Cryptocurrency Posts

Crypto Briefing

Michigan's increased Bitcoin ETF investment signals growing institutional crypto adoption, potentially influencing other state funds and policies.

The post Michigan state pension fund triples Bitcoin ETF investment in Q2 appeared first on Crypto Briefing.

Galaxy Digital's strategic asset reallocation highlights a shift towards Bitcoin dominance, potentially influencing market dynamics and investor sentiment.

The post Galaxy Digital adds 4,272 Bitcoin in Q2, reduces ETH, XRP exposure appeared first on Crypto Briefing.

Bhutan's strategic Bitcoin management could enhance its economic resilience and attract ESG-focused investments through sustainable crypto initiatives.

The post Bhutan government moves $59 million in Bitcoin to new wallet appeared first on Crypto Briefing.

Coinbase's funding strategy may enhance its market position, enabling strategic acquisitions and bolstering financial resilience.

The post Coinbase proposes $2 billion convertible note offering to fund growth and acquisitions appeared first on Crypto Briefing.

The executive order could reshape banking practices, ensuring crypto firms receive equitable financial services and challenging political biases.

The post Trump to sign executive order penalizing banks for discriminating against crypto firms appeared first on Crypto Briefing.

HTTP error 403 on https://bitcoinmagazine.com/feed/

Failed to fetch feed: https://bitcoinmagazine.com/feed/

Failed to fetch feed.

CryptoSlate

Indonesia has opened discussions on integrating Bitcoin (BTC) into its national reserves following a high-level meeting between the Vice President’s office and Bitcoin Indonesia, Asia’s largest BTC community.

The meeting marked a pivotal moment in Indonesia’s evolving approach to digital assets, as officials explored the potential role of Bitcoin in strengthening long-term economic resilience.

Among the ideas discussed were the use of Bitcoin mining as a reserve strategy and the benefits of holding BTC as a hedge against inflation and global monetary instability.

Bitcoin as a reserve asset

Bitcoin Indonesia facilitated the meeting by presenting macroeconomic trends, including changing global reserve strategies, inflationary risks, and increasing crypto adoption among sovereign nations.

Officials reportedly showed interest in further education on the asset class, with some expressing curiosity about projections linking Bitcoin’s value trajectory to Indonesia’s 100th independence anniversary in 2045.

Indonesia’s reserve portfolio currently consists primarily of gold, U.S. dollars, and sovereign bonds. The inclusion of Bitcoin would mark a strategic expansion into digital assets, following in the footsteps of countries like El Salvador and Bhutan, which have incorporated Bitcoin through state-led purchases and mining operations.

Sovereign accumulation

The meeting came as other nations accelerate their Bitcoin strategies after the US established its own Strategic Bitcoin Reserve earlier this year, holding nearly 200,000 BTC it confiscated over the years.

Meanwhile, US states like Texas have furthered plans to establish their own BTC reserves separate from the federal government.

Trailblazer El Salvador holds more than 6,000 BTC, while Bhutan has built one of the world’s largest sovereign Bitcoin positions through mining.

Kazakhstan is reviewing investment plans involving Bitcoin ETFs and blockchain firms, while neighboring Pakistan is looking to direct excess energy to mining Bitcoin and adopt it as a reserve asset.

These developments have prompted Indonesian officials to reassess their reserve mix and consider whether digital assets offer advantages in a shifting global economy.

Presenters suggested that gradual adoption, through limited holdings or mining, could complement existing frameworks without disrupting traditional reserve structures.

The post Indonesian officials eye Bitcoin mining for national reserves after key meeting appeared first on CryptoSlate.

Publicly listed Bitcoin (BTC) treasury companies bought $552 million worth of BTC while holders divested exchange-traded fund (ETF) shares between July 31 and August 4.

According to Farside Investors’ data, US-traded spot Bitcoin ETFs registered $1.25 billion in outflows between July 31 and August 4. At the same time, data from Bitcoin Treasuries highlighted that corporate treasuries added 4,869 BTC in the same period.

The amount added by Bitcoin treasuries is worth nearly $552 million at the price of $113,418 as of press time, almost $700 million below the amount shed by ETF investors.

Metaplanet bought the largest amount of Bitcoin in the period, with 463 BTC added, worth over $54 million.

James Butterfill, CoinShares’ head of research, attributed the recent outflows to macro drivers. He cited last week’s Federal Open Market Committee remarks and stronger-than-expected economic data.

Supply shock

Despite the sell pressure from ETF holders surpassing the acquisition by publicly traded Bitcoin treasury vehicles, the BTC supply shrank significantly this year.

As of Aug. 4, public companies have bought 343,394 BTC, while Bitcoin investors exposed through ETFs have added 181,276 BTC. The combined amount of these two cohorts equals 524,670 BTC in practically seven months.

According to Glassnode data, 98,503 BTC were mined during the same period, over 5x lower than the amount absorbed by public companies and ETFs.

Notably, estimates point to a total of 164,250 BTC to be mined this year, which makes the stash of ETF investors and public companies more than 3x higher already, with more than four months to go.

Using Bitcoin’s price as a proxy, the supply shock scenario seems to be apparent to investors. Despite the recent macro turmoils, Bitcoin fell by only 4.2% last week.

Furthermore, BTC is still only 7.5% away from its all-time high of $122,054.86 registered on July 14.

The post Public Bitcoin treasuries step in with $552M buys amid $1.25B ETF outflows appeared first on CryptoSlate.

An intriguing twist in the trial of Tornado Cash co-founder Roman Storm emerged after one juror reportedly requested time off to attend her mother’s birthday celebration.

On Aug. 4, Inner City Press shared updates from the courtroom, revealing that the juror, identified as “Ms. Nelson,” had asked for a break from deliberations on Aug. 5.

The juror reportedly explained that she was required to attend her mother’s all-day birthday party, which included a pedicure.

While the other jurors reportedly agreed to her request, US District Judge Katherine Polk Failla swiftly intervened and rejected the proposal.

According to the report, Judge Failla stated:

“I can tell them I have a sentencing later this week, and that other jurors have conflicts. And we do want them to sit for some portion of every day. I think the pedicure’s got to go. And I’m so sorry to say that. I don’t want to pick on her.”

As a result, the Inner City report noted that the jury agreed to adjust their deliberation timetable, continuing their discussions with a revised schedule of 8:30 A.M. to 12:00 P.M. instead of the usual 4:00 P.M. conclusion.

The Judge stated:

“[The jurors] proposed to deliberate tomorrow to 12:30, then the next days to 3:45, Friday until 1 P.M.”

The juror’s request has prompted mixed reactions from legal experts and within the crypto community.

Legal analyst James Murphy, known as MetaLawMan, pointed out the irony of the situation, noting that Storm is facing the possibility of decades in prison for creating immutable smart contract code while one of his jurors is seeking time off for a birthday celebration and pedicure.

Meanwhile, concerns have also emerged about how this could affect the trial’s outcome.

Aragon CEO Anthony Leutenegger warned that denying the juror’s request might lead to frustration, potentially influencing her decision in Storm’s case.

He stated:

“Not allowing her might sway her judgement as it might piss her off. Can you imagine this level of subjective decision making on someone’s life?”

Storm faces charges of conspiracy to commit money laundering, violating sanctions, and operating an unlicensed money-transmitting business.

If convicted, he could face up to 45 years in prison for his alleged role in aiding hackers and cybercriminals to launder over $1 billion using the privacy tool, Tornado Cash.

The post Birthday plans clash with Tornado Cash’s Roman Storm trial deliberations appeared first on CryptoSlate.

Tether CEO Paolo Ardoino has revealed that USDT accounts for 40% of all on-chain transaction fees across nine major blockchains, including Ethereum, Tron, and Solana.

This dominance isn’t unexpected as stablecoins are increasingly seen as crypto’s “ChatGPT moment,” a breakthrough that makes digital value transfer faster, cheaper, and accessible across borders.

Ardoino pointed out that USDT has become a financial lifeline in many emerging economies.

According to him, millions of users rely on the stablecoin daily to protect their wealth from inflation and volatile national currencies.

