available tokens on exchanges, and wait for demand to kick in. Less supply, same or rising demand—prices tend to respond.

In the past few days, over 13 million SHIB have been burned. It’s not a headline figure, but it’s part of the pattern. When burns coincide with large buys, it sets up conditions for a possible squeeze. The implication is clear: while retail might be scared off by the 10 percent dip, long-term holders are quietly making moves.

The Price Action Behind the Headlines

The daily Shiba Inu Price chart tells us this: SHIB has slipped below its middle Bollinger Band, showing bearish momentum. It’s hugging the lower band right now, which typically means it's in oversold territory or nearing it.

But here’s what matters more. Price action over the last ten sessions shows a string of red Heikin Ashi candles, but they’re shrinking. Momentum is fading. That often marks the start of a base formation before a potential reversal.

Support sits close at 0.00001100, a level marked by previous consolidation in late June. As long as this holds, there’s room for a rebound, especially if accumulation continues and on-chain burn trends persist. Upside resistance appears near 0.00001400, around the mid-July cluster. That’s the first line SHIB would need to reclaim to suggest momentum is shifting.

Shiba Inu Price Prediction: What’s next?

If whale accumulation persists and exchange supply keeps falling, SHIB price could bottom out soon and start grinding higher. If it breaks back above the 20-day moving average and the middle Bollinger Band, momentum could shift back toward bulls. Until then, price might chop sideways between 0.00001100 and 0.00001300.

But if demand kicks in faster than expected, especially from retail or new market inflows, and the burn rate spikes, SHIB price could be looking at a rapid move back to 0.00001600 and beyond.

For now, the smart money isn’t exiting. It’s shifting pieces on the board. Watch what the whales are doing—not just what the price is saying.

Buy SHIB on OKX

Looking to buy SHIB? OKX is one of the top exchanges with low fees, fast execution, and hundreds of listed assets.

👉 Join OKX here and claim your welcome bonus

$ShibaInu, $SHIB

Aavegotchi Officially Leaves Polygon, Joins Base

The Aavegotchi team has announced the completion of its migration from the Polygon blockchain to Base, signaling the end of its multi-year deployment on Polygon. This transition repositions Base as the new home for Aavegotchi’s assets, smart contracts, gameplay, and DAO governance.

All smart contracts on Polygon have been frozen, and Aavegotchi’s ecosystem now functions exclusively on Base going forward.

Why Base Was Chosen

The decision to migrate wasn’t arbitrary. According to the announcement, four key factors drove the move:

- Infrastructure Scalability: Base offers a more robust technical foundation capable of supporting Aavegotchi’s shift from a gamified NFT project to a full-fledged onchain protocol.

- Simplified User Onboarding: With the new Base app (formerly Coinbase Wallet), users can access the Aavegotchi universe with reduced friction and better self-custody.

- Ethereum Alignment: Unlike other chains, Base does not introduce its own token, which allows Aavegotchi to remain aligned with Ethereum’s core values.

- Cultural Fit: Base encourages experimentation and composability—traits that have defined Aavegotchi’s approach since its inception.

What the Migration Means for Users

With the move complete, Aavegotchi assets such as NFTs, wearables, and gameplay items have been mirrored to Base via snapshot and minting. Most users don’t need to take any action—assets should appear in their Base wallets automatically.

- Polygon tokens remain visible as non-transferable ERC-721s for reference.

- REALM Parcels and in-game items like Installations and Alchemica are expected to migrate in a later phase.

- GHST token holders are encouraged to migrate to Base, as DAO voting will soon be restricted to GHST on Base only.

For those who held assets in contracts like Gotchi Vault or Gnosis Safes, the team has replicated those holdings to equivalent addresses on Base. Any issues can be resolved through support tickets in the Aavegotchi Discord.

What’s Next for Aavegotchi on Base

Now based on Base, Aavegotchi is preparing to launch new projects including Gotchi Guardians, DAO infrastructure, and expanded community tools. The migration also aligns with ongoing efforts to expand GHST liquidity and Base-native integrations.

While it’s a significant shift, the team maintains that this is part of a broader move toward a more scalable, decentralized, and Ethereum-aligned ecosystem.

Where to Access Aavegotchi on Base

Assets can now be viewed and traded directly on:

Aavegotchi.com

OpenSea – Aavegotchis

OKLink – Aavegotchi Assets

In what could be the largest undisclosed crypto theft in history, blockchain analytics firm Arkham Intelligence has revealed a stunning heist of 127,426 Bitcoin, valued at $14.5 billion today, from Chinese mining pool LuBian. The theft, which took place in December 2020, went unnoticed for years while rumors swirled about LuBian’s sudden disappearance in early 2021. But Arkham’s latest findings suggest it wasn’t a quiet shutdown or government action—it was a catastrophic breach likely caused by a weak private key algorithm. The attacker hasn’t moved the stolen BTC in over a year, leaving behind a trail of mystery, technical failures, and unanswered questions.

What Did Arkham Intelligence Discover?

Arkham Intelligence has brought a four-year-old crypto mystery back into the spotlight. According to the blockchain analytics firm, a total of 127,426 BTC — worth roughly $14.5 billion today — was stolen from Chinese mining pool LuBian in December 2020. At the time, the value of the stolen Bitcoin was around $3.5 billion, making this the largest known single theft in crypto history by USD value at the time of occurrence.