Considering this, Ardoino claimed that blockchains offering low transaction fees and native support for USDT are likely to lead the next phase of digital payments.

He also suggested that these networks’ affordability, speed, and stability will be key factors for crypto mass adoption, particularly in regions where traditional banking infrastructure is either weak or inaccessible.

USDT remains the leading stablecoin in the crypto market, commanding 61% of the total stablecoin supply. Its circulating supply now exceeds $163 billion, based on data from CryptoSlate.

The post Tether’s USDT captures 40% of all on-chain fees across 9 major blockchain networks appeared first on CryptoSlate.

The US Securities and Exchange Commission’s (SEC) Division of Corporation Finance issued new staff guidance stating that liquid staking does not automatically constitute a securities offering.

According to an Aug. 5 statement, neither the liquid staking activities nor the associated staking receipt tokens (SRTs) constitute offers or sales of securities that require registration.

The statement defines liquid staking as depositing “covered crypto assets” with a protocol or service provider and receiving newly minted SRTs one-for-one with the deposited assets.

SRTs function as receipts that evidence the holder’s ownership of the staked assets and any rewards, while preserving liquidity for use as collateral or in other applications without unstaking.

Rewards and slashing adjust SRT economics either by changing the SRT-to-asset ratio or by issuing/burning SRTs, with redemption subject to protocol unbonding rules.

The model is how most liquid staking providers in DeFi currently work.

Additional clarity

On the legal analysis, the Division applies Howey and finds the provider’s role administrative or ministerial, not the kind of entrepreneurial or managerial efforts that create an investment contract.

Providers facilitate staking but do not decide whether, when, or how much a depositor stakes, nor do they set or guarantee rewards.

As a result, the covered liquid staking activities do not involve securities transactions, and SRTs themselves are not securities, being so much as receipts for non-security assets.

Secondary-market offers of SRTs likewise do not require registration under the described conditions.

Yet, the SEC issued a follow-up statement clarifying that the view does not extend to providers that go beyond administrative functions or to structures that deviate from the statement.

Consequently, although most of the SRT currently offered in the market are not considered securities, the agency’s statement is not a blanket approval for liquid staking in the US.

Elaborating on staking

The update builds on a May 29 staff statement that addressed other forms of protocol staking, such as self/solo, delegated, custodial, and non-custodial. Likewise, the regulator concluded that participants do not need to register those activities.

The earlier guidance also noted that features such as early withdrawals, bundled rewards, slashing protection, or asset aggregation do not convert staking into a securities offering by themselves.

Together, the two statements sketch more precise boundaries for staking under federal securities laws while leaving room for fact-specific assessment.

The post SEC clarifies liquid staking tokens are receipts, not securities appeared first on CryptoSlate.

Cryptoticker

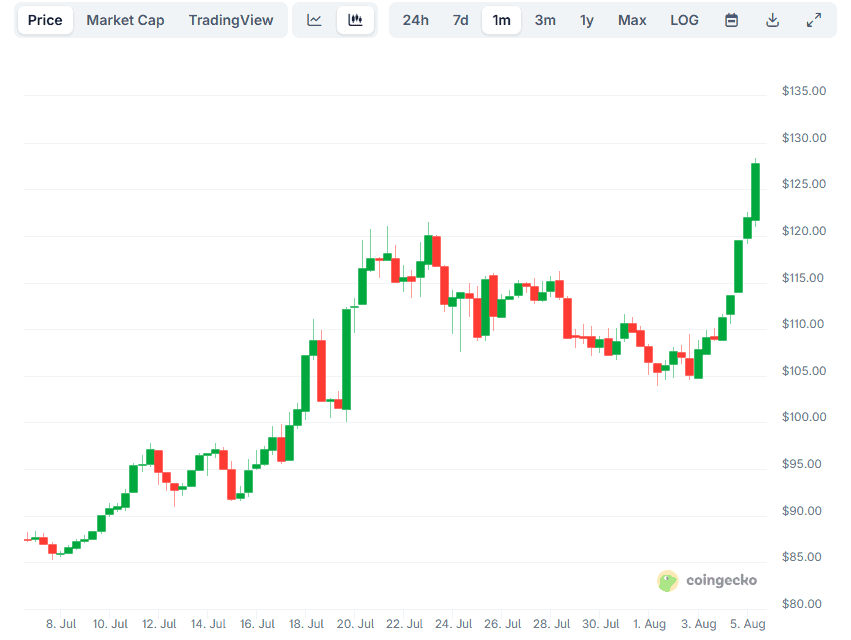

Litecoin just saw its strongest price spike in months, and it’s not hard to see why. A powerful mix of speculative energy, corporate action, and ETF optimism has lit a fire under LTC, pushing it to a five-month high of $128.40. But is this LTC price momentum sustainable, or is the market getting ahead of itself?

Let’s break it down.

Litecoin Price Prediction: What’s Driving the Price Surge?

First, the numbers. Litecoin is up over 41 percent this month and nearly 6 percent in the past 24 hours alone. As of now, it’s holding around $123, giving it a market cap close to $9.4 billion. That move isn’t random. It comes right after two major catalysts.

The big one? MEI Pharma raised $100 million—not for R&D, not for expansion, but to become a Litecoin treasury firm. That’s a massive bet on LTC from a publicly listed pharmaceutical player, and it’s sending a strong message to the broader market: Litecoin isn’t just for payments anymore, it’s a corporate asset.

Then there’s the ETF speculation. While prediction platform Polymarket places the odds of a Litecoin ETF approval this year at 83 percent, competing platforms like Myriad show users expect XRP to beat Litecoin to the finish line. Regardless, multiple filings from Canary Capital, Grayscale, and CoinShares suggest the race is on. The fact that these institutions are even in the conversation is enough to inject serious momentum.

What the LTC Price Chart Says?

Looking at the TradingView daily chart, LTC broke above both the midline and upper band of the Bollinger Bands, which typically signals an overbought yet strong bullish condition. It’s riding above the 20-day moving average comfortably, and the Heikin Ashi candles show clear bullish continuity after a minor pullback.

That pullback after hitting $128.40 wasn’t a reversal—it looks more like a healthy consolidation. The current candle has reclaimed the upper Bollinger Band, suggesting that bulls are still in control. Momentum is strong, and the price structure is climbing with higher lows and higher highs.

If Litecoin can close above $125 in the next couple of sessions, the door opens to a retest of $135 to $140. Above that, $150 becomes the psychological level to watch. On the downside, $110 acts as strong support, and a drop below $105 would invalidate this bullish thesis.

Are ETF Rumors Already Priced In?

Litecoin ETF approval speculation has been around since February, when the SEC first acknowledged the filings. What we’re seeing now isn’t fresh news—it’s a resurfacing of old optimism, coupled with fresh capital from MEI Pharma. That matters.

In fact, the MEI investment could be the more important long-term catalyst. ETF approvals can move prices quickly, but if more firms start adding LTC to their balance sheets, that builds a deeper base of demand. And unlike ETF rumors, treasury allocations tend to stick around.

Litecoin Price Prediction: What Comes Next for LTC Price?

Short term, expect volatility. The market is jittery, and LTC will swing on every new ETF headline. But if treasury adoption continues and Litecoin maintains its role as a top payment coin—it recently captured 14.5 percent of crypto payments on CoinGate—there’s a longer runway here.

Keep an eye on three things: SEC decisions around Litecoin ETFs, corporate announcements hinting at LTC treasury positions, and any major payment platform adopting LTC.

The price is reacting to signals of real-world usage and institutional interest. If those signals get stronger, this could be the beginning of a structural uptrend, not just a hype-driven pump.

Buy LTC on OKX

Looking to buy LTC? OKX is one of the top exchanges with low fees, fast execution, and hundreds of listed assets.

👉 Join OKX here and claim your welcome bonus

$LTC, $Litecoin, $LTCPrice, $LitecoinPrice, $LitecoinETF, $ETF

XRP Price Prediction: Will Support at $3 Hold?

XRP ($XRP) is currently trading around $3.02, down 1.53% on the day and 3.17% over the past week, according to the latest market performance. Despite these short-term losses, the token is still up 36.34% over the past month, 27.02% in 6 months, and a solid 45.51% year-to-date.

But can this momentum continue—or are we looking at the beginning of a deeper correction?

XRP Chart Analysis: Key Levels to Watch

The daily chart shows XRP recently broke down from a local top near $3.60 and is now consolidating just above the psychological $3.00 level. This level is critical for bullish momentum to remain intact.

- Support Zones: $3.00 (green horizontal), followed by the 50-day SMA at $2.68 and the 200-day SMA at $2.45.

- Resistance Zones: Immediate resistance lies near $3.20. A breakout above this could trigger a retest of $3.61.

- RSI (Relative Strength Index): RSI has cooled off from its overbought zone and is now hovering around 52. This suggests XRP has room to move in either direction but lacks strong momentum for now.

XRP/USD 1-day chart - TradingView

A breakdown below $3.00 could open the doors to a quick dip towards $2.68 or even $2.45. However, holding this level would signal bullish consolidation and the potential for a bounce.

Market Context: Ripple's Blockchain Report Adds Confidence

In the midst of this technical uncertainty, $Ripple official X post offers a bullish long-term narrative for XRP and blockchain adoption:

“The shift is happening: banks are investing in blockchain.

➡️ $100B+ invested in blockchain companies since 2020

➡️ $700B/month in stablecoin volume

➡️ $18T projected in tokenized assets by 2033”

This data comes from Ripple's new report in partnership with CB Insights and UK Cryptoasset Business Council, highlighting the growing integration of blockchain into traditional finance.

These macro signals can act as a tailwind for XRP’s future valuation—especially if XRP remains a go-to option for cross-border payments and tokenized liquidity.

XRP Outlook: Price Prediction for August 2025

If XRP can maintain support above $3.00, the next leg up could push toward the $3.60 resistance zone. However, if Bitcoin ($BTC) continues to slide or the broader crypto market weakens, XRP may revisit lower support levels.

Potential Scenarios:

- Bullish Case: Bounce from $3.00, retest $3.20, and aim for $3.60+. Breakout above $3.60 could send XRP to new highs.

- Bearish Case: Failure to hold $3.00 sends XRP down to $2.68 or even $2.45. RSI breakdown would confirm bearish momentum.

The crypto market in the US might be on the verge of a major turning point. Donald Trump is expected to sign an executive order that takes aim at what many in the space have called a quiet crackdown by banks and regulators. The order would investigate whether financial institutions acted illegally when they dropped crypto clients, and it could force a regulatory reset that reopens critical banking access. For a sector still recovering from the FTX fallout and ongoing regulatory pressure, this move could change everything. Let’s look at what’s really happening — and what comes next.

Trump’s Executive Order on Crypto Debanking Could Reshape the US Digital Asset Market

Donald Trump is reportedly preparing to sign an executive order that challenges the long-standing accusations of unfair treatment toward crypto firms by US banking regulators. If this order is signed as expected, it could mark a pivotal shift in how traditional financial institutions engage with digital asset companies.

Could This Reverse the Chill from Operation Choke Point 2.0?

For over two years, crypto executives have argued that regulators quietly squeezed digital asset firms out of the financial system. They called it Operation Choke Point 2.0. The accusation? Regulators allegedly pressured banks to cut ties with crypto businesses, especially after the FTX collapse. A Freedom of Information Act request revealed that the FDIC even asked banks to pause crypto activities, validating what many insiders had claimed all along.

Trump’s proposed executive order goes straight for the jugular of this issue. It directs federal agencies to examine whether those regulatory moves violated antitrust or fair lending laws. If regulators are found complicit, legal action may follow. That sends a loud signal that a new sheriff could be back in town—and that crypto firms might soon find the doors of traditional finance swinging back open.

What This Means for the Crypto Market in the Short Term

If Trump signs the order this week, expect a sentiment boost across the crypto sector. Coins most dependent on US banking infrastructure, such as stablecoins and platforms like Coinbase, could see immediate bullish momentum. Even before the ink dries, the market tends to price in regulatory easing when it sees political will leaning toward crypto support.

Tokens with close ties to US innovation—think Ethereum, Chainlink, and Solana—may benefit from improved fiat on-ramps and less friction for US-based liquidity providers. If banks begin re-evaluating their relationships with crypto firms, that could mean more capital flows, better infrastructure support, and reduced compliance headaches.

How Might Investors React Over the Coming Weeks?

This is where things get more complex. Regulatory relief doesn’t mean the SEC and CFTC will instantly back down. Investors will wait to see whether the Department of Justice actually follows up on the order and whether banking policies truly change. But even anticipation of those changes could push Bitcoin and other top tokens higher in the near term.

The key trigger to watch: whether financial institutions begin re-engaging with previously off-limits crypto clients. If major banks like JPMorgan or Wells Fargo quietly resume onboarding or offering services to digital asset companies, that would confirm the shift is real—not just political posturing.

Could This Open the Floodgates for a US Crypto Revival?

Not overnight. The order would first trigger investigations and reviews, not immediate enforcement. But it sets the groundwork. For startups, this could remove one of the biggest barriers to growth: banking access. For large exchanges like Coinbase, it could reduce compliance risks and strengthen US market positioning.

If the order also restores confidence in the rule of law for conservative political groups, it could unite two powerful constituencies—crypto libertarians and right-leaning financial backers—under a shared cause. That political alignment could shape future US crypto policy for years.

What to Watch Next?

Three things matter now.

- Whether Trump actually signs the order this week or delays it

- The reaction from US banking regulators like the FDIC and Federal Reserve

- Price movement in US-domiciled crypto assets and listed companies like Coinbase

If this story develops into real regulatory pressure on agencies that sidelined crypto firms, expect a new wave of bullish energy to enter the market. It’s early days, but the crypto winter in the US might finally be thawing.

$CryptoMarket, $Bitcoin, $DonaldTrump, $ETH, $SOL, $LINK, $Coinbase, $FTX

The market just got a serious curveball. A Nasdaq-listed firm, Verb Technology, is pivoting from social commerce to becoming a Toncoin (TON) treasury giant. This isn’t just a small-cap experiment. They’re raising $558 million in a private placement with over 110 institutional backers. The end goal? Load up on TON, stake it, rebrand as TON Strategy Co., and cement their position as one of the token's biggest holders.

It’s a coordinated bet from crypto-native players like Blockchain.com, Ribbit Capital, Animoca, Kraken, Pantera, and BitGo. More importantly, it shows how Toncoin price is moving from Telegram-native coin to institutional-grade asset. Let’s unpack why this matters for the TON price and what the chart is already signaling.

TON Price Prediction: Why This News Is a Big Deal?

According to the report, Verb isn’t just adding TON to its balance sheet. It’s restructuring its entire corporate identity around it. That’s miles beyond the usual “added crypto to our reserves” story. This $558 million PIPE deal also means fresh capital is flowing into TON, and about 5 percent of TON's circulating supply is about to be pulled off the open market.

For traders and long-term holders, that’s an immediate supply shock narrative. Less TON on the market. Higher chance of upward price pressure. Plus, 77 percent of the capital will be held in reserve, which suggests firepower to buy dips, support liquidity, or buffer volatility.

But there's a catch. A large portion of the company’s shares is under lock-up for up to 12 months. That stabilizes insider activity but also keeps parts of the narrative speculative until we see TON actually move into the treasury.

Just a few days ago, Toncoin took a major step up in legitimacy. STONfi, its leading decentralized exchange, locked in $9.5 million in Series A funding led by Ribbit Capital and CoinFund—two of the most respected names in fintech. This isn’t casual support. It’s a clear signal that serious players are backing the TON ecosystem. The capital is important, but the credibility it brings is bigger. Now all eyes are on the chart to see if TON can convert that trust into a breakout.

How the Chart Confirms the Buzz?