While hacks like Mt. Gox involved more coins (744,000 BTC), Bitcoin’s price back then meant those losses were worth hundreds of millions, not billions.

Who or What Was LuBian?

LuBian wasn’t just another small-time mining pool. It launched in April 2020 and, in a matter of months, became the sixth-largest mining pool on the Bitcoin network. On its website, it boldly called itself “the safest high-yielding mining pool in the world.” But then in early 2021, it disappeared without explanation.

At the time, theories swirled. Maybe Chinese regulators had shut it down. Maybe it went private. But according to Arkham’s latest research, the truth may be darker — LuBian didn’t exit; it was obliterated by a massive breach that drained nearly all its Bitcoin reserves in a matter of days.

How Was the Hack Pulled Off?

Here’s where it gets technical. Arkham believes the attackers exploited a vulnerability in LuBian’s private key generation algorithm. Simply put, LuBian used an insecure method to generate private keys, possibly using patterns that could be guessed or brute-forced.

On December 28, 2020, hackers allegedly stole over 90% of LuBian’s Bitcoin. The very next day, an additional $6 million in BTC and USDT was siphoned off from LuBian's Bitcoin Omni Layer address. This wasn’t just a single breach — it was a sustained, coordinated takedown.

What Happened After the Theft?

LuBian didn’t stay silent. It used Bitcoin's OP_RETURN field — a little-used feature that lets you embed data in transactions — to send messages directly to the hacker. The messages read like digital ransom notes, calling the attacker a potential whitehat and offering a reward if the stolen assets were returned.

Here’s part of what LuBian wrote:

“To the whitehat who is saving our asset, you can contact us...to discuss the return of asset and your reward.”

But so far, nothing’s been returned. Interestingly, none of the stolen BTC has moved since July 2024, suggesting the attacker is either incredibly patient, extremely cautious, or simply unable to move the funds without detection.

LuBian didn’t lose everything. About 11,886 BTC — currently valued at $1.35 billion — was preserved and remains in their known wallets. That’s still a massive chunk of crypto wealth, but it's a far cry from what was stolen.

This case is a wake-up call for the mining ecosystem. It shows that even large, successful pools can crumble overnight if they ignore key management best practices. Unlike smart contract exploits or phishing scams, this hack targeted the core of crypto security: private key generation.

That’s rare. And it’s terrifying.

Will the Stolen BTC Ever Be Recovered?

It’s unlikely. The coins haven’t been laundered or mixed — yet — but their sheer volume makes them radioactive. Moving even a fraction of 127,426 BTC would draw instant attention from every major exchange, law enforcement agency, and blockchain analyst in the world.

The hacker may try to wait until blockchain surveillance becomes less effective, but with platforms like Arkham and Chainalysis getting more advanced, that window keeps closing.

What's Next?

Arkham’s report has already reignited interest in the case. If law enforcement wasn’t fully aware of the hack before, they certainly are now. And if the attacker moves the BTC, it’ll trigger real-time alerts across the crypto intelligence community.

Meanwhile, the lesson is clear: crypto security isn’t just about protecting against phishing emails or smart contract bugs — it starts with the fundamentals like private key hygiene. One flawed algorithm can cost billions.

$Bitcoin, $BTC

Decrypt

From Mafia and Madden to Metal Gear and Shinobi, this month is a full-on revival tour for some of gaming’s greatest franchises.

From Reddit thrill-seekers to Goldman Sachs trading desks, everyone’s testing AI chatbots to pick stocks. One teen’s 24% return went viral, but pros say proceed with extreme caution.

Bitcoin has soared to well over $100,000—we explore the latest academic research explaining what gives Bitcoin its value.

With the passing of the GENIUS Act, stablecoins are no longer a regulatory grey area—but usability challenges still remain.

Bitcoin miners had a profitable month in July, JP Morgan analysts noted in a report, as the price of the digital coin broke a new record.

U.Today - IT, AI and Fintech Daily News for You Today

Ripple is among the most valuable private companies in the world alongside such names as SpaceX, OpenAI, and Revolut

RippleX's Mayukha Vadari brakes silence on talks about starting XRP Ledger from scratch using Rust

XRP fell below $3 as selling pressure intensified

Can next week become bullish for SHIB?

Can traders expect Cardano (ADA) to bounce back soon?

Blockonomi

Cryptocurrency markets have been rocked in recent years, with market leaders like Ethereum, XRP, and Solana falling to significant price declines. Meanwhile, elsewhere, projects like Remittix are still moving forward stealthily with real-world adoption solutions. The launch of the Remittix beta wallet is generating buzz as the project works towards its $18 million soft cap target.

Market Overview: Ethereum, XRP, and Solana Take a Hit

Ethereum price dropped to $3,499.86, losing 4.05%, and XRP dropped to $2.92, losing 2.39%.

Solana fared slightly better but still dropped to $164.59, losing 0.49%.

Along with losses in price, trading volumes took a hit. Ethereum volume dropped by 13.01%, XRP volume dropped by 23.3%, and Solana volume dropped by 27.73%.

These figures indicate growing investor caution as regulatory uncertainty and macro pressures persist.