Current Toncoin (TON) Price: $3.37

According to CryptoTicker’s price page

- Weekly Change: Down 1.86%

- Market Cap: $8.15 billion (down 6.5%)

- 24h Volume: $420.89 million (up 10.65%)

- Volume-to-Market Cap Ratio: 5.13%

- Circulating Supply: 2.41 billion TON

- Total Supply: 5.13 billion TON

- Max Supply: Unlimited

Now let’s pivot to the daily chart. TON recently pushed above its Bollinger Band midline and rode a clean uptrend for over two weeks. It touched a local high near the 3.65 zone before cooling off slightly to 3.48. The current price is still riding above both the 20-day simple moving average and the lower Bollinger Band, keeping the bullish structure intact.

What’s more telling is the Heikin Ashi trend shift that began mid-July. We saw the first major green candle break out after a prolonged range. That wasn’t a coincidence. It lines up with insiders and whales positioning ahead of the public news.

The price also entered a Fibonacci extension zone that aligns with potential targets around 3.90 and 4.20 if momentum resumes. With this kind of headline and strong capital injection, retesting these levels isn’t just possible—it’s likely. If the bullish volume returns post-August 7 (when the deal is expected to close), expect a possible push toward the 4.5 psychological mark.

Short-Term Outlook

In the short term, the market might see a brief pullback or consolidation between 3.30 and 3.55 as traders digest the news. But unless TON price breaks below the 3.20 level with volume, the bullish setup remains intact.

Any sharp dip in Toncoin price before the treasury buy begins could be a front-running opportunity. Smart money knows that this kind of news can create temporary volatility before a long-term climb.

TON Price Prediction: Long-Term Projection

The real shift begins when the treasury starts acquiring and staking TON. That creates consistent upward pressure and potential APR-driven lock-ins. If Telegram keeps pushing TON as its native payment rail and the user base keeps growing, the floor valuation of TON could fundamentally change.

Institutional buy-in. Retail adoption through Telegram. Native staking yield. The story is now aligning with value, not just hype.

A $558 million war chest is now being aimed directly at Toncoin price. The rebrand to TON Strategy Co. is more than symbolic. It signals a long-term bet on the ecosystem.

If the execution matches the intent, TON isn’t just another altcoin anymore. It’s fast becoming one of the few tokens with actual institutional capital, Web3 infrastructure, and native utility through Telegram. The chart already began reacting. The bigger wave might just be starting.

📊 Compare Top Crypto Exchanges

Buy TON on OKX

Looking to buy TON? OKX is one of the top exchanges with low fees, fast execution, and hundreds of listed assets.

👉 Join OKX here and claim your welcome bonus

$Toncoin, $TON, $VerbTechnologyCompany, $VERB

Ethereum Price Prediction: Bullish Recovery or Short-Term Trap?

Ethereum ($ETH) is trading at $3,550, recovering from a recent drop that tested support just above $3,500. After a multi-week rally that peaked below the $3,838 resistance, the chart suggests ETH is consolidating—but is it ready for another leg up, or will we see more downside?

ETH Coin Holding Above Key Support

After reaching a local top near $3,838, Ethereum retraced and found support around the $3,530–$3,550 zone. This area has become a crucial short-term demand level. The bounce here is encouraging, especially with the daily candle forming a higher low relative to the July lows.

ETH/USD 1-day chart - TradingView

The 50-day SMA is currently at $3,012, which acted as dynamic support during the June-July rally. As long as ETH stays above this level, the bullish structure remains intact.

Major Levels to Watch

From the chart:

Resistance:

🔼 $3,838 (Recent High)

🔼 $3,620 (Minor Horizontal Resistance)

Support:

🔽 $3,530 (Current Support)

🔽 $3,200 (Key Horizontal Support)

🔽 $3,012 (50-Day SMA)

🔽 $2,732 (Strong demand zone)

Losing the $3,530 level could open a retest of $3,200. Below that, $3,012 becomes the make-or-break level for bulls.

RSI Suggests Potential Momentum Rebuild

The 14-day RSI recently cooled off from overbought territory, now sitting around 56.05. This suggests there's still room to move higher before ETH becomes overheated again.

Importantly, RSI bounced after a clean test of the 50-level—historically a good sign of bullish continuation during trending phases.

ETH vs. Bitcoin: A Correlation to Monitor

While Ethereum is holding support, it’s worth noting that Bitcoin is still consolidating near its support levels between $112K and $115K. If BTC breaks lower, ETH could follow—even if its own chart looks healthy.

The macro environment is also a factor: with the broader crypto market pulling back slightly this week, caution is warranted before assuming an immediate breakout.

Ethereum Price Prediction: $3,200 or $3,838 Next?

Given current chart structure and momentum:

- If ETH holds above $3,530 and gains strength, the next target remains $3,838, with a breakout possibly taking ETH to $4,000+ in a new leg.

- If ETH loses $3,530, the price may drop to $3,200, and potentially down to the $3,012 SMA support zone.

- Bias: Neutral-to-bullish while above $3,530. Bullish confirmation only if ETH closes daily candles above $3,620.

📈 Check $Ethereum's Real-Time Price

📊 Compare Top Crypto Exchanges

Decrypt

The funds have had outflows as the prices of their underlying assets have declined.

Mantle, "the largest ETH-backed treasury amongst Web3 entities," is surprising traders today in an otherwise down market.

The gpt-oss-120b and gpt-oss-20b models are OpenAI's first open-weight language releases since GPT-2, with the smaller version needing just 16GB of memory to operate.

The move comes after the agency exempted self-custodial and custodial staking in May.

Galaxy recently sold 80,000 Bitcoin on behalf of a Satoshi-era investor. The company's Q2 earnings fell short of expectations.

U.Today - IT, AI and Fintech Daily News for You Today

Tom Lee would pick Ethereum (ETH) over Bitcoin (BTC) if he had to choose just one asset

Ripple's stablecoin has surpassed $600 million in market cap

SharpLink continues its relentless ETH buying spree

BlackRock stuns Coinbase Exchange with $372 million Ethereum amid bouts of sell-offs

More companies adopting XRP strategy

Blockonomi

Futures traders notably increased trading in Solana (SOL) during July, exploding futures trading volume by 252%. Meanwhile, an otherwise quieter but no less formidable competitor is gaining traction among early adopters — Remittix (RTX), a payments-focused protocol already having surpassed $18 million raised. This new utility token is gaining traction heading into its listing cycle.

Solana’s Volume Spike Hides Mixed Signals

Whereas Solana futures experienced firework activity, the spot market is a different experience. SOL is currently priced at $163.51, 1.26% higher, with a market capitalization close to $88.04 billion. The daily trading volume, however, is 8.74% lower, reaching about $4.11 billion.

This divergence suggests leveraged-contract speculation wagering, yet overall sentiment in SOL’s fundamentals may be weakening. As ETF approvals remain uncertain, some traders are reducing exposure to spot holdings—looking instead for more utility-focused counterparts.

Remittix (RTX): A Utility-First Crypto Solving Real Problems

Remittix (RTX) stands out not through hype, but utility. Built as a cross-chain DeFi initiative, it enables users to transfer cryptocurrency—like SOL, ETH, and XRP—to bank accounts in 30+ nations instantly being converted to fiat through its beta wallet, launching in Q3 2025.

Remittix’s key milestones:

- Token price: $0.0895

- Tokens sold: 580 million+

- Funds raised: $18 million+, within the soft cap reach

- Incentives: 40% bonus live + $250,000 Remittix Giveaway

- Wallet release: Q3, mobile-first functionality and real-time FX conversion

Unlike hype tokens, Remittix is a cryptocurrency that possesses actual utility—to make payments transborder easier, without using central exchanges or clunky offramps.

Why Investors Think RTX is the Smarter Alternative

While Solana futures are blowing up but spot liquidity is deflating, most traders are flocking into systems of real use. Remittix comes in line with future trends like low gas fee cryptocurrency, global utility, and fast-growing crypto presales that offer real adoption rather than short-term flipping.

Key benefits:

- Real payments to real bank accounts—fast and cheap

- Already live infrastructure and growing

- Satisfies investor need for early-stage investment in cryptocurrency with clarity

- Quoted as among the top new crypto initiatives of 2025

- Setting Up Prior to Listing Frenzy

Whereas Solana’s performance in futures makes front-page news, the lack of consistent volume growth indicates that the action could be short-lived. In the meantime, Remittix (RTX) is quietly building a product, use case, and a growing user base—preparing the way for healthy adoption as listings approach.

For all those balancing access to SOL with strategic diversification, Remittix DeFi project offers a risk-adjusted alternative, based on usability and scalability.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

The post Solana Futures Volume Surges 252% In July; Remittix ICO Soars Past $18M Raised As Listing Announcements Near appeared first on Blockonomi.

In 2024, investors saw incredible returns from tokens that most had discarded. Solana (SOL) made a comeback of over 85%, and Ripple (XRP) skyrocketed by more than 235%, while Dogecoin (DOGE) soared over 300%, all due to a mix of utility, hype, and momentum. Looking forward to 2025, a new set of under-$1 tokens with the same explosive appeal are making waves. Among them, Little Pepe (LILPEPE), Pudgy Penguins (PENGU), and Cardano (ADA) are increasingly being hailed as the next millionaire-makers.

Little Pepe (LILPEPE): The Meme Coin with Real Utility and a 5000% Upside

As of writing, Little Pepe (LILPEPE) is in Stage 9 of its presale, with tokens selling at $0.0018, having already raised over $14 million out of its $16.47 million target. With a listing price of $0.003, this ERC-20 token could offer a 5,000%+ increase from presale levels if it mirrors the price trajectories of Solana or Dogecoin. The zero market cap at launch gives it ample upside, especially for early entrants seeking outsized returns. But LILPEPE isn’t just riding on meme fuel. It’s launching with Layer 2 blockchain infrastructure, offering ultra-low fees, blazing speeds, and zero taxes on buys and sells. Little Pepe has a clearly defined ecosystem and token utility, unlike many presale tokens with vague roadmaps. The project is also built with whale-grade appeal, thanks to a vesting schedule that prevents dumping, deep liquidity provisioning, and chain reserves for sustainable growth. On top of that, LILPEPE was recently listed on CoinMarketCap, marking a major step toward legitimacy and visibility in the crypto space. To celebrate its momentum, the project runs a $777,000 giveaway, offering $77,000 worth of tokens to 10 winners, with over 164,000 entries recorded. Participating in the presale offers price exposure and increases the chances of winning a life-changing prize. With its bold branding, strong presale metrics, whale interest, and real infrastructure, LILPEPE is positioned to echo the meme-fueled explosions of DOGE and the protocol evolution of SOL, combining the best of both worlds.

Pudgy Penguins (PENGU): The NFT Brand Turning Into a DeFi Juggernaut

Once known primarily for its cute and collectible NFTs, Pudgy Penguins (PENGU) is now transforming into a full-fledged DeFi ecosystem with a Layer 2 network and growing real-world utility. Trading at around $0.0367 as of writing, PENGU has already seen significant whale accumulation and multiple high-momentum breakout attempts, including a 17% single-day pump. With a market cap surpassing $2 billion, it’s gaining traction beyond meme status. Bullish technical formations like breakout patterns and RSI divergence have been observed by analysts, suggesting that a price spike may be on the horizon. With upside projections reaching $0.091, or an 85% to 150% rally, PENGU could return to and break resistance near $0.045 if confirmed. These actions are reminiscent of Solana and XRP’s initial setups before their explosive 2024 ascents. What sets Pudgy Penguins apart is its broad and engaged community and integration into physical toys, media, and an upcoming L2 chain. With over 563,000 holders and viral marketing muscle, PENGU is proving it has the firepower to evolve into a top-tier altcoin. Like Solana and Dogecoin before it, PENGU’s blend of culture, tech, and community could be the perfect formula for a 2025 breakout.

Cardano (ADA): The Sleeping Giant Preparing to Roar

Often labeled as a “slow and steady” project, Cardano (ADA) might just be the most underestimated of the under-$1 club. As of writing, ADA is trading between $0.76 and $0.78, but technical analysts believe it’s coiling for a breakout. With indicators such as symmetrical triangle formations and bullish MACD alignment, ADA is flashing signs of a move toward $1.40 or even $1.60 in the near term. Cardano’s fundamentals are just as impressive. Its upcoming Layer-2 protocol, Hydra, will dramatically boost transaction speeds and lower fees. The growing ecosystem is showing signs of traction. With the talk of an ADA ETF, institutional interest is quietly being built. If ADA can repeat Solana’s or XRP’s trajectory, a return to its all-time high of $3.09 is not just plausible—it’s entirely within reach. According to Coindoo and InvestingHaven, bullish projections for ADA put it between $2 and $3 during 2025. That would mean nearly 4x gains from today’s levels. With proven staying power, growing utility, and renewed investor interest, Cardano could once again reward those who accumulate while others wait.

Conclusion: LILPEPE, PENGU, and ADA Could Be 2025’s Life-Changers

As 2024 showed with Solana, XRP, and Dogecoin, the crypto market continues to reward bold innovation and strong communities. In 2025, Little Pepe, Pudgy Penguins, and Cardano are forming the next wave of under-$1 altcoins with millionaire-making potential. Whether it’s LILPEPE’s meme-fueled Layer-2 blockchain, PENGU’s expanding NFT-DeFi ecosystem, or ADA’s highly anticipated breakout, these coins offer real upside at a fraction of the cost. With LILPEPE still in presale and listed on CoinMarketCap, the opportunity to enter early is shrinking fast. Add the $777,000 giveaway and 5,000% growth potential, a moment most investors shouldn’t sleep on. Start small. Think big. But most of all, don’t be late to the next wave of crypto’s biggest winners.

For more information about Little Pepe (LILPEPE) visit the links below:

Website: https://littlepepe.com

Whitepaper: https://littlepepe.com/whitepaper.pdf

Telegram: https://t.me/littlepepetoken

Twitter/X: https://x.com/littlepepetoken

The post These 3 Coins Under $1 Could Become 2025’s Millionaire-Makers Like Solana (SOL) appeared first on Blockonomi.

Currently trading around $0.27, Dogecoin (DOGE) is showing strong potential to outperform major players like Solana (SOL). However, while DOGE’s legacy and momentum make it a formidable contender, a new meme coin, Little Pepe (LILPEPE), priced under $0.002, is gaining traction as a potential leader in gains.

DOGE Displays Strength as Solana Stumbles

Dogecoin is now pulling ahead of Solana on several key performance measures. Trading above $0.25, DOGE has created solid support at $0.22. The latest break above previous resistance levels has analysts eyeing quick targets of $0.40 to $0.50.

A fresh golden cross, where the short-term moving average crosses above the long-term, adds to the bullish picture. Plus, addresses holding over 100 million DOGE have boosted their stacks by 12% in the last month, showing that the big players still believe. Meanwhile, Solana is struggling to keep the momentum. Even with cutting-edge tech and a busy developer hub, SOL is stuck at about $180, and the climb has stalled. Ongoing worries about handling peak traffic and network slowdowns haven’t vanished.

Little Pepe (LILPEPE): A Meme Coin with Bigger Aspirations

While DOGE’s legacy is hard to match, a new contender, Little Pepe (LILPEPE), is entering the spotlight with serious growth potential. Unlike most meme coins that rely on hype alone, LILPEPE has been built on a fast, secure Layer 2 blockchain infrastructure, combined with ultra-low transaction fees and a highly active community. LILPEPE takes the iconic Pepe meme and flips it into a fresh brand that’s catching serious attention. The project mixes humor, lightning-fast transactions, and easy entry points. This combo is pulling in meme coin fans who want the next big laugh and sharper-eyed investors who know a good early bet when they see one.

Presale Momentum and Community Growth

Presale Momentum and Community Growth

LILPEPE’s presale has already passed major milestones. The project raised $13,775,000 through eight stages, and it’s currently in stage nine with a token price of $0.0018. At this stage, 1.5 billion tokens are available to raise another $2.7 million. So far, the total raised has crossed $14.08 million, highlighting strong investor demand. Another important step for LILPEPE is its recent listing on CoinMarketCap. With visibility comes volume, and that could create the momentum needed to match or even exceed the performance of DOGE. As part of its push to reward early supporters, the LILPEPE team is running a major giveaway campaign. Ten lucky winners will each receive $77,000 worth of LILPEPE tokens, a move that has already attracted over 164,000 entries.