Despite these hiccups, the crypto market continues to evolve with new DeFi projects and cross-chain DeFi projects offering low gas fee alternatives and crypto staking opportunities. The majority of investors are considering crypto with real-world utility and early-stage crypto investments that can offer better stability in volatile times.

Remittix: The DeFi Project Addressing Real-World Problems

Remittix (RTX) is positioning itself as a serious contender for the future of crypto platforms. Priced at $0.0895 per token, Remittix has already raised over $17.9 million and sold over 579 million tokens during its presale. A 50% token bonus is still active, rewarding early adopters as the project nears its $18 million soft cap.

The upcoming Remittix beta wallet, launching in Q3 2025, will offer a mobile-first experience with real-time foreign exchange conversion. It enables sending cryptocurrency to bank accounts directly in 30+ countries, a giant leap for the mainstream adoption of cryptocurrency into finance.

- Global Reach: Support for 40+ cryptocurrencies and 30+ fiat currencies

- Security: Audited by CertiK, trust and transparency assured

- Utility: Designed for both crypto beginners and veterans

- Presale Incentives: 50% token bonus and 20% referral rewards

- Real-Time FX: Transparent and instant currency exchange

Why Remittix Stands Out in 2025’s Crypto Landscape

Remittix is getting attention as one of the best DeFi projects of 2025 and as a strong contender for best crypto under $1. Its practical approach to the $19 trillion payments problem globally is what sets it apart. Unlike most speculative altcoins, Remittix is focused on crypto for real-world problem-solving with its cross-chain DeFi project infrastructure.

With features like crypto staking, a deflationary token model, and an expanding business API, Remittix is built to provide long-term value to holders. With its fast presale momentum and planned wallet release, it is poised for mass adoption and is therefore of interest to individuals seeking information on where to buy crypto early and the next big crypto launch prospects.

While Ethereum, XRP, and Solana struggle, projects such as Remittix show that the crypto industry continues to innovate. With the upcoming beta wallet release and continued incentives such as the $250,000 Remittix Giveaway, RTX is a project to keep an eye on for those interested in crypto with passive income streams and tangible utility.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

The post Can Crypto Recover? Analysts Give Their Take After Ethereum, XRP And Solana Price Shattered appeared first on Blockonomi.

- Shiba Inu’s price is showing signs of life, with whales snapping up 400B SHIB and token burns cutting market supply.

- Pepeto’s presale is charging ahead, driven by utility features, staking rewards, and vibrant community enthusiasm.

- Shiba Inu’s whale moves and price action are boosting interest in Pepeto’s presale as investors track both coins closely.

Shiba Inu is far from its $1 dream, but it remains a crypto market standout. Its price swings often ripple through the meme coin world. Enter Pepeto, a bold new project igniting presale buzz and drawing attention. Its early success raises a big question: could Pepeto’s presale explode if Shiba Inu hits $1?

Shiba Inu Price Action and Whale Power

Shiba Inu dropped 1.79% today, trading near $0.000012. Analyst Joe Swanson has spotted two bullish patterns—a cup-and-handle and a double bottom—hinting at a recovery. “If SHIB holds $0.0000103 and breaks $0.0000171, it could climb to $0.0000239,” Swanson shared in a recent post.

Big investors are gearing up. IntoTheBlock data shows whale netflows spiked from 26 billion to 422 billion SHIB in a day, with whales buying nearly 400 billion tokens. Meanwhile, the SHIB burn rate soared 1,700% over the week, wiping out over 629 billion tokens.

These moves shrink supply and pressure sellers. Analysts suggest sustained buying could lock in Shiba Inu’s support. If the price gains traction, Pepeto’s presale could ride the wave as investors seek fresh meme coin prospects.

Pepeto Presale Gains Momentum

Priced at $0.000000144, Pepeto’s presale has already raised over $5.8 million. Its tiered pricing model drives early investment, with rising prices per stage spurring demand. The community is buzzing, and funding is keeping pace.

Pepeto’s roadmap emphasizes utility and progress. It’s set to launch PepetoSwap, a zero-fee trading platform, and a cross-chain bridge to connect meme coins across networks. Staking programs reward long-term holders, easing selling pressure during the presale.

The project is already delivering. A demo of its exchange has been unveiled to the community, proving Pepeto is on track with its goals. If this momentum holds, the presale could gain even more steam.

Could Pepeto Echo SHIB’s Rise?

If Shiba Inu charges toward $1, meme coin demand could skyrocket. Pepeto, blending meme culture with real infrastructure, is poised to capture that excitement. Its low presale price means even small investments could yield big returns if momentum builds.

Pepeto’s tokenomics support this potential. From a 420 trillion token supply, 30% goes to the presale, 30% to staking rewards, with clear allocations for marketing, liquidity, and development.

A no-trading-tax policy sweetens the deal, attracting long-term holders as the ecosystem grows.

With Shiba Inu’s market clout and Pepeto’s growing community, both coins are in the spotlight. A SHIB rally toward $1 could turbocharge Pepeto’s presale, shaping a major 2025 narrative.

Key Takeaway

Shiba Inu’s $1 goal is uncertain, but its whale buys and token burns are fueling optimism across meme coins. Pepeto’s $5.8M presale is tapping into this energy, backed by utility features and strong community support.

If SHIB surges toward $1, Pepeto’s presale could see explosive demand—making it a top meme coin to watch in 2025.