The tokenomics are structured for scalability and community involvement. Of the total 100 billion token supply:

- 26.5% is allocated to the presale

- 10% to liquidity

- 30% for chain reserves

- 10% for decentralized exchange allocation

- 10% for marketing

- 13.5% for staking and rewards

- 0% tax on transactions

This distribution supports long-term sustainability and active trading without unnecessary friction.

LILPEPE’s Massive Upside Potential

Market analysts are starting to give LILPEPE serious attention. While DOGE could realistically achieve 2x returns in the coming months, projections for LILPEPE are significantly higher. Some forecasts suggest a potential of up to 54,000% gains, especially if its exchange listings and community engagement continue on their current trajectory. LILPEPE’s appeal lies in its early positioning. With a price still under $0.002, the upside for those entering now could be considerable, especially given its already-planned listings on two major centralized exchanges and the biggest global exchange. These developments could act as major catalysts for price discovery once public trading opens.

Final Thoughts: The Meme Coin Race Is Far From Over

While Dogecoin continues to prove its strength, it may not be the most explosive mover of this bull cycle. With high engagement, strong presale performance, a built-in meme identity, and a Layer 2 backbone, Little Pepe (LILPEPE) is positioning itself as more than just another coin; it’s aiming to become the next major crypto culture icon. Investors who caught DOGE under $0.01 saw life-changing gains. With LILPEPE still priced below $0.002, many are eyeing this opportunity as the next big move before broader market exposure sends it soaring.

For more information about Little Pepe (LILPEPE) visit the links below:

Website: https://littlepepe.com

Whitepaper: https://littlepepe.com/whitepaper.pdf

Telegram: https://t.me/littlepepetoken

Twitter/X: https://x.com/littlepepetoken

The post Dogecoin (DOGE) to Outperform Solana (SOL) This Bull Cycle, But Rising Token Under $0.002 Could Lead in Gains appeared first on Blockonomi.

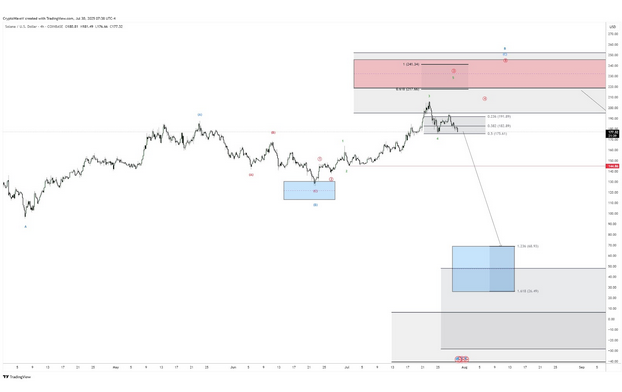

Solana is still trending in crypto circles, especially after its major push in tokenized real-world assets (RWAs). But traders are beginning to rotate into newer Ethereum-based plays like PEPE and Remittix (RTX), a fast-rising PayFi coin. Many are now calling it one of the best crypto to buy now in 2025.

Solana Sees RWA Surge, But Momentum Slows

Solana has led the way in RWA growth this year. The number of tokenized asset holders on the network is up 1,281%, reaching close to 63,000 users. The total RWA value has jumped by 176%, now worth over $479 million. That’s huge for adoption and use case expansion.

Still, recent Solana updates hint at slowing momentum. Although Solana briefly moved past the $160 resistance when Bitcoin surged above $122K, the rally didn’t hold. Analysts now expect SOL to dip as low as $145 before any strong bounce.

source: TradingView

Technical indicators show weakness. The RSI is under 50 and the MACD is flashing red. Price action has stayed trapped between $125 and $180 for most of 2024, and despite spikes, Solana always returns to this range.

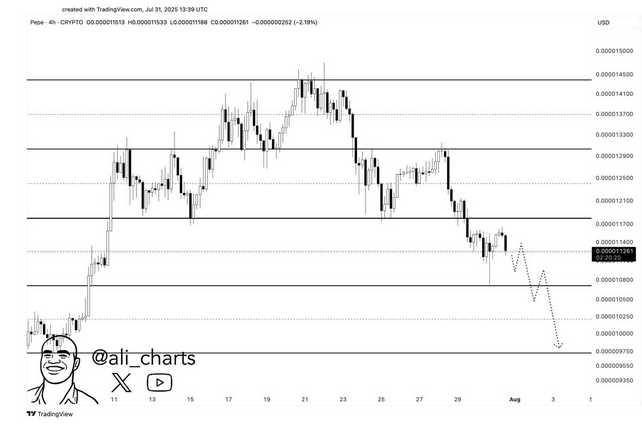

PEPE Whales Accumulate While Price Finds Support

PEPE is trading around $0.00001042 and holding on to key support near $0.0000108. Still, whale activity shows confidence. Nansen data confirms that whale holdings have increased to 305.52T, while exchange balances are down to 250.62T. That means less selling pressure ahead.

source: @ali_charts on X

PEPE latest news shows the token is moving inside a symmetrical triangle. If it breaks out, targets could hit $0.0000130 to $0.0000145. Analyst Token Talk believes a big move is coming soon as the price tests both the triangle resistance and psychological levels. Despite the weak short-term momentum, PEPE still has the kind of volatility traders love.

With the Ethereum ecosystem gaining steam, and whales increasing their PEPE exposure, it’s clear this altcoin still has attention. Some say it could be the next 100x crypto if the bull run heats up again.

Remittix (RTX) Keeps Quietly Climbing

While Solana updates and PEPE latest news dominate headlines, Remittix has been building steadily. It’s a PayFi token built for real-world payments, and it recently activated cross-chain capability, meaning users can now send money across blockchains, not just within them.

RTX has already raised over $18 million, sold more than 580 million tokens, and the wallet beta is coming this quarter. It’s not just hype. Real people are using Remittix to move crypto across borders quickly and cheaply. That’s why it’s becoming one of the best DeFi projects 2025 has seen.

Here’s why Remittix stands out:

- Real utility: send crypto straight to bank accounts in 30+ countries

- Supports 40+ cryptos and 30+ fiat currencies at launch

- Built-in FX conversion and transparent pricing

- Q3 wallet beta launch incoming with mobile-first access

- Bonus tokens: 40% extra available now for early buyers

Final Thoughts: Traders Rotate Out Of SOL, Into RTX and PEPE

This year’s data makes one thing clear, rotation is happening. While Solana updates show growing RWA adoption, the price trend is stalling. Meanwhile, PEPE latest news suggests whales are preparing for a major move. And Remittix is showing quiet, steady progress that might surprise even seasoned investors.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

The post The Rotation From Solana Continues As Investors Trade Into Ethereum Heavyweights PEPE and RTX appeared first on Blockonomi.

TLDR:

- Bitcoin drops under $114K, shifting focus to a tough $115K–$116K resistance zone.

- $114K support now acts as a hurdle that bulls must reclaim to regain momentum.

- Sellers control price action with 4-hour 200MA and 200EMA adding resistance pressure.

- Market eyes $115K recovery, but failure could trap BTC in a tightening range.

Bitcoin is losing ground again. The price now trades under the $114K support, erasing a key level bulls fought to hold. Sellers are pressing harder, forcing the market into defensive mode.

Traders are watching whether buyers can take back $114K before any push higher. Without it, the road toward $116K and a stronger rally remains blocked.

Bitcoin Price Slips While Key Levels Tighten

According to CoinGecko, Bitcoin is at $113,522, down 1.49% in the past 24 hours. It has dropped 4.44% in the last week. This move takes the price under the $114K support that held earlier in the month.

The next big challenge sits at $115K to $116K, a zone that has been tough to crack. Bulls now face two steps: reclaim $114K first, then break through $116K.

Daan Crypto Trades pointed out that the $115K-$116K range is a critical battle zone. On the 4-hour chart, this area has acted as both support and resistance. Repeated rejections from this level show sellers are still in control.

He also noted the 4-hour 200MA and 200EMA, which sit right above this region. These moving averages add another layer of resistance. Until price clears them, momentum remains capped.

$BTC Important area around $115K-$116K.

The horizontal level has been respecting price on both sides very well so far.

We also have the 4H 200MA/EMA right above price which have acted as resistance as well.

Bulls need to break this region to be back in control and start aiming… pic.twitter.com/1MsH8ZkDOg

— Daan Crypto Trades (@DaanCrypto) August 5, 2025

BTC Price Support at $114K Now Turns Into a Hurdle

Losing $114K changes the game. Buyers once defended it, but it is now the first barrier they need to reclaim. If they fail, price could drift lower, putting fresh pressure on the market.

Traders are closely watching how Bitcoin reacts around this point. A quick recovery could spark a push toward $115K and $116K. Failure might keep it stuck in a tightening range.

Bitcoin’s path back to strength is clear but not easy. Reclaim $114K, break $116K, and only then can bulls think about higher targets. For now, sellers hold the upper hand.

With price slipping under support, the next few sessions will decide if Bitcoin finds its footing or stays trapped. Traders are bracing for another test of this critical zone.

The post Bitcoin Breaks Below $114K as BTC Bulls Face Tough Road Back appeared first on Blockonomi.

CryptoPotato

Coinbase-incubated Layer 2 network, Base, has outpaced Solana in daily token launches over the past two weeks.

Zora and Farcaster have significantly boosted Base token creation, pushing its daily launches above that of Solana’s.

Token Launch Frenzy

The data shared by CryptoRank revealed a dramatic shift beginning in July, when Base first surpassed Solana in new token deployments. It has since maintained and even widened its lead.

Dune Analytics further confirms this trend. On July 27, Base saw a record 54,341 tokens launched in a single day, which is more than twice the number of Solana’s 25,460. This rapid rise is attributed mainly to the integration of Zora and Farcaster into the Base app. This move appears to have significantly boosted user engagement and token creation activity.

Zora, a decentralized content network, allows tokenization of user posts as ERC-20 tokens or NFTs. Farcaster, on the other hand, is a decentralized social protocol that improves the distribution and visibility of these tokenized assets.

Together, these integrations allow users to instantly mint posts into tradable tokens paired with automated Uniswap liquidity pools, incentivizing rapid content creation and speculation. The resulting surge in token launches pushed the Layer 2 network’s daily figures from around 6,600 at the start of July to consistent daily volumes surpassing 45,000 by month-end.

Despite this explosive growth, Solana continues to lead Base in terms of trading volume for these newly created tokens. This essentially indicates a disconnect between the sheer quantity of token launches and actual market activity.

The momentum around the Layer 2, however, has helped the network position itself as an emerging hub for meme coins and experimental tokens – a space historically dominated by Solana. CryptoRank also noted that this same integration of Zora within the Base ecosystem contributed to a staggering 1,000% rally in the ZORA token during July, further fueling speculation around Base-related assets.

Lead in Revenue

Base has also emerged as the most profitable Layer 2 network after averaging $185,291 in daily revenue over the past six months. It has far surpassed Arbitrum’s $55,025 and the combined $46,742 from 14 other top Layer 2s.

Galaxy Digital attributed this to Base’s EIP-1559-inspired fee mechanism, which prioritizes transactions via dynamic, per-gas unit bidding rather than fixed-rate systems like Arbitrum’s Timeboost. Priority fees, averaging $156,138 daily, accounted for 86% of the network’s revenue.

The recent Flashblocks upgrade and strong DEX activity, which captured 50%-65% of Layer 2 DEX volume, have further helped Base’s lead in monetizing block space demand while keeping user fees low.

The post Here’s How Base Is Crushing Solana in Daily Token Launches appeared first on CryptoPotato.

The hottest month of the year also saw some of the hottest climbs for the largest digital asset, which reached unseen territories driven by global demand.

The market is naturally cooling after a month of events, and speculation about the next direction is high. Here’s CryptoQuant’s take on why BTC dipped at the end of July.

Potential Triggers

The month of July, which marked the second half of the year, saw a spectacular BTC run that drove the asset to a new all-time high of just over $123,000. At the end of the month, however, bitcoin experienced a significant drop, losing 7-8% of its value and falling to a multi-week low of $112,000.

Given that this ATH was a level not previously seen, it was natural for some profit-taking to occur, whether by institutions, investors, miners, or OG holders who decided to exit at this price range. A notable sell-off took place in the last few days of the month. Galaxy Digital disposed of 80,000 BTC for a client, valued at around $9 billion.

While it was a strong month for BTC Exchange-traded funds (ETFs), with only 4 days marking outflows, anything that goes up must come down, right? On July 31st and August 1st, over $920 million left ETFs, according to data from SoSoValue. The following graph, shared by CryptoQuant, is a good visualization of the sharp decline.

“ETF inflows were intermittent and not stable during periods when funds were withdrawn from ETFs. There was no alternative demand to compensate for this shortfall,” was noted by the blockchain page ArabxChain.

The macroeconomic scene also did not help much, with the most recent Federal Reserve meeting from last week, despite the US economy posting a 3% increase. President Trump used this opportunity to urge Fed Chair Jerome Powell to cut rates, but they remained unchanged.

Future Outlook

The crypto asset with the largest market capitalization experienced a few wobbly days and appears to be still recovering from them, with overall market santiment split between bearish and bullish.

The most recent liquidation heatmap from Coinglass indicates strong investor confidence that Bitcoin will regain its previous levels, with a significant cluster of positions centered around the $120,000 mark.

Michaël van de Poppe noted on X that “Bitcoin is doing great,” but also emphasized the possibility that BTC is not entirely out of the woods yet.

“Rejection here? Yes, that would mean we’re retesting the area around $110-112K.”

The author and advocate of BTC, Robert Kiyosaki, is still leaning toward a more bearish stance, citing historically low August levels. Although he will not shy away from buying the dip, should it happen.

The post End-of-July Bitcoin Dip Explained: What Triggered It? (CryptoQuant) appeared first on CryptoPotato.

TL;DR

- BNB trades around $760, maintaining stability while other top cryptocurrencies faced steeper market losses.

- A rounding bottom breakout puts $745 as key support and potential targets at $790 to $1,000.

- Institutional players like Nano Labs are adding BNB to treasuries, signaling rising corporate interest.

Price Near Record Levels

BNB changed hands at $760 at press time, with over $1 billion in 24-hour volume. Prices dipped slightly in a day and 9% over the past week.

In the last 24 hours, BNB traded between $755 and $770. Its seven-day range was $735 to $833. The token is still only 12% below its record high of $858 (CoinGecko data), set on July 28, 2025.

Crypto analyst Crypto Patel pointed out that BNB has outperformed most major altcoins during this market downturn. Many tokens have fallen 60–80% from their peaks, but BNB never slipped beyond 30%. That steadiness keeps it close to record levels while the broader crypto market remains shaky.

$BNB is performing better than most other major coins.

While many dropped by 60–80%, #BNB never fell more than 30%.

Now it’s already close to its all-time high.Quietly strong and consistent.

Source: CryptoQuant@cz_binance @binance pic.twitter.com/EIhlqQO4WO

— Crypto Patel (@CryptoPatel) August 4, 2025

Market data tracking the drawdown from all-time highs for top altcoins shows a clear difference. BNB, marked in blue, saw its pullbacks stay between -6% and -30%. XRP ranged from -15% to -38%, while ETH also touched -38%. SOL had the heaviest losses, dropping over 60% from its high.

Interestingly, the numbers show that BNB stayed more stable than its peers. It held its ground during periods where other coins swung sharply lower, giving it a reputation for relative consistency.

Chart Patterns and Future Targets

Analyst Jonathan Carter identified a rounding bottom pattern on the daily chart. BNB broke above the neckline near $745 and is now retesting that level as support. Holding this zone would keep the bullish setup in place.

#BNB

Binance Coin is retesting the broken neckline of a rounding bottom pattern on the daily timeframe

The price needs to hold above the neckline level to confirm the support and continue the bullish momentum

If confirmed, we could see the price surge toward targets at… pic.twitter.com/KTrtx2T4aV

— Jonathan Carter (@JohncyCrypto) August 4, 2025

In case of a resumed momentum, Carter identified potential highs at $790, $850, $900, and $1,000. Volume and the RSI readings indicate that the current rally has taken a breather, and the price is consolidating upon breaking out.