For more information about PEPETO, visit the links below:

Website: https://pepeto.io

Whitepaper: https://pepeto.io/assets/documents/whitepaper.pdf?v2=true

Telegram: https://t.me/pepeto_channel

Instagram: https://www.instagram.com/pepetocoin/

Twitter/X: https://x.com/Pepetocoin

The post Pepeto Presale Soars as Shiba Inu (SHIB) Whales Spark Meme Coin Hype appeared first on Blockonomi.

A new meme coin has entered the arena, leaving PEPE in the dust. Little Pepe ($LILPEPE) is an Ethereum-based meme token with its own Layer-2 blockchain, and it’s quickly becoming one of the most talked-about projects in the meme coin space. While Pepe Coin (PEPE) grabbed headlines in 2023 with its astronomical rise, 2025 may belong to a different frog. Now in stage 8 of its presale at just $0.00017, the token has drawn the attention of none other than Grok, Elon Musk’s AI chatbot. Grok recently referred to the token as a possible 15,000% gainer in 15 weeks.

Little Pepe ($LILPEPE): The Token Grok Believes Could Explode 15,000%

Little Pepe ($LILPEPE) extends beyond simple memes; it’s developing its blockchain. Unlike other meme coins, just tokens on Solana or Ethereum, Little Pepe ($LILPEPE) is developing a Layer-2 blockchain tailored for meme coins and community tokens. Its infrastructure includes sniper bot protection for fair launch, ultra-low fees, near-instant finality, and a special Meme Launchpad that allows new projects to deploy directly on the chain.

Moreover, the initiative highlights the absence of taxes on purchases and sales, directly appealing to decentralised finance enthusiasts and traders seeking transparent and cost-effective transactions. Little Pepe’s Ethereum compatibility and planned future features such as staking, NFTs, and other community utilities set the stage for a meme-oriented Web3 ecosystem.

Elon Musk’s Grok AI considers Little Pepe one of the most promising meme coins of 2025. Its analysis estimates a 15,000% increase in price in 15 weeks, mainly because of early-stage pricing, unique tech stack, and meme-first branding. Grok highlighted the blend of meme culture with real blockchain technology, distinguishing it from other tokens like PEPE, which have no roadmap or infrastructure.

Due to the presale demand, Little Pepe ($LILPEPE) has an expanding social community and genuine utility, and Little Pepe ($LILPEPE) is touted to give explosive short-term returns in the meme coin market. Grok believes it has the potential to be the best option for investors.

Presale Stage 8: Price, Progress, and What’s Next

Little Pepe is now on stage 8 of its presale round. The tokens are being sold at $0.0017. While that is a 70% growth from stage 1, where it was sold at $0.001, it is still quite reasonable to think it is undervalued. A projection has also been released that suggests it could list at $0.03.

Little Pepe presale has raised over $13 million while selling billions of tokens to the early adopters. Only a few presale stages are left, and demand keeps increasing. After the presale, token holders can go to the official website to claim their Little Pepe ($LILPEPE) tokens and trade them on two exchanges confirmed for launch day. Tokens can be claimed and are ready to be traded on two exchanges confirmed for launch day.

In the next 15 weeks, key drivers could propel Little Pepe ($LILPEPE) to new highs. To begin with, the project is set to launch on two marquee centralized exchanges, which will immediately enhance liquidity and provide access to institutional traders. In addition, the mainnet for the Layer-2 Little Pepe Chain is set to launch, enabling staking, rewards, and smart contracts.

In addition, the Meme Launchpad will begin to host other meme tokens, fully transforming Little Pepe into a meme token platform rather than just a project. Ultimately, the presale buyer token claim window will be active, enabling investors to claim their tokens and trade, which will most likely trigger substantial price movement. These factors could drive Little Pepe ($LILPEPE) upwards to the 15,000% increase Grok stated.

Conclusion

For those who were not fast enough to capitalize on the explosion of PEPE, or who didn’t get on board the Shiba Inu train, Little Pepe ($LILPEPE) is providing a scarce second opportunity. Little Pepe ($LILPEPE) blends everything meme investors crave, including humor, community, and virality on top of real underlying memeable blockchain technology that tackles significant challenges within DeFi and the broader meme-building ecosystem. Grok has named it one of the top picks on Ethereum, alongside its growing ecosystem and roadmap filled with powerful catalysts. This has turned Little Pepe $LILPEPE into a meme and a movement.

It may be very early to call a potential breakout with only $0.00017 mark price. Nonetheless, for both meme enthusiasts and serious investors looking for asymmetrical returns, $LILPEPE is the go-to token.

For more information about Little Pepe (LILPEPE) visit the links below:

Website: https://littlepepe.com

Whitepaper: https://littlepepe.com/whitepaper.pdf

Telegram: https://t.me/littlepepetoken

Twitter/X: https://x.com/littlepepetoken

The post Next Pepe Coin (PEPE)? Grok Names Ethereum-Based Meme Coin That Could Rise 15,000% in 15 Weeks appeared first on Blockonomi.

The crypto market may be a tricky spot at the moment for most investors, as the top tokens are in crucial positions. The Ethereum price prediction is hanging in the balance, but general perception says Ethereum will hit the green soon.

It’s been a splendid month for the ETH token; here’s more on how it went.

Ethereum Price Prediction: ETH Could Rally Again

Top altcoins hit a surge in July, as Bitcoin pulled the rest of cryptocurrency into a bullish swing. But for tokens like Ethereum, there was more driving their token prices up.

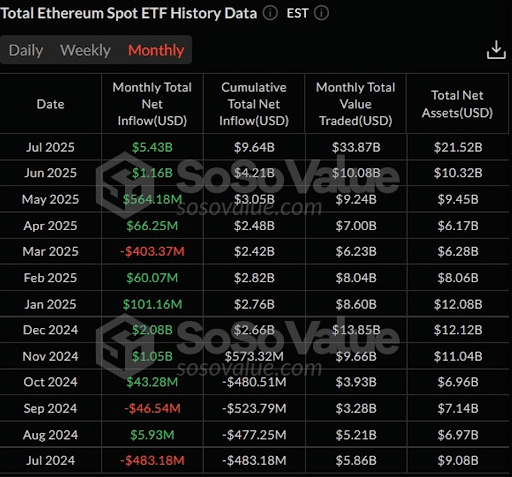

The Ethereum ETFs are gradually establishing themselves as a core source of capital on Ethereum, and this month was proof of it. Inflows into the ETFs rose by 369% over June’s revenue, but that’s not where it ended.

The inflows for July were valued at about $5.43 billion, the highest they have ever pulled since they were launched in June 2024. And with the rise in ETH price, the value of the ETF assets has risen to about 4% of the total Ethereum market capitalization.

If there was any need for proof of the impact Ethereum’s ETFs have on the project, July was the month for that. And with the rise in Ethereum’s fortunes, there has been a spike in the Ethereum price predictions.

Some of the Twitter/X analysts believe Ethereum’s current descending wedge is a signal of better days to come. Gert van Langen believes that the trend for Ethereum is up, and the target is set at $9,000.

So, at any rate, Ethereum could be getting to the $5,000 mark in no time. Watch out for the top altcoin and more updates from its chain.

Including Remittix’s soft cap launch coming in a few weeks. But first, what’s Remittix?

Remittix: The Next Thing In Crypto Payments

The PayFi sector is getting ready for the next big thing in cryptocurrency. Crypto assets in wallets will soon be accessible directly from fiat bank accounts, and it will all happen on Remittix.

Remittix is introducing fresh aspects of crypto token usage, but it all starts simply. The traders will be able to send their crypto assets directly into fiat bank accounts all over the world. This makes such funds readily available for their use, be it for tuition fee processing or shop cart clearances.

But far beyond that, Remittix is opening an opportunity for crypto tokens in global payments. Soon, with the wave of crypto adoption all over the world, crypto tokens will be payable on websites and acceptable for most online services.

So, gradually, Remittix and its RTX tokens will gain relevance in the market. With increased traffic of users, all with ever-rising token value, Remittix could be set for the top already!

RTX Tokens Up For Grabs!

Remittix’s presale continues to grow its holders, and the tokens are going for only $0.0895. There’s profit potential there that you don’t want to miss.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/Remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

The post How Many Years Will It Take For Ethereum Price To Reach $5,000? It May Be Sooner Than You Think appeared first on Blockonomi.

Before Solana (SOL) took off to triple-digit prices and Cardano (ADA) attracted global recognition, both ecosystems shared one thing in common — a quiet but powerful accumulation phase. Investors who recognized utility, roadmap clarity, and ecosystem innovation before listings were the ones who turned modest allocations into generational wealth. Today, a similar opportunity appears to be unfolding with Mutuum Finance (MUTM), a rising decentralized finance project that’s ticking the right boxes — from Layer-2 readiness to a stablecoin mechanism designed to disrupt current DeFi norms.

While still under the radar, Mutuum Finance (MUTM) is gathering serious momentum. The token is currently in Phase 6 of its presale, priced at $0.035 with over 14,800 holders onboard and 10% of the 170 million allocated tokens already sold. This isn’t just a spike in attention — it reflects strong organic traction. With the next phase scheduled to bump the price up by 15% to $0.040, the project is entering the kind of steep growth curve once seen in early SOL and ADA.

A Beta-Ready Platform With Built-In Demand Loops

What sets Mutuum Finance (MUTM) apart is how it builds real, compounding demand into the core of its model. At launch, the platform will introduce Peer-to-Contract (P2C) lending, where users can deposit stablecoins or blue-chip assets like Ethereum (ETH), Avalanche (AVAX), or USD Tether (USDT) into liquidity pools. In return, they’ll receive mtTokens in 1:1, which not only reflect the deposited value but also grow with passive yield. For example, a user depositing $2,000 in AVAX into a lending pool can expect to earn an annual yield of 9.8% APY, while retaining full exposure to their AVAX — a strategy that’s expected to become extremely popular once the platform goes live.

Meanwhile, borrowers can access overcollateralized loans by locking their assets, creating a highly liquid lending market that adjusts interest rates automatically based on pool usage. This fluidity ensures constant utilization while offering lenders a powerful incentive to keep their funds locked in. Beyond that, the platform will also support Peer-to-Peer (P2P) lending, where individual terms are negotiated directly between users — ideal for those seeking exposure to riskier or emerging tokens.

Another major highlight is the upcoming launch of a decentralized, overcollateralized stablecoin. Unlike algorithmic tokens that risk depegging under pressure, Mutuum’s model enforces minting only when a loan is issued and burns the tokens when the loan is repaid. This ensures tight supply control and preserves the $1 peg with a clear economic mechanism. It’s not just innovation for show — this system brings tangible utility, giving DeFi users a stable value anchor that’s fully governed by code and collateral.

The design also includes a staking mechanism. Users of mtTokens can stake them in dedicated smart contracts and earn dividends in MUTM tokens. What makes this rewarding is the fact that the MUTM rewards aren’t minted arbitrarily — they are purchased back from the open market using protocol-generated revenue. This creates a buyback loop that supports long-term price appreciation while rewarding protocol participants.

Audited, Scalable, and Positioned for Major Listings

Mutuum Finance (MUTM) hasn’t just focused on product mechanics. Its foundation is reinforced with strong security credentials, including a comprehensive CertiK audit. The Token Scan score currently stands at an impressive 95.00, with a Skynet rating of 78.00. To further support platform integrity, a $50,000 bug bounty is live — designed to attract white-hat hackers for ongoing review and stress testing.

Another key strength is its Layer-2 deployment strategy. The platform plans to integrate L2 scalability at launch, which is expected to drastically reduce gas fees while speeding up transactions — an essential feature for high-volume lending protocols. With a roadmap that spans four development phases from Initiation to Final Delivery, the Mutuum team has demonstrated both structure and momentum.

Social engagement is also growing fast. With over 12,000 followers on Twitter and consistent presale momentum, Mutuum Finance (MUTM) is steadily capturing the attention of early DeFi adopters. And this is happening before the token even lands on major exchanges. Early access investors will have the advantage, especially once projected listings on platforms like KuCoin and MEXC go live.

Analysts tracking Mutuum’s trajectory have drawn comparisons not just with SOL and ADA’s formative stages, but also suggest a conservative long-term target of $2 per MUTM — a growth curve that would reflect nearly 57x from the current $0.035 price. That return isn’t hypothetical. Investors from earlier presale phases like Phase 1 already sit on 3.5x gains, and those entering in Phase 6 are still positioned at a steep discount from the listing price of $0.06.

As the presale advances toward Phase 7 and listing preparations accelerate, Mutuum Finance (MUTM) is shaping up as one of the few DeFi projects that merges innovation, utility, and scalability with a strong economic design. For those who remember what SOL and ADA looked like before the boom — this is starting to look very familiar.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

The post From $0.035 to $2? This DeFi Project’s Growth Curve Resembles Early Solana (SOL) and Cardano (ADA) appeared first on Blockonomi.

CryptoPotato

A Canadian teen has been sentenced for a $37 million Bitcoin (BTC) heist and the hacking of several X accounts.

This follows on-chain sleuth ZachXBT’s calls for stricter penalties against SIM swapping and social engineering fraudsters.

Suspect’s Sentence

ZachXBT revealed via a July 29 X post that Cameron Redman had been convicted and ordered to pay compensation following his involvement in a $37 million Bitcoin theft and a related X hacking case that the investigator had uncovered.

Court documents show that Redman has been sentenced to 12 months and 1 day, followed by a three-year supervised release term for each count, with all sentences to be served concurrently. He has also been ordered to pay a $400 special assessment, $248,257.07 in restitution, and a $60,000 fine.

On February 22, 2020, the Canadian teenager used a SIM swap attack to take control of crypto investor Josh Jones’s mobile number, allowing him to bypass two-factor authentication and access his wallets. He then stole 1,547 BTC and 60,000 Bitcoin Cash (BCH), valued at around $37 million at the time.

Following the theft, Redman began laundering the stolen assets through hundreds of small transactions. These tokens were eventually funneled through centralized exchanges in an attempt to hide the trail.

The perpetrator was later linked to phishing scams and the hacking of several NFT profiles on X. According to ZachXBT, in June 2022, Redman offered access to an internal X panel for sale on the platform SWAPD. This was then sold for 250 ETH and led to the compromise of over 10 accounts and the theft of millions through phishing scams.

The detective added that the Canadian youth initially used fake identity documents on SWAPD before submitting his real information, withdrew the sale proceeds through Tornado Cash, and then deposited the funds into a Stake account.

On-chain data linked the wallet he used to the compromised X accounts. The investigation identified victims, including Beeple, DeeKay, Zeneca, Nouns DAO, and JRNY Club.

Calls for Tougher Rules

The suspect was formally charged on November 17, 2021, by Hamilton Police in Ontario. Authorities recovered $5.4 million in crypto, but the remaining $31.5 million is still missing.

At the time of his arrest, Redman was still legally underage, which meant his name remained sealed and his photo was not released. ZachXBT has previously highlighted how this kind of secrecy is part of the problem, saying the convicted criminal’s identity should have been revealed earlier on to prevent further unlawful conduct.

Such cases are on the rise, with research from Keepnet Labs showing a 1,055% increase in SIM swap incidents in the UK in 2024. Elliptic’s State of Crypto Scams 2025 analysis also highlighted phishing as a key method used by cybercriminals like North Korea’s Lazarus, with attackers increasingly automating campaigns using AI tools.

Meanwhile, ZachXBT previously reported that between November and December last year, a single hacker breached over 15 X accounts, stealing more than $500,000.

The post Canadian Teen Convicted in $37M Bitcoin Heist and 2020 X Hacking Spree appeared first on CryptoPotato.

Ripple’s price is experiencing a pullback after an impulsive rally that began in June. As both the USDT and BTC pairs are now showing signs of bearish momentum, investors are cautiously looking to see if the available support levels can hold and prevent a full-on reversal.

Technical Analysis

By ShayanMarkets

The USDT Pair

On the XRP/USDT pair, Ripple’s token has been rising since early July, before sweeping the liquidity above the $3.40 high and reversing to the downside. The market is currently pulling back toward both the 100-day and 200-day moving averages, which are located near the $2.50 mark, and have just created a bullish crossover.

As things stand, the $3.00 level is lost, and if a quick recovery back above this level does not occur, the mentioned moving averages will be the next targets. While the convergence of these moving averages creates a potentially strong support, if it gets broken to the downside, a much deeper drop toward the $1.60 area would be probable.

The BTC Pair

The XRP/BTC pair is going through a similar pullback, following a swift rejection from the 3,200 SAT resistance zone. The price is currently testing the 200-day moving average and the higher boundary of the broken descending channel around the 2,500 SAT mark.

The RSI has also dropped from deeply overbought levels to just below 50, showing a clear shift in momentum. If the 2,500 SAT support zone gets broken to the downside, the price will drop back into the channel, and would likely pull toward the 2,000 SAT area. This scenario would potentially result in a lengthy consolidation and reset the current bullish trend.

The post Ripple Price Analysis: These Are XRP’s Next Defense Lines After a Breakdown Below $3 appeared first on CryptoPotato.

Bitcoin came under notable selling pressure following heightened geopolitical concerns stemming from the escalating conflict between Russia and the United States over nuclear threats.

Despite the bearish momentum, the cryptocurrency has now reached a key support zone, expected to hold in the short term.

Technical Analysis

By ShayanMarkets

The Daily Chart

After a prolonged consolidation within the $116K–$123K range, BTC encountered heavy selling pressure, driven by escalating concerns over the Russia–US nuclear conflict. This led to a breakdown below the critical $114K support, sparking fear and uncertainty in the market.

However, BTC has now approached a major support zone between $111K and $112K, an area defined by the lower boundary of a multi-month ascending channel and a key previous swing high.

This confluence of technical support is likely to attract patient buyers, potentially initiating a bullish consolidation phase. Still, if the price fails to hold above this region, a rapid decline toward the psychological $100K level could follow.

The 4-Hour Chart

On the lower timeframe, Bitcoin’s breakdown from the bullish flag pattern marks a bearish technical signal, confirming the pattern’s failure. The sharp rejection from the flag’s upper boundary triggered a steep decline, bringing the price to a critical support near the $112K zone, which also aligns with the 0.618 Fibonacci retracement level. This particular one often acts as a magnet for short-term bullish reactions.

As long as the price holds above this range, a corrective bounce is likely. However, if bearish momentum persists, another sell-off targeting a sweep below $111K–$112K may occur. Until then, short-term consolidation remains the most probable outcome.

On-chain Analysis

By ShayanMarkets

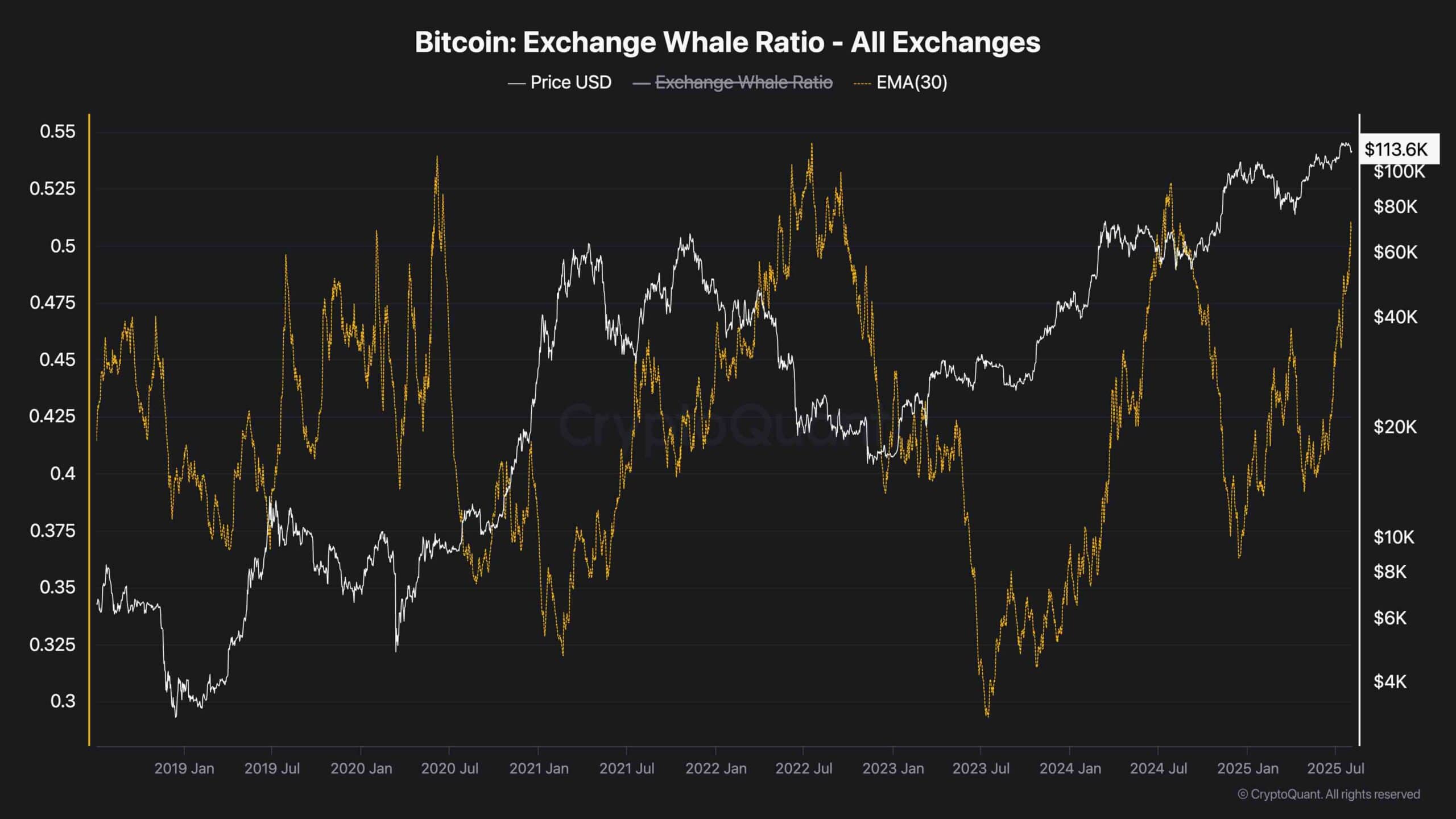

The Exchange Netflow indicator shows that 16,417 BTC flowed into exchanges yesterday, the highest daily net inflow since mid-July. This suggests a significant number of holders are moving their Bitcoin to exchanges, typically a precursor to selling activity.

At the same time, the Exchange Whale Ratio surged above 0.70, indicating that the majority of these deposits came from large holders (whales). Historically, when whale-dominated inflows coincide with elevated exchange activity, the market often faces increased selling pressure and price declines.

If this trend continues and whales persist in depositing BTC at this pace, further downside risk could follow. Such activity may reflect profit-taking, preparation for a correction, or strategic reallocation in anticipation of near-term volatility.

The post Bitcoin Price Analysis: $100K Breakdown Looms for BTC if This Support Fails appeared first on CryptoPotato.

Kraken reported $412 million in revenue for Q2 2025. This represented an 18% increase year-over-year but a decline of 13% quarter-over-quarter, for the crypto exchange

Adjusted EBITDA, however, plunged by 7% during the same period and reached $79.7 million from $85.5 million.

Seasonal Weakness

Total exchange volume rose 19% year-over-year to $186.8 billion, though activity slowed quarter-over-quarter amid market turbulence tied to US tariffs and broader macroeconomic uncertainties. Kraken noted that Q2 is typically a seasonally weaker period for trading across the industry.

The exchange’s funded accounts grew 37% from a year earlier to 4.4 million, while assets on the platform rose 47% year-over-year to $43.2 billion. Kraken also revealed expanding its market share in spot trading, which was supported by ongoing product improvements. In fact, the company saw strong momentum in stablecoin-related trading, as its share of stable-fiat spot volumes climbed from 43% to 68% over the quarter.

Kraken has announced a series of product expansions targeting both retail and institutional users. In Europe, the company launched what it describes as the region’s largest MiFID-regulated crypto futures suite, including 24/7 FX perpetual futures for EUR, GBP, AUD, JPY, and CHF trading pairs on Kraken Pro.

In the United States, the platform introduced a regulated derivatives offering to allow users to access CME-listed crypto futures through its integrated platform. For institutional clients, the company debuted Kraken Prime, a brokerage service that combined trade execution, custody, and liquidity.

The crypto exchange also expanded its custody business by adding support for Solana (SOL), XRP, and reward-bearing USDG, to target high-net-worth individuals and institutional clients seeking secure asset storage and staking solutions.

Co-Founder Cleared by DOJ

Amid these operational milestones, the company saw a separate legal issue concerning its former CEO reach a conclusion. The US Department of Justice recently closed its investigation into Kraken co-founder Jesse Powell, which stemmed from allegations unrelated to crypto. The probe focused on a governance dispute involving Verge Center for the Arts, a nonprofit Powell founded.

He was accused of hacking accounts and blocking access. The FBI raided Powell’s home in 2023 and seized devices that have now been returned. Prosecutors informed Powell’s team in April that no charges would be filed. The founder called the raid “devastating” and plans civil action against Verge’s board.

The decision comes as Kraken eyes a potential IPO in 2026. Powell remains on the company’s board after stepping down as CEO.

The post Kraken Revenue Soars Year-Over-Year – But EBITDA Takes a Hit appeared first on CryptoPotato.

Just over a year after the Dencun upgrade gave Layer 2 networks a massive boost, and only months before the much-anticipated Fusaka release, Ethereum co-founder Vitalik Buterin floated a bold proposal.

In an April forum post, he suggested the network could eventually replace its longtime workhorse, the Ethereum Virtual Machine (EVM), with RISC-V, a low-level, open-source instruction set architecture.

The Allure of a New Foundation