Ecosystem Updates and Institutional Interest

Binance rolled out a web wallet that allows traders to approve transactions for up to seven days and opened bitcoin options writing to all users. Both changes are designed to support active traders and strengthen BNB’s ecosystem.

Corporate interest has picked up as well. CEA Industries, Liminatus Pharma, Windtree Therapeutics, and Nano Labs have all revealed BNB-related plans. Nano Labs said it purchased 128,000 BNB as part of its new treasury strategy.

BNB remains on watch as it retests support and approaches critical resistance zones that could lead to new highs.

The post BNB Defies Selloffs, Stays Within 30% of All-Time High appeared first on CryptoPotato.

Over the past three weeks, bitcoin (BTC) has been testing its local range lows near $115,800. Unfortunately, it gave way over the weekend, and the leading cryptocurrency fell to $112,000.

Interestingly, altcoins followed suit, seemingly abandoning the bullish momentum they had ridden during this altseason. This raises the question of whether this decline is just a break in the altseason or the end altogether.

Bitcoin Falls Below Local Support

Bitcoin’s decline follows persistent market weakness amid aggressive speculative risk rotation toward ether (ETH) and other altcoins. According to the latest Bitfinex Alpha report, the move signals a shift in market structure and rising downside vulnerability.

The market’s current condition suggests that speculative appetite is declining across sectors, with cautious sentiment and elevated leverage. Before any catalysts can trigger strong directional momentum, there could be a period of reduced volatility and consolidation. This could be exacerbated as bitcoin’s loss of range support acts as resistance.

Although BTC is struggling and may continue to do so in the meantime, altcoins are having it worse. Despite recent selling pressure, bitcoin’s market cap has remained above $2.2 trillion, accounting for almost double its 2021 cycle peak. ETH and the aggregate altcoin market, on the other hand, have failed to exceed their 2021 highs. This suggests that investors have remained cautious even while rotating their capital into high-beta and less mature assets.

Is Altseason Dead?

Worse still, altcoins performed worse than bitcoin last week. While BTC has fallen just 8.9% from its all-time high, ETH closed last week with a 9.7% plunge. The OTHERS index, which tracks the broader altcoin market aside the top ten, showed that this group of assets closed the week 11.5% in the red. ETH has plummeted 15% from its recent local peak, while the OTHER index is down 18.7% below its cycle high.

Furthermore, the OTHERS index has shed roughly $59 billion in value over the last 11 days, reflecting rapid derisking among investors.

“This contraction signals a clear waning of speculative appetite in the altcoin sector, which had seen a rapid expansion of open interest throughout July, even as BTC remained trapped within a tight trading range,” Bitfinex analysts stated.

Meanwhile, only two large-cap assets are in the green over the last two trading weeks: ENA, the utility token of the synthetic dollar protocol, Ethena, and PENGU, the native asset of the non-fungible token (NFT) project, Pudgy Penguins. Although both assets are up 14.5% and 8.4%, respectively, they are also down from their all-time highs.

The post Altseason on Hold? Altcoins Decline as Bitcoin Falls Below Local Support (Bitfinex) appeared first on CryptoPotato.

TL;DR

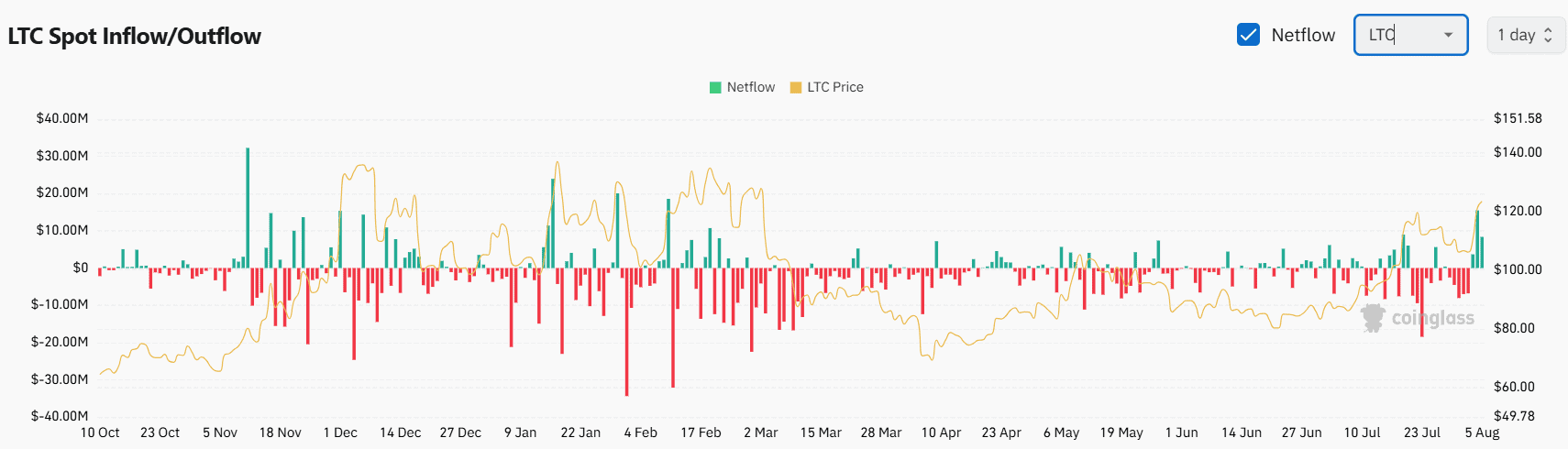

- LTC witnessed a substantial price uptick, fueled by MEI Pharma’s $110 million purchase of Litecoin tokens.

- While analysts foresee a rally toward $150 and beyond, technical indicators such as the rising RSI and increased exchange inflows suggest that a possible short-term correction may be in play.

The Next Targets

Litecoin (LTC) is among the few leading cryptocurrencies well in the green on a daily scale. Currently, it trades at approximately $124, representing a 41% increase over the past month.

Its positive performance coincides with the actions of MEI Pharma, which recently acquired 929,548 LTC at an average price of $107.58, establishing a treasury position valued at over $110 million.

Thus, the pharmaceutical company became the first US-listed public firm to adopt Litecoin as a primary reserve asset. The strategic move was developed in partnership with GSR and with guidance provided by Charlie Lee (creator of the crypto project).

“Litecoin has long embodied sound, scalable, and decentralized money. By initiating this strategy, MEI is taking a clear, institutional step forward that recognizes Litecoin’s role as both a reserve asset and an integral part of global financial systems,” Lee stated.

Several analysts have noted the positive price performance of LTC, seeing this as the beginning of a major rally. X user Crypto Dios claimed the cryptocurrency “is showing the same setup we saw before its 5x run in 2020.”

Lucky, who has over 2.2 million followers on X, forecasted a potential spike to almost $150 in the short term, while Rain set a similar target.

Litecoin has been on a strong rise since April.

Now trading above $120 at a critical level. $150 is the nearest target, with big moves likely to come. Volume and momentum pick up$LTC is showing more strength than many altcoins.

Time to return to all time highs is near. pic.twitter.com/uPsHWfTLb1

— Rain (@raintures) August 5, 2025

Observing Some Indicators

Despite the aforementioned optimism from the analysts, LTC’s Relative Strength Index (RSI) suggests a pullback might be incoming.

The technical analysis tool measures the recent speed and magnitude of price changes to help traders spot potential reversal points. Readings above 70 signal that the asset is overbought and could be due for correction, while anything below 30 is considered a buying opportunity. Currently, the RSI stands at around 71.

Next on the list is LTC’s exchange netflow. Over the last three days, inflows have surpassed outflows, indicating a shift from self-custody methods toward centralized platforms. This, in turn, increases the immediate selling pressure.

The post Litecoin (LTC) Soars by 40% Monthly: Is There More Room for Growth? appeared first on CryptoPotato